The rise of

artificial intelligence (AI) has pushed NVIDIA (NASDAQ: NVDA) into historic territory, transforming it from a gaming-focused chipmaker into one of the most valuable companies on the planet. In October 2025, NVIDIA became the first company in history to surpass a $5 trillion market valuation, driven by massive demand for its GPUs, record data-center revenue, and multi-billion-dollar partnerships with industry leaders. Yet despite NVIDIA’s global influence and rapid stock growth, high share prices and traditional brokerage restrictions can still make it difficult for many investors to access NVDA directly.

This is where

tokenization of real-world assets (RWAs) comes in.

Tokenized stocks or xStocks use blockchain to create on-chain versions of traditional equities, backed 1:1 by real shares held in regulated custody. These assets give users the flexibility of crypto markets with exposure to traditional finance, including 24/7 trading, fractional ownership, and seamless integration into digital portfolios. Popular examples include tokenized versions of

Apple (AAPLX),

Tesla (TSLAX), and

S&P 500 (SPYX).

Following this trend, Nvidia tokenized stock, NVDAX and NVDAON, mirrors the real-time market price of NVDA while offering the advantages of blockchain trading. This makes it easier for global users to invest without needing a brokerage account, large capital, or market-hour restrictions. In this guide, we’ll explain what NVDAX is, how it works, how it compares to traditional NVDA shares, and key factors to consider before trading.

What Is Nvidia (NVDA)?

NVIDIA Corporation is widely recognized as the engine powering the AI revolution. Founded in 1993, the company began as a graphics processor brand for PC gaming and later evolved into the global leader in artificial intelligence computing. Today, NVIDIA’s GPUs run everything from ChatGPT-style language models to self-driving cars, robotics, cloud data centers, and advanced scientific research. As the world’s demand for AI accelerates, NVIDIA has become one of the most important technology companies of the decade.

The numbers highlight its dominance. Over the last five years, NVIDIA’s stock has gained 1,576%, with fiscal 2025 revenue hitting $130.5 billion, up 114% year-over-year. In 2024 alone, NVDA surged 171%, followed by another 50%+ gain year-to-date in 2025. In October 2025, NVIDIA made history by becoming the first company ever to reach a market valuation above $5 trillion, surpassing every tech competitor in global markets. Its data-center business continues to explode, with Q1 2025 revenue reaching $39.1 billion, a 73% increase from the previous year, fueled by demand from OpenAI, Microsoft, Google, Meta, and government-level AI programs.

NVIDIA’s expansion now goes beyond chips. The company announced plans to build seven new U.S. government supercomputers, took a $1 billion stake in Nokia to develop 6G wireless, and is supplying 50,000 GPUs to Samsung for a new “AI Megafactory.” NVIDIA is also investing heavily in AI startups, including plans to inject up to $1 billion in Poolside, alongside previous multibillion-dollar investments in Intel and self-driving car platform Wayve.

With GPUs powering data centers, AI models, autonomous vehicles, mobile devices, and blockchain applications, NVIDIA has become a cornerstone of modern computing. This massive growth and market leadership make NVDA one of the most followed stocks in the world, and a key reason why tokenized versions like NVDAX are gaining strong interest from crypto traders.

What Are Tokenized Stocks or xStocks?

Tokenized stocks are blockchain-based representations of real-world equities. Each digital token is designed to track the live market price of a publicly traded stock and is typically backed 1:1 by actual shares held in regulated custody. This structure lets users gain exposure to companies like NVIDIA, Apple, Tesla, and even the S&P 500 directly through a

crypto wallet, without needing a brokerage account,

KYC with a stockbroker, or access to specific regional markets.

Because tokenized stocks operate on-chain, they combine the familiarity of traditional equities with the advantages of digital assets. Traders can buy or sell them 24/7, even when stock exchanges like NASDAQ or NYSE are closed. They also support fractional ownership, allowing investors to start with small amounts instead of purchasing a full share, an important feature as companies like NVIDIA trade at high nominal prices. This makes tokenized stocks especially attractive to crypto users who want to diversify into traditional markets.

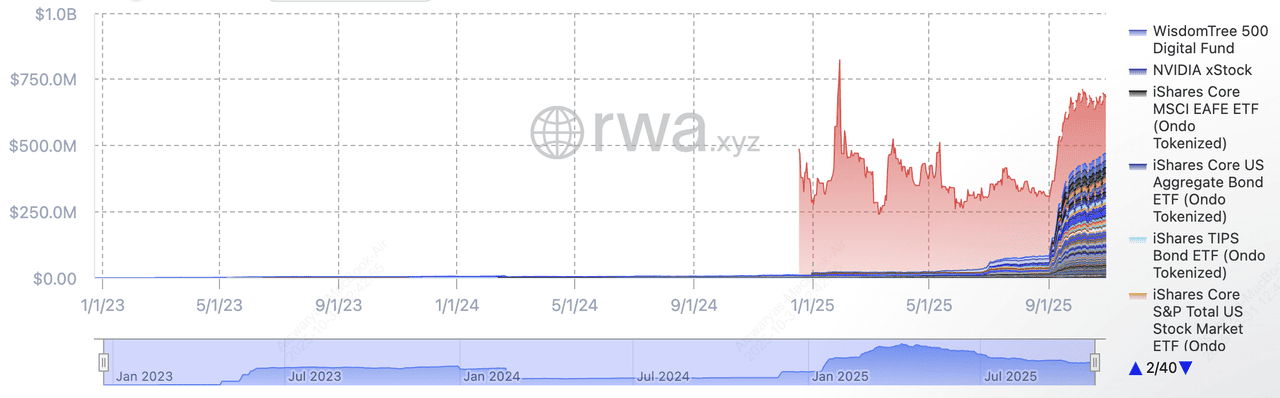

Tokenized Stocks TVL (Total Value Locked) | Source: RWA.xyz

Among the leaders in this category is Backed Finance, the issuer behind the popular xStocks series. These tokens are fully collateralized, held by a licensed custodian, and structured to mirror the price movements of the underlying equities in real time. As adoption grows, tokenized stocks continue to gain market share. As of July 2025, the sector reached a TVL of $487 million, up more than 20% month-over-month, with Backed Finance controlling roughly 77% of the market. This trend reflects rising demand for real-world assets on-chain, particularly among global traders who want faster settlements, easier access, and lower barriers to entry.

What Is NVDAX NVIDIA Tokenized Stock and How Does It Work?

NVDAX is the tokenized version of NVIDIA Corporation (NASDAQ: NVDA), the world’s most valuable tech company and the driving force behind the global AI boom. After a record-breaking run in 2024 and 2025, NVIDIA’s stock became the first in history to push the company above a $5 trillion market valuation, solidifying NVDA as one of the most in-demand assets in global markets. Its daily trading volume regularly reaches tens of billions of dollars, and year-to-date gains exceeded 50% by late October 2025, following a 171% surge in 2024.

Tokenizing NVIDIA stock makes this exposure more accessible. NVDAX mirrors the real-time price of NVDA, but trades on the blockchain, giving users:

• 24/7 trading, with no market-hour restrictions

• Fractional ownership, ideal for high-priced assets

• Instant settlement through cryptocurrencies like

USDT• No need for a brokerage account or stock-market access

This allows traders from any region to participate in NVIDIA’s market movements using only a crypto wallet or crypto exchange account.

Like most regulated tokenized stocks, NVDAX is backed 1:1 by real NVIDIA shares held in licensed custody. This keeps its value aligned with the underlying equity while removing many of the friction points of traditional markets. Because NVIDIA is at the center of the AI revolution, with government contracts, trillion-dollar partnerships, and expanding demand for GPUs, NVDAX has emerged as a popular choice for investors who want long-term exposure but prefer the speed and flexibility of digital assets.

What’s the Difference Between Trading NVIDIA Stocks and Tokenized Stocks?

Both NVIDIA shares (NVDA) and the tokenized version NVDAX track the same underlying asset, but the way traders access, buy, and sell them is very different. NVDA trades on traditional stock exchanges like NASDAQ, which operate on fixed hours and require a brokerage account. Investors must usually purchase full shares, and settlements can take two business days (T+2) to complete. While this method provides full shareholder rights, such as voting power and eligibility for dividends; it creates barriers for smaller investors and users outside supported regions.

Tokenized NVIDIA stock (NVDAX) works differently. Because NVDAX lives on the blockchain, it offers 24/7 trading, instant settlement, and fractional ownership, allowing users to invest with only a small amount of capital. Instead of needing a broker, traders can buy or sell NVDAX directly using a crypto exchange or digital wallet. This makes NVDAX accessible to global investors, including those in markets without direct access to U.S. equities.

However, it is important to note that tokenized stocks like NVDAX typically do not include shareholder rights or dividends. They are designed to mirror NVIDIA’s real-time price performance, not replace ownership in the company.

The chart below highlights the key differences between NVDA stock and NVDAX tokenized stock:

| Feature |

NVDA (Traditional Stock) |

NVDAX (Tokenized Stock) |

| Trading Hours |

Limited to exchange hours |

24/7 trading |

| Settlement |

T+2 business days |

Nearly instant |

| Access |

Requires brokerage and regional support |

Global access with a crypto wallet |

| Fractional Ownership |

Usually not available |

Yes, invest with small amounts |

| Shareholder Rights |

Voting + dividends |

Not included |

| Minimum Capital |

High, due to full share price |

Low, fractional units |

These differences make NVDAX appealing for traders who want flexibility, lower entry requirements, and global accessibility while still gaining exposure to NVIDIA’s market movements, especially as NVIDIA continues to lead the AI boom and set new valuation records.

How to Trade NVDA Tokenized Stock on BingX

You can trade NVDAX on both the

BingX Spot Market and the

BingX Perpetual Futures Market, making it easy to access NVIDIA’s price movements whether you prefer long-term investing or short-term trading. BingX also lists NVDAON, another on-chain NVIDIA price tracker, giving users multiple ways to gain exposure through Spot trading. Additionally, BingX AI provides real-time market insights to help you make more informed decisions.

Step 1: Search for NVDAX/USDT or NVDAON/USDT on the Spot Market

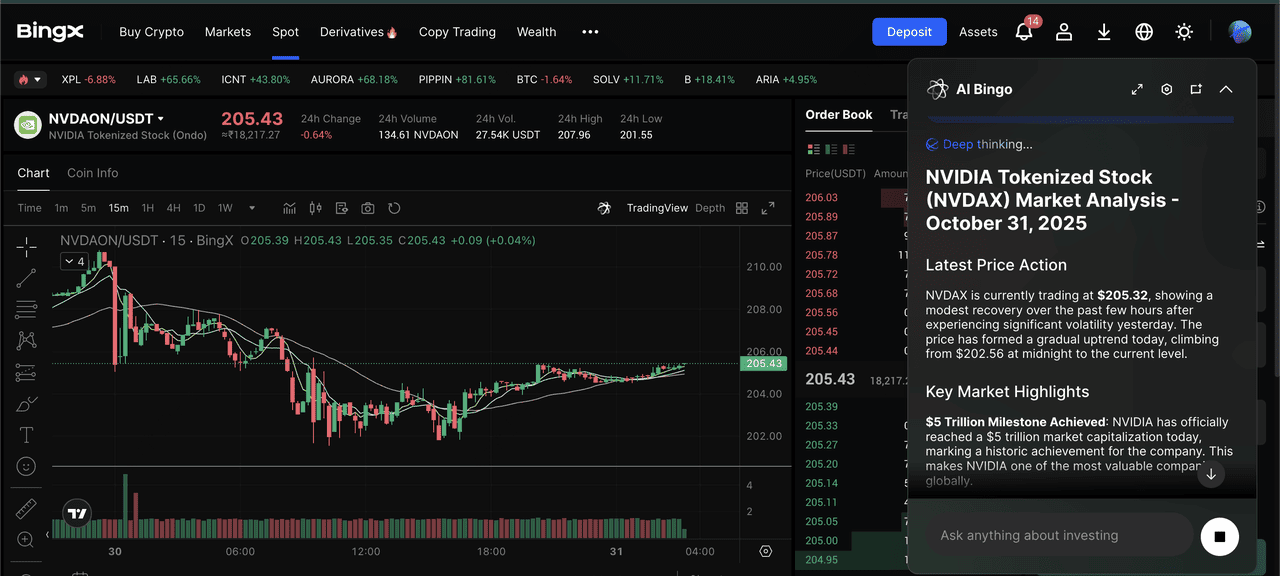

NVDAON/USDT trading pair on the spot market powered by BingX AI

1. Open the Spot tab on BingX.

3. Choose between:

• Limit Order – Set your preferred price and wait for execution.

Spot trading is ideal if you want to build a long-term position in NVIDIA’s tokenized stock, diversify your crypto portfolio with RWAs, or simply buy and hold.

Spot supports fractional ownership, which means you can start trading with small amounts instead of paying the full price of a share.

Step 2: Trade NVDAX Perpetual Futures for Short-Term Price Movements

• Go long if you believe NVIDIA’s price will rise

• Go short if you expect a pullback

• Optional leverage to amplify exposure, use responsibly

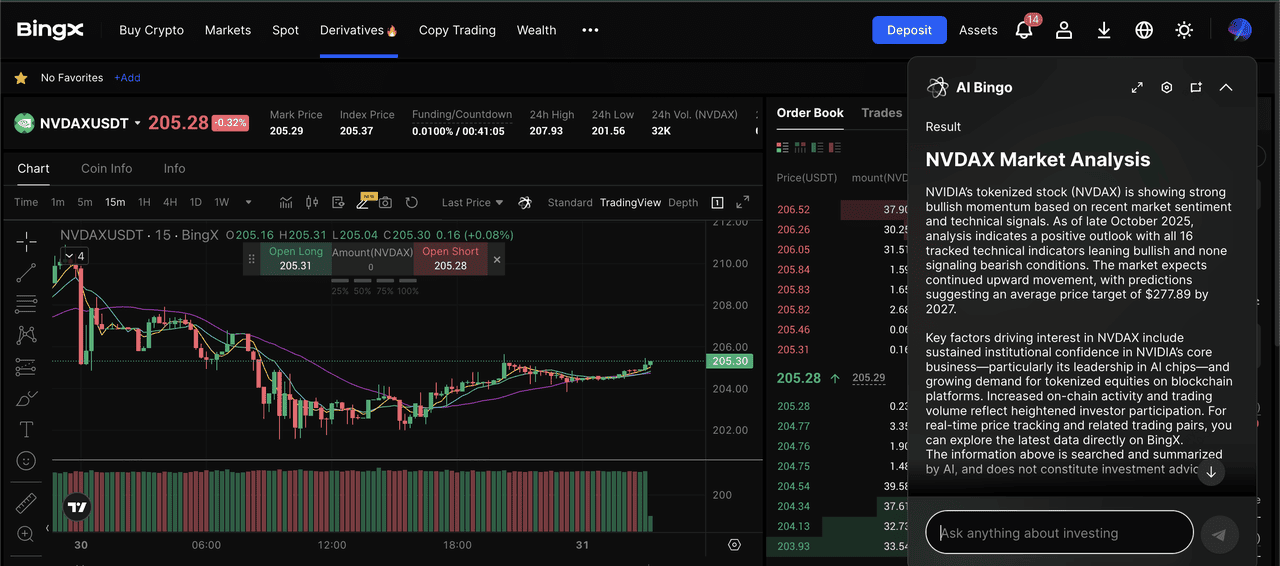

Step 3: Activate BingX AI for Real-Time Market Analysis

Click the AI icon on the NVDAX chart to enable

BingX AI. The AI engine analyzes trading data and highlights:

• Current trend direction

• Support and resistance levels

• Potential reversal zones

• Buy and sell order clusters

This helps you avoid emotional entries, spot better entry points, and react to rapid market changes faster.

Step 4: Plan Your Trades with Market Insights

Because NVDAX tracks NVIDIA stock, staying updated on NVDA earnings, GPU announcements, AI industry news, and macro market sentiment can give you a major advantage. Events such as:

• Quarterly earnings

• New GPU releases (Blackwell, Rubin, Hopper upgrades)

• Government contracts

• Major AI partnerships (Samsung, Nokia, OpenAI) can cause price volatility on both traditional markets and tokenized versions like NVDAX.

Key Considerations Before Investing in NVDAX

While NVDAX makes it easier to gain exposure to NVIDIA’s price movements, it is important to understand the risks and limitations before trading. Here are the key factors every investor should evaluate:

1. Regulatory Environment: Tokenized stocks operate differently from traditional securities. In many regions, they fall into a regulatory gray area, meaning they may not offer the same protections as officially listed shares. Rules vary by jurisdiction, so traders should confirm whether tokenized assets are supported in their region and review the platform’s legal disclosures.

2. Custody and Backing: NVDAX is typically backed 1:1 by real NVIDIA shares held by a licensed custodian. However, this depends on the issuer. Always verify that the exchange or provider clearly explains how tokens are backed, stored, and redeemed. Transparency around custody is essential when dealing with real-world asset tokenization.

3. Liquidity Differences: NVIDIA stock (NVDA) regularly trades tens of billions of dollars per day on NASDAQ. Tokenized versions like NVDAX rely on the liquidity of the exchange where they are listed. Lower trading volume can lead to wider spreads, slippage, and slower order execution, especially for large orders.

4. No Shareholder Rights: Unlike regular NVDA shares, tokenized stocks do not provide voting rights, dividends, or direct ownership in the company. NVDAX is designed solely to track NVIDIA’s market price, not offer corporate participation.

5. Market Volatility and Crypto Risks: Even though NVDAX mirrors NVDA’s price, crypto markets can introduce extra volatility due to exchange mechanics, funding rates in futures trading, and investor behavior. Proper risk management, stop-losses, position sizing, and staying informed about NVIDIA news, is essential.

Final Thoughts: Should You Buy NVIDIA xStock (NVDAX)?

NVDAX gives investors a modern way to benefit from NVIDIA’s market performance without needing a brokerage account or full-share capital. NVIDIA recently became the first company in history to hit a $5 trillion valuation and continues to dominate AI with government contracts, data-center demand, and massive partnerships with Samsung, Nokia, and major cloud providers. Given this momentum, many investors want exposure, but the high share price and regional restrictions can be barriers.

Tokenizing the stock removes many of these hurdles. With 24/7 trading, fractional ownership, instant settlement, and access through a crypto wallet, NVDAX offers flexibility that traditional markets cannot match. Still, traders should balance these benefits against the risks: regulatory uncertainty, lower liquidity than NASDAQ, and the absence of shareholder rights or dividends.

For investors who believe in NVIDIA’s long-term growth and prefer blockchain-based markets, NVDAX can be a useful addition to a diversified portfolio. As tokenized assets expand across stocks, commodities, and indexes, products like NVDAX are likely to play a bigger role in how global investors participate in the world’s leading companies.

Related Reading