With a fully diluted valuation (FDV) of approximately $3 billion in pre-market trading,

Monad (MON) is stepping into the spotlight as one of the most anticipated Layer-1 launches of 2025. Additionally, the public token sale on Coinbase raised over $216 million, eclipsing its $187 million target, and signaling serious momentum for the ecosystem.

Why the buzz? Monad is built for speed, scale and seamless

Ethereum-compatibility. With claims of up to 10,000 transactions per second, 400 ms block times, and 800 ms finality, the Monad team says it has constructed “the high-performance EVM blockchain built for scale.”

This article walks you through how Monad works, what gives it an edge over legacy chains like Ethereum and other EVM-chains, MON tokenomics and airdrop claim process, and how to approach trading MON on platforms such as BingX.

What Is Monad (MON) Layer-1 Blockchain and How Does It Work?

Monad (MON) is an ambitious

Layer-1 blockchain, fully compatible with the Ethereum Virtual Machine (EVM). It aims to deliver a major leap in performance: up to 10,000 transactions per second (TPS), block times as low as roughly 400 ms, and finality in 800 ms, all while allowing developers to deploy existing Ethereum smart contracts seamlessly.

Because of that architecture, Monad positions itself as ideal for high-throughput use cases: DeFi protocols, NFT marketplaces, on-chain gaming, real-time

Web3 social apps and payments, anything where speed, low latency and low cost matter. With full EVM compatibility, projects from Ethereum and other EVM chains can migrate with minimal frictions.

How Does Monad Deliver Faster and Cheaper Transactions?

1. MonadBFT Consensus — A BFT-style consensus protocol at the heart of Monad that enables extremely fast finality and low latency.

2. RaptorCast Networking — Optimised block propagation and data sharing among validators to reduce latency and increase throughput; a key part of achieving the high TPS target.

3. Asynchronous Execution — Consensus ordering and transaction execution are decoupled to make full use of the block window, improving efficiency under load.

4. Parallel Execution and MonadDB — Transactions are processed across multiple cores in parallel, and MonadDB (a custom database/storage layer) keeps state access fast and infrastructure hardware requirements modest.

5. Full EVM Compatibility — Unlike some high-throughput chains that require new tooling, Monad supports EVM bytecode and Ethereum RPC interfaces out of the box, meaning developer migration from Ethereum is far smoother.

Monad combines familiar tools and developer flows from Ethereum with dramatically enhanced performance, offering a user-experience akin to mainstream fast, low-cost web apps and a developer environment familiar from the EVM ecosystem.

Monad vs. Ethereum vs. BNB and Other EVM-Compatible L1 Chains: A Comparison

Monad sets a new performance benchmark for Ethereum-compatible Layer 1 blockchains. While networks like

BNB Chain and

Avalanche have improved speed through optimizations, Monad rebuilds the execution layer to achieve higher throughput and faster finality without compromising decentralization.

| Category |

Ethereum |

Other EVM-L1s (BNB Chain, Avalanche) |

Monad |

| Transaction Speed |

15–30 TPS |

BNB: 260–2,500 TPS, Avalanche: 300–4,500 TPS |

Up to 10,000 TPS |

| Finality |

10–60 seconds |

1–2 seconds |

0.8 seconds, block 0.4 seconds |

| Gas Fees |

High during congestion |

Moderate-to-low |

Very low and predictable |

| Developer Tools |

Native EVM |

Fully EVM-compatible |

Fully EVM-compatible, plug-and-play |

| Scalability |

Limited |

Moderate-to-high |

High scalability at Layer 1 |

| Decentralisation |

Strong |

Moderate |

Globally distributed validators, consumer-grade nodes |

Monad stands out because it combines next-generation performance with full Ethereum compatibility, offering a seamless upgrade path for developers and users. Its architecture delivers a massive leap in throughput and finality, achieving tens of thousands of TPS with sub-second settlement, while its EVM-compatible bytecode and RPC layer let developers migrate dApps without rewriting code.

Unlike many chains that rely on rollups or layered optimizations, Monad reengineers the execution layer itself, using parallel execution, asynchronous pipelines, and a custom database for consistent high-speed performance. With consumer-grade validator requirements that lower the barrier to decentralisation, Monad delivers the power of a high-performance L1 without sacrificing accessibility, making it one of the fastest and most developer-friendly blockchains to watch in 2025.

EVM-Compatible Layer 1 vs. Ethereum Layer 2: What’s the Difference?

Both EVM-compatible Layer 1 chains and

Ethereum Layer 2 networks aim to increase speed and reduce cost, but the approach and trade-offs differ.

• EVM-Compatible Layer 1s, e.g., Monad, BNB Chain, Avalanche, are independent blockchains. They run their own consensus, validators and infrastructure, while supporting Ethereum tool-chains. This grants full control over performance, scalability and gas mechanics.

• Ethereum Layer 2s, e.g.,

Arbitrum,

Optimism,

Base, sit on top of Ethereum. They process transactions off-chain or semi off-chain and post proofs or rollups back to Ethereum mainnet. This gives them strong base-layer security, but they remain dependent on Ethereum’s settlement and face additional design constraints.

| Category |

EVM-Compatible Layer 1 |

Ethereum Layer 2 |

| Network Type |

Stand-alone blockchain with its own validators |

Layer built on top of Ethereum |

| Transaction Speed |

Range: low hundreds → up to ~10,000 TPS (depending on design) |

~20–4,000 TPS, but settlement depends on L1 |

| Gas Fees |

Typically $0.01–$0.05+ (varies) |

Often under $0.01, but includes overhead for posting to L1 |

| Finality |

Sub-second to ~2 seconds |

1–10 minutes depending on L1 confirmation time |

| Security Model |

Secured by its own consensus mechanism |

Inherits Ethereum base-layer security |

| Independence |

Fully autonomous |

Dependent on Ethereum mainnet availability |

Because Monad is in the first group, EVM-compatible L1, it offers full EVM compatibility with the added advantages of faster transactions, lower fees and native scalability, all without waiting for a separate root chain settlement.

How Does Monad Ensure EVM-Compatibility?

“EVM-compatible” describes a blockchain that supports the same smart-contract environment as Ethereum, using the same tooling, wallets, programming languages and developer workflows. At its core, it means that the EVM executes smart-contracts, and any chain that mirrors that environment can offer seamless interoperability and migration.

For MON, the native token of Monad, this compatibility translates into real-world benefits: developers can deploy existing Ethereum dApps unchanged, and users can engage via familiar wallets, such as

MetaMask, with lower friction. In turn, Monad inherits the vast Ethereum infrastructure while delivering faster transactions, drastically lower fees and improved scalability.

For users, this means:

- Reduced fees and smoother experience compared to legacy chains

For developers, Monad offers:

- Use of Solidity, Hardhat, Foundry, and existing Ethereum smart-contract libraries

- Deploy dApps faster without rewriting code

- Access to a high-throughput environment of up to 10,000 TPS with lower latency and cost

In short, Monad merges Ethereum’s developer-friendly foundation with next-generation performance and efficiency, offering you the best of both worlds.

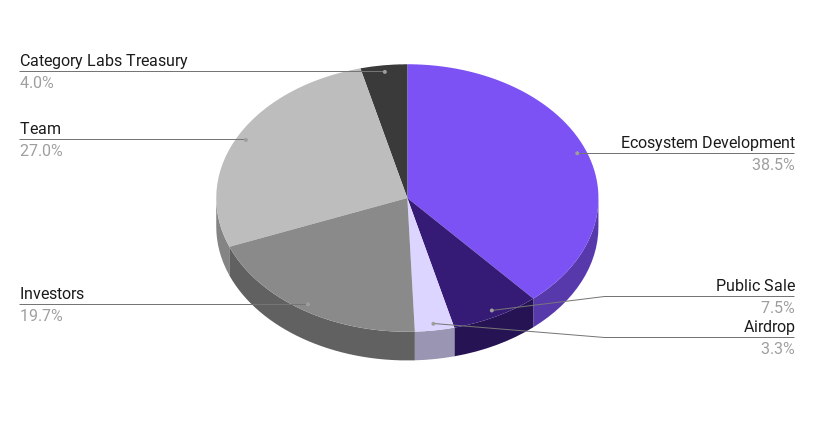

What Is Monad (MON) Tokenomics?

Monad’s MON token powers the entire high-performance Layer-1 ecosystem and is designed to support ultra-fast execution, staking security, and decentralized governance at scale. The network has a fixed total supply of 100 billion MON, with a structured, multi-year distribution plan that prioritizes ecosystem growth, validator incentives, and broad community participation.

Monad (MON) Token Utility

MON serves three core functions across the network:

• Transaction Fees: Used to pay gas for transfers and smart-contract execution on the Monad blockchain, with low and predictable fees thanks to high network throughput.

• Staking & Network Security: Validators and delegators stake MON to participate in consensus, secure the network, and earn block rewards. MonadBFT and consumer-grade validator hardware support wider decentralization.

• Governance: Holders can vote on protocol upgrades, economic parameters, ecosystem funding, and governance proposals, influencing the long-term direction of the Monad ecosystem.

MON Token Distribution

MON token allocation | Source: Monad blog

Monad has officially released its full tokenomics structure. The 100,000,000,000 MON supply is allocated as follows:

• 38.5% — Ecosystem Development: Grants, incentives, validator delegation, and long-term ecosystem growth.

• 27% — Team: Subject to multi-year lockups and vesting.

• 19.7% — Investors: Allocated to early backers with long-term vesting.

• 7.5% — Public Sale: Distributed through Coinbase’s token sale platform.

• 3.95% — Category Labs Treasury: Reserved for compensation and operational needs.

• 3.3% — Airdrop: Allocated to early supporters and crypto community participants.

At mainnet launch, around 10.8% of the total supply will be unlocked and circulating. The remainder will vest gradually through 2029 and beyond.

When Is the Monad Airdrop, and Who Is Eligible to Claim $MON?

Monad confirmed that its first airdrop claim portal opened on October 14, 2025, marking the official start of MON’s distribution phase ahead of mainnet. This airdrop is one of the most widely anticipated of the year, targeting both early Monad supporters and high-activity on-chain users across the broader crypto ecosystem.

Claim Period

• Opened: October 14, 2025

• Closed: November 3, 2025

Users must claim within this window as unclaimed MON will not be automatically credited.

Eligibility Criteria for the MON Token Airdrop

Allocations and claims for the Monad airdrop | Source: Monad blog

According to the official announcement, the airdrop includes 5,500 Monad community members, plus 225,000 active crypto users, selected for on-chain activity and ecosystem participation.

Eligible wallets were categorized across five groups:

1. Monad Community

2. Active On-Chain Users

3. Crypto Community Members

4. Crypto Contributors, including developers, founders, researchers, tool builders

5. Monad Builders, such as testnet contributors, ecosystem developers

How to Claim MON Tokens Safely

1. Visit the official Monad Claim Portal linked from Monad’s website and official X account.

2. Connect your wallet using Privy, the only supported method.

3. Sign the authorization message.

4. Complete the claim process and receive MON directly to your wallet.

Important: There is only one official portal. Beware of fake websites or phishing links circulating on social media.

For step-by-step airdrop details, please check our

Monad Airdrop claim guide.

$MON Token Market Valuation During Pre-Launch Trading

Ahead of its official listing, the MON token for Monad has already seen active trading on futures and pre-launch perpetual contracts across multiple platforms. For example, the opening price of the public sale via Coinbase was $0.025, implying a base fully diluted valuation (FDV) of $2.5 billion.

Other derivative and pre-market platforms record trading prices in the $0.03-0.05 range, implying market perceptions of FDV between $3–5 billion. These figures mark MON as one of the largest pre-listing tokens of 2025 and underscore strong demand for early exposure pre-mainnet.

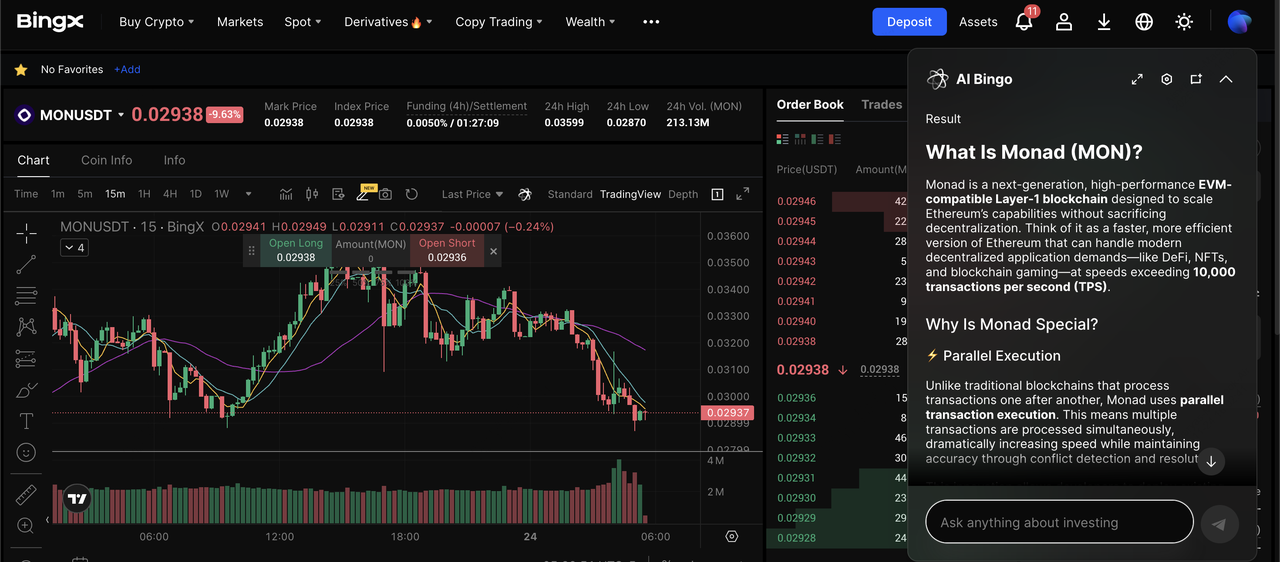

How to Trade MON on BingX Before Listing

MONAD/USDT perpetual contract on the futures market powered by BingX AI

You can gain early exposure to MON on BingX via its Pre-Launch

Futures Market:

2. Choose Long (buy) if you expect the price to rise, or Short (sell) if you expect it to fall.

5. Monitor price movements and derivative

funding rates. Pre-launch markets often show marked volatility and speculative bias.

Tip: Pre-launch perpetual trading carries elevated risk; leverage amplifies both gains and losses, liquidation risk is higher, and no spot market backup exists yet.

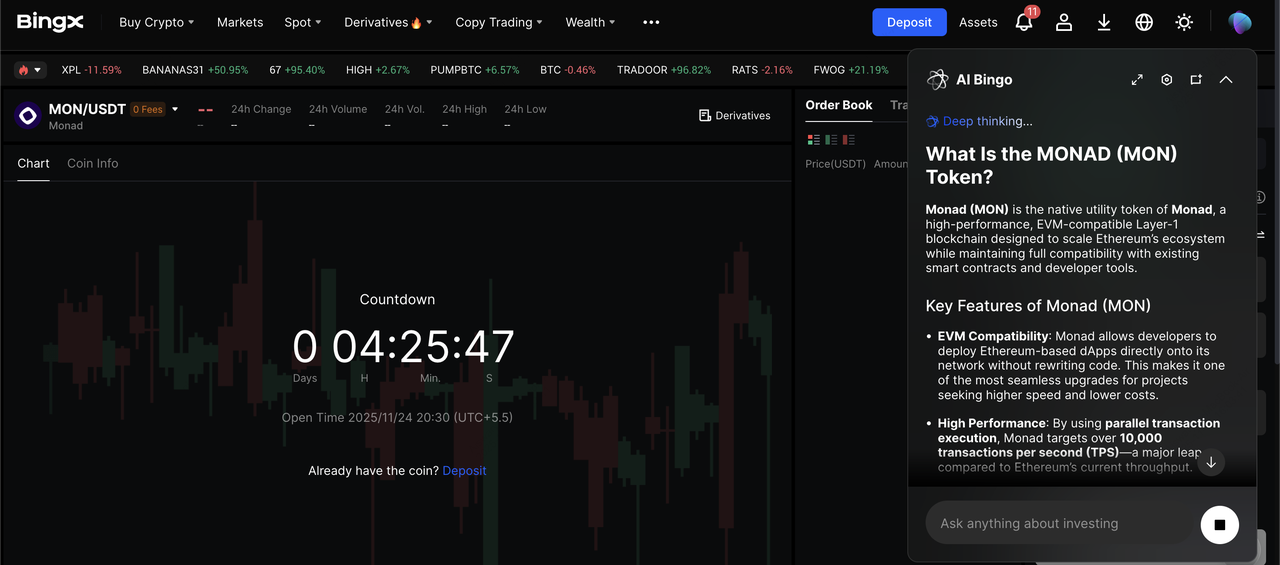

How to Trade Monad (MON) on BingX After Listing

Once MON is officially listed on the spot market, you will have standard asset access. Here’s how to approach it:

For Spot Trading

MONAD/USDT trading pair on the spot market powered by BingX AI insights

1. Deposit MON: Withdraw from your wallet and send a small test amount to your BingX account’s official MON deposit address.

3. Place a market order for instant execution, or a limit order if you want a specific entry price.

4. Monitor your open position from your dashboard. You can hold for the long term for staking, governance use, or trade actively based on market conditions.

5. Use limit orders and monitor liquidity and slippage. Initial listing periods often bring sharp price swings and thin order books.

For Futures Trading After Token Listing

Continue using the MON/USDT perpetual contract, now backed by a spot listing, with the same leverage and risk controls. Post-listing, trading can shift from speculative premia to more stable arbitrage and spot-linked dynamics.

Tip: Avoid large market orders during high-volatility listing events; slippage and adverse fills are common.

Final Thoughts

Monad is shaping up to be one of the most anticipated Layer-1 launches of 2025. By combining full EVM-compatibility with massive throughput, ultra-fast finality and low fees, it extends the Ethereum developer ecosystem into a more scalable environment. With the airdrop claim portal opened in mid-October and trading opportunities now live via BingX Pre-Launch Futures, users have a first look at how Monad might perform in action. As always, rely solely on official sources and be vigilant for fake links, rumours and hype.

Related Reading