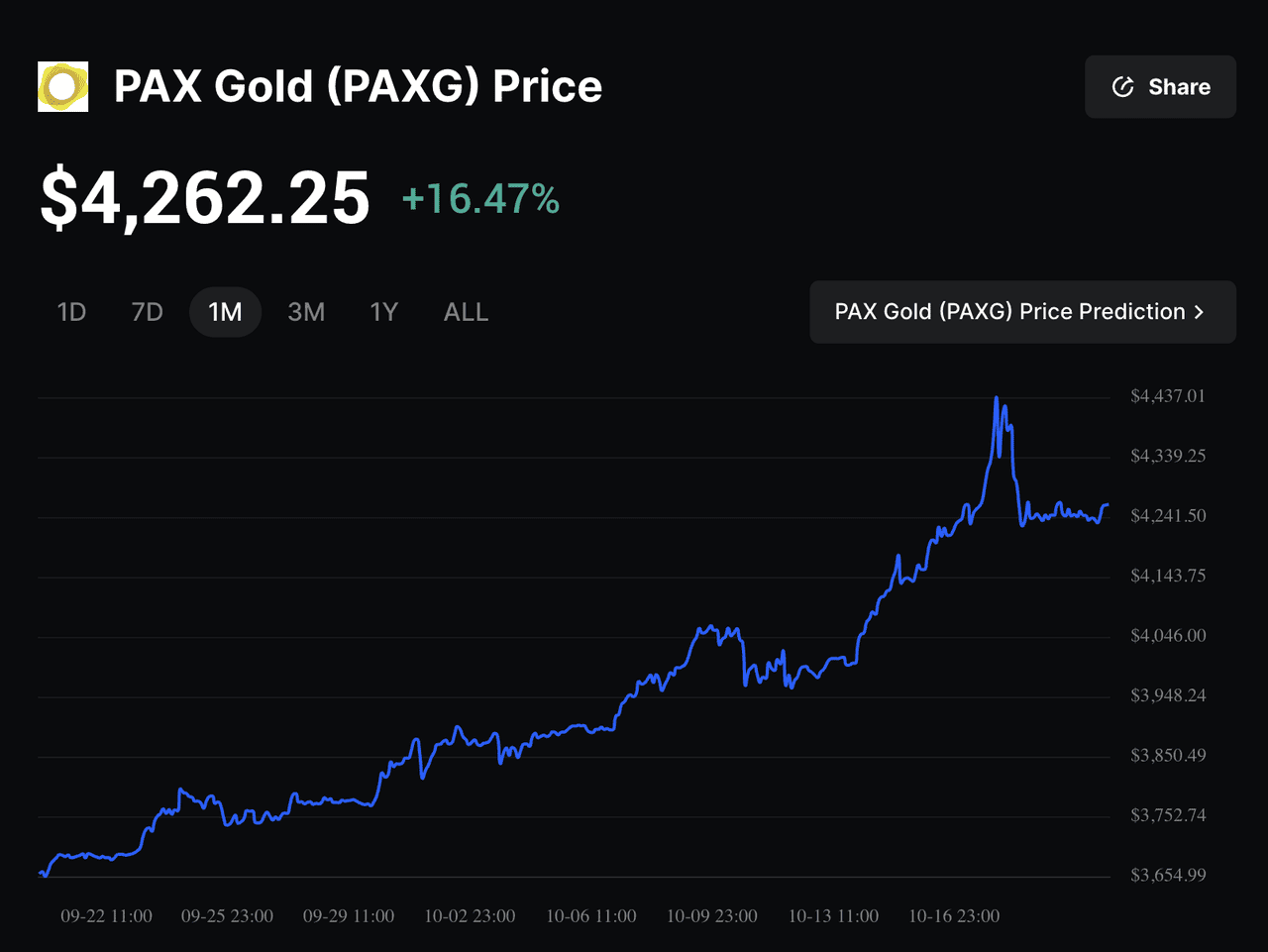

In an era where digital assets are reshaping traditional finance, gold-backed cryptocurrencies like

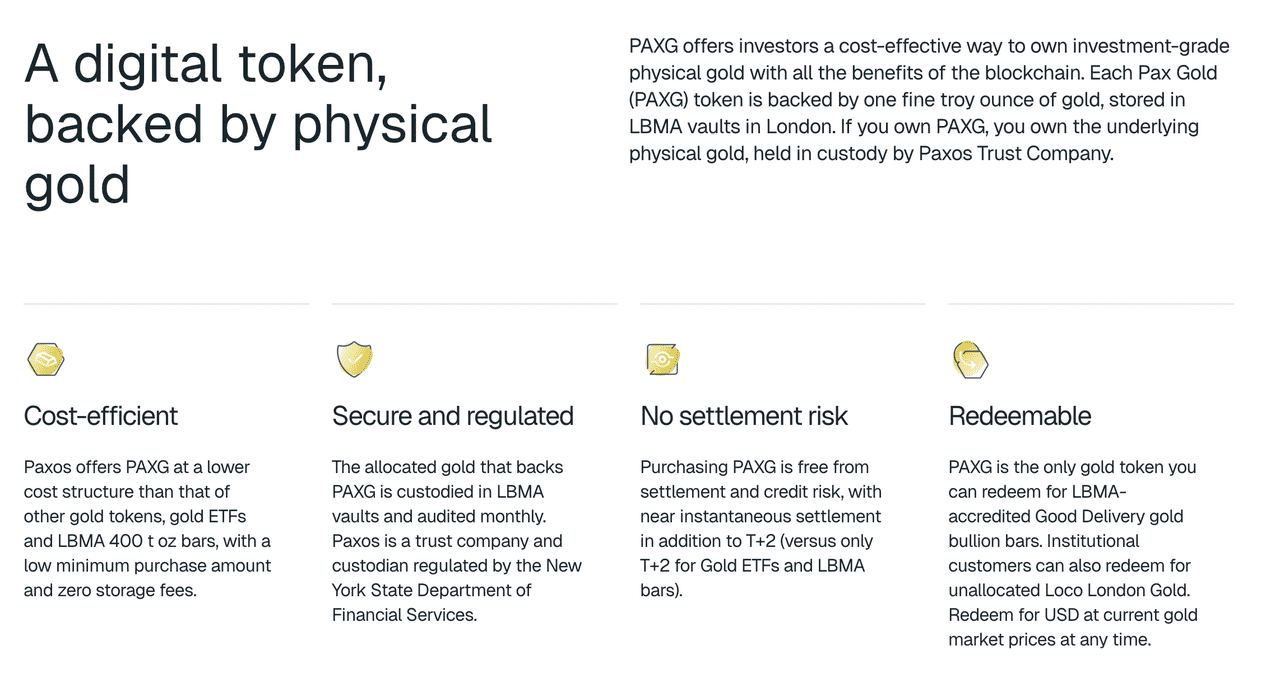

PAX Gold (PAXG) offer a compelling bridge between the timeless value of precious metals and the efficiency of blockchain technology. PAX Gold (PAXG) is a regulated, blockchain-based token that represents direct ownership of physical gold, combining the stability of precious metals with the flexibility of digital assets. As

tokenized real-world assets gain momentum, understanding PAXG's mechanics, benefits, and safeguards is essential for anyone exploring this fusion of stability and innovation.

What Is PAXG the Tokenized Gold Coin?

PAX Gold (PAXG) is an

ERC-20 token on the

Ethereum blockchain that represents direct ownership of one fine troy ounce of physical London Good Delivery gold bar, stored in professional LBMA-accredited vaults in London and custodied by Paxos Trust Company. Unlike gold ETFs or futures, which may involve counterparty risks or derivatives, PAXG provides token holders with verifiable legal ownership rights to specific, allocated gold bars, complete with unique serial numbers, purity details, and weight specifications. This asset-backed structure ties PAXG's value directly to the real-time spot price of gold, enabling investors to benefit from its role as a hedge against inflation and currency fluctuations while leveraging blockchain for seamless transfers across exchanges, wallets, and DeFi platforms.

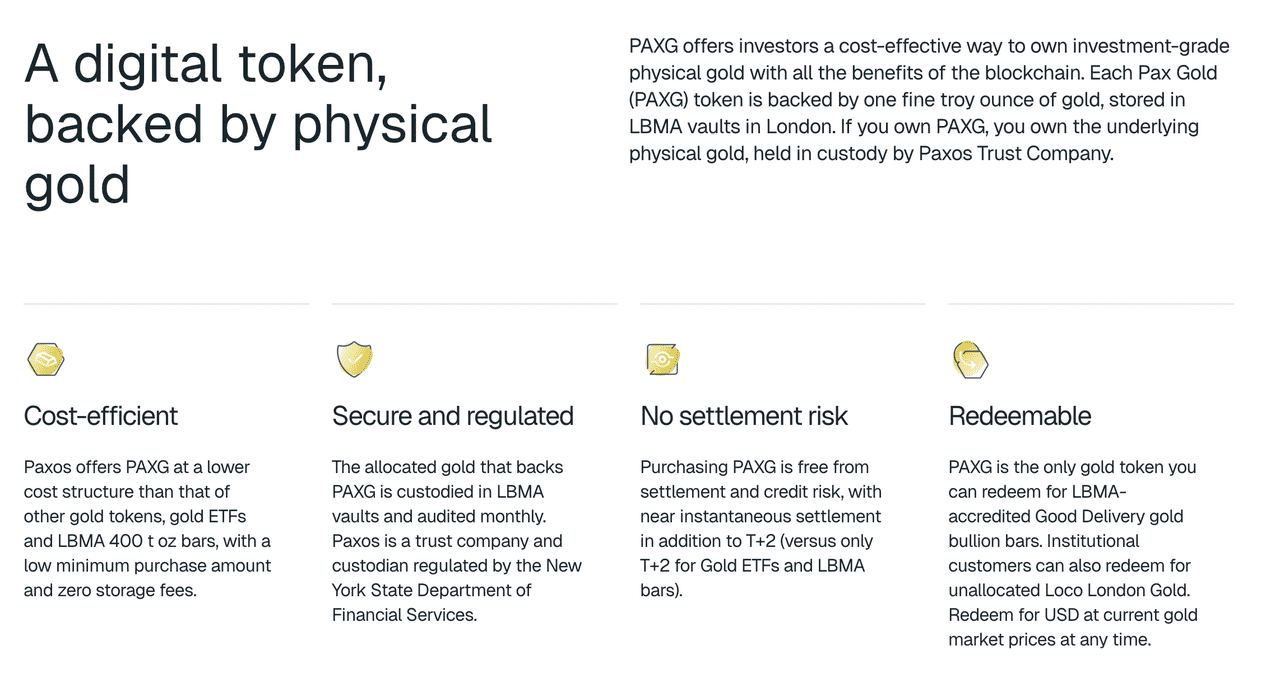

Launched by Paxos Trust Company on September 5, 2019, PAXG allows investors to own physical gold without the logistical hassles of storage, transport, or high minimum investments, all while enjoying the divisibility and 24/7 tradability of digital tokens. This innovation addresses key inefficiencies in gold ownership, such as settlement delays and custodial risks, making it an attractive option for both retail and institutional investors seeking portfolio diversification amid economic uncertainty.

How Does PAXG Work?

PAXG operates through a straightforward minting and redemption process managed by Paxos: when users purchase PAXG with fiat or crypto on the Paxos platform, equivalent physical gold is allocated from LBMA vaults, and tokens are minted on-chain in a 1:1 ratio; conversely, burning tokens allows redemption for physical gold bars, unallocated loco London gold (for institutions), or USD at current market prices, with near-instantaneous settlement to eliminate traditional T+2 delays. Holders can fractionally own gold down to 18 decimal places, starting from a minimum of 0.01 PAXG (about $20), and transfer tokens globally without storage fees or settlement risks, while Paxos handles vaulting and covers Ethereum gas fees for on-chain moves. This system combines the tangibility of physical assets with digital mobility, allowing users to trade PAXG on crypto exchanges or integrate it into lending protocols effortlessly.

The process generally works as follows:

1. Gold deposit: The issuer places LBMA-certified gold bars in a regulated vault such as Brink's or Malca-Amit.

2. Token creation: Verified gold is tokenized through smart contracts on a blockchain like Ethereum.

3. On-chain proof: The total supply and reserves are published for public audit to confirm each token's backing.

What Are PAXG Tokenomics?

The tokenomics of PAXG are designed for simplicity and alignment with physical gold reserves, maintaining a dynamic total supply that mirrors the circulating gold backing, currently fluctuating with market demand but always at a precise 1:1 ratio of one troy ounce per token, with no fixed cap to accommodate growth. Fractional divisibility enables micro-investments as low as 0.01 PAXG, democratizing access beyond the high minimums of traditional 400-troy-ounce LBMA bars, while fees are minimal: zero for storage and on-chain transfers (subsidized by Paxos), with small creation/destruction charges only on direct platform buys/sells, and standard trading fees on external exchanges. This cost-efficient model is free from the premiums of ETFs or futures which positions PAXG as a liquid, scalable vehicle for gold exposure with its market capitalization directly reflecting global gold prices and holder redemptions ensuring perpetual reserve integrity.

PAXG Security and Transparency

PAXG prioritizes security through Brink's LBMA-vaulted storage of allocated gold bars and monthly independent audits by firms like KPMG LLP (since February 2025) which verify reserves exceed token supply via AICPA standards, with all reports publicly available on the official PAXG website for real-time scrutiny. Token holders enhance personal transparency using the free Gold Allocation Lookup tool, entering their

Ethereum wallet address to instantly retrieve serial numbers, photos, and details of their specific backing gold, exclusive to

non-custodial wallets, while blockchain immutability prevents double-spending or unauthorized issuance. These security measures are combined with Paxos' role as a regulated custodian and lead to mitigating risks like those in unallocated gold schemes. These practices foster trust by ensuring every PAXG is fully backed, auditable, and redeemable without counterparty vulnerabilities. Each PAXG token is fully redeemable for physical gold and supported by publicly auditable bar serial numbers. PAXG stands out for its strong compliance framework, institutional custody standards, and seamless redemption process, making it one of the most trusted and legally robust ways to hold tokenized gold today.

How Is PAXG Regulated?

As the first regulated gold token, PAXG is issued and custodied by Paxos Trust Company, a New York-chartered trust entity under the stringent oversight of the New York State Department of Financial Services (NYDFS), which mandates comprehensive compliance, anti-money laundering protocols, and monthly reserve attestations to protect consumer assets. This regulatory framework distinguishes PAXG from unregulated stablecoins or tokens, enforcing segregated client accounts, capital requirements, and redemption rights that align with traditional financial standards, while enabling seamless integration into global crypto ecosystems. By adhering to these rules, Paxos not only shields investors from fraud or insolvency risks but also positions PAXG as a compliant gateway for institutions entering tokenized assets, with ongoing NYDFS supervision ensuring evolving standards meet blockchain's rapid innovations.

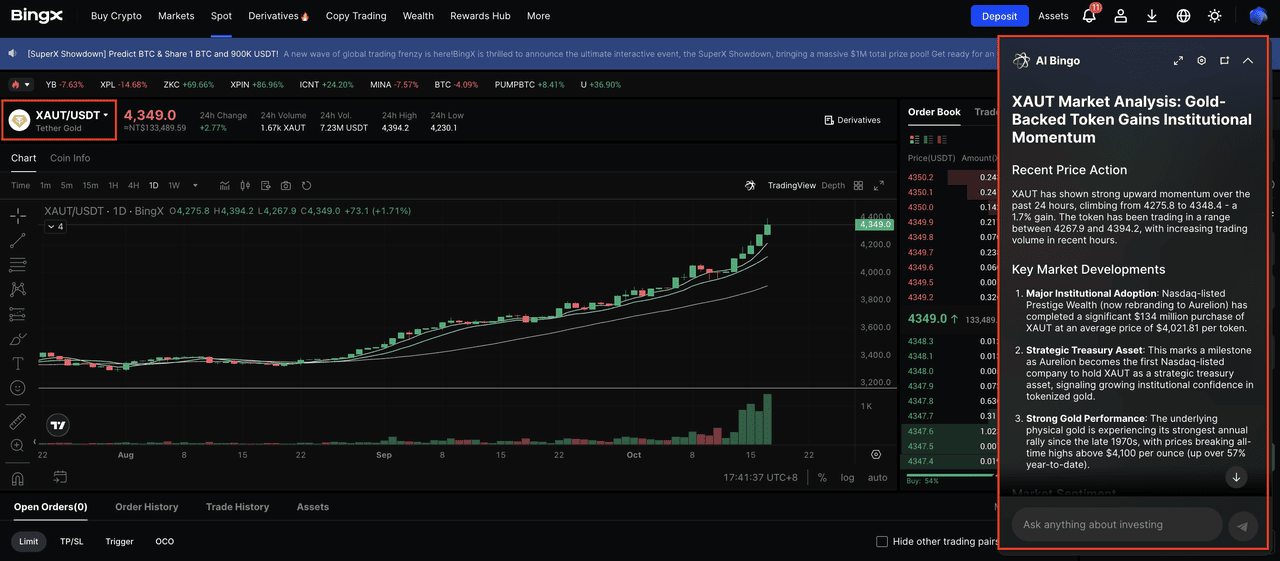

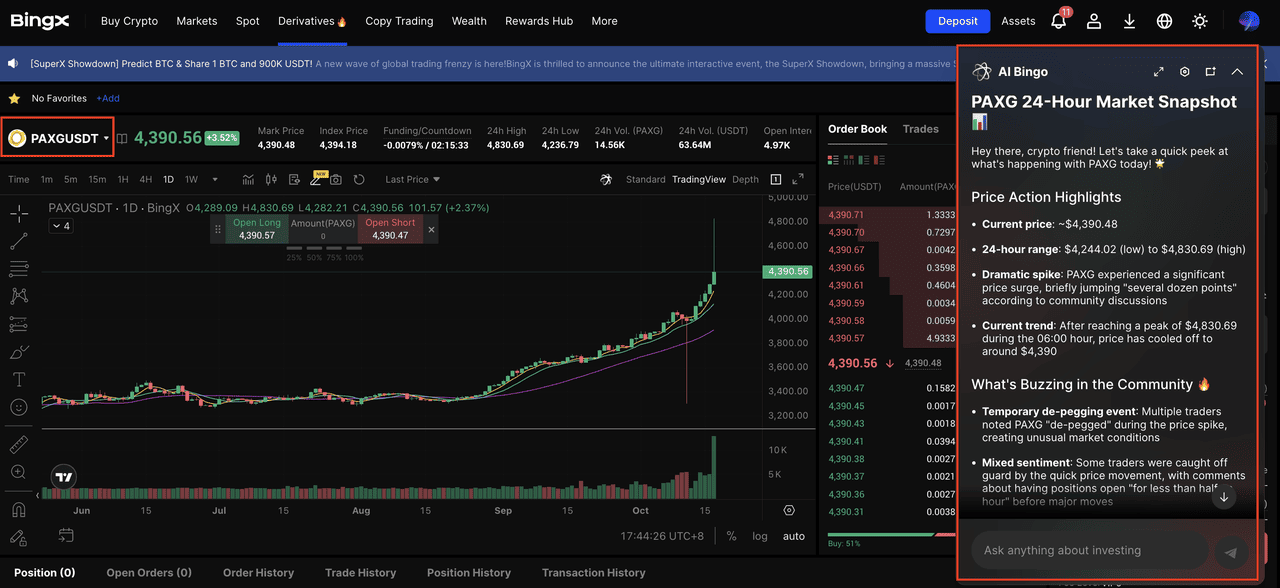

How to Buy and Trade PAXG on BingX

For those ready to add the stability of gold to their digital portfolio, BingX stands out as an ideal platform to purchase PAXG. BingX offers low trading fees, deep liquidity with robust market depth that minimizes

slippage and trading risks, and flexible buying options.

Whether you're investing for long-term stability or trading short-term movements in gold prices, BingX supports leading gold-backed cryptocurrencies like PAX Gold (PAXG), through both Spot and Futures Markets.

With

BingX AI integrated directly into the trading interface, you can access real-time insights, price analysis, and gold market forecasts to make more informed trading decisions.

1. Buy or Sell Gold-Backed Tokens on the Spot Market

If your goal is to accumulate gold-backed assets or take advantage of price dips, the

Spot Market is the most straightforward option.

Step 1: Go to the BingX Spot Market and search for your preferred trading pair, for example

PAXG/USDT.

Step 2: Click the AI icon on the chart to activate BingX AI, which displays support and resistance levels, detects potential breakout zones, and suggests entry points based on current price action.

Step 3: Choose between a Market Order for instant execution or a Limit Order at your preferred price. Once your trade is completed, your tokens will appear in your BingX balance, ready to hold or transfer to an external wallet.

2. Trade Gold-Backed Tokens with Leverage on Futures

For more active traders, the BingX

Futures Market allows you to trade gold-backed tokens with leverage, enabling profit opportunities in both rising and falling gold markets.

Step 1: Search for

PAXG/USDT in the BingX Futures Market.

Step 2: Click the AI icon on the chart to activate BingX AI, which analyzes price trends, volatility, and momentum in real time to assist with trade timing.

Step 3: Adjust your leverage level, set your entry price, and choose between a Long (Buy) or Short (Sell) position depending on your market outlook. Manage your position using

Stop-Loss and Take-Profit levels for better risk control.

Conclusion

PAX Gold reimagines gold ownership by merging blockchain efficiency with institutional-grade asset backing, offering a secure, transparent alternative to ETFs or physical bullion that eliminates barriers like high costs and illiquidity. With its regulatory clarity, fractional accessibility, and verifiable reserves, PAXG stands poised to anchor the tokenized real-world assets movement in decentralized finance, potentially transforming how investors hedge against volatility in an increasingly digital economy. As adoption grows, PAXG's blend of tradition and technology invites broader participation in gold's enduring value, prompting the question: in a world of fleeting trends, could this gold-standard token redefine wealth preservation for generations to come?

Related Reading