Bitcoin Cash (BCH) is a Layer-1,

proof-of-work (PoW) blockchain designed to do one thing extremely well: process fast, low-fee peer-to-peer payments at scale. It forked from

Bitcoin in August 2017 after a community split over how to solve Bitcoin’s congestion and high fees, and chose a different path: bigger blocks, higher throughput, and a focus on everyday transactions.

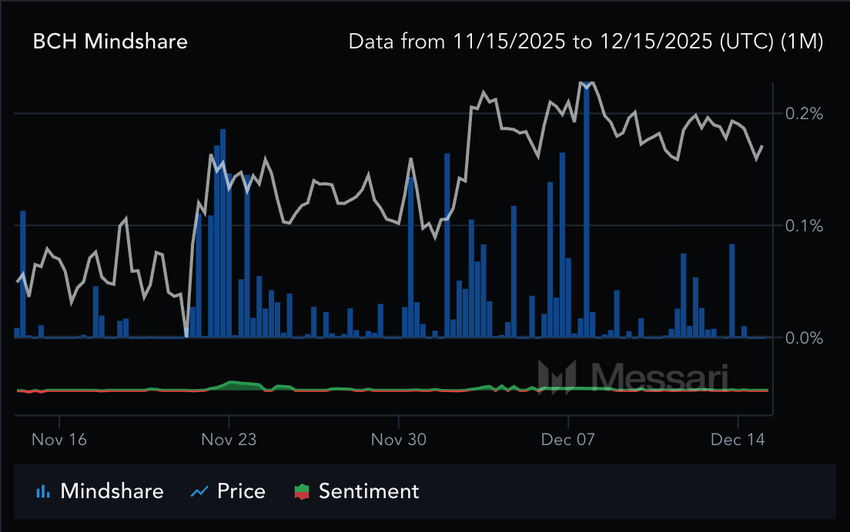

Bitcoin Cash's Mindshare on the rise | Source: Messari

In 2025, that simple design has put BCH back in the spotlight. Multiple datasets show Bitcoin Cash has gained nearly 40% this year, making it the best-performing major Layer-1 blockchain, while many other L1 tokens remain in deep negative territory.

This guide breaks down what Bitcoin Cash is, how its Layer-1 architecture works, why it’s outperforming other L1s in 2025, and how you can buy and trade Bitcoin Cash (BCH) on BingX spot and futures markets.

What Is Bitcoin Cash (BCH) Layer-1 Blockchain for Payments?

Bitcoin Cash (BCH) is a

Layer-1 blockchain built for fast, cheap, everyday payments, capable of processing far more transactions per second than Bitcoin thanks to its 32 MB block size (compared to Bitcoin’s original 1 MB). It uses the same PoW mining system and UTXO transaction model as Bitcoin, but keeps fees extremely low, often below $0.01 per transaction, and has a fixed supply of 21 million coins, released gradually through halvings around every 4 years. In simple terms, BCH is Bitcoin redesigned to behave like digital cash: quick to send, inexpensive to use, and scalable for global payments.

How Did Bitcoin Cash Start?

Bitcoin Cash was created in August 2017 after years of debate over Bitcoin’s scalability limits. At the time, Bitcoin’s 1 MB block size restricted throughput to around 3–7 transactions per second, causing network congestion and fees that frequently surged above $30 during peak periods. One group in the community supported off-chain scaling solutions like SegWit and

Lightning, while another argued for increasing Bitcoin’s block size to scale directly on-chain.

When consensus couldn’t be reached, the network split on 1 August 2017, creating a new blockchain, Bitcoin Cash (BCH), which launched with 8 MB blocks, which later expanded to 32 MB, and without SegWit. Anyone holding Bitcoin at the fork automatically received an equal amount of BCH.

Since launch, Bitcoin Cash has continued to evolve with:

• 32 MB block size (2018): enabling high-throughput payments.

• ASERT difficulty adjustment (2020): ensuring more stable 10-minute block times.

• CashTokens upgrade (2023): adding native tokens, NFTs, and covenant-based smart contracts directly on BCH Layer-1.

Bitcoin Cash today remains one of the longest-running blockchain networks focused specifically on peer-to-peer electronic cash for global use.

How Does Bitcoin Cash L1 Blockchain Work?

Under the hood, Bitcoin Cash looks very similar to Bitcoin, with key changes for scale.

1. UTXO Ledger and Transactions

Bitcoin Cash uses the UTXO (Unspent Transaction Output) model, where each wallet controls discrete chunks of BCH that must be fully spent and recreated in every transaction. When you send BCH, your wallet consumes one or more UTXOs and generates new outputs for the recipient and any remaining change. Nodes verify these transactions by checking digital signatures, ensuring the inputs haven’t been spent before, and validating them against consensus rules. Because UTXOs can be processed independently, BCH can validate thousands of transaction outputs in parallel, which supports its large 32 MB blocks and high-throughput design.

2. Proof-of-Work Mining (SHA-256)

Bitcoin Cash uses SHA-256 Proof-of-Work, the same mining algorithm as Bitcoin, meaning miners compete to solve cryptographic puzzles and add new blocks, up to 32 MB of transactions at a time, to the chain. Each valid block earns miners a block reward plus transaction fees, which together secure the network by making attacks financially prohibitive due to the high hash power required. Because BCH shares the SHA-256 ecosystem with BTC, miners can switch between chains based on profitability, ensuring BCH remains protected by one of the most mature mining industries in crypto.

3. Larger Blocks and Higher Throughput

The defining difference in Bitcoin Cash is its 32 MB block size, enabling significantly higher transaction capacity than Bitcoin’s 1 MB block limit. Stress tests have shown BCH can fit tens of thousands of transactions in a single block, compared with Bitcoin’s typical 1,000–1,500 transactions. This capacity keeps fees extremely low, often under $0.01, even during surges, making BCH practical for remittances, micro-payments, merchant payments, and high-frequency on-chain activity that would be too costly on Bitcoin.

4. Difficulty Adjustment and Halving

BCH targets a 10-minute block interval, adjusting mining difficulty automatically using the ASERT algorithm to maintain stable block times even when hash power fluctuates. Like Bitcoin, BCH undergoes a halving every 210,000 blocks, around 4 years, reducing new supply over time: 12.5 BCH at launch (2017), 6.25 BCH in April 2020, and 3.125 BCH after the April 2024 halving; the next halving in 2028 is expected to drop rewards to 1.5625 BCH. This predictable, decreasing emission schedule reinforces BCH’s fixed 21 million coin supply, supporting long-term scarcity.

5. Tokens and Smart Contracts on Bitcoin Cash

Although Bitcoin Cash began as a payments-only chain, it expanded its capabilities with CashTokens in 2023, a native token and smart contract upgrade enabling fungible tokens, NFTs, programmable vaults, covenant-based logic, and automated on-chain applications directly on L1, without needing a virtual machine. For developers needing Ethereum-style programmability, SmartBCH, an EVM-compatible sidechain, allows deployment of Solidity dApps using BCH as gas or collateral. Together, these upgrades preserve BCH’s fast, low-fee payments core while enabling new DeFi,

tokenization, and automation use cases.

Bitcoin Cash (BCH) vs. Bitcoin (BTC): Key Differences

Bitcoin Cash and Bitcoin share the same original codebase, PoW mining algorithm, and 21 million coin supply, but they diverge in scalability, fees, and intended use. Bitcoin prioritizes being a store of value, keeping its 1 MB block size and relying on Layer-2 networks like Lightning for faster payments. Bitcoin Cash, on the other hand, scales directly on-chain with 32 MB blocks, allowing it to process far more transactions per second and keep fees typically under $0.01, even during peak demand. As a result, Bitcoin is often treated as “digital gold,” while Bitcoin Cash functions more like digital cash, optimized for everyday spending, micro-transactions, and low-cost global transfers.

Key Features of Bitcoin Cash

Bitcoin Cash's key features | Source: Bitcoin Cash

1. Fast, Low-Fee Payments: Bitcoin Cash transactions broadcast within seconds and typically confirm within one block or around 10 minutes, while network fees consistently remain under $0.01, even during periods of high activity. This makes BCH practical for small purchases, global remittances, micro-transactions, and tipping, where high-fee chains become unusable.

2. High On-Chain Scalability: With a 32 MB block limit, 32× larger than Bitcoin’s original 1 MB cap, Bitcoin Cash can process significantly more data per block, with stress tests demonstrating up to 25,000 transactions in a single block. This high capacity keeps the network uncongested and fees low, although it requires more storage and bandwidth from full nodes.

3. Fixed Supply and Simple Tokenomics: BCH preserves Bitcoin’s hard-capped 21 million coin supply, with roughly 19.96 million BCH already in circulation by December 2025, leaving fewer than 1.1 million coins left to be mined. With no ICO, no foundation treasury, no VC allocations, and no vesting cliffs, BCH’s clean, fully circulating supply has become a key narrative driving investor interest in 2025.

4. Decentralized, Multi-Client Development: Bitcoin Cash is maintained by several independent node teams, including BCHN, Bitcoin Unlimited, and BCHD, reducing reliance on any single developer group and minimizing governance centralization. This multi-client model results in slower but more conservative upgrades, supporting BCH’s identity as a stable, predictable payments blockchain rather than a high-risk experimental platform.

Bitcoin Cash (BCH) Tokenomics Explained

Bitcoin Cash (BCH) follows a simple, transparent token model designed to mirror Bitcoin while supporting high-throughput payments. BCH is the native asset of the Bitcoin Cash Layer-1 blockchain, used to pay transaction fees, secure the network through mining, and function as peer-to-peer electronic cash.

Core Supply and Emissions

• Maximum supply: 21,000,000 BCH, permanently capped, with no ability to mint additional coins.

• Circulating supply: 19.96 million BCH as of December 2025, meaning over 95% of total supply is already mined, with fewer than 1.1 million coins remaining.

• Consensus mechanism: SHA-256 Proof-of-Work, where miners validate transactions and earn block rewards + fees.

• Block time: Around 10 minutes, similar to Bitcoin.

• Block reward: 3.125 BCH per block after the April 2024 halving; the next halving in 2028 will cut issuance to 1.5625 BCH.

• Halving cycle: Every 210,000 blocks or 4 years until the final BCH is mined around the year 2140, ensuring predictable, declining issuance.

This emission schedule mirrors Bitcoin’s scarcity model, making BCH a deflationary asset with decreasing supply pressure over time.

BCH Holder Distribution and Concentration

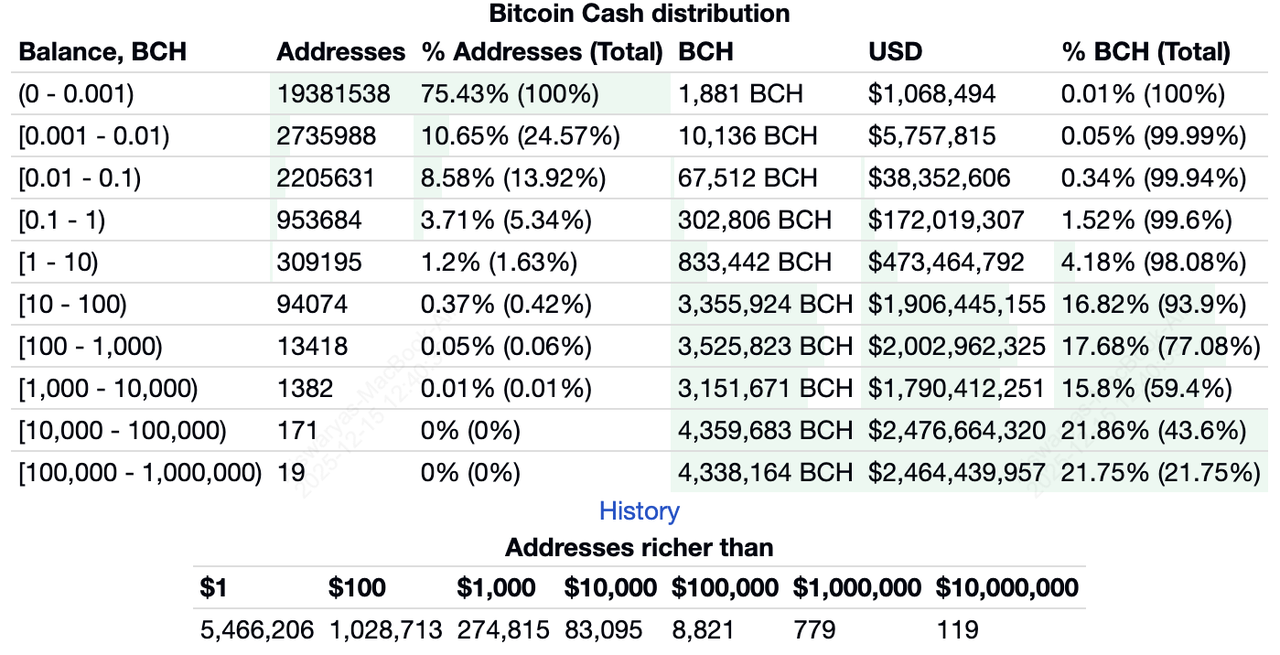

BCH holder distribution | Source: BitInfoCharts

On-chain data shows that Bitcoin Cash ownership is highly concentrated, with just 190 large wallets (10,000–1,000,000 BCH) collectively holding over 8.7 million BCH, or roughly 44% of the entire supply. By contrast, more than 96% of all BCH addresses each hold less than 1 BCH and together account for under 2% of supply, highlighting the extreme imbalance between small holders and large entities.

Many of the biggest wallets, often exchanges, custodians, or early adopters, remain dormant for long periods, which reduces liquid supply but also increases market sensitivity. This concentration can intensify price movements, enabling stronger rallies when large holders stay inactive while amplifying downside risk if any major wallet suddenly transfers or sells.

What Are the Real-World Use Cases of Bitcoin Cash?

Based on data from the official Bitcoin Cash ecosystem and multiple third-party analytics sources, Bitcoin Cash is actively used for:

1. Everyday Payments and Merchants: Bitcoin Cash is widely used for in-store and online payments because transactions cost less than a cent and settle quickly, making it cheaper than credit cards that charge 2–3% fees. Many merchants also offer BCH-only discounts because they avoid chargebacks and reduce payment processing costs.

2. Global Remittances: BCH enables international transfers to arrive in minutes instead of the multiple days required by traditional banks or remittance services. With fees typically under $0.01, users can send cross-border payments at a fraction of the cost of services like Western Union or SWIFT.

3. Micro-Payments and Tipping: Because BCH fees are so low, users can tip creators, streamers, and communities directly on-chain without losing money to platform fees. It also supports pay-per-download, pay-per-article, and machine-to-machine payments, which are impractical on higher-fee blockchains.

4. Token Ecosystem and On-Chain Apps: The CashTokens upgrade allows developers to create fungible tokens, NFTs, programmable vaults, and automated smart contract logic directly on Bitcoin Cash L1. For EVM-based applications, SmartBCH provides an

Ethereum-compatible environment where dApps run using BCH as gas or collateral.

5. Self-Custody “Digital Cash”: BCH users can store their funds in non-custodial wallets, giving them full control without relying on banks that may freeze accounts, censor transactions, or impose withdrawal limits. This makes Bitcoin Cash function like sovereign digital cash, aligning with the “be your own bank” principle.

Why Is Bitcoin Cash Outperforming Other Layer-1s in 2025?

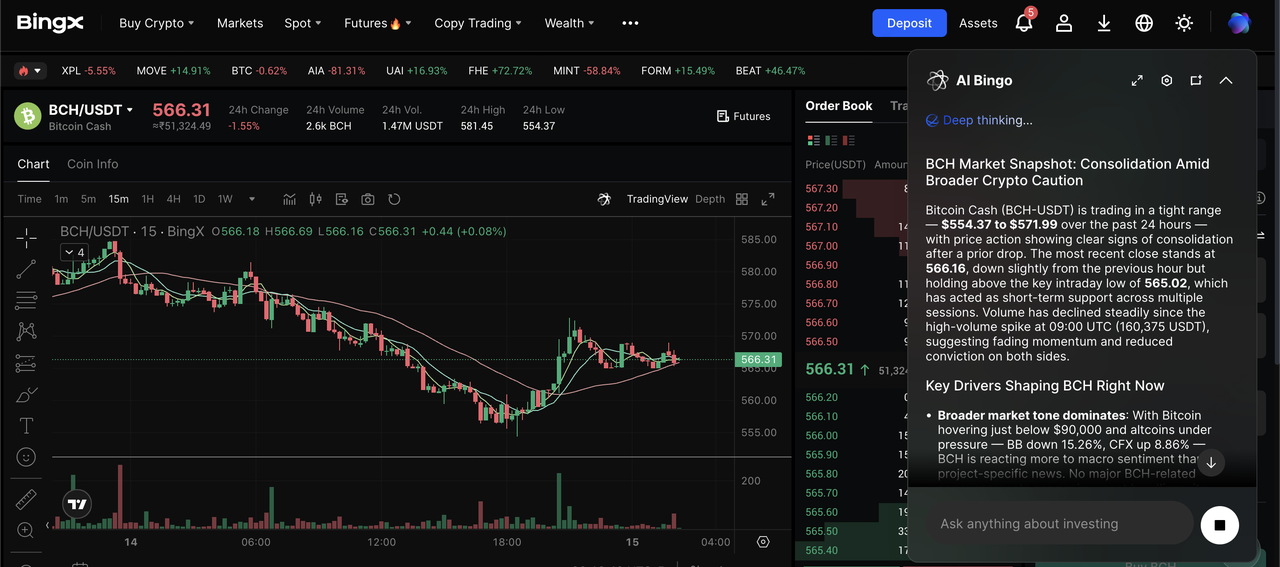

Bitcoin Cash (BCH) price chart | Source: BingX

Bitcoin Cash is outperforming other major Layer-1 blockchains in 2025 primarily because of its clean supply structure and minimal sell pressure. With no foundation treasury, no VC unlock schedules, and over 95% of BCH already in circulation, the market faces far less forced selling compared to newer L1s dealing with billions in token unlocks. This scarcity profile has become a key narrative driver as investors rotate away from complex tokenomics toward assets with transparent emission schedules and predictable halvings. Data from 2025 shows BCH up roughly 40% year-to-date, while many competing L1 tokens, such as

ETH,

SOL,

AVAX,

ADA, and

DOT, have posted steep double-digit declines. Adding to this momentum, mF International announced a $500 million private placement to launch a

digital asset treasury strategy centered on acquiring Bitcoin Cash, signaling one of the largest institutional commitments to BCH to date and reinforcing market confidence in its long-term viability.

At the same time, Bitcoin Cash continues to benefit from steady, incremental technical upgrades, such as improved node efficiency, scaling optimizations, and the CashTokens rollout, which enhance usability without introducing governance turmoil. Media coverage and analyst commentary highlighting BCH’s role as a low-fee "digital cash" alternative have also contributed to rising retail attention, especially as Bitcoin faces higher fees and growing reliance on Layer-2 solutions. Still, BCH’s strong performance comes with risks: its concentrated holder distribution means major wallet movements can trigger volatility, and institutional accumulation cuts both ways if sentiment shifts. As always, past performance is not indicative of future results, and investors should evaluate BCH according to their risk tolerance, research, and long-term thesis.

How to Trade Bitcoin Cash (BCH) on BingX

Bitcoin Cash is available on BingX Spot and Futures, giving you multiple ways to gain exposure to the top-performing Layer-1 payments chain, supported by

BingX AI for real-time market insights, automated analysis, and smarter trading decisions.

Buy or Sell BCH on BingX Spot

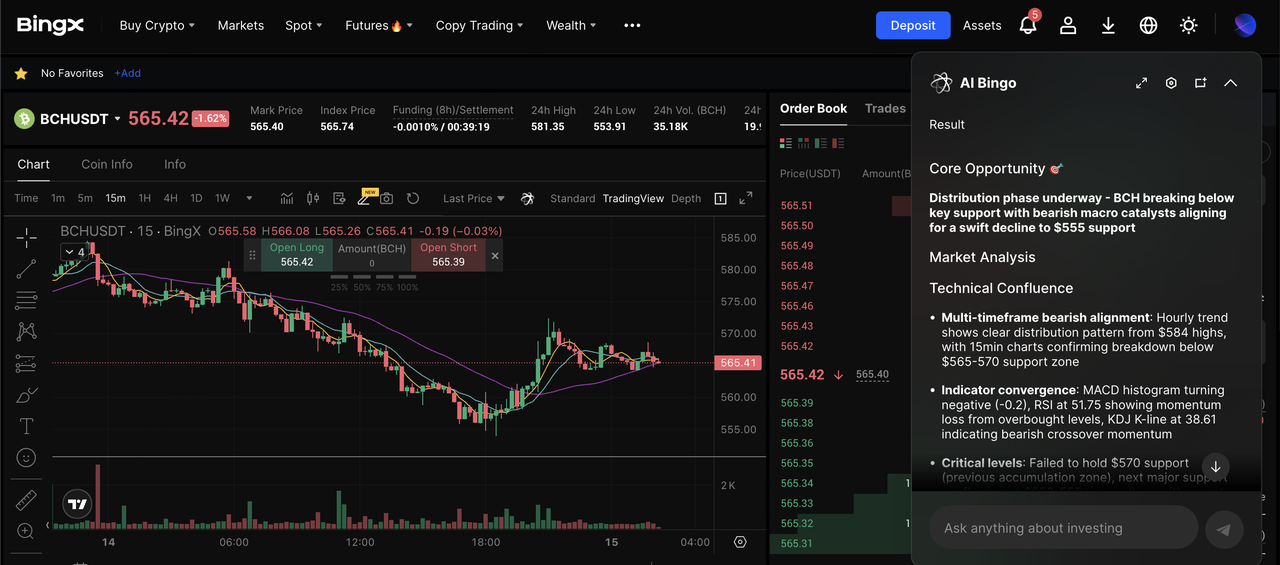

BCH/USDT trading pair on the spot market powered by BingX AI

You can trade BCH/USDT on the BingX Spot Market.

1. Create or log in to your BingX account.

3.

Deposit USDT or another supported asset into your Spot Wallet.

4. Go to Spot, search “BCH," and select

BCH/USDT trading pair.

5. Choose

Market Order for instant trading or Limit Order at your chosen price.

6. Confirm the trade and monitor your BCH position in your Spot Wallet.

You can also use BingX AI tools to analyze BCH price trends, set

auto-DCA plans, or follow sentiment insights directly from the trading interface.

Long or Short BCHUSDT Perpetual Futures

BCHUSDT perpetual contract on the futures market powered by BingX AI

For more advanced traders, BCHUSDT and BCHUSDC perpetual contracts are available on BingX Futures:

2. Transfer USDT from your Spot Wallet to your Futures Wallet.

4. Choose margin mode (Cross or Isolated) and set your leverage.

5. Decide whether to go long (bullish) or short (bearish) based on your outlook.

BingX also supports

copy trading, allowing you to follow experienced BCH futures traders, but you should still understand the risks of leverage and high volatility.

Risks and Limitations to Consider Before Buying Bitcoin Cash (BCH)

Before investing in BCH, it’s important to understand its trade-offs:

1. Limited DeFi and dApp Ecosystem: BCH has far less DeFi and NFT activity than chains like Ethereum or

Solana. SmartBCH and CashTokens are growing, but still small.

2. Competition from L2s and Stablecoins: Cheap payments now exist on

Bitcoin L2s,

stablecoins, and alt L1s, which may limit BCH’s total addressable market.

3. Hash Power Competition: Since BCH shares SHA-256 with Bitcoin, it competes with

BTC miners for hash power. Sustained low fees and block rewards could pressure miner profitability long term.

4. Holder Concentration: Large wallets controlling a big share of BCH supply can create liquidity and governance risks if a few entities are very active.

Final Thoughts: Should You Buy Bitcoin Cash (BCH)?

Bitcoin Cash offers a clear value proposition as a payments-focused Layer-1 blockchain, combining simple tokenomics, low-fee transactions, and a mature PoW network that has remained operational for more than eight years. Its strong performance in 2025, supported by clean supply dynamics and growing market interest, reflects renewed confidence in assets with predictable emission schedules and practical real-world utility.

However, BCH also operates in a competitive landscape shaped by fast-growing

L2 networks, stablecoins, and ecosystems with deeper smart-contract functionality. Holder concentration and shared hash power with Bitcoin can introduce additional volatility. If you choose to gain exposure, BingX offers flexible ways to trade and manage BCH positions. As always, cryptocurrencies are highly volatile, and you should only invest what you can afford to lose while relying on careful research and risk management.

Related Reading