Bitcoin mining scams remain one of the most persistent and costly forms of crypto fraud. As mining becomes more technical, capital-intensive, and opaque to beginners, scammers exploit the complexity to sell fake services, nonexistent hardware, and impossible returns.

Total losses from cloud mining scams | Source: CoinLaw

By 2026, mining-related fraud is no longer limited to shady websites; it now spans cloud-mining Ponzi schemes, fake mobile apps,

phishing stores impersonating ASIC manufacturers, and cryptojacking malware that silently hijacks devices. According to industry data from CoinLaw,

cloud-mining–style scams alone defrauded investors of more than $500 million in 2024, contributing to a broader crypto-fraud landscape where scam and fraud flows topped at least $9.9 billion on-chain in 2024 and investors lost nearly $2.5 billion to hacks and scams in the first half of 2025. Such figures illustrate how pervasive and costly fraudulent mining operations have become, with regulators and blockchain analysts flagging thousands of scam platforms and millions in individual victim losses.

In this guide, you’ll learn what Bitcoin mining scams are, how they work, the most common scam types to watch for in 2026, and how to protect yourself when exploring mining or crypto investing.

What Is a Bitcoin Mining Scam and How Does It Work?

A Bitcoin mining scam is any fraudulent scheme that claims to generate BTC through mining but lacks real mining operations. Instead of earning Bitcoin through computational work, these platforms rely on deception, upfront fees, or new user deposits to pay earlier participants.

According to blockchain analytics and crypto-crime reports, scam and fraud flows in the broader cryptocurrency ecosystem have been massive in recent years, with an estimated $53 billion sent to fraud-related addresses since 2023 alone and Ponzi-style schemes like cloud-mining and high-yield scams collecting more than $24 billion in losses since 2014.

Meanwhile, individual Ponzi scams such as PlusToken alone are estimated to have taken between $2 billion and $2.9 billion from investors worldwide, significantly impacting markets when stolen BTC was liquidated. This data shows that mining-related and investment frauds have affected hundreds of thousands of users globally, contributing to billions of dollars in cumulative losses.

Legitimate Bitcoin mining requires:

• Specialized ASIC hardware

• Continuous electricity and cooling

• Participation in real mining pools

• Transparent operating costs and fluctuating profitability

Scam operations bypass all of this. They monetize trust, urgency, and technical confusion, not hash power.

Why Are Bitcoin Mining Scams Still Growing in 2026?

Mining scams continue to thrive for three reasons:

1. Earning BTC Mining Rewards are Harder Than Ever: After the 2024

Bitcoin halving, block rewards dropped to 3.125 BTC. At the same time, Bitcoin’s elevated price has boosted

BTC mining profitability, making it appear more lucrative, which allows scammers to exploit demand by marketing “easy” or “guaranteed” mining returns that ignore real-world costs and competition.

2. Cloud Mining Sounds Legitimate to Beginners: Renting hash power sounds simpler than buying hardware. Scammers exploit this by offering fake dashboards and guaranteed returns.

3. Crypto Payments Are Irreversible: Once

BTC or

USDT is sent to a scammer, recovery is extremely difficult. This makes mining scams highly profitable and low-risk for criminals.

What Are the Top Bitcoin Mining Scams to Beware of?

Bitcoin mining scams typically fall into a few repeatable patterns, such as cloud mining fraud, Ponzi-style “mining” platforms, fake apps, hardware phishing, and cryptojacking, each designed to exploit users who don’t have visibility into real mining economics or infrastructure.

1. Fraudulent BTC Cloud Mining Platforms

Fraudulent cloud mining remains the single most common Bitcoin mining scam heading into 2026, largely because it promises passive income without hardware, technical skills, or electricity costs.

These platforms claim users can “rent” hash power from remote data centers and receive daily BTC payouts. In reality, many own no mining rigs at all. Earnings shown on dashboards are either completely fabricated or temporarily paid using funds from new investors, a classic Ponzi structure.

A high-profile enforcement case involved VBit Technologies Corp. In December 2025, the U.S. SEC charged its CEO with defrauding roughly 6,400 investors, alleging the company sold hosting agreements for mining rigs that largely did not exist and misappropriated $48.5 million for personal use, including gambling and transfers to family members. As the SEC warned, these “

passive income” mining contracts qualified as securities because investors relied entirely on the operator’s efforts.

What Are the Common Red Flags of Bitcoin Cloud Mining Scams?

• Guaranteed daily or monthly returns

• “No-risk” or “fixed ROI” mining contracts

• Withdrawal fees labeled as tax, activation, or conversion charges

• No verifiable participation in public mining pools, e.g., no BTC.com or F2Pool data

2. Bitcoin Mining-Themed Ponzi Schemes

Some scams go further than fake cloud mining and operate as full-scale Ponzi schemes, using “Bitcoin mining” as a marketing story rather than an actual business.

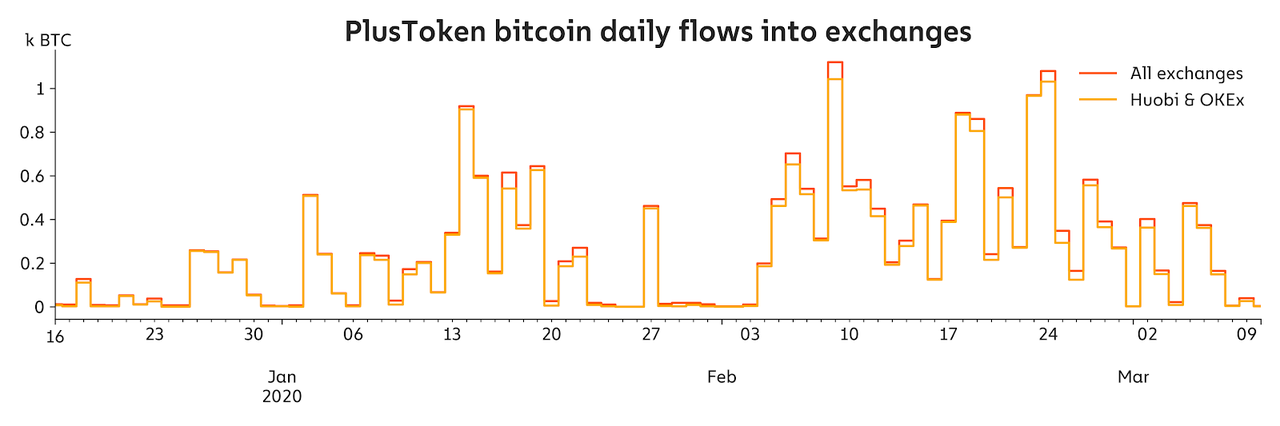

The most infamous example is PlusToken, which marketed itself as a

crypto wallet and mining platform promising returns of up to 30%. In reality, it had no legitimate operations. According to Chainalysis, the scheme accumulated over 180,000 BTC, 6 million ETH, and large amounts of USDT, assets that would be worth around $30 billion by 2025. Chinese courts later confirmed PlusToken was a pyramid scheme, and authorities seized nearly 195,000 BTC during the investigation.

PlusToken flows into exchanges | Source: Chainalysis

Notably, Chainalysis reported that the liquidation of PlusToken’s BTC through OTC desks directly impacted Bitcoin’s market price, showing how large mining-themed scams can affect the broader ecosystem.

By 2026, similar structures still follow the same pattern:

• Fake mining dashboards showing steadily rising “daily yield”

• Pressure to upgrade hash-power tiers to unlock higher returns

• Referral bonuses that reward recruitment more than mining output

Rule of thumb: If payouts depend on new deposits rather than block rewards, it isn’t mining; it’s a pyramid.

3. Fake Bitcoin Mining Apps on Mobile and Desktop

Example of a fake Bitcoin cloud mining provider website | Source: CCN

Fake Bitcoin mining apps continue to target beginners searching for terms like “

mine Bitcoin on phone” or “free BTC mining app.” These apps perform no real mining, generate revenue through ads, subscriptions, or data harvesting, and display fake BTC balances that cannot be withdrawn

Security researchers and app-store moderators have repeatedly removed apps such as BitFunds, Bitcoin Miner, and MineBit Pro after identifying them as fraudulent. However, new clones appear regularly under different names.

Critical red flag: If an app claims to

mine Bitcoin on a laptop or phone without ASIC hardware, it is not real mining. Modern Bitcoin mining requires specialized ASICs and industrial-grade cooling, something mobile devices physically cannot support.

4. Fake ASIC Hardware Sales and Phishing Stores

Another growing scam involves phishing websites impersonating real mining-hardware manufacturers, especially Bitmain. Scammers create near-identical websites advertising popular rigs like the Antminer S19 series, often at prices far below market value. Victims pay in Bitcoin or USDT and never receive the equipment.

Common tactics include:

• Slightly misspelled domains that mimic official vendors

• “Limited stock” countdown timers to create urgency

• Discounts that ignore real ASIC supply-demand economics

• Crypto-only payments with no buyer protection

Always verify domains carefully and avoid purchasing mining hardware through unsolicited links or social-media ads.

5. Cryptojacking and Malware-Based Mining

Cryptojacking is a silent mining scam where malware hijacks your device’s CPU or GPU to mine cryptocurrency for an attacker, without your knowledge or consent. This commonly occurs through:

• Fake mining software downloads

• Infected browser extensions

• Compromised public Wi-Fi networks

According to cybersecurity reports, cryptojacking can cause overheating, severe performance slowdowns, higher electricity bills, and permanent hardware damage. You earn nothing; the attacker keeps all mining rewards.

In short, cryptojacking doesn’t make you money. It turns your device into someone else’s mining rig.

How to Spot a Bitcoin Mining Scam: 7 Key Indicators

If you see any of the following red flags, walk away from a potential BTC mining scam:

1. Guaranteed profits or fixed ROI

2. Upfront fees to unlock withdrawals

3. Unverified or anonymous teams

4. Heavy referral or MLM focus

5. No proof of mining pool activity

6. Urgency tactics like “account expiring,” “last chance”

7. Communication via WhatsApp or Telegram only

Legitimate mining businesses do not need pressure tactics.

How to Protect Yourself From Bitcoin Mining Scams

Bitcoin mining scams rely on confusion and unrealistic expectations, but you can avoid most of them by understanding how real mining works and following a few simple safety rules before committing any money.

1. Avoid “Passive Mining” Promises: Bitcoin mining is an industrial operation that requires expensive ASIC hardware, constant electricity, and ongoing maintenance; there is no such thing as effortless, risk-free mining income. If a platform promises guaranteed profits with no work, no hardware, and no energy costs, it is almost certainly a scam.

2. Verify On-Chain Mining Activity: Legitimate miners can show proof of real activity, such as participation in known mining pools and wallet addresses receiving block rewards. If a platform cannot demonstrate verifiable on-chain mining data or refuses to share basic operational details, you should not trust it.

3. Never Pay Fees to Withdraw “Earnings:” A common scam tactic is claiming you have earned Bitcoin, then asking you to pay a “tax,” “activation fee,” or “conversion fee” to withdraw it. Real mining payouts do not require upfront payments; being asked to pay to access your own funds is a strong sign of fraud.

4. Secure Your Devices Against Mining Malware: Fake mining software and malicious websites can secretly hijack your device to mine crypto for attackers. Use reputable antivirus software, enable firewalls, keep your system updated, and avoid downloading mining tools or apps from unofficial sources, especially on public Wi-Fi.

5. Never Share Private Keys or Seed Phrases: Your private keys and recovery phrases give full control over your crypto and should never be shared under any circumstances. Legitimate mining platforms, wallets, and exchanges will never ask for your seed phrase, even for “verification” or “support.”

6. Use Trusted Platforms for Bitcoin Exposure: If your goal is simply to gain exposure to Bitcoin,

buying or trading BTC on a regulated exchange like BingX is usually safer and more transparent than experimenting with high-risk mining schemes. Mining carries operational, technical, and scam risks that many beginners underestimate.

How to Trade Bitcoin on BingX

BingX helps you analyze market trends, manage risk, and trade Bitcoin more confidently using real-time data, smart insights, and professional-grade tools, powered by BingX AI.

Buy and Sell Bitcoin Directly on Spot Trading

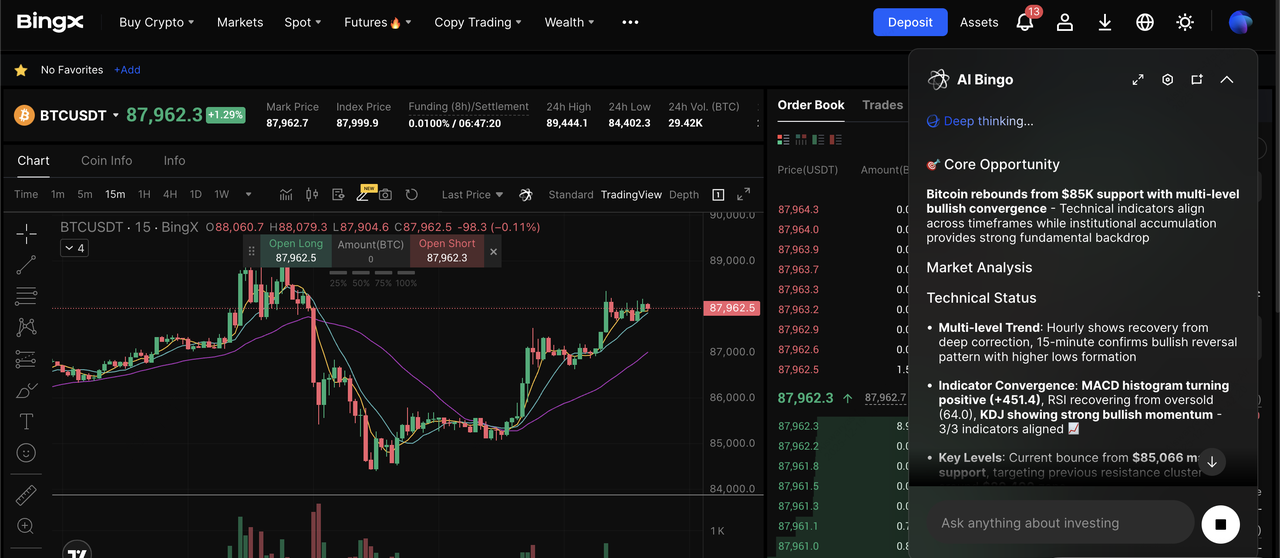

BTC/USDT trading pair on the spot market powered by BingX AI

BingX Spot Trading lets you buy and sell Bitcoin at real-time market prices and take direct ownership of BTC. You can place

market, limit, or conditional orders on

BTC/USDT, making spot trading ideal if you want straightforward exposure to Bitcoin without leverage or liquidation risk.

Long or Short Bitcoin With Leverage on Futures Trading

BTC/USDT perpetual contract on the futures market powered by BingX AI

BingX

Futures Trading allows you to trade Bitcoin price movements using leverage, enabling you to go long or short based on market conditions. With built-in risk controls, flexible leverage options, and AI-assisted insights,

BTC/USDT perpetual contract futures trading is designed for experienced traders who want to manage positions more actively.

Where to Report Bitcoin Mining Scams

If you encounter or fall victim to a Bitcoin mining scam, reporting it promptly can help authorities trace funds, shut down fraudulent platforms, and prevent others from being harmed. In the United States, you can submit detailed reports to the SEC Tips, Complaints, and Referrals portal for investment-related fraud and to the FBI’s Internet Crime Complaint Center (IC3) for online and crypto-enabled scams. In Australia, incidents involving crypto mining fraud or suspicious transactions should be reported to AUSTRAC, which monitors financial crime and money laundering risks.

Globally, you can also report scams to public Crypto Scam Tracker databases and your local financial regulator, as these reports are often shared with law enforcement and blockchain analytics firms to disrupt scam networks and recover stolen assets where possible.

Final Takeaways

Bitcoin mining scams are not disappearing in 2026, but are becoming more sophisticated. Fraudsters rely on technical complexity, fake dashboards, and guaranteed returns to lure victims.

If a mining opportunity promises easy profits, requires upfront withdrawal fees, or cannot prove real operations, it is almost certainly a scam. Mining is hard, competitive, and volatile by design. Understanding that reality is your strongest defense.

For more crypto safety guides, scam alerts, and beginner-friendly education, follow BingX Academy and stay informed before committing funds to any mining-related offer.

Related Reading