Circle

tokenized stocks are on-chain representations of Circle Internet Group’s publicly listed shares, designed to give investors digital, fractional exposure to Circle’s stock performance. Following

Circle’s IPO in June 2025, products such as

CRCLX (xStocks) and

CRCLON (Ondo) have emerged as crypto-native alternatives to traditional stock investing.

Through platforms such as BingX, users can access Circle tokenized stocks directly from a crypto exchange, trading them with

USDT without opening a U.S. brokerage account.

Circle is best known as the issuer of

USD Coin (USDC), one of the world’s largest regulated

stablecoins, and has become a key infrastructure provider in the global crypto financial system. Beyond stablecoin issuance, Circle has expanded into payments, treasury management, and cross-border settlement, positioning itself as a core layer for digital dollar movement as stablecoins gain adoption across both crypto markets and traditional finance.

What Is Circle (CRCL) and What Does Circle Do?

Source: Circle Official Site

Circle Internet Group is a U.S.-based financial technology company that focuses on digital dollars, blockchain-based payments, and on-chain financial infrastructure. Founded in 2013, Circle is best known as the issuer of USD Coin (USDC), one of the largest and most widely used U.S. dollar–backed stablecoins in the global crypto market.

USDC is designed to maintain a 1:1 peg with the U.S. dollar and is widely used across centralized exchanges,

decentralized finance (DeFi) protocols, payment platforms, and institutional settlement systems. Circle positions USDC as a

regulated, transparent digital dollar, with reserves primarily held in cash and short-duration U.S. Treasury assets.

Beyond stablecoin issuance, Circle provides a broader suite of blockchain-native financial services, including:

• Programmable payments and treasury tools: Enable businesses to manage, move, and automate digital dollar flows using USDC across blockchain networks.

• On-chain settlement infrastructure: Supports faster and more efficient global transactions by settling payments directly on public blockchains.

• APIs and developer tools: Allow developers and enterprises to integrate USDC and blockchain-based payments into their applications and financial systems.

Circle operates at the intersection of traditional finance and Web3, serving crypto exchanges, fintech firms, enterprises, and institutions seeking compliant access to digital dollar infrastructure. This role has made Circle a key player in the stablecoin ecosystem and a central beneficiary of growing demand for regulated, dollar-backed on-chain assets.

Circle Stock Price Analysis: June 2025 IPO, YTD Performance, and 2026 Outlook

Circle Internet Group, the issuer of the USDC stablecoin, went public on June 5, 2025, listing on the NYSE under the ticker CRCL. Priced at $31, the stock surged 168% on its first trading day, closing at $83.23 and raising more than $1.1 billion, giving Circle a market capitalization above $16 billion. The IPO reflected strong institutional demand for regulated stablecoin and digital payment infrastructure.

After the initial rally, CRCL entered a consolidation phase. As of December 18, 2025, the stock is trading around $79, with a YTD decline of roughly 4%. The price action shows a typical post-IPO pattern, with early momentum giving way to profit-taking and more fundamentals-driven valuation in the second half of the year.

Several factors influenced Circle’s YTD performance:

• Post-IPO volatility as the market moved through price discovery

• Interest rate sensitivity, given Circle’s reliance on yield from USDC reserves

• Broader repricing of crypto-related equities during late 2025

Looking into 2026, Circle’s stock performance will likely hinge on continued USDC adoption, expansion of the Circle Payments Network (CPN), and regulatory clarity around stablecoins. While competition in the stablecoin and payments space is increasing, Circle’s compliance-first positioning may support longer-term growth.

Circle’s public listing also enabled tokenized stock products such as CRCLX (xStocks) and CRCLON (Ondo), allowing crypto-native investors to gain on-chain exposure to CRCL as the stock transitions from IPO momentum to mature market pricing.

What Are Circle Tokenized Stocks CRCLx and CRCLon and How Do They Work?

Circle tokenized stocks are blockchain-based assets designed to track the price performance of Circle Internet Group’s publicly traded shares (CRCL). Instead of holding the stock through a traditional brokerage account, investors gain on-chain, fractional economic exposure via digital tokens that mirror CRCL’s market price. These products are built for crypto-native users who prefer stablecoin settlement, extended trading access, and lower entry sizes.

In practice, tokenized stocks function as price-tracking instruments, not direct equity ownership. Holders do not receive shareholder rights such as voting or dividends, but the token’s value is designed to move in line with Circle’s stock price based on the issuer’s backing and pricing mechanisms.

There are two main Circle tokenized stock formats available in the market:

What Is CRCLX Tokenized Circle Stock by xStocks?

CRCLX is part of the

xStocks ecosystem, which focuses on bringing U.S. equities on-chain in a simplified, crypto-native format. These tokens are typically issued on blockchains such as

Solana or

Ethereum, allowing fast settlement and easy integration with wallets and DeFi tools. CRCLX tracks Circle’s share price and is designed for trading, portfolio exposure, and on-chain accessibility rather than long-term equity ownership.

What Is CRCLON Tokenized Stock for Circle by Ondo?

CRCLON is issued under

Ondo Finance’s tokenized equity framework, which emphasizes institutional-grade structuring and alignment with regulated custodians. Like CRCLX, CRCLON provides economic exposure to Circle’s stock price without conferring shareholder rights. Ondo’s model is often positioned toward investors seeking tokenized exposure that closely follows traditional market pricing and custody standards.

| Feature |

CRCLX (xStocks) |

CRCLON (Ondo) |

| Issuer |

xStocks |

Ondo Finance |

| Structure |

Crypto-native tokenized stock |

Institutionally structured tokenized stock |

| Blockchains |

Solana, Ethereum |

Ethereum (and supported networks) |

| Primary Use Case |

On-chain price exposure to Circle (CRCL) |

On-chain price exposure to Circle (CRCL) |

| Shareholder Rights |

None |

None |

At a high level, both CRCLX and CRCLON share the same core mechanics:

• Price tracking: Designed to reflect CRCL’s market price movements

• Fractional access: Investors can buy small amounts without purchasing a full share

• Crypto-native settlement: Trades are typically settled using stablecoins like USDT

• No shareholder privileges: No voting rights, dividends, or direct equity ownership

For crypto investors, Circle tokenized stocks represent a bridge between public equities and on-chain finance, enabling exposure to a major stablecoin infrastructure company without leaving the crypto ecosystem.

How to Buy Circle Tokenized Stocks CRCLX and CRCLON on BingX

BingX supports trading for selected tokenized stocks, allowing users to gain price exposure to U.S. equities like Circle Internet Group without using a traditional brokerage account. On BingX, users can access Circle-related exposure through spot tokenized stocks such as CRCLX (xStocks) and CRCLON (Ondo), as well as Circle stock price–linked futures.

Availability may vary by region and regulatory requirements, and product offerings can differ between spot and futures markets.

1. Buy Circle Tokenized Shares CRCLX, CRCLON on BingX Spot

If you prefer 24/7 access, fractional exposure, and a crypto-native trading experience, you can buy Circle tokenized stocks directly on

BingX Spot using USDT.

Step 2: Deposit USDT or supported assets: Transfer USDT or other supported stablecoins into your BingX wallet. Confirm the correct blockchain network and review any deposit minimums or fees before proceeding.

Step 3: Search for Circle tokenized stocks in Spot Trading: Navigate to the Spot market and search for

CRCLX/USDT or

CRCLON/USDT, depending on availability. Review the real-time price, order book depth, and recent trading activity.

Step 4: Use BingX AI to assess market conditions: Before placing an order, you can ask

BingX AI about recent price trends, key support or resistance levels, or short-term market sentiment related to Circle’s stock.

Step 5: Place your buy order: Choose between a

market order for immediate execution or a limit order to set your preferred entry price. Enter the purchase amount and confirm the trade.

Once completed, Circle tokenized stocks will appear in your BingX spot wallet and can be held alongside other crypto assets.

For users seeking leverage, directional exposure, or hedging strategies,

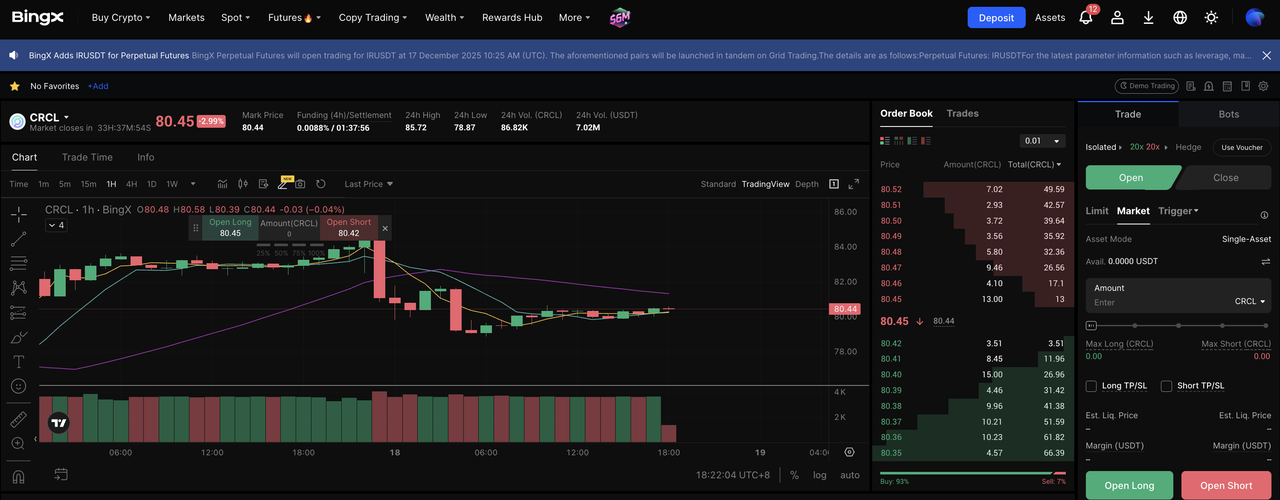

BingX Futures offers Circle stock price–linked futures, which allow traders to speculate on Circle’s stock price movements without holding the spot tokenized stock.

Step 1: Enable futures trading: Log in to your BingX account, complete KYC verification, and transfer USDT or supported collateral into your Futures wallet.

Step 2: Open the Circle stock price–linked futures market: Search for the

CRCL-USDT perpetual contract and review leverage options, funding rates, and margin requirements before entering a position.

Step 3: Use BingX AI to evaluate volatility and sentiment: Ask BingX AI about recent volatility, trend direction, or sentiment shifts to better understand potential entry points.

Step 4: Choose long or short with your preferred leverage: Go long if you expect Circle’s stock price to rise, or short if you anticipate a decline. Adjust leverage carefully based on your risk tolerance.

Risks and Considerations Before Investing in Tokenized Circle Stock

Before investing in Circle tokenized stocks such as CRCLX (xStocks) or CRCLON (Ondo), investors should be aware of several key risks related to both the tokenized structure and Circle’s business model.

• Regulatory uncertainty: Tokenized stocks are subject to changing regulations, and availability may vary by region or platform.

• No shareholder rights: These products provide price exposure only and do not include dividends, voting rights, or shareholder protections.

• Liquidity and pricing risk: Lower trading volumes may lead to wider spreads or price deviations from the underlying stock.

• Platform and custody risk: Investors depend on exchange operations and custodial structures to maintain access and price tracking.

• Interest rate sensitivity: Circle’s revenue is closely tied to interest earned on USDC reserves, making performance sensitive to rate changes.

• Rising competition: Increasing competition from stablecoin issuers and fintech firms may pressure Circle’s long-term growth.

Overall, Circle tokenized stocks are best suited for investors who understand both the structural limitations of tokenized equities and the business risks tied to stablecoin-based revenue models.

Circle tokenized stocks such as CRCLX (xStocks) and CRCLON (Ondo) provide price exposure to Circle Internet Group’s publicly traded shares without requiring a traditional brokerage account. They offer fractional access and USDT-based trading, making them practical for crypto-native or international investors who want equity-linked exposure within the crypto ecosystem.

The investment case, however, is ultimately about Circle itself. Circle is increasingly viewed as a financial infrastructure company, with its business centered on USDC, one of the largest regulated stablecoins. Revenue is mainly driven by interest on reserves and enterprise payment services, positioning Circle to benefit from long-term growth in digital payments and on-chain settlement.

Tokenized stocks should be seen as access tools rather than equity ownership. They do not include dividends, voting rights, or shareholder protections, and pricing may be affected by platform liquidity in addition to the underlying stock.

Overall, Circle tokenized stocks may suit investors seeking crypto-native exposure to a stablecoin infrastructure company, while traditional equity investors may prefer holding CRCL directly through stock markets.

Related Reading

FAQs on Circle Tokenized Stocks

1. What is the difference between CRCLX and CRCLON tokenized stocks?

CRCLX is issued under the xStocks framework, while CRCLON is issued by Ondo. Both are designed to track Circle’s stock price, but they may differ in issuer structure, supported blockchains, and liquidity depending on the platform.

2. Do Circle's tokenized stocks pay dividends?

No. Circle tokenized stocks provide price exposure only. They do not include dividends, voting rights, or any traditional shareholder benefits.

3. Is CRCLX or CRCLON the same as owning CRCL shares?

No. Holding CRCLX or CRCLON does not mean you own Circle stock. These tokens are equity-linked instruments, not direct equity ownership.

4. Can I trade Circle tokenized stocks outside U.S. market hours?

Yes. Tokenized stocks on crypto exchanges can often be traded beyond traditional U.S. stock market hours, although price movements are still influenced by U.S. market activity.

5. What is the difference between spot tokenized stocks and stock price–linked futures?

Spot tokenized stocks (CRCLX, CRCLON) track Circle’s price and can be held in your portfolio. Stock price–linked futures (CRCL) are derivatives used for leveraged trading or hedging and do not involve holding the tokenized stock.

6. Are Circle tokenized stocks available in all regions?

No. Availability depends on local regulations, platform policies, and user eligibility. Always check whether the product is accessible in your jurisdiction before trading.

7. Is investing in Circle tokenized stocks risky?

Yes. Like all equity-linked and crypto products, they carry risks including market volatility, liquidity constraints, regulatory changes, and platform-related risks.