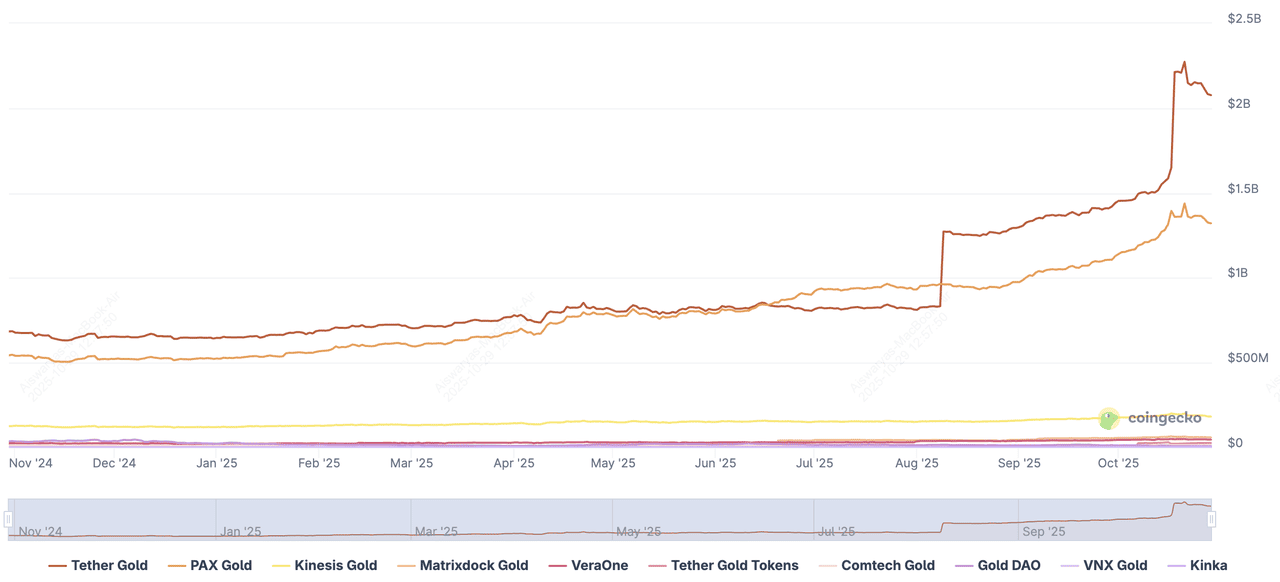

The rally has also ignited explosive growth in tokenized gold within the crypto market. According to CoinGecko, the tokenized gold market cap has swelled to over $3.7 billion, with daily trading volume crossing $1 billion.

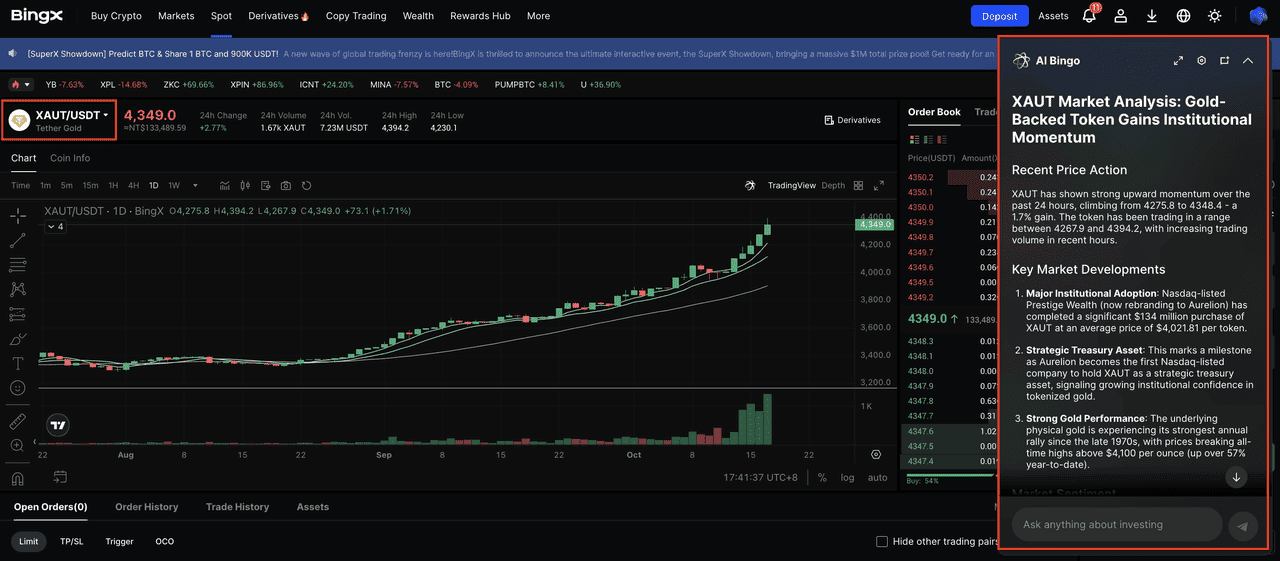

Tether Gold (XAUT) now leads the sector, backed by more than 375,000 ounces, around 11.6 metric tons, of physical gold stored in Swiss vaults under El Salvador’s Digital Asset Issuance Law, pushing its market value toward $2.1 billion.

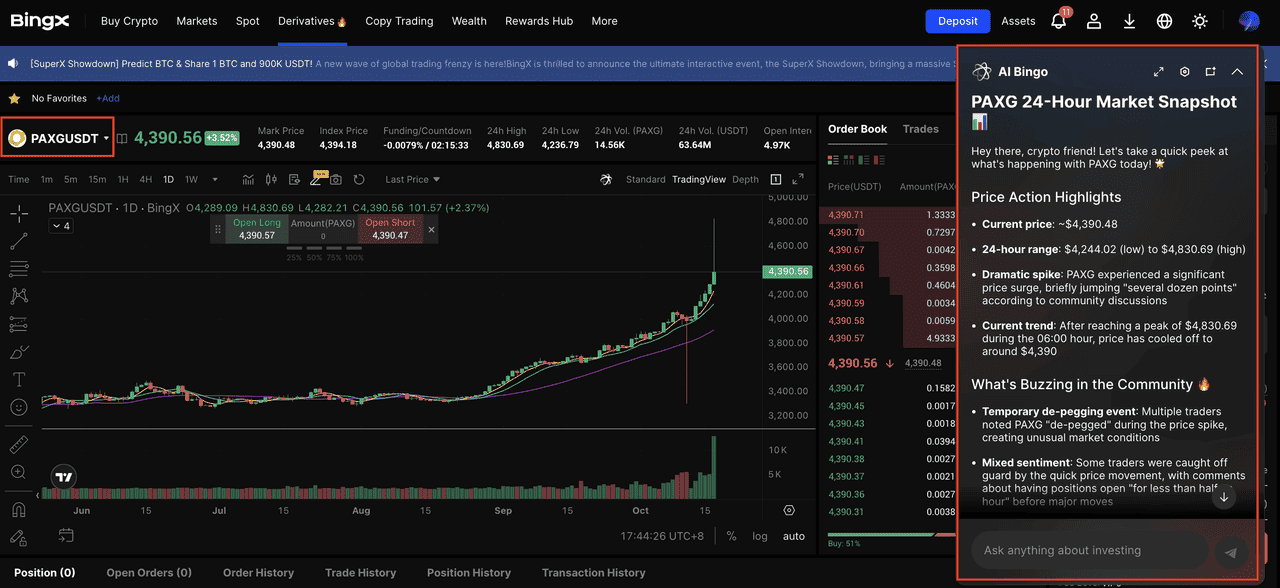

PAX Gold (PAXG) continues to trail closely, as regulated digital ownership and on-chain audits attract both retail and institutional demand.

In this article, we’ll break down the top 10 tokenized gold cryptos of 2025, and examine how each project bridges real-world assets with decentralized finance, instant settlement, fractional ownership, and 24/7 global liquidity.

What Is a Gold-Backed Crypto Token and How Does Tokenized Gold Work?

Gold-backed crypto tokens are digital assets that represent verifiable ownership of physical gold held in secure, audited vaults. Each token is typically pegged 1:1 to a specific weight of gold, most commonly one troy ounce, the standard used by Tether Gold (XAUT) and PAX Gold (PAXG). This means holders can trade the token on exchanges or redeem it for the underlying metal, depending on the issuer’s terms.

How Tokenized Gold Tokens Work

1. Physical gold acquisition: The issuer purchases LBMA-certified bars and stores them in regulated vaults such as Brink’s, Malca-Amit, or Swiss facilities. As of September 2025, Tether confirmed 375,572 ounces, around 11.6 tons, backing XAUT, held in Switzerland.

2. Token minting on blockchain: Each unit of vaulted gold is tokenized via smart contracts, most commonly on Ethereum (ERC-20) or Tron (TRC-20), creating a transparent on-chain record.

3. 1:1 reserve verification: Tokens in circulation must match the exact amount of physical gold held in custody. Leading issuers publish audits and attestation reports, allowing the public to verify reserves at any time.

4. Redemption and burning: Tokens can be redeemed for physical gold, often in minimum redemption units such as 430 ounces, or converted to cash. Redeemed tokens are burned to maintain the peg.

This structure blends gold’s role as a safe-haven asset with crypto’s advantages, including fractional ownership, 24/7 global liquidity, and low-cost transfers. It also increases accessibility: investors in emerging markets who cannot open metal accounts or buy ETFs can hold tokenized gold in a regular crypto wallet.

Why Did Gold Price Surge to Record Highs in October 2025?

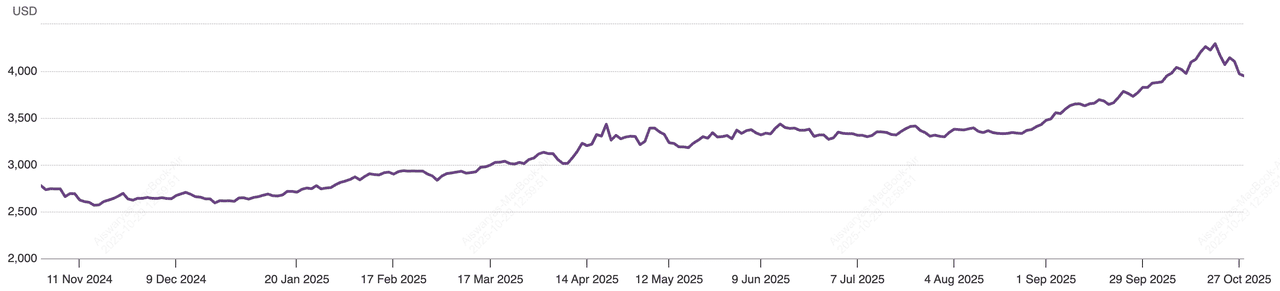

Gold has entered one of its strongest rallies in modern history. As of October 17, 2025, spot gold set a new all-time high of $4,391.49 per ounce, gaining more than 17% in 30 days before consolidating in the $4,100–$4,400 range. This surge pushed gold’s total market capitalization above $30 trillion, surpassing NVIDIA, Apple, Microsoft, and

Alphabet combined.

Bitcoin also touched a fresh high above $126,000 in October, but gold outperformed most risk assets, signaling that investors still favor physical and tokenized gold during periods of macro uncertainty.

Top 5 Factors Behind Gold Prices Spiking

Gold price performance over the past year | Source: World Gold Council

1. U.S. government shutdown and fiscal stress: The shutdown that began on October 1 triggered concerns around debt sustainability, pushing investors toward safe-haven assets.

2. Rate-cut expectations and sticky inflation: With inflation still above target and recession fears rising, markets now expect the Federal Reserve to begin an easing cycle; lower real yields historically strengthen gold demand.

3. Weakening U.S. dollar: The dollar index fell to multi-month lows, making gold cheaper for foreign buyers and adding upward price pressure.

4. Central bank accumulation: Nations including China, Russia, Turkey, and Middle Eastern reserve funds continue adding gold, purchasing more than 100 tons in recent quarters as they diversify away from U.S. Treasuries.

5. Geopolitical and trade tensions: Conflicts in key regions and deteriorating global trade conditions have fueled a flight to hard assets. Institutional investors are allocating more to physical bullion and tokenized gold as defensive positioning.

Gold Price Prediction: How High Could the Precious Metal Go?

Analysts remain bullish. Forecasts from ANZ and other commodity desks suggest gold could retest $4,400 by year-end and potentially reach $4,600 by mid-2026 if monetary easing and geopolitical risks persist. While technical charts show short-term overbought signals, momentum and sentiment remain firmly in gold’s favor.

Top 10 Gold-Pegged Cryptos to Watch in 2025

The tokenized gold sector has expanded rapidly alongside spot gold’s record rally. As of late October 2025, the market capitalization of gold-backed cryptocurrencies has surged to over $3.7 billion, supported by rising demand for audited, on-chain reserves and frictionless global trading. With spot gold hitting an all-time high of $4,391.49 per ounce on October 17, 2025, tokenized gold is becoming one of the fastest-growing

real-world-asset (RWA) categories in crypto.

Below are the largest tokenized gold projects by market capitalization, based on late-October 2025 market data:

3. Kinesis Gold (KAU)

Market Cap: $183 million as of late October 2025

Kinesis Gold (KAU) turns physical gold into a yield-bearing digital currency. Each token is backed 1:1 by allocated, audited bullion stored in global vaults, while users earn micro-yields from transaction fees within the Kinesis Monetary System. This model allows holders to benefit from both gold price appreciation and passive income, positioning KAU as one of the few tokenized gold assets with built-in rewards. With growing adoption in emerging markets and active exchange listings, KAU appeals to investors seeking security, liquidity, and yield in a single asset.

4. Matrixdock Gold (XAUM)

Market Cap: $59.8 million as of late October 2025

Matrixdock Gold (XAUM) provides institutional-grade tokenization with independently verified proof-of-reserves, transparent custody, and audited supply data. Operated from Singapore, XAUM targets professional traders, asset managers, and fintech platforms seeking compliant, on-chain exposure to gold without the complexity of physical storage. Its emphasis on regulatory alignment and real-time asset verification makes XAUM a trusted gateway for institutions entering the RWA gold market, even as the broader sector approaches $4 billion in capitalization.

5. VeraOne (VRO)

Market Cap: $46.8 million as of late October 2025

VeraOne (VRO) offers a regulated European path to digital gold ownership, backed by fully audited bullion held in secure French vaults. Unlike ounce-based tokens, VRO is denominated in grams, giving retail users an accessible entry point into gold markets with small unit purchases. Through euro-linked settlement, licensed custody, and public attestations of reserves, VeraOne appeals to EU investors seeking transparent, regionally regulated gold exposure without relying on offshore issuers or ETF intermediaries.

6. Comtech Gold (CGO)

Market Cap: $13.8 million as of late October 2025

Comtech Gold (CGO) delivers Sharia-compliant, traceable, and DMCC-certified gold on-chain. Each token is backed by one gram of physical bullion stored in Dubai, with full supply-chain verification from mint to vault. Built on the XDC Network, CGO provides low-cost transfers, fast settlement, and compliance features tailored for investors across the Middle East, Africa, and South Asia. Its halal-certified structure and transparent attestation framework make it a leading choice for faith-aligned commodity investing within Web3.

7. Tether Gold Pool (XAUT0)

Market Cap: $27.4 million as of late October 2025

Tether Gold Pool (XAUT0) is designed to scale liquidity and price discovery across centralized and decentralized markets. It is tied to the same Swiss vault reserves that back XAUT but optimized for institutional market-making, arbitrage, and cross-venue trading. By separating liquidity functions from primary issuance, XAUT0 helps tighten spreads, deepen order books, and support 24/7 global trading without adding custodial complexity. As tokenized gold volumes rise above $3.7 billion, XAUT0 has become a key liquidity layer in Tether’s RWA ecosystem.

8. VNX Gold (VNXAU)

Market Cap: $3.7 million as of late October 2025

VNX Gold (VNXAU) is a MiCA-aligned digital gold token issued from Liechtenstein, backed by bullion stored in Swiss vaults and verified through regular public attestations. Its regulatory structure appeals to European institutions that require compliance with EU securities rules rather than offshore frameworks. By combining audited reserves, euro-friendly rails, and transparent redemption options, VNXAU offers a smaller but highly regulated alternative for investors seeking tokenized gold without exposure to U.S. or Asian custodians.

9. Gold DAO (GOLDAO)

Market Cap: $8.6 million as of late October 2025

Gold DAO (GOLDAO) tokenizes physical gold bars into on-chain assets and governs them through DAO voting and treasury management. Holders can propose decisions, vote on reserve policies, and direct future allocations, creating a decentralized model of collective gold ownership. While smaller than regulated issuers, GOLDAO stands out for its community governance and transparency, offering a novel experiment where token holders manage real-world gold reserves using on-chain rules instead of centralized custodianship.

10. Kinka (XNK)

Market Cap: $1.9 million as of late October 2025

Kinka (XNK) aims to make gold accessible at retail scale by representing small, fractional units tied to audited bullion held in secure vaults. Built for simplicity and low minimum purchases, XNK focuses on everyday users who want easy entry into gold ownership without traditional storage, account setup, or minimum-bar requirements. While small in liquidity, its transparency and micro-unit format position it as a retail-friendly bridge between bullion investing and everyday crypto users.

How Is Tokenized Gold Different From Physical Gold and Gold ETFs?

Gold remains one of the world’s most trusted stores of value, but the way investors access it has evolved. Today, exposure comes in three primary forms: physical bullion, exchange-traded gold funds (ETFs), and gold-backed cryptocurrencies. Each offers different levels of ownership, liquidity, transparency, and cost, and each fits a different investor profile.