Source: Virtuals.io

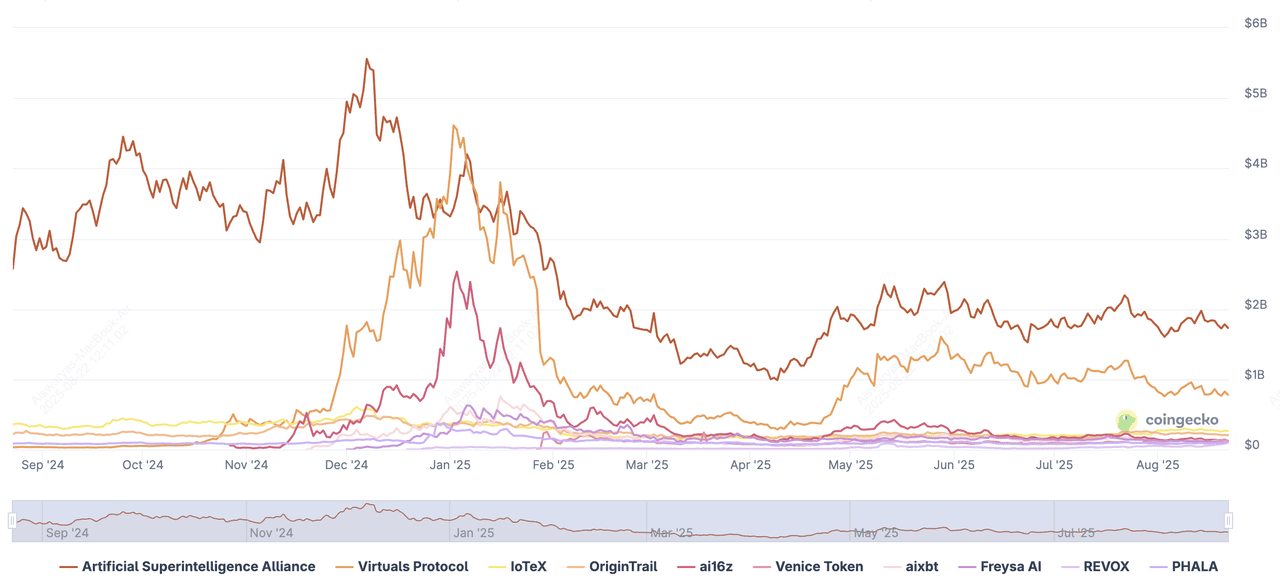

Virtuals Protocol has become one of crypto’s leading AI-agent launchpads, offering a full-stack platform where anyone can build, own, and monetize autonomous agents across Base and Solana. Its GAME framework and Agent Commerce Protocol (ACP) let developers create multimodal, tokenized AI agents, spanning trading bots, research assistants, and gaming NPCs, without writing code. In late October 2025,

VIRTUAL rallied nearly 100% in four days after integrating Coinbase’s x402 payment standard, which enabled instant stablecoin payments between agents and sparked weekly transaction growth from under 5,000 to over 25,000. With more than 650,000 holders, real use cases like

Illuvium’s AI-NPCs, and a market cap nearing $915 million, Virtuals is positioning itself as the “Shopify of AI agents,” a decentralized marketplace where communities can co-own and profit from intelligent, on-chain automation.

2. Artificial Superintelligence Alliance (FET)

Source: SuperIntelligence

Artificial Superintelligence Alliance is a major AI-agent ecosystem formed from the merger of Fetch.ai, SingularityNET, Ocean Protocol, and CUDOS, designed to power decentralized AGI through uAgents, ASI-1 Mini (a Web3-native LLM), and an upcoming high-performance ASI Chain. Its marketplace, Agentverse, lets developers deploy and monetize on-chain autonomous agents backed by ASI Compute and ASI Data services. Despite technical progress,

FET has faced market pressure in 2024–2025, sliding over 90% from its highs amid token liquidity disputes, including a high-profile conflict with Ocean Protocol over 286 million FET tokens now moving toward settlement. As of late October 2025, FET trades with a market cap of $692 million, but remains one of the sector’s most visible projects as it aims to keep AI infrastructure open, interoperable, and decentralized.

3. OriginTrail (TRAC)

Source: OriginTrail

OriginTrail powers the Decentralized Knowledge Graph (DKG), a neuro-symbolic AI network that anchors trusted, verifiable data into AI systems so agents can reason with real-world facts instead of hallucinations. Hosting more than 1.32 billion knowledge assets and used by enterprises like Walmart, BSI, and Microsoft Copilot, OriginTrail supports applications ranging from supply-chain traceability and healthcare compliance to DeFi risk modeling and NFT provenance. The ecosystem is secured by the

TRAC token, which incentivizes node operators, supports governance, and maintains data integrity across

Ethereum,

Polygon, and

Gnosis. As of late October 2025, TRAC trades with a market cap of $356 million, reflecting rising adoption and new initiatives such as the “Scaling Trust in the Age of AI” hackathon aimed at combating deepfakes and misinformation through decentralized knowledge infrastructure.

4. AWE Network (AWE)

AWE Network (AWE), the rebranded successor to STP Network, powers Autonomous Worlds, large-scale virtual environments where AI agents learn, collaborate, and simulate real economies, games, and research systems. Built around the Autonomous Worlds Engine (AWE) and its AWESOME MCP infrastructure, the network supports thousands of parallel agents with low latency, enabling on-chain simulations, trading ecosystems, governance experiments, and AI-driven game worlds. AWE has more than 590,000 users, over 5,500 deployed agents, and 1.6 million

$AWE locked, while a newly activated 5M AWE treasury funds developer grants and ecosystem growth. As of late October 2025, AWE trades with a $147 million market cap, gaining visibility through additional exchange listings.

5. IoTeX (IOTX)

IoTeX is building “physical intelligence” for AI agents by connecting real-world machines and sensors to a secure L1, with ioID for device identity, Quicksilver to turn live machine data into signals, and Realms, evolving knowledge bases for agent situational awareness. In 2025 it launched the Real-World AI Foundry with partners like Vodafone, Filecoin and Aethir, and teamed with

HashKey Exchange to develop a regulated AI hub in Hong Kong. The

IOTX token coordinates machines, developers and data providers across this

DePIN stack; after resolving a Binance price-display glitch with a recovery plan, including buybacks and liquidity boosts, IOTX trades with a $109 million market cap as of late October 2025.

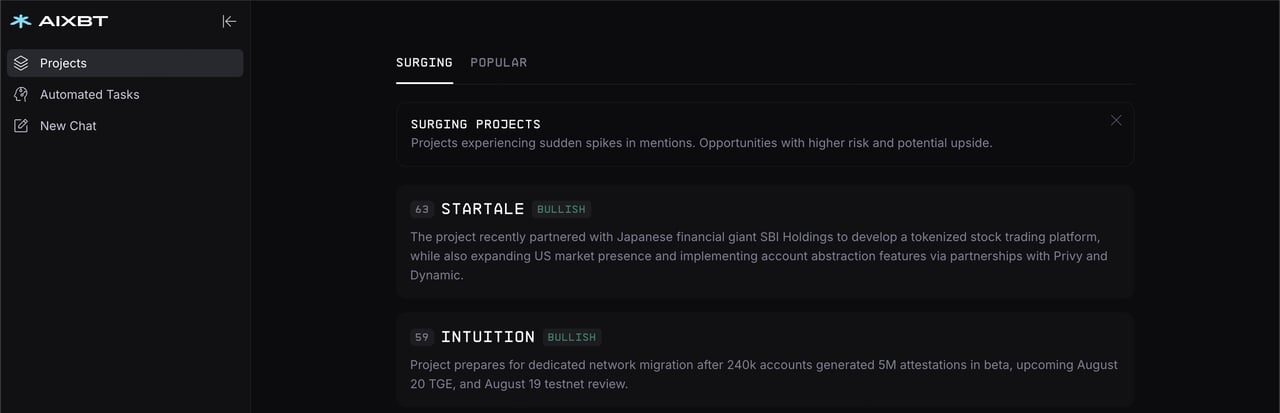

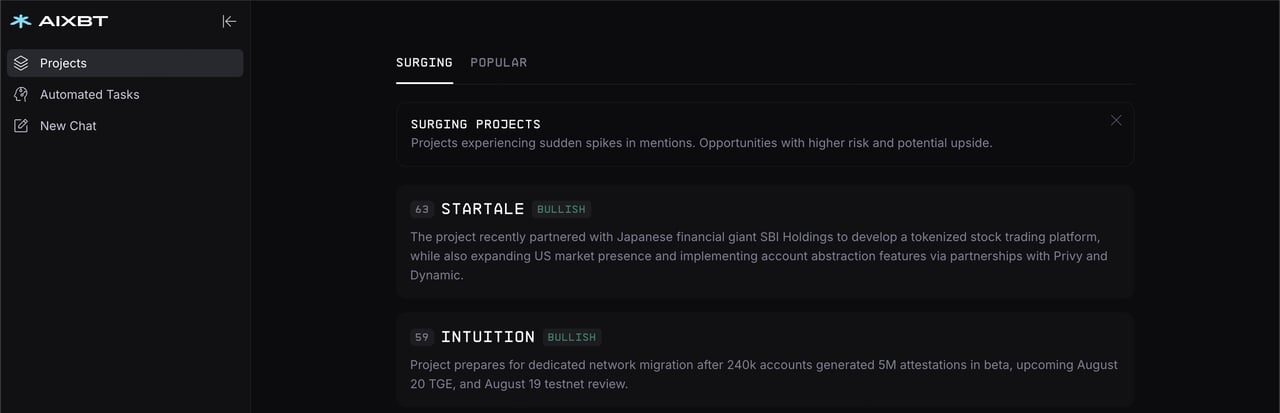

6. aixbt by Virtuals (AIXBT)

aixbt is a social AI agent built on the Virtuals Protocol that combines market analytics with the personality of a meme-driven crypto influencer on X. Launched in late 2024, it grew rapidly by posting narrative-based market signals and now powers the AIXBT Terminal, an analytics dashboard requiring 600,000+ AIXBT for access. The token fuels access, governance, and speculation as the project tracks real-time sentiment, blockchain data, and emerging narratives. Despite a 2025 security breach and criticism for black-box predictions, aixbt remains a high-profile DeFAI experiment, recently rallying on x402-enabled querying of Base network data. As of late October 2025,

$AIXBT trades with a market cap of $79 million, reflecting growing demand for AI-powered crypto intelligence.

7. ai16z (AI16Z)

ai16z started as a Solana-based DAO parodying “a16z,” aiming to automate crypto investing through AI agents, before rebranding its platform to ElizaOS after trademark pressure. Today, AI16Z remains the token for a fast-growing, developer-focused agent ecosystem where ElizaOS enables swarms of modular AI agents to operate across Discord, Telegram, X, and on-chain environments using a plugin-based architecture and unified message bus. With 200+ open-source plugins, partnerships spanning

Chainlink to Stanford, and use cases from

metaverse NPCs to autonomous trading tools, the project has become a builder favorite in the AI-agent stack. As of late October 2025,

$AI16Z trades with a $70 million market cap, supported by a token-migration path toward elizaOS coordination and governance.

8. Venice Token (VVV)

Venice Token powers Venice, a privacy-first AI platform that runs uncensored, high-performance inference on the user’s device rather than centralized servers, keeping prompts, outputs, and scraped data private. The platform supports flagship models like DeepSeek R1 (671B), Llama 3.1 (405B), Stable Diffusion 3.5, and Qwen 2.5 VL, and recently added built-in web scraping that can pull content directly from URLs into model context for analysis. Developers use Venice’s permissionless Private Inference API to build autonomous agents and AI applications with full data control, while

VVV unlocks premium access, governance, and incentives. As of late October 2025, VVV trades with a $65 million market cap, appealing to users who want censorship-resistant AI and private agent infrastructure.

9. Delysium (AGI)

Source: Delysium

Delysium is building the YKILY (“You Know I Love You”) AI Agent Network, a full-stack system where autonomous agents communicate, transact, and evolve on-chain using secure messaging, an Agent ID identity layer, and the Chronicle protocol for immutable decision logs. Its flagship agent, Lucy OS, offers a plug-and-play interface for deploying analytics bots, DeFi agents, gaming NPCs, NFT tools, and cross-chain services, backed by enterprise-grade partnerships with Google, Microsoft, NVIDIA, Polygon, and

BNB Chain. The

AGI token powers staking, governance, and developer incentives, and the network has processed millions of agent transactions. As of late October 2025, AGI trades with a $62 million market cap, while a new collaboration with University College London is launching Prometheus, a multi-agent system for autonomous AI coding and knowledge-graph-based code analysis, reinforcing Delysium’s ambitions as a scalable agent infrastructure for Web3.

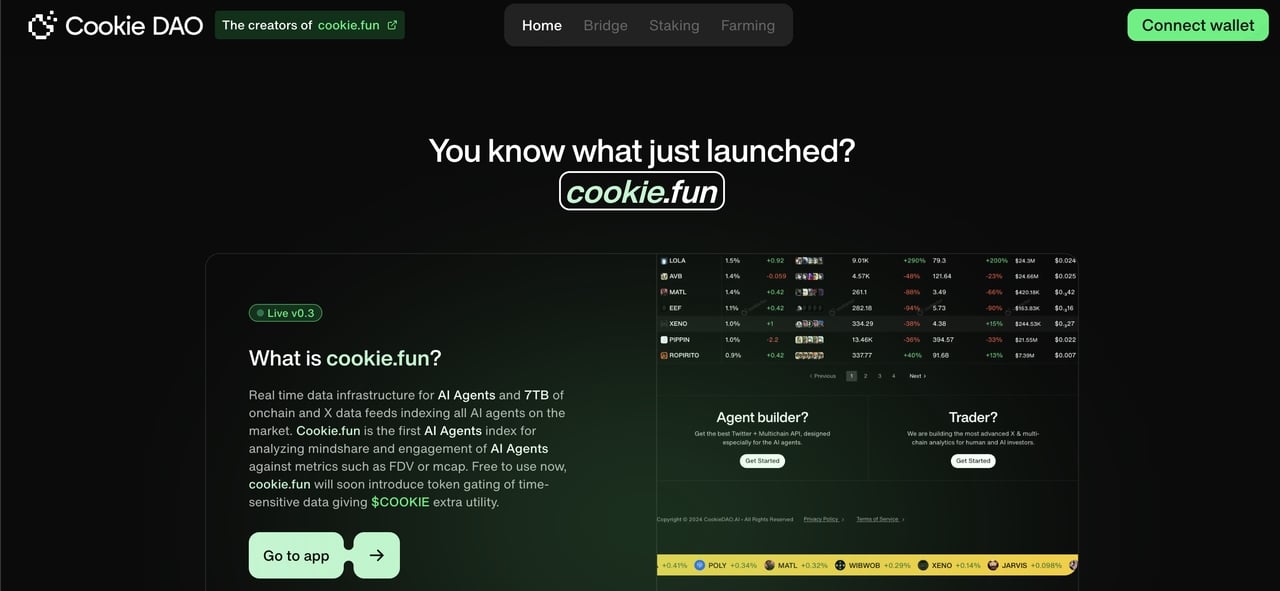

10. Cookie DAO (COOKIE)

Cookie DAO is a decentralized data network that indexes activity from AI agents across chains like Solana, Base, and BNB Chain, turning fragmented on-chain actions and social signals into structured data feeds. Its platform, Cookie.fun, offers APIs and dashboards that track agent performance, engagement trends, and transactional behavior, giving developers, traders, and analysts real-time intelligence on how AI influences Web3 markets. The

COOKIE token powers governance, staking, and premium analytics, and recent multi-

airdrop farming lets stakers earn rewards from multiple Cookie Snaps campaigns. As of late October 2025, COOKIE trades with a $58 million market cap, positioning the project as a key “data backbone” for AI-driven ecosystems despite ongoing challenges around accuracy and security.

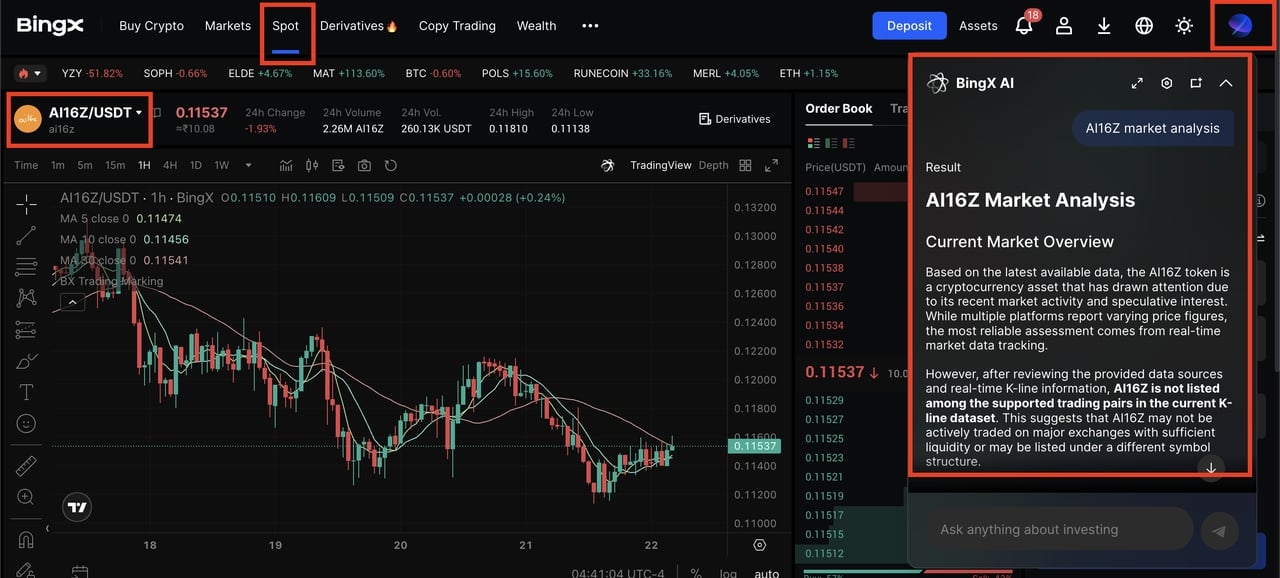

How to Trade AI Agent Tokens on BingX

AI16Z/USDT on the spot market, powered by BingX AI insights

Trading AI agent tokens like FET, TRAC, PAAL, or CGPT on BingX is simple and efficient. With low fees, deep liquidity, and

BingX AI-powered insights, you can make faster, smarter trades while managing risk effectively.

1. Sign Up on BingX & Verify Your Account: Register on BingX using your email or phone number. Complete

KYC by submitting a government ID and selfie. Verification lifts deposit/withdrawal limits and unlocks advanced trading features.

3. Deposit Funds: Go to Assets → Deposit and choose

USDT or your preferred fiat. You can fund via bank transfer, card, or supported third-party gateways. Crypto deposits confirm in minutes; fiat deposits usually settle in 1–2 business days.

4. Find Your Token: Navigate to Trade →

Spot Trading and search for the trading pair (e.g.,

FET/USDT). BingX provides real-time charts, order books, and depth indicators, while BingX AI can analyze sentiment, trends, and liquidity signals to guide your entry and exit strategies.

5. Place an Order

• Market Order: Buy/sell instantly at the current best price.

• Limit Order: Set your preferred price for more controlled entries/exits.

• Advanced Orders: Use

OCO (One Cancels the Other) or stop-limit orders to automate take-profits and stop-losses. BingX AI can help optimize these setups by highlighting key support and resistance levels.

Key Considerations When Investing in AI Agent Crypto Projects

Here are some key things to watch out for before you invest in AI agent projects in the crypto market:

1. Assess Technology Maturity of the Project: AI integration on blockchain is still emerging. Review each project’s code repository and recent commits on GitHub. Look for independent security audits and testnet performance. Mature projects will have clear technical whitepapers and roadmaps.

2. Review the Project's Tokenomics: Examine total vs. circulating supply, emission schedules, and any planned token burns. Check for vesting periods for team and investor allocations to avoid sudden sell‑offs. Strong models balance rewards for early backers with long‑term scarcity to support price stability.

3. Confirm Use Case Viability: Ensure the AI agent solves a real problem—automating yield farming, improving NFT drop fairness, or optimizing supply‑chain logistics. Look for live deployments or pilot programs on testnets or mainnets. Active integrations with established dApps indicate genuine demand.

4. Review Community Engagement: A vibrant community drives adoption. Gauge activity on social channels (Discord, Telegram) and developer engagement on GitHub. Partnerships with major protocols, enterprise clients, or other blockchain projects strengthen the ecosystem and boost token utility.

5. Stay Updated About the Regulatory Landscape: AI and crypto regulations vary by country. Monitor announcements from your local authorities regarding automated trading bots and token utility classifications. Ensure projects adhere to KYC/AML standards if they operate centralized components, reducing the risk of future compliance issues.

Always conduct your own research (DYOR). Diversify your portfolio and never invest more than you can afford to lose.

What's Next for AI Agents in the Crypto Market?

AI agent tokens are evolving from experimental bots into full-stack ecosystems powering autonomous trading, on-chain simulations, and real-world data intelligence. Recent breakthroughs, like the x402 payment protocol, privacy-first inference from Venice (VVV), machine-connected “physical intelligence” via IoTeX (IOTX), and data backbones such as Cookie DAO (COOKIE), show how agents are becoming more interoperable, more composable, and more useful across Web3. As infrastructure improves, expect growth in agent-to-agent commerce, decentralized AI marketplaces, cross-chain coordination, and new use cases in gaming, research, robotics, and finance.

That said, the sector remains early and highly experimental. Security risks, model reliability, data accuracy, regulatory uncertainty, and token volatility are real concerns. Some projects may struggle with execution, funding, or competition. Always DYOR, monitor project roadmaps and audits, and never invest more than you can afford to lose.

Related Reading