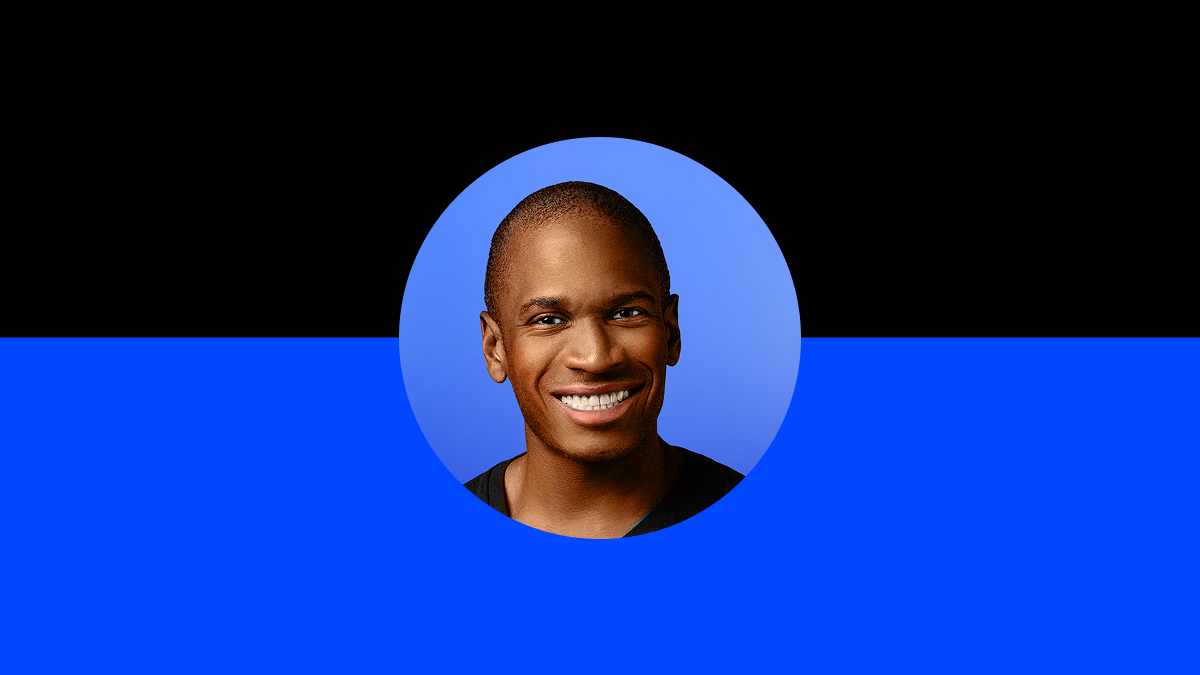

The financial landscape of 2026 represents a definitive maturation of the digital asset sector, characterized by the convergence of legacy institutional frameworks and aggressive crypto-native innovation. At the center of this transformation is Arthur Hayes, the co-founder and former CEO of

BitMEX, whose professional trajectory serves as a primary case study for the evolution of wealth in the digital age.

Historically recognized for pioneering the perpetual swap contract, an innovation that fundamentally reshaped the global derivatives market, Hayes now operates as a pivotal market strategist, venture capitalist, and provocative essayist through his family office, Maelstrom. As of February 2026, the valuation of Hayes' personal net worth must be viewed through a multidimensional lens that accounts for liquid on-chain assets, residual equity in the BitMEX ecosystem, and the strategic deployment of capital into emerging sectors like Decentralized Science (DeSci) and

Zero-Knowledge (ZK) proofs.

Who Is Arthur Hayes?

Arthur Hayes is one of the most influential and controversial figures in the history of cryptocurrency. Born in 1985 and raised in Buffalo, New York, Hayes graduated from the Wharton School of the University of Pennsylvania before moving to Hong Kong to pursue a career in traditional finance. He served as an equity derivatives trader at Deutsche Bank and Citigroup, where he mastered the complexities of market-making and financial engineering in the Asian markets.

In 2014, Hayes transitioned from

TradFi to the burgeoning world of

Bitcoin, co-founding BitMEX (Bitcoin Mercantile Exchange) alongside Ben Delo and Samuel Reed. Under his leadership as CEO, BitMEX became the dominant platform for crypto derivatives, popularized by its perpetual swap, which allowed retail traders to access up to 100x leverage without expiration dates.

Despite his immense success, Hayes faced significant legal hurdles. In 2022, he pleaded guilty to violating the U.S. Bank Secrecy Act (BSA) for failing to implement adequate Anti-Money Laundering (AML) protocols. After serving his sentence and receiving a full presidential pardon from Donald Trump in March 2025, Hayes has re-emerged as the Chief Investment Officer of Maelstrom, focusing on the vicissitudes of dollar liquidity and the long-term institutionalization of the crypto economy.

How Did Arthur Hayes Build His Wealth?

The bedrock of Arthur Hayes’ wealth was forged through the massive cash flows generated by BitMEX during the 2017–2020 era. At its operational peak in 2019, BitMEX was valued at approximately $3.6 billion, handling over $1 trillion in annual trading volume. As a primary founder with an initial one-third stake, Hayes’ paper wealth soared into the ten-figure range during the 2021 bull cycle.

However, unlike figures who maintain wealth through a single public entity like

Brian Armstrong with

Coinbase, Hayes' 2026 wealth profile is more fragmented and agile. His fortune is currently built upon three distinct pillars:

1. BitMEX Residual Equity: While the exchange has lost significant market share to competitors like Binance and Bybit, it remains a cash-generating asset with a stabilized enterprise value of roughly $500 million in 2026.

2. Maelstrom Family Office: A venture and private equity engine that seeds high-growth projects, e.g.,

Ethena and

Ether.fi, at the earliest stages.

3. Macro-Trading: Hayes is an active whale who manages a large personal treasury of liquid assets, primarily

Ethereum and strategic beta plays.

How Much Is Arthur Hayes' Net Worth in 2026: Key Estimates

As of February 2026, the estimated net worth of Arthur Hayes is positioned between $200 million and $400 million.

| Asset Category |

Estimated Value (USD) |

Primary Components |

| Traceable On-Chain Assets |

$55M – $75M |

ETH, EETH, WEETH, ENA, PENDLE |

| BitMEX Equity |

$100M – $200M |

Residual ownership in HDR Global Trading |

| Maelstrom VC/PE Portfolio |

$50M – $125M |

Stakes in Ethena, Bio Protocol, Zcash, River |

| Real Estate & Cash |

$25M+ |

Holdings in Singapore and Hong Kong |

| Total Net Worth |

$200M – $400M |

Synthesized 2026 Estimate |

This valuation reflects a nuanced reality that separates media-driven billionaire narratives from verifiable financial data. While public analytics platforms like Arkham Intelligence track approximately $57 million in identifiable Arthur Hayes wallets, the opacity of his private equity holdings in Maelstrom and the likelihood of dark addresses suggest the true figure is higher.

The Role of Dark Liquidity

Analysts note that Hayes frequently rotates capital through institutional-grade liquidity providers like Wintermute and FalconX. In early 2026, Hayes executed a "liquidity sprint," transferring roughly $3.14 million worth of

ENA and

ETHFI to exchanges, moves typically interpreted as preparatory steps for acquiring larger private equity positions or hedging against macroeconomic volatility.

Arthur Hayes' Crypto Holdings: Detailed On-Chain Portfolio Breakdown (Feb 2026)

Arthur Hayes is widely identified as a significant "

Ethereum whale." His 2026 strategy reflects a long-term conviction in the Ethereum network’s role as the "global settlement layer."

• Ethereum (ETH): The core of his liquid portfolio. Following a major purchase of 1,750 ETH in August 2025, his verifiable holdings sit at roughly 6,174 ETH, valued at around $26.5 million in early 2026.

• Ether.fi (EETH/WEETH): Hayes is a major proponent of liquid restaking. His holdings in Ether.fi products represent approximately $18.7 million, allowing him to earn layered yields while maintaining liquidity.

• Ethena (ENA): Inspired by his own "Dust on Crust" essay, Ethena has become a cornerstone of his venture success. His traceable ENA holdings are valued at ~$3.9 million, though his total exposure through Maelstrom is likely much higher.

•

Zcash (ZEC): In a bold narrative shift for 2026, Hayes has positioned Zcash as his portfolio's Privacy Beta. He predicts a $1,000 ZEC price target, citing a global 2026 trend toward financial privacy in the face of tightening CBDC surveillance.

What Drives Arthur Hayes' Net Worth: 4 Key Factors

Arthur Hayes’ net worth is shaped by a combination of entrepreneurial success, market timing, and exposure to high-risk, high-reward crypto cycles, with several core factors playing an outsized role in its growth.

1. The Liquidity-First Macro Thesis

Hayes’ wealth is a dynamic product of his macroeconomic framework. In 2026, he operates on the belief that the U.S. Federal Reserve is engaged in "Stealth QE" through Reserve Management Purchases (RMP). He argues that as long as the Fed injects $40 billion monthly into the system, "hard" digital assets will continue to appreciate.

2. Maelstrom Equity Fund I

In late 2025, Hayes pivoted Maelstrom from purely token-based VC to a $250 million private equity fund. This fund targets off-chain infrastructure, companies that build the "rails" for the next wave of institutional adoption. By owning the data tools and trading infrastructure like

Alpaca and

River, Hayes mitigates token volatility while capturing industry growth.

3. The BitMEX Recovery

The 2025 Presidential Pardon removed the legal overhang that plagued BitMEX for years. While the exchange is no longer #1, the removal of Hayes' convicted felon status has allowed the platform to re-engage with certain institutional counterparties, stabilizing the valuation of his equity.

4. Intellectual Alpha and the Substack Effect

Hayes is unique because he can move markets with a single essay. His 2023 prediction for a synthetic dollar led to the birth of

Ethena USDe yield bearing stablecoin. This intellectual alpha allows him to seed projects at extremely low valuations before his public endorsement drives retail and institutional interest, creating a self-fulfilling loop of wealth creation.

Beyond Crypto: Hayes' Longevity and Biohacking

In 2026, Arthur Hayes is as much a biohacker as he is a financier. Following his pardon, he took a significant board seat and lead investment stake in a stem cell business with clinics in Mexico and Bangkok.

"I want to live as long as possible, as healthy as possible. Just as crypto disrupted the centralized financial system, stem cell technology and DeSci will disrupt the aging process." — Arthur Hayes, 2025

This personal investment in longevity research (including the BIO Protocol and Neuramint) reflects a broader trend among 2026 crypto titans like

Vitalik Buterin and Brian Armstrong, who are deploying their digital wealth to solve biological mortality.

How Does Arthur Hayes’ Wealth Compare to Other Crypto Titans?

While Hayes is a "whale," he operates at a different scale than the industry’s institutional giants.

| Individual |

Primary Entity |

Est. Net Worth (Feb 2026) |

| Elon Musk |

Muskonomy (SpaceX/xAI) |

$844 Billion |

| Changpeng Zhao (CZ) |

Binance |

$79 Billion |

| Giancarlo Devasini |

Tether |

$22.4 Billion |

| Michael Saylor |

MicroStrategy (BTC) |

$9.4 Billion |

| Arthur Hayes |

BitMEX / Maelstrom |

**$0.4 Billion** |

The disparity between Hayes and

CZ at $79 billion highlights the difference between an ecosystem owner and a strategic trader. While CZ owns the world's largest exchange, Hayes has prioritized agility and lifestyle freedom, opting for a smaller, more specialized family office model rather than a massive corporate empire.

Future Outlook: The Equity Perps Revolution (2026-2029)

Arthur Hayes’ most provocative prediction for the late 2020s involves the migration of traditional stock trading onto crypto platforms via Equity Perpetuals. He predicts that by the end of 2026, price discovery for the

S&P 500 will happen on decentralized perpetual markets.

If this shift occurs, Maelstrom-backed platforms like

Hyperliquid are positioned to capture a massive share of the global derivatives market. This would likely lead to a substantial revaluation of Hayes' equity stakes, potentially propelling him back toward the billionaire status he briefly touched in 2021.

Conclusion

Arthur Hayes’ net worth in 2026 reflects the successful professionalization of the digital pioneer. His estimated fortune of $200 million–$400 million is a testament to his ability to survive systemic shocks, both legal and financial, and emerge with a more diversified, institutionalized portfolio.

For the modern investor, tracking Hayes isn’t about watching a static bank account; it’s about following a blueprint for the 2026 economy: a blend of macro-vigilance, private equity infrastructure, and a focus on biological longevity. Whether through the mass adoption of Zcash or the scaling of the Maelstrom Equity Fund, Hayes remains a central architect of the decentralized world.

Related Reading

FAQs on Arthur Hayes' Net Worth

1. Is Arthur Hayes a billionaire in 2026?

While media speculation placed him in the billionaire bracket in 2021, current 2026 estimates suggest a net worth of $200–$400 million. This is due to the lower valuation of BitMEX compared to its peak and the illiquidity of his private equity holdings.

2. How did the 2025 Presidential Pardon affect his wealth?

The pardon by Donald Trump in March 2025 cleared Hayes' criminal record, allowing him to legally lead the Maelstrom Equity Fund and re-enter global banking relationships that were previously restricted.

3. What is Arthur Hayes’ biggest crypto holding?

Verifiable on-chain data shows Ethereum (ETH) as his largest liquid holding, followed by significant positions in Ether.fi and Zcash.

4. What is Maelstrom?

Maelstrom is Arthur Hayes’ family office. In 2026, it operates both as a venture capital firm and a $250 million private equity fund focusing on crypto infrastructure and cash-flowing Web3 businesses.