The landscape of

XRP (XRP) ownership has reached a pivotal stage of maturity in early 2026. Following the full resolution of legacy regulatory hurdles, XRP has transitioned from a speculative asset into a core utility layer for global finance. As XRP trades near the $1.50 mark during the February Flush, the focus has shifted from retail hype to institutional Smart Money accumulation and high-scale production use cases.

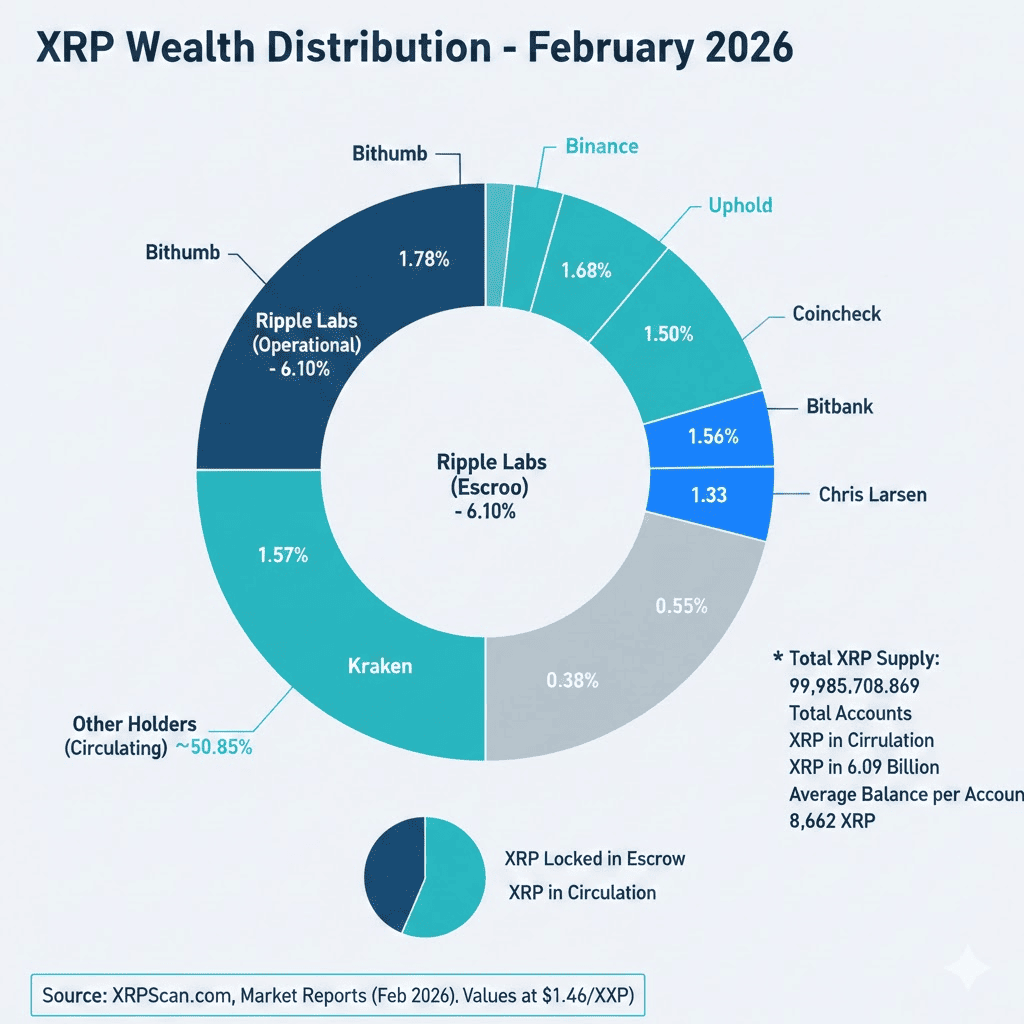

By February 2026, the total circulating supply of XRP stands at approximately 66.09 billion, with another 33.90 billion held in secure, programmatic Ripple Escrows. With over 7.6 million active accounts on the

XRP Ledger (XRPL), the network has become one of the most widely distributed blockchains. However, the concentration of supply remains high among a select group of exchanges, corporate treasuries, and early founders.

This article breaks down the 2026 XRP Rich List, identifying the top 10 XRP whales and entities that control the liquidity of the digital asset designed for global payments.

Who Are the Top 10 XRP Holders: 2026 Entity Breakdown

When analyzing the 2026 rich list, it is essential to distinguish between corporate locked supply and exchange custodial supply, which represents millions of individual retail users.

| Rank |

Holder / Entity |

Account Type |

Balance (XRP) |

% of Total Supply |

| 1 |

Ripple Labs (Escrow) |

Corporate Reserve |

33,895,022,637 |

33.90% |

| 2 |

Ripple Labs (Operational) |

Treasury/Operations |

6,100,000,000 |

6.10% |

| 3 |

Bithumb |

Exchange Custody |

1,787,273,582 |

1.78% |

| 4 |

Binance |

Exchange Custody |

1,679,562,275 |

1.68% |

| 5 |

Uphold |

Exchange Custody |

1,505,748,328 |

1.50% |

| 6 |

UPbit |

Exchange Custody |

1,365,082,732 |

1.36% |

| 7 |

Chris Larsen |

Individual (Founder) |

1,330,027,112 |

1.33% |

| 8 |

Bitbank |

Exchange Custody |

571,995,370 |

0.57% |

| 9 |

Coincheck |

Exchange Custody |

552,978,265 |

0.55% |

| 10 |

Kraken |

Exchange Custody |

384,812,266 |

0.38% |

Data as of February 16, 2026. Values calculated at $1.46/XRP.

Key Insights into the XRP Distribution

1. The Ripple Whale: By combining the escrows, Ripple Labs remains the largest entity by a significant margin. Of the original 100 billion XRP, roughly 40% is still under company control when you add their operational treasury to the locked escrow accounts.

2. Exchange Concentration: More than 7% of the total supply is held in the cold wallets of the top five exchanges. These are not proprietary holdings but represent the combined wealth of retail investors. High concentration in Korean exchanges like Bithumb, UPbit and Japanese exchanges like Bitbank and Coincheck reflects XRP's strong regional dominance in Asia.

3. Individual Founders: Chris Larsen remains the only identified individual with a direct on-chain balance high enough to rival major global exchanges. While Arthur Britto and Brad Garlinghouse are also significant holders, their assets are often distributed across multiple smaller wallets or institutional custody platforms that do not appear as a single top 10 address.

4. XRP's Circulating vs. Total Supply: As of February 2026, the circulating supply is approximately 66.09 billion XRP. The remaining 34 billion is strictly locked in the XRP Ledger’s escrow feature, releasing roughly 1 billion per month, a significant portion of which is typically re-locked by Ripple to manage market liquidity.

The XRP Rich List 2026: Top 10 Ripple (XRP) Holders (February 2026)

Who are the 10 largest holders of XRP as of February 2026? | Source: XRPScan

Here is the updated breakdown of the top 10 unique holders of XRP as of February 2026. This list consolidates Ripple’s tranches and categorizes entities by their total on-chain footprint.

1. Ripple Labs' XRP Escrow System

As of February 16, 2026, Ripple Labs remains the dominant entity on the ledger, controlling 33.9 billion XRP, approx. 33.9% of total supply, locked in cryptographically enforced escrows. This system executes a smart-contract-led release of 1 billion XRP on the first of every month; however, data from the February 1, 2026, unlock cycle shows that Ripple consistently re-escrows 70–80%, approx. 700–800 million XRP, of the released funds. This programmatic relocking strategy ensures that the net monthly addition to circulating supply is capped at roughly 300 million XRP, effectively neutralizing inflationary pressure.

2. Ripple Labs' Operational and Treasury XRP Holdings

Beyond the escrow, Ripple maintains a liquid operational treasury of approximately 6.1 billion XRP or 6.1% of supply. These funds serve as the primary liquidity buffer for Ripple Payments, formerly ODL, facilitating instant cross-border settlements for hundreds of financial institutions globally. In early 2026, these holdings have been increasingly utilized to seed the

RLUSD (Ripple USD) stablecoin ecosystem, providing the essential bridge collateral required for institutional DeFi and liquid staking applications on the XRPL.

3. Bithumb

South Korean powerhouse Bithumb leads the non-corporate rich list with a staggering 1.79 billion XRP held in its primary cold storage. This concentration represents a 30% increase in balance since early 2025, fueled by intense retail demand in the APAC region. Because XRP often accounts for up to 28% of Bithumb’s daily volume, these holdings serve as a critical liquidity hub for the Kimchi Premium, reflecting the collective assets of hundreds of thousands of individual South Korean investors.

4. Binance

Binance remains the world’s largest custodial holder by volume, managing 1.68 billion XRP across its secure 34xp4 cold wallet and associated sub-addresses. As of February 2026, Binance’s

Proof of Reserves (PoR) confirms that these holdings are backed 1:1, providing a transparent 100% reserve ratio for its global user base. This massive pool of liquidity makes Binance the primary venue for global XRP price discovery, handling over $3 billion in monthly capital velocity.

5. Uphold

Uphold has transitioned from a retail safe haven to an institutional powerhouse, holding over 1.5 billion XRP in 2026. Following the launch of

Spot XRP ETFs, Uphold’s reserves have seen a strategic shift, now custodying assets for several European and U.S. managed funds. With XRP consistently ranking as Uphold’s most-traded asset, the platform’s real-time transparency dashboard proves that its holdings are over-collateralized, making it a cornerstone for the Western XRP ecosystem.

6. UPbit

UPbit closely follows its regional rivals with a consolidated balance of 1.36 billion XRP. Data from early 2026 indicates that UPbit has the highest wallet-to-user ratio in South Korea, with XRP trading volume frequently outpacing both

Bitcoin and

Ethereum on the platform. The exchange’s high-velocity transfers between hot and cold wallets are a leading indicator of Asian retail sentiment, often signaling broader market moves before they hit Western exchanges.

7. Chris Larsen

Among individuals, Ripple Co-founder Chris Larsen is the premier mega-whale, with approximately 2.7 billion XRP, roughly 2.7% of total supply, attributed to his personal addresses. While on-chain sleuths identified a $150 million or 213 million XRP security breach in 2024 related to his personal accounts, his remaining holdings are now secured via advanced institutional-grade multisig governance. Larsen’s stake remains one of the largest single individual allocations in the history of digital finance.

8. Bitbank

Japan’s Bitbank maintains a significant footprint with 571 million XRP in custody. This reflects Japan's status as a premier regulatory environment for the XRPL, supported by the SBI Ripple Asia partnership. Bitbank’s holdings are characterized by high HODL conviction, with

on-chain data showing a lower churn rate compared to Korean or U.S. exchanges, as Japanese investors increasingly view XRP as a long-term retirement and settlement asset.

9. Coincheck

Coincheck holds approximately 552 million XRP, solidifying Japan’s dominance in the top 10 rich list. Following the implementation of the Japan Crypto Asset Business Association (JCBA) standards, Coincheck has reported a surge in institutional buy-and-hold activity. Its presence in the top tier highlights a significant trend of Japanese retail wealth moving into XRP as a primary alternative to the Yen for digital wealth preservation.

10. Kraken

Kraken rounds out the top 10 with 384 million XRP, serving as the primary bridge for North American institutional liquidity. Since the full regulatory resolution in 2025, Kraken has seen its XRP balances rise as U.S. pension funds and 401(k) providers begin seeking direct exposure. Kraken’s commitment to self-custody education and regulated reserves makes its holdings a key bellwether for the return of American Smart Money to the XRP Ledger.

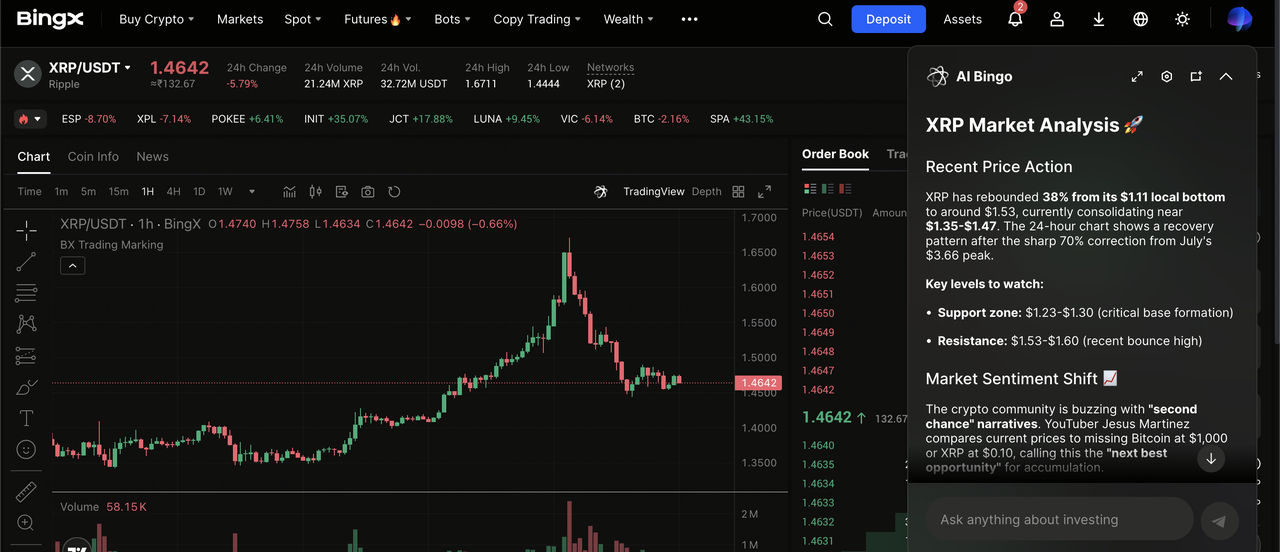

How to Trade Ripple (XRP) on BingX

Whether you want to hold like a whale or capitalize on the 2026 correction, BingX provides the tools to manage your XRP portfolio with ease.

Buy or Sell XRP on the Spot Market

XRP/USDT trading pair on the spot market powered by BingX AI insights

Spot trading is ideal for long-term investors who believe in the 2026 institutional blueprint.

1. Create and verify your BingX account.

3. Use

Market Order for immediate execution or Limit Order to buy the $1.45 Sniper Zone.

4. Secure your assets in the BingX wallet.

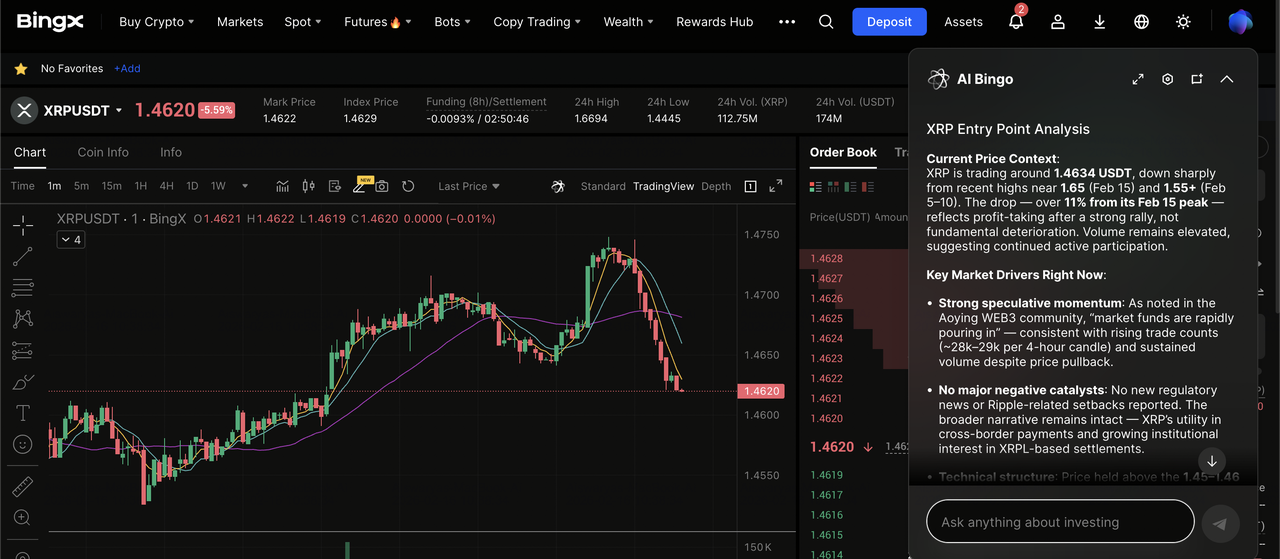

Long or Short XRP with Futures

XRP/USDT perpetual contract on the futures market featuring BingX AI insights

For traders looking to profit from whale-induced volatility, BingX offers up to 100x leverage on XRP Perpetual Contracts.

3. Use

BingX AI signals to identify liquidity clusters or whale zones.

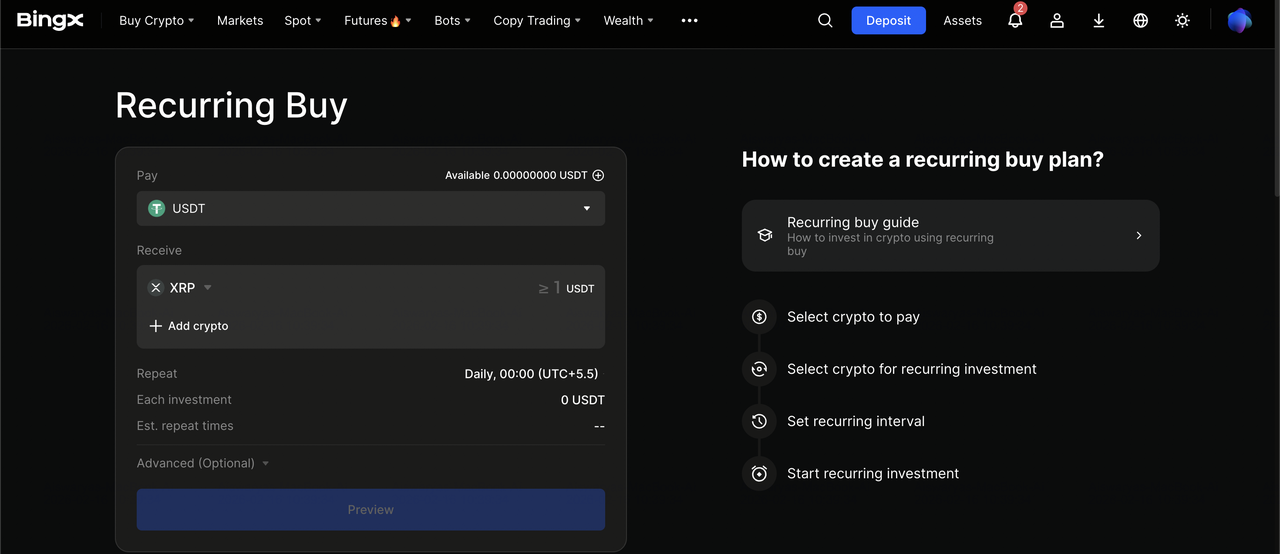

DCA XRP with BingX Recurring Buy

How to DCA XRP on BingX Recurring Buy

BingX Recurring Buy is the most effective tool for long-term investors to mimic whale-like accumulation by removing emotional bias and market timing stress.

1. Access the Feature: Log in to the BingX App or website, navigate to

Recurring Buy.

2. Select Your Assets: Choose

USDT or

USDC as your payment currency and XRP as your target asset.

3. Customize Your Strategy: Set your investment amount and choose your frequency from Hourly, Daily, Weekly, or Monthly cycles.

4. Activate and Automate: Review your plan and click Confirm. BingX will now automatically buy XRP at the exact market price during each scheduled interval.

5. Manage Your Plan: Track your progress or adjust your strategy anytime under the Recurring Buy Dashboard with zero penalties.

What Are the 5 Key Risks for XRP Holders in 2026?

While the Rich List indicates strong conviction from major players, the 2026 market carries unique risks that could challenge even the most hardened holders. Beyond the core concerns of centralization and exchange custody, several emerging 2026-specific factors have surfaced that could impact your XRP strategy:

1. Escrow and Inflationary Pressure: Ripple still controls approximately 33.9 billion XRP in programmatic escrows. While the monthly release of 1 billion XRP provides predictability, it creates a constant supply overhang. If institutional demand from ODL (On-Demand Liquidity) or ETFs does not keep pace with these releases, the recurring influx of tokens can suppress price appreciation and cap long-term growth.

2. Tax and Compliance Complexity (1099-DA): The implementation of the 1099-DA reporting standards in early 2026 has significantly increased the burden on retail investors. Moving XRP between self-custody wallets and exchanges now triggers complex cost-basis tracking requirements. Failure to maintain rigorous records can lead to cost-basis confusion, resulting in accidental tax overpayments or increased audit risks as governments tighten blockchain oversight.

3. CBDC and Stablecoin Redundancy: As nations launch proprietary, closed-loop

Central Bank Digital Currencies (CBDCs) and regulated stablecoins like RLUSD, XRP faces a utility threat. If sovereign networks develop direct interoperability without requiring a neutral bridge asset, XRP’s primary use case as a global settlement layer could become redundant in key financial corridors.

4. Smart Contract and XRPFi Exposure: The rise of Institutional DeFi on the XRP Ledger (XRPL) or XRPFi has enabled

liquid staking and AMM yield opportunities. However, this adds a layer of smart contract risk that was largely absent in previous HODL cycles. Bug exploits or protocol failures in these new yield-bearing environments could lead to total capital loss for holders who move their XRP out of basic cold storage.

5. Institutional Sell the News Dynamics: With the 2025 regulatory settlements and the launch of Spot XRP ETFs now in the rearview mirror, XRP is no longer valued on courtroom hype. It is now judged on measurable transaction volume. If high-profile 2026 partnerships, such as those with Aviva or Zand Bank, do not translate into significant on-chain activity, the market may re-rate XRP downward as the speculative premium for future potential fades.

Conclusion: Should You Follow the XRP Whales?

The 2026 XRP Rich List proves that the Smart Money has moved from retail speculation to institutional utility. With major asset managers and corporate treasuries integrating XRP into their strategic reserves, the network is becoming a core piece of the global financial stack.

For the average investor, the top-heavy nature of XRP is both a risk and a gift. While whales control major levers of liquidity, the tightening of circulating supply via escrows and ETF accumulation suggests a long-term scarcity play. Neutral analysis of on-chain data shows that large holders are currently in a phase of accumulation rather than distribution.

DYOR, track the data, and use professional tools to manage your risk as the XRP ecosystem matures.

Risk Reminder: Digital asset markets are inherently volatile. Concentrated ownership by whales can lead to significant price swings if large positions are liquidated. Never invest more than you can afford to lose and consider the 2026-specific risks of compliance and smart contract exposure.

Related Reading