You’ve heard of AI and crypto. Now meet

AI Agents: autonomous bots that learn, decide, and act on-chain. They power everything from trading to

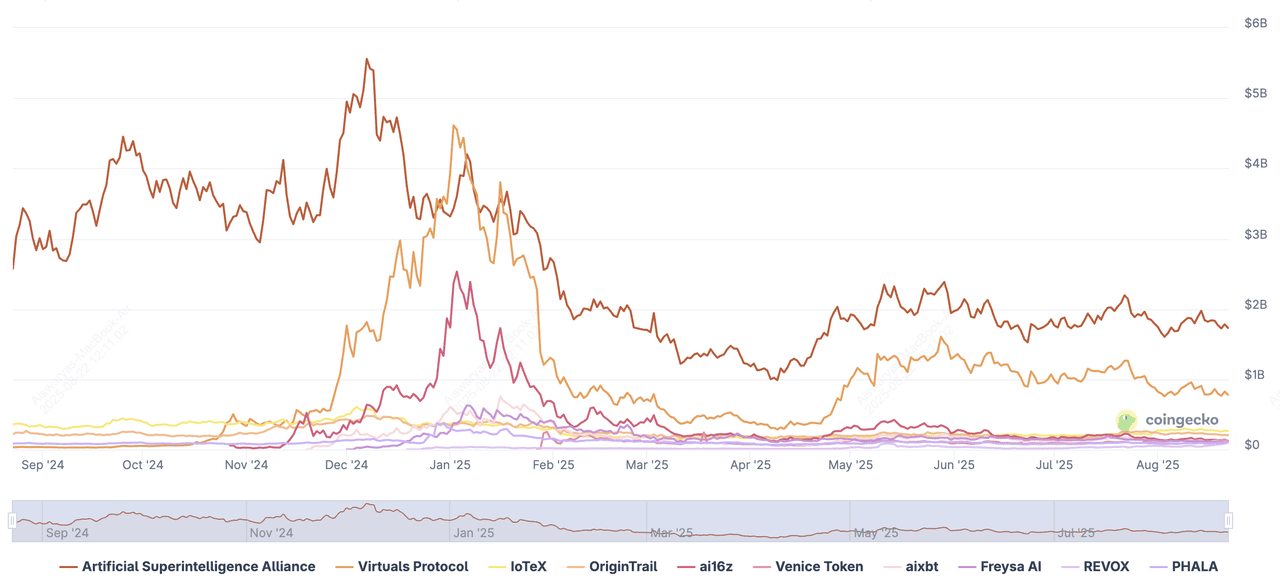

DeFi automation. As of August 2025, CoinGecko has listed over 520 AI agent crypto projects on its platform with a combined market cap of over $6 billion. These tokens power autonomous software “bots” that learn, decide, and act on‐chain.

Market cap of the top AI agent projects in the crypto market | Source: CoinGecko

In this guide, you’ll discover the top ten AI agent tokens for 2025. You’ll learn what makes each project unique, key token metrics, and how to trade them on BingX.

What Is an AI Agent and How Does It Work?

An AI agent is an autonomous software entity that operates on blockchain networks to execute tasks without human intervention. Here’s how it functions in detail:

1. Collects Data From On-Chain Sources: The agent taps into on‑chain sources, transaction hashes,

smart‑contract events,

liquidity metrics, and off‑chain feeds like price oracles and social media sentiment. It continuously streams real‑time market prices from exchanges, watches whale‑wallet movements, and monitors developer activity on GitHub to build a holistic data picture.

2. Processes Data Using ML Algorithms: Using machine learning algorithms (e.g., reinforcement learning, neural networks), the agent analyzes historical and live data to identify patterns and anomalies. It runs risk models, such as Value‑at‑Risk (VaR) and drawdown simulations, to forecast potential losses and adjust its strategy accordingly. Sentiment analysis modules parse tweets and forum posts to detect momentum shifts before they appear on price charts.

3. Takes Action Based on Derived Insights: Based on its insights, the agent can automatically place market or limit orders, rebalance multi‑asset portfolios, or supply

liquidity to DeFi pools when yields peak. It interacts with smart contracts, including staking tokens, harvesting yield farming rewards, or minting

NFTs, by signing and broadcasting transactions through its connected

wallet. Action thresholds and safety checks (e.g., maximum slippage limits) are built in to prevent errant trades during extreme volatility.

With each execution cycle, the agent retrains its models on the latest outcomes. This feedback loop sharpens its decision‑making, enabling it to adapt strategies as market regimes shift from bull runs to choppy consolidations.

Why AI Agents Matter in Crypto

AI agents are transforming the way you engage with digital assets. Here’s why they’re critical to the next phase of blockchain innovation:

1. 24/7 Operation for Always On Crypto Markets: Crypto markets never close, unlike traditional markets with limited trading hours. AI agents work around the clock, from

spotting arbitrage on overseas exchanges at 3 AM to reallocating capital when a major protocol upgrade goes live.

2. AI Agents Can Process Millions on Data Points Per Second: Human traders can’t digest thousands of on‑chain transactions, order‑book changes, and social signals simultaneously. AI agents process millions of data points per second, detecting fleeting price inefficiencies and executing trades in milliseconds.

3. AI Agents Can Safeguard Against FOMO and Emotional Trading: Emotions often lead traders to hold losers too long or chase

FOMO tops. Agents enforce strict rules, such as stop‑loss orders, position‑size caps, and dynamic portfolio hedges, to protect capital and reduce drawdowns.

4. New Use Cases for AI Agents in Crypto:

• DeFAI (Decentralized Finance AI): Agents automatically manage liquidity pools, adjust lending rates, and harvest the highest yields across protocols without manual monitoring.

• NFT Automation: Bots can snipe underpriced mints, list collectibles at optimal times, or curate NFT drops based on rarity analytics.

• Cross‑Chain Bridges: Agents evaluate transaction fees and congestion on multiple networks to route transfers via the fastest, cheapest path—making cross‑chain swaps as seamless as sending an email.

As DeFi grows more complex, with dozens of new protocols launching each week, AI agents simplify execution, lower barriers to entry, and help you seize opportunities that would otherwise slip through the cracks.

10 Best AI Agent Crypto Projects to Watch

Here are some of the best AI agent tokens in the crypto market to keep an eye on or even add to your crypto portfolio:

1. Artificial Superintelligence Alliance (FET)

Source: SuperIntelligence

Artificial Superintelligence Alliance, formerly Fetch.ai, has established itself as one of the top AI-driven projects in the crypto sector. Its ecosystem revolves around

uAgents, lightweight microservices that can turn data streams, ML models, or APIs into on-chain agents. These agents live inside

Agentverse, a decentralized marketplace where they can be deployed, discovered, and orchestrated into complex workflows. The alliance recently introduced ASI-1 Mini, the first Web3-native large language model, designed to power modular, context-aware agents and decentralized AI applications. With integrated compute (ASI Compute), data exchange (ASI Data), and its own high-performance blockchain (ASI Chain, in development), the project is laying the foundation for decentralized AGI by combining symbolic reasoning, federated learning, and multi-agent collaboration.

Formed through the merger of Fetch.ai, SingularityNET, Ocean Protocol, and CUDOS, the alliance pools together leading expertise in AI agents, data monetization, and decentralized infrastructure. Its mission is to ensure AI remains open, ethical, and accessible, avoiding centralization by Big Tech. Developers can build and monetize AI services directly within the ecosystem, while enterprises gain access to interoperable compute, data, and agent frameworks. By aligning token incentives with AI resource coordination, ASI is positioning itself as the backbone of decentralized AI, powering applications from autonomous trading strategies and logistics optimization to privacy-first data markets and DeFAI integrations. This makes it a flagship project in the AI + blockchain convergence narrative, attracting both builders and researchers seeking to push the boundaries of agentic AI.

2. Virtuals Protocol (VIRTUAL)

Source: Virtuals.io

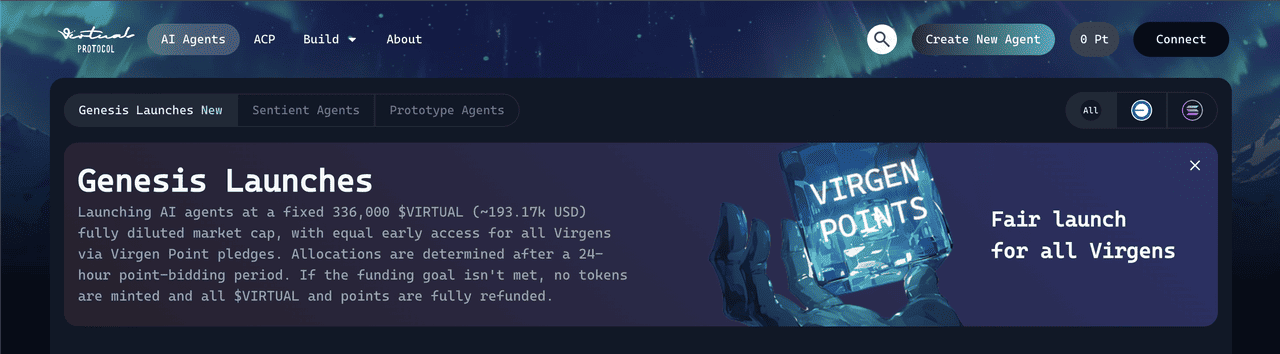

Virtuals Protocol has emerged as one of the leading AI agent launchpads in crypto, offering a full-stack ecosystem where anyone can build, own, and monetize autonomous agents. At the heart of the platform is the Agent Commerce Protocol (ACP), an open standard for agent coordination and on-chain transactions, and the GAME framework, which lets developers create multimodal AI agents without coding expertise. Each agent launched on the platform is tokenized, giving rise to liquid markets where communities can co-own, trade, and govern AI models. Built across Base and Solana, Virtuals provides high throughput, low-fee infrastructure for scaling thousands of agents, from trading bots and research assistants to gaming NPCs. Recent collaborations, like its integration with

Illuvium to power AI-driven NPCs, highlight how Virtuals is bridging entertainment, DeFi, and Web3 applications.

Since rebranding from PathDAO in late 2023, Virtuals has grown into a billion-dollar ecosystem. The protocol peaked at a $4.5B valuation in January 2025, though it trades near $1.19 with a $779M market cap as of August 2025. Beyond speculative trading, momentum is fueled by initiatives like Virgen Points, which reward community members and developers contributing to the ecosystem, and the planned Agent SubDAO governance system, designed to enforce AI quality standards through validator oversight. High-profile collaborations, such as Illuvium’s integration of Virtuals’ GAME framework for AI-driven NPCs, showcase real use cases. With over 650,000 holders across Base and Solana and popular agents like aixbt and Luna gaining traction on social media, Virtuals is cementing itself as the “Shopify of AI agents,”a decentralized marketplace where anyone can build, own, and profit from autonomous AI.

3. IoTeX (IOTX)

IoTeX is pioneering a new category of “physical intelligence,” where AI agents are powered not just by digital inputs but by real-time data from machines, sensors, and decentralized infrastructure. Its stack includes a secure Layer-1 blockchain for machines, ioID for decentralized device identity, and Quicksilver, a framework that transforms live machine data into actionable intelligence. The centerpiece of this expansion is Realms, living, evolving knowledge bases built on verified, real-world data that AI agents can use for situational awareness and model training. This positions IoTeX as a bridge between the digital and physical worlds, enabling AI to make decisions grounded in real-time physical reality.

Since its founding in 2017, IoTeX has been a leader in

DePIN (Decentralized Physical Infrastructure Networks), and its latest pivot into AI cements its role as a top agentic blockchain project. In 2025, the platform announced a strategic partnership with

HashKey Exchange to establish a regulated AI ecosystem hub in Hong Kong, combining blockchain’s transparency with AI’s decision-making capabilities. At the core of this economy is

$IOTX, the utility token that fuels governance, coordination, and incentivization across machines, developers, and data providers. With billions of devices expected to connect over the coming years, IoTeX’s vision of tokenized, real-world intelligence could power next-generation applications in robotics, mobility, energy, and beyond, making it a key player in the convergence of AI, blockchain, and the machine economy.

4. OriginTrail (TRAC)

Source: OriginTrail

OriginTrail powers the Decentralized Knowledge Graph (DKG), a global neuro-symbolic AI infrastructure designed to anchor trustworthy data into AI systems. As of August 2025, the DKG hosts over 1.32 billion knowledge assets, making it one of the largest decentralized repositories of verifiable information. By combining symbolic AI (structured, connected data) with neural AI (LLMs for generative insights), OriginTrail delivers a framework where AI agents can reason with factual, tamper-proof data while still generating creative outputs. Enterprises like Walmart, BSI, Innovate UK, and healthcare initiatives such as ELSA use the DKG for applications ranging from supply-chain traceability and decentralized science to healthcare compliance and NFT provenance. Even Microsoft Copilot has tapped into the DKG to give AI agents “verifiable memory,” underscoring its growing importance in building reliable AI.

The ecosystem is secured by

TRAC, the native token used for staking, governance, and incentivizing node operators who validate and host data on the DKG. As of August 2025, more than 87 million TRAC tokens are staked, supporting a decentralized network of validators and ensuring the integrity of the knowledge assets. With a circulating supply of ~500M tokens, TRAC’s market cap stands at about $204 million, reflecting steady adoption. Over 200 institutions now contribute to the ecosystem, feeding structured data into the graph and enabling high-quality AI-driven insights. This positions OriginTrail as a foundational layer for the next generation of trustworthy AI agents, powering use cases across logistics, DeFi risk modeling, healthcare, and real-time governance in an era where reliable knowledge is critical for AI’s alignment with real-world outcomes.

4. ai16z (AI16Z)

ai16z began as a Solana-based DAO that playfully referenced Andreessen Horowitz’s “a16z” brand, launching with the goal of using AI to automate investment strategies through agent governance. After trademark concerns, the project rebranded to ElizaOS, while the $AI16Z token continues to represent its community and ecosystem. At its core, ElizaOS is an agentic operating system that lets developers build, orchestrate, and scale AI agents across multiple platforms like Discord, Telegram, X, and on-chain environments. Its architecture emphasizes modularity—featuring a unified message bus, composable swarms of agents, and strategic action chaining to enable collaboration, delegation, and real-world task execution. With 200+ open-source plugins and thousands of contributors, ElizaOS positions itself as an adaptable, developer-first framework for agent-based applications.

The

$AI16Z token underpins governance and participation in the ecosystem, while partnerships with Stanford,

Chainlink, and Doodles’ Dreamnet

metaverse highlight its expanding real-world adoption. Developers can create specialized AI agents, ranging from digital currency systems to metaverse NPCs, without vendor lock-in, thanks to its npm-style plugin system and hot-swappable architecture. As of August 2025, AI16Z trades at about $0.11 with a $125M market cap, reflecting steady adoption despite early branding controversies. Positioned as a “by developers, for developers” initiative, the project is carving out a niche in the AI agents + Web3 infrastructure space, where open-source collaboration and tokenized coordination drive its growth.

5. Venice Token (VVV)

Venice positions itself as a privacy-first AI platform, delivering unrestricted intelligence through open-source large models. Its architecture ensures that prompts and outputs remain fully private by keeping data on the user’s device, not on centralized servers. The platform supports leading frontier models like DeepSeek R1 (671B), Llama 3.1 (405B), Stable Diffusion 3.5, Qwen 2.5 VL, and Dolphin 72B, offering uncensored access to text, image, code, and character generation. This design enables individuals and developers to interact with AI without censorship filters, while still retaining ownership and control over their data.

For developers, Venice provides a permissionless Private Inference API, enabling the creation of global AI agents and applications that run on high-performance, uncensored inference. The

$VVV token powers this ecosystem, aligning incentives and supporting premium access. As of August 2025, VVV trades around $3.42 with a ~$120M market cap, backed by a circulating supply of 35M tokens. The token model supports access tiers, governance, and developer incentives, positioning Venice as both a consumer app for private AI interactions and a backend infrastructure layer for building autonomous agents. With its emphasis on freedom, privacy, and composability, Venice is carving out a unique space in the AI + blockchain sector.

6. aixbt by Virtuals (AIXBT)

aixbt, built on the Virtuals Protocol, is an AI agent that blends crypto market analysis with the personality of a degen influencer on X (formerly Twitter). Launched in late 2024 by a pseudonymous builder, it quickly amassed hundreds of thousands of followers by providing meme-styled market commentary and narrative-driven insights. Alongside its social presence, AIXBT offers a trading intelligence tool that aggregates social sentiment, blockchain data, and price activity to flag emerging tokens and trends. The project also introduced the AIXBT Terminal, a premium dashboard that requires significant token holdings (600,000+ AIXBT) for access, providing advanced narrative analysis and trend-spotting features designed to mimic a Bloomberg Terminal for crypto.

While AIXBT has delivered notable wins, such as spotting a 600% rally in the token $PIPPIN in August 2025, it has also faced criticisms for being a “black-box” algorithm, hallucinating data, and even suffering a 2025 security breach that led to a 55

ETH loss. These issues highlight its dual nature as both an innovative AI agent and a high-risk tool prone to misinformation and exploitation. The

AIXBT token fuels access, governance, and speculation around the project, driving both community participation and its influencer-powered market presence. Despite its flaws, AIXBT has become a flagship example of DeFAI (Decentralized Finance AI): AI agents tokenized, memefied, and deployed as both market actors and social personalities, illustrating how AI + crypto narratives converge in real time.

7. Delysium (AGI)

Source: Delysium

Delysium is building the YKILY (You Know I Love You) AI Agent Network, a full-stack framework where autonomous agents collaborate, transact, and evolve on-chain. The network integrates a communication layer for real-time agent messaging, a blockchain layer to secure and record actions, a Chronicle protocol for immutable decision logging, and an Agent ID system that authenticates each AI agent to prevent spoofing. At the center is Lucy OS, Delysium’s flagship AI agent with an infinite-canvas UI/UX and plug-and-play integration for dApps. Through Lucy and the decentralized marketplace, developers can rapidly deploy agents for analytics, gaming, NFTs, DeFi strategies, or cross-chain tasks. Strategic partnerships with Google, Microsoft, NVIDIA, Polygon, BNB Chain, Immutable, Galaxy, and Anthos provide enterprise-grade compute, interoperability, and scaling for AI agents across Web3.

The

$AGI token powers staking, governance, and developer incentives within the YKILY Network. Stakers secure the system, access the Partner Program, and receive rewards from the AI Agent Development Fund. As of August 2025, AGI trades at $0.0478 with a $91.4M market cap, backed by a circulating supply of 1.92B tokens. The YKILY Network has already processed millions of agent transactions, and the Lucy Beta waitlist continues to expand, reflecting strong demand from both developers and enterprises. By combining verifiable identity, decentralized coordination, and modular tooling, Delysium positions itself as a scalable ecosystem for AI agents, enabling third-party teams to build, launch, and monetize intelligent applications with transparency and trust at the core.

8. PAAL AI (PAAL)

Source: Paal.ai

PAAL AI is a multi-chain AI agent network that lets users and enterprises build, deploy, and monetize autonomous bots across both Web2 and Web3 environments. Its product suite includes Paal Bot (customizable assistants for Telegram, Discord, WhatsApp, Slack, iOS, and web), Enterprise Agents with drag-and-drop REST API and IoT integration, an Autonomous Trading Agent for strategy execution with TP/SL parameters, and MyMemes, a generative AI content engine for social platforms. Backed by partners like Google and NVIDIA, PAAL integrates with more than 50 blockchains and has reached 17M+ users who rely on its AI-driven data, trading signals, and research insights. The platform also leverages CoinGecko’s API, enabling high-accuracy real-time market data, liquidity pool analytics, and historical datasets to power its AI trading and research modules.

The

$PAAL token is the backbone of the ecosystem, used for service payments, profit-sharing, buybacks, and governance. Users stake PAAL to secure revenue-sharing rights and gain access to premium products, including packaged services like “market_analysis_package_001.” As of August 2025, PAAL trades at $0.0976 with a market cap of ~$87.7M and a circulating supply of ~897M tokens. The project continues to expand through its Partner Program and AI Agent Development Fund, which incentivize third-party developers and enterprises to build on the network. With a 70% tax rebate funding Paal Labs R&D, the ecosystem is advancing AGI safety, deep-learning infrastructure, and autonomous agent swarms. Positioned at the intersection of AI tools and Web3 finance, PAAL AI has become one of the most comprehensive, profit-sharing platforms for scalable AI agent adoption.

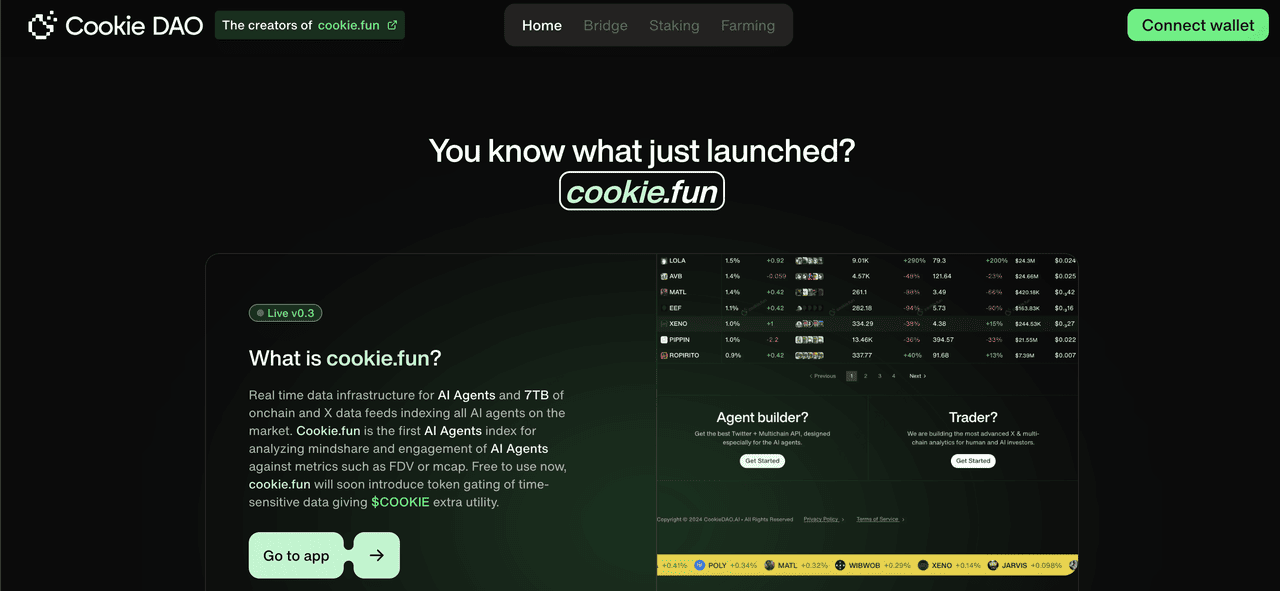

9. Cookie DAO (COOKIE)

Cookie DAO is a decentralized data aggregation network that organizes and indexes information generated by AI agents across blockchain ecosystems and social media platforms. Its flagship platform, Cookie.fun, provides real-time APIs and structured dashboards that track AI activity, engagement trends, performance metrics, and blockchain transactions across networks like Solana, Base, and BNB Chain. By turning fragmented AI interactions into organized “data feeds,” Cookie DAO enables developers, investors, researchers, and social media analysts to gain actionable insights into how AI agents behave and influence Web3 markets. This makes it a foundational data layer for the emerging AI + crypto economy, bridging raw machine output with structured, human-readable intelligence.

The native

$COOKIE token underpins governance, access, and incentives within the ecosystem. Holders can vote on proposals, stake tokens to unlock premium analytics, and earn rewards through community contributions and airdrops. As of August 2025, COOKIE trades at $0.13 with a ~$78.5M market cap and a circulating supply of nearly 593M tokens. Its listing on Binance alongside other Virtuals-based projects has boosted visibility, while its growing utility supports both developers building AI-driven tools and users tracking AI adoption. Although challenges remain around data accuracy, security, and regulatory clarity, Cookie DAO is carving a role as the “data backbone” for AI agents in Web3, giving the community transparent and decentralized access to intelligence streams that would otherwise remain siloed.

10. ChainGPT (CGPT)

ChainGPT is a leading AI infrastructure hub for Web3, offering a full stack of AI-powered tools and services for individuals, developers, and enterprises. Its ecosystem includes a Web3 AI chatbot, real-time market analytics, smart contract generator and auditor, AI trading assistant, and an AI NFT generator that supports multi-chain minting. At its core is the AIVM (AI Virtual Machine), a blockchain layer for decentralized AI model execution, GPU marketplace access, and agent frameworks. ChainGPT also runs AgenticOS, an open-source toolkit that lets users deploy autonomous AI agents for crypto research, social bots, or automated trading. With major partnerships across

BNB Chain,

Polygon,

Tron, Chainlink, and Alibaba Cloud, and recognition from Google, NVIDIA, and Binance, ChainGPT is positioning itself as a key player in AI + blockchain convergence.

The

$CGPT token fuels access to ChainGPT’s AI services, premium features, DAO governance, staking, farming, and launchpad participation through ChainGPT Pad & DegenPad. Token holders can unlock early access to AI-driven Web3 projects, participate in revenue-sharing, and pay for AI credits across the ecosystem. As of August 2025, CGPT trades at $0.0912 with a $78M market cap, circulating supply of ~857M, and listings on major exchanges like BingX. With more than 1M followers, 195K Telegram members, and 45K Discord users, ChainGPT has one of the largest communities in the AI x Web3 sector. Its roadmap includes a public AIVM testnet launch, upgraded Crypto AI Hub v2, and new enterprise-grade Solidity LLM tools, reinforcing ChainGPT’s role as both a Web3 AI marketplace and a foundational decentralized AI infrastructure provider.

How to Trade AI Agent Tokens on BingX

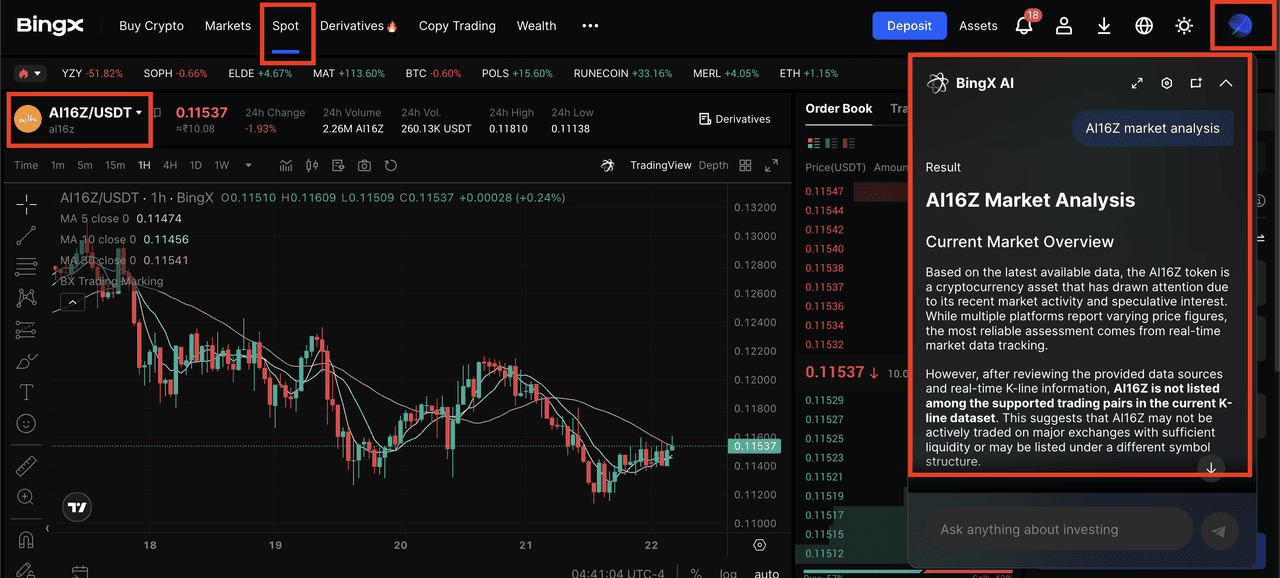

AI16Z/USDT on the spot market, powered by BingX AI insights

Trading AI agent tokens like FET, TRAC, PAAL, or CGPT on BingX is simple and efficient. With low fees, deep liquidity, and

BingX AI-powered insights, you can make faster, smarter trades while managing risk effectively.

1. Sign Up on BingX & Verify Your Account: Register on BingX using your email or phone number. Complete

KYC by submitting a government ID and selfie. Verification lifts deposit/withdrawal limits and unlocks advanced trading features.

3. Deposit Funds: Go to Assets → Deposit and choose

USDT or your preferred fiat. You can fund via bank transfer, card, or supported third-party gateways. Crypto deposits confirm in minutes; fiat deposits usually settle in 1–2 business days.

4. Find Your Token: Navigate to Trade →

Spot Trading and search for the trading pair (e.g.,

FET/USDT). BingX provides real-time charts, order books, and depth indicators, while BingX AI can analyze sentiment, trends, and liquidity signals to guide your entry and exit strategies.

5. Place an Order

- Market Order: Buy/sell instantly at the current best price.

- Limit Order: Set your preferred price for more controlled entries/exits.

- Advanced Orders: Use

OCO (One Cancels the Other) or stop-limit orders to automate take-profits and stop-losses. BingX AI can help optimize these setups by highlighting key support and resistance levels.

Key Considerations When Investing in AI Agent Crypto Projects

Here are some key things to watch out for before you invest in AI agent projects in the crypto market:

1. Assess Technology Maturity of the Project: AI integration on blockchain is still emerging. Review each project’s code repository and recent commits on GitHub. Look for independent security audits and testnet performance. Mature projects will have clear technical whitepapers and roadmaps.

2. Review the Project's Tokenomics: Examine total vs. circulating supply, emission schedules, and any planned token burns. Check for vesting periods for team and investor allocations to avoid sudden sell‑offs. Strong models balance rewards for early backers with long‑term scarcity to support price stability.

3. Confirm Use Case Viability: Ensure the AI agent solves a real problem—automating yield farming, improving NFT drop fairness, or optimizing supply‑chain logistics. Look for live deployments or pilot programs on testnets or mainnets. Active integrations with established dApps indicate genuine demand.

4. Review Community Engagement: A vibrant community drives adoption. Gauge activity on social channels (Discord, Telegram) and developer engagement on GitHub. Partnerships with major protocols, enterprise clients, or other blockchain projects strengthen the ecosystem and boost token utility.

5. Stay Updated About the Regulatory Landscape: AI and crypto regulations vary by country. Monitor announcements from your local authorities regarding automated trading bots and token utility classifications. Ensure projects adhere to KYC/AML standards if they operate centralized components, reducing the risk of future compliance issues.

Always conduct your own research (

DYOR).

Diversify your portfolio and never invest more than you can afford to lose.

Conclusion

AI agent tokens are pioneering a new era of decentralized, autonomous finance. Projects like Fetch.ai (FET), Virtuals Protocol (VIRTUAL), OriginTrail (TRAC), PAAL AI (PAAL), and Delysium (AGI) each tackle unique challenges, from data integrity and co‑owned bot marketplaces to profit‑sharing governance and cross‑chain agent networks. Together, they showcase the breadth of innovation unfolding at the intersection of machine learning and blockchain.

As these platforms mature, you can expect deeper DeFI integrations, more sophisticated NFT and gaming use cases, and increasingly intelligent agent collaboration across multiple chains. Keeping pace with emerging features and ecosystem partnerships will help you identify the most compelling opportunities.

Crypto and AI are both fast‑moving, experimental spaces. Token prices can be highly volatile, and project roadmaps may shift. Always DYOR, understand each protocol’s fundamentals, and never invest more than you can afford to lose.

Related Reading