1. The Evolution of Cryptocurrency Exchanges

The rapid growth of cryptocurrencies has driven the fast-paced iteration of exchange industries. Reflecting on history, the development of cryptocurrency exchanges can be broadly divided into four stages, each characterized by unique technological features and business models. Hyperliquid, as a fourth-generation exchange, represents the latest direction in the industry. Its evolution is as follows:

First Generation: Early Budding Phase (2010–2013) – Centralized and Small-Scale Trading

Exchanges began to emerge, focusing on trading between Bitcoin and fiat currencies. Representative platforms included BitcoinMarket.com and Mt.Gox. This stage was characterized by simple functionality, a small market scale, and the initial establishment of trust mechanisms.

Second Generation: Rapid Development Phase (2014–2018) – Increasing Cryptocurrency Variety (BTC/ETH/LTC/BCH), Initial Regulatory Involvement

With the rise of Ethereum and other cryptocurrencies, exchanges began supporting a wider variety of crypto asset trading and exploring features like derivatives and lending. Platforms like Binance, Huobi, Coinbase, OKX, and FTX became mainstream, while governments gradually stepped in with regulations.

Third Generation: Explosive Growth and Reorganization Phase (2018–2023) – Rise of DeFi, On-Chain Liquidity Aggregation,

Institutional Investor Influx, Continuous Regulatory Tightening

The rise of decentralized finance (DeFi) spurred the prosperity of on-chain exchanges. Uniswap, Curve, and other DEXs (decentralized exchanges) led the liquidity mining trend, while centralized exchanges (CEXs) remained competitive through high-frequency trading and asset diversification.

Fourth Generation: Comprehensive Tools and New Exploration Phase (2023–Present) – New Asset Issuance Methods and Exploration of Exchange Forms Under Diversified Tools

Exchanges in this phase emphasize full-chain transparency and user experience optimization. Emerging platforms like Hyperliquid combine the convenience of CEXs with the decentralization of DEXs, leveraging on-chain technology and innovative tools to explore new asset issuance methods.

2. Hyperliquid: Innovator in Decentralized Trading

Hyperliquid is built on a high-performance Layer-1 blockchain, creating a fully on-chain decentralized exchange (DEX) designed to offer users a trading experience comparable to centralized exchanges.

Core Technology and Features

- High-Performance Layer-1 Blockchain: Employs the HyperBFT consensus algorithm to achieve ultra-low latency (median 0.2 seconds, 99th percentile 0.9 seconds) and high throughput (200,000 orders per second).

- On-Chain Perpetual Contract Exchange: Supports a fully on-chain order book model, ensuring all transactions are transparent and not dependent on off-chain mechanisms.

- User-Friendly Experience: Simplifies on-chain operations to deliver a seamless trading experience akin to CEXs.

Analysis of Innovative Features

- On-Chain Order Book Mechanism: Enables truly decentralized perpetual contract trading, offering advanced features such as stop-loss and take-profit orders. Supports dual protocols: HIP-1 is a native token standard for spot trading, akin to Ethereum's ERC-20 tokens. Tokens adhering to this standard can establish on-chain spot order books and participate in perpetual contract trading on the Hyperliquid platform. HIP-2 ensures that tokens issued under HIP-1 have sufficient initial liquidity, thereby promoting trading activity.

- HyperBFT Consensus Algorithm: A proprietary algorithm optimizes trade ordering to enhance performance. The results of the traditional voting consensus mechanism (two-thirds approval) are passed between leaders and validators. Since transaction ordering does not require waiting for block confirmation, block waiting times are significantly reduced. Theoretically supports 2 million transactions per second (compared to Binance's 1.4 million transactions per second).

- Cross-Chain Bridge for Deposits and Withdrawals: Integrates with the Arbitrum chain through a native cross-chain bridge, also validated by Hyperliquid L1. Users can stake USDT and USDC through this bridge into Hyperliquid L1 without paying Arbitrum gas fees. Instead, Hyperliquid charges a flat fee of 1 USDC. To prevent malicious attacks, this native cross-chain bridge has been audited for security by Zellic.

- Liquidation Mechanism: Updates oracle quotes every 3 seconds, incorporating spot prices from major exchanges such as Binance, OKX, Bybit, and KuCoin. Oracle prices are jointly calculated and weighted with Hyperliquid spot prices to produce the mark price, which serves as the liquidation standard for perpetual contract trading, ensuring fair operation of the exchange.

3. Breaking Through the Dual Competition Between CEX and DEX

Hyperliquid’s technological positioning allows it to strike a unique balance between CEXs and DEXs, successfully appealing to professional traders.

Comparison with Centralized Exchanges (CEX)

- Decentralization: No single point of failure, and user funds are not controlled by the platform. However, the current use of PBFT consensus with four nodes requires further decentralization.

- Transparency: All transactions are publicly recorded on-chain.

- Security: Distributed architecture reduces the risk of attacks.

- Performance: Matches the trading speed of CEXs while maintaining full decentralization.

Differentiation from Decentralized Exchanges (DEX)

- Performance Breakthrough: Compared to dYdX, which relies on Layer-2 solutions, Hyperliquid significantly improves throughput with its standalone Layer-1 blockchain.

- Order Book Transparency: Fully operated on-chain with no reliance on off-chain order books.

- Cross-Chain Bridge Mechanism: Reduces friction costs associated with DEX trading.

In summary, Hyperliquid’s uniqueness lies in its attempt to create a truly decentralized, high-performance, and fully transparent on-chain perpetual contract trading platform. Rather than aiming to build a comprehensive DeFi ecosystem, it focuses on addressing the shortcomings of traditional DEXs in terms of performance and decentralization.

4. The Unique Value of Hyperliquid

Hyperliquid is not merely a DEX but a decentralized trading blockchain with unique advantages. Its distinct value lies in being a rare manifestation of the "Degen" ethos in the crypto market—respecting the community, understanding the industry, and achieving professionalism. The design and operational logic of its products reflect an uncommon decentralization spirit in the crypto market and a strong emphasis on the community, empowering users to participate in platform governance and profit distribution.

Hyperliquid’s founder, Jeff Yan, has a strong background in quantitative trading, having worked on high-frequency trading systems at Google and Hudson River Trading. In 2018, he founded Chameleon Trading, a top-ranked high-frequency cryptocurrency trading company, demonstrating a deep understanding of market-making strategies.

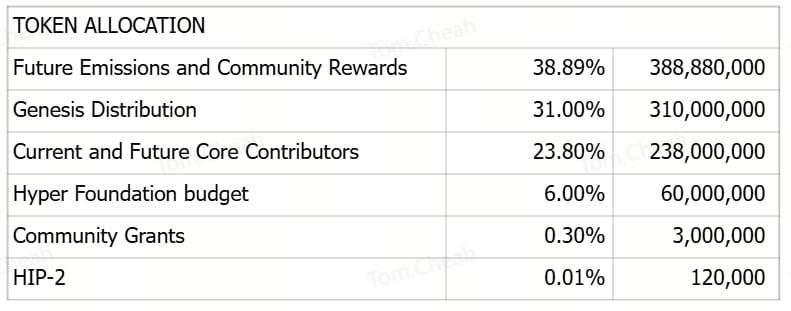

The project has conducted no funding rounds, effectively avoiding pressure from venture capital and token unlocking risks. Its tokenomics model is cleverly designed, with 31% of tokens directly airdropped to early users. Before the token launch, the community was consistently incentivized through weekly airdrops and two phases of trading rewards campaigns. As the token does not circulate on EVM chains and does not seek CEX listings, the Hyperliquid platform maintains ample liquidity and avoids unnecessary costs.

Since the token launch, key metrics have continued to improve, and user activity has far exceeded expectations. TVL has grown by 5% to reach $1.5 billion, vault size has increased by 50% to surpass $250 million, and daily trading volume remains stable at a historic high of $6 billion. These achievements demonstrate the platform’s robust vitality and high user loyalty.

5. Data Insights: Post-TGE Performance

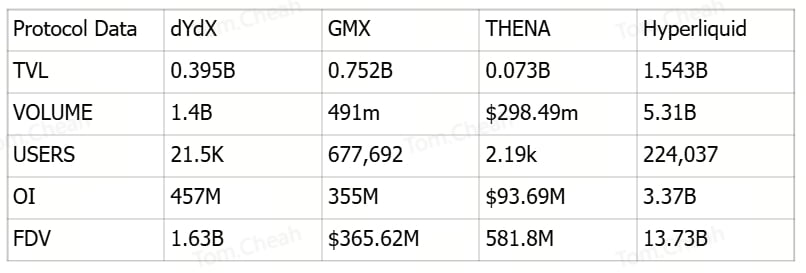

Since its token generation event (TGE), Hyperliquid has demonstrated robust growth momentum, with key metrics significantly outperforming some competitors, such as dYdX.

As of December 10, Hyperliquid’s total USDC value locked (TVL) reached $1.543 billion, nearly four times that of dYdX and on par with MEXC, ranked 14th among centralized exchanges. Additionally, Hyperliquid’s 24-hour trading volume far surpassed that of dYdX, reaching $5.31 billion, highlighting the platform's strong attraction to user funds and resulting in exceptional trading activity and user engagement. Furthermore, Hyperliquid’s open interest (OI) scale and fully diluted valuation (FDV) are also significantly higher than dYdX. With this substantial market scale, the market holds high expectations for its long-term development potential.

These data points indicate that Hyperliquid’s Layer-1 architecture, on-chain order book, and high-performance technological advantages have received positive market feedback and achieved notable progress in the competitive DEX market.

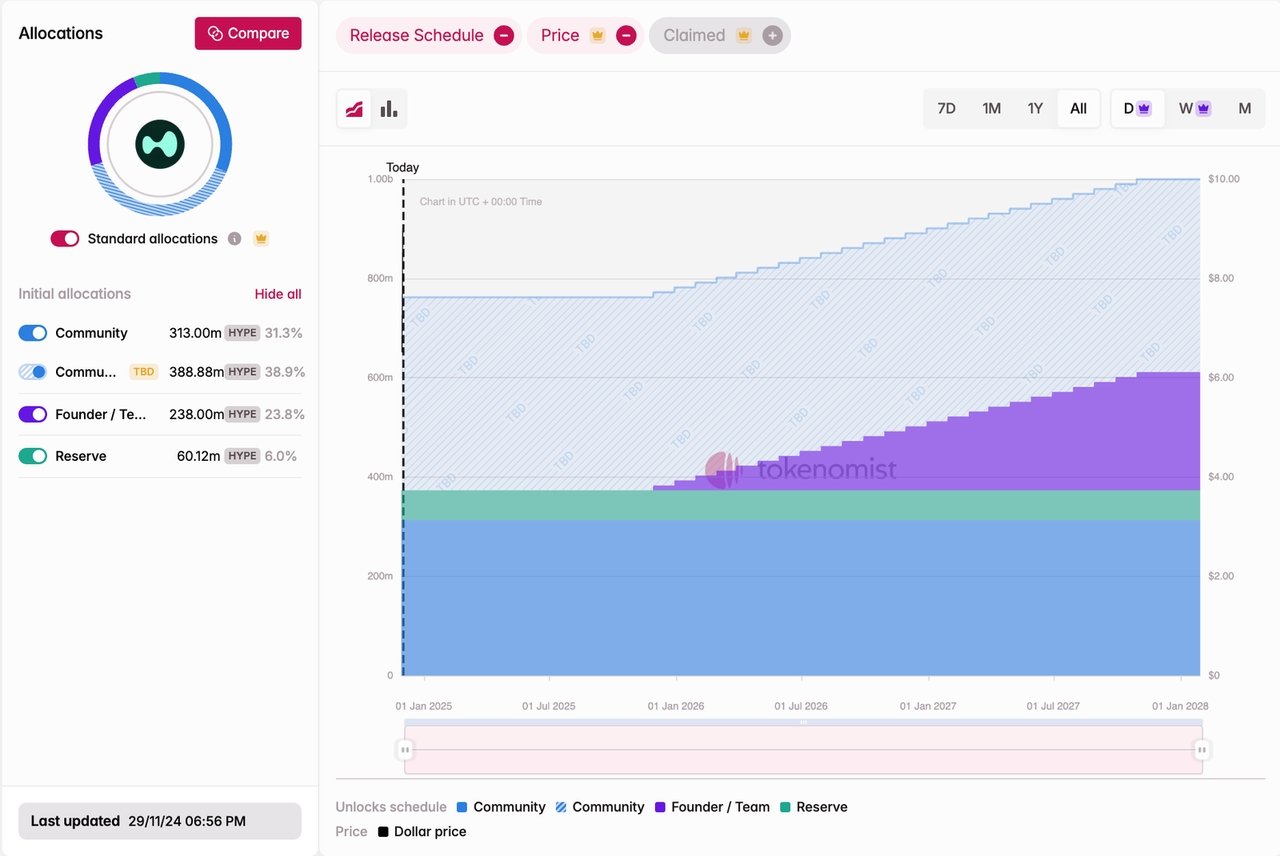

Hype Token Economics:

Hype is the native token of the Hyperliquid protocol, with a total supply of 1 billion tokens. Its utilities include serving as gas for HyperEVM and staking to ensure network security. The token distribution currently has 37% in circulation, with the release of the remaining tokens expected to be completed by 2028, though specific details remain undisclosed.

Hyperliquid’s revenue model is entirely community-oriented and is implemented through the following methods:

a. Dutch Auction Fees: Revenue is generated through gas fees, which are paid in USDC during the alpha phase before the mainnet token launch. The latest Dutch auction closed at $123,256.11 USDC, with the total annual auction revenue from the last 15 rounds estimated at $15 million. This revenue stream is expected to continue growing.

b. Trading Fees: All trading fees on the Hyperliquid platform, including those for spot trading and perpetual contracts, are collected and distributed to the community.

- HLP (Hyperliquidity Provider): The majority of trading fees are allocated to the HLP, a community-owned liquidity provision mechanism. Participants earn a share of trading fees by providing liquidity.

- Assistance Fund: A portion of the trading fees is allocated to the assistance fund to address emergencies, such as platform security vulnerabilities or unforeseen events. For security purposes, most of the assistance fund’s assets are held in Hype tokens, stored in an address that requires unanimous validator votes for access (0xfefefefefefefefefefefefefefefefefefefefe).

Revenue Performance:

As of December 9, the protocol has generated at least $100,377,183.84 in revenue, with HLP contributing $47,084,871.00. The assistance fund currently holds 10,654,299.17 Hype tokens, yielding $97,737,705.04 in profits. Approximately $53,292,312.84 USDC was used to buy Hype tokens at an average price of $5. These Hype tokens primarily come from ongoing transfers to the assistance fund post-Hyperliquid launch and subsequent purchases after the token launch.

Buyback Hypothesis: Based on the current daily trading volume of $5 billion, assuming a trading fee rate (after deductions for rebates and maker discounts) of 0.008%, approximately $3.6 million worth of Hype tokens can be repurchased monthly. If the trading volume increases tenfold, the monthly buyback amount will reach $36 million. This represents an annual buyback ratio of 2.4% of the total market capitalization, significantly impacting Hype’s market value, far exceeding other exchanges’ token buyback levels.

Note: A more intuitive approach is to observe the growth in the assistance fund, which directly reflects the funds allocated to HLP and the assistance fund and their respective proportions.

6. Future Outlook: Hyperliquid’s On-Chain Vision

The Hyperliquid ecosystem is flourishing, with its core centered on its on-chain exchange, attracting an increasing number of users.

Community-driven tools such as Hypurrfan (token deployment tool), pvp.trade (trade tracking and social trading bot), and Hypurrscan (on-chain monitoring tool) greatly enhance the user experience.

Additionally, the official mascot, Purr meme coin, keeps up with trends and brings vitality to the community. As Hyperliquid’s blockchain continues to evolve, along with the addition of more native token protocols and EVM protocols, the ecosystem will attract more developers and projects, driving protocol revenue growth and community prosperity.

In conclusion, Hyperliquid’s future looks promising. Its community-driven exchange model and robust tool ecosystem will serve as its core competitive advantages.

Sources:

https://stats.Hyperliquid.xyz/

https://app.mode.com/dydx_eng/reports/58822121650d?secret_key=391d9214fe6aefec35b7d35c

https://app.gmx.io/#/dashboard

https://alpha.thena.fi/analytics

https://tokenomist.ai/Hyperliquid

https://Hyperfnd.medium.com/Hype-genesis-1830a4dc2e3f

https://hypurrscan.io/address/0xfefefefefefefefefefefefefefefefefefefefe

https://app.Hyperliquid.xyz/vaults/0xdfc24b077bc1425ad1dea75bcb6f8158e10df303

Click the image below to receive exclusive gifts up to $6,000 by signing up for a BingX user account.