USAT (USA₮) is a U.S.-regulated, dollar-backed

stablecoin launched on January 27, 2026, supported by Tether and issued by Anchorage Digital Bank, N.A., an OCC-regulated, federally chartered digital asset bank. Built to operate within the

GENIUS Act federal stablecoin framework, USAT is structured with 1:1 dollar backing, regulated issuance, and institutional-grade reserve oversight, positioning it as a compliant

on-chain dollar for U.S. markets rather than offshore crypto liquidity.

Unlike

USDT, which is positioned as Tether’s global “digital dollar,” USAT is purpose-built for U.S. regulatory and institutional requirements. In practical terms, USAT is aimed at institutions, regulated platforms, and U.S. users that prefer (or require) a stablecoin with a U.S. issuance and oversight structure.

What Is Tether USAT (USA₮) Stablecoin and How Does It Work?

USAT (USA₮) is a U.S.-regulated, dollar-backed stablecoin supported by Tether and issued by Anchorage Digital Bank, N.A., a federally chartered digital asset bank regulated by the Office of the Comptroller of the Currency (OCC). It is designed to operate within the GENIUS Act federal stablecoin framework, which mandates regulated issuance, full 1:1 dollar backing, and ongoing compliance. At launch on January 27, 2026, USAT entered circulation as an ERC-20 token on Ethereum, allowing it to integrate seamlessly with existing wallets, exchanges, and on-chain settlement infrastructure while maintaining a U.S. banking and reserve structure.

Unlike USDT, which primarily serves global and offshore crypto markets, USAT is purpose-built for U.S.-based institutions, exchanges, and payment providers that require a domestically issued digital dollar under U.S. regulatory oversight. Reserve custody and primary dealer responsibilities are handled by Cantor Fitzgerald, providing institutional-grade reserve management and transparency. Early distribution partners include Kraken, OKX, Crypto.com, Bybit, and MoonPay, with USAT launching as a fully circulating stablecoin, no mining, staking, or inflation mechanism, focused on payments, settlement, and compliant dollar liquidity within the U.S. financial system.

How USAT, Tether's US-Focused Stablecoin Works

USAT functions as a 1:1 dollar-pegged payment stablecoin, where each token represents a claim on one U.S. dollar held in reserve. The stablecoin is designed for instant settlement, allowing transfers to clear in seconds rather than through multi-day banking rails.

The issuance flow differs from traditional crypto stablecoins:

1. USAT is minted and redeemed through Anchorage Digital Bank, not an offshore entity.

2. Reserves are held in liquid, dollar-denominated assets, with Cantor Fitzgerald acting as reserve custodian and preferred primary dealer.

3. On-chain USAT tokens circulate on Ethereum, while compliance, governance, and reserve management occur within a U.S. banking framework.

This structure aligns USAT with GENIUS Act requirements around regulated issuance, transparency, and institutional suitability, making it usable by U.S. broker-dealers, fintechs, custodians, and regulated exchanges that may be restricted from interacting with offshore stablecoins.

How USAT Fits into Tether’s Broader Stablecoin Strategy

Source: Tether

USAT is a regulated, U.S.-specific counterpart to USDT rather than a replacement. While USDT continues to function as the primary global liquidity layer for offshore markets, emerging economies, and crypto-native trading, USAT is designed for U.S.-regulated capital, institutional settlement, and compliant payment flows under federal oversight. This creates a segmented stablecoin model, where U.S.-based, regulated activity can route through USAT, while international crypto liquidity remains anchored to USDT, allowing Tether to serve both markets in parallel within a unified ecosystem.

What Is the U.S. GENIUS Act, and Why Does It Matter for Tether and USAT?

The GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins), signed into law on July 18, 2025, establishes the first federal framework for U.S. payment stablecoins. The law restricts issuance to permitted entities, including federally chartered banks, and requires full 1:1 reserve backing in high-quality liquid assets, regular disclosures and attestations, and bank-level AML, sanctions, and compliance controls. Critically, it draws a clear distinction between onshore, federally supervised stablecoins and offshore dollar tokens, giving U.S. regulators direct oversight of issuance, reserves, and governance.

For institutions, this changes stablecoin adoption dynamics. Under the GENIUS Act, legal issuer status and regulatory alignment are no longer optional for banks, broker-dealers, and fintechs operating in the U.S., even if offshore stablecoins offer deeper liquidity. USAT is structured specifically to meet these requirements, with issuance through Anchorage Digital Bank (OCC-regulated) and reserve custody handled by Cantor Fitzgerald, allowing regulated capital to access on-chain dollars without stepping outside federal compliance boundaries. In short, the GENIUS Act shifts competition from scale alone to regulatory credibility, and USAT exists to compete on that axis.

USAT vs. USDT vs. USDC: What’s the Difference?

As U.S. stablecoin regulation tightens under the GENIUS Act, differences between major dollar-backed tokens are no longer just about liquidity or brand—they increasingly come down to issuer structure, regulatory perimeter, and target users. USAT, USDT, and USDC each serve distinct roles within the dollar stablecoin market.

| Feature |

USAT (USA₮) |

USDT |

USDC |

| Issuer |

Anchorage Digital Bank, N.A. |

Tether (global issuance) |

Circle |

| Regulatory status |

U.S.-regulated, GENIUS Act–aligned |

Primarily offshore |

U.S.-aligned, regulated |

| Primary market |

U.S. institutions & regulated platforms |

Global & offshore markets |

U.S. institutions & fintechs |

| Reserve custody |

Cantor Fitzgerald |

Multiple custodians (global) |

U.S.-based custodians |

| Market cap (approx.) |

$20 million |

$190 billion |

$71.5 billion |

| Blockchain support |

Ethereum (ERC-20 at launch) |

Multi-chain |

Multi-chain |

| Core use case |

Compliant payments and settlement |

Trading liquidity and remittances |

Institutional payments and DeFi |

USAT vs. USDT: Regulated U.S. Rails vs. Global Liquidity

USDT remains the dominant stablecoin globally, with a market capitalization nearing $190 billion and deep integration across centralized exchanges, DeFi protocols, and emerging-market payment flows. Its strength lies in liquidity and ubiquity, making it the primary settlement asset for global crypto trading and cross-border value transfer.

USAT, by contrast, is designed for U.S.-regulated capital. Issued by Anchorage Digital Bank under OCC oversight and structured to comply with the GENIUS Act, USAT targets institutions, broker-dealers, and payment providers that cannot interact with offshore stablecoins. Rather than competing on scale, USAT competes on regulatory eligibility, allowing compliant U.S. entities to access on-chain dollars without stepping outside federal supervision.

USAT vs. USDC: Competing for Institutional Trust

USD Coin (USDC), issued by Circle, has long been the default stablecoin for U.S. institutions, with a market cap of roughly $70+ billion and established adoption across fintechs, banks, and regulated exchanges. Its growth has been driven by transparency, domestic alignment, and early regulatory positioning.

USAT enters this arena as the first credible U.S.-focused challenger from Tether, combining bank-issued structure with access to Tether’s broader liquidity ecosystem. Analysts note that USAT’s potential advantage lies in its institutional partnerships like Anchorage Digital, Cantor Fitzgerald and the possibility of interoperability with USDT, giving institutions access to compliant U.S. issuance without fully isolating themselves from global crypto liquidity.

Where to Buy Tether (USAT)

At launch, Tether (USAT) is available through a select group of centralized exchanges and payment platforms focused on regulated access and institutional-grade liquidity. According to Tether’s official launch communications, early distribution partners include Kraken, OKX, Crypto.com, Bybit, and MoonPay, allowing users to acquire USAT through spot markets or on-ramp services, depending on platform availability and regional compliance.

Tether has also outlined a broader USAT ecosystem that includes exchanges, wallets, and payment rails intended to support adoption over time. As with any newly launched stablecoin, actual availability may vary by jurisdiction, and users should verify official listings, supported trading pairs, and contract addresses directly on each platform before purchasing or transferring USAT.

How to Buy Tether (USDT) on BingX

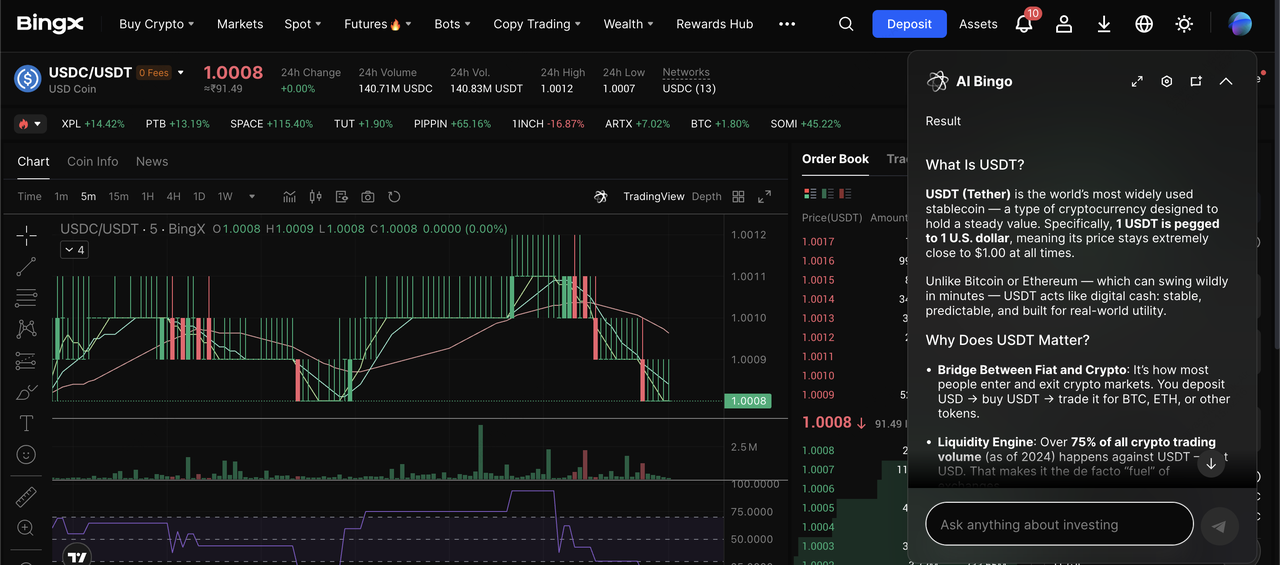

USDC/USDT trading pair on the spot market powered by BingX AI insights

You can also buy Tether (USDT) on BingX to gain global market exposure, as USDT serves as the primary trading and settlement currency across international crypto markets, allowing you to access over 1,000 spot and futures pairs, trade 24/7, and move capital seamlessly between global exchanges and DeFi platforms.

Buying Tether (USDT) on BingX is quick and beginner-friendly. Start by creating a BingX account on the website or app, completing KYC verification, and enabling basic security features like 2FA. Once your account is ready, you can fund it using fiat payment methods (credit/debit cards, Apple Pay, Google Pay, bank transfers, or UPI in supported regions) or by depositing crypto from an external wallet.

After funding your account, BingX offers multiple ways to get USDT. You can use Quick Buy for instant purchases at real-time prices,

Spot Trading to buy USDT through trading pairs like

BTC/USDT or

ETH/USDT,

Convert to swap other cryptocurrencies into USDT with no order book, or

P2P Trading to buy directly from other users with escrow protection. Once purchased, USDT can be held securely, traded across Spot and Futures markets, used for

copy trading, or withdrawn anytime to supported blockchain networks.

3 Key Risks and Checks Before Using USAT and Other Stablecoins

Before holding or transacting with a stablecoin, it’s important to understand that stability depends on legal structure, reserves, and execution, not just the $1 price tag.

1. Issuer and redemption risk: A stablecoin’s peg relies on who issues it, how redemptions work, and the quality of reserves. Even with 1:1 backing claims, redemption access may be limited to certain users or platforms, and delays or operational constraints can emerge during periods of market stress. Always review who can redeem directly, under what conditions, and how reserves are managed.

2. Regulatory and platform risk: Regulatory alignment does not eliminate risk. Rules can change, jurisdictions may impose new restrictions, and exchanges or payment platforms can add or remove support based on compliance requirements. Availability may vary by country, user type, or platform policy, even for regulated stablecoins.

3. Smart contract, custody, and transfer risk: When using stablecoins on-chain, users must verify they are interacting with the official contract address on the correct network. Wallet vulnerabilities, bridge exploits, and incorrect transfers (wrong network or address) can result in irreversible losses, regardless of the stability of the underlying token.

Bottom line: Stablecoins reduce price volatility, not operational or systemic risk, due diligence matters just as much as with any other crypto asset.

Final Thoughts

USAT represents a meaningful step in the evolution of U.S. stablecoins, reflecting how the market is shifting from scale-driven adoption toward regulatory alignment and institutional suitability. By issuing USA₮ through a federally chartered bank and designing it to operate within the GENIUS Act framework, Tether is positioning USAT as a compliant on-chain dollar for U.S.-regulated capital, while continuing to rely on USDT for global liquidity and offshore markets.

That said, USAT remains a newly launched stablecoin, and adoption will ultimately depend on real-world usage, platform integration, and regulatory consistency over time. As with any stablecoin, users should understand issuer structure, redemption mechanics, and platform support before holding or transacting. Stablecoins are designed to reduce price volatility, not eliminate risk, and prudent due diligence remains essential.

Related Reading

FAQs on Tether USAT (USAT)

1. Is USAT legal tender in the United States?

No. USA₮ is not legal tender and is not issued, approved, or guaranteed by the U.S. government. It is also not FDIC- or SIPC-insured, meaning holders do not receive government-backed deposit or investor protections.

2. What does USAT stand for?

USAT is the ticker symbol commonly used for USA₮, a U.S.-focused, dollar-backed stablecoin supported by Tether.

3. Who issues USAT (USA₮)?

USAT is issued by Anchorage Digital Bank, a federally chartered digital asset bank operating under U.S. banking oversight.

4. When did USAT launch?

The official public launch of USAT was announced on January 27, 2026.

5. Which law is USAT designed to comply with?

USAT is structured to operate within the U.S. federal stablecoin framework established by the GENIUS Act, which emphasizes regulated issuance, full reserve backing, disclosures, and compliance controls for payment stablecoins.

6. Is USAT the same as USDT?

No. USDT is Tether’s global stablecoin used widely in offshore and international crypto markets, while USAT is a U.S.-market stablecoin issued through a U.S.-regulated bank and designed for compliant, domestic use cases.

7. What blockchain network does USAT run on?

Public blockchain trackers list USAT as an Ethereum-based ERC-20 token, with an on-chain contract address and explorer data available for verification.

8. Is USAT backed 1:1 by U.S. dollars?

USAT is designed as a 1:1 dollar-backed stablecoin, with reserves held in liquid assets under a regulated custody and oversight structure. As with any stablecoin, users should review official reserve disclosures and redemption terms.

9. Can USAT lose its $1 peg?

While USAT is designed to maintain a $1 value, no stablecoin is risk-free. Peg stability depends on reserve quality, redemption access, operational reliability, and market conditions.