As the Executive Chairman and co-founder of

Strategy Inc. (formerly MicroStrategy), Michael Saylor’s wealth is perhaps the ultimate "high-beta" play in the financial world. Unlike traditional tech billionaires, Saylor’s fortune is a real-time barometer for the health of the

Bitcoin ecosystem. By early February 2026, real-time trackers like Forbes placed Saylor’s net worth at roughly $4.7 billion, ranking him #866 globally. This reflects a dramatic $5.4 billion contraction from his 2025 peaks, highlighting the intense volatility inherent in his "maximalist" approach to capital.

Who Is Michael Saylor, the CEO of Strategy (MSTR)?

Michael J. Saylor is the Executive Chairman of Strategy Inc. and one of the most prominent institutional advocates for Bitcoin. Born in 1965, Saylor studied aeronautics and astronautics at MIT, where he met Sanju Bansal, with whom he co-founded MicroStrategy in 1989. For decades, Saylor was known as a titan of the business intelligence (BI) software industry, having taken his company public in 1998.

Saylor’s career is a study in resilience. According to Forbes, during the dot-com bubble, he briefly reached a net worth of $7 billion before an accounting restatement and market crash led to a personal loss of $6 billion in a single day. He spent the next twenty years rebuilding MicroStrategy into a stable analytics powerhouse before making the fateful decision in August 2020 to pivot the company’s treasury to a Bitcoin standard, a move that would redefine his legacy and the modern corporate balance sheet.

How Did Michael Saylor Build His Wealth?

Michael Saylor’s multi-billion dollar fortune is the result of a high-conviction transformation from a software pioneer to a leading Bitcoin treasury architect. Originally building his foundational wealth as the co-founder of MicroStrategy in 1989, Saylor established himself as a titan of the business intelligence (BI) industry, taking the firm public in 1998. However, his most significant wealth-creation phase began in August 2020, when he pivoted the company's capital allocation toward a Bitcoin-standard treasury model. According to TradingView, Saylor initially converted $250 million of corporate cash into Bitcoin, eventually rebranding the firm to Strategy Inc. in February 2025.

in 2025 to reflect its identity as a "

Bitcoin Treasury Company." His strategy utilizes a sophisticated "reactor" model of financial engineering, leveraging low-interest debt, convertible notes, and equity issuance via the "42/42 Plan" to aggressively accumulate over 713,500 BTC. This dual-leverage approach, combined with his personal stash of 17,732 BTC, has inextricably linked his net worth to the appreciation of digital capital, effectively turning his software-based fortune into a real-time proxy for the global adoption of "digital gold."

How Much Is Michael Saylor's Net Worth in 2026: Key Estimates

As of early February 2026, Michael Saylor’s net worth is estimated at approximately $4.7 billion, according to real-time data from Forbes. This figure represents a high-sensitivity valuation that functions as a live proxy for the performance of the broader digital asset market.

Unlike traditional billionaires whose wealth is often insulated by diversified holdings, Saylor’s fortune is fundamentally linked to a "leveraged loop" of digital capital. This loop is primarily composed of his dominant equity stake in Strategy Inc. (formerly MicroStrategy) and his significant personal Bitcoin treasury, making his financial standing a real-time reflection of institutional Bitcoin adoption and market sentiment.

| Metric |

February 2026 Data |

| Forbes Real-Time Net Worth |

$4.7 Billion |

| Strategy Inc. Market Cap |

~$43.02 Billion |

| Corporate BTC Holdings |

713,502 BTC |

| Personal BTC Holdings |

17,732 BTC |

The early 2026 valuation marks a dramatic $5.4 billion drawdown from peak levels seen in late 2025, when Bloomberg and Forbes trackers estimated his wealth as high as $10.1 billion. This volatility is not a byproduct of operational shifts in Strategy Inc.'s legacy software business, but rather a direct result of the "Saylor Premium" compression. During the 2025

bull market,

MicroStrategy (MSTR) shares frequently traded at a significant multiple, often 2.0x or higher, to the Net Asset Value (NAV) of its Bitcoin holdings. However, market reports from MarketWatch and The Block indicate that by February 2026, this multiple collapsed toward parity, briefly trading at a ratio of 1.02x to 1.14x mNAV as Bitcoin's price discovery faced renewed headwinds.

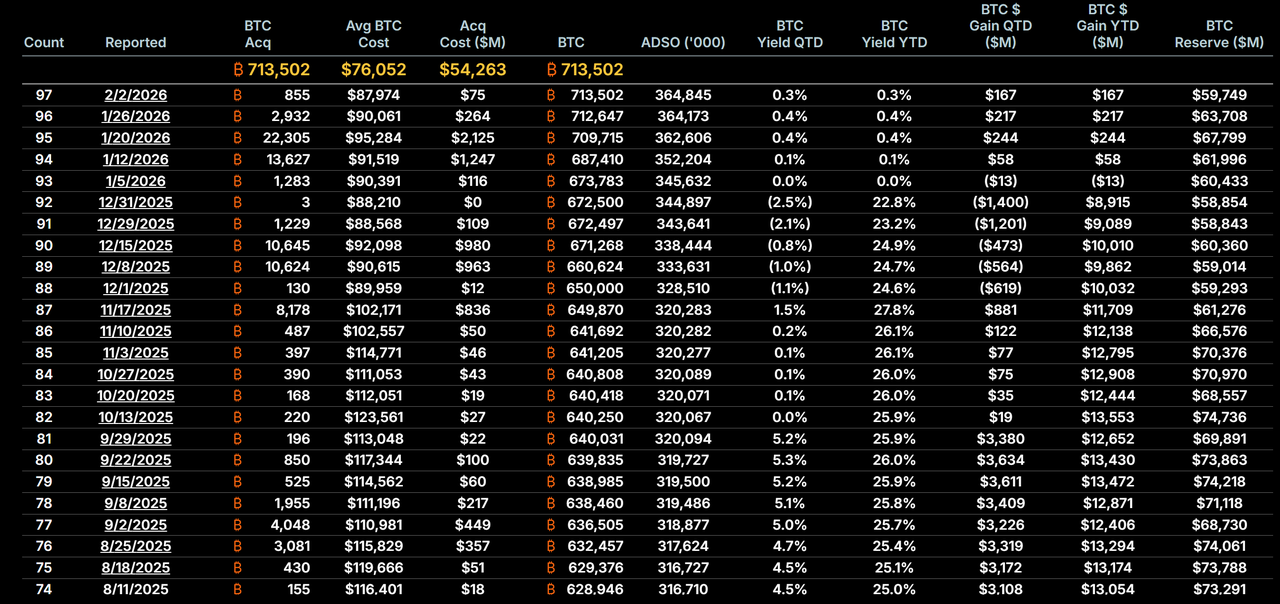

The primary driver behind this sharp contraction was a "market violation" in the first week of February, where Bitcoin dipped into the $72,000 range. This price action briefly pushed Strategy Inc.’s massive treasury of 713,502 BTC into an unrealized loss position against its aggregate cost basis of $76,052 per coin. Because Saylor has utilized aggressive financial engineering, including the "42/42 Plan" to raise billions via equity and convertible notes, the stock acts as a high-beta instrument. When Bitcoin faces a correction, the "premium" typically attributed to Saylor's management evaporates, resetting his net worth to the "floor" of the underlying digital assets and his personal stash of 17,732 BTC.

Source: Strategy Inc. BTC Holdings, Strategy.com

The 2026 Crypto Market Violation: Strategy (MSTR) Tests the "Point of No Return"

The first week of February 2026 provided a dramatic stress test for Saylor’s strategy. Following a sharp market correction, Bitcoin dipped into the $72,000 range, briefly pushing Strategy Inc.’s massive treasury "underwater."

According to MarketWatch, with a corporate average cost basis of $76,052 per BTC, the company faced unrealized losses for the first time since late 2023. This "market violation" triggered a nearly 70% tumble in MSTR stock from its July 2025 highs. For Saylor, whose wealth is largely tied to Class B shares with 10:1 voting power, this meant a paper loss of billions in mere weeks.

However, despite the "Extreme Fear" in the market, Investing.com reports that Strategy Inc. continued its relentless accumulation, purchasing another 855 BTC in early February 2026, signaling that Saylor’s conviction remains unshakeable even when the margin of safety narrows.

What Drives Michael Saylor's Net Worth: 4 Key Factors

1. MSTR Equity and Voting Power: Saylor holds approximately 19.6 million Class B shares. His wealth is directly tied to the MSTR stock price, which acts as a leveraged play on Bitcoin.

2. The "BTC Yield": A metric used by Strategy Inc. to measure Bitcoin held per diluted share. The Block notes that if dilution from new share offerings outpaces Bitcoin accumulation, Saylor’s personal equity value can suffer.

3. Personal Bitcoin "Whale" Status: Saylor revealed in 2020 that he personally owns 17,732 BTC. At early 2026 prices, this stash alone is worth over $1.3 billion.

4. Institutional Sentiment: As noted by Grayscale and MSCI, the inclusion of "Bitcoin Treasury Companies" in major global indexes is a secondary but powerful driver of the stock's valuation and Saylor's wealth.

How Does Michael Saylor's Wealth Compare to Other Crypto Titans?

In the global hierarchy of crypto wealth, Michael Saylor occupies a unique position as the "Institutional Maximalist." Unlike other founders whose wealth is tied to the operational success of service-based platforms (exchanges), Saylor’s fortune is a pure bet on the underlying asset's scarcity.

| Leader |

Primary Entity |

Est. Net Worth (Feb 2026) |

Wealth Source |

| Changpeng Zhao (CZ) |

Binance |

$79B - $88B |

Exchange Equity / BNB |

| Brian Armstrong |

Coinbase |

$9B - $14B |

Public Exchange Equity (COIN) |

| Michael Saylor |

Strategy Inc. |

$4.7B - $8.6B |

Bitcoin / MSTR Equity |

| Vitalik Buterin |

Ethereum |

$800M - $1.1B |

ETH Holdings |

As of early 2026,

Changpeng Zhao (CZ) remains the outlier, with a fortune driven by

Binance global dominance.

Brian Armstrong follows, with his net worth functioning as a real-time proxy for U.S. crypto trading volume. In contrast,

Vitalik Buterin’s net worth, while more modest by billionaire standards, reflects a "philosopher-founder" profile. According to BingX Academy, Buterin’s wealth is primarily in his 240,000+

ETH holdings, but his influence is measured by protocol utility rather than corporate leverage.

While Saylor ranks below CZ and Armstrong in total dollar value, his wealth is arguably the most strategically concentrated. While Armstrong’s wealth is tied to exchange commissions and Buterin's to the Ethereum ecosystem, Saylor’s fortune is a singular, unhedged bet on the long-term status of Bitcoin as "digital gold." This makes his net worth the most volatile on the list, but also the one most likely to skyrocket if his "13 million per coin" prediction moves toward reality.

Conclusion

Michael Saylor’s net worth in 2026 is a testament to the risks and rewards of the "Bitcoin Standard." By merging his personal fortune with a corporate treasury experiment, he has created a financial vehicle that is both a target for skeptics and a beacon for believers. Whether he is viewed as a visionary or a high-stakes gambler, his $4.7 billion fortune remains the ultimate barometer for the future of digital capital.

Related Reading