RaveDAO (RAVE) is redefining how culture, entertainment, and blockchain come together. It transforms live music experiences like festivals, raves, and club nights into an on-chain cultural ecosystem, where fans, artists, organizers, and Web3 builders share ownership, governance, and economic rewards. RaveDAO uses real-world events as the organic on-ramp to crypto adoption, turning every ticket, interaction, and community decision into verifiable

on-chain participation.

In this guide, you can discover what RaveDAO is, how the RAVE token functions, how this cultural protocol works as a bridge from real-life experiences into a decentralized Web3 economy, how you can buy or trade RAVE on BingX Spot and Futures markets.

What Is RaveDAO (RAVE)?

RaveDAO is a Web3-powered entertainment project that turns music festivals and global events into easy entry points for people to experience crypto, issuing

NFT tickets that act as on-chain proof of attendance. It works as a community-governed protocol where every event, ticket, and participant helps build a shared digital economy and identity system.

RaveDAO delivers a practical, real-world bridge between culture and blockchain at a scale few Web3 projects have reached. By using large-format festivals to onboard 100,000+ participants and issuing 70,000+ NFT tickets as permanent on-chain identities, it removes Web3’s typical friction while creating lasting user engagement. Its model ties around 20% of event revenue to philanthropic impact, and its multi-million-dollar annual earnings demonstrate genuine commercial sustainability rather than speculative growth. As a result, RaveDAO functions not just as an events brand but as a cultural operating system, where music, technology, governance, and community participation reinforce each other in a continuously expanding real-world economy.

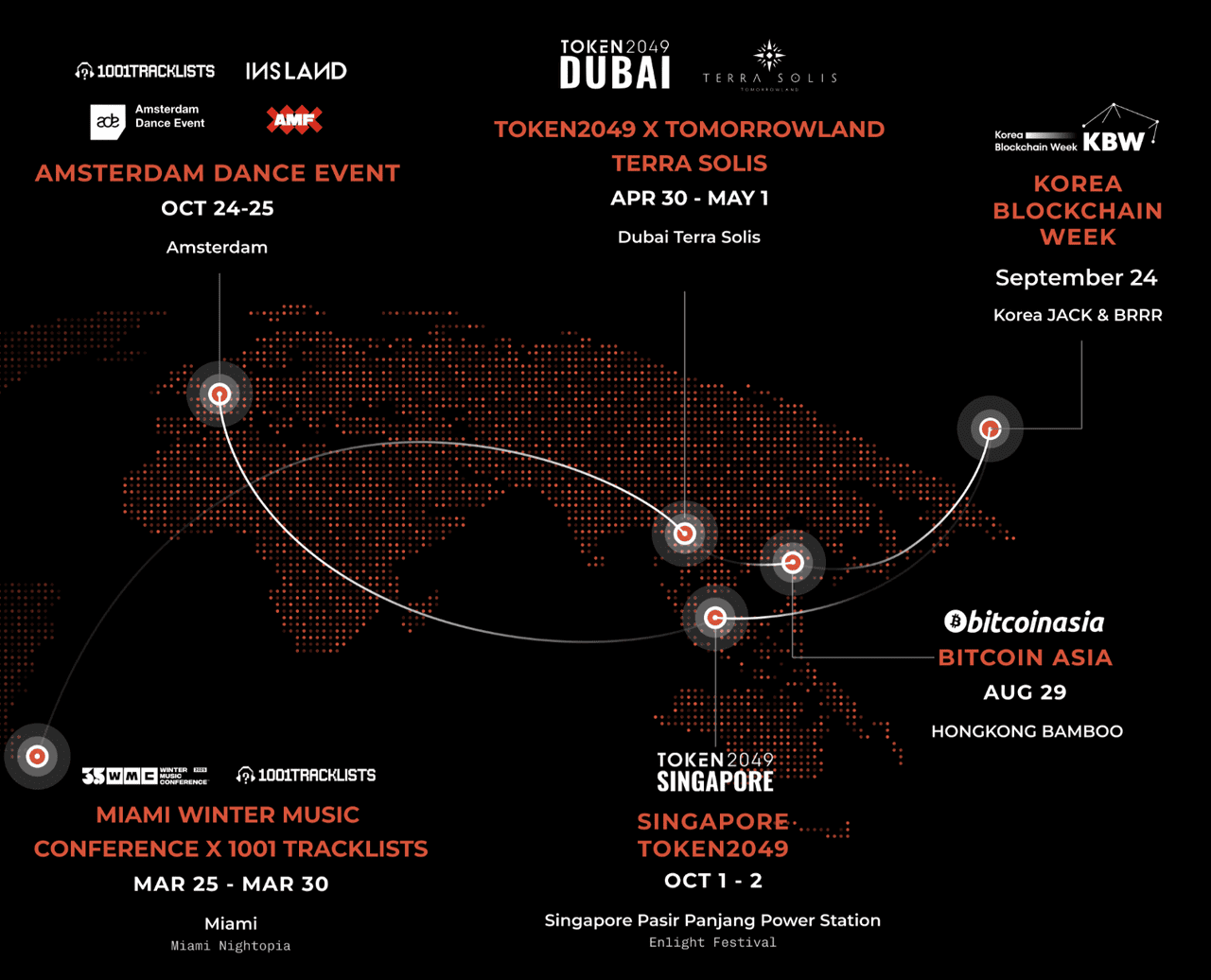

RaveDAO 2025 roadmap | Source: RaveDAO

At its core, RaveDAO:

• Runs flagship festivals and community chapters across Singapore, Dubai, Seoul, Amsterdam, Miami, and more.

• Mints NFT tickets that act as permanent, verifiable on-chain identities for each attendee.

• Enables token-powered governance, letting RAVE holders vote on city locations, artist lineups, themes, and charity allocations.

• Allocates around 20% of event revenue to philanthropy, funding eye surgeries in Nepal and global wellness programs.

Instead of onboarding users through tutorials and complex Web3 UX, RaveDAO makes crypto experiential, embedding it into dance floors, social identity, community ownership, and cultural participation. This “culture-first adoption model” is why RaveDAO is becoming one of Web3’s most influential real-world ecosystems.

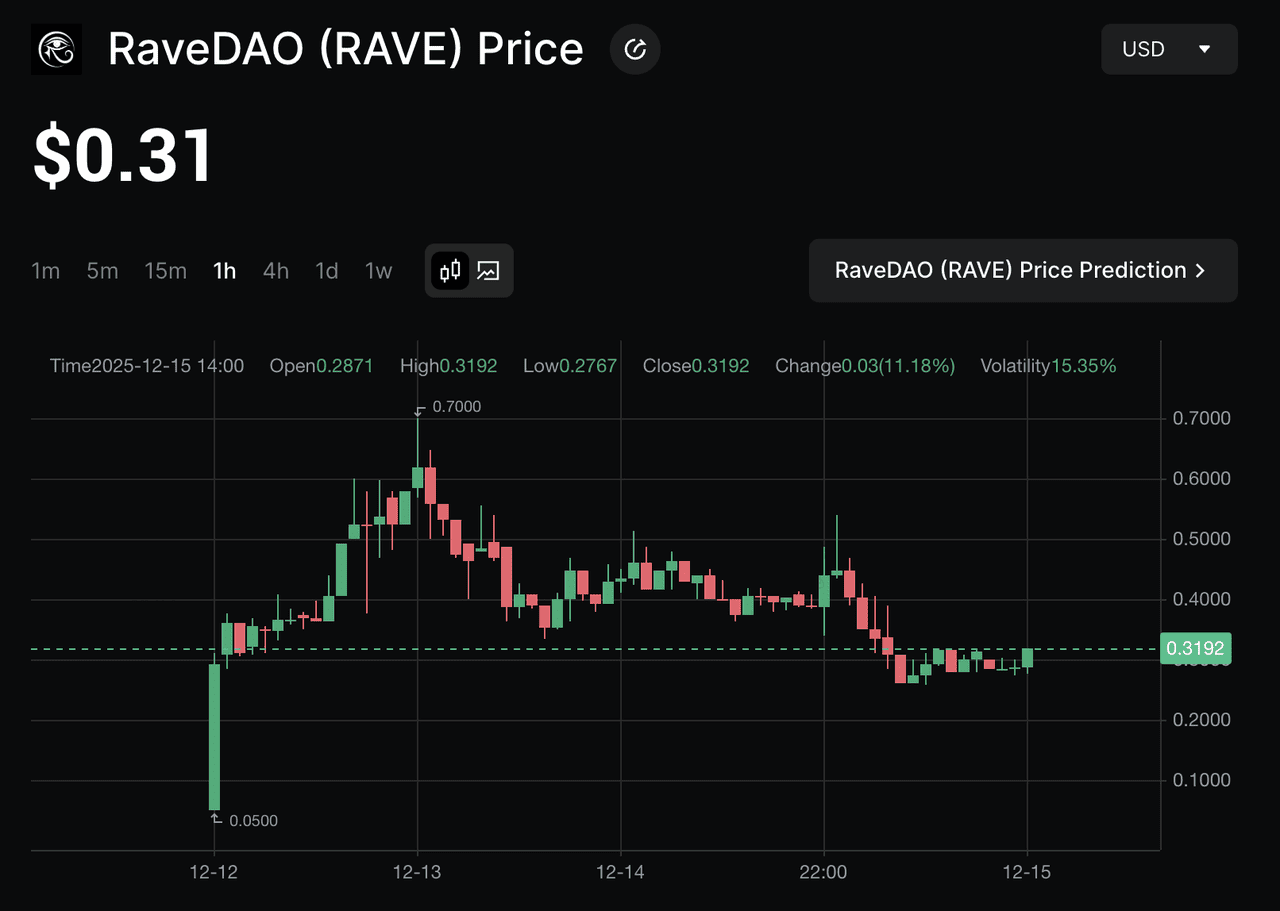

RaveDAO (RAVE) price chart | Source: BingX

RAVE recorded strong early momentum following its TGE in December 2025, where 23.03% of the supply entered circulation and the token was listed across multiple major exchanges. The price surged to a post-launch all-time high of $0.64 on December 13, 2025 before stabilizing within the $0.26–$0.51 range, supported by a $68 million market cap, over $70 million in 24-hour trading volume, and a circulating supply of 230.3 million tokens. This trading activity reflects healthy initial liquidity and market participation as RaveDAO expands its real-world event ecosystem and on-chain economy.

How Does RaveDAO Work?

RaveDAO works by combining real-world festivals, on-chain identity, DAO governance, and token-driven participation into a unified cultural protocol that bridges offline experiences with Web3.

1. Real-World Events Serve as On-Chain Entry Points

RaveDAO turns its global festivals and community chapters into seamless entry points for on-chain participation. Whether in Dubai, Singapore, Seoul, or Amsterdam, every event is designed to onboard users into Web3 through familiar cultural touchpoints rather than technical onboarding flows. NFT tickets are minted automatically for each attendee, acting as a permanent on-chain passport that records where and how users engage with the ecosystem, forming the foundation of their RaveDAO identity.

To eliminate friction, RaveDAO integrates

x402 payments on

Base, allowing users to pay with crypto or traditional methods like credit cards, Apple Pay, Alipay, and WeChat while the system silently generates and links their wallets in the background. This makes the “on-chain” experience nearly invisible to newcomers. Around 20% of event proceeds are also directed to community-selected philanthropic causes, ensuring that every participation, whether attending, paying, or voting, feeds back into cultural and social impact.

RaveDAO's partners | Source: RaveDAO

2. NFT Ticketing as Identity

RaveDAO’s NFT ticketing system transforms event access into a dynamic on-chain identity layer. Each NFT serves as a permanent proof of attendance, a membership passport that can unlock future perks, and a gateway to ecosystem rewards, voting, and airdrops. As users collect these stamps across different cities and events, their participation forms a richer, verifiable cultural profile, turning real-world experiences into lasting digital identity and value within the RaveDAO ecosystem.

3. Decentralized Governance and Community Ownership

RaveDAO operates as a DAO, where $RAVE holders help steer the ecosystem. Through governance:

• Event cities, themes, and lineups can be chosen by the community.

• Charity allocations and ecosystem grants are voted on democratically.

• Local chapters or RaveDAOx can be funded and activated under the shared RaveDAO framework.

This transforms cultural engagement into participatory economy loops, where contribution is recognized, rewarded, and influential.

What Is RAVE, the Native Token of RaveDAO?

The $RAVE token is the economic heart of the RaveDAO ecosystem. It ties together real-world activity, governance, and rewards, enabling culture to operate as protocol.

RAVE Token Utility

• Governance: Vote on event strategies, locations, and philanthropic allocations.

• Licensing and Staking: Organizers and vendors stake tokens to license RaveDAO IP and host events.

• Access and Rewards: Unlock exclusive benefits like VIP access, early ticketing, drops, and community rewards.

• Economic Activity: Used for payments, staking, and participation incentives within the ecosystem.

RaveDAO Tokenomics Snapshot

RAVE token allocation | Source: RaveDAO docs

The total supply of $RAVE is fixed at 1 billion tokens.

• Community: 30% (rewards, governance, incentives).

• Ecosystem: 31% (partners, growth, integrations).

• Foundation and Grants: 6% (impact initiatives).

• Team and Early Supporters: 25% combined with vesting schedules.

• Liquidity and Airdrops: 8% to ensure market access and reward early contributors.

Real-world revenues from events, sponsorships, and IP licensing feed token buyback and burn mechanisms, reinforcing scarcity and demand.

How to Earn RAVE Token Rewards on RaveDAO

RaveDAO rewards users for participating in its cultural ecosystem, turning actions like attending events, engaging with the community, and contributing to governance into on-chain value. The primary way to earn within RaveDAO is through RAVE token incentives, tied to both real-world activity and on-chain participation.

Users can earn rewards by:

1. Attending Events: NFT tickets act as proof of participation and can qualify holders for future airdrops, exclusive drops, or loyalty rewards.

2. Holding Membership NFTs: Genesis Membership Passes include RAVE points that convert into $RAVE tokens and offer multiplier bonuses for raffles and rewards.

3. Participating in Community Governance: Voting on event themes, city locations, and impact allocations can unlock participation-based incentives.

4. Joining or Organizing RaveDAO Chapters: Community-led chapters (RaveDAOx) may receive token grants or revenue-sharing benefits for contributing to the ecosystem.

5. Engaging with the RaveDAO Ecosystem: Referrals, content creation, social engagement, and collaboration with partners may qualify users for reward campaigns or ecosystem incentives.

As RaveDAO expands globally and integrates more partners, additional reward channels, such as staking utilities, artist collaborations, and experience-based bonuses, will continue to evolve, giving users multiple ways to benefit from active participation.

How to Buy and Trade RaveDAO (RAVE) on BingX

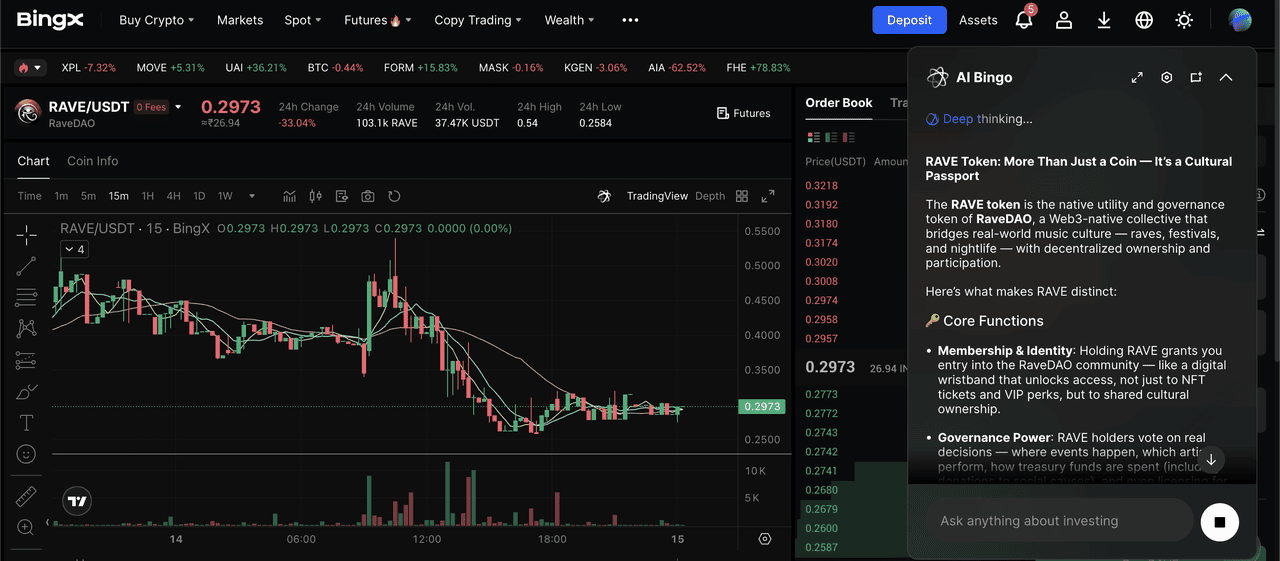

BingX AI provides real-time insights, market signals, and automated analysis to help you trade RAVE more confidently across both Spot and Futures markets.

Buy or Sell RAVE on the BingX Spot Market

RAVE/USDT trading pair on the spot market powered by BingX AI insights

Spot trading is ideal if you want to hold RAVE, use it for governance, or participate in ecosystem utilities.

1. Log in to your BingX account or create a new one.

4. Choose a

Market Order for instant execution or a Limit Order to set your preferred price.

5. Confirm the trade and view your RAVE holdings in your Spot Wallet.

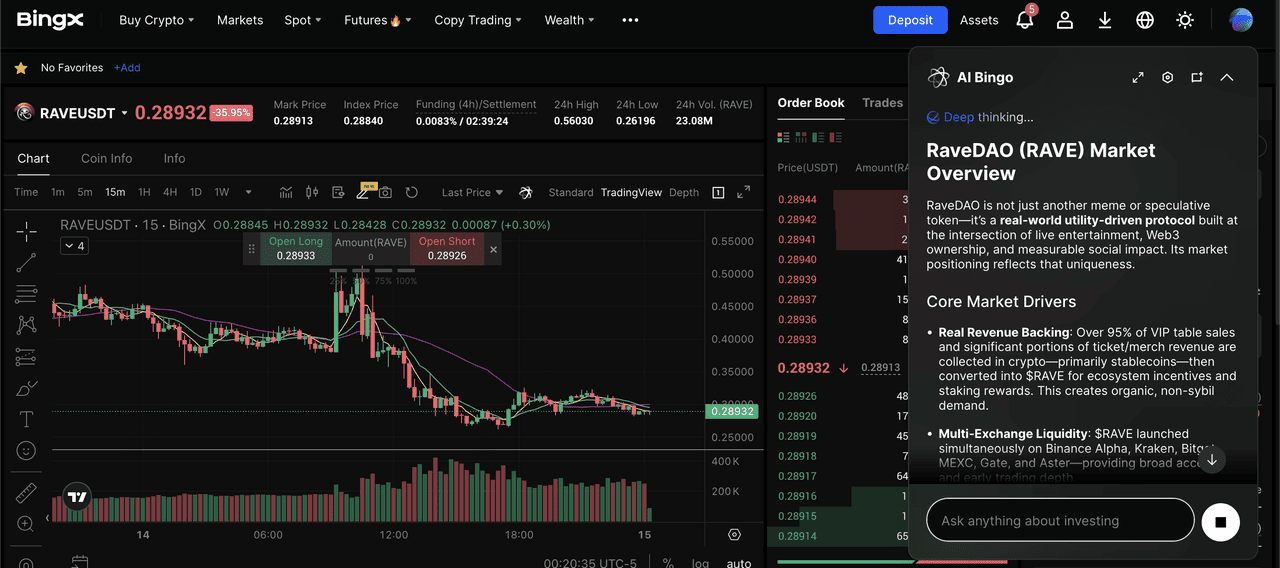

Trade RAVEUSDT Perpetuals on BingX Futures

RAVE/USDT perpetual contract on the futures market powered by BingX AI

Futures trading allows you to hedge, speculate on short-term volatility, or amplify exposure with leverage.

1. Open BingX Futures and transfer USDT to your Futures Wallet.

3. Select your desired leverage and choose Cross or Isolated margin mode.

4. Open a Long position if you think RAVE will rise or a Short position if you expect a price decline.

Conclusion: What's Next for RaveDAO?

RaveDAO is building a new pathway for Web3 adoption by embedding blockchain into familiar cultural experiences such as festivals, community chapters, NFT ticketing, and impact-driven participation. According to its 2025–2027 roadmap, the project plans to expand flagship events across Dubai, Singapore, Hong Kong, Los Angeles, New York, and more; pilot community-led chapters worldwide; and scale attendance from over 100,000 participants in 2026 to more than 300,000 across 50+ decentralized events by 2027. RaveDAO also aims to grow beyond music into gaming, sports, creator ecosystems, and education, positioning itself as a decentralized cultural network that combines grassroots ownership with global reach.

However, like all emerging Web3 ecosystems, RAVE carries risks, including market volatility, adoption uncertainty, and execution challenges, so users should conduct their own research and participate responsibly.

Related Reading