The long-standing blockchain project

Lisk (LSK) saw its token price surge by more than 70% on November 11, 2025, marking one of its strongest single-day rallies in years. Despite being one of the older altcoins from the early ICO era, Lisk’s sudden rebound caught the market’s attention as trading activity on South Korean exchanges spiked sharply, driving a wave of renewed speculative interest.

Once a quiet legacy project from the 2016 ICO cycle, Lisk is a blockchain network designed to make Web3 development more accessible. The project is regaining visibility as traders rotate into older altcoins showing renewed momentum. While the token’s fundamentals remain unchanged since its 2024 migration to

Ethereum’s Optimism-based Layer 2 framework, short-term market sentiment and speculative flows have pushed the Lisk token back into the spotlight.

What Is Lisk and How Does It Work?

Lisk is a Layer-2 blockchain network built on the

Optimism (OP) Stack and secured by

Ethereum. It offers a scalable, low-cost infrastructure for developers to build decentralized applications (dApps) using familiar

EVM-compatible tools such as Solidity, Hardhat, and Foundry.

Originally launched in 2016 as one of the earliest blockchain projects focused on accessibility through JavaScript SDKs and sidechains, Lisk has evolved into a modern Ethereum-aligned Layer-2 network. This new version of Lisk inherits Ethereum’s security while providing faster transactions, lower fees, and seamless interoperability within the Optimism Superchain ecosystem.

The network maintains 2-second block times and transaction fees typically under $0.01, making it cost-efficient for high-volume applications and users in emerging markets. Developers can deploy smart contracts instantly and connect their dApps with liquidity and users across the broader Superchain, which also includes Optimism,

Base, and other OP Stack chains.

Beyond the technology, Lisk’s mission is to empower founders in high-growth regions such as Africa, Southeast Asia, and Latin America. The project combines its blockchain infrastructure with funding initiatives like the EMpower Fund and local accelerator programs to support builders creating real-world Web3 solutions.

Key Features of Lisk

• EVM Equivalence: Fully compatible with existing Ethereum tools and smart contracts.

• Ethereum Security: Transactions are anchored to Ethereum’s

L1 for verified finality.

• Ultra-Fast Performance: 2-second block time and near-zero gas fees.

• Superchain Interoperability: Native connectivity with Optimism, Base, and other OP Stack chains.

• Founder-Focused Ecosystem: Programs and capital to support Web3 startups in emerging markets.

LSK Price Up 70% in Single Day on November 11, 2025 Driven by Korean Market

On November 11, 2025, the Lisk (LSK) token surged by more than 70% in 24 hours, marking one of its largest single-day gains in recent years. The rally pushed LSK back into the spotlight after months of muted performance, highlighting renewed speculative interest in older altcoins.

1. South Korean Exchanges Dominate LSK Trading by 65%

Trading data shows that South Korean platforms accounted for over 65% of total LSK spot volume, led by LSK/KRW pairs, which became the most actively traded markets globally. Combined turnover exceeded 390 million USD in a single day, underscoring the influence of Korean retail traders in driving Lisk’s price momentum. The dominance of LSK/KRW pairs highlights how the Korean market moves differently from global exchanges. Local traders tend to favor fiat-based pairs, creating concentrated liquidity and sharper volatility. This distinct trading pattern often drives isolated rallies in legacy tokens like LSK, even when global activity stays subdued.

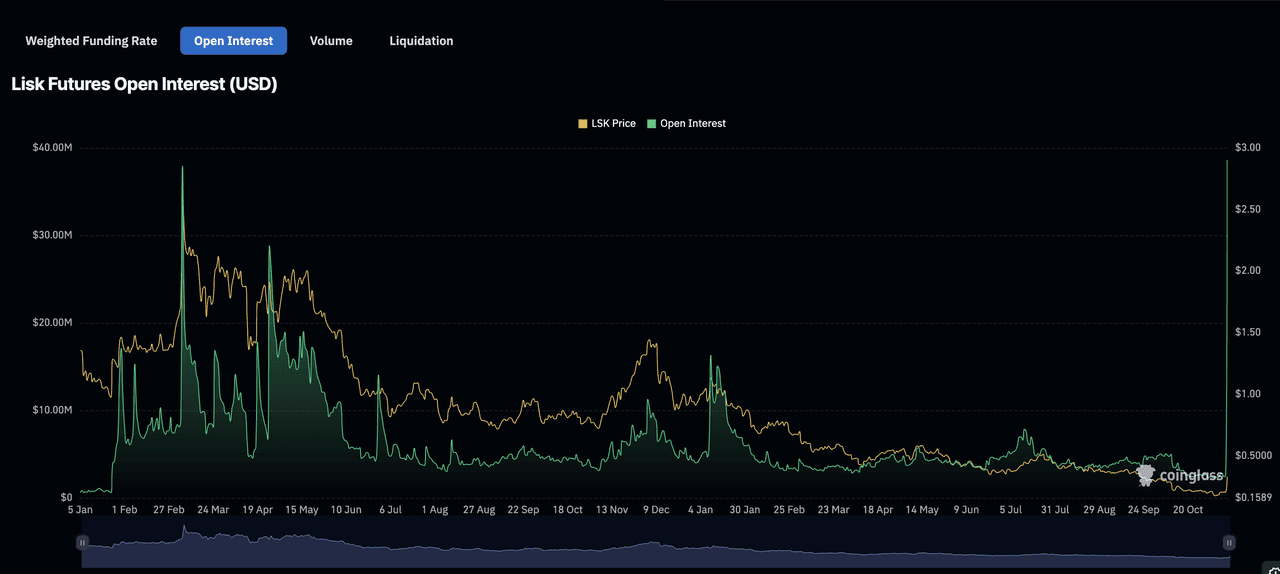

2. Open Interest in LSK Derivatives Climbed to a 22M All-Time High

Derivative activity rose sharply alongside spot trading.

Open interest in LSK futures exceeded 22 million USD, setting a new record as leveraged traders positioned around short-term volatility. The surge in derivatives participation amplified price swings, helping LSK break above resistance levels near 0.34 to 0.42 USD.

3. Old Altcoins Spark "Dino Coin Frenzy" in Korean Market

The LSK rally also coincides with a broader “Dino Coin” (short for “dinosaur coin”) trend in the Korean market, referring to older cryptocurrencies making sudden comebacks after years of quiet trading.

These movements highlight how Korean traders are rotating into older, low-liquidity assets with nostalgic value, creating short bursts of momentum distinct from broader global market trends.

Lisk (LSK) Tokenomics Overview

Lisk introduced a complete token model upgrade in April 2024, known as LSK 2.0, as part of its migration to an ERC-20 token on Ethereum. The upgrade replaced the old inflationary system with a fixed-supply structure and introduced governance, staking, and ecosystem incentives designed for long-term sustainability.

$LSK Token Utilities

Under the new model, LSK serves multiple purposes within the Lisk ecosystem:

• Governance and DAO participation: Holders can lock LSK to vote on proposals, funding allocations, and network upgrades through the Lisk DAO.

• Staking rewards: Participants

earn yield by locking tokens for governance or validator support during the transition to decentralized sequencing.

• Transaction fee payments: With future account-abstraction features, users may be able to use LSK to pay gas fees on the Lisk Layer-2.

• Ecosystem incentives: Developers and early users receive airdrops, grants, and retroactive funding tied to real on-chain activity.

The migration to Ethereum’s OP Stack Layer-2 also enhances liquidity, composability, and compatibility with the broader DeFi ecosystem.

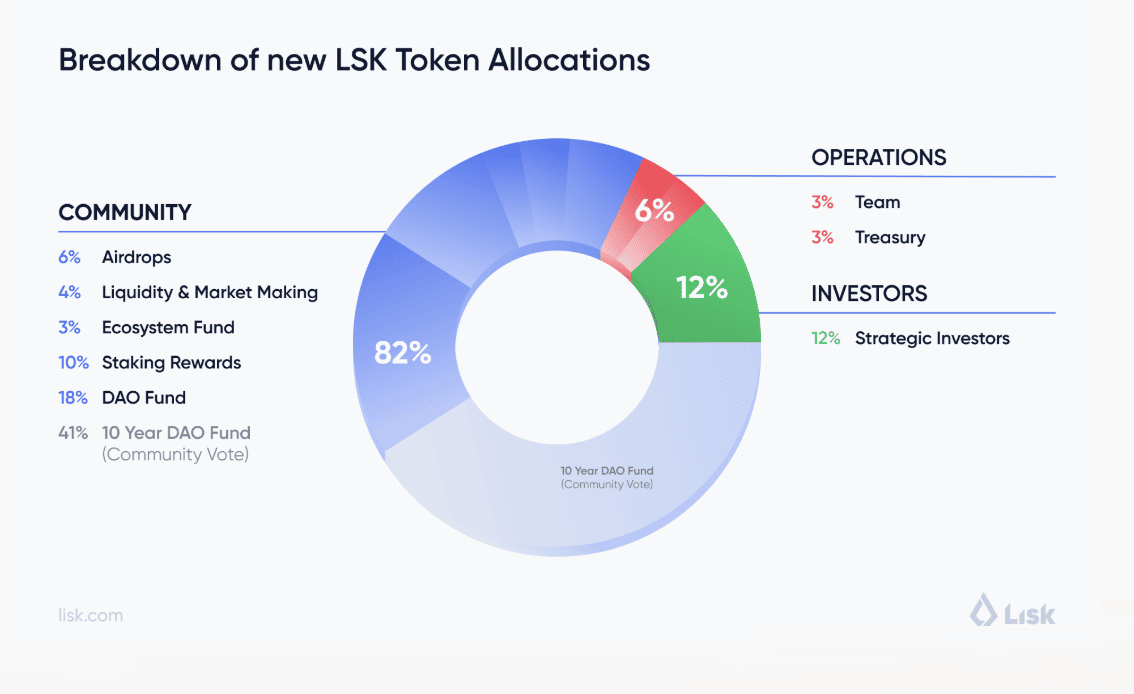

$LSK Token Allocation

Lisk’s total token supply is capped at 400 million LSK, distributed across community, operations, and strategic initiatives. Over 80% of the supply is allocated to community-driven programs, emphasizing decentralized participation and ecosystem growth.

1. Community 82%

• Airdrops (6%): Rewards for early supporters and new users joining Lisk’s Layer-2.

• Liquidity & Market Making (4%): Dedicated to improving trading depth and reducing price volatility.

• Ecosystem Fund (3%): Provides grants up to 100,000 USD per project to support developers and dApps.

• Staking Rewards (10%): Multi-year incentive plan for governance and participation.

• DAO Fund (18%): Core community treasury for long-term ecosystem development.

• 10-Year DAO Fund, Community Vote (41%): Subject to a community decision to either allocate to the DAO or burn, potentially reducing total supply to 300 million.

2. Team 6%

• Team (3%): Reserved for long-term contributors and key hires.

• Treasury (3%): Used for flexible operational needs and unforeseen priorities.

3. Investors 12%

• Strategic Investors (12%): Targeted toward partnerships and capital providers aligned with Lisk’s Layer-2 roadmap.

This structure prioritizes transparency, decentralization, and community alignment, ensuring most of the supply supports active builders and governance participants rather than centralized entities.

Risks and Considerations Before Investing in LSK and Other Dino Coins

While legacy tokens like Lisk (LSK), Groestlcoin (GRS), Civic (CVC), and BORA (BORA) have recently regained market attention, traders should approach these rallies with caution.

• Korean Market Dynamics: The Korean market is known for rapid sentiment shifts and high retail participation, which can lead to faster and more pronounced price reactions compared to global exchanges.

• High Volatility: Dino Coins often experience sharp price swings due to concentrated liquidity and short-term speculative trading.

• Low Liquidity Risk: Some older tokens have thinner order books outside of specific regions, which can increase slippage during large trades.

• Narrative-Driven Momentum: Price surges may be driven more by temporary hype than by new technology or ecosystem growth.

• Market Timing Sensitivity: Korean retail-driven rallies can fade quickly once local trading activity slows.

• Leverage Risk: Trading LSK futures with leverage can magnify both gains and losses; using stop-loss and take-profit tools is essential.

Investors should always assess their risk tolerance, avoid overexposure to speculative assets, and diversify across more stable holdings within their portfolios.

How to Buy and Trade Lisk (LSK) on BingX

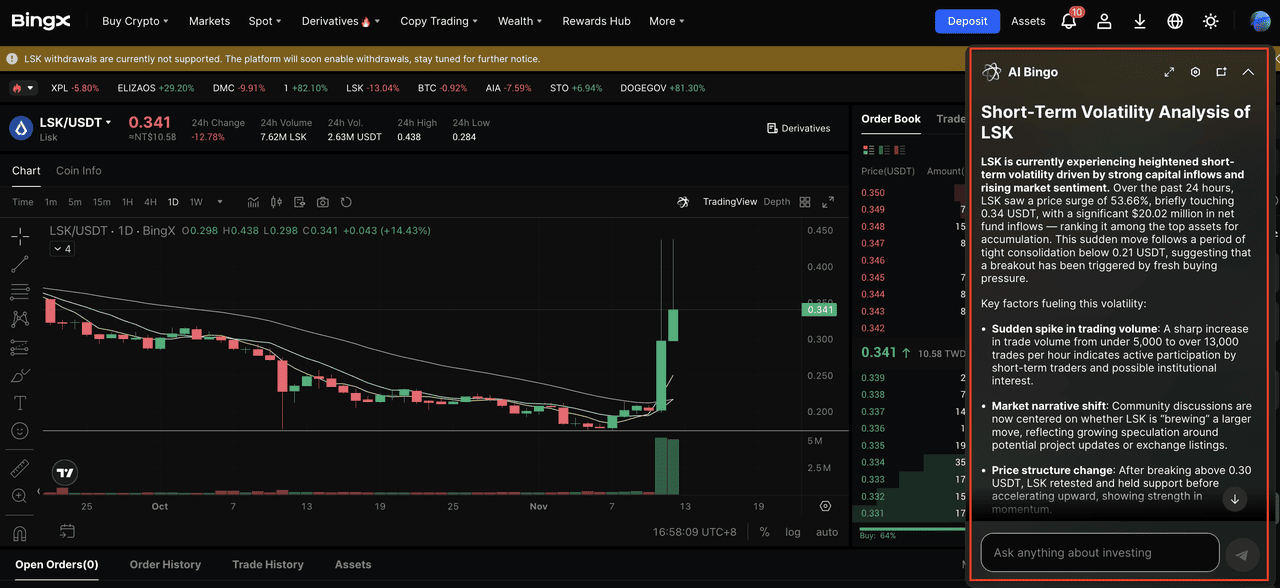

Whether you want to build a long-term LSK position, trade short-term volatility, or capture opportunities from its renewed market momentum, BingX makes it easy with both Spot and Futures markets. With

BingX AI integrated directly into the trading interface, you can also access real-time insights such as support and resistance levels, volatility trends, and price patterns: all designed to help you trade smarter.

1. Buy or Sell LSK on the Spot Market

If your goal is to accumulate LSK or buy during market dips, the

Spot Market is the simplest place to start.

Step 1: Go to the BingX Spot Market and search for

LSK/USDT.

Step 2: Click the AI icon on the chart to activate BingX AI. It will display real-time price zones, highlight potential breakout ranges, and identify key resistance and support levels.

Step 3: Choose between a market order for instant purchase or a limit order at your preferred price. Once your order is executed, your LSK will appear in your BingX wallet, ready to hold, stake, or transfer to an external wallet.

2. Trade LSK with Leverage on Futures

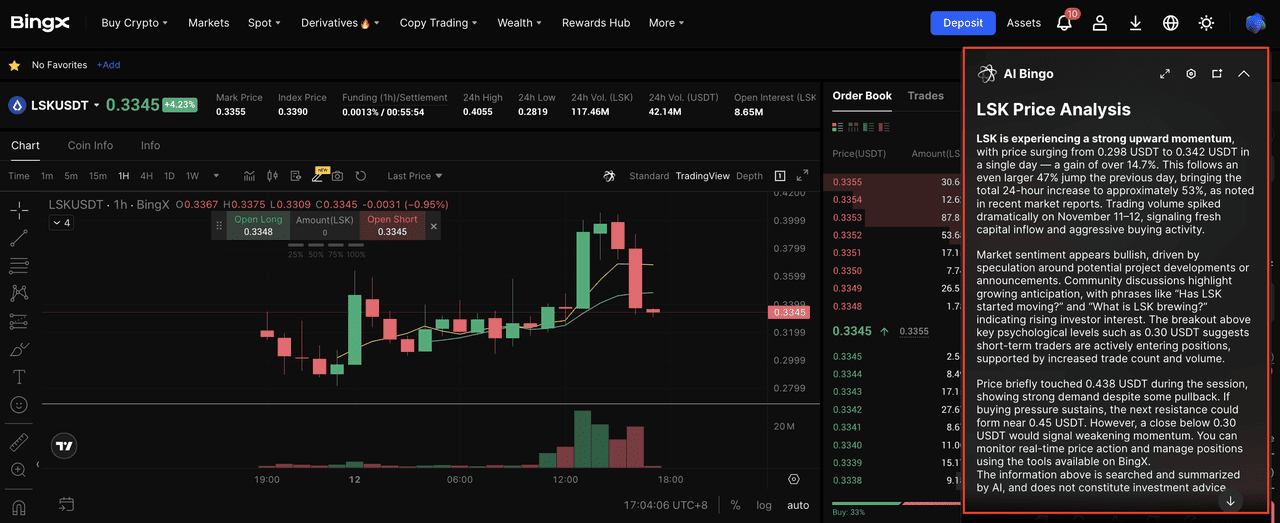

For more active traders, the BingX

Futures Market allows you to go long or short on LSK with leverage, taking advantage of both rising and falling prices.

Step 1: Search for

LSK/USDT in the BingX Futures section.

Step 2: Click the AI icon to activate BingX AI. It will analyze market momentum, volatility, and trend strength to help identify potential entry points.

Step 3: Set your leverage level, choose your entry price, and place a long (buy) or short (sell) order. Use

stop-loss and take-profit settings to manage risk and protect profits.

Related Reading