LetsBONK.fun merges

BONK’s passionate community with

Raydium’s battle-tested launchpad to create a no-code,

memecoin-focused token issuance platform on

Solana. In just three days after its April 25 debut, the platform generated $800,000 in fees, saw 2,700+ new tokens launched, and propelled over 70 projects into Raydium

liquidity pools. Meanwhile, BONK’s own price jumped by more than 50% in the week following launch, driven by sustained buybacks and

trending memecoins launched on LetsBONK.fun.

This guide breaks down everything you need to know: what LetsBONK.fun is, how to mint your token in minutes, how fees are recycled back into the network, and what’s on the roadmap for this high-velocity memepad.

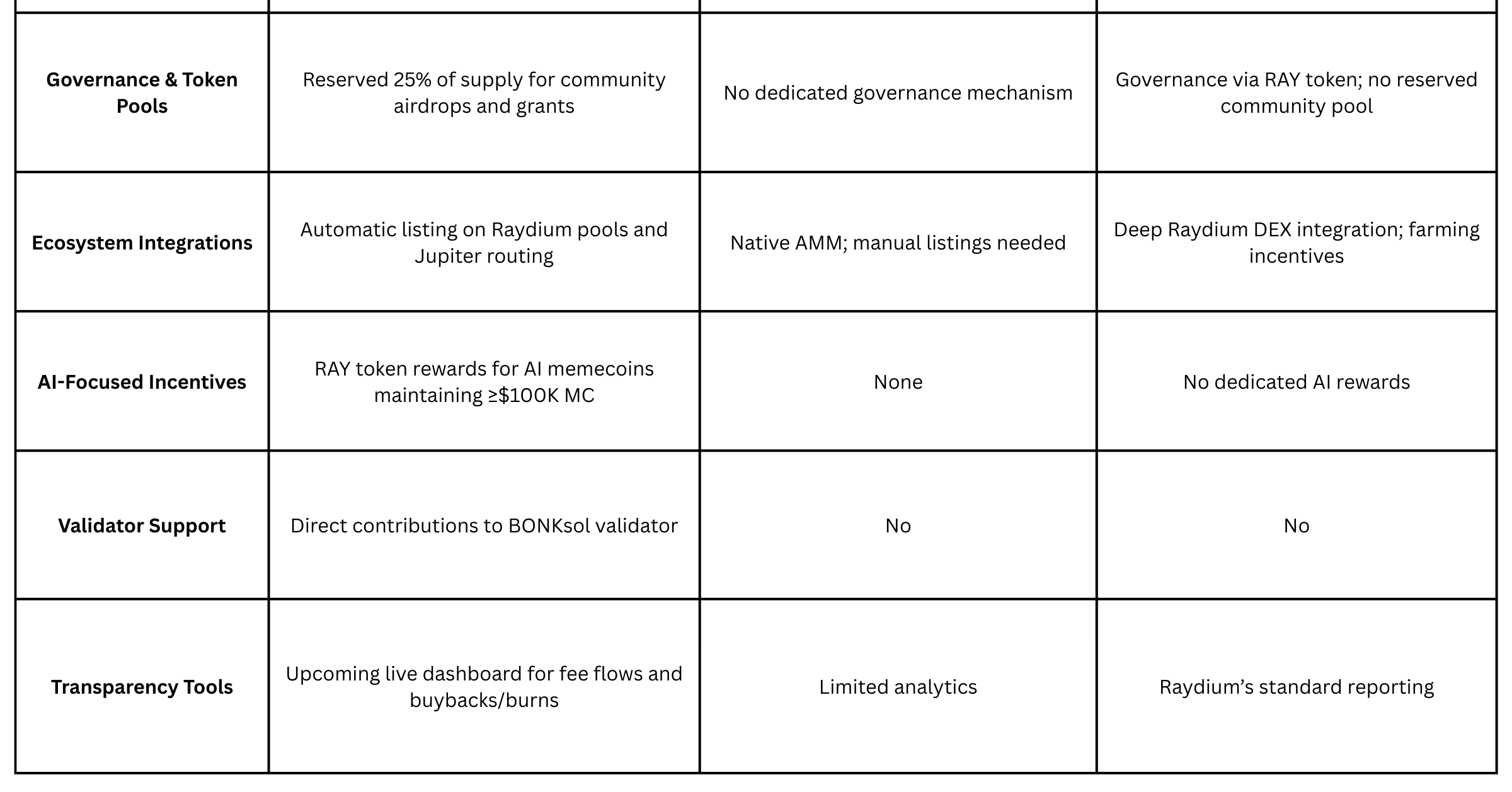

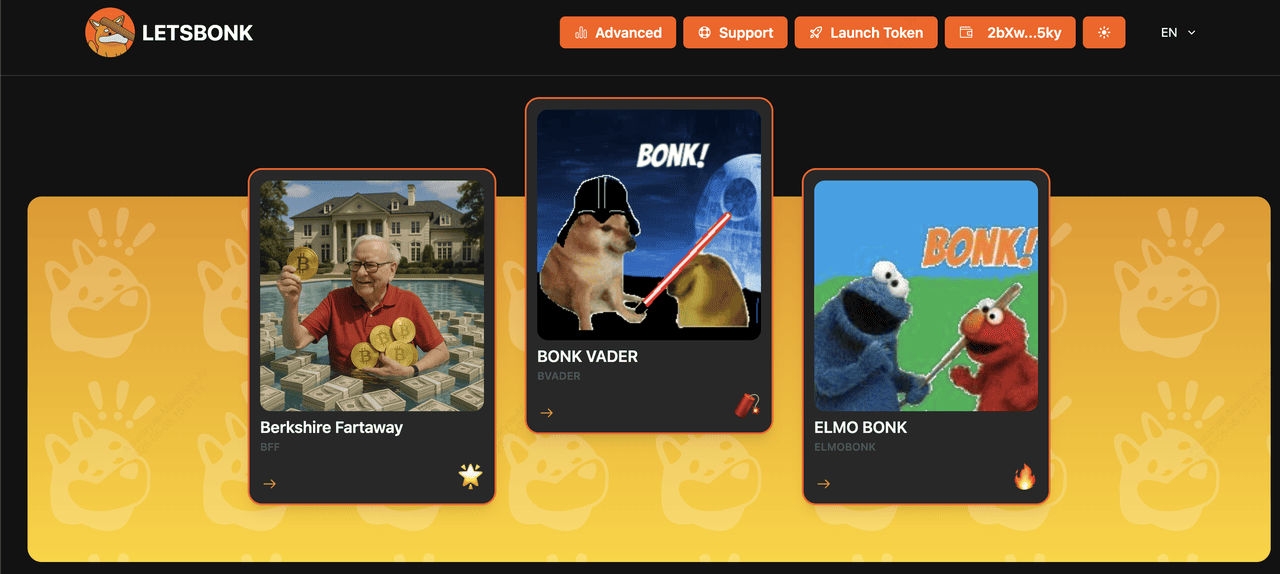

What Is LetsBONK.fun Memecoin Launchpad?

Source: LetsBONK.fun

LetsBONK.fun is a community-driven

memecoin launchpad built on Solana by BONK enthusiasts in partnership with Raydium Protocol. It streamlines token issuance with an intuitive interface, removing technical barriers so anyone, from seasoned builders to first-time creators, can mint, list, and grow their own BONK-based tokens in seconds. Under the hood, it leverages Solana’s high throughput and low fees to offer a seamless,

gas-free experience for token creators and traders alike.

By integrating directly with Raydium and

Jupiter, every token launched on LetsBONK.fun gains immediate access to decentralized exchange (

DEX) liquidity and routing, helping new projects gain traction quickly. The platform’s ethos centers on community empowerment: portions of its fees are channeled back into network security, development funding, and token buybacks, ensuring that growth benefits both users and the broader Solana ecosystem.

Key Features of Let's BONK Launchpad

• Instant Token Creation: Launch a memecoin in three clicks - no coding, no

smart-contract deployment required.

• Transparent Fee Model: A flat 1% swap fee plus a small post-migration volume fee feeds platform development, validator support, and BONK buybacks/burns.

• Bonding Curve Mechanics: Dynamic pricing based on demand ensures liquidity; creators can adjust supply parameters during setup.

• Ecosystem Integrations: Native support on Raydium, Jupiter, and AlphaScan’s Launchpad Filters for maximum discoverability.

LetsBONK.fun plugs directly into Solana’s top

DeFi rails to give your memecoin instant visibility and traction. Once your token “graduates,” it’s automatically listed in Raydium liquidity pools, tapping into deep liquidity and farming rewards without any extra steps.

Meanwhile, Jupiter and Jupiter Pro handle order routing and showcase new issues in AlphaScan’s Launchpad Filters, so traders can discover and swap your token immediately. On top of that, AI-focused memecoins that maintain a market cap above $100,000 qualify for special RAY token rewards, adding another layer of incentive and support for innovative projects.

How Does LetsBONK.fun Work?

LetsBONK.fun combines simplicity with powerful DeFi mechanics: you can create, launch, and list a memecoin in minutes without any development background, while its 1% swap fee underwrites ongoing platform enhancements, BONKsol

validator support, and regular BONK buybacks.

Thanks to automatic listings on Raydium and Jupiter, new tokens benefit from deep liquidity and broad visibility, driving significant early traction - over $800K in fees and a 50% surge in BONK’s price in the first week alone, underscoring the strength of this community-driven launchpad.

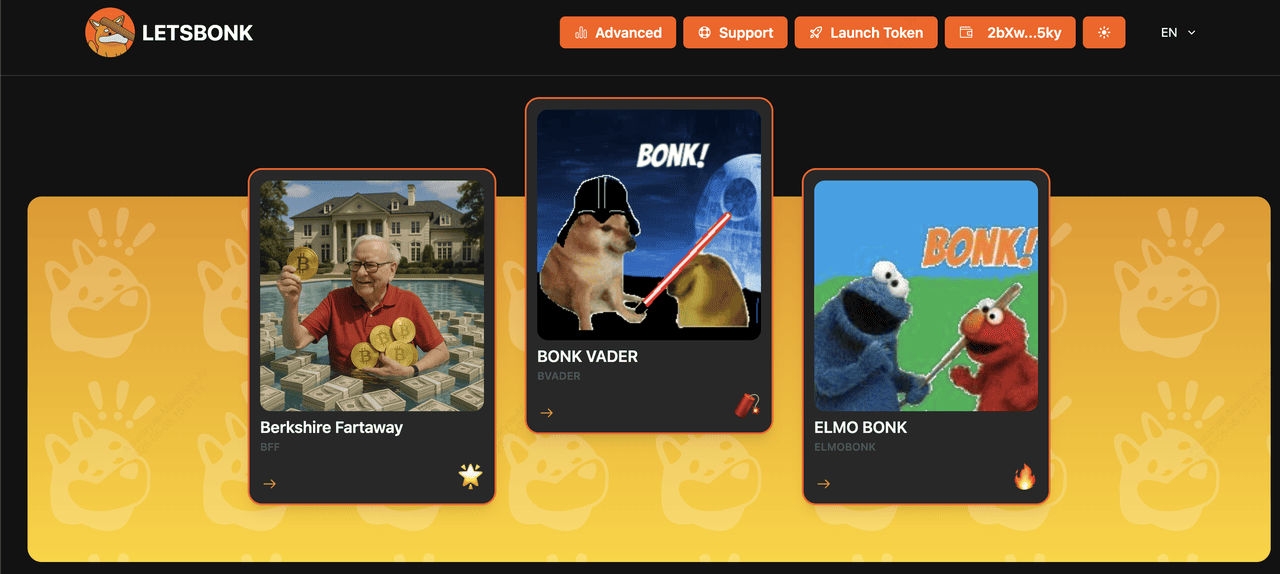

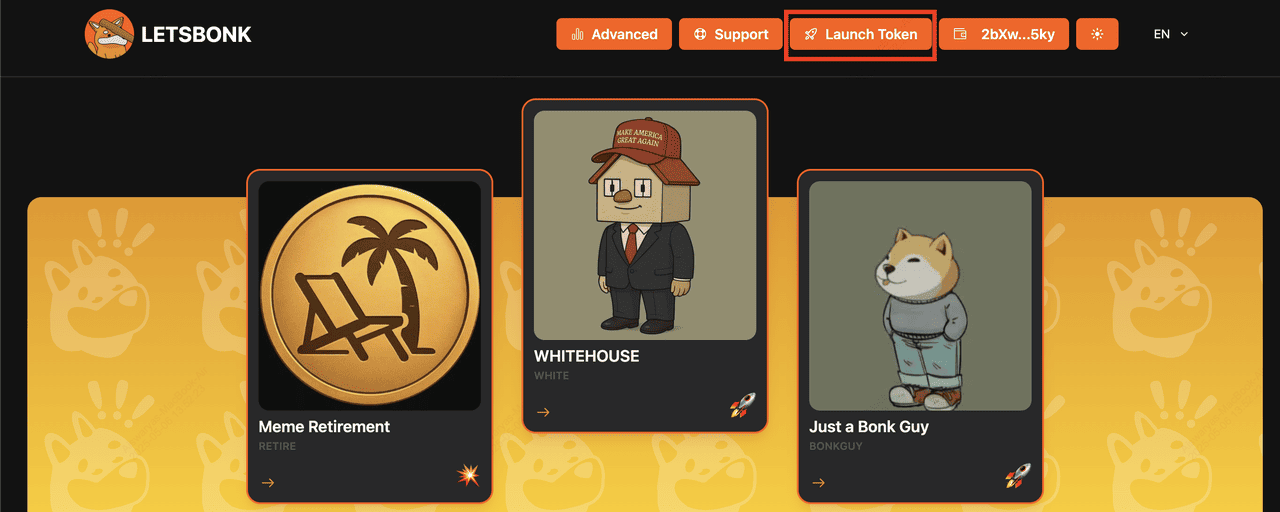

How to Create and Launch a Memecoin on LetsBONK.fun Launchpad

LetsBONK.fun turns memecoin creation into a simple, three-step experience, no coding required. Here’s what how you can launch a meme coin on LetsBONK.fun:

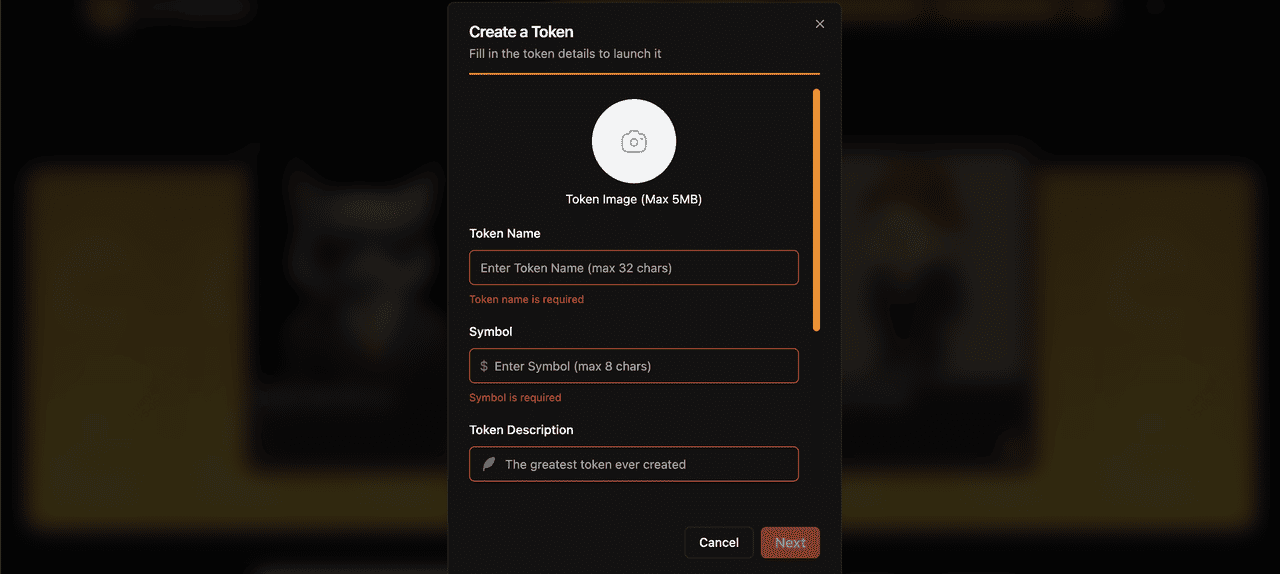

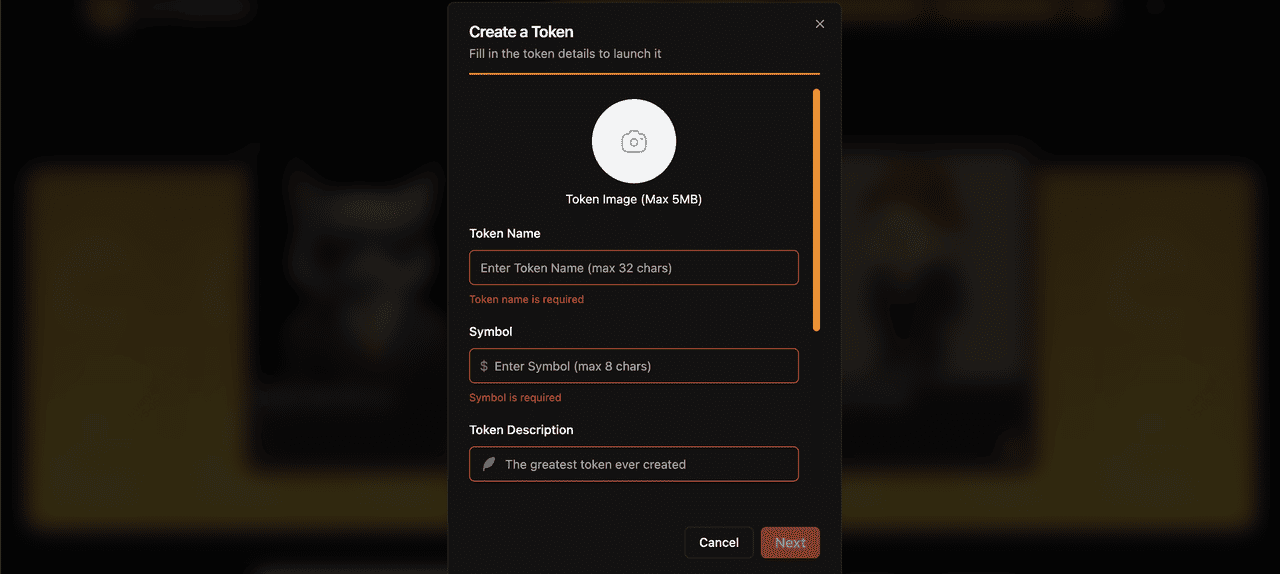

1. Create Your Token

• Access the Creator Portal: Head to LetsBONK.fun and hit Create Token.

• Define Your Identity: Enter your token’s name, symbol, and a brief description to explain its theme or lore.

• Upload Assets: Add a custom logo or image to make your memecoin stand out in listings and social shares.

Source: LetsBONK.fun

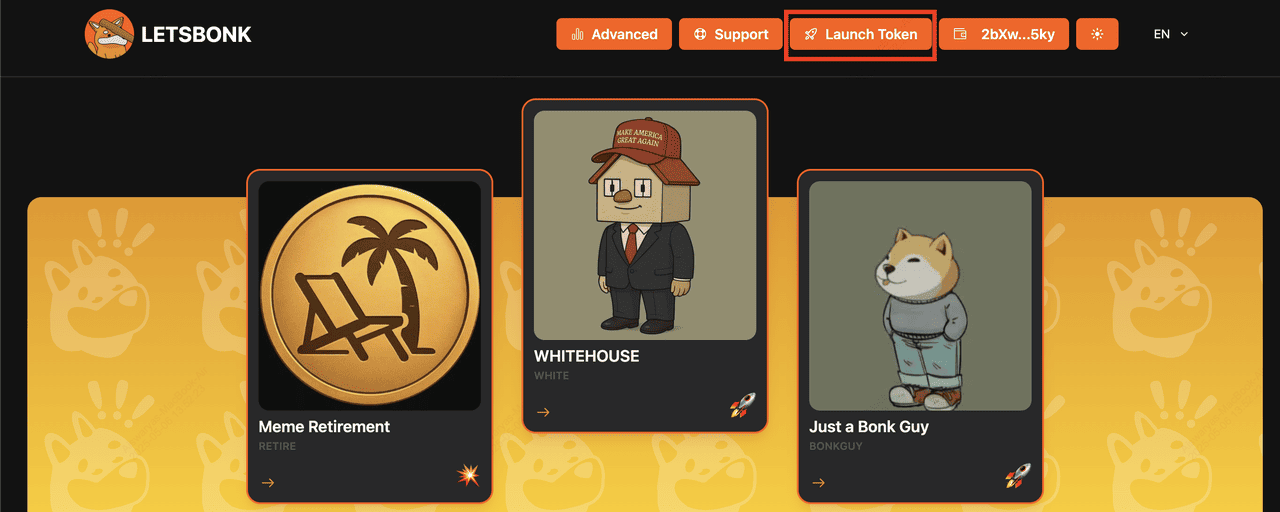

2. Configure Supply & Curve

• Choose Your Supply Model: Decide between a fixed total supply or a “bonded” model where a percentage of your tokens back liquidity.

• Set Bonding Curve Parameters: Use intuitive sliders or input fields to define how price reacts to buy pressure—e.g., steeper curves for fast appreciation or gentler curves for gradual growth.

• Allocate Reserved Tokens: Reserve up to 25% of your supply for community

airdrops, developer grants, or partnership incentives. This pool remains off-curve until you distribute it.

Source: LetsBONK.fun

3. Launch & Distribute

• One-Click Deployment: Click Launch to deploy your token contract on Solana in seconds.

• Automatic Listing: Upon launch, your token is instantly added to Raydium liquidity pools and available through Jupiter’s routing network—no manual pool creation needed.

• Notify Your Community: Share your token’s launch page link; early buyers interact directly with the bonding curve contract.

Behind the scenes, 75% of your bonded supply locks into an on-chain smart contract that adjusts price in real time as users buy and sell. The lockup ensures there’s always liquidity and that price discovery remains fair. The remaining 25% sits in a reserved pool for future airdrops, grants to ecosystem partners, and rewards for top contributors, aligning incentives between you, your community, and early supporters.

Fee Structure and Allocation

Every trade on LetsBONK.fun carries a 1% swap fee, plus a small post-migration volume fee once your token graduates to Raydium. Here’s how the core 1% fee is reinvested to sustain growth and network health:

• Platform Development (≈40%): Funds ongoing feature work, everything from user-interface refinements and

smart-contract audits to new creator tools and mobile support.

• Network Support (≈30%): Channels resources to the BONKsol validator, boosting Solana’s decentralization and securing every transaction your token generates.

• BONK Buybacks & Burns (≈30%): Converts fee revenue into BONK purchases on the open market, then burns those tokens , shrinking supply and creating deflationary pressure that benefits all BONK holders.

In addition, a post-migration volume fee (e.g., 0.1–0.2% on Raydium trades) further tops up these same three buckets, ensuring long-term sustainability.

Transparency Tools Coming Soon: A live dashboard will display real-time metrics on fee collection, validator contributions, and BONK buyback/burn volumes, giving you full visibility into how every trade supports the platform and the network.

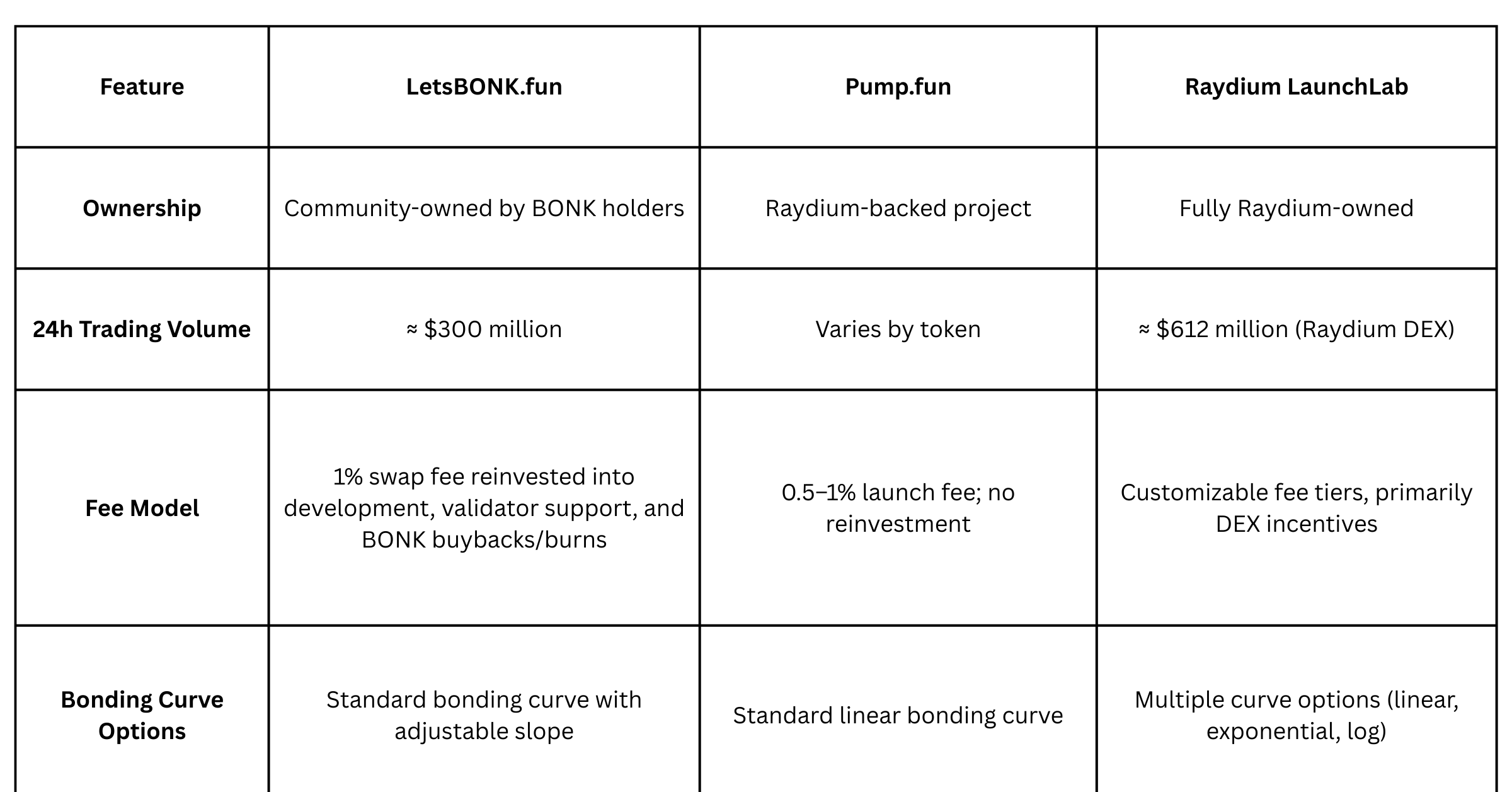

LetsBONK.fun vs. Pump.fun vs. Raydium LaunchLab

While

Pump.fun and Raydium’s upcoming LaunchLab dominate Solana’s memepad headlines, LetsBONK.fun stakes its claim through deeper community alignment and targeted incentives. Pump.fun, the pioneering memecoin factory launched in January 2024, lets anyone spin up a token and trade immediately on its own AMM, but it bills itself primarily as a “ground zero” for meme launches, without built-in support for ecosystem reinvestment or community governance. In contrast, LetsBONK.fun funnels 1% swap fees directly into platform development, BONKsol validator funding, and ongoing BONK buybacks/burns, ensuring that every trade strengthens both project infrastructure and network security.

Raydium’s LaunchLab, set to rival Pump.fun, expands on bonding-curve mechanics by offering multiple pricing models (linear, exponential, logarithmic) and integration with Raydium’s liquidity lockers—features designed for power users and institutional projects alike. However, LaunchLab is still Raydium-owned, with fee flows largely retained for DEX incentives. In comparison, LetsBONK.fun is community-owned by BONK holders, with AI-focused rewards that pump RAY tokens into innovative memecoin projects maintaining a $100,000+ market cap, and reserved token pools for grants and airdrops. This tri-pillared approach - community governance, sustainable fee reinvestment, and targeted developer incentives, gives LetsBONK.fun a unique edge in a crowded field.

Challenges and Risks of LetsBONK.fun

While LetsBONK.fun delivers a streamlined token-launch experience, creators and users should be mindful of potential pitfalls that come with rapid innovation in the memecoin sector:

• Fee Sustainability: The platform’s early success generated over $800K in three days, but maintaining that fee velocity depends on continued user growth and token launches. If memecoin launches slow or user enthusiasm wanes, revenue could drop, limiting funds for development, validator support, and buybacks.

• Token Quality Control: Lowering the barrier to creation means anyone can spin up a token, good faith projects and opportunistic scams alike. Without robust vetting or curation, low-quality or malicious tokens could flood the platform, harming trader confidence and community reputation.

• Market Volatility: Both BONK and SOL are known for sharp price swings. Sudden drops in these base assets can disrupt bonding-curve pricing, reduce liquidity, and erode user incentives, potentially leaving creators and early supporters exposed to unpredictable losses.

• Platform Security: As a newly launched protocol, LetsBONK.fun may still uncover technical bugs or vulnerabilities. While audits are underway, full transparency around security reviews and contingency plans is essential to building long-term trust and safeguarding user funds.

What’s Next for LetsBONK.fun?

The LetsBONK.fun team is hard at work enhancing user transparency and engagement.

1. First up is a Public Fee Dashboard, which will display real-time metrics on swap fees collected, BONK buybacks and burns, and validator contributions—giving creators and community members full visibility into how every trade supports the platform and Solana’s security.

2. Next, the platform will roll out Graduation Alerts, automated notifications that inform token issuers and holders the instant their projects reach the liquidity thresholds required for Raydium listing. These alerts will make it easier to coordinate liquidity strategies, farming incentives, and community announcements without manual monitoring.

3. Beyond notifications, LetsBONK.fun plans to improve its native token economy with an Enhanced Staking UI for $BONK. This update promises a more intuitive dashboard for staking BONK tokens, viewing accrued rewards, and claiming buyback distributions, all in a single, streamlined interface.

4. Finally, the roadmap points toward Cross-Chain Support, as the team explores integrations with other high-throughput blockchains to broaden access for developers and traders. By branching beyond Solana, LetsBONK.fun aims to become a multi-chain memepad, bringing its community-driven model and sustainable fee reinvestment to a wider DeFi audience.

Final Thoughts

LetsBONK.fun demonstrates how memecoin culture can be harnessed to build scalable, community-driven DeFi infrastructure. By combining BONK’s grassroots momentum with Raydium’s proven launchpad technology, it provides an intuitive, transparent, and incentive-aligned framework for token creation and growth. Whether you’re interested in launching meme-driven airdrops, developing a niche community token, or simply exploring Solana’s DeFi ecosystem, LetsBONK.fun offers compelling features and integrations to get started.

That said, rapid innovation carries inherent risks: fee sustainability may fluctuate with market cycles, ease of token creation can invite low-quality projects, and volatility in BONK and

SOL prices can affect liquidity and incentives. Before participating, be sure to conduct thorough due diligence and consider the potential downsides alongside the platform’s significant upside.

Related Reading

Source: LetsBONK.fun

Source: LetsBONK.fun Source: LetsBONK.fun

Source: LetsBONK.fun Source: LetsBONK.fun

Source: LetsBONK.fun