Kaspa (KAS) is one of the fastest-growing

PoW blockchains in crypto, processing 10 blocks per second (BPS) today and targeting 32–100+ BPS with upcoming upgrades, speeds thousands of times higher than

Bitcoin’s 1 block per 10 minutes.

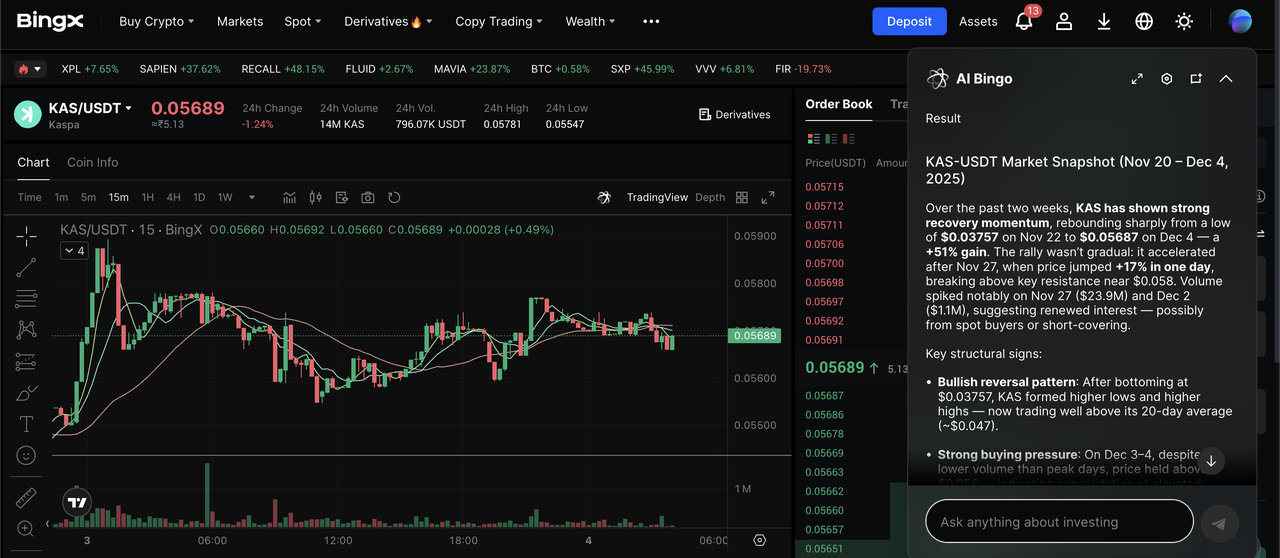

Kaspa price chart | Source: BingX

Powered by a blockDAG, not a linear chain, Kaspa accepts multiple blocks in parallel, delivering sub-second confirmations, high throughput, and near-zero fees while preserving full PoW decentralization and 51% security. As of December 2025, KAS trades with a market cap of roughly $1.53 billion, ranking 47 globally after gaining over 28% in November 2025, supported by rising liquidity and growing ecosystem activity.

In this guide, you’ll learn what Kaspa is, how its BlockDAG and GHOSTDAG tech work, KAS tokenomics and use cases, and the main pros and risks to consider before you trade it.

What Is Kaspa (KAS) PoW Layer-1 Blockchain?

Kaspa is a high-performance PoW layer-1 blockchain optimized for instant, low-fee transactions. Instead of a single chain of blocks like Bitcoin, Kaspa structures its ledger as a blockDAG, where blocks mined in parallel are all accepted and then ordered by consensus.

Launched in November 2021 as a fair-launched project with no pre-mine, no ICO, and no venture allocations, Kaspa positions itself as “Bitcoin’s design, but upgraded for internet-speed payments.” All KAS coins are distributed through mining, reinforcing its cypherpunk, community-first ethos.

This architecture is powered by the GHOSTDAG/PHANTOM protocol, a generalization of Nakamoto consensus that allows Kaspa to increase block production speed by orders of magnitude while keeping 51% PoW security.

As of December 2025, Kaspa processes around 10 blocks per second, targets even higher rates (32–100+ BPS), and maintains a capped max supply of 28.7 billion KAS with a smooth, deflationary emission schedule.

Kaspa’s vision is to act as a fast, decentralized transaction layer for everyday payments, remittances, and future DeFi or smart-contract ecosystems, while staying faithful to Bitcoin-style principles: PoW mining, UTXO model, deflationary monetary policy, and no central governance.

What Are the Key Features of the Kaspa Network?

• Scalability via BlockDAG: Parallel block creation allows consistently high throughput and fast confirmation times.

• Robust PoW security: Maintains Bitcoin-like 51% security while enabling far higher block rates.

• Active R&D roadmap:

- DAGKnight: Next-generation consensus for faster convergence and stronger global performance.

- vProgs: On-L1 verifiable programs enabling logic-based transactions without a heavy VM.

- Layer-2 smart contracts, e.g., Kasplex: EVM-compatible environments for DeFi, dApps, and programmable automation built on Kaspa’s PoW settlement layer.

How Does Kaspa Work?

Kaspa’s performance comes from its blockDAG architecture and GHOSTDAG consensus, enabling the network to validate multiple blocks per second without compromising decentralization or 51% PoW security.

1. BlockDAG vs. Traditional Blockchain

In a traditional blockchain, miners extend one longest chain. Competing blocks become “orphans” and are discarded. In Kaspa, miners reference all tips they know about. These blocks form a directed acyclic graph (DAG) rather than a single line.

This “revelation principle” means the network doesn’t throw away valid work. Instead, Kaspa’s consensus protocol later orders all those parallel blocks into a single, consistent history.

2. Kaspa's GHOSTDAG Consensus Mechanism

Kaspa uses GHOSTDAG (Greedy Heaviest Observed SubTree), which:

• Accepts multiple blocks per second, even if they were mined at nearly the same time.

• Classifies well-connected, honest blocks as “blue” and orders them first.

• Keeps security similar to Bitcoin’s longest-chain rule, but at much higher block rates.

The result: fast first confirmations, often within 1–2 seconds, and fully confirmed transactions in around 10 seconds, while still relying on open PoW mining.

3. Proof-of-Work with kHeavyHash

Kaspa is secured by PoW mining using the kHeavyHash algorithm, designed to be efficient on GPUs and later extended to FPGAs and ASICs.

Because blocks are produced frequently, mining rewards arrive more regularly, reducing variance for small miners and easing pressure to join large pools. This improves mining decentralization compared to slow-block PoW networks like Bitcoin.

What Makes Kaspa Attractive: 5 Key Strengths

Key benefits of Kaspa blockchain | Source: Kaspa

Kaspa stands out by combining high-speed Proof-of-Work performance with fair token distribution, strong decentralization, and an ambitious technical roadmap designed for long-term scalability.

1. High-speed PoW confirmations: Kaspa delivers near-instant inclusion and 10 blocks per second (BPS), with upgrades targeting 32–100+ BPS for greater throughput.

2. Ultra-low fees: Network fees remain near-zero, making Kaspa suitable for micro-transactions, merchant payments, and high-frequency transfers.

3. Fair-launch decentralization: No pre-mine, no presale, and no VC allocations. All KAS is mined through PoW, appealing to Bitcoin-style decentralization advocates.

4. Deflationary and capped supply: A max supply of around 28.7 billion KAS and smooth geometric emissions support long-term scarcity without abrupt halving shocks.

5. Growing market presence: Kaspa now holds a multi-billion-dollar market cap and top-50 ranking, reflecting rising adoption and investor interest.

What Is KAS Coin Used For?

On Kaspa, KAS is the native coin and powers the network:

• Transaction fees: You pay fees in KAS when sending transactions or interacting with future L2 dApps.

• Mining rewards: Miners receive KAS for securing the blockDAG with PoW.

• Medium of exchange: Fast, cheap transfers make KAS suitable for peer-to-peer payments, remittances, and merchant settlements.

As programmability via vProgs and L2 smart contracts matures, KAS may also be used as gas, collateral, or settlement asset in DeFi protocols built around the Kaspa ecosystem.

What Is Kaspa Tokenomics: Supply, Emission, and Distribution

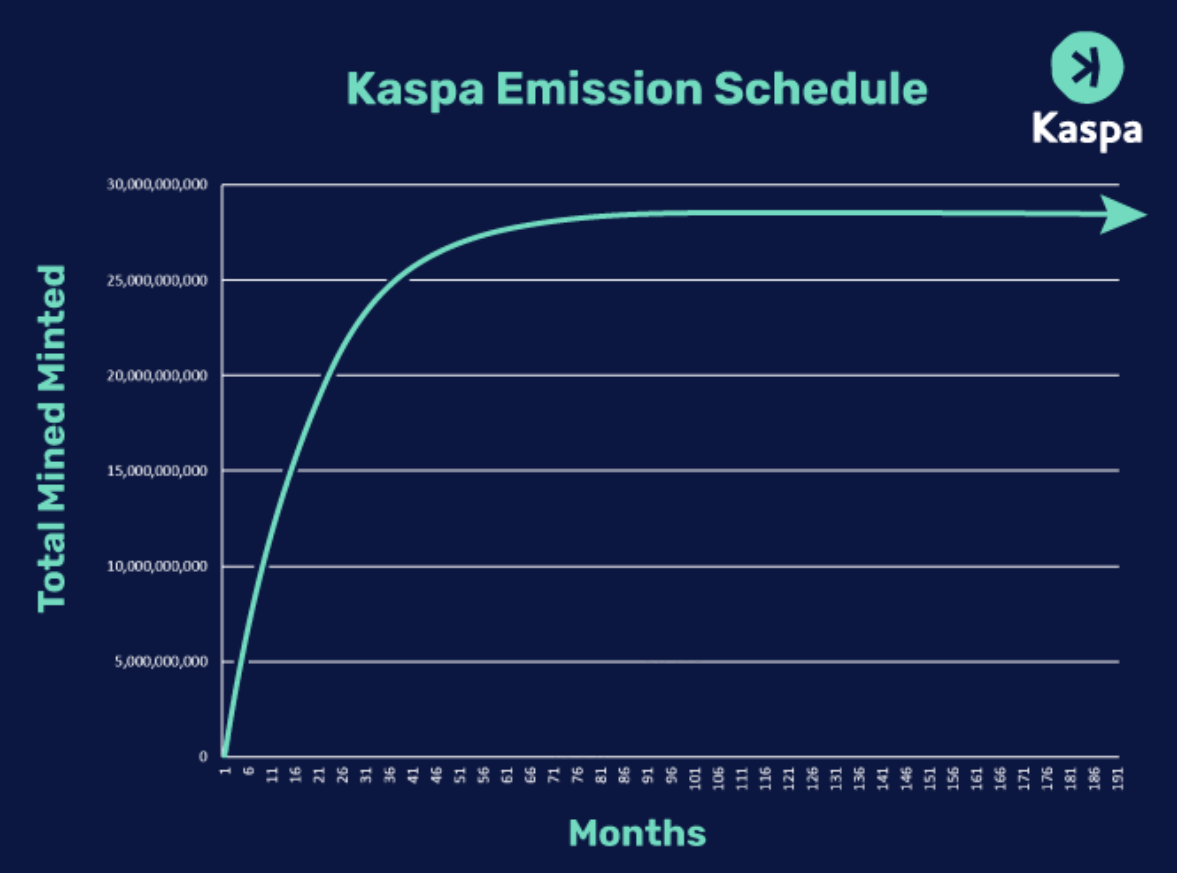

KAS emission schedule | Source: Kaspa

Kaspa’s tokenomics are built around a capped maximum supply of 28.7 billion KAS, with approximately 27 billion already in circulation as of December 2025. Instead of sharp halving events like Bitcoin, Kaspa uses a smooth geometric emission schedule, where block rewards decrease monthly by a fixed decay factor.

This design preserves long-term scarcity while avoiding sudden miner revenue shocks. It also keeps incentives more predictable for miners and investors.

Distribution and Launch

Kaspa launched as a fully fair-mined PoW network with no pre-mine, no ICO, and no early investor allocations, ensuring every coin in circulation was earned through open mining from day one. Early stages were dominated by CPU and GPU miners, followed by the gradual introduction of FPGA and ASIC hardware as the ecosystem matured. This organic, market-driven distribution model resonates strongly with users who prefer transparent, PoW-secured networks over VC-funded or pre-allocated token launches.

What Are the Main Use Cases of Kaspa Blockchain?

Kaspa’s technology enables several practical and emerging use cases across payments, decentralized finance, and real-world industry applications.

1. Fast, Low-Fee Payments and Remittances

Kaspa’s 10 blocks per second throughput and sub-second block propagation make it ideal for real-time payments, from everyday peer-to-peer transfers to merchant checkout flows where delays hurt conversion. With fees typically far below $0.001, Kaspa offers a faster, cheaper alternative to Bitcoin and other PoW chains for cross-border remittances, enabling near-instant settlement even during high network activity. This speed lets merchants and users accept payments with confidence within seconds instead of minutes.

2. DeFi and Programmable Finance: Emerging Use Case

Kaspa is expanding toward programmability through

Layer-2 smart-contract platforms and vProgs or verifiable programs, which introduce on-chain logic for conditional payments, automated execution, and ZK-verified workflows. Upcoming EVM-compatible L2s aim to support

DEXs,

lending, and derivatives, anchored to Kaspa’s PoW settlement layer for security. As Kaspa targets 32–100+ blocks per second in future upgrades, its high-speed base layer provides strong infrastructure for DeFi protocols requiring rapid finality and predictable settlement performance.

3. Industrial and Enterprise Applications

Through the Kaspa Industrial Initiative (KII), the network is being tested in high-throughput environments such as supply-chain tracking, industrial automation, smart-grid coordination, and enterprise settlements. These scenarios benefit from Kaspa’s ability to handle parallel block creation and deliver fast confirmation assurances while remaining fully decentralized. By combining Kaspa’s L1 security with emerging programmable layers, these pilots position Kaspa as a potential backbone for real-world industrial systems that need both speed and cryptographic integrity.

How to Buy Kaspa (KAS) on BingX

KAS/USDT trading pair on the spot market powered by BingX AI insights

You can buy and trade KAS easily on BingX, a leading global crypto exchange enhanced by

BingX AI for smarter insights and a more efficient trading experience.

1. Create or log in to your BingX account. Complete identity verification (

KYC) to gain access to all features on the platfrom.

2. Deposit funds. Deposit crypto like USDT to your BingX wallet, or use supported fiat on-ramps where available.

3. Search for KAS. Go to the Spot trading section. Search for

KAS/USDT or other available KAS pairs.

4. Place your order.

• Use a

Market order if you want to buy KAS instantly at the current price.

• Use a Limit order if you want to set your own entry price.

5. Manage your holdings. You can hold KAS directly on BingX, set take-profit/stop-loss orders, or move it to a self-custodial wallet if you prefer full control.

How to Long or Short Kaspa (KAS) on BingX Futures

KAS/USDT perpetual contract on the futures market powered by BingX AI

If you prefer leveraged trading or want to hedge your KAS exposure, you can also trade KAS Futures on BingX with advanced order types and built-in risk controls.

2. Choose your leverage level, adjusting it based on your risk tolerance; lower leverage is generally safer for volatile assets like KAS.

3. Select your order type - Market, Limit, or Trigger orders, depending on your trading strategy.

4. Open a Long position if you expect KAS price to rise, or open a Short position if you expect a decline.

Futures trading offers more flexibility than Spot, but it also carries higher risk due to leverage. Always trade responsibly and start small if you’re new to derivatives.

Why Is BingX the Best Place to Buy Kaspa (KAS)?

BingX is one of the best places to buy Kaspa because it offers deep liquidity, competitive fees, and fast order execution across both Spot and Futures markets, ensuring smooth trading even during periods of high volatility. The platform also provides BingX AI, which helps users analyze market trends, identify trading opportunities, and manage risk more effectively. With strong security practices, a user-friendly interface, and global accessibility, BingX gives both beginners and advanced traders a reliable and efficient environment for trading KAS.

What Are the Key Risks and Limitations of Kaspa to Consider?

Kaspa also comes with risks you should weigh carefully:

• Competition from PoS and high-throughput L1s: Kaspa competes with fast PoS chains like Solana, Avalanche, and others that already host large DeFi and NFT ecosystems.

• Emerging programmability stack: vProgs and Layer-2 smart contracts are still under active development. The timing and quality of these rollouts will influence Kaspa’s long-term utility.

• PoW economics: As emissions decline, miners rely more on transaction fees and price appreciation. If demand or fees stay low, network security incentives could be pressured over the long run. However, this is a general PoW concern, not unique to Kaspa.

• New attack surfaces: BlockDAG consensus and vProgs introduce new complexity. While peer-reviewed, these designs are less battle-tested than classic linear chains and may face unexpected edge-case risks.

• Market volatility: KAS has experienced strong rallies and drawdowns; like other altcoins, it remains highly volatile and speculative.

Closing Thoughts: Is Kaspa a Good Investment?

Kaspa (KAS) is a next-generation PoW blockchain that aims to address the blockchain trilemma by replacing a linear chain with a BlockDAG architecture, powered by the GHOSTDAG protocol. This design supports fast, low-fee, and scalable transactions while maintaining the security and decentralization associated with open Proof-of-Work mining. With its fair-launch distribution, capped supply, and roadmap featuring upgrades like DAGKnight, vProgs, and Layer-2 smart-contract frameworks, Kaspa positions itself as a potential candidate for high-speed digital payments and future DeFi infrastructure.

However, the project still faces competition from established L1 networks, execution risks tied to its ongoing technical development, and the broader volatility of the crypto market. For users interested in high-performance PoW ecosystems, Kaspa may be worth monitoring, but it’s important to evaluate the risks carefully before trading or investing on BingX or any other platform.

Related Reading

FAQs on Kaspa (KAS)

1. Is Kaspa a layer-1 blockchain or a layer-2 solution?

Kaspa is a layer-1 blockchain built around a PoW-secured blockDAG. It is not a layer-2. However, teams are building Layer-2 smart-contract platforms and programmability solutions like vProgs on top of it.

2. How fast is Kaspa compared to Bitcoin?

Kaspa currently processes around 10 blocks per second, while Bitcoin produces one block roughly every 10 minutes. That means Kaspa can confirm transactions much faster and at higher throughput, making it more suitable for day-to-day payments and high-frequency flows.

3. How Is Kaspa Different from Bitcoin?

Kaspa replaces Bitcoin’s linear blockchain with a BlockDAG, enabling 10 blocks per second compared to Bitcoin’s 1 block every 10 minutes. This allows Kaspa to confirm transactions within 1–2 seconds, versus Bitcoin’s typical 10–60 minutes. Both use Proof-of-Work, but Kaspa’s GHOSTDAG consensus accepts parallel blocks rather than discarding them, improving scalability without altering PoW security. Kaspa also uses a smooth monthly emission decay instead of Bitcoin’s quadrennial halvings, while maintaining a fair-launch, no-premine distribution model.

4. Is Kaspa environmentally friendly?

Kaspa still uses PoW mining, so it consumes energy like Bitcoin. However, the kHeavyHash algorithm is designed for efficient parallelization, and Kaspa’s focus on high throughput means more transactions per unit of energy than many older PoW chains. The exact environmental impact depends on miners’ hardware and energy sources.

5. How can I store KAS safely?

You can store KAS directly on BingX, which is convenient if you trade often and prefer exchange-managed custody with quick access to Spot or Futures markets. For users who prefer full control of their assets, Kaspa also supports self-custodial wallets, including community-built browser and mobile wallets, as well as hardware wallet integrations as they become available. Always verify official download links, keep your seed phrase backed up securely, and avoid sharing it with anyone to maintain wallet safety.