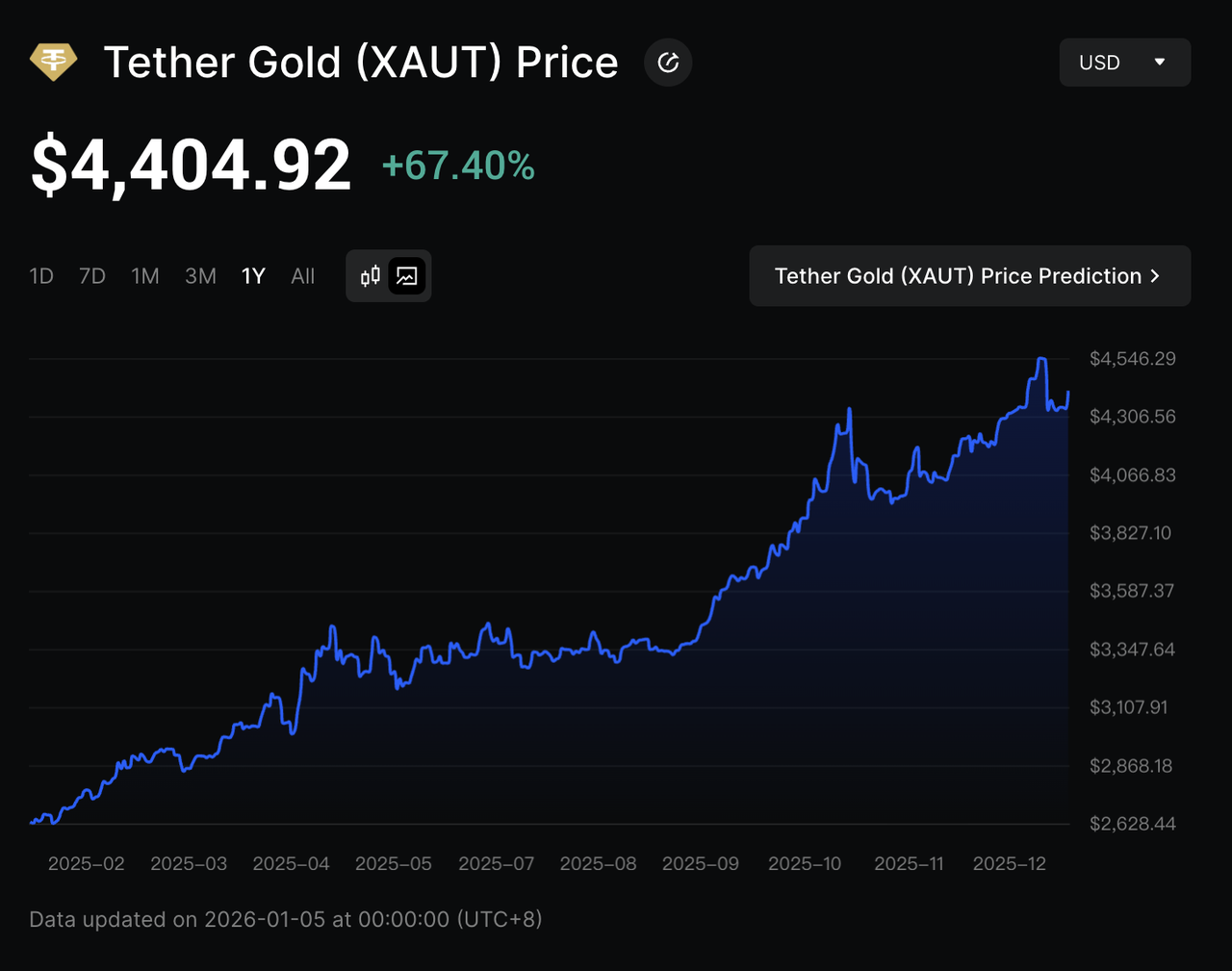

As of January 5, 2026, the market capitalization of gold-backed cryptocurrency tokens has reached approximately $4.45 billion, extending the sector’s growth as spot gold prices trade above $4,400 per ounce. This expansion reflects rising investor interest in

tokenized real-world assets (RWAs) amid ongoing macroeconomic uncertainty and persistent demand for safe-haven exposure. Gold-backed crypto tokens are blockchain-based digital assets that provide price exposure to physical gold reserves, combining gold’s store-of-value characteristics with on-chain liquidity and global accessibility. Market activity continues to be driven primarily by leading issuers such as

PAX Gold (PAXG) and

Tether Gold (XAUT).

Gold’s momentum entering 2026 is evident in spot prices holding above $4,400 per ounce, following gains of roughly 65–70% in 2025, reinforcing its appeal as a long-standing store of value during periods of fiscal and monetary uncertainty.

Bitcoin, meanwhile, continues to trade around the $90,000 range after consolidating from late-2025 highs, remaining an important component of digital portfolios. Together, these dynamics set the stage for a closer look at how gold is being reintroduced into digital markets through tokenization, and why gold-backed crypto tokens are emerging as a practical bridge between traditional safe havens and on-chain finance.

What Is a Gold-Backed Crypto Token?

A gold-backed crypto token or tokenized gold is a blockchain-based digital asset that represents direct economic exposure to physical gold held in secure vaults. Each token is typically backed 1:1 by a specific amount of gold, most commonly one troy ounce of London Good Delivery–grade bullion, with ownership recorded and transferred on-chain rather than through traditional custody accounts.

Unlike stablecoins pegged to fiat currencies, gold-backed tokens derive their value from allocated physical gold reserves, which are verified through audits or third-party attestations. For this reason, they are often categorized as

commodity-backed stablecoins, as their price stability is anchored to a real-world commodity rather than sovereign currency issuance. This structure allows holders to gain gold exposure without handling storage, insurance, or cross-border settlement, while still benefiting from the liquidity, divisibility, and programmability of crypto assets.

Well-known examples of tokenized gold projects include:

• Tether Gold (XAUT): Managed by

Tether, XAUT is the largest gold-backed crypto token by market size, with underlying gold held in Swiss vaults and strong liquidity across major crypto platforms.

• PAX Gold (PAXG): Issued by Paxos on the

Ethereum blockchain, with each token backed by allocated physical gold stored in professional vaults. PAXG is widely used across centralized exchanges and select

DeFi applications.

Some issuers also provide redemption mechanisms, allowing eligible holders to exchange tokens for physical gold or fiat equivalents, subject to minimum thresholds and processing fees.

In practice, gold-backed tokens sit at the intersection of traditional commodities and digital finance. They are used for portfolio hedging, on-chain collateral, cross-border settlement, and as a bridge for investors seeking exposure to gold within decentralized finance ecosystems, without exiting the crypto rails.

How Does Tokenized Gold Work? The Mechanics Behind Digital Gold Assets

Tokenized gold converts physical bullion into a digital, blockchain-native asset by linking on-chain tokens to real gold held in secure vaults. Through a reserve-backed structure, these tokens allow gold to be traded, transferred, and used globally with the efficiency of crypto, while remaining anchored to the value of the underlying commodity.

1. Physical Gold Deposit and Custody: The process starts with LBMA-standard gold bars deposited into audited vaults operated by custodians such as Brink's or Malca-Amit. Each bar is serialized and documented to ensure transparency before tokens are issued.

2. Token Issuance and Smart Contracts: Corresponding tokens are minted on blockchains like Ethereum, typically using

ERC-20 standards. Smart contracts control supply and redemption rules, maintaining a strict 1:1 backing between tokens and physical gold.

3. Transparency, Audits, and Costs: Issuers publish regular audits and on-chain data so holders can verify reserves directly. Storage and insurance fees are generally lower than traditional gold products, often around 0.2% to 0.5% annually.

4. Redemption, Risks, and Regulation: Redemption involves burning tokens to release physical gold or fiat equivalents. While this model reduces risks such as rehypothecation, issuer solvency remains a key consideration, as discussed by CoinMarketCap. Regulatory frameworks like the EU’s MiCA are strengthening oversight to improve market trust.

Together, these mechanisms allow gold to operate as a programmable digital commodity, blending traditional asset backing with blockchain efficiency and global accessibility.

What Are the Use Cases for Gold-Backed Tokens?

Gold-backed tokens extend beyond simple storage, integrating into modern financial ecosystems. Primary applications include:

• Hedging Against Volatility: Investors increasingly use gold-backed tokens as a low-volatility hedge during periods of equity and crypto market volatility. With gold holding above $4,400 per ounce entering 2026, these tokens offer capital preservation while remaining fully on-chain.

• Decentralized Finance (DeFi) Integration: Tokens can be staked in protocols like

Aave or

Yearn Finance to

earn yields, or used as collateral for loans without liquidating the underlying asset. This composability turns gold into a productive capital tool.

• Cross-Border Transactions and Remittances: In regions facing currency instability, such as parts of Latin America or Eastern Europe, tokens facilitate low-cost transfers of value. Their fractional nature supports micro-investments, democratizing access to gold.

Emerging uses involve tokenized RWAs in ecosystems like

Cosmos, where indices such as GMRWA track performance. Central banks are also exploring similar structures for reserve diversification, potentially expanding institutional adoption.

Why Are Tokenized Gold Coins Surging in 2026?

The surge in tokenized gold from 2025 and into 2026 reflects a structural reallocation toward hard, non-sovereign assets, driven by concrete macroeconomic and geopolitical catalysts rather than short-term market speculation.

Key drivers include:

• Persistent Macro and Political Uncertainty: Recurrent U.S. government shutdown risks, widening fiscal deficits, and prolonged debates over debt sustainability have heightened concerns around sovereign credibility. At the same time, renewed U.S.–Latin America tensions, including Venezuela-related geopolitical developments, have contributed to broader global risk-off sentiment.

• Monetary Policy Shifts and Fed Rate Expectations: As inflation moderates from its peaks and economic growth shows signs of uneven momentum, markets increasingly expect the

Federal Reserve to pause or begin cutting interest rates. Lower real yields reduce the opportunity cost of holding non-yielding assets like gold, reinforcing demand for both physical and tokenized gold as a hedge against long-term currency debasement.

• Geopolitical Fragmentation and Central Bank Demand: Ongoing conflicts, trade frictions, and sanctions risks have pushed central banks to continue accumulating gold as a neutral reserve asset. This sustained official-sector demand tightens physical supply and supports higher spot prices, which in turn strengthens interest in tokenized gold exposure.

• Crypto-Native Demand for Stability: Within digital asset markets, investors increasingly seek low-volatility, on-chain assets during periods of equity and crypto market consolidation. Tokenized gold coins offer 24/7 liquidity, transparent backing, and seamless integration with crypto portfolios, making them a preferred defensive allocation without exiting blockchain infrastructure.

Together, these factors position tokenized gold coins as a long-term bridge between traditional safe-haven demand and on-chain financial systems, supporting their continued growth well beyond 2025.

Gold vs. Bitcoin: Which Is the Better Investment in 2025?

Gold vs. Bitcoin performance in 2025 | Source: TradingView

Both gold and Bitcoin are often framed as alternatives to fiat money, but their paths in 2025 revealed clear differences in risk and return. Bitcoin experienced pronounced volatility throughout the year, rallying aggressively during liquidity-driven phases before correcting as macro conditions tightened. After reaching cycle highs in late 2025, BTC retraced into the $85,000–$90,000 range and entered early 2026 trading near $90,000, underscoring its sensitivity to shifts in risk appetite and capital flows. Gold, by contrast, followed a steadier trajectory. Supported by declining real yields, sustained central bank purchases, and safe-haven demand, gold advanced consistently and finished the year up approximately 65–70%, with spot prices holding above $4,400 per ounce.

The divergence was also visible in relative terms. The Bitcoin-to-gold ratio continued to compress through 2025, moving from the low 40s in late 2024 toward the low 30s, reflecting gold’s stronger risk-adjusted performance during periods of market stress. While Bitcoin remained attractive for investors seeking asymmetric upside, gold proved more effective at preserving value during drawdowns. These dynamics help explain why interest in tokenized gold accelerated during 2025. As investors sought exposure to gold’s stability without exiting digital markets, gold-backed tokens emerged as a practical bridge between traditional safe-haven assets and crypto-native portfolios.

How to Buy Gold-Backed Tokens on BingX

As gold surges past $4,400 per ounce amid the U.S.–Latin America tensions, tokenized gold is surging. You can buy gold-backed tokens on BingX for a chance to capitalize on this momentum. With

PAXG and

XAUT driving a $4 billion+ market cap and $640 million in 24-hour volumes, these assets deliver gold's stability with crypto's speed and DeFi yields, all on BingX's seamless platform. Outperforming

BTC lately, they're the perfect hedge to buy on BingX today with low fees and instant trades to secure your edge.

Buy Gold-Backed Tokens on BingX Spot

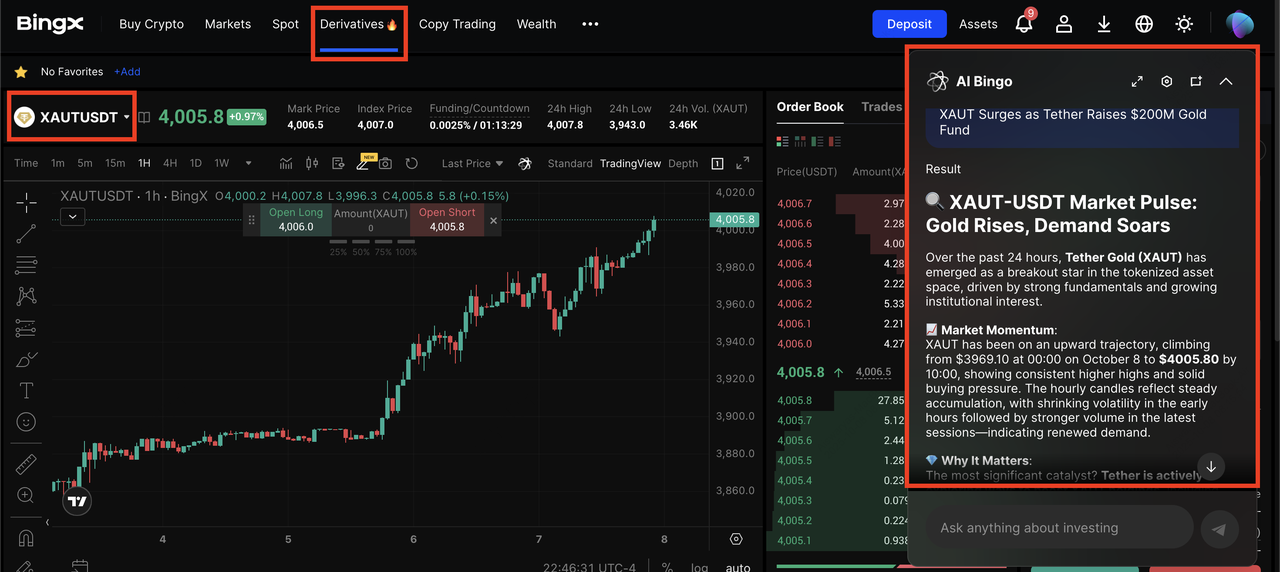

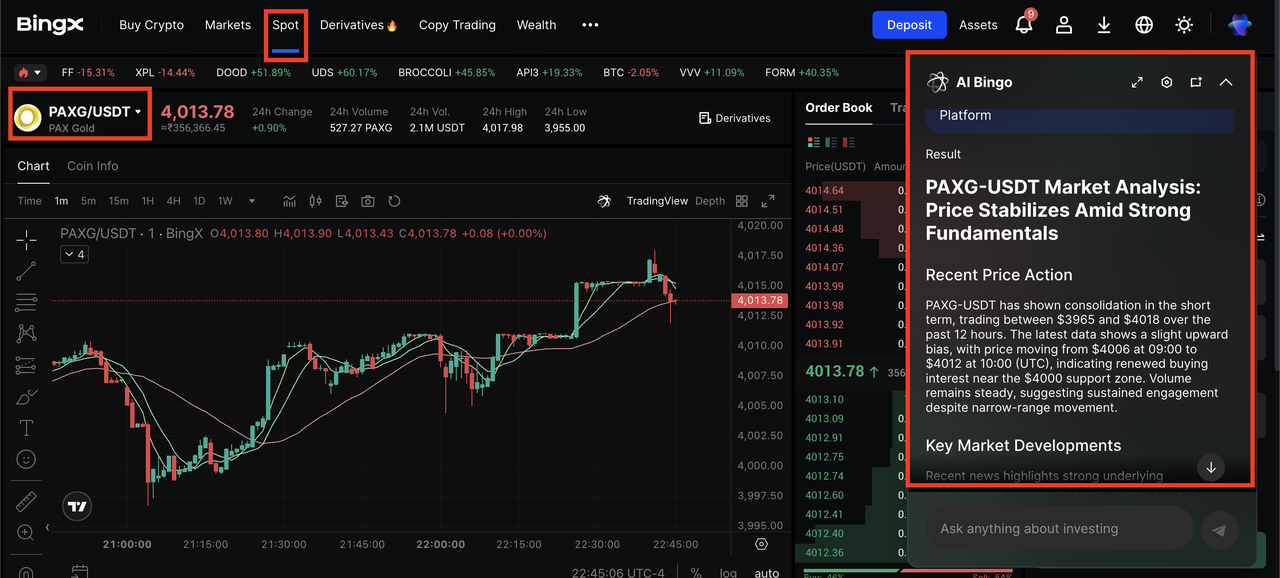

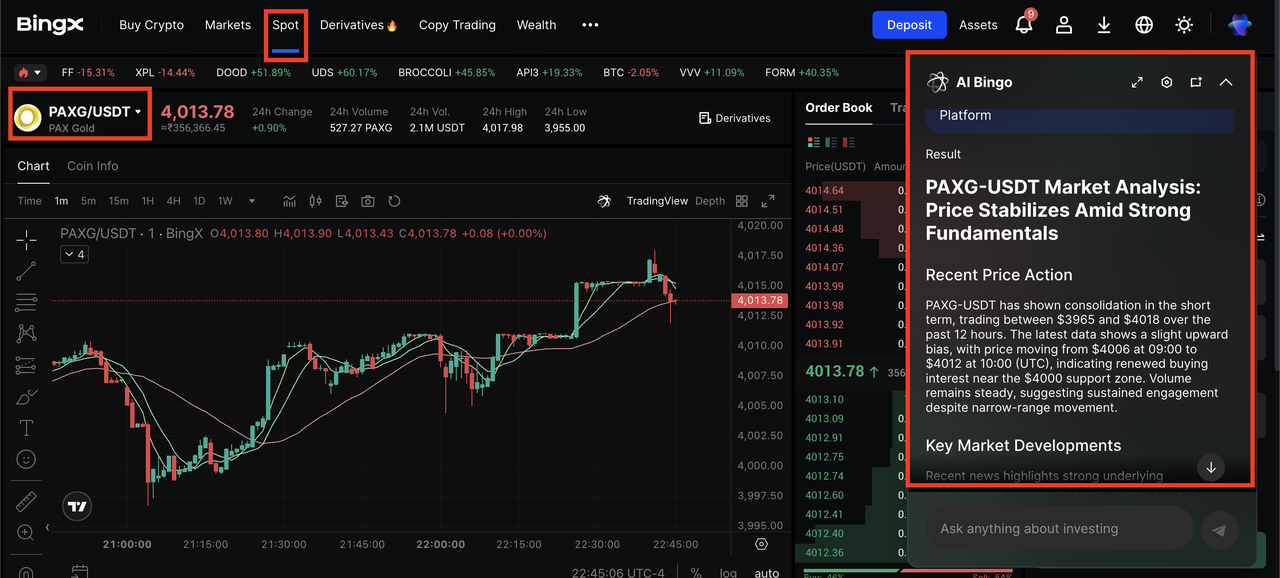

PAXG/USDT trading pair on the spot market, powered by BingX AI

To buy on the BingX Spot Market, simply log in to your account, search for

PAXG/USDT or

XAUT/USDT, and select “Buy”. You can choose between a

Market Order for instant execution or a Limit Order to set your preferred entry price. Once purchased, your tokens will appear directly in your BingX Spot Wallet, where you can hold, trade, or transfer them anytime with full transparency and zero custody hassle.

Trade Gold-Backed Tokens on BingX Futures

For advanced traders, BingX also offers Futures Contracts for tokenized gold assets like XAUT/USDT perpetuals or

PAXG/USDT perpetuals, allowing you to profit from both rising and falling markets. Choose from USDT-M or Coin-M futures pairs, adjust your leverage, and monitor your margin requirements to optimize your position. This lets you hedge gold price movements, amplify gains during volatile periods, and diversify your portfolio using BingX’s institutional-grade trading tools, all backed by real-time data and low transaction costs.

Conclusion

Gold and Bitcoin played distinct but complementary roles in 2025. Bitcoin delivered upside during risk-on phases, while gold provided steadier performance and stronger downside protection as macro uncertainty persisted. Rather than acting as substitutes, the two assets reflected different investor priorities, growth versus capital preservation.

The continued rise of tokenized gold highlights this shift. By combining gold’s defensive properties with on-chain liquidity and accessibility, gold-backed tokens offer a practical bridge between traditional safe havens and digital markets. Supported by regulatory progress and technological advances, including layer-2 scaling that reduces transaction costs, tokenized gold’s growth trajectory appears increasingly durable. Continued institutional inflows into real-world assets could propel the sector toward multi-billion-dollar scale, though risks such as issuer solvency and abrupt shifts in yield expectations remain important considerations.

Related Reading

PAXG/USDT trading pair on the spot market, powered by BingX AI

PAXG/USDT trading pair on the spot market, powered by BingX AI