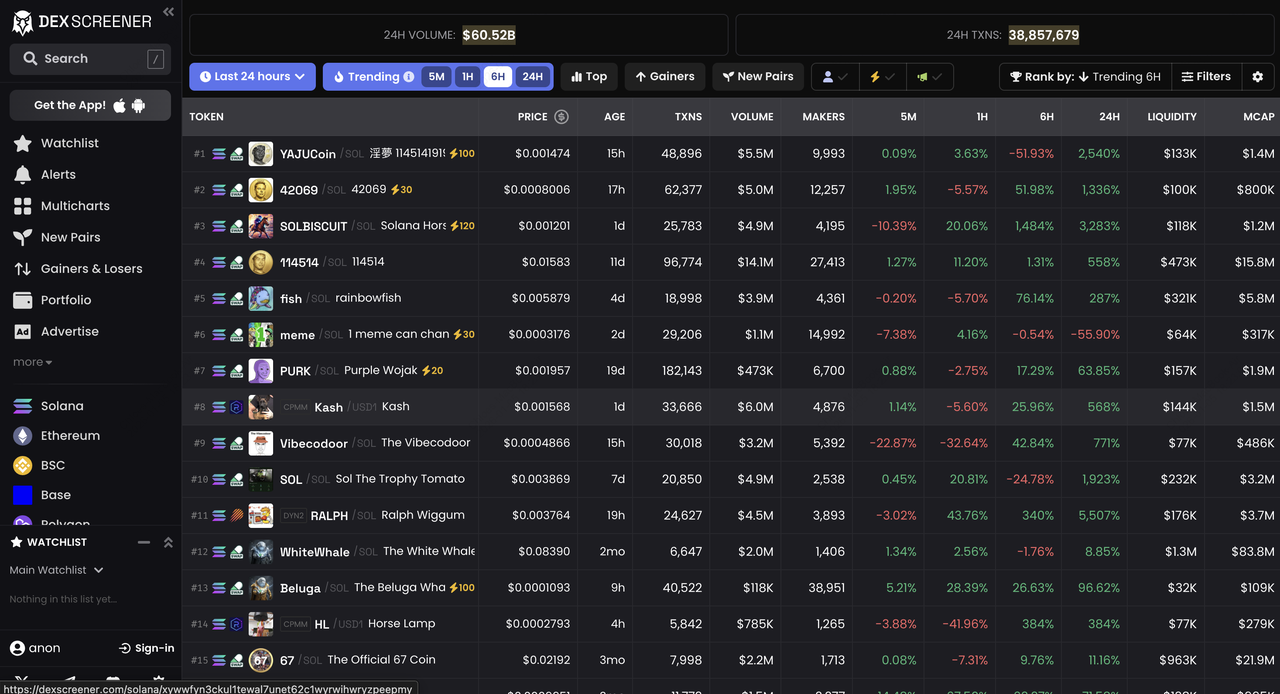

Dex Screener has solidified its position as the premier real-time analytics platform for decentralized exchange (DEX) trading in 2026, aggregating comprehensive

on-chain data from more than 100 blockchain networks and thousands of DEXs to provide traders and investors with precise, actionable insights.

This completely free platform levels the playing field for everyone, from retail traders searching for emerging memecoins and new token launches to professional developers monitoring liquidity pools and protocol performance, enabling faster discovery of market opportunities in an ecosystem where early entry can deliver substantial returns amid rapidly evolving trends.

What Is Dex Screener?

Dex Screener is a highly accessible, no-account-required blockchain analytics platform that directly sources raw data from over 100 supported chains and major

DEXs such as

Uniswap,

PancakeSwap,

Raydium,

Jupiter,

Orca, and

Aerodrome to deliver up-to-the-second token prices, liquidity metrics, trading volumes, and market trend analysis. Originally launched in 2021 and continually upgraded with community feedback, it employs a proprietary custom indexer that refreshes information every few seconds to minutes, guaranteeing superior accuracy without dependence on third-party APIs.

In 2026, Dex Screener monitors millions of active trading pairs, offers dedicated mobile applications for iOS and Android with complete charting capabilities, and functions as the primary discovery engine for new tokens through features like Moonshot for verified fair launches and integrated security audits introduced in recent updates, making it an essential daily tool for the global DeFi community.

What Are the Key Features of Dex Screener and Who Founded It?

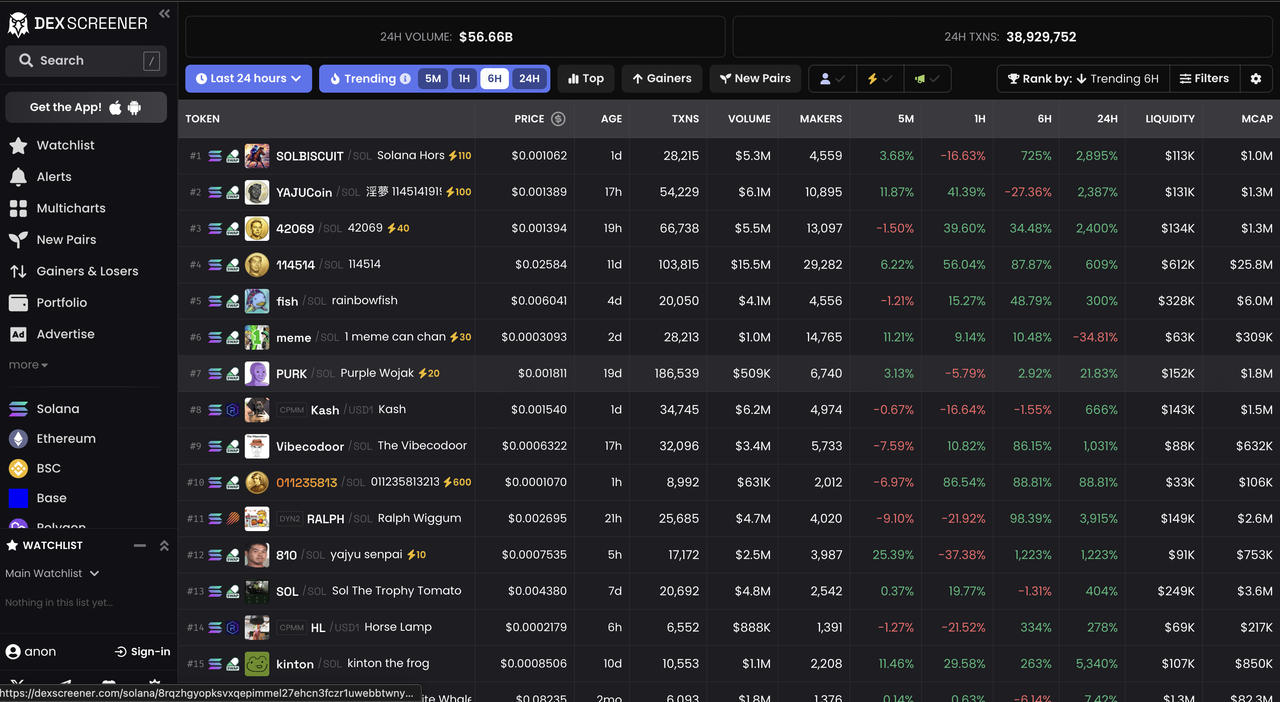

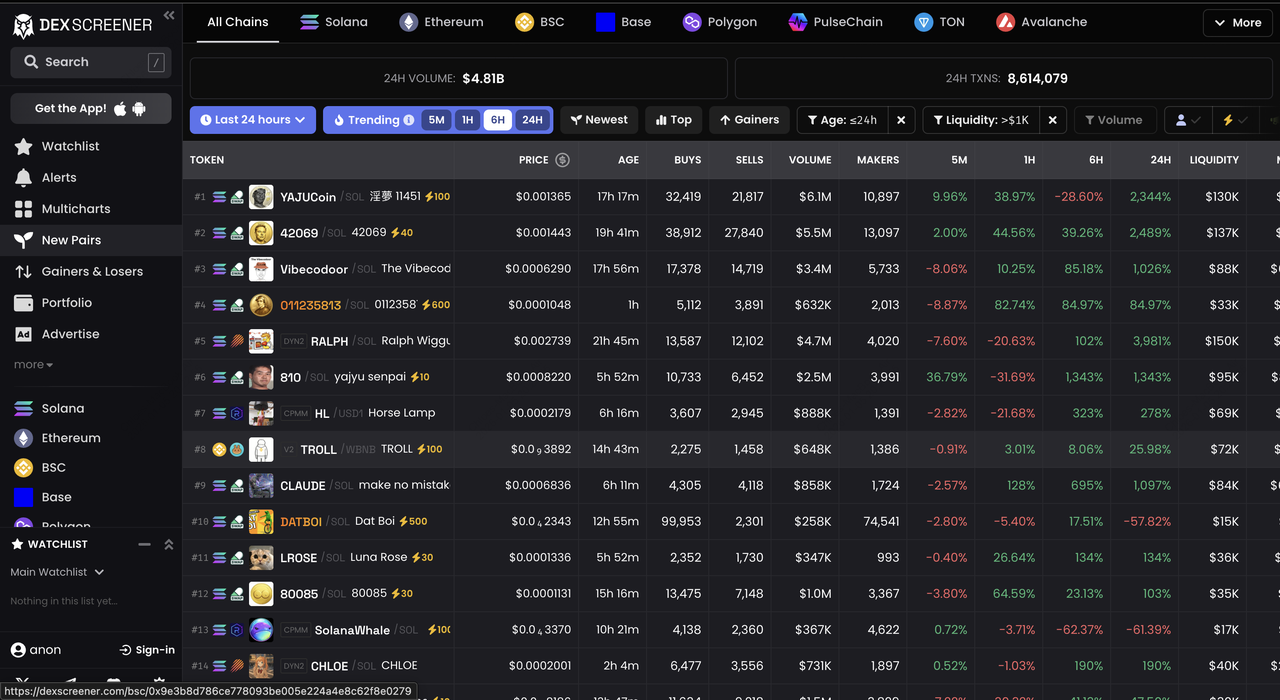

The platform also features dedicated sections for trending tokens, top gainers, and top losers, with advanced filters based on timeframe, blockchain, liquidity, and volume. A New Pairs feed highlights recently launched tokens, helping traders spot opportunities early. Dex Screener allows unlimited custom watchlists and price alerts, making it easier to track multiple markets at once.

At the core of the platform is a proprietary Trending Score, which evaluates metrics like trading volume, liquidity depth, transaction activity, unique holders, and community engagement. Dex Screener also provides developer APIs, enabling custom dashboards, integrations, and automated trading tools.

Founded anonymously in 2021 by a decentralized team, Dex Screener prioritizes privacy and community-driven development. Without public founders or venture marketing, the platform has grown organically to millions of daily active users, driven primarily by its functionality, neutrality, and open-source ethos.

Some key features of DEX Screener include:

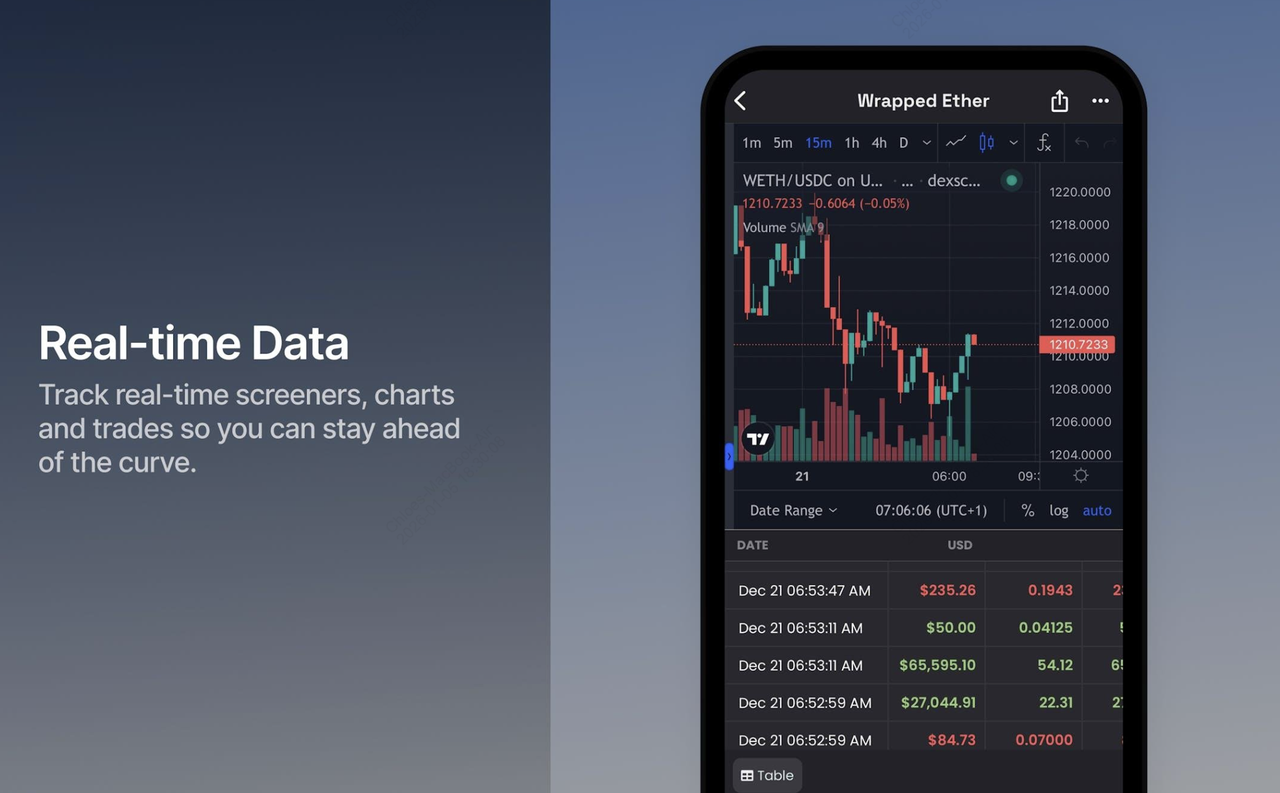

• Real-time charts and trades

• Unlimited watchlists

• Unlimited price alerts

• Customizable screeners with several metrics such as volume, price change, liquidity and market cap

• Support for 60+ chains, hundreds of DEXes and hundreds of thousands of pairs

With millions of active users worldwide, DEX Screener has established itself as the most trusted and widely adopted real-time analytics platform for decentralized exchange trading in 2026. Whether you are a seasoned professional trader hunting for alpha across chains or a newcomer exploring DeFi for the first time, DEX Screener delivers powerful, free tools that help you discover crypto opportunities, analyze trends, and make smarter, data-driven decisions to maximize your crypto investments.

How Does DEX Screener Work?

Dex Screener functions by leveraging a sophisticated custom-built indexer that directly extracts and processes raw on-chain records from supported blockchains, bypassing external APIs to ensure maximum accuracy and near-instantaneous updates on critical metrics like token prices, pool

liquidity, trading volumes, and transaction counts.

The platform integrates seamlessly with TradingView for professional-grade charting, allowing users to overlay technical indicators and analyze multiple timeframes while applying filters for specific chains or performance criteria. Its Trending Score algorithm dynamically weighs factors including trading activity, unique participant counts, holder distribution, and social momentum to surface emerging opportunities, complemented by the verification system that confirms fair launches through contract audits and ownership renouncement.

In 2026, ongoing enhancements include improved oracle integrations and proactive scam flagging, supporting traders in navigating an increasingly complex market with thousands of new pairs launching daily.

DEX Screener vs. CEX Screener: Key Differences

Dex Screener specializes in decentralized exchanges, providing unrestricted access to early-stage tokens and memecoins, extensive pair coverage running into millions, complete privacy without KYC requirements, and direct wallet-based trading across permissionless networks, making it the preferred choice for alpha hunters and new project discovery on high-throughput chains like

Solana and

Base.

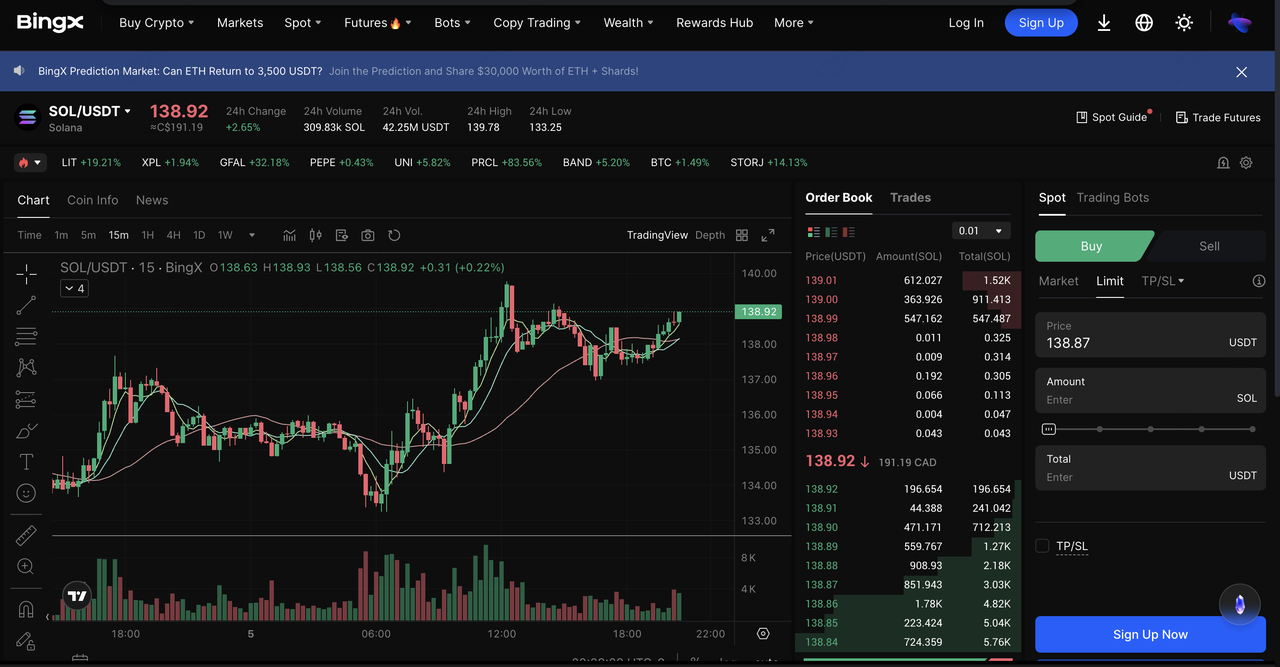

In contrast, centralized exchange (CEX) screeners available on platforms like

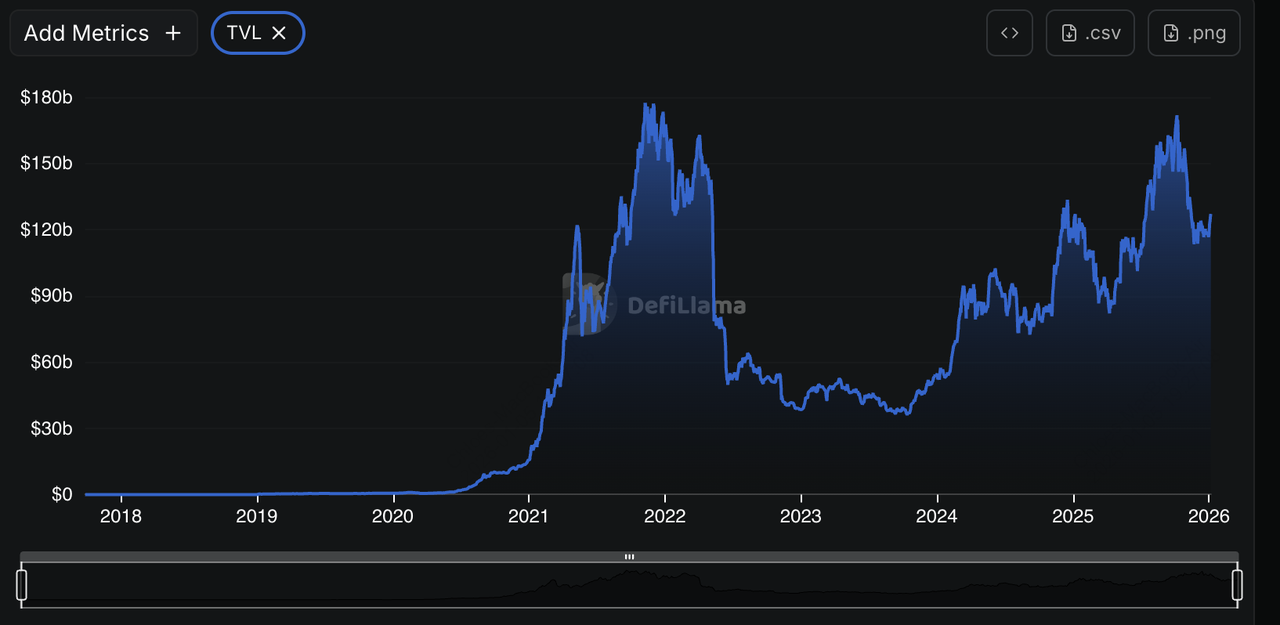

BingX offer superior liquidity depth, fiat on and off ramps, advanced order types including futures and margin trading, and regulatory compliance features, though limited to vetted listings requiring identity verification. In 2026, DEX trading volumes have captured 40-50% of spot market share globally, positioning Dex Screener as indispensable for uncovering opportunities before CEX listings, while CEX tools excel in execution speed, derivatives, and institutional-grade features.

What Is the DEX Screener Trending Score?

The Trending Score serves as Dex Screener's proprietary ranking metric that evaluates real-time token momentum by combining weighted factors such as trading volume, liquidity depth, transaction frequency, unique buyer/seller/holder counts, and community engagement signals from social platforms.

Tokens achieving higher scores gain prominent visibility on trending lists and bars, frequently experiencing accelerated inflows and price appreciation, with top-ranked assets in 2026 commonly delivering 100-1000% short-term gains during viral phases.

Paid boosts are clearly marked to maintain transparency, while organic scores prioritize genuine market activity, enabling traders to filter across 5-minute, 1-hour, and 24-hour windows for precise identification of emerging trends and potential breakout opportunities.

DEX Screener Alternatives

Leading alternatives to Dex Screener include DEXTools, which provides advanced analytics, a unique Trust Score system for risk assessment, and premium ad-free features unlocked via token holding; DexGuru, recognized for its sleek modern interface, whale activity tracking, and intuitive multi-chain liquidity visualizations that have driven over 200% user growth in recent years.

While DEXView is favored for its straightforward, reliable screening focused on essential metrics without overwhelming complexity. Each platform caters to specific preferences, with DEXTools appealing to professional traders, DexGuru to design-conscious users, and DEXView to those seeking simplicity, yet Dex Screener maintains dominance through unmatched chain coverage exceeding 100 networks, completely free core functionality, and innovative tools like Moonshot and Trending Score.

How to Use Dex Screener to Trade and Analyze Crypto: Step-by-Step Guide

Dex Screener offers an intuitive interface that makes trading and analysis straightforward, even for beginners navigating the vast DeFi landscape in 2026.

Step 1: Access Dex Screener

Visit dexscreener.com or download the mobile app for iOS and Android. No signup required for basic use.

Step 2: Search for Trading Pairs or Tokens

Use the central search bar to enter token names, addresses, or pair symbols. Filter by chain (ex. Solana, Ethereum) for targeted results.

Step 3: Analyze Crypto Charts and Metrics

Click a pair for detailed TradingView charts; add indicators, switch timeframes, and review liquidity and volume.

Step 4: Explore Trending, Gainers, or New Pairs

Navigate tabs for trending tokens, top performers, or fresh launches to spot momentum.

Step 5: Set Watchlists and Alerts

Add pairs to watchlists and configure price notifications for proactive monitoring.

Step 6: How to Automate your Trading Strategy with Dex Screener

Use APIs from Dex Screener to trigger alerts for whale trades, funding spikes, unlock events, or volatility signals. Combine these signals with

BingX AI inside your BingX account to get real-time trade insights, risk alerts, and automated pattern detection that help refine your final trade decisions. You can then execute and manage trades on BingX, using this on-chain and market data as a decision layer, and not as a guarantee.

Key Considerations When Using DEX Screener

Although Dex Screener sources data directly from blockchains for exceptional accuracy, always cross-verify critical information before executing large trades, as minor discrepancies can occur in high-volatility environments.

Cryptocurrency markets remain highly volatile, so combine platform insights with proper risk management techniques including stop-loss alerts, position sizing, and diversification across assets.

Security remains paramount, connects only trusted

self-custody wallets, beware of

phishing sites mimicking the official domain, and utilizes Moonshot or audit flags to avoid potential rugs and scams prevalent in new launches. The learning curve for advanced features like MultiCharts and custom filters rewards time investment, while complementing Dex Screener with sentiment tools or portfolio trackers enhances overall strategy effectiveness in 2026's competitive

DeFi landscape.

Conclusion

Dex Screener stands as the essential analytics powerhouse for

DeFi and DEX trading in 2026, delivering free, real-time insights across an expansive multi-chain ecosystem with superior coverage, intuitive tools, and community-driven innovations. From discovering new token pairs and analyzing trends to setting alerts and executing informed strategies, it equips traders of all levels to capitalize on opportunities responsibly while navigating risks in volatile markets. Begin exploring DEX Screener today to elevate your crypto trading approach and stay ahead in the dynamic decentralized finance space.

Related Reading