one of the world’s leading Big Tech firms, alongside companies like

Apple,

Microsoft,

Amazon,

Meta Platforms, and

NVIDIA, Alphabet Inc. continues to dominate global technology markets. From search and digital advertising to Android, YouTube, and

AI-driven cloud services, Alphabet plays a central role in the modern internet economy. As a result, demand for flexible, 24/7 exposure to GOOGL has grown sharply.

Tokenized equities like

GOOGLX (xStock) and

GOOGLON (Ondo tokenized stock) respond to this demand by enabling fractional, borderless, and programmable access to Alphabet’s share price, without relying on a traditional brokerage account.

In this guide, you’ll learn what GOOGLX and GOOGLON are, how Alphabet’s tokenized stocks work, how they are issued and backed, their real-world use cases, benefits and risks, and how to buy or trade Alphabet tokenized stocks on BingX.

What Is Alphabet Google Tokenized Stock and How Does It Work?

Alphabet tokenized Google stock is a blockchain-based digital asset that tracks the real-world price of Alphabet Inc. Class A shares (GOOGL). Instead of buying the stock through a traditional brokerage, you gain

on-chain economic exposure to Google’s share price via tokens such as GOOGLX (xStock) and GOOGLON (Ondo tokenized stock). These tokens mirror GOOGL’s market value in near real time but do not grant shareholder rights like voting or direct dividends.

Regulated issuers such as

Backed Finance and Ondo Finance create tokenized representations of Alphabet stock that are fully backed or economically linked to

real GOOGL shares held with qualified custodians. New tokens are minted when underlying exposure is created and burned when redeemed, helping keep the token price aligned with the actual stock.

Because these tokens live on public blockchains like

Ethereum,

Solana, and

BNB Chain, Alphabet tokenized stocks can be traded 24/7, transferred globally, held fractionally, and integrated with crypto trading platforms and DeFi infrastructure, offering a more flexible and accessible way to track Google’s stock performance without relying on a traditional stock exchange account.

Alphabet (GOOGL) Stock vs. Tokenized Google Stock

Alphabet (GOOGL) stock performance | Source: Google

Alphabet Inc. Class A shares (GOOGL) trade on NASDAQ and reflect traditional equity market dynamics such as fixed trading hours, brokerage access, and settlement cycles. As of late December 2025, GOOGL is priced around $307, up 1.55% on the day, with a market capitalization of roughly $3.7 trillion, a P/E ratio of ~30.7, and a 52-week range between $140.53 and $328.83, highlighting both strong long-term growth and notable volatility. Alphabet also pays a modest dividend, currently yielding about 0.27% annually.

By contrast, Google tokenized stocks like GOOGLX and GOOGLON closely track GOOGL’s real-time price performance but trade on-chain, 24/7, without being constrained by NASDAQ trading hours. While tokenized versions do not provide shareholder rights or direct dividend payouts, they offer continuous liquidity, fractional access, and faster settlement, making them more flexible for global and crypto-native investors. In practice, when Alphabet’s stock price moves during market hours, tokenized Google stocks generally mirror those movements, while also allowing traders to react before and after traditional markets close.

GOOGLX and GOOGLON follow this same principle but differ in issuer, blockchain deployment, and target user base.

What Is Alphabet xStock (GOOGLX), Google's Tokenized Stock by xStocks?

GOOGLX is the xStock (tracker certificate) version of Alphabet Inc. Class A stock, issued by Backed Finance under Swiss financial regulations. GOOGLX is issued as an SPL token on Solana, giving users access to fast settlement, low transaction fees, and deep DeFi liquidity across multiple ecosystems. The token tracks Alphabet’s share price and is designed to provide regulatory-compliant, on-chain exposure to GOOGL.

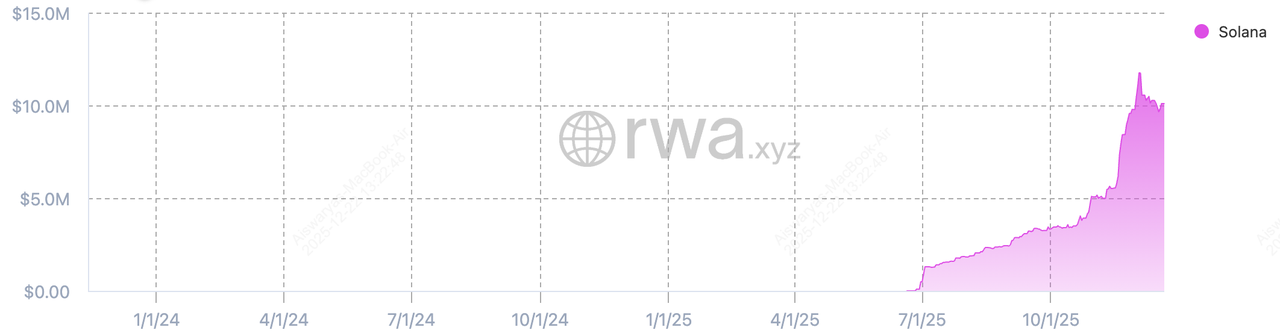

GOOGLX xStock total value | Source: RWA.xyz

GOOGLX (Alphabet xStock) currently reflects a net asset value of around $307, closely tracking the market price of Alphabet Inc. Class A shares. The token has grown to a total on-chain asset value of approximately $10.1 million, supported by a broad base of over 10,700 holders, indicating strong retail adoption. Monthly on-chain transfer volume of about $36 million highlights active trading and liquidity across supported blockchains. At present, GOOGLX charges no ongoing management fee, though users should note that issuance and redemption fees of up to 0.5% may apply depending on market and platform conditions.

What Is Alphabet Ondo Tokenized Stock (GOOGLON)?

GOOGLON is the

Ondo Global Markets' tokenized version of Alphabet Class A stock, issued by

Ondo Finance for non-U.S. retail and institutional investors. GOOGLON provides economic exposure equivalent to holding GOOGL shares, including dividend reinvestment equivalents. Ondo allows eligible users to mint and redeem tokenized U.S. stocks 24 hours a day, five days a week, with routing to traditional exchange liquidity.

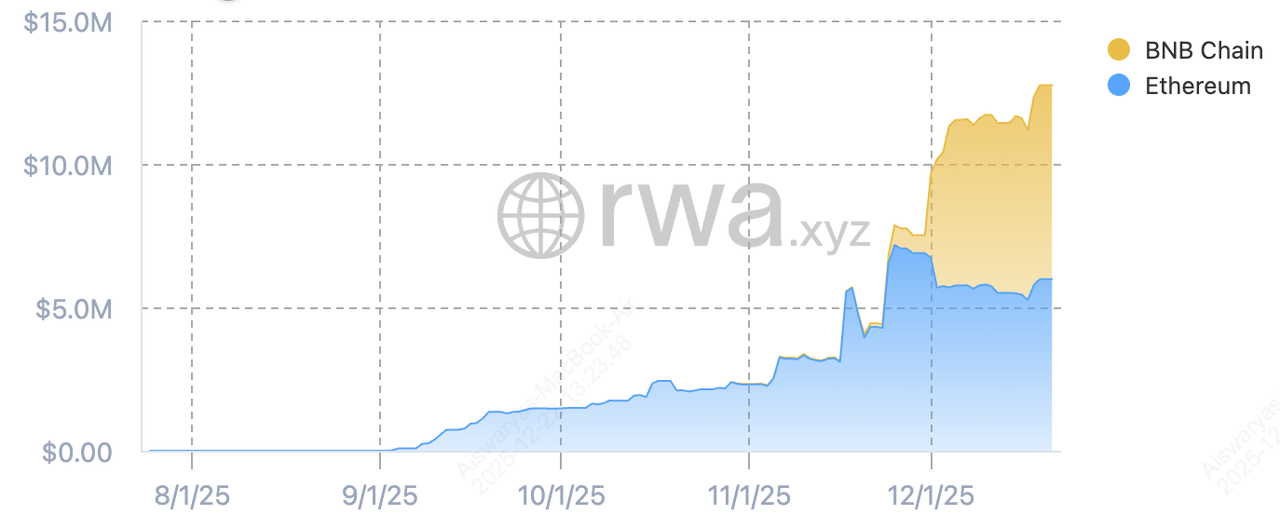

GOOGLon tokenized stock total value | Source: RWA.xyz

GOOGLON (Alphabet Ondo Tokenized Stock) currently trades at a net asset value of around $307, in line with Alphabet Inc. Class A shares, and has reached a total asset value of approximately $12.7 million. Despite a smaller holder base of around 970+ wallets, GOOGLON shows exceptionally strong usage, with monthly transfer volume of about $137 million, representing over 400% month-over-month growth. Issued primarily on Ethereum, GOOGLON is increasingly expanding across multiple blockchains, reflecting rising institutional and DeFi-driven demand for regulated, on-chain access to U.S. equities.

How GOOGLX and GOOGLON Google Tokenized Stocks Work

Alphabet’s tokenized stocks rely on a regulated issuance and collateral framework that bridges traditional finance with blockchain infrastructure.

1. Custody and Backing

• GOOGLX is issued by Backed Finance and structured as a tracker certificate referencing Alphabet shares held with regulated custodians.

• GOOGLON is issued via Ondo Global Markets and backed through qualified custodial arrangements that mirror Alphabet’s economic performance.

2. Minting and Redemption: New tokens are minted when underlying exposure is created and burned upon redemption, maintaining parity with Alphabet’s share price. Ondo enables institutional-grade mint/redemption windows with direct access to traditional exchange liquidity.

3. Price Tracking: Both tokens track GOOGL using:

• Institutional pricing feeds

• Exchange-based reference pricing

• On-chain liquidity across DEXs and CEXs

4. On-Chain Utility: GOOGLX and GOOGLON can be traded, transferred, and, where supported, used in DeFi strategies such as liquidity provision or collateralized lending.

GOOGLX vs. GOOGLON: Key Differences

While both tokens track Alphabet Inc. Class A shares, they serve slightly different audiences.

Solana-based tokenized stock GOOGLX emphasizes multi-chain flexibility, especially Solana-based speed and low fees, making it attractive to DeFi-native users. GOOGLON focuses on regulated global access, deeper liquidity routing, and institutional-grade issuance for non-U.S. investors.

Both tokens deliver Alphabet price exposure, but their design choices reflect different approaches to accessibility, compliance, and ecosystem integration.

What Are the Use Cases of Alphabet Tokenized Stocks GOOGLx and GOOGLon?

Tokenized Alphabet shares unlock several real-world applications:

1. 24/7 Trading Access – Trade GOOGL exposure even when U.S. stock markets are closed.

2. Fractional Ownership – Buy small portions of Alphabet stock without large capital requirements.

3. Global Accessibility – Participate without a traditional brokerage account.

4. DeFi Integration – Use tokenized equities alongside crypto assets in on-chain strategies.

5. Portfolio Diversification – Combine big-tech equity exposure with digital assets in one portfolio.

How to Buy Alphabet Tokenized Stock GOOGLX and GOOGLON on BingX

You can buy and trade Alphabet tokenized stocks on the BingX spot market, which supports tokenized equities alongside spot and derivatives markets.

Buy GOOGLX or GOOGLON on the BingX Spot Market

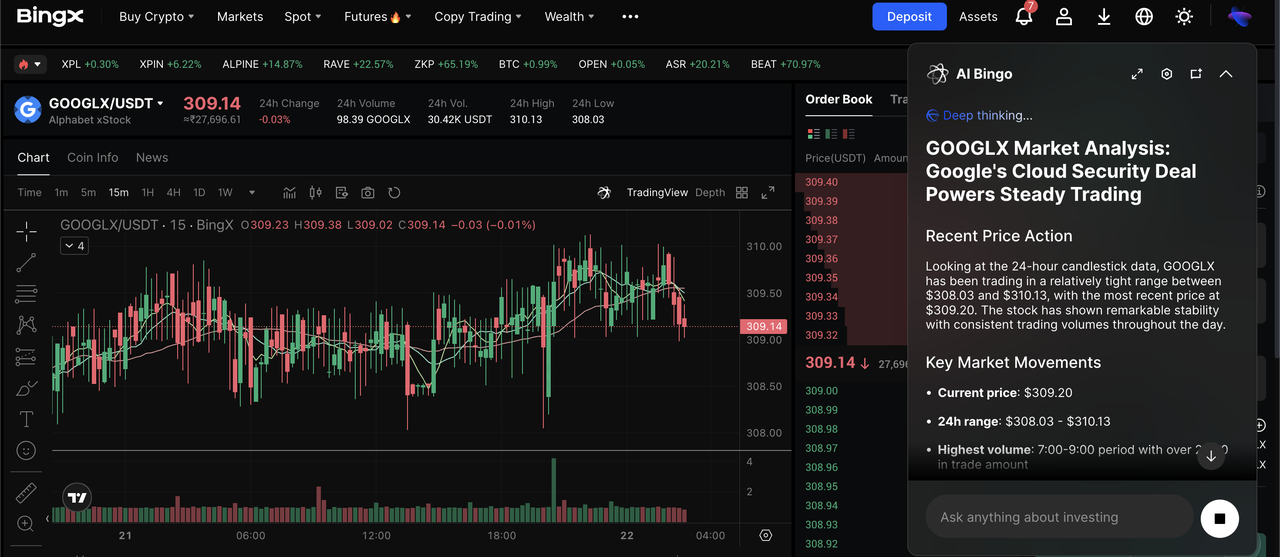

GOOGLX/USDT trading pair on the spot market powered by BingX AI insights

1. Log in to your BingX account.

5. Enter the amount and confirm your trade.

Trade Alphabet (GOOGL) Exposure With Leverage on BingX Futures

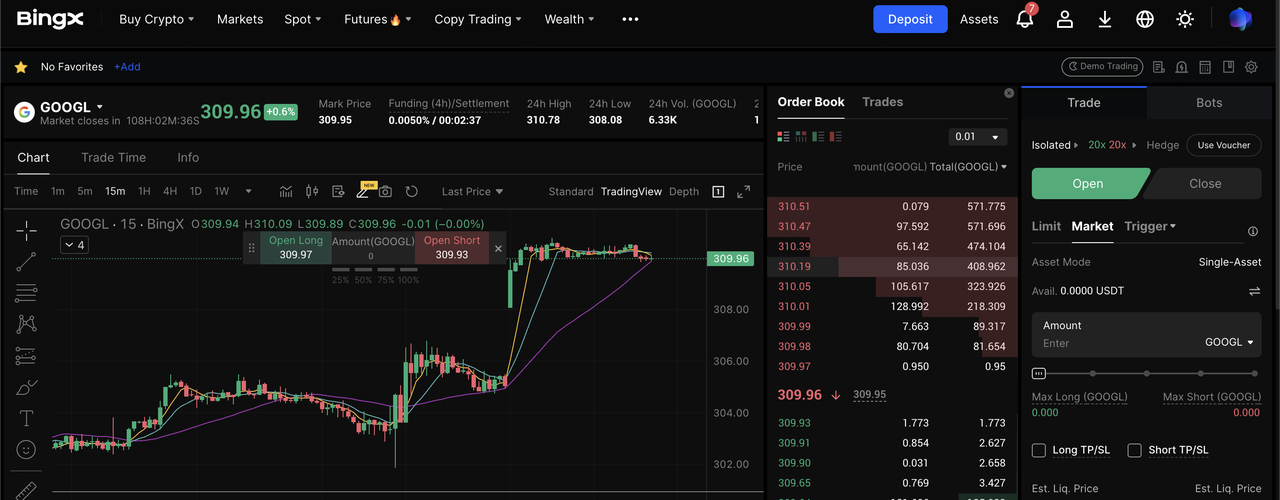

GOOGL-USDT perpetual contract on the futures market powered by BingX AI

Beyond Google's tokenized shares, BingX also offers GOOGL perpetual futures, allowing traders to go long or short Alphabet’s price movements using leverage.

3. Choose your margin mode (Isolated or Cross) and set your leverage based on your risk level.

4. Pick your direction: Long (Buy) if you expect GOOGL to rise, or Short (Sell) if you expect it to fall.

5. Select an order type (Market or Limit), enter your position size, and confirm the trade.

7. Review market signals, volatility, and trend context before adding, reducing, or closing your position.

What Are the Pros and Cons of Investing in Alphabet Tokenized Stocks?

Alphabet tokenized stocks offer a new way to gain Google exposure through blockchain markets, but they come with both clear advantages and important trade-offs that investors should understand before investing.

Pros of Google Tokenized Shares

• 24/7 global access: Trade Alphabet (GOOGL) exposure at any time without being limited by U.S. stock market hours.

• Fractional ownership: Buy small portions of Google exposure without the high capital requirements of full shares.

• No traditional brokerage needed: Access Alphabet’s price performance directly through crypto platforms.

• On-chain transparency: Token balances, transfers, and settlement occur on public blockchains.

• Crypto-native flexibility: Easily integrate GOOGLX and GOOGLON with spot trading, futures, and DeFi-enabled strategies.

Cons of Trading Tokenized Google Stock

• No shareholder rights: Holding GOOGLX or GOOGLON does not provide voting rights or direct dividend payments.

• Regulatory constraints: Availability, minting, and redemption depend on jurisdiction-specific rules, especially for non-U.S. users.

• Issuer and custody dependence: The value of the tokens relies on the issuer’s compliance, custody arrangements, and operational integrity.

• Liquidity variability: On-chain liquidity can differ across blockchains and platforms, sometimes leading to wider spreads than traditional equity markets.

Final Thoughts: Should You Buy Alphabet Tokenized Stock GOOGLx, GOOGLon?

GOOGLX and GOOGLON represent a powerful evolution in how investors access blue-chip equities like Alphabet Inc. They combine the economic exposure of Google stock with the speed, programmability, and accessibility of blockchain markets.

While they are not replacements for owning real GOOGL shares, Alphabet tokenized stocks offer a compelling alternative for crypto-native investors, global users, and traders seeking 24/7 access to one of the most important companies in the digital economy.

Related Reading