x402 is an open, HTTP-native payments standard that brings instant, tokenized micropayments to the web, reviving the long-dormant HTTP 402 “Payment Required” code for a new era of programmable commerce. Authored by Coinbase and backed by Cloudflare’s x402 Foundation and launched in September 2025, it enables pay-per-use transactions for APIs,

AI agents, and digital content, typically using

USDC for on-chain settlement. Early adoption data shows that over 120 developers and 40 apps have already tested x402 middleware integrations across

Base and

Arbitrum testnets, signaling growing traction in “machine-to-machine” and micro-service economies.

In this article, you’ll learn how the x402 protocol works, why it’s gaining momentum in 2025, and which tokens and projects are leading the emerging x402 ecosystem, complete with data, practical insights, and investor takeaways.

What Is x402 Payments Protocol?

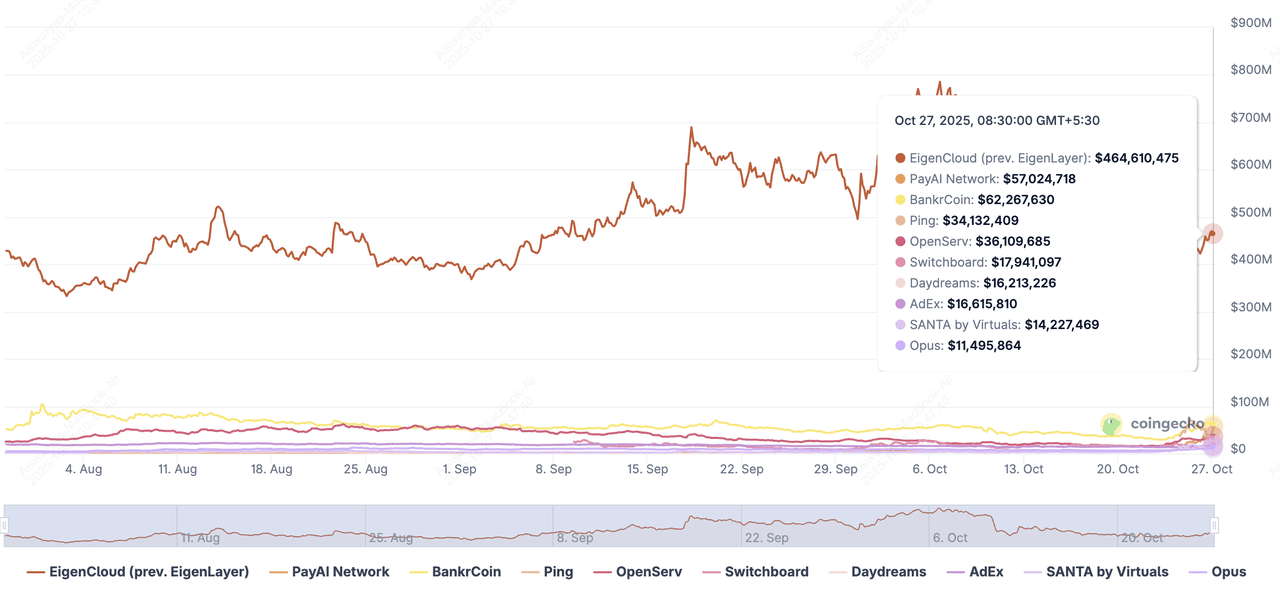

Market cap and performance of top x402 ecosystem coins | Source: CoinGecko

The x402 protocol is an open-standards payment system built for the web; that means your browser, apps, or even AI agents can pay for digital resources like APIs, premium content or compute in a single step, with minimal setup. In essence:

• A client - you, your app or an AI agent, requests access to something-paid.

• The server says: “402 Payment Required,” with details about how much, what token, and where to pay.

• The client pays, for example a stablecoin such as USDC, and retries the request with a payment header.

• The server verifies payment, settles it on-chain or via a facilitator and grants access.

As of October 2025, the x402 ecosystem, which includes nearly 40 tokens tied to projects building on or inspired by the HTTP 402 payment standard, has reached a combined market capitalization of roughly $806 million, with 24-hour trading volumes above $224 million. The sector recorded an impressive +365% daily surge, reflecting intense investor curiosity around micropayment and agent-based finance innovations. However, this volatility also highlights how young and speculative the market remains, as many x402-linked tokens are still in early development and driven more by narrative momentum than proven utility.

How Does the x402 Protocol Work?

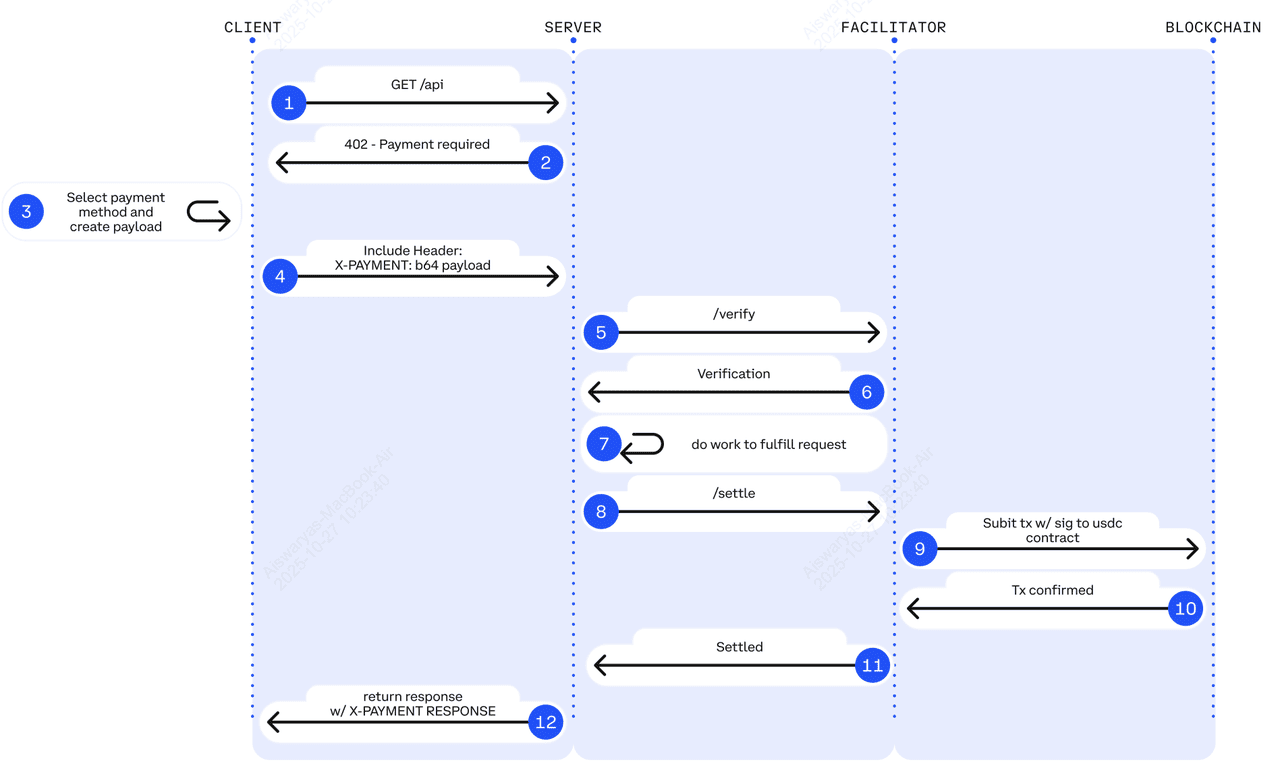

How the x402 payment flow works | Source: x402 whitepaper

x402 works by embedding a simple payment handshake directly into standard web requests. On the server side, a developer adds lightweight middleware that defines how much access to a specific route costs; for example, $0.10 per call to /premium-api. When a user or AI agent requests that endpoint without paying, the server returns an HTTP 402 Payment Required response containing payment details such as amount, accepted token (often USDC), destination address, and supported network. Once the payment is verified, either directly or through a facilitator, the server confirms settlement and returns a normal 200 OK response with the requested data and an optional payment receipt header.

On the client side, the process is equally straightforward. The user or agent interprets the 402 response, signs and sends payment to the designated address, and then retries the request with an X-PAYMENT header carrying the signed proof of payment. If everything checks out, access is instantly granted. Developers can configure which chains or tokens to accept, choose between self-hosted or third-party facilitators, and even enable batched or deferred payment schemes, such as Cloudflare’s optional extension, to streamline multiple microtransactions.

What Are the Top x402 Ecosystem Tokens to Watch in 2025?

Here are seven standout tokens selected for their strong market traction, developer adoption, and direct alignment with the x402 payment standard, representing key segments like AI agents, oracles, and infrastructure. Most of these projects are still early-stage and highly volatile, so investors should approach them with careful research and risk awareness.

1. EigenCloud (EIGEN)

Formerly known as EigenLayer,

EigenCloud represents the evolution of

Ethereum’s

restaking and modular security infrastructure into a full-scale decentralized cloud platform supporting verifiable compute and

AI workloads. With a market capitalization of $465 million, fully diluted valuation surpassing $2.09 billion, and TVL (total value locked) exceeding $17.6 billion, EigenCloud ranks among the most systemically significant projects in the modular blockchain stack. The token trades at $1.19 with a 24-hour volume of $110 million as of late October 2025, reflecting active participation from both restakers and institutional partners.

Its new products, EigenCompute and EigenAI, now in Mainnet Alpha, enable developers to deploy verifiable off-chain compute with blockchain-grade security, while EigenDA continues to deliver industry-leading 50 MB/s data throughput for rollups. Having already paid out $154 million in operator rewards across 161 active AVSs (Actively Validated Services), EigenCloud is positioning itself as the decentralized backbone for scalable AI and data services in the Web3 economy.

2. PayAI Network (PAYAI)

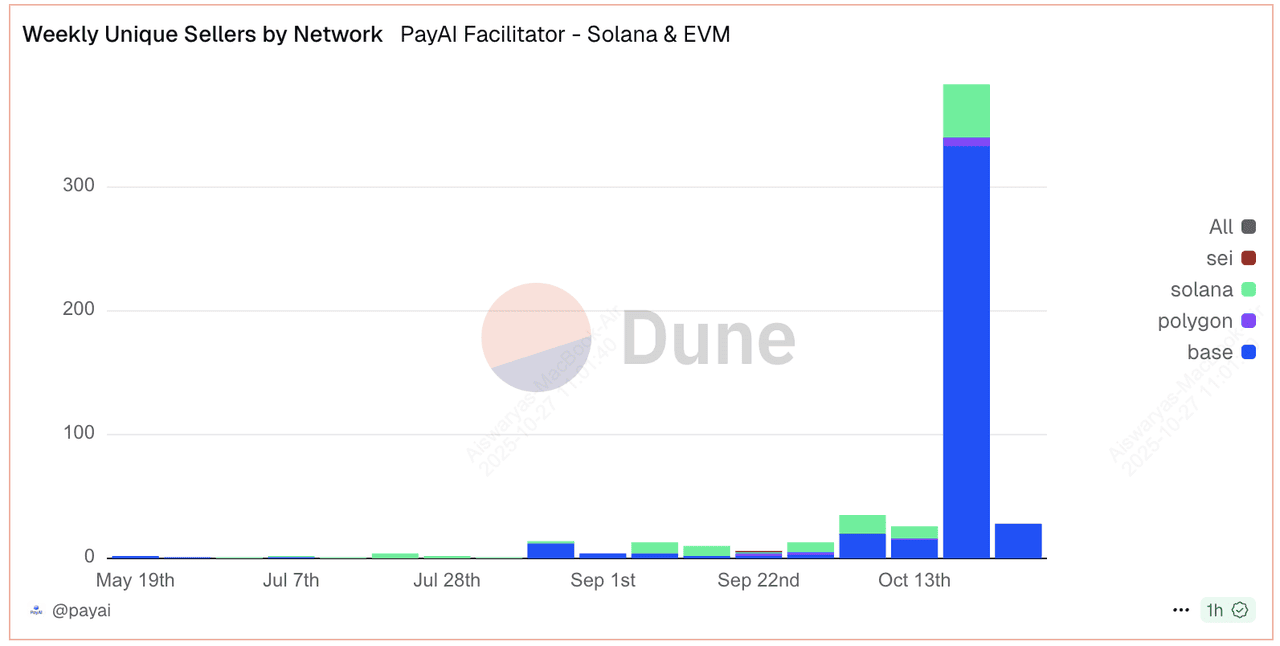

Weekly unique PayAI Network sellers by network | Source: Dune Analytics

PayAI Network is emerging as the core settlement and routing layer of the x402 ecosystem, designed to enable instant, invisible payments between web servers, users, and AI agents. Built primarily on

Solana but extending to Base,

Polygon,

Sei,

Avalanche, and

IoTeX, PayAI acts as a multi-chain facilitator that verifies, processes, and settles microtransactions under one second, perfect for AI agent-to-agent commerce. The token surged over 130% in 24 hours and 1,300% in the past week, with a market cap of $60.6 million and $27.6 million in daily trading volume, reflecting strong early adoption momentum.

Supported by integrations with Coinbase,

Raydium,

ElizaOS, and the Solana Foundation,

PAYAI powers live demos like the “x402 Echo Merchant” that refund real test payments to users. Its roadmap includes tools for agent monetization, token-gated apps, and a global freelance AI marketplace, positioning it as the technical backbone for scalable x402 transactions. Long-term growth will hinge on its execution of cross-chain settlement, SDK adoption, and developer uptake across Web3 payment platforms.

3. BankrCoin (BNKR)

BankrCoin is one of the flagship tokens in the emerging x402 ecosystem, acting as the native asset of Bankr, an AI-powered trading agent built on Farcaster that helps users buy and sell digital assets directly within social feeds. With a market cap of $62.7 million and 24-hour trading volume exceeding $7.4 million, BNKR ranks around #685 globally, reflecting strong retail interest despite its early-stage utility. The token surged over 69% in the past week, driven by momentum from x402 narrative growth and its integration with Base for upcoming features like a private trading terminal, token recommendations, and limit orders. BNKR’s fees from in-app swaps are routed back to support the token, giving it an emerging revenue loop. While its first-mover visibility has drawn speculative attention, sustained value will depend on whether Bankr successfully expands its AI-driven financial tools into broader x402-compatible payments and agent-based services.

4. OpenServ (SERV)

OpenServ functions as the infrastructure backbone for developers building x402-enabled applications and APIs, offering middleware and plug-and-play API connectors for pay-per-request monetization. With a market cap of $35.7 million and a daily trading volume of roughly $693,000, SERV has gained over 125% in the past week, reflecting rising developer curiosity around “agentic app” infrastructure.

The platform supports modular projects such as Wispr (

SocialFi), Modl (community management agents), and MythOS (AI marketing) through its Appcelerator program, a 30-day incubator for launching AI-powered startups. Despite the momentum, GoPlus analysis flags that the contract creator retains modification privileges like adjusting fees or minting tokens, a red flag for cautious investors. OpenServ’s long-term success will depend on transparent audits, consistent developer adoption, and liquidity improvements, as the project aims to evolve from concept-stage infrastructure to a credible multi-agent economy powering x402-based payments.

5. Ping (PING)

Launched as the first token on the x402 protocol and built on the Base

Ethereum layer-2 network,

Ping (ticker PING) quickly achieved a market capitalization of approximately $35.9 million, with around $43 million in reported 24-hour trading volume. Its surge, driven by a one-dollar mint-for-5,000 token model and over 8,000% volume growth in a week, reflects strong community and speculative interest. However, analysts flag it as largely a meme-driven launch with minimal real-world use cases so far. Its long-term value trajectory will depend on conversion from hype into genuine integration: merchant adoption of x402 pay-per-use flows, agent-enabled transactions, and measurable utility beyond being a first-mover novelty.

6. Switchboard (SWTCH)

Switchboard is a multi-chain oracle and data-bridging network that underpins over $5 billion in secured value across 10+ blockchains, providing the real-time data feeds essential for x402-style payment verification and cross-chain automation. With a market cap of $18.3 million and a 24-hour trading volume of $7.36 million, the SWTCH token has gained over 20% in a single day and 90% over the past month, reflecting growing developer and investor interest in modular oracle infrastructure.

Operating as a permissionless oracle, Switchboard allows developers to deploy custom data feeds, price oracles, and randomness services within seconds, critical components for decentralized payments and AI-driven commerce. Its staked node model secures thousands of live feeds across networks like Solana, Base, and Polygon, while upcoming features aim to unify payment request validation across ecosystems. If x402 adoption accelerates, Switchboard could evolve into the data backbone for verifiable machine payments and real-time transaction trust in the broader Web3 economy.

7. Daydreams (DREAMS)

Daydreams (DREAMS) is an AI-driven agent framework and multichain payment router built on the x402 protocol, designed to let autonomous agents plan, execute, and pay for tasks in USDC across networks like Solana, Base, and Starknet. With a market cap of $17.8 million, FDV of $21.6 million, and 24-hour trading volume of $3.45 million, the token has rallied over 60% in the past day and an impressive 447% month-over-month, signaling accelerating traction among early adopters of AI-agent infrastructure.

The platform’s architecture integrates three core layers, the Daydreams agent library, the Lucid orchestration hub, and the DREAMS Router, which together enable fully autonomous agent operation and seamless x402-powered payments. Led by pseudonymous founder LordOfAFew, the project positions itself as an “AI lab for the frontier,” aiming to make machine-to-machine coordination and payment settlement as seamless as a web request. If adoption of AI agents continues at its current pace, Daydreams could become a cornerstone of the autonomous AI-commerce stack emerging around x402.

How Developers Benefit from the x402 Protocol’s AI‑Native Payments

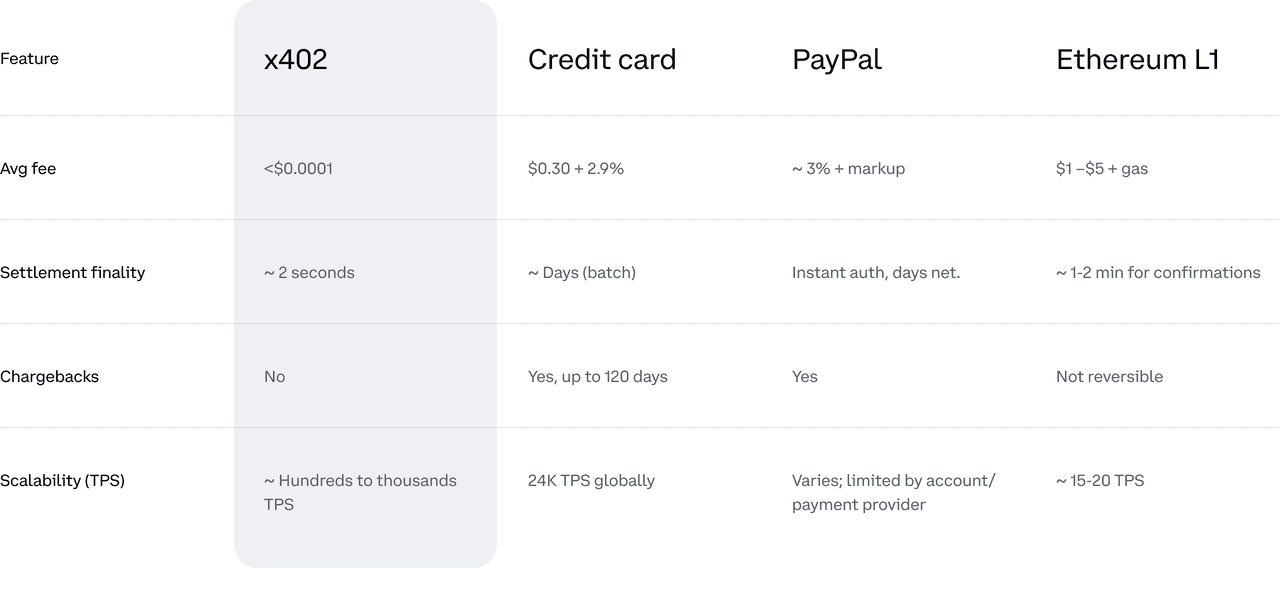

A comparison of different payment protocols | Source: Coinbase

The x402 protocol introduces a simple, programmable way to integrate payments directly into web requests, making it ideal for developers, creators, and AI builders who want frictionless monetization and automation.

Here are the main benefits:

1. Frictionless Access: Eliminate user accounts and API keys; payment itself acts as instant authorization for access or API calls.

2. True Micropayments: Enable sub-cent transactions via stablecoins like USDC, making small, on-demand purchases finally cost-effective.

3. Instant Settlement: Complete transactions in seconds on-chain or through facilitators, reducing delays, chargebacks, and manual reconciliations.

4. Multichain Flexibility: Accept payments across multiple blockchains and tokens; start with USDC today and expand to other assets later.

5. Easy Developer Integration: Add pay-per-request logic using standard HTTP 402 responses and lightweight middleware, no complex setup needed.

6. Agent-Native Design: Allow AI agents, bots, and IoT devices to pay and interact autonomously, unlocking machine-to-machine commerce.

7. Global Monetization: Reach anyone worldwide through open blockchain rails, letting creators and developers earn directly from users without intermediaries.

Key Considerations Before Investing in x402 Projects

Before diving into x402-related tokens or projects, it’s essential to recognize that the ecosystem is still in its infancy. Many tokens are tied to early-stage or demo-phase projects, meaning products may not yet have full functionality or real-world traction. The market is highly volatile, price swings of over 50% in a single day are not uncommon, and liquidity can vary drastically across exchanges. Additionally, because x402 deals directly with payments and stablecoins, it may face evolving regulatory scrutiny as authorities clarify rules around machine-to-machine payments and tokenized money transfers.

To make informed decisions, investors should apply a structured evaluation framework:

1. Verify Real Utility: Focus on projects with live x402 integrations; for example, working pay-per-API endpoints, content paywalls, or agent-based payment demos. Avoid tokens that rely solely on hype or whitepapers.

2. Assess Token Purpose: Confirm how the token is actually used, whether for payments, staking, governance, or facilitator rewards. Tokens without a clear use case often struggle to sustain value.

3. Track Ecosystem Traction: Check metrics like active users, payment volume, number of x402-enabled endpoints, and developer participation. Consistent growth signals real adoption.

4. Evaluate Security & Multichain Support: Choose projects with audited contracts, transparent code, and support for multiple blockchains to reduce technical and settlement risk.

5. Review Liquidity & Team Execution: Examine trading depth, circulating supply, and unlock schedules. Prioritize teams with visible roadmaps, credible experience, and proven delivery.

If you’re a developer or operator, start by reading the official x402 whitepaper and GitHub documentation to understand the protocol’s architecture. Experiment by launching a pilot endpoint; for instance, charging $0.01 per API call using USDC on Base, and monitor payment success rates, latency, and conversion metrics. Gradually expand once the integration proves stable.

For investors or users, begin with small allocations, track listings and partnerships, and follow ecosystem metrics such as facilitator activity and x402 transaction growth. Treat participation as a learning experience in an emerging internet-native payment standard rather than a guaranteed return opportunity. In this fast-evolving space, disciplined research and risk management are your best tools to separate genuine innovation from speculative hype.

Final Thoughts

x402 represents a meaningful shift toward making value exchange on the web as simple and ubiquitous as data exchange. For the first time the HTTP 402 code is activated in a meaningful way, enabling micro-payments, agent-economies, pay-per-use services, and web-native monetization without traditional gatekeepers.

If the protocol achieves broad adoption, we could see a wave of applications: pay-per-article, per-API-call billing, autonomous agents transacting, and a new “internet of value” layer.

However, it’s early days. The ecosystem is still developing, token markets are speculative, regulatory dynamics remain fluid, and actual usage must scale. For readers, understand the opportunity, but treat it cautiously. Start small, focus on utility, ask the right questions, and keep an eye on how the standard evolves.

Related Reading