Crypto mining is no longer just about noisy rigs and warehouse-sized farms. In 2025, a new generation of cloud and mobile mining apps lets you tap into professional mining infrastructure directly from your phone. You typically rent hash power from remote data centers, track rewards in an app, and withdraw mined coins to your own wallet, without ever touching hardware.

At the same time, scam “mining” apps and misleading faucets are everywhere. Profitability is highly variable and depends on coin prices, contracts, and fees. So you need to be picky.

In this guide, you’ll discover how mobile and cloud mining apps work, why they’re popular in 2025, and which 10 apps stand out this year. You’ll also learn how to choose safe platforms, transfer mined coins to BingX for trading, and understand the key risks before getting started.

Important: Mining rewards and returns are never guaranteed. All examples here are for education, not financial advice. Always do your own research and never invest more than you can afford to lose.

What Are Crypto Mining Apps for Your Phone and How Do They Work?

When you mine crypto on your phone in 2025, you’re usually doing one of three things:

1. Cloud mining via a mobile app: You rent hash power in a remote data center that runs ASICs/GPUs. The provider operates the hardware and pays you a share of the mined coins, minus fees. You manage contracts, payouts, and reinvestment from your phone.

2. Hash-power marketplaces or pools with mobile dashboards: You buy or sell hash power through a marketplace. Or you connect your own machines to a mining pool and monitor everything via mobile apps. Your phone is a control panel, not the device doing the heavy work.

3. Reward, faucet, or “simulated mining” apps: Some apps award small crypto rewards for tasks, ads, or social activity and call it “mining.” No real Proof-of-Work is happening on your phone. These can be harmless loyalty apps or outright scams.

Because real Proof-of-Work mining requires massive hash power and electricity, your smartphone itself is almost never the device doing the actual hashing. It’s mainly a remote control and tracking tool.

Why Are Mobile and Cloud Mining Apps Popular in 2025?

Several trends are driving interest in cloud and mobile mining this year:

1. Lower barrier to entry: Cloud mining apps let you start with small contracts, sometimes under $50, instead of buying expensive hardware. Platforms like ECOS and Hashing24 sell fixed-term contracts backed by real data centers in Iceland, Armenia, and other low-cost energy regions.

2. AI-optimized operations: Newer providers, such as AutoHash, run AI engines that reallocate hash power across farms and pools based on power prices, difficulty, and coin volatility to squeeze out better efficiency.

3. Renewable-energy infrastructure: Many data centers now rely heavily on hydro, wind, solar, or geothermal energy to lower costs and appeal to ESG-focused users. AutoHash and ECOS both highlight renewable energy in Norway, Iceland, and Armenia.

4. Retail “earn from your phone” narrative: Articles and comparison sites heavily promote lists of “best free mining apps” and “Android mining apps,” often mixing legit cloud services with risky offers. Average users see phrases like “no hardware” and “$100 free trial” and want to try mining with minimal friction.

In short, mobile mining apps sit at the intersection of yield hunting, mobile convenience, and AI/green-energy marketing. That makes careful due diligence more important than ever.

The 10 Best Crypto Mining Apps for Your Phone in 2025

Here’s a quick overview of 10 widely discussed mining apps and platforms you can manage from your phone in 2025:

| # |

App / Platform |

Type |

Main Coins |

What It’s Best For |

| 1 |

AutoHash |

AI cloud mining |

BTC, DOGE |

AI-optimized cloud mining with Swiss registration and $100 trial credits |

| 2 |

Pi Network |

Mobile “mining” (SCP-style consensus) |

PI |

Earning PI through mobile check-ins, social graphs, and KYC-based mainnet migration |

| 3 |

ECOS |

Licensed cloud mining |

BTC |

Regulated BTC cloud-mining contracts with mobile tracking |

| 4 |

Hashing24 |

Bitcoin cloud mining |

BTC |

Simple, long-running BTC cloud mining provider |

| 5 |

BeMine |

Fractional ASIC ownership |

BTC, LTC & others |

Owning full or fractional ASIC miners hosted in data centers |

| 6 |

Mining Rig Rentals |

Hash-power marketplace |

BTC, LTC, ETC, many |

Renting specialized rigs for flexible, multi-algorithm PoW mining |

| 7 |

NiceHash |

Hash-power marketplace + app |

BTC payout, multi-algo |

Auto-switching algorithm mining with a dedicated mobile app |

| 8 |

CryptoTab Farm |

Multi-device mining suite |

BTC plus limited alt rewards |

Browser + app CPU mining with multi-device control |

| 9 |

StormGain Cloud Miner |

Mobile BTC cloud mining |

BTC |

Free, mobile-first cloud mining inside the StormGain exchange app |

| 10 |

YouHodler |

Cloud mining–style yield tools |

BTC, others |

CeFi yield + “mining-style” earning products via mobile |

Now let’s walk through each mobile app for mining cryptocurrency in more detail.

1. AutoHash

AutoHash is an AI-driven cloud-mining platform run by Blockchain Finance AG in Zug, Switzerland, combining Swiss DLT-style registration with renewable-energy data centers across regions like Norway, Iceland, Canada, and Spain. From its mobile-friendly site or app, you can claim a $100 “Hydro Farm Entry” trial, 5 TH/s for 1 day with an advertised $1.6 payout and deposit return, and then upgrade to paid

BTC mining plans ranging roughly from 10–390 TH/s, priced between $150 and $43,200 with 1–3-day durations and daily rewards specified in USD equivalents. The OptiHash AI engine dynamically allocates hashrate across supported coins such as

BTC,

LTC,

DOGE,

ETC, and XMR, while deposits and withdrawals can be made in major assets including BTC,

ETH, LTC,

USDT,

USDC,

TRX,

BCH,

BNB, and DOGE; maintenance costs are bundled into contract pricing rather than charged as separate fees.

Key features of AutoHash

• AI-driven allocation designed to maximize efficiency

• Green-energy data centers for lower operating costs

• Daily auto-payouts to your linked wallet or account

Key Considerations

• High advertised ROI always carries risk; returns depend on market conditions.

• You rely entirely on the provider’s honesty and uptime; there is no on-chain proof of hash power.

• Always verify registration details and read independent reviews before depositing.

2. Pi Network

Pi Network is a mobile-first cryptocurrency project that lets users earn PI through a lightweight “mining” process powered by SCP-style federated consensus rather than Proof-of-Work. Mining simply involves tapping the app once every 24 hours, building Security Circles to boost your rate, and optionally running a desktop Node, with full utility unlocked after completing

KYC and migrating tokens to the Open Mainnet wallet introduced in 2025.

Key Features of Pi Mining App

• Zero hardware requirements; mining runs without using CPU/GPU power

• Massive mobile user base and simple onboarding

• Social trust graph via "Security Circles" to establish consensus and boost mining rate

• Migration to mainnet wallets for real PI transfers, subject to KYC approval

• Expanding in-app ecosystem:

Pi Wallet, Pi Browser, Pi App Studio, and early dApps

Key Considerations Before Mining PI Coins

• This is not traditional mining; no real hashpower or PoW security is involved

• PI’s exchange listing, liquidity, and price discovery depend on future ecosystem adoption

• Daily user activity is required to maintain your mining streak

• Full utility depends on KYC completion and ongoing mainnet migration progress

3. ECOS

ECOS operates in Armenia’s Hrazdan Free Economic Zone and offers

Bitcoin (BTC)-only cloud-mining contracts, with entry plans starting as low as US$150 for a 30-day term, according to recent reviews. Contract durations range from approximately 6 months up to 50 months, and documented pricing shows a 24-month contract with ~19.8 TH/s capacity priced at US$2,000, with a service fee of roughly US$0.05 per TH/s per 24 h. ECOS supports payments in major cryptocurrencies and credit cards, and the mobile app tracks real-time stats, offers a built-in profitability calculator, factoring electricity costs and BTC price, and handles contract activation and payouts.

Key Features of ECOS Cloud Mining App

• Official registration and government-backed free-economic zone status

• Multiple contract terms and hash-power options

• Real-time monitoring of revenue, daily payouts in BTC

• Optional staking and investment products in the same app

Key Considerations Before Mining BTC on ECOS App

• Minimum investment is typically higher than some “free app” competitors.

• Maintenance and management fees can eat into returns, especially in bear markets.

• You must trust ECOS to keep hardware and contracts running as advertised.

4. Hashing24

Hashing24 is one of the longest-running Bitcoin cloud-mining providers, offering BTC-only hash-power contracts backed by ASIC miners in Iceland and Canada. Users can buy small or large contracts directly from their phone, with entry options starting as low as 1 TH/s and larger 12- or 24-month plans priced around 0.018–0.036 BTC. Daily maintenance fees, often around US $0.33 per TH/s, are deducted from mining revenue, and Hashing24 manages all hardware, electricity, and uptime, making it a simple hands-off way to participate in Bitcoin mining, though profitability depends heavily on BTC price and network difficulty.

Hashing24's Key Features

• Long operating history relative to many newer cloud miners

• Straightforward pricing with BTC-only focus

• Mobile-friendly web dashboard to track daily income

Key Considerations Before Mining BTC on Hashing24

• No guarantees: profitability depends on BTC price, difficulty, and fees.

• Less diversification than multi-coin platforms.

• Do not treat historical uptime as a guarantee of future performance.

5. BeMine

BeMine offers real ASIC-backed cloud mining where users can purchase full miners or fractional shares as small as 1/100th, with hardware like Antminer S21 Hydro and S19 XP priced at roughly US $250–$410 per fraction and full units around US $8,000+. It supports primarily SHA-256 coins such as BTC, along with some Scrypt and Equihash miners for altcoins, and includes all hosting, electricity, and maintenance in its service fees. Users can track hashrate, uptime, and payouts through the mobile dashboard, and BeMine also provides an 11-day free trial, though profitability varies based on miner efficiency, network conditions, and coin prices.

BeMine's Key Features

• Real hardware backing and not purely virtual contracts

• Fractional purchase lowers entry cost for individual miners

• Detailed stats on hash rate and device uptime

Key Considerations Before Downloading BeMine App

• You pay both for hardware and ongoing hosting/maintenance.

• Liquidity for re-selling fractional shares may be limited.

• As with any cloud-hosted miner, you must trust the operator’s reporting.

6. Mining Rig Rentals

Mining Rig Rentals is a peer-to-peer hash-power marketplace where users can rent mining rigs across 100+ algorithms like SHA-256, Scrypt, Ethash, KawPow, RandomX, and more, and point them to any compatible pool to mine coins like BTC, LTC, DOGE, RVN, ETC, or XMR. Pricing is set by rig owners, common listings range from small rentals to large farms, with rates such as 0.0008 BTC per PH/day appearing on SHA-256 rigs, and the platform takes roughly a 3% fee on transactions. Payments can be made in BTC, LTC, ETH, DOGE, or BCH, and the entire process is managed via the mobile website, allowing you to browse rigs, pay, set your pool credentials, and monitor real-time performance directly from your phone.

Key Features of Mining Rig Rentals

• Very flexible: supports many PoW coins and algorithms

• Transparent rig descriptions and historical performance charts

• Suitable for power users who want fine-tuned control

Key Considerations Before Using Mining Rig Rentals

• More complex than “click to buy” cloud contracts.

• You bear more responsibility for choosing pools and managing settings.

• As always, only rent from sellers with strong reputations and clear history.

7. NiceHash

NiceHash is a well-established hash-power marketplace that allows users to buy or sell computing power across many algorithms and receive payouts in BTC, all via its Android/iOS app. You can begin buying hashrate for as little as 0.001 BTC per contract and the platform charges buyer-side service fees of approximately 1%-4% depending on usage. It supports deposit and withdrawal in multiple currencies like BTC, LTC, DOGE, ETH etc., though minimum withdrawal for BTC via non-

Lightning network is 0.002 BTC plus network fees.

Key Features of NiceHash Mining App

• Real-time profitability tracking in the app

• Auto-switching between profitable algorithms

• Payouts consolidated in BTC for simpler accounting

• Active community and documentation

Key Factors to Consider Before Mining on NiceHash App

• You take marketplace risk when buying power from unknown sellers.

• Profitability can swing rapidly with market conditions.

• Always enable strong security via 2FA, withdrawal whitelists.

8. CryptoTab Farm

CryptoTab Farm allows users to build a mining “farm” of connected Windows/macOS computers (and cables to mobile dashboard) with the aim of earning BTC via their proprietary mining algorithm. The app claims no hardware cost for basic connection, enables withdrawals of BTC “with no commission” from the first day. It supports only Bitcoin (BTC) payouts, not a suite of alt-coins, and users may increase earnings via a “Cloud Boost” feature, e.g., ×15–×100 speed multipliers, per user review, though details on cost are unclear.

CryptoTab Farm's Key Features

• Simple onboarding for non-technical users

• Mining through browser activity and device CPU, within limits

• Multi-device management with real-time stats

• Low minimum withdrawals, e.g., $2 in BTC/ETH/USDT per recent reviews

What to Watch When Mining on CryptoTab Farm App

• CPU-based “mining” is limited; earnings are typically small per device.

• Free tiers may show intrusive ads; premium tiers add subscription cost.

• Ensure your device cooling and battery health are monitored.

9. StormGain Cloud Miner

StormGain’s Cloud Miner is a free mobile-based feature built into its exchange app that is advertised as letting users earn small amounts of Bitcoin (BTC) without hardware or upfront investment. According to the platform, the “free Bitcoin mining” allows you to press a “Mining” button every few hours, typically every 4 hours, and accumulate rewards, but you may need to trade or meet certain conditions before withdrawals are permitted.

Key Features of StormGain Cloud Miner

• 100% mobile-friendly BTC cloud mining

• Zero hardware, zero fees, no contract commitment

• Rewards can be used for trading or withdrawn after meeting activity requirements

• Clean, beginner-friendly UX

StormGain Cloud Miner's Key Considerations

• Earnings are small and tied to trading activity requirements.

• Not real Proof-of-Work mining; rewards come from StormGain’s internal model.

• Higher withdrawal thresholds require active use of StormGain exchange services.

10. YouHodler

YouHodler is a hybrid CeFi platform offering yield accounts, lending, and a “Cloud Miner” style rewards system rather than true hardware mining. Users can deposit from a wide range of supported coins and

stablecoins, e.g., BTC, ETH, USDT, USDC, DOGE, LTC,

ADA and 40 + others, and earn up to ~18% p.a. on some assets via yield programs. The Cloud Miner itself is gamified: for example, at Newbie level you might earn ~0.000004 BTC per block (2 Sparks required, 6 hours) and at VIP level ~0.0001 BTC per block (35 Sparks required, 1 hour) after achieving large monthly trading volumes of over $5 million and higher level status.

Key Features of YouHodler

• Regulated in certain European jurisdictions. Check latest licenses before getting started

• Combines yield, lending, and “mining”-branded products

• Daily or weekly payouts, often insured custodial wallets

Key Considerations Before Using YouHodler

• This is not classic PoW mining. It’s CeFi yield with platform risk.

• Returns depend on YouHodler’s underlying strategies and risk management.

• Always read terms, risk disclosures, and audit reports before depositing.

Reminder: Inclusion here does not mean BingX endorses any of these platforms. This is an educational overview so you can evaluate them yourself.

How to Choose the Best Crypto Mining App for Your Phone

Before you sign up anywhere, walk through this checklist:

1. Verify legitimacy and registration: Look for clear company details, registration numbers, and data-center locations. AutoHash and ECOS publicly cite Swiss/Armenian registration and energy sources; that’s a good sign, but still verify independently.

2. Understand the business model: Understand how each app earns rewards: cloud mining sells you hash power, marketplaces rent rigs, CeFi apps pay yield instead of mining, and faucet/task apps reward activity rather than real hashing.

3. Check fees and contract structure: Maintenance fees, management fees, withdrawal fees, and hidden spreads matter more than headline APY. Use mining profitability calculators but treat them as scenarios, not guarantees.

4. Look at supported coins and liquidity: Mining BTC, LTC, DOGE,

KAS, or other liquid PoW coins is safer from an exit-liquidity perspective. Make sure the coin is listed on reputable exchanges, such as BingX, with solid daily volume.

5. Security and app permissions: Only download apps from official stores or verified websites. Be cautious if an app requests access to SMS, camera, contacts, or other unnecessary permissions. Enable 2FA and withdrawal whitelists wherever possible.

6. Start small, then scale: Treat your first contract as a test. Verify that payouts arrive, dashboards match on-chain data, if available, and support responds. Increase allocation only after several successful cycles.

From Mining Rewards to Trading: Using BingX With Mining Apps

BingX does not offer cloud-mining contracts, but you can use BingX as your trading and risk-management hub once you’ve earned coins from external mining apps.

1. Deposit Your Mined Coins to BingX

In your mining app, set the payout address to your BingX deposit address for that coin, e.g., BTC, LTC, DOGE, KS). Confirm network type, e.g., BTC mainnet, LTC mainnet. Wait for on-chain confirmations, then check your BingX spot wallet.

Note: Always send a small test amount first to avoid mis-configured addresses or networks.

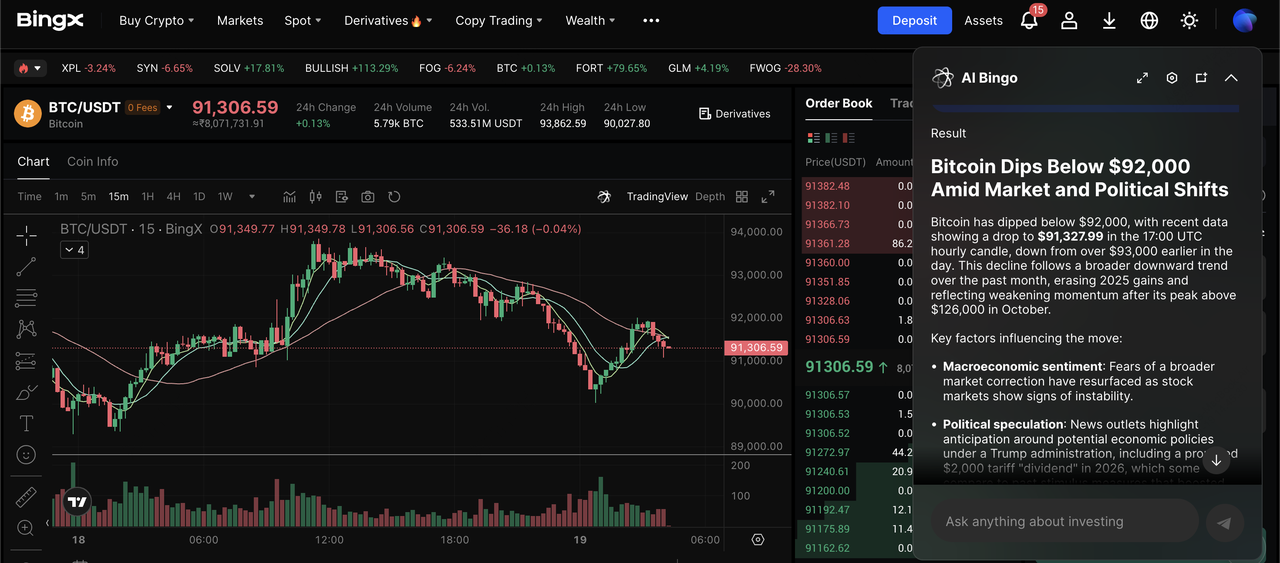

2. Trade Mined Coins on the BingX Spot Market

BTC/USDT trading pair on the spot market powered by BingX AI insights

3. Hedge or Amplify Exposure With BingX Futures

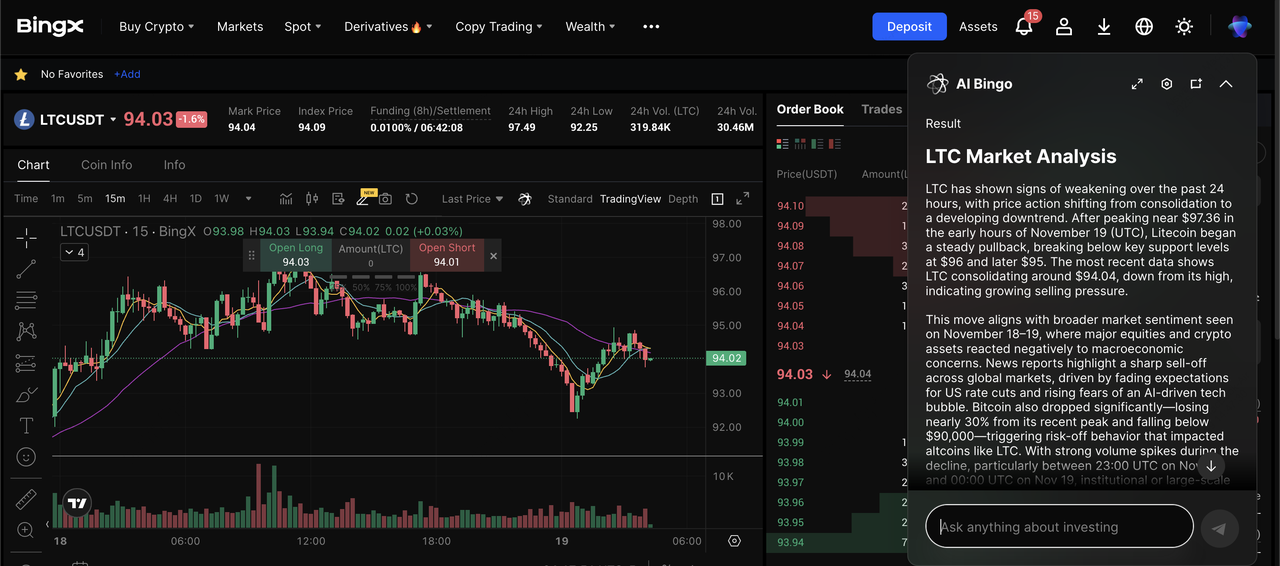

If you mine BTC or other PoW coins and want to hedge price swings:

• Open short futures to hedge downside risk during volatile periods.

• Or open long positions with moderate leverage if you expect a strong uptrend.

What Are the Key Risks of Mining Crypto on Your Smartphone?

Mining apps are not free money. Here are the main risk buckets:

1. Platform and scam risk: Many “free mining” apps are Ponzi schemes or ad farms. If an app promises very high returns with zero risk and no clear business model, assume extreme caution.

2. Profitability and market risk: Mining returns can flip from profitable to negative if BTC price falls or difficulty rises. Cloud contracts often lock you in; you may not be able to exit early.

3. Fee drag: Maintenance, management, and withdrawal fees can quietly erode most of your earnings. Always model net returns after all fees.

4. Custodial and counterparty risk: If your mining app also holds your funds, you face similar risks to any centralized platform. Hacks, mismanagement, or regulatory shutdowns can lead to losses.

5. Device and privacy risks on mobile: Fake mining apps may install malware, collect sensitive data, or abuse permissions. Stick to official app stores, check reviews carefully, and periodically audit device permissions.

6. Regulatory and tax considerations: Mining income can be taxable in many jurisdictions. Some countries restrict mining or require specific disclosures. Keep good records of contracts, payouts, and sale prices.

Final Word

If you want to experiment with crypto mining from your phone in 2025, mobile and cloud mining apps offer an easy entry point without buying hardware. Platforms like AutoHash, ECOS, Hashing24, BeMine, NiceHash, CryptoTab Farm, StormGain Cloud Miner, Mining Rig Rentals, and YouHodler cover the full spectrum, from AI-optimized cloud mining to hash-power marketplaces and hybrid CeFi earning tools.

Still, none of these apps guarantee profits, and they carry far more risk than simply

buying BTC, LTC, or DOGE on an exchange. The safest approach is to start small, verify the platform’s credibility, understand all fees, and use BingX to store, trade, or hedge any mined coins with proper risk controls.

Remember, mobile mining should be treated as a speculative side experiment, not your main investment strategy. Never commit funds you can’t afford to lose.

Related Reading

FAQs on Crypto Mining Apps for Your Phone

1. Can you really mine Bitcoin on your phone in 2025?

Your phone itself doesn’t generate meaningful hash power for Bitcoin. Instead, mobile apps connect you to cloud mining or hash-power marketplaces where real ASICs do the work. Your phone is a control panel, not a mining rig.

2. Which crypto mining app pays the most?

No mining app consistently pays the most because returns vary based on contract terms, coin prices, network difficulty, fees, and operating costs. While some review sites show examples of a few dollars in daily earnings for larger contracts, these are scenarios, not guaranteed results.

3. Are free Bitcoin mining apps legit?

A few platforms offer small free trials, e.g., $100 hash-power credits as promotions. But most “free mining” apps either pay tiny faucet-level rewards or are outright scams. Always research the company, check if mining rewards are actually withdrawable, and be skeptical of “free BTC” marketing.

4. Is mobile crypto mining profitable in 2025?

For most people, crypto mining is not profitable and cannot be considered a primary income source. Mobile-managed cloud mining can be modestly profitable in certain conditions, but returns are usually small relative to risk and volatility. It’s better to treat it as a hobby or diversification, not a core strategy.

5. What’s safer: mining apps or just buying crypto on BingX?

Mining apps add extra layers of risk (platform, contract, fee, and regulatory risk) on top of normal price volatility. Buying BTC, LTC, or DOGE directly on BingX and using solid risk management tools is usually simpler and more transparent for most users.

6. How do I avoid scam mining apps?

Always download mining apps from official stores or verified websites and avoid platforms that make unrealistic promises or lack a clear business model. Before committing funds, confirm that withdrawals are smooth and verifiable, and check independent reviews or warnings from reputable crypto communities.