Russia has officially ascended to Europe’s largest crypto market, processing a staggering $376 billion in annual transaction volume as of early 2026. Following the July 2025 legislative pivot, the market has split into two high-velocity lanes: a strictly regulated domestic infrastructure and an explosive global DeFi sector.

With institutional transfers exceeding $10 million growing by 86%, crypto derivatives are no longer just for speculators but they have become Russia's primary hedge against ruble volatility. Whether you are seeking the global liquidity of offshore platforms like BingX, legal "cleanliness" of the Moscow Exchange’s (MOEX) $636 million futures market or the 200,000 orders-per-second speed of decentralized protocols, choosing the right platform is now a matter of regulatory survival and capital efficiency.

Despite global volatility, Russia’s derivatives volume has hit record highs this year, as traders increasingly use leverage not just for speculation, but as a critical tool for hedging against ruble fluctuations and market corrections.

What Is Crypto Futures Trading and How Does It Work?

Crypto futures trading lets you trade the price of an asset like

Bitcoin without owning it, using contracts that track market price instead of holding the coins themselves. Unlike

spot trading where you buy and hold crypto, futures allow you to use leverage, profit in both rising and falling markets, and manage risk more flexibly.

• Leverage for amplified exposure: Futures let you control a larger position with a smaller amount of capital. For example, using 10× leverage, a $1,000 margin controls a $10,000 position, boosting gains but also increasing liquidation risk if the market moves against you.

• Short selling to profit from declines: Futures allow you to short the market, meaning you can profit when prices fall by selling high and buying back lower, something not possible in spot trading.

• Perpetual futures with no expiry: Most crypto futures are perpetual contracts, which do not expire. Positions can be held as long as margin requirements are met, with funding rates periodically exchanged between long and short traders to keep prices aligned with the spot market.

In short, crypto futures are a high-efficiency trading and hedging tool, but they require disciplined risk management due to leverage and volatility.

An Overview of Russia’s Crypto Derivatives Landscape in 2026

The 2026 regulatory shift has moved crypto derivatives into the center of Russia’s financial infrastructure. Russia is now officially Europe's largest crypto market, processing over $376 billion in transaction volume annually. As the ruble faces ongoing volatility, derivatives have evolved from speculative toys into essential macro-hedging tools for both institutions and individuals.

The Two-Tiered Market Structure

Under the comprehensive legal framework finalized on July 1, 2026, access to the derivatives market is strictly stratified to balance growth with investor protection:

• Qualified Investors: This elite group (individuals with over 100M RUB in assets or 50M+ RUB annual income) enjoys unrestricted access to the full range of derivatives. They are the primary drivers of the $636 million monthly volume record set on MOEX.

• Retail (Non-Qualified) Traders: To protect casual investors, the Central Bank has imposed an annual purchase cap of 300,000 RUB, approx. $3,800, through a single regulated intermediary. Traders must also pass a mandatory "risk-awareness" test before opening their first futures position.

Russia’s rapid adoption of Digital Financial Assets (DFAs),

tokenized instruments backed by

commodities such as

gold and

oil, has expanded into a $13 billion market, with major institutions like Sberbank and T-Bank integrating DFAs directly into their banking ecosystems and piloting crypto-backed lending by early 2026.

At the same time, heightened AML enforcement under Central Bank of Russia’s 115-FZ framework has split market behavior: regulated venues now dominate for liquidity, compliance, and seamless RUB on-ramps, while decentralized protocols have seen a 3.5× increase in activity from users prioritizing privacy, non-custodial asset control, and flexibility beyond domestic transaction limits.

What are the Top 5 Futures Trading Platforms for Crypto Traders in Russia?

When selecting a derivatives platform in 2026, Russian users must balance regulatory compliance, payment reliability (RUB on-ramps), and execution speed. Here are the five most practical options.

1. BingX

BingX has emerged as the definitive

Web3-AI powerhouse for Russian traders in 2026, recently surpassing $2 billion in daily

TradFi volume. By bridging the gap between digital assets and traditional markets, it allows users to manage a globally diversified portfolio using a single USDT-collateralized account.

For the Russian market, BingX provides a frictionless entry point via its high-velocity

P2P desk. In 2026, most RUB-to-USDT trades are settled via T-Bank, formerly Tinkoff, and SBP, Fast Payment System, typically completing in 15–30 minutes. This liquidity flows instantly into two specialized futures tiers:

• Standard Futures (Beginner-Friendly): Optimized for speed and simplicity, perfect for users who want to trade major indices and commodities with a straightforward interface and zero slippage via the Guaranteed Price (GTD) feature.

• Perpetual Futures (Pro-Grade): Built for high-frequency traders, offering deep market depth, sophisticated order types like TWAP and Post-Only, and industry-leading 500x leverage on TradFi pairs.

A standout feature for the local market is

BingX Futures Copy Trading, which has become the largest social trading network in Russia with over 400,000 active traders. This system allows beginners to automatically mirror the positions of

Elite Traders who manage a combined $80 billion in volume, providing a practical way to navigate volatile 2026 market trends without manual chart monitoring.

The TradFi Advantage: In early 2026, BingX’s gold perpetuals alone saw over $1.5 billion in volume, as users leveraged crypto-native infrastructure to

trade gold,

oil (WTI/Brent), and the

S&P 500 without needing traditional brokerage accounts. This is backed by a

$150 million Shield Fund and a landmark partnership with

Scuderia Ferrari HP, cementing its status as a top-tier global exchange.

Best for: Russian traders seeking a high-performance, all-in-one ecosystem that blends P2P security, AI-driven insights powered by BingX AI, and instant access to global TradFi instruments, including forex, commodities, equities, and indices.

2. Moscow Exchange (MOEX)

As Russia's premier regulated trading floor, MOEX hit a milestone in early February 2026, with Bitcoin Index futures volume skyrocketing 434% to ₽2.03 billion, approx. $30 million, in a single week. The exchange has expanded its suite beyond BTC and ETH to include ruble-settled indices and monthly futures for

Solana (SOL),

Ripple (XRP), and

Tron (TRX), specifically targeting institutional demand for "clean" exposure. These instruments are exclusively available to qualified investors, utilizing a cash-settlement model that bypasses the need for digital wallets while providing a state-backed hedge against global market volatility.

Key Consideration: These are strictly cash-settled in rubles; no actual crypto is delivered. This makes them the "safest" legal option for institutional and qualified investors concerned with AML compliance.

Best for: High-net-worth individuals and corporate entities who require a 100% regulated, domestic financial environment.

3. PrimeXBT

PrimeXBT remains the premier destination for Russian "macro" traders, supporting over 100+ global markets within a single USDT-settled account. In a major 2026 upgrade, the platform boosted its leverage to 500x for Bitcoin and 400x for

Ethereum, while maintaining a massive 1000x leverage for Forex and Commodities. Its proprietary PXTrader 2.0 platform is engineered for high-frequency execution with ultra-low spreads from 0.1 pips and 0% commission on all non-crypto CFDs. For those seeking passive growth, the

Copy Trading module features veteran "Strategy Providers" with historical ROIs exceeding 1,400%, allowing beginners to automate their participation in global trends.

Key Consideration: PrimeXBT offers massive leverage of up to 1000x on some assets and a robust Copy Trading module. However, its lack of a native P2P marketplace means users often buy USDT on BingX first before transferring it here.

Best for: Experienced margin traders who want to diversify their crypto profits into traditional markets like Brent Oil or Gold.

4. Hyperliquid

Hyperliquid has cemented its status as the structural leader of the decentralized derivatives market, processing over $225 billion in volume in January 2026 alone. Unlike traditional

DEXs, it operates on a purpose-built

Layer-1 blockchain (HyperCore) capable of 200,000 orders per second with sub-second finality. Its unique HIP-3 and HIP-4 upgrades have transformed the platform into a multi-asset hub, where open interest for

real-world assets (RWAs) and "outcome contracts" (prediction markets) now share the same margin framework as 130+ perpetual crypto markets. For Russian traders, the appeal is purely practical: zero gas fees and a fully on-chain order book that delivers CEX-grade execution while maintaining 100% self-custody and zero-KYC barriers.

Key Consideration: For Russian users concerned about international sanctions or data privacy, Hyperliquid offers self-custody trading. You connect via a

Web3 wallet, and your funds never leave the blockchain.

Best for: Privacy-conscious professionals and DeFi enthusiasts who want high-speed, non-custodial trading with zero gas fees.

5. dYdX

Operating on its own high-speed

Cosmos-based "v4" chain,

dYdX is the gold standard for transparent, decentralized settlement, processing a cumulative $1.55 trillion in lifetime volume as of early 2026. The platform’s centerpiece is its MegaVault liquidity system, which manages a TVL of $12 million to ensure "instant market listings" for over 380+ trading pairs. Unlike AMM-based DEXs, dYdX utilizes a decentralized off-chain order book that supports institutional-grade tools like TWAP and scaled orders with ultra-fast execution. For Russian traders, the practical edge lies in its "MegaVault" automated market-making, which allows users to

earn passive yield on

USDC while providing the deep liquidity necessary for 20x leveraged trades on both crypto and emerging RWA perpetuals.

Key Consideration: dYdX is highly resilient against censorship. While its interface is slightly more complex than BingX, its MegaVault liquidity system allows for highly efficient trades on over 180 markets.

Best for: Advanced traders who prioritize decentralization and want to participate in protocol governance while trading with up to 20x leverage.

Why BingX Is the Best Choice for Russian Futures Traders

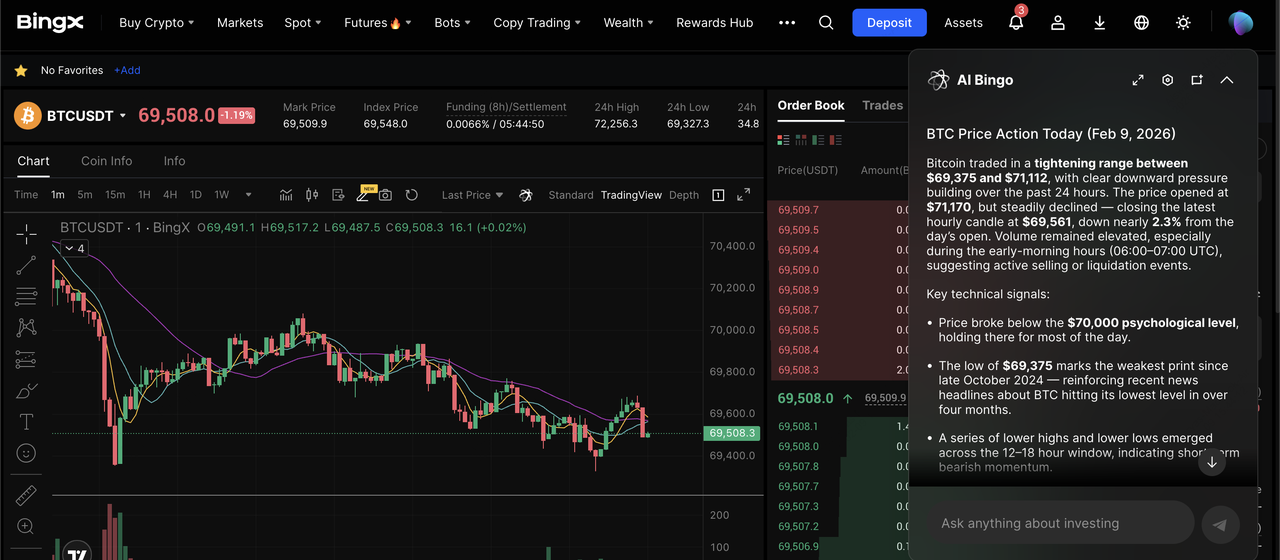

BingX has established itself as Russia’s premier "Web3-AI powerhouse" in 2026, recently achieving a massive milestone with $2 billion in daily TradFi trading volume. For Russian traders navigating the July 1st regulatory landscape, BingX offers a unique "super-app" experience that bridges local RUB liquidity with global markets. The platform’s P2P marketplace, optimized for T-Bank, Sberbank, and SBP, enables users to bypass the friction of traditional banking, moving from ruble to USDT-settled futures in under 15 minutes.

The practical edge of BingX lies in its performance-driven infrastructure: it currently leads the market in USDT-settled Gold and Oil perpetuals, allowing users to pivot from Bitcoin to traditional assets with up to 500x leverage using the same collateral account. This is reinforced by a $150 million Shield Fund and a $300 million BingX AI integration, featuring AI Bingo and AI Master, that provides real-time technical analysis and

risk management. With a world-class Copy Trading ecosystem where 400,000 elite traders manage over $80 billion in volume, BingX empowers both beginners and pros in Russia to automate complex strategies with institutional-grade security and

100% Proof of Reserves.

How to Start Futures Trading on BingX: Step-by-Step Guide

Trading futures is the most efficient way for RUB users to leverage their capital. Once you have acquired USDT via P2P, you can move it to your Futures account instantly.

5 Steps to Your First Futures Trade

1. Fund Your Account: Transfer

USDT from your "Fund Account" to your "Futures Account."

2. Select Your Contract: Choose between Standard Futures (easier for beginners) or Perpetual Futures.

3. Choose Margin Mode: Select Isolated Margin where risk is limited to one trade or Cross Margin, which uses your entire balance to prevent

liquidation.

4. Set Leverage: Adjust your leverage, e.g., 10x or 20x.

Pro Tip: High leverage increases risk significantly.

Top 3 Safety Tips for Futures Trading in Russia (2026)

In a market defined by the July 1, 2026, regulatory deadline and peak 115-FZ monitoring, maintaining operational security is the difference between a profitable portfolio and a frozen bank account.

1. Master the "Dual-Price" Logic: Platforms like BingX use a Mark Price to prevent manipulation and a Last Price, which is market price. Always calculate your liquidation based on the Mark Price.

2. Beware of "Black Triangle" P2P Risks: When on-ramping RUB to fund your futures account, only use verified merchants to ensure your funds aren't flagged by banks.

3. Use Guaranteed Price (GTD): In the 2026 market, "flash crashes" are common. Use GTD tools to ensure your

Stop Loss executes at the exact price you set, avoiding devastating slippage.

Final Thoughts: Finding Your Edge

By 2026, success in Russia’s crypto futures market depends less on access and more on strategic alignment with regulation and infrastructure. As the distinction between qualified and retail investors becomes fully codified from July 1, 2026, platform selection directly impacts capital efficiency, execution flexibility, and long-term legal exposure. For the modern macro trader, BingX stands out as a balanced all-in-one solution, bridging local RUB rails (including T-Bank and SBP) with global crypto and TradFi perpetuals from a single interface. However, crypto futures remain high-risk leveraged instruments.

For most active traders, hybrid platforms that combine global liquidity with local RUB access are becoming the practical middle ground. Traders should be mindful that leverage can amplify losses as quickly as gains, and in the Russian regulatory environment of 2026, failure to comply with tax reporting requirements, AML rules, or annual purchase limits under the 115-FZ framework can lead to account restrictions or freezes. Only trade with capital you can afford to lose, and ensure your strategy fits both your risk tolerance and regulatory status.

Related Reading