At the same time, macro conditions are keeping index volatility tradable: rate-cut expectations, rotation between AI and non-AI sectors, and regional performance gaps are creating frequent opportunities in benchmark indices.

This beginner-friendly guide explains what stock index trading with crypto is, how index perpetual futures work, and how to trade indices with crypto on BingX TradFi.

What Are Stock Indices, and Why Are They Popular to Trade?

A stock index tracks the weighted performance of a defined group of equities, allowing traders to express a single, high-signal macro view on an entire market, such as growth vs. value, AI-led momentum vs. catch-up sectors, or regional leadership, without selecting individual stocks.

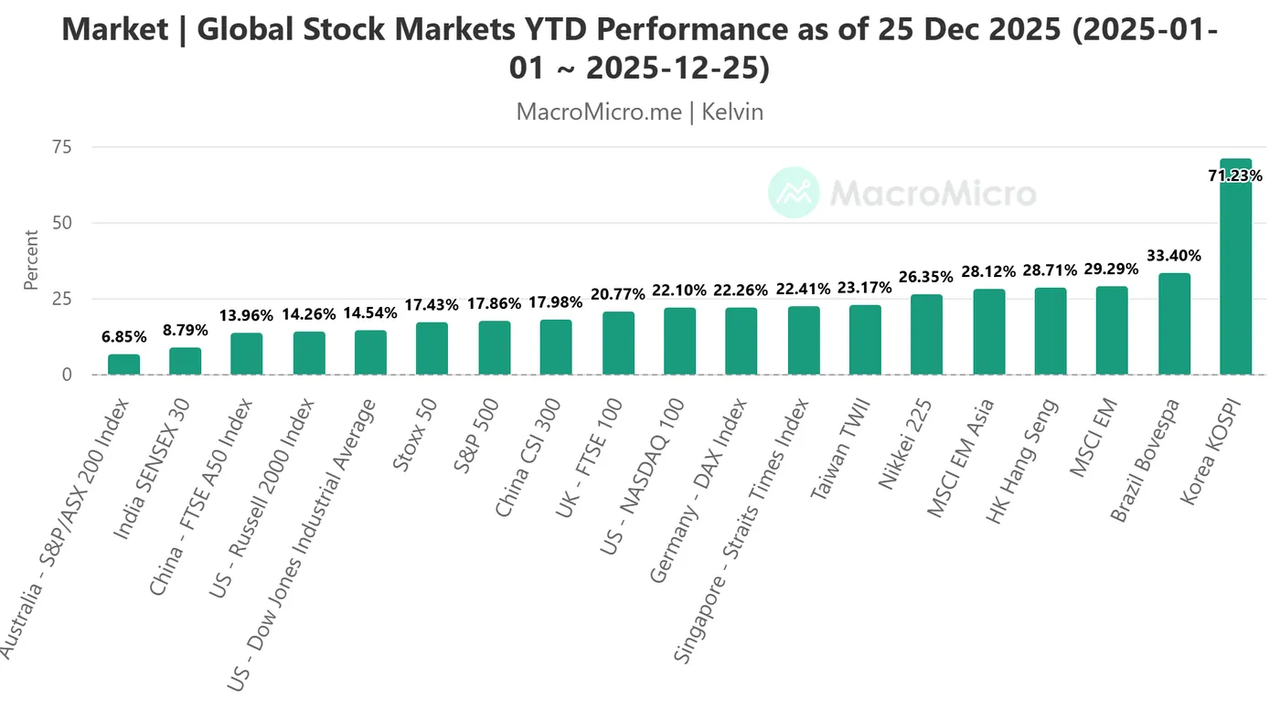

In 2026, this matters because equity performance is highly polarized. According to J.P. Morgan Global Research, global equities are still expected to post double-digit gains, but returns are increasingly split between AI-exposed sectors and non-AI laggards, and between regions like the U.S., Japan, and emerging Asia. At the same time, OANDA Market Pulse highlights rotation away from crowded U.S. mega-cap tech toward value, cyclicals, Japan, and selected Asia markets, making index-level positioning more efficient than single-stock bets.

Widely traded benchmarks include:

•

S&P 500 (SP500): Broad U.S. equity exposure, sensitive to Fed policy, earnings growth, and liquidity conditions.

•

NASDAQ 100 (NASDAQ100): Growth- and AI-heavy index, closely tied to capex cycles, rate expectations, and technology earnings momentum.

Top 5 Reasons Stock Indices are Gaining Traction in 2026

Market performance of global benchmark stock indices | Source: MarketPulse by OANDA

Stock indices have become one of the most efficient instruments for trading macro narratives in 2026, especially as

TradFi markets migrate onto crypto-native infrastructure.

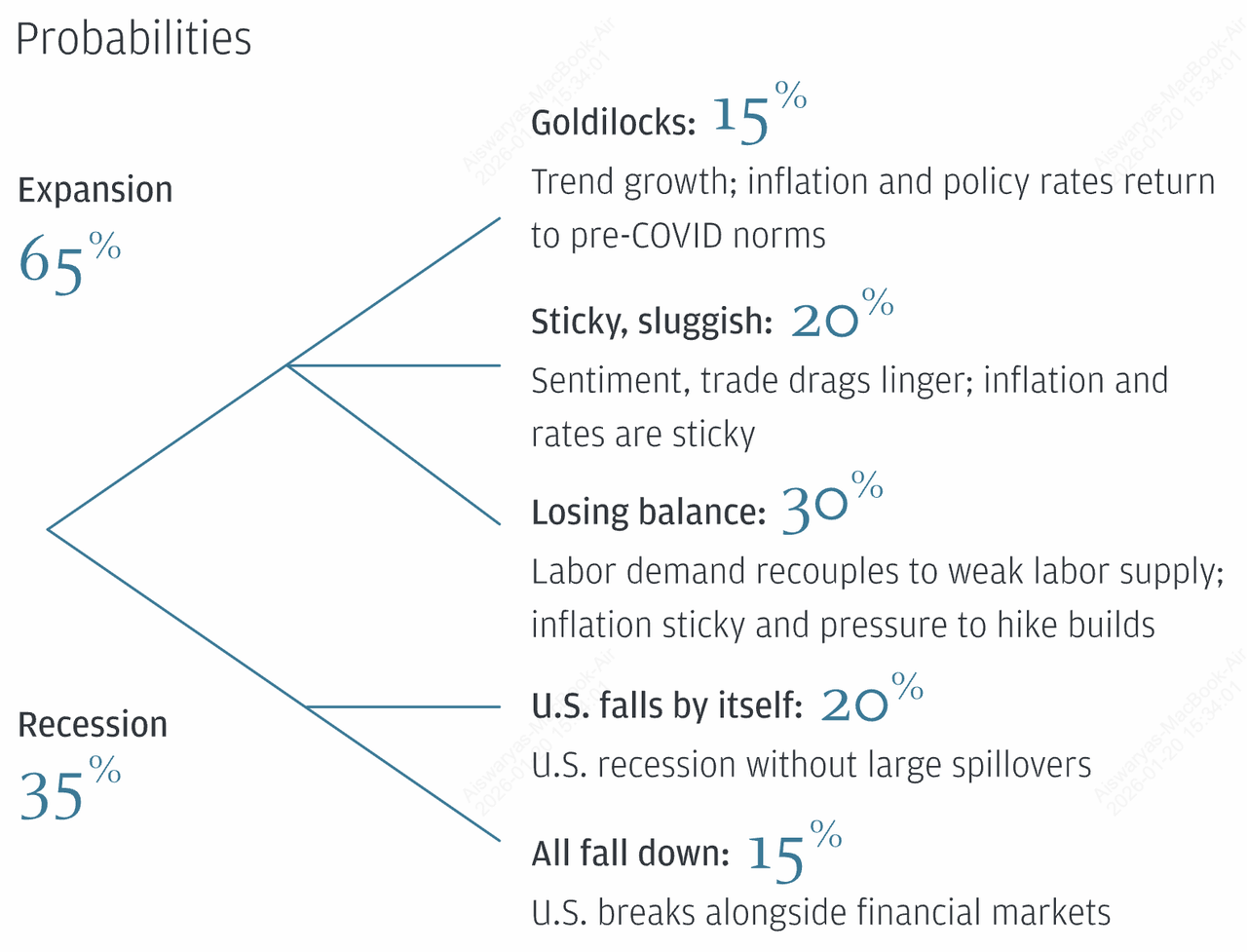

1. Macro views in one trade. With J.P. Morgan assigning a 35% probability of a global recession yet remaining constructive on equities overall, indices let you position for resilience or downside risk without idiosyncratic stock risk.

2. Fast reaction to data and policy. Indices move immediately on CPI, jobs data, Fed guidance, and yield-curve shifts, key drivers in a year where rate paths and inflation stickiness still dominate price action.

3. Designed for rotation markets. OANDA notes potential leadership shifts in 2026, such as value and Dow-linked sectors catching up to AI-heavy Nasdaq, making long/short index strategies more relevant than ever.

4. Regional and thematic clarity. Japan’s Nikkei strength, U.S. value recovery, and selective EM outperformance are cleanly expressed through indices, not fragmented stock baskets.

5. Crypto-native execution. Trading indices via USDT-margined perpetual futures allows you to apply familiar crypto risk tools like leverage, stops, real-time PnL to traditional equity markets without brokers or fiat rails.

How Stock Index Trading Works With Crypto

Traditionally, trading stock indices requires a brokerage account, fiat funding, contract-specific margin rules, and expiry management. Index futures on venues like CME also force traders to roll positions every quarter, creating execution friction and added cost, especially during volatile macro periods.

On crypto-native platforms such as BingX TradFi, index exposure is delivered through USDT-margined perpetual futures, which are designed to mirror real-world index prices while using crypto-style execution. In practice, this means:

• You trade index price movements only. There is no ownership of shares or ETFs; PnL (profit and loss) is purely based on whether the index rises or falls.

• No contract expiries or rollovers. Positions do not expire, removing quarterly rollover risk and allowing you to hold macro views as long as margin requirements are met.

• USDT-based margin and settlement. All collateral, profits, and losses are settled in

USDT, eliminating bank transfers, FX conversion, and multi-currency balances.

• Two-way exposure with leverage. You can go long or short major indices such as the S&P 500 or Nasdaq 100, with adjustable leverage to match risk tolerance.

• Crypto-native risk controls. Real-time PnL, liquidation price visibility, stop-loss and take-profit orders, and funding rates operate the same way as crypto perpetuals.

With

BingX TradFi, this structure allows traders to react quickly to 2026 macro catalysts like rate cuts, earnings rotations, and regional equity leadership, using a single,

USDT-funded futures account, rather than navigating multiple traditional brokerage workflows.

Which Stock Indices Can You Trade on BingX TradFi?

As of early 2026, BingX TradFi offers USDT-margined perpetual futures on several of the world’s most actively traded equity indices, allowing traders to express macro and regional equity views directly from a crypto futures account.

Available index perpetuals on BingX TradFi include:

1. NASDAQ100 – A tech- and AI-heavy index dominated by U.S. large-cap growth companies. It is highly sensitive to interest-rate expectations, earnings momentum, and corporate capex cycles, making it a key barometer for growth and innovation themes.

2. SP500 – A broad benchmark covering large-cap U.S. equities across all major sectors. Traders use it to express views on Fed policy, recession risk, earnings breadth, and overall U.S. equity market sentiment.

3. DowJones – An index with greater exposure to value-oriented sectors such as industrials, financials, and consumer staples. It is often used to trade factor rotation, yield-curve dynamics, and “old economy” catch-up narratives versus tech-heavy benchmarks.

4. Nikkei 225 – Japan’s flagship equity index, reflecting corporate earnings trends, domestic reforms, and export competitiveness. It is closely linked to Bank of Japan policy shifts, yen movements, and global capital flows into Asia.

5. Russell 2000 – A benchmark for U.S. small-cap stocks, making it more sensitive to domestic growth conditions, credit availability, and risk appetite. Traders often use it to gauge risk-on versus risk-off shifts and early-cycle economic momentum.

Together, these contracts cover U.S. large caps, U.S. small caps, and Japanese equities, giving traders practical tools to position for AI-driven leadership, value catch-up, and regional outperformance in 2026.

BingX TradFi also integrates indices alongside commodities, forex, and stocks within the same futures interface, enabling cross-asset macro strategies, such as pairing equity index exposure with

gold,

oil, or FX positions, using a single USDT-funded account.

Note: Index availability and leverage limits may vary by region due to regulatory requirements. Always confirm supported markets directly in your BingX app or web interface.

How to Trade Stock Indices With Crypto on BingX: Step-by-Step Guide

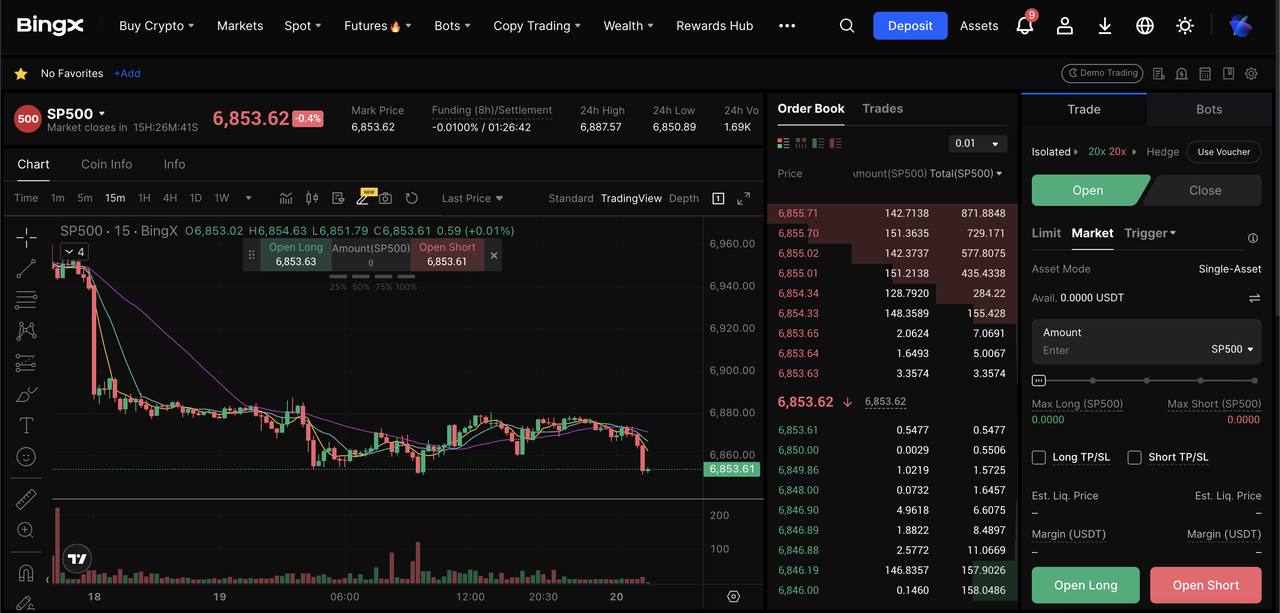

S&P 500 perpetual contract on the futures market

BingX index perps are designed to be simple if you already trade crypto futures. Here's how to get started:

Step 1: Set Up Your BingX Account

Step 2: Choose an Index Market

Step 3: Set Leverage

BingX offers up to 500× leverage on selected index contracts (limits depend on tiers/position size). Lower leverage is safer, especially around market open/close.

Step 4: Select an Order Type

• Limit order: executes at your chosen price

Note: Some advanced features like BingX AI and copy trading may not be available for index perps. Refer to

BingX Help Center for more information on feature availability.

Step 5: Open and Manage Your Position

• Long if you expect the index to rise

• Short if you expect it to fall

Why Trade Stock Indices With Crypto on BingX TradFi?

BingX index perpetuals are built for crypto-native traders. If you already trade crypto futures, the workflow feels immediately familiar, USDT-based margin, real-time PnL, adjustable leverage, and built-in risk tools, while giving you direct exposure to major global equity indices instead of tokens.

What sets BingX TradFi apart is its unified access to indices, commodities, forex, and stocks within the same USDT-margined futures account. This lets you trade macro themes, such as equity rotations, rate-cut cycles, or

risk-off moves into gold, without brokers, fiat funding, or switching platforms, making BingX one of the most efficient venues to trade TradFi markets with crypto in 2026.

Here’s what you’re optimizing for when you trade indices via USDT-margined perps:

1. USDT settlement. One margin currency across markets.

2. High leverage flexibility. Up to 500× on selected index contracts, but remember to use leverage cautiously.

3. Long/short in one place. Trade both bull and bear regimes.

4. Macro portfolio tools. Pair index exposure with gold/oil/FX views in the same TradFi suite.

5. Designed for crypto-native traders. Perp mechanics, real-time PnL, and familiar risk controls.

Top 3 Things to Know Before Trading Index Perpetual Futures

Index perps do not behave like 24/7 crypto markets. These details matter.

1. Trading Hours and Market Closures

Index perps have specific open/close hours tied to underlying markets. During closures, you can cancel orders, but you typically cannot open/close positions or modify pending orders, and liquidation can still happen if funding/price effects push margin too low.

If you are holding a U.S. index perp like S&P 500 or Nasdaq 100 late on Friday, the market closes at 21:59 UTC and remains closed through Sunday. During this period, you cannot open or close positions, but funding fees can still apply and margin can tighten.

If major macro news breaks over the weekend, such as unexpected policy announcements or geopolitical events, the index may reopen on Monday at 23:00 UTC with a price gap, potentially pushing your position closer to liquidation before you have a chance to react.

This is why traders often lower leverage, add margin buffers, or reduce exposure ahead of Friday’s close, especially when holding positions over the weekend.

2. Funding Rates Are a Real Cost

Index perpetuals use funding payments to keep futures prices aligned with their underlying stock indices. These payments are exchanged between long and short traders at set intervals. For example, if funding is positive, long positions pay shorts; if it is negative, shorts pay longs.

While a single payment may seem small, holding a position in an index like the S&P 500 or Nasdaq 100 across multiple funding intervals, especially during strong trending or crowded trades, can meaningfully erode returns. This is particularly relevant for multi-day macro positions, where funding costs can rival or exceed short-term price gains.

3. Leverage Amplifies Everything

Leverage allows you to control a larger index position with less capital, but it also shrinks the margin for error. A 1% move in an index can translate into a 10% PnL swing at 10× leverage, and far more at higher levels. This becomes especially risky around market reopenings or major data releases, such as CPI or central-bank decisions, when indices can gap sharply.

For example, a weekend gap in U.S. indices or a surprise inflation print can bypass stop levels and accelerate losses. Using conservative leverage, smaller position sizes, and margin buffers is essential if you plan to hold index perps through volatile sessions.

Three Core Drivers Shaping Global Equity Market Direction

Global outlook for equity markets in 2026 | Source: JP Morgan Global Research

If you want a simple, repeatable process, focus on these top 3 drivers that impact global equity markets:

1. Rate-cut path and risk sentiment. A more dovish Fed narrative tends to support equities, but leadership can rotate quickly.

2. Rotation signals, e.g. AI vs. non-AI. MarketPulse notes the potential for leadership shifts, such as catch-up in Dow/value vs. AI-heavy growth.

3. Regional momentum. Japan’s Nikkei has remained a major focus in cross-market equity narratives entering 2026.

Should You Trade Stock Indices With Crypto in 2026?

In 2026, trading stock indices with crypto is a practical way to get macro equity exposure without brokers, fiat rails, or stock custody. On BingX TradFi, you can trade index price movements using USDT-margined perpetual futures like SP500 and NASDAQ100, with expanded access including DowJones and Nikkei 225.

That said, index perps are still leveraged derivatives. Trading hours, funding, reopen gaps, and liquidation dynamics can hurt you fast if you oversize. Use conservative leverage, define risk with stops, and keep margin buffers, especially around market open/close.

Risk reminder: Index perpetual futures involve significant risk and may not be suitable for all traders. This article is for educational purposes only and does not constitute financial or investment advice.

Related Reading