Apple has been a defining force in consumer technology for more than forty years, and in 2025 it remains near the top of global market-cap rankings. With a valuation of roughly 3.9 trillion US dollars,

Apple (AAPL) sits alongside

Microsoft (MSFT),

Alphabet (GOOGL), and

Nvidia (NVDA) as one of the three most valuable companies in the world. Its position reflects steady demand across its hardware lineup, a growing subscription-driven services business and the strength of its unified ecosystem.

Apple’s long-term advantage comes from the tight integration of hardware, software and custom silicon, along with the rollout of Apple Intelligence, its new suite of AI-enhanced features. These developments reinforce Apple’s strategy of deepening user engagement and expanding recurring revenue. As a result, investor interest in AAPL remains strong in 2025 through both traditional brokerage platforms and newer crypto-native formats such as tokenized Apple stocks including

AAPLx and

AAPLon.

What Is Apple (AAPL) and What Does Apple Do?

Apple is a global consumer technology company and one of the most recognized hardware-software ecosystems in the world. Its work spans smartphones, computers, tablets, wearables, operating systems, digital services and custom silicon. Apple’s mission to design products that integrate seamlessly has evolved into building an ecosystem that shapes how billions of users communicate, work, learn and access digital content every day.

1. Apple’s consumer hardware product line remains its largest business segment.

This includes the iPhone, the world’s most widely adopted premium smartphone; the Mac lineup of laptops and desktops powered by Apple’s M-series chips; the iPad family of tablets; and wearables such as Apple Watch and AirPods. Together, these products anchor Apple’s global device ecosystem and drive upgrade cycles across regions and demographics.

2. Apple’s software and infrastructure product line supports the experience across all Apple devices.

This segment includes the company’s operating systems such as iOS, macOS, iPadOS, watchOS, tvOS and visionOS, which provide system-level security, app distribution, device continuity and developer tools. It also includes Apple’s custom silicon programs, where the A-series and M-series chips power performance, graphics, battery efficiency and on-device intelligence across the hardware portfolio.

3. Apple’s services and subscription product line is becoming increasingly central to its long-term strategy.

• App Store, the global distribution platform for developers

• iCloud, Apple’s cloud storage and sync service

• Apple Music and Apple TV+, subscription entertainment offerings

• Apple Pay and Wallet, used for payments, transit and identity

• Apple Arcade, Fitness+ and AppleCare, extending service coverage and digital engagement

Although Apple does not report AI as a standalone revenue category, many new features across its platforms are powered by “Apple Intelligence,” the company’s systemwide layer of machine intelligence integrated into writing tools, search, assistant functions and on-device understanding.

Apple Stock Analysis and Investor Outlook in 2025

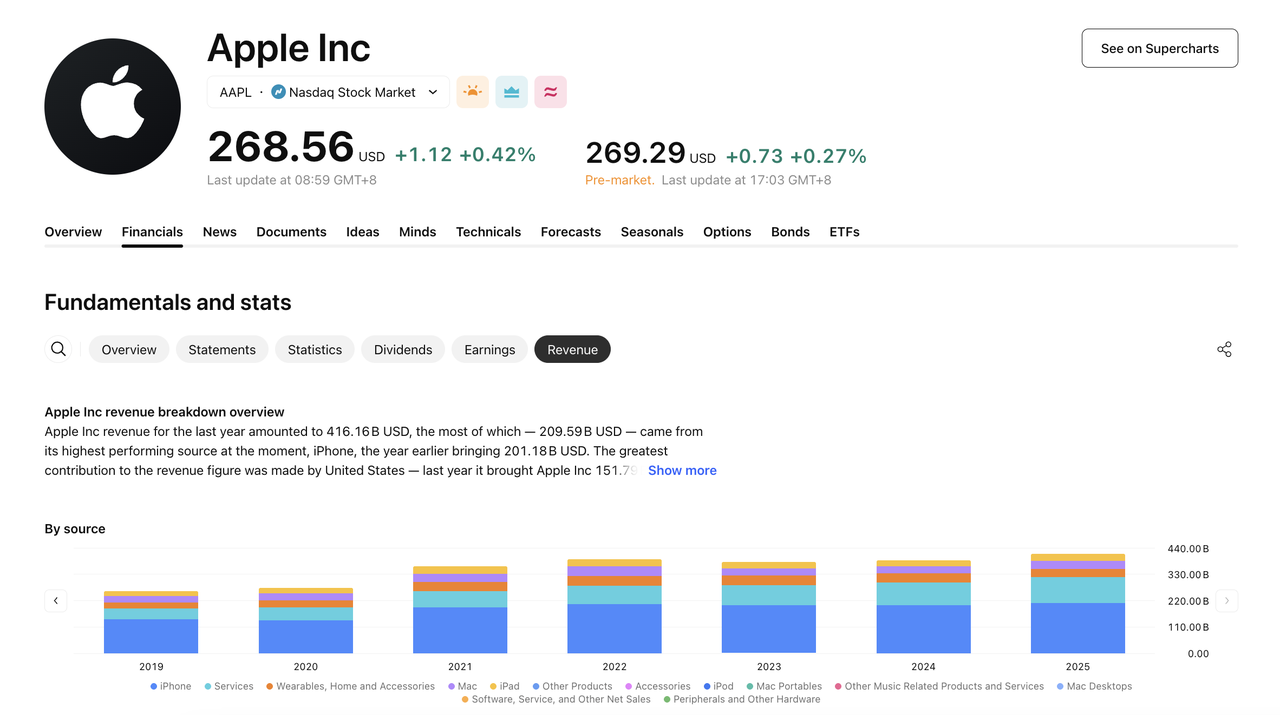

According to Apple’s fiscal Q4 and full-year 2025 Annual report filed with the U.S. Securities and Exchange Commission, Apple generated approximately 102.5 billion US dollars in revenue for the quarter ended September 27 2025, representing about 8% year-over-year growth. The same filing shows that Apple’s total revenue for fiscal year 2025 reached about 416 billion US dollars.

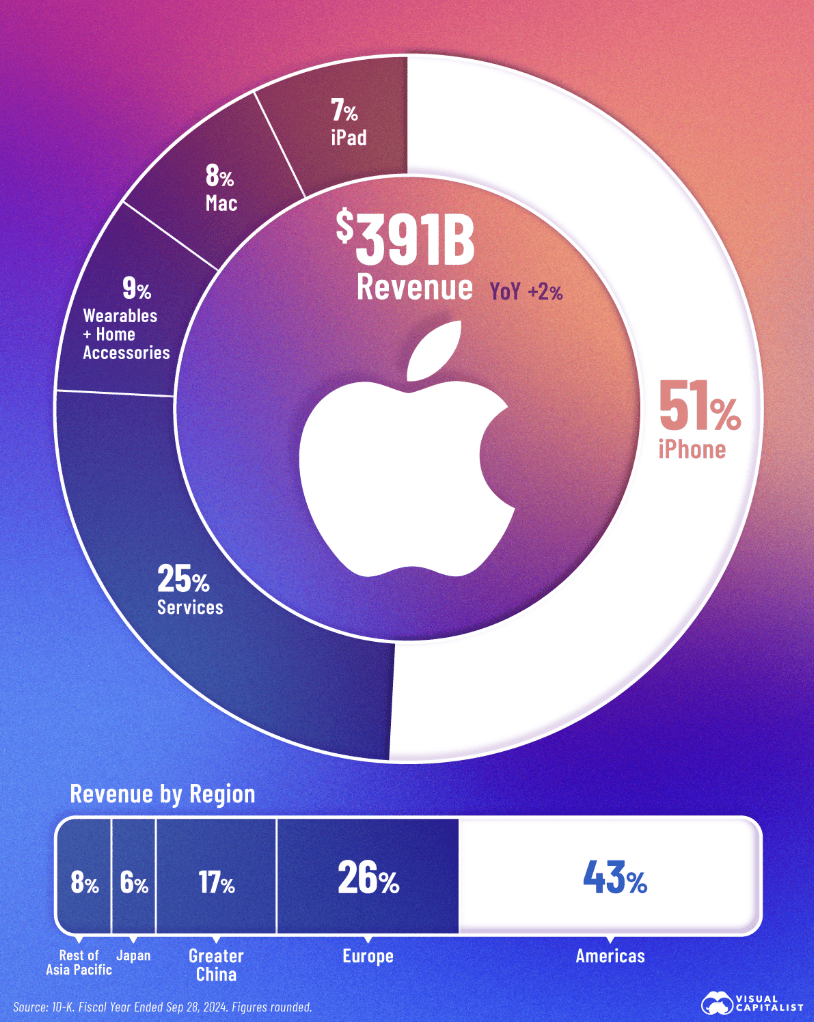

1. iPhone and other hardware remain Apple’s largest revenue contributors.

The iPhone business delivered about 49 billion US dollars in Q4 2025, growing roughly 6% year-over-year. Mac, iPad and wearables and home accessories also contributed to hardware revenue, with varying performance depending on product cycles and regional demand.

2. Services achieved record performance and expanded its share of overall revenue.

Apple reported approximately 28.8 billion US dollars in Services revenue for Q4 2025, an increase of around 15% year-over-year. This segment includes digital content, cloud storage, subscription services and payment solutions tied to Apple’s global installed base.

3. Asia-Pacific, Americas and Europe remain key geographic revenue zones.

Apple’s earnings reflect steady growth in the Americas and Europe, supported by strong device ecosystems and high service adoption. Growth in Greater China and broader Asia-Pacific markets fluctuated based on local economic conditions, competitive dynamics and upgrade cycles.

4. Operating cash flow remained strong and supported capital returns.

Apple generated about 29.7 billion US dollars in operating cash flow during the quarter, enabling continued share repurchases, dividend payments and investment across hardware, software and services.

5. Long-term growth drivers include ecosystem monetisation, custom silicon and integrated services.

Apple’s expansion of its services ecosystem, combined with the adoption of A-series and M-series chips across devices, continues to strengthen its product integration. In 2025, the introduction of “Apple Intelligence” further deepened the connection between hardware, software and AI-powered system features.

How to Invest in Apple Stocks: A Step-by-Step Guide in 3 Different Ways

Investors can gain exposure to Apple through traditional equity markets or through newer crypto-native products on BingX. Below are three clear paths depending on your preference for access, flexibility or trading tools.

1. Buy Apple Shares (AAPL) on a Brokerage Platform

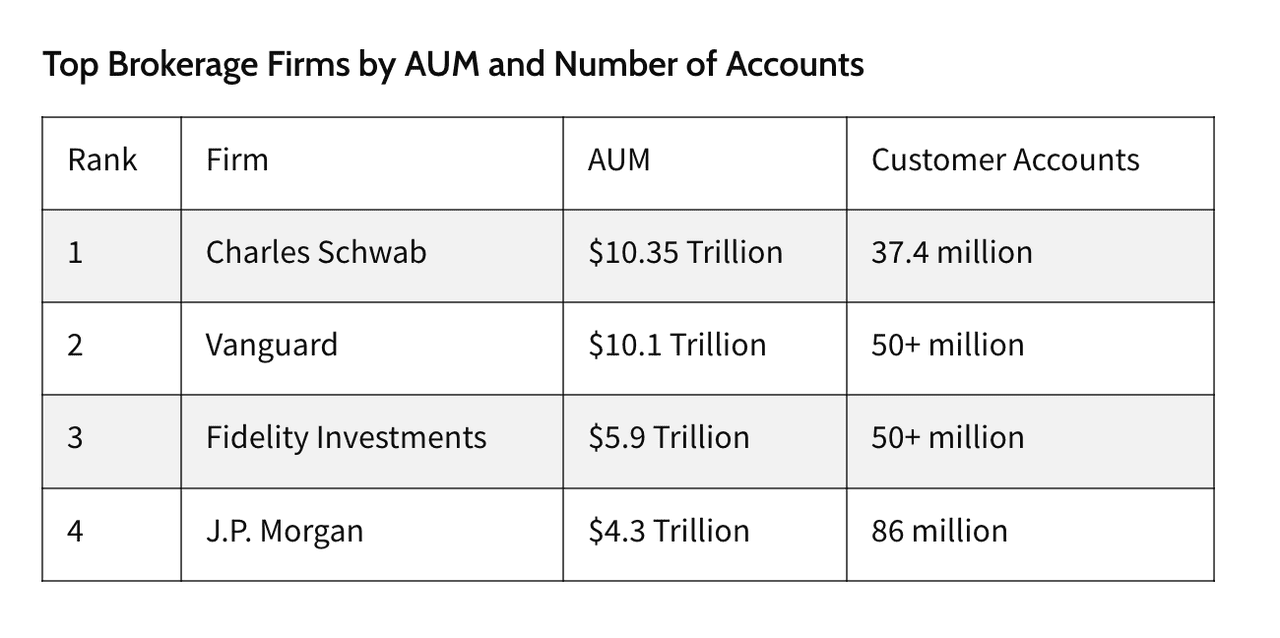

If you want direct exposure through regulated equity markets and full shareholder rights, you can buy Apple stock (AAPL) on any brokerage that supports Nasdaq-listed securities.

Step 1: Choose a brokerage: Select a regulated platform that provides Nasdaq access, clear fee structures, USD funding options and reliable trading tools.

Step 2: Verify your account: Complete registration by providing identification, passing KYC checks and submitting any required tax forms for non-U.S. investors.

Step 3: Fund your account: Deposit USD through supported payment methods or convert your local currency within the platform before placing your order.

Step 4: Buy AAPL stock: Search for the ticker AAPL, review market data, choose a market or limit order, enter your preferred amount and confirm the trade.

2. Buy Tokenized Apple Stock (AAPLx / AAPLon) on BingX

If you prefer fractional access, global availability or a crypto-native experience, you can buy tokenized Apple stock directly on

BingX Spot.

Step 1: Create and secure your BingX account: Register,

complete KYC and enable security features such as two-factor authentication.

Step 2: Deposit USDT or supported assets: Transfer

stablecoins to your BingX wallet, confirm the correct network and review any deposit fees or minimums.

Step 3: Search for the Apple token: Open the Spot market and look for Apple-linked symbols such as

AAPLon or

AAPLx, depending on the issuer supported on BingX.

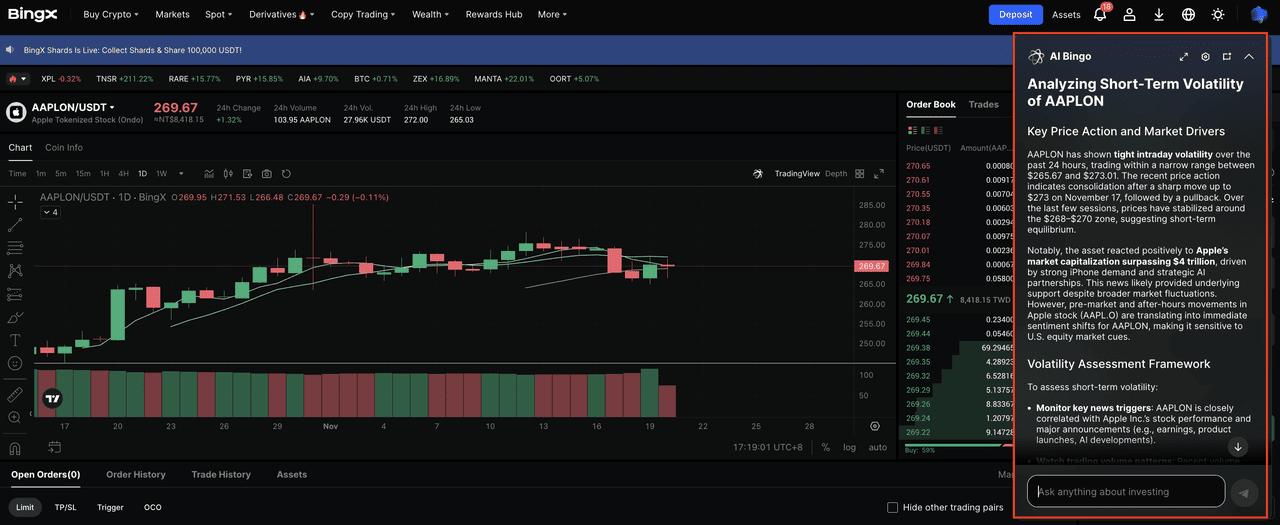

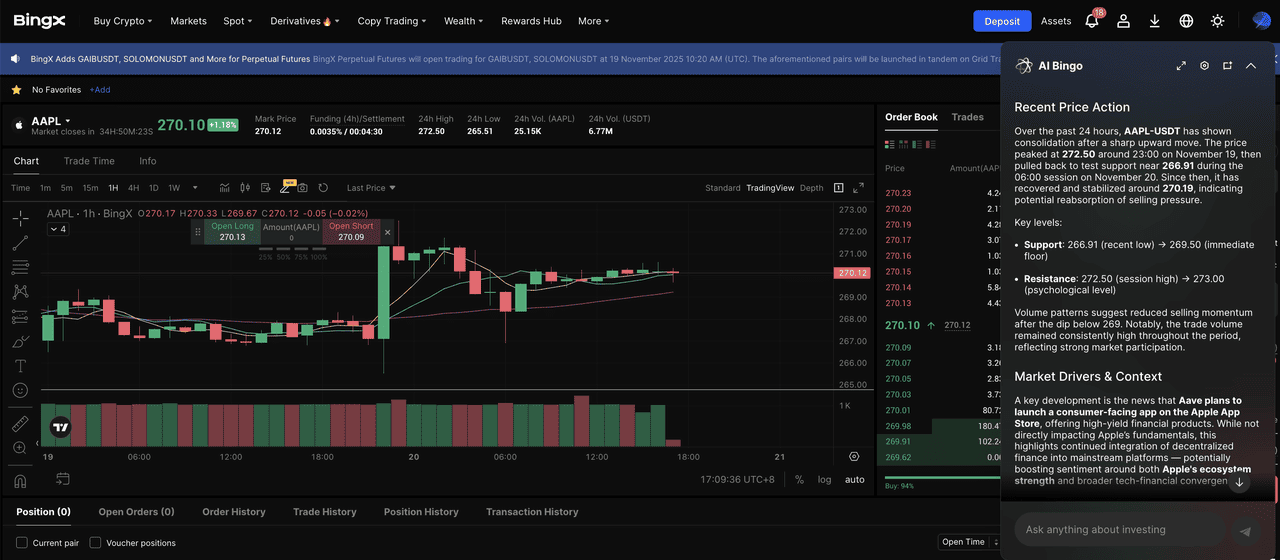

Step 4: Use BingX AI for market insights: Select the AI icon to ask questions about price trends, key support levels or recent movements before placing an order.

Step 5: Place your buy order: Choose a

market or limit order, enter your amount, review liquidity and confirm your purchase.

3. Trade Apple Tokenized Stock Futures on BingX

If you want leverage, directional exposure or hedging strategies, Apple tokenized stock futures on

BingX Futures offer a flexible way to trade Apple’s price movements without holding the underlying stock.

Step 1: Enable futures trading: Open your BingX account, complete KYC and transfer USDT or supported collateral to your Futures wallet.

Step 3: Use BingX AI to explore trend insights: Select the AI feature to ask about volatility, support and resistance levels or overall market sentiment before entering a trade.

Step 4: Choose long or short: Go long if you expect Apple’s price to rise or short if you expect it to fall, adjusting leverage according to your risk tolerance.

Step 5: Execute and manage your trade: Place your order,

set take-profit and stop-loss levels and monitor funding rates, margin levels and market volatility inside BingX Futures.

What Is Apple Tokenized Stock and How Does It Work?

Apple

tokenized stock is a blockchain-based representation of Apple Inc. (AAPL) shares issued by different providers. These tokens allow users to gain economic exposure to Apple’s stock price without buying shares through a traditional brokerage. Depending on the issuer, tokenized Apple stocks appear under tickers such as AAPLon, AAPLx, or AAPL2-USD, and they can be traded on platforms like BingX for easier global access, fractional ownership and extended trading hours.

How Apple Tokenized Stock Works

1. Price tracking: Apple tokenized stocks follow the live price of AAPL on Nasdaq, updating during supported trading hours to reflect Apple’s real market performance.

2. Backing method (varies by supplier): Different issuers use different mechanisms to keep their token aligned with the real AAPL price, which is why tickers vary across platforms.

• xStocks: Uses custodial backing by holding underlying Apple shares or equivalent financial instruments.

•

Ondo: Provides economic exposure to Apple stock through custodial or synthetic structures depending on platform and jurisdiction.

• Zipmex: Tracks Apple’s price using derivatives such as AAPL2-USD, a synthetic futures-style product rather than a token backed by real shares.

3. Trading structure: Apple tokenized stocks trade like digital assets. They can be purchased with stablecoins such as USDT, transferred between compatible wallets and traded on platforms like BingX outside standard U.S. market hours. Liquidity is provided by the exchange rather than Nasdaq.

4. No shareholder rights: Token holders gain economic exposure only. They do not receive Apple voting rights or legal ownership and dividends may be reflected synthetically depending on issuer design.

Why Investors Use Apple Tokenized Stock

• Allows fractional access with smaller minimum purchases

• Provides global availability for users without access to U.S. Brokerages

• Fits naturally inside crypto portfolios on platforms like BingX

• Supports weekday 24-hour trading compared to fixed U.S. market hours

• Can be paired with Apple tokenized stock futures for leveraged or hedged exposure

Risk and Considerations Before Investing in Apple Tokenized Stock

Apple tokenized stocks provide flexible access to AAPL price movements, but they also come with structural differences and risks that investors should evaluate carefully.

1. No shareholder rights: Tokenized Apple stocks provide price exposure only. Investors do not receive voting rights and may not receive dividends in the same way as traditional shareholders. Corporate actions such as splits or buybacks may also be handled differently depending on the issuer.

2. Backing and price alignment differences: Some Apple tokens are fully backed by custodial shares, while others use synthetic exposure. These differences can affect how closely the token tracks Apple’s real stock price and how events like earnings or dividends are reflected.

3. Liquidity and trading conditions: Tokenized stocks rely on exchange-provided liquidity rather than Nasdaq’s order books. This can lead to wider spreads, thinner depth, or short periods where token prices deviate from AAPL’s official market value.

4. Regulatory and jurisdictional uncertainty: Tokenized equities operate in developing regulatory environments. Regional policy changes may impact availability, redemption rights, or the treatment of tokenized assets relative to traditional securities.

5. Exposure to Apple’s business fundamentals: Even in tokenized form, investors remain exposed to Apple’s actual operating performance, including iPhone upgrade cycles, competitive pressures, geopolitical risks, supply chain dependence and fluctuations in key regions such as Greater China.

Final Thoughts

Apple remains one of the most significant companies in the global technology landscape, supported by a large device ecosystem, expanding services revenue and strong cash flow generation. Its long-term position is shaped by the integration of hardware, software and custom silicon, as well as the growing role of intelligence-based features across its platforms.

Whether accessed through traditional shares or through tokenized formats, the core investment thesis centers on Apple’s scale, product consistency and recurring-revenue model. Tokenized exposure offers additional flexibility such as fractional access and extended trading availability, while traditional shares provide full ownership rights and established investor protections. Each format serves different needs depending on access preferences, regulatory environments and investment objectives.

For investors evaluating Apple in 2025, the decision ultimately depends on risk tolerance, desired exposure type and comfort with emerging digital asset structures. Apple’s stability and ecosystem reach continue to attract long-term interest, and understanding the differences between investment formats can help determine the approach that best aligns with individual goals.

Related Reading