As of January 2026, the global

stablecoin market capitalization has exceeded $310 billion, with

Tether (USDT) accounting for approximately $185 billion, maintaining its position as the world's third-largest cryptocurrency, only behind

Bitcoin and

Ethereum. USDT's daily trading volume ranges between $140 billion to $150 billion, consistently exceeding Bitcoin's spot trading volume, demonstrating its role as the primary liquidity vehicle in the cryptocurrency market.

In the cryptocurrency market, USDT's core value lies not only in price stability, but in serving as a critical bridge connecting the traditional fiat system with the crypto world. Entering 2026, with the passage of the US

stablecoin bill "GENIUS Act", stablecoins are increasingly viewed as part of the digital financial system, and USDT's role has evolved from a simple trading denomination unit to an intermediary asset responsible for capital flows and market liquidity. For Taiwanese users, mastering USDT's purchasing and conversion process is essentially completing the first step of "New Taiwan Dollar entry into the crypto system," and the efficiency of deposits, actual costs, and usage flexibility will directly impact all subsequent trading and asset allocation operations.

In this market environment, for Taiwanese users, the key operational focus is: how to convert New Taiwan Dollars to USDT with reasonable costs, stable liquidity, and high efficiency. This article will organize the main methods and processes for purchasing USDT in Taiwan in 2026, and use BingX as an example to explain the complete operation from registration, deposit to actual USDT purchase, helping users successfully complete their first or advanced allocation.

What Is USDT (Tether) and How Does the USD Stablecoin Work?

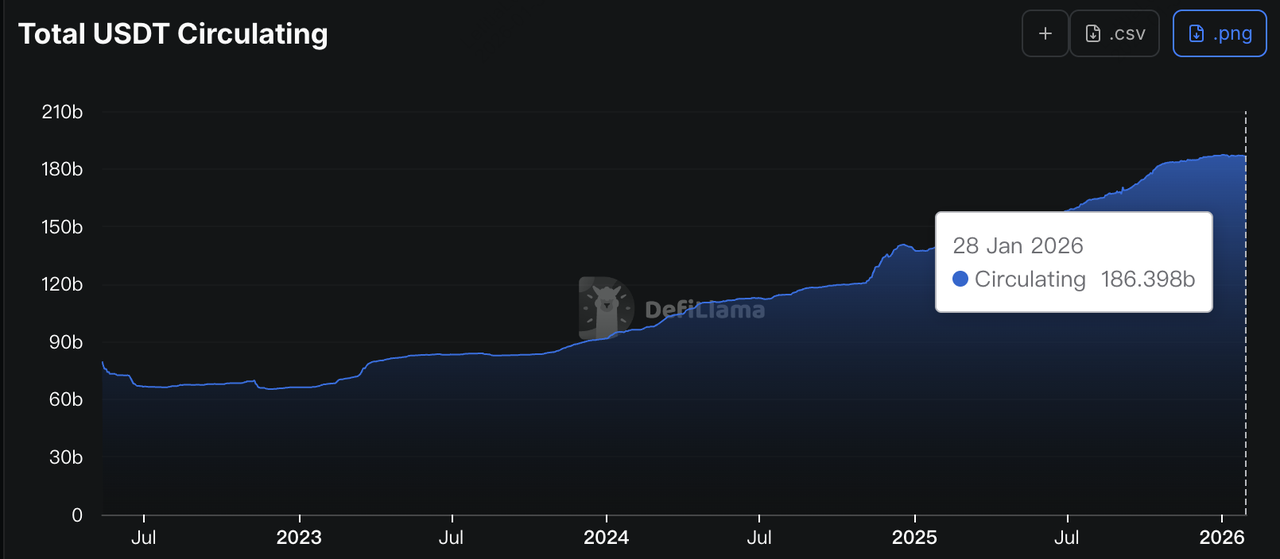

USDT market cap exceeded $186 billion in 2026 | Data source: DefiLlama

USDT (Tether) is a USD stablecoin pegged 1:1 to the US Dollar, launched by Tether in 2014. Its core design purpose is to provide a relatively stable price and instantly circulating "digital dollar" form in the highly volatile cryptocurrency market. Compared to Bitcoin, Ethereum and other crypto assets whose prices fluctuate dramatically with market sentiment, USDT does not derive its primary value from price appreciation, but rather through stability, carrying functions such as capital flow, market settlement and asset transfer, enabling market participants to quickly switch between different assets and strategies without frequently exiting the crypto system.

As the cryptocurrency market continues to expand, USDT's role has also been continuously amplified. Looking back at recent market developments, the crypto market's total market cap grew from less than $300 billion during the 2020 pandemic period to approximately $4.31 trillion at its peak in 2025. The market's demand for "capital flow efficiency," "liquidity management" and "infrastructure stability" has significantly increased. Against this backdrop, stablecoins have gradually evolved from auxiliary tools to core components supporting the entire market operation, with USDT becoming the most representative entity. As of January 2026, the total stablecoin market cap has exceeded $310 billion, with USDT holding approximately $185 billion market cap and over 70% market share, maintaining its dominant position; its daily trading volume consistently exceeds $140 billion, often surpassing Bitcoin itself. These data show that USDT is no longer just a pricing unit for trading pairs, but actually serves as the primary intermediary asset carrying global capital flow, allocation and parking.

What Is USDT Used For? The Role of Tether in the Crypto Market

In the overall structure of the cryptocurrency market, USDT serves as the "intermediate layer between fiat currency and the crypto world." It allows USD-denominated value to flow instantly on the blockchain and has become the most commonly used settlement and transfer asset in the market. For most market participants, USDT is not just a stablecoin option, but the "base currency" in the crypto system, supporting core activities such as trading, capital allocation and risk management.

In Taiwan's practical operations, the most common process for New Taiwan Dollar to enter the crypto market is: New Taiwan Dollar → USDT → Bitcoin and other crypto assets. This means first converting New Taiwan Dollar to USDT, then when the target asset (such as Bitcoin) price retreats and suitable entry opportunities appear, use USDT to complete the purchase allocation.

Specifically, USDT's main uses and advantages in the cryptocurrency market include:

1. Hedging function and price stability: Pegged 1:1 to the USD, it can serve as a stable value carrier while retaining liquidity during volatile or deleveraging phases.

2. Capital transfer tool after fiat deposit: USDT serves as an intermediary asset after entering the crypto system, facilitating quick switching between different allocations.

3. Core pricing unit for trading and quotation: Most mainstream spot and derivative products are quoted and settled in USDT, forming a unified USD pricing framework.

4. Cross-platform and cross-chain capital allocation medium: USDT has been deployed on multiple mainstream blockchains and can be quickly transferred between different chains and trading platforms, becoming the most commonly used cross-chain capital carrier in practical operations.

5. 24/7 settlement and cross-border flow capability: Compared to traditional banking systems limited by business hours and cross-border processes, USDT can transfer and settle year-round, making capital allocation more flexible.

With the continuous accumulation of the above use cases, USDT's role has gradually evolved from a "stable-price token" to a fundamental asset that actually supports the daily operation of the cryptocurrency market, becoming an indispensable key component connecting fiat value and the crypto system.

What Are the Most Common Ways to Buy USDT in Taiwan in 2026?

For Taiwanese users, the method of purchasing USDT actually depends on the funding source, cost sensitivity, and whether subsequent trading or cross-platform operations are needed. The current mainstream approaches can be divided into the following channels, each suitable for different use scenarios.

1. Purchasing USDT through Taiwanese Local Exchanges

Main characteristics: Clear deposit process, low operational barriers, relatively limited functionality and liquidity

Taiwanese local exchanges typically support New Taiwan Dollar bank transfer deposits, with clear processes and stable account reconciliation speeds. Users can operate after completing registration and identity verification. The advantage of these platforms is the clear fiat on/off-ramp channels, suitable for completing the first step of "New Taiwan Dollar conversion to USDT." However, local exchanges have relatively limited trading pairs and advanced features, with USDT mainly serving entry-level or transit purposes. If subsequent comprehensive trading,

DeFi participation, or use of contracts and other derivative tools is needed, USDT still needs to be transferred to international trading platforms in practice.

2. Purchasing USDT through International Exchanges

Main characteristics: High liquidity, complete functionality, can directly connect to subsequent trading and capital allocation

International exchanges typically provide more comprehensive market depth and product lines, covering spot, futures, strategy tools and diversified asset allocation options. Taiwanese users can obtain USDT directly on the platform through New Taiwan Dollar deposits, third-party payments or asset transfers. Taking BingX as an example, users can purchase USDT on the platform after completing deposits and conduct trading, transfers or position management in the same environment, reducing time costs and operational risks brought by cross-platform transfers. This approach typically has advantages in overall efficiency and subsequent usage flexibility.

3. Purchasing USDT through P2P (Peer-to-Peer) Trading

Main characteristics: High exchange rate flexibility, high counterparty risk, relatively frequent fraud cases

P2P trading allows users to directly exchange New Taiwan Dollars and USDT with other individuals, with typically greater price flexibility, making it attractive for users who highly value exchange rates. However, such transactions are highly dependent on counterparty credit and payment processes, with practical risks significantly higher than general exchange models. The market does have cases of fake accounts, false releases,

phishing payments, fake transfer screenshots and other

P2P fraud cases. Even with platform arbitration or guarantee mechanisms, users still need to verify payment and receipt status and transaction records themselves. Once mishandled, fund recovery is difficult, making it unsuitable for inexperienced users or those with lower risk tolerance.

4. Purchasing USDT through Credit Cards or Third-Party Payment Services

Main characteristics: Fast speed, simple operation, relatively high overall costs

Some platforms support using credit cards or third-party payment tools to directly purchase USDT, with fast processes that can usually be credited immediately, making it very convenient for temporary fund replenishment or small-amount needs. However, this approach often includes higher handling fees, service charges or implicit exchange rate differences, with long-term costs significantly higher than bank transfers or in-exchange conversions. Therefore, credit cards or third-party payments are more suitable as short-term or emergency solutions rather than long-term, fixed primary purchase channels.

Which Is the Best Way to Buy USDT in Taiwan?

Considering various purchase channels, over-the-counter trading (OTC/P2P) although having exchange rate flexibility, has relatively high risks in Taiwan's practical operations, with fraud cases not uncommon. It requires high control over transaction counterparties and payment processes, making it unsuitable as the primary purchase method for most investors; while purchasing USDT through credit cards or third-party payments is fast, it usually comes with higher handling fees and exchange rate differences, making long-term costs relatively disadvantageous.

In comparison, purchasing USDT through cryptocurrency exchanges remains the most balanced choice for Taiwanese investors in terms of stability, cost and operational flexibility. Taking international exchanges like BingX as an example, the platform has higher liquidity and transparent pricing, allowing users to complete deposits, exchanges and subsequent asset allocation in the same environment. For most Taiwanese users planning to use USDT for crypto asset allocation in 2026, choosing a suitable international exchange remains the most risk and efficiency controllable approach.

Best USDT Exchanges in Taiwan for 2026

For Taiwanese investors, choosing which exchange to purchase USDT actually involves three core aspects: New Taiwan Dollar deposit pathways, USDT liquidity sources, and flexibility for subsequent asset utilization. The differences between exchanges are mainly reflected in functional positioning and usage scenarios, rather than a simple comparison under a single standard.

From a practical perspective, USDT exchanges commonly used by Taiwanese users can be divided into two types: international exchanges and Taiwanese local exchanges, with clear differences in their role divisions. The following organizes currently available USDT trading platforms for Taiwanese users that remain representative in 2026, explaining their respective positioning and suitable usage scenarios.

1. BingX Exchange

Positioning: Comprehensive cryptocurrency trading platform providing USDT spot trading and diversified asset management tools.

Founded in 2018, BingX serves over 40 million users as of 2026, covering over 100 countries and regions. For Taiwanese investors, BingX's common usage methods are mainly two: first, directly purchasing crypto assets or USDT through New Taiwan Dollar credit cards or third-party payment methods; second, after obtaining USDT, conducting trading, asset allocation and capital management on the platform. USDT can be directly applied to most trading scenarios on the platform, reducing the complexity of asset conversion and operational processes.

In terms of USDT spot trading and capital utilization, BingX provides stable market depth and real-time pricing. USDT can directly exchange for most mainstream crypto assets and is commonly used as an intermediary for position adjustments, asset rotation and capital parking. BingX's spot trading fees are 0.1% (maker/taker), with relatively clear fee structures; compared to some international exchanges' general spot fees ranging from 0.2%–0.4%,

BingX fees have certain competitiveness in crypto spot trading costs, suitable for one-time allocation, batch entry or strategic adjustments using USDT.

In terms of trading assistance and asset management, BingX provides social trading and

copy trading, and integrates

BingX AI as an auxiliary tool for market observation and analysis, helping users understand USDT-denominated market structure and volatility patterns. The platform also provides demo trading mechanisms, allowing users to familiarize themselves with operational processes without using actual USDT. In terms of asset security, BingX employs hot-cold wallet separation and multi-signature mechanisms, and provides

BingX Shield Fund and

100% Proof of Reserves for user verification; for Taiwanese users, the complete Traditional Chinese interface and operational support also help reduce practical usage barriers.

2. Kraken Exchange

Positioning: International cryptocurrency exchange known for its compliance framework and fiat on/off-ramp system.

Founded in 2011, Kraken is one of the oldest mainstream cryptocurrency exchanges, long serving European and American markets and known for transparency and institutional completeness. For Taiwanese investors, Kraken's main role is to provide a trading environment highly integrated with traditional financial systems, suitable for conversions between fiat and stablecoins, and operational scenarios more oriented toward long-term asset management.

In terms of USDT trading and account management, Kraken provides stable spot markets and clear pricing mechanisms. USDT can be used to exchange most mainstream crypto assets and serves as an intermediary tool for capital allocation and position conversion. Spot trading fees adopt a tiered system with transparent fee structures but overall levels slightly higher than some high-frequency oriented platforms; in terms of security, Kraken emphasizes cold wallet custody and multi-layer risk controls. However, the platform mainly provides English interface with professional-oriented operations, and actual available deposit methods and functions may vary by region, so it's recommended to confirm suitability before use.

3. Crypto.com Exchange

Positioning: International cryptocurrency platform combining trading, payment and card consumption scenarios.

Founded in 2016, Crypto.com is centered around mobile applications, integrating crypto asset trading, holding and actual consumption into the same ecosystem. For Taiwanese users, its features lie not only in supporting USDT and mainstream crypto asset trading, but also extending to daily payment and card consumption scenarios, enabling stablecoins to more directly connect to real-life usage.

In terms of USDT trading and practical applications, Crypto.com supports USDT spot trading and exchanges for most mainstream assets, and can serve as a capital transfer tool. Spot trading fees are linked to

native token CRO, with basic fees up to about 0.4%. Staking CRO can reduce fees but requires bearing its price volatility risk. The platform's Visa card allows converted USDT to be used for consumption and can be linked to LINE Pay in Taiwan; however, conversion to New Taiwan Dollars practically involves about 0.8% exchange rate costs, which are common hidden fees. Overall, Crypto.com is more suitable for users who want to combine trading with daily payment scenarios.

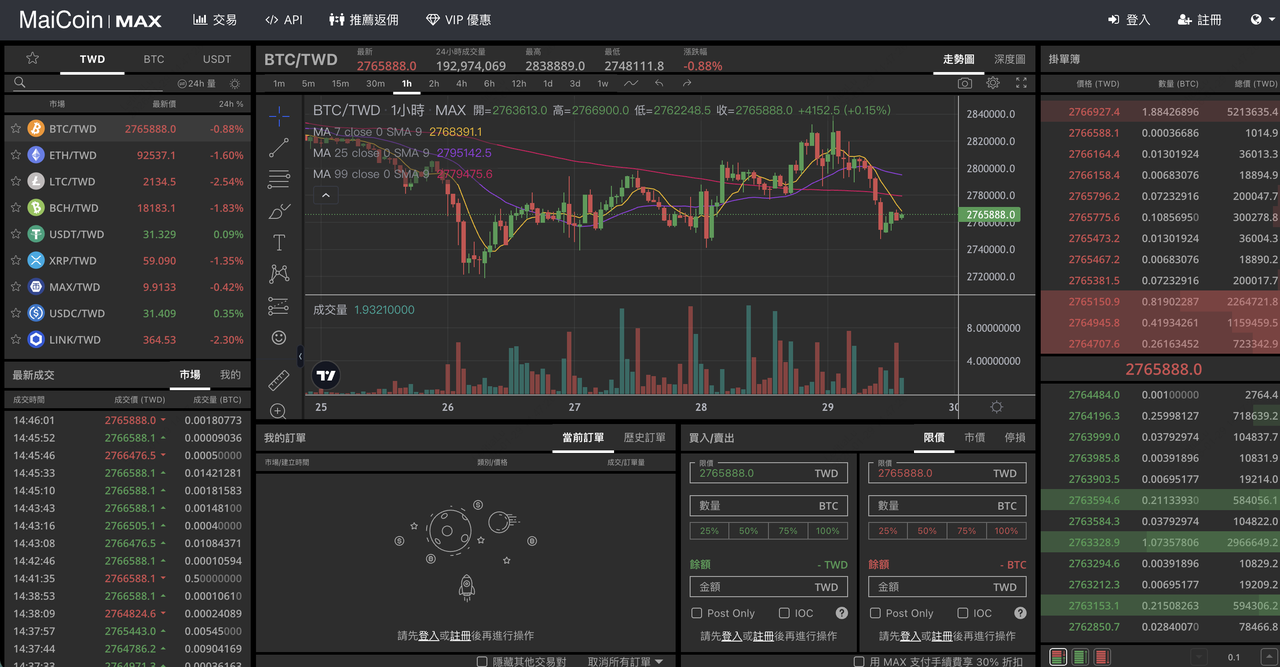

4. MAX Exchange Exchange

Positioning: Taiwanese local cryptocurrency exchange focused on New Taiwan Dollar deposits and USDT/TWD spot trading.

Founded in 2018, MAX Exchange is part of Taiwan's MaiCoin Group and is one of the largest domestic cryptocurrency trading platforms in Taiwan by trading volume and user base. According to CoinMarketCap data, MAX is one of the few Taiwanese platforms to enter the global exchange top rankings, with recent 24-hour trading volume of tens of millions of USD, providing relatively concentrated liquidity in the Taiwan market. For Taiwanese investors, MAX's core role is to provide stable, predictable New Taiwan Dollar on/off-ramp channels, serving as the main entry point for fiat to USDT conversion.

In terms of USDT purchasing and trading depth, MAX provides USDT/TWD spot trading pairs, supporting direct USDT purchases after bank transfer deposits. Since platform users are mainly Taiwanese local funds, USDT/TWD liquidity has available depth within general amount ranges, but for large-amount trades, exchange rates usually show about 0.5%–1% premiums, reflecting local market supply-demand structure and liquidity scale limitations. Trading fees adopt a tiered system at approximately 0.05% (Maker) to 0.15% (Taker), with additional fee discounts available using platform token MAX Token, maintaining clear and transparent fee structures.

In terms of fund security and account management, MAX is among the first exchanges globally to place user fiat funds under bank trust custody, cooperating with Far Eastern Bank to establish trust accounts, ensuring user New Taiwan Dollar funds don't enter exchange proprietary accounts. In information security, the platform has passed ISO 27001 security certification and stores most crypto assets in cold wallets. For USDT deposits and withdrawals, MAX supports multiple mainstream chains including Ethereum, TRC20, BSC, Polygon, Arbitrum One, facilitating user transfers to other international exchanges or on-chain applications after purchasing USDT. Overall, MAX's positioning for USDT leans more toward "local node for New Taiwan Dollar to stablecoin exchange" rather than a primary platform for high-frequency trading or complex strategies.

5. BitoPro Exchange

Positioning: Taiwanese local cryptocurrency exchange providing New Taiwan Dollar deposits and USDT/TWD spot trading, with convenience store deposit services.

Founded in 2018, BitoPro is one of Taiwan's local cryptocurrency trading platforms, long focused on New Taiwan Dollar deposits and spot trading as main services. For Taiwanese investors, BitoPro's actual role is similar to MAX, mainly serving as a local gateway for New Taiwan Dollar to USDT conversion, but additionally provides convenience store payment and other physical channel options for deposit methods, making capital entry into the crypto system more flexible.

In terms of USDT purchasing and trading depth, BitoPro provides USDT/TWD spot trading pairs, supporting direct orders after bank transfers and convenience store deposits. Since platform user base and overall trading volume are relatively concentrated in the local market, USDT/TWD liquidity can meet daily needs within general amount ranges, but for larger trades, actual transaction prices may be affected by market depth, resulting in slippage or widened bid-ask spreads. Trading fees roughly fall in the range of Maker around 0.1%, Taker around 0.2%, typical for local exchanges; convenience store deposits require additional attention to about 1% handling fee costs.

In terms of product structure and usage limitations, BitoPro currently focuses on spot trading and doesn't provide contracts, futures or other derivative products, so USDT usage scenarios mainly concentrate on New Taiwan Dollar to stablecoin exchange, temporary storage and subsequent transfers. The platform supports slightly more coin types compared to some Taiwanese exchanges but still has significant gaps with large international exchanges, and some trading pairs have low transaction volumes, requiring attention to execution efficiency in practice. Overall, BitoPro's positioning for USDT leans more toward "convenient local deposit node," suitable for small or temporary deposit needs, with users still needing to evaluate whether its liquidity and cost structure fit their operational scenarios based on fund scale and trading purposes before use.

How to Buy USDT in Taiwan in 2026: Complete Guide

For Taiwanese users, USDT is usually the first practical operational asset after entering the cryptocurrency market. Whether subsequently purchasing Bitcoin, Ethereum, or conducting other trading and asset allocation, most processes will first use USDT as an intermediary.

In practice, Taiwanese local exchanges mainly handle New Taiwan Dollar deposits and initial currency exchange, but still have limitations in coin variety and market liquidity, so many users transfer USDT to international exchanges like BingX after obtaining it to conduct subsequent trading and allocation, gaining more complete trading options and execution efficiency.

The following organizes two common paths for USDT when Taiwanese users operate through BingX in 2026: directly purchasing on BingX, or first buying USDT on Taiwanese exchanges then transferring to BingX, explaining their respective actual processes.

Method 1: Buy USDT on BingX With a Credit Card (Fastest Option)

For users who want to quickly complete deposits without going through Taiwanese exchange transfers, directly purchasing USDT on BingX using credit cards is currently the most direct method with the fewest operational steps. This method is handled by third-party payment service providers for card processing and currency exchange, with USDT being directly deposited into BingX spot accounts after payment completion.

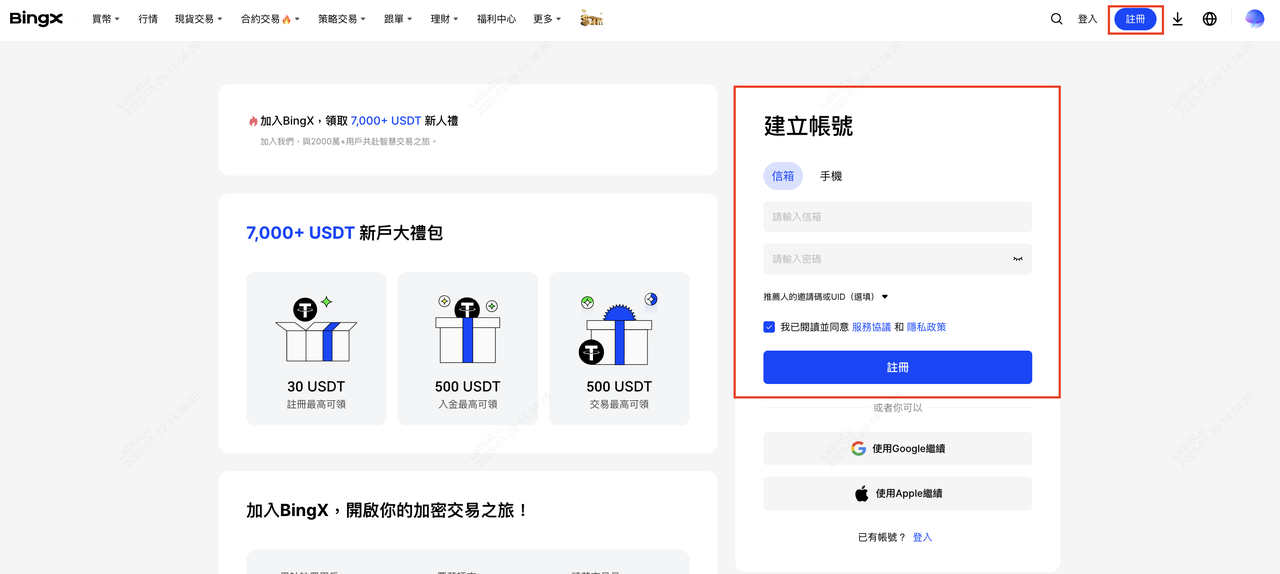

Step 1: Register BingX Account and Complete Identity Verification

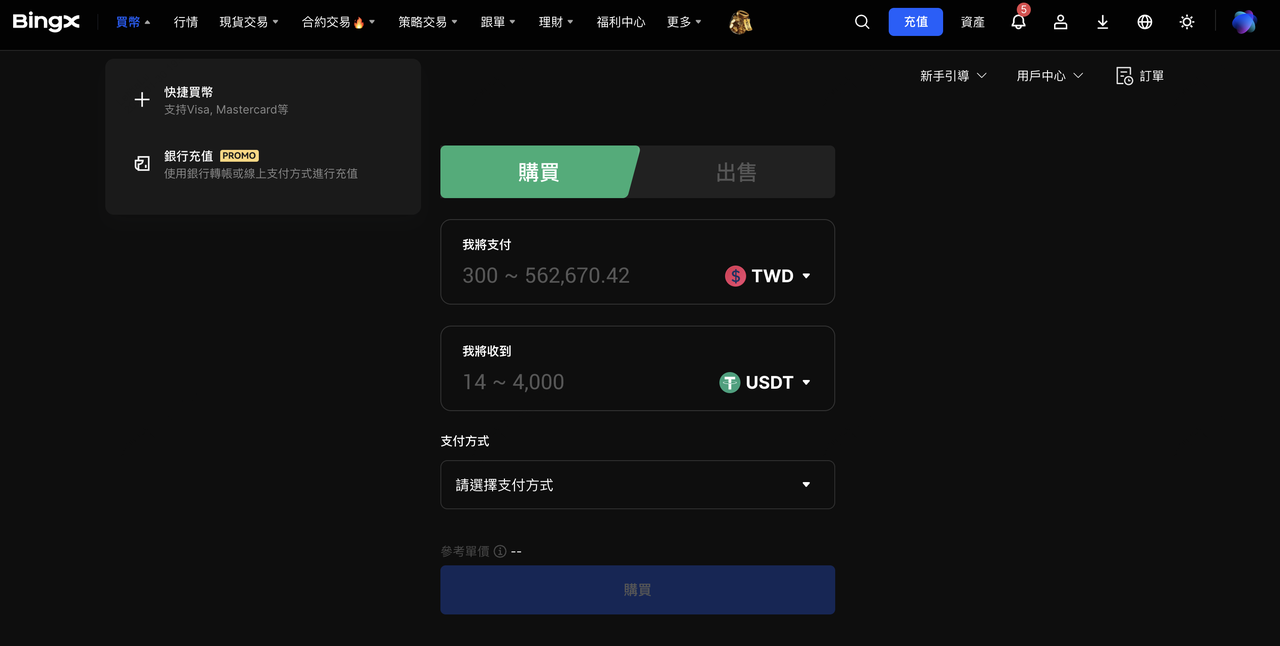

Step 2: Select Credit Card Buy Crypto Function and Purchase USDT

After logging in, on the "

Quick Buy" page, select USDT as the currency, enter the desired purchase amount, and choose "Credit Card/Debit Card" or "Third-Party Payment" as the payment method. The system will display corresponding limits, exchange rates and fees for each option, allowing users to compare and choose. After completing the card payment, USDT usually arrives within minutes.

Step 3: Confirm USDT Arrival and Conduct Subsequent Operations

After purchase completion, USDT will appear in BingX's spot wallet and can be immediately used for trading, transfers or subsequent asset allocation without additional transfer processes.

Pros and Cons of Buying USDT on BingX With a Credit Card

• Fast deposit speed: Processed through third-party payment service providers, from order placement, card payment to USDT arrival usually takes only minutes, suitable for scenarios requiring quick fund replenishment.

• Simple operational process: Can directly complete purchases on BingX without first registering for Taiwanese exchanges or conducting cross-platform transfers, reducing initial operational complexity.

• Higher deposit costs: Credit card purchases usually include third-party service fees and exchange rate differences, with overall costs mostly ranging around 3%–5%, slightly higher than purchasing USDT through Taiwanese exchanges.

• Credit card support needs confirmation: Some Taiwanese-issued credit cards still have restrictions on cryptocurrency transactions, so actual successful card payments depend on issuing bank and card type policies.

• More suitable for small amounts or temporary deposits: This method suits smaller amounts, urgent deposits, or users wanting quick operations without handling transfer processes; for long-term allocation or large deposits, handling fees and exchange rate costs need careful evaluation.

Method 2: Buy USDT on Taiwan Exchanges and Transfer to BingX (Lower Cost)

For most Taiwanese users, first purchasing USDT with New Taiwan Dollars on Taiwanese local exchanges, then transferring USDT to BingX for use, is currently the most cost-effective and common operational method. While this method has more steps, it can effectively reduce card handling fees and exchange rate differences, particularly suitable for medium-large amounts or long-term allocation needs.

Step 1: Purchase USDT with New Taiwan Dollars on Taiwanese Exchanges

First complete registration and KYC identity verification on Taiwanese exchanges, and link personal bank accounts. After completion, deposit New Taiwan Dollars through bank transfers. Once funds arrive, place orders in USDT/TWD trading pairs to purchase USDT.

Key Point: Most Taiwanese exchanges' USDT spot fees range around 0.05%–0.15%, significantly lower costs compared to credit card purchases.

Step 2: Obtain BingX USDT Deposit Address

Log into BingX, go to assets or deposit page, select USDT as deposit currency, and confirm blockchain network (such as TRC20). The system will generate a unique deposit address which needs to be completely copied for pasting into the Taiwanese exchange.

Key Point: When subsequently withdrawing from Taiwanese exchanges, the selected network must exactly match the BingX deposit network.

Step 3: Withdraw USDT from Taiwanese Exchange and Transfer to BingX

Return to the Taiwanese exchange's withdrawal page, paste BingX's USDT deposit address, select the same blockchain network (commonly TRC20), enter withdrawal amount and submit. USDT usually arrives at BingX within 5–10 minutes.

Key Point: For first-time operations, it's recommended to test with small amounts first, confirming correct processes before transferring larger amounts.

Pros and Cons of Buying USDT on Taiwan Exchanges and Transferring to BingX

• Lower overall costs: Taiwanese exchange spot fees plus on-chain transfer fees mostly total around 0.05%–0.2%, lower than credit card purchases.

• Mature New Taiwan Dollar deposit process: Bank transfer deposits are stable with fast arrival times, more intuitive for users with New Taiwan Dollars as primary funding source.

• Full trading functionality after transfer: USDT transferred to BingX can directly be used for spot trading, strategy tools or other asset allocation without local exchange coin and depth limitations.

• Requires cross-platform operations: This method requires simultaneous operation of Taiwanese exchanges and BingX, with relatively more processes requiring time for first-time users to familiarize.

• Network selection requires special attention: If withdrawal and deposit networks are selected incorrectly, assets may be unrecoverable, so operations must be double-checked.

• More suitable for medium-large amounts and long-term use: For users prioritizing costs, requiring regular deposits or conducting larger amount allocations, this method is more efficient long-term.

How Is USDT Used for Trading and Investment?

In actual operations, USDT is not just a transitional asset for "buying coins," but an important tool throughout trading decisions, capital allocation and cross-platform operations. For Taiwanese users, USDT's trading strategies can be roughly categorized into the following three practical aspects.

1. Serving as Core Medium for Cryptocurrency Trading

USDT's primary trading strategy role is serving as an intermediary asset for market entry and exit. Since most spot trading pairs and derivative products are denominated in USDT, investors can directly purchase with USDT when market opportunities arise; when market volatility increases or risks rise, they can also convert held assets back to USDT to reduce short-term price volatility impacts on net asset value. This characteristic of quickly switching between entry and exit states makes USDT the most commonly used base trading asset in practical operations.

2. Yield-Based Capital Allocation with USDT via BingX

When not urgently needed for trading, some users allocate temporarily unused USDT to wealth management and yield products provided by platforms as part of trading strategies, to improve overall capital utilization efficiency. On BingX, USDT can be used for various wealth management and yield allocations, covering different terms and operational methods, with annual yields ranging approximately 2%–100%. Users can directly participate in related products with USDT, allocating funds not yet deployed in trading as part of overall fund management and trading rhythm arrangements.

3. Serving as Cross-Platform and Cross-Border Trading Fund Allocation Tool

USDT is also commonly used for fund transfers and cross-border allocation between exchanges, serving as fund adjustment means in actual trading strategies. Compared to traditional bank international remittances requiring several days and involving higher fees and exchange rate costs, USDT transfers can be completed in short time and support year-round operations. When needing to move funds between different platforms, adjust trading allocations or redeploy positions, USDT provides an operational method combining efficiency and flexibility.

Key Considerations Before Buying USDT in Taiwan

Before buying USDT in Taiwan, besides understanding acquisition methods and operational processes, there are several practical risks and details requiring attention. Since USDT often serves as the first asset when entering the cryptocurrency market, these factors often directly impact subsequent trading costs and security.

1. Platform Security and Fund Storage Risks: Even when purchasing USDT through established cryptocurrency exchanges, it's still recommended to complete KYC, enable two-factor authentication (2FA), and avoid long-term concentration of large funds on single platforms. When holding larger amounts or not needing operations short-term, diversifying platforms or transferring to personal wallets helps reduce single-point risks.

2. Purchase Costs and Actual Transaction Price Differences: Different purchase methods have significant cost structure differences. Credit card purchases usually include third-party service fees and exchange rate differences; purchases through Taiwanese exchanges require attention to USDT/TWD spreads and market depth. Actual transaction prices may differ from real-time quotes, so handling fees, slippage and exchange rate differences should be considered together before purchasing.

3. Transfer Network Selection and Operational Error Risks: USDT supports multiple blockchain networks, and transfers must confirm outgoing and incoming networks are completely identical. Cryptocurrency transfers are mostly irreversible operations, and selecting wrong chains or incorrect addresses may result in unrecoverable assets. In practice, first-time transfers should test with small amounts first.

4. P2P/OTC Trading Fraud Risks: P2P and OTC fraud cases related to USDT in Taiwan's market are common, with typical scenarios including private currency exchange, fake investment communities and impersonated customer service. While P2P trading has higher flexibility, risks are also relatively concentrated. For most users, purchasing through exchanges with KYC and risk control mechanisms provides higher security.

5. Regulatory, Tax and Financial Planning Awareness: Currently Taiwan doesn't prohibit individual holding or trading of USDT, but related regulatory and tax regulations are still evolving. It's recommended to maintain complete trading and transfer records and keep basic awareness of potential reporting obligations. Also, since USDT is commonly used as funds awaiting market entry, usage should include advance planning of fund purposes and allocation strategies.

Conclusion: Why BingX Is the Best Platform for USDT Trading in Taiwan (2026)

Considering deposit flexibility, USDT liquidity, trading depth and completeness of subsequent asset utilization, Taiwanese users in 2026 practical operations still mostly use BingX as the primary USDT platform. Whether purchasing USDT quickly via credit cards or first buying on Taiwanese exchanges then transferring, BingX can connect subsequent trading, capital allocation and strategy configuration needs, reducing cross-platform operational friction costs. For Taiwanese investors hoping to maintain flexibility in crypto markets while balancing efficiency and controllable risks, this configuration approach remains one of the more mature and practical choices currently available.

FAQs on Buying and Using USDT in Taiwan

1. Do I need to buy USDT before trading cryptocurrencies in Taiwan?

In practice, most trading and asset allocation first converts to USDT. Since mainstream trading pairs and market liquidity are mostly centered on USDT, holding USDT first can improve market entry/exit flexibility and help reduce short-term price volatility interference.

2. Is it safe to buy USDT with a credit card on international exchanges?

Credit card USDT purchases are not inherently high-risk activities, but handling fees and exchange rate costs are usually high, and some Taiwanese banks may restrict cryptocurrency card transactions. It's recommended to confirm issuing bank policies before use and avoid investing overly large amounts at once.

3. Why do many Taiwan users buy USDT on local exchanges and transfer it to global platforms?

Main considerations are cost and liquidity. Local exchanges support New Taiwan Dollar deposits with relatively controllable fees and exchange differences; international exchanges provide higher USDT liquidity and more trading choices. Combining both achieves balance between cost and operational flexibility.

4. Why is TRC-20 the most common network for USDT transfers?

TRC-20 network has fast transfer speeds and low fees, making it cost-effective when moving funds between Taiwanese and international exchanges. However, operations must confirm outgoing and receiving platforms use the same network to avoid asset loss from selecting wrong chains.

5. Is USDT suitable for long-term holding?

USDT itself is not an asset aimed at price growth, more commonly used for fund parking, awaiting entry or strategy allocation. Whether to hold long-term should depend on personal capital allocation and market judgment, not simply holding duration.

6. What risks are associated with holding USDT?

USDT is a relatively stable USD stablecoin with lower volatility risks than Bitcoin and other crypto assets, but still has risks including issuer credit, platform custody and transfer operational errors. Diversifying platform storage and enabling two-factor authentication help reduce overall risks.

7. Do you need to pay taxes when buying USDT in Taiwan?

Currently Taiwan doesn't prohibit individual holding or trading of cryptocurrencies, but related tax regulations are still evolving. It's recommended to maintain complete trading records and keep basic awareness of potential taxable scenarios, consulting professional advice when necessary.