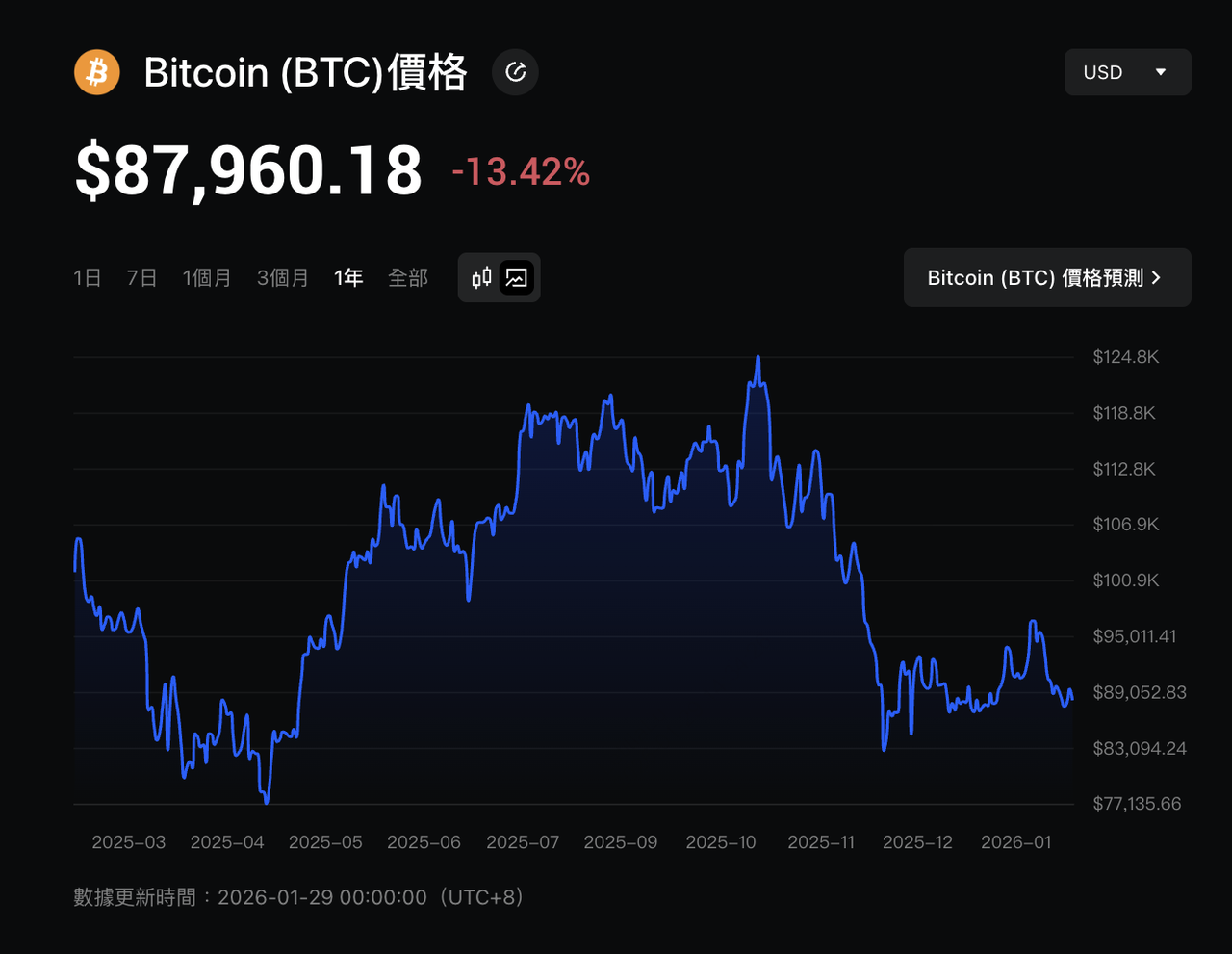

As of January 2026,

Bitcoin price is hovering around $89,000, compared to its all-time high of approximately $126,000 reached in October 2025. The market has entered a high-level consolidation phase. Despite multiple capital inflow and outflow fluctuations in

Bitcoin Spot ETFs during this period, Bitcoin's overall price structure remains stable, indicating that the market has developed more mature support capabilities with increased institutional participation.

In this market environment, for Taiwanese users, the key practical considerations are: choosing a safe Bitcoin trading platform with sufficient liquidity and efficient capital deposit/withdrawal processes. This article will outline the key considerations for choosing Bitcoin exchanges in Taiwan in 2026, and use BingX as an example to explain the complete process from registration and deposit to actually purchasing Bitcoin, helping users quickly complete their first or advanced allocation.

Bitcoin Price Forecast 2026: Citibank and Standard Chartered Predict $120,000–$170,000

Since the beginning of 2026, the Bitcoin market has experienced intense volatility. After reaching an all-time high of approximately $126,000 on October 6, 2025, the market immediately entered a high-volatility correction phase, evaporating over $1.2 trillion in total market capitalization within just six weeks. However, what remains after this storm is not panic, but a more mature cryptocurrency ecosystem with a more stable capital structure. As of late January 2026, Bitcoin price has stabilized around $89,000, and most market analysts believe that this period of volatility and consolidation is accumulating energy for the next trend movement.

For Taiwanese investors, whether to enter the market to buy Bitcoin in 2026 presents particularly delicate timing. On one hand, Bitcoin Spot ETFs allow institutional capital to flow in and out of the market more freely. Even though recent ETF capital flows have shown obvious volatility and multiple net outflows, Bitcoin prices have not crashed as a result, but have consolidated in high-level ranges, reflecting that the market has gradually adapted to the reality that institutional capital does not hold tight for the long term, but adjusts positions according to market conditions. On the other hand, as major global central banks gradually shift their monetary policy stance towards easing, the overall liquidity environment is relatively favorable for non-yielding, anti-inflation narrative assets like Bitcoin, providing macro-level support for the market to find direction after volatility. Against this backdrop, several international financial institutions have given relatively positive predictions for Bitcoin prices in 2026.

Among them, Citibank analysts believe that Bitcoin could reach approximately $143,000 in 2026, and in more optimistic scenarios, even challenge $189,000; while Standard Chartered Bank has set an annual target price of approximately $150,000. Overall, the mainstream institutional consensus for Bitcoin in 2026 roughly falls in the range of $120,000 to $170,000, with some extreme bullish analysts proposing long-term target prices above $400,000, reflecting the high divergence and imagination space in the market for the next cycle.

What Are the Most Common Ways to Buy Bitcoin in Taiwan in 2026?

In Taiwan, Bitcoin purchase methods can be mainly divided into four categories: through cryptocurrency exchanges, through over-the-counter trading (OTC/P2P), through international platforms or third-party services, and through convenience stores. Different channels show significant differences in security, cost, operational difficulty, and risk tolerance, and are suitable for different types of users. The following will explain the characteristics and considerations of each method according to practical usage scenarios.

1. Buying Bitcoin Through Cryptocurrency Exchanges

Features: Most mainstream option in Taiwan with relatively controllable risks.

Using cryptocurrency exchanges to purchase Bitcoin is currently the most common and mature method for Taiwanese investors. The general process involves completing registration and identity verification, then using New Taiwan Dollar deposits or first exchanging for stablecoins (such as USDT), then buying BTC in the spot market. The advantages of this method include high liquidity, transparent pricing, clear trading rules, and the ability to use market orders, limit orders, and other tools to control transaction costs.

For most Taiwanese users, international exchanges have become a primary choice due to their higher market depth and more complete product offerings. For example, BingX provides Bitcoin spot trading and related derivative products, with relatively intuitive operating interfaces, and can complete asset management and trading needs on the same platform, making it suitable as a primary purchase channel.

2. Buying Bitcoin Through Over-the-Counter Trading (OTC/P2P)

Features: High trading flexibility, but significantly higher risks.

Over-the-counter trading (OTC) and P2P (peer-to-peer trading) refer to Bitcoin buying and selling directly between individuals or merchants without going through public matching markets. In Taiwan, such transactions often carry higher risks, especially when involving private transfers or operating outside platform protection mechanisms, making them easier targets for fraud cases. In recent years, Taiwan and Chinese-speaking regions have seen frequent

P2P scam cases, with common tactics including not receiving Bitcoin after payment, forged transfer certificates, or inducing users to conduct private transactions.

Although OTC/P2P offers certain flexibility in payment methods and trading conditions, prices usually include premiums, and counterparty risks must be borne individually. For investors lacking experience, this method is not suitable as a primary choice for first-time Bitcoin purchases, and risks should be carefully evaluated before use.

3. Buying Bitcoin Through International Platforms or Third-Party Services

Features: Convenient operation and low entry barriers, but higher overall costs.

Some Taiwanese users choose to purchase Bitcoin directly through international platforms or third-party services, such as using credit or debit cards for purchases, or first obtaining BTC/USDT and then transferring to exchanges for operations. Common international third-party deposit services include MoonPay, Simplex, Transak, etc., which are often integrated into exchanges or crypto wallets, allowing users to complete purchases directly.

The advantage of this method is its simple process, suitable for first-time small-amount trials or temporary top-ups; however, attention should be paid to credit card fees, exchange rate differences, and service fees, as actual costs are usually higher than exchange spot prices. For users with long-term investment or high trading frequency, the overall cost-effectiveness should still be evaluated.

4. Buying Bitcoin Through Convenience Stores

Features: Low entry barriers, but many restrictions and high costs.

In Taiwan, some service platforms have provided or still provide "buying Bitcoin through convenience stores" methods, usually by creating orders online first, then completing payment at convenience store counters or kiosks, after which the platform transfers Bitcoin to designated wallets. This method does not require bank accounts or online transfers, making it relatively accessible for users with no cryptocurrency experience.

However, buying Bitcoin through convenience stores usually has single transaction and daily amount limits, high handling fees, and prices may differ from real-time market quotes. Overall, this channel is more suitable for small-amount experiences or short-term use, and is not suitable as a long-term investment or primary purchase method.

What Is the Best Way to Buy Bitcoin in Taiwan?

Considering all the above channels, over-the-counter trading (OTC/P2P) although flexible, carries obviously high risks in Taiwan's practical context, with frequent related fraud cases, making it unsuitable as a primary purchase method for most investors; while buying Bitcoin through international third-party platforms or convenience stores, although relatively convenient to operate, usually involves higher handling fees, exchange rate differences, and amount restrictions, resulting in significantly higher long-term costs.

In comparison, buying Bitcoin through cryptocurrency exchanges remains the most stable and relatively controllable choice for Taiwanese investors. Exchanges offer higher liquidity and transparent pricing, can complete deposits, trading, and asset management on the same platform, and are more suitable for adjusting strategies according to different market environments. Therefore, for most Taiwanese users hoping to enter the market or continue allocating Bitcoin in 2026, choosing a suitable cryptocurrency exchange is often the most balanced approach between overall cost and security.

Best Bitcoin Exchanges in Taiwan for 2026

In 2026's market environment, as Bitcoin enters high-level volatility and structural maturity, Taiwanese investors are no longer just focused on price itself when choosing trading platforms, but more on platform stability, product completeness, security mechanisms, and long-term usability. Below are currently available and still representative Bitcoin trading platforms for Taiwanese users in 2026, explaining their respective positioning and suitable usage scenarios.

1. BingX Exchange

Positioning: Comprehensive trading platform offering Bitcoin spot trading and diverse trading tools.

BingX was established in 2018 and has served over 40 million users across more than 100 countries and regions as of 2026. For Taiwanese investors, BingX's primary use case is depositing stablecoins and directly

purchasing Bitcoin (BTC) in the spot market for medium to long-term holding or strategic allocation.

For Bitcoin spot trading, BingX provides relatively stable market liquidity and real-time quotes, suitable for one-time purchases or dollar-cost averaging operations. BingX spot trading fees are 0.1% (maker/taker), compared to general spot trading fees of 0.2%-0.4% at some international exchanges, giving BingX certain competitiveness in Bitcoin trading costs. For investors prioritizing cost considerations and long-term Bitcoin allocation,

BingX fees structure is relatively transparent. When combined with

dollar-cost averaging (DCA) or batch buying strategies, it can reduce the impact of short-term price volatility on entry timing.

In terms of trading tools and strategy assistance, BingX provides social trading and

copy trading systems, and also integrates

BingX AI as an auxiliary analysis tool. Users can use AI-provided market data compilation, trend observation, and trading behavior analysis to assist in judging Bitcoin market's short-term volatility and overall rhythm. The social copy trading function publicly displays historical performance, win rates, and maximum drawdown indicators, helping users evaluate risk profiles of different trading strategies. Additionally, the platform provides 100,000 USDT in demo trading funds, allowing users to familiarize themselves with Bitcoin trading processes and market volatility characteristics without actual capital risk, helping newcomers to BTC trading reduce initial operational errors.

In terms of security and asset protection, BingX employs cold-hot wallet separation and multi-signature mechanisms, and provides

BingX Shield Fund and

100% Proof of Reserves, allowing users to independently verify platform asset coverage. The platform requires KYC verification completion and recommends enabling two-factor authentication (2FA). For Taiwanese users, Traditional Chinese interface and customer support also make operational barriers relatively low when actually purchasing Bitcoin and managing assets.

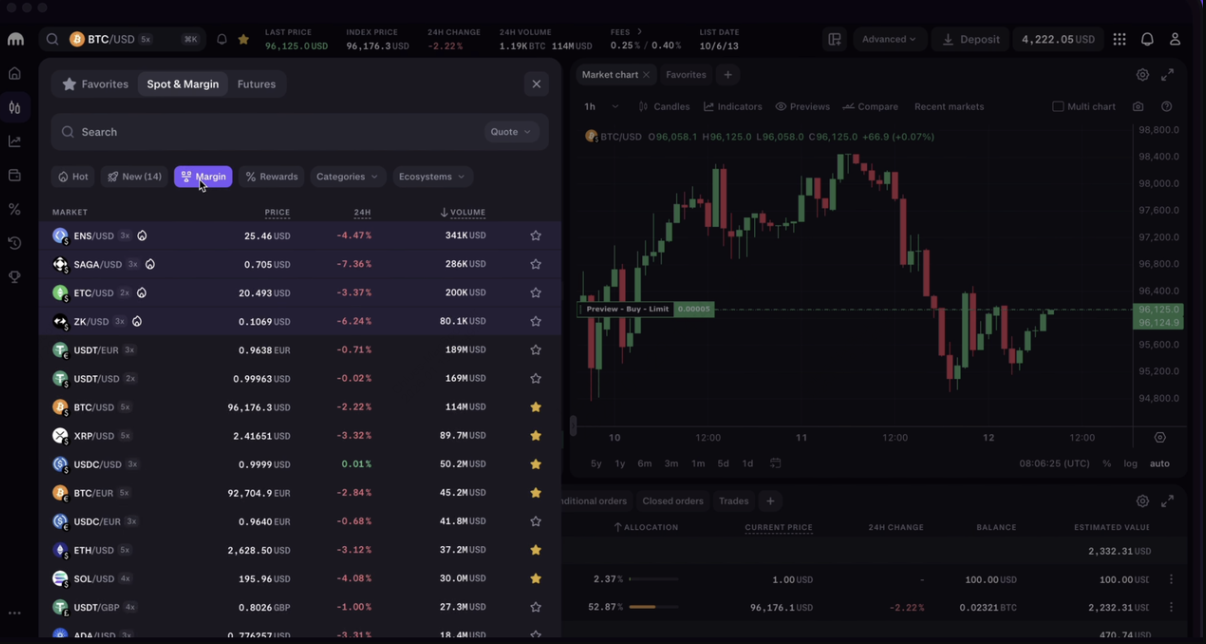

2. Kraken Exchange

Positioning: Historically established Bitcoin trading platform focused on security and compliance.

Kraken was established in 2011 and is one of the earliest cryptocurrency exchanges supporting Bitcoin (BTC) trading, long known in the industry for security and compliance. Entering 2026, Kraken announced plans for an IPO in Q1 with a target valuation of approximately $15 billion, showing its intention to further integrate Bitcoin trading into the traditional financial system.

In terms of Bitcoin trading functionality, Kraken provides BTC spot and margin trading, supporting multiple order types and technical analysis tools. Its professional interface Kraken Pro is designed more for advanced users, more suitable for investors with trading experience who want to conduct strategic Bitcoin operations, rather than complete beginners.

In terms of security, Kraken has long maintained high standards, with official data showing over 95% of user assets (including Bitcoin) stored in cold wallets, with no major security incidents to date. However, for Taiwanese users, its interface and operational processes are relatively complex, and actual available deposit methods and service items vary by region, so users should confirm compatibility with their needs before use.

3. Coinbase Exchange

Positioning: Bitcoin trading platform focused on compliance and institutional transparency.

Coinbase is one of the largest cryptocurrency exchanges in the United States and went public on NASDAQ in 2021, becoming the first publicly listed mainstream cryptocurrency platform. The platform is led by founder and CEO

Brian Armstrong, with long-term emphasis on cooperation with regulatory agencies and institutional transparency. Entering 2026, Coinbase continues developing towards an integrated financial platform, attempting to incorporate Bitcoin trading into a broader financial system.

In terms of Bitcoin (BTC) trading functionality, Coinbase provides BTC spot trading and basic asset management tools, with interface design leaning towards simplicity. The platform offers both general trading interface and Coinbase Advanced Trade, with the latter supporting more complete order types and relatively lower fees, suitable for users requiring more detailed Bitcoin trading operations. As of 2026, Coinbase manages approximately $516 billion in assets, representing about 16% of global cryptocurrency market cap, demonstrating its continued influence in brand trust and institutional adoption.

In practical use, Coinbase's Bitcoin trading costs are relatively high, especially when using the general trading interface, where fees and spreads can reach up to 3.49%. Additionally, the platform does not provide direct New Taiwan Dollar deposit services, with most Taiwanese users needing to use third-party deposits or first obtain stablecoins before conducting BTC trading, making operational processes more cumbersome compared to local exchanges. Therefore, it leans more towards compliance-oriented Bitcoin trading options rather than prioritizing cost and convenience as a primary platform.

4. Crypto.com Exchange

Positioning: Mobile-focused Bitcoin trading platform combining trading and payment scenarios.

Crypto.com is a global cryptocurrency trading platform with core products centered on mobile applications, providing Bitcoin (BTC) spot trading and asset management functions, extending to payment and card usage scenarios. The platform aims to integrate Bitcoin and other crypto assets into financial systems closer to daily use, rather than limiting to trading purposes only.

In Bitcoin trading and fee structure, Crypto.com's design is highly connected to its

native token CRO. The platform's basic spot trading fees can reach up to 0.4%, but users who stake CRO and reach specified levels can gradually reduce Bitcoin trading fees, with some high-tier levels reducing to nearly 0%-0.075% range. This mechanism helps reduce long-term trading costs, but also means users must bear additional risks from CRO price volatility. It's worth noting that Bitcoin itself is not a staking asset, with related yields mainly coming from other cryptocurrencies or platform reward designs.

For Taiwanese users, Crypto.com does not provide direct New Taiwan Dollar deposit channels, with practical operations mostly through credit cards, third-party deposits, or first obtaining stablecoins before BTC trading, requiring attention to credit card fees and exchange rate differences. Overall, Crypto.com is more suitable for investors who value mobile operation experience and are willing to participate in the platform ecosystem (including CRO mechanisms); if the main goal is simple, low-cost Bitcoin allocation, the fee structure and usage complexity should still be carefully evaluated.

5. MAX Exchange

Positioning: Bitcoin trading platform providing New Taiwan Dollar deposits and focused on local fiat currency channels.

MAX Exchange is operated by MaiCoin Group and is one of Taiwan's earlier established cryptocurrency exchanges, with the primary function of allowing users to directly purchase Bitcoin (BTC) with New Taiwan Dollars. The platform cooperates with banks to provide TWD trust custody mechanisms, separating user New Taiwan Dollar funds from exchange operating funds, providing a certain trust foundation for investors who value fiat currency fund security and local compliance.

In practical Bitcoin trading, MAX provides BTC/TWD spot trading pairs, suitable for regular or small-amount Bitcoin allocation with TWD. Platform spot trading fees fall around 0.15% (varying slightly by user level), which is common among local exchanges. Due to limited market depth and trading volume compared to large international exchanges, when single transaction amounts are large, attention should be paid to execution slippage and order execution speed, making it more suitable for batch Bitcoin deployment.

For Taiwanese users, MAX's biggest advantage is its relatively simple New Taiwan Dollar deposit and withdrawal process, which can be completed through online banking transfers, reducing fiat currency conversion barriers. However, its tradeable cryptocurrencies and advanced trading tools are relatively limited, with overall positioning leaning more towards "TWD entry platform for purchasing Bitcoin." In practice, many investors use MAX as the first stop for TWD Bitcoin purchases, then transfer Bitcoin to other exchanges for subsequent allocation or management based on needs.

6. BitoPro Exchange

Positioning: Taiwan Bitcoin trading platform combining New Taiwan Dollar deposits and diverse purchase channels.

BitoPro is another major cryptocurrency exchange in Taiwan, providing services for directly purchasing Bitcoin (BTC) with New Taiwan Dollars, with core positioning focused on lowering entry barriers. The platform supports BTC/TWD spot trading pairs, allowing users to directly buy and sell Bitcoin with TWD, providing certain convenience for investors who don't want to handle cross-border remittances or stablecoin conversion processes.

In terms of Bitcoin trading and fees, BitoPro's spot trading fees fall in the 0.1%-0.2% range (varying by user level), which is common among Taiwan local exchanges. The platform's market depth and liquidity are still limited compared to large international exchanges, so when conducting larger Bitcoin transactions, attention should be paid to execution slippage and the necessity of batch order execution. For users primarily focused on long-term holding or regular Bitcoin purchases, its trading environment remains practical.

Additionally, BitoPro also provides over-the-counter trading (OTC) services, featuring large-amount Bitcoin buying and selling assisted by dedicated personnel to reduce market impact. However, it should be noted that in Taiwan's market, OTC and P2P type transactions have long carried higher risks, with related fraud cases occurring from time to time. Even when conducted through platforms, trading counterparties and process security should still be carefully evaluated. Overall, BitoPro is more suitable as one of the local options for TWD Bitcoin purchases, but for large transactions and long-term asset allocation, good risk management and platform diversification strategies are still needed.

How to Buy Bitcoin in Taiwan in 2026: Complete Guide

For Taiwanese users, purchasing Bitcoin (BTC) through international cryptocurrency exchanges remains one of the methods with better liquidity and more stable execution prices. Compared to local platforms with limited currencies and depth, international exchanges usually provide more complete trading functions and higher market efficiency.

In practical operations, many Taiwanese investors choose to use BingX for Bitcoin trading, as its spot market has sufficient liquidity, supports BTC/USDT trading pairs, and features social copy trading, dollar-cost averaging, and automated strategy tools, while providing 100% Proof of Reserves and cold-hot wallet separation mechanisms, achieving relative balance between trading efficiency and asset security.

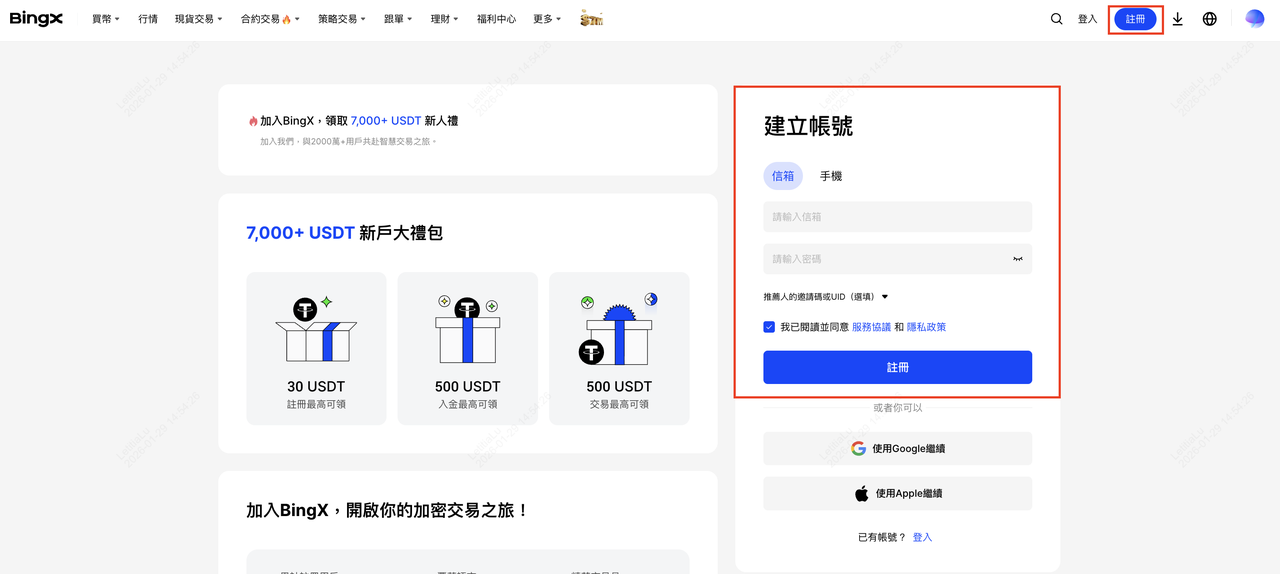

Step 1: Register Account and Complete Identity Verification

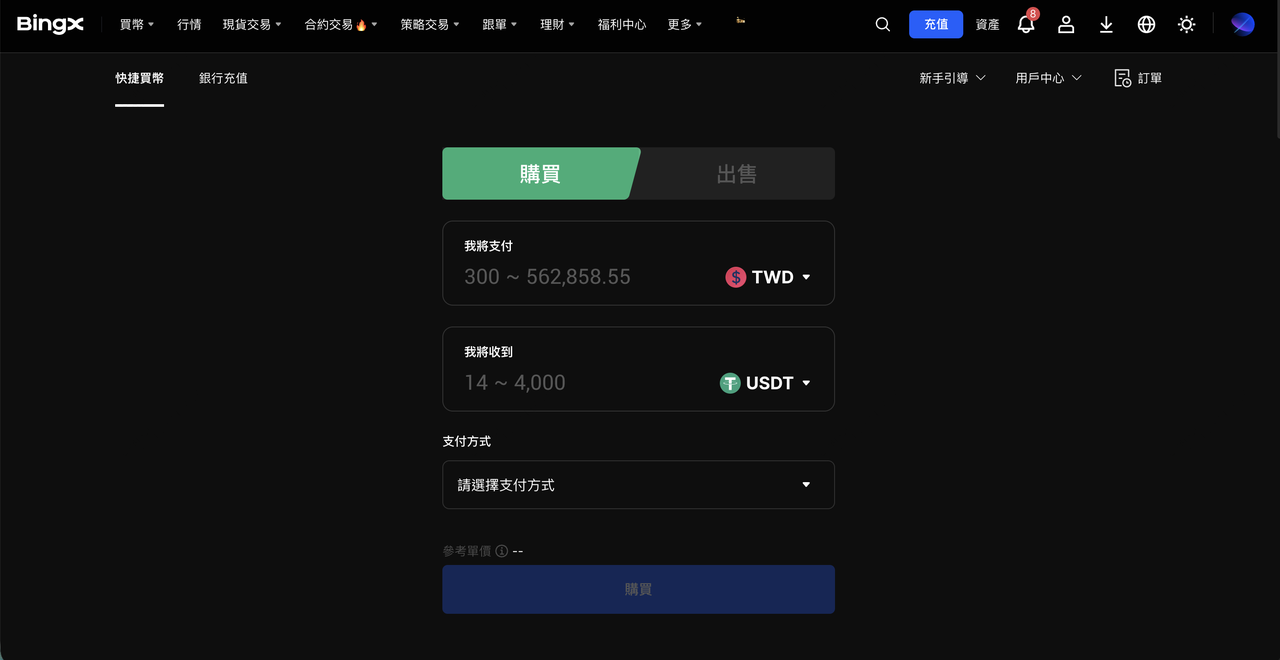

Step 2: Prepare Trading Funds (USDT)

1. Purchase Bitcoin After USDT Deposit

For users who already have crypto assets, they can first obtain

USDT from other platforms or wallets, then transfer USDT to BingX's designated wallet address. After funds arrive, users can enter the BTC/USDT spot market for trading. This method offers higher flexibility, relatively simple fee structure, and usually lower overall trading costs, suitable for investors prioritizing trading efficiency and cost control.

2. Use Credit Cards or Debit Cards to Directly Purchase Bitcoin

BingX also supports using credit cards or debit cards to

directly purchase stablecoins or Bitcoin with New Taiwan Dollars through third-party payment services. This method simplifies processes and offers fast arrival times, suitable for users wanting to complete transactions quickly. However, attention should be paid to credit card fees and exchange rate differences, as overall costs are usually higher than USDT trading. In practice, Taiwanese users can flexibly choose between the two methods based on amount size and convenience needs.

Step 3: Enter Spot Market and Select BTC/USDT

On the spot trading page, select

BTC/USDT trading pair. BingX's Bitcoin market has relatively sufficient depth, supporting

market orders and limit orders, suitable for one-time purchases or batch deployment; it can also be combined with

BingX AI provided market data compilation and trend observation functions to assist in judging current Bitcoin price rhythm and order timing.

Step 4: Place Order to Purchase Bitcoin

Enter the desired USDT amount or BTC quantity and confirm the order. After execution, Bitcoin will appear in the spot wallet. BingX spot trading fees are approximately 0.1%, compared to general spot trading fees of 0.2%-0.4% at some international exchanges, giving BingX certain competitiveness in Bitcoin trading costs.

Step 5: Hold or Withdraw Bitcoin

After completing the purchase, you can choose to keep Bitcoin in BingX as a holding asset, or transfer it to a cold wallet for long-term storage according to personal risk preferences. Subsequently, you can also combine with dollar-cost averaging (DCA) or other automated strategy tools to diversify entry timing risks and conduct more disciplined asset management.

Key Considerations Before Buying Bitcoin in Taiwan

Before purchasing Bitcoin (BTC) in Taiwan, besides understanding the purchase process and platform selection, there are several practical risks and details that require special attention:

1. Platform and Fund Security Risks: Even when conducting Bitcoin trading through major cryptocurrency exchanges, it's recommended to enable two-factor authentication (2FA) and avoid keeping all assets concentrated on a single platform for extended periods. When holding larger amounts, transferring to cold wallets for self-custody can effectively reduce platform risks.

2. Trading Costs and Actual Execution Price Differences: Different purchase methods (USDT trading, credit card purchases, third-party payments) show significant differences in fees, exchange rates, and slippage, with actual execution prices potentially differing from real-time market prices. Before placing orders, understand the differences between market orders and limit orders to avoid affecting final purchase costs.

4. P2P and OTC Trading Fraud Risks: Taiwan's market has seen frequent P2P and OTC cryptocurrency-related fraud cases in recent years, with common tactics including fake investment communities, private currency exchanges, and impersonating customer service. In comparison, conducting Bitcoin trading through exchanges with KYC and risk control mechanisms carries relatively controllable risks.

5. Market Volatility and Emotional Trading Risks: Bitcoin price volatility is relatively large, with dramatic ups and downs in short periods not being uncommon. It's recommended to plan trading strategies in advance, such as batch buying or dollar-cost averaging (DCA), to avoid chasing highs or panic operations due to emotions.

6. Basic Understanding of Regulations and Taxation: Currently, Taiwan does not prohibit individuals from holding or trading Bitcoin, but related regulatory policies are still evolving. It's recommended to maintain complete trading records and have basic awareness of potential tax reporting obligations to reduce future compliance risks.

Conclusion: Why BingX Is the Best Platform to Buy Bitcoin in Taiwan in 2026

In 2026's market environment, Bitcoin price maintains high-level volatility while market structure and funding sources have significantly matured. For Taiwanese investors, when purchasing Bitcoin, choosing trading methods with liquidity, transparent fee structures, and comprehensive security mechanisms remains an important foundation for risk reduction.

From a practical perspective, compared to over-the-counter trading or convenience stores with higher costs and harder-to-control risks, conducting Bitcoin spot trading through mainstream cryptocurrency exchanges offers clearer processes and easier asset management and subsequent adjustments. Combined with strategies like batch buying or dollar-cost averaging (DCA), this helps balance entry costs in volatile environments.

Overall, buying Bitcoin in Taiwan in 2026 requires understanding trading processes, mastering costs and risk sources, and choosing platforms and operational methods that best suit individual needs. As markets continue evolving, stable, disciplined allocation methods remain important prerequisites for long-term participation in Bitcoin markets.

FAQs on Buying Bitcoin in Taiwan

1. Is buying Bitcoin legal in Taiwan?

Currently, Taiwan does not prohibit individuals from holding or trading Bitcoin. General investors can legally purchase and hold Bitcoin through cryptocurrency exchanges, but should still pay attention to relevant regulations and platform compliance requirements.

2. Can I buy Bitcoin with New Taiwan Dollars (TWD)?

Yes. Some Taiwanese exchanges provide BTC/TWD trading pairs for direct Bitcoin purchases with New Taiwan Dollars; international exchanges mostly complete transactions through USDT or credit card methods.

3. Is it safe to buy Bitcoin with a credit card in Taiwan?

Credit card purchases offer fast processes and convenient operations, but usually generate higher fees and exchange rate differences. For larger amounts or cost-conscious users, Bitcoin trading through USDT usually offers more flexibility.

4. Do I need to move Bitcoin to a cold wallet after buying?

Not necessarily. For smaller amounts or frequent trading needs, temporary storage in exchange wallets is acceptable; for larger amounts or long-term holding, transferring to cold wallets for self-custody carries relatively lower risks.

5. Is buying Bitcoin via P2P or OTC safe in Taiwan?

Relatively higher risks. Taiwan has seen frequent P2P and OTC fraud cases in recent years, involving private fund flows and counterparty risks. In comparison, trading through exchanges with KYC and risk control mechanisms is more controllable.

6. What is the best Bitcoin investment strategy in 2026?

In high volatility environments, batch buying or dollar-cost averaging (DCA) are common allocation methods, helping reduce price risks from single entry points.

7. Do you need to pay taxes when buying Bitcoin in Taiwan?

Current cryptocurrency taxation regulations in Taiwan are still developing. It's recommended to maintain complete trading records and stay aware of potential income or transaction-related tax regulations in the future.