Tokenized stocks represent a transformative innovation in financial markets, blending traditional equities with blockchain technology. In 2026, these assets, also known as xStocks or similar variants, allow investors to gain exposure to real-world company shares like

Apple,

Tesla, or

NVIDIA through digital tokens backed 1:1 by underlying equities held in regulated custody.

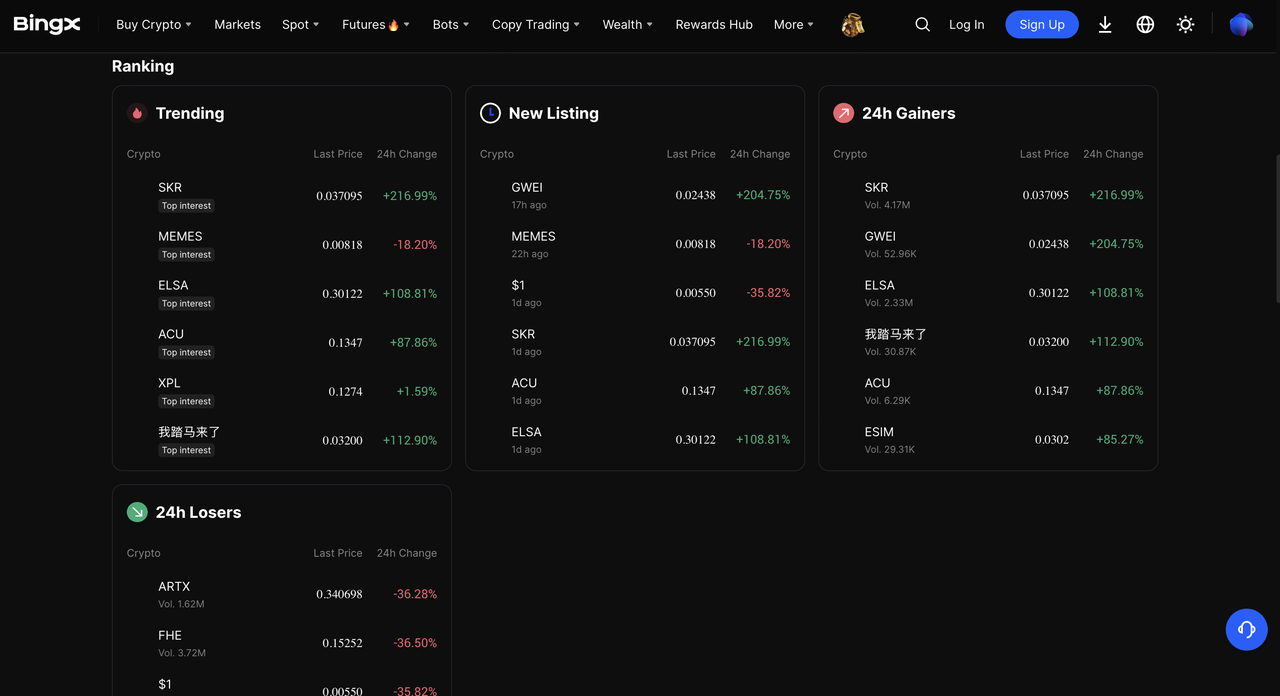

The top platforms leading this space include

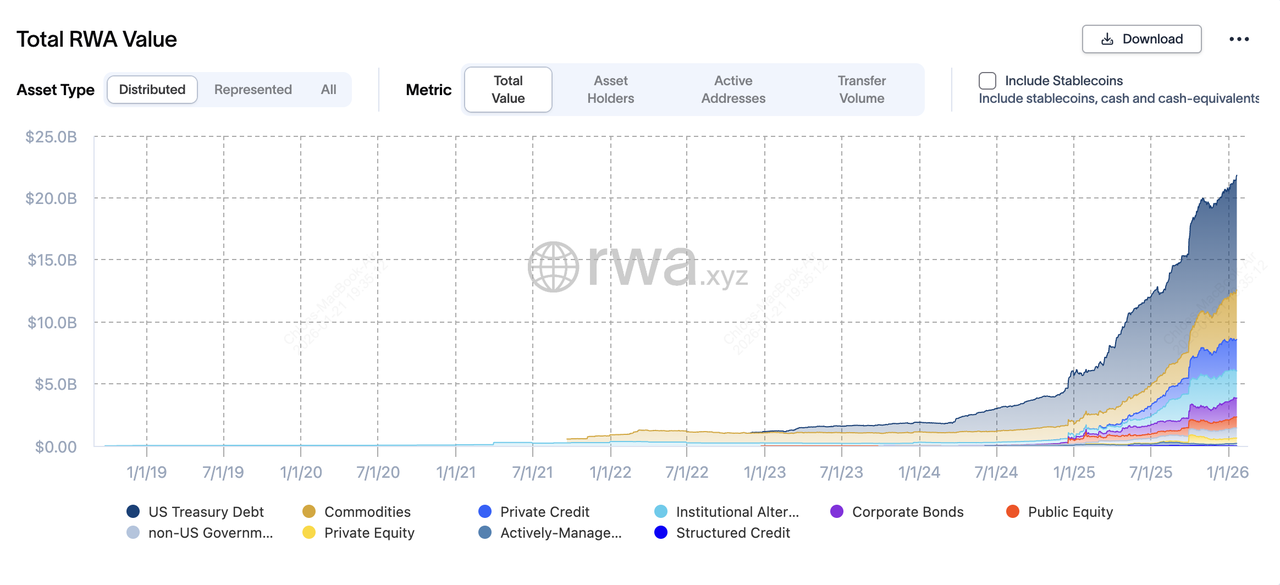

BingX, NYSE, Kraken xStocks, Bybit xStocks, Gemini Tokenized Stocks, Raydium, Robinhood EU, Jupiter, Kamino, and Phantom. The broader tokenized

real-world assets (RWA) market, which includes tokenized stocks alongside treasuries, bonds,

indices, and

commodities, has seen explosive growth, with projections estimating it could reach up to $400 billion by the end of 2026 from around $36 billion earlier in the year, driven by institutional adoption and

DeFi convergence.

Tokenized equities specifically contribute to this surge, with leading tokens like

TSLAX (Tesla) holding market caps in the tens of millions, such as approximately $71 million for

TSLAX, and overall tokenized stock liquidity expanding rapidly on chains like

Solana, dominating with over $875 million in value and more than 95% of trading volume in recent periods, and

Ethereum.

What Are Tokenized Stocks (xStocks) and How Do They Work?

Tokenized stocks or xStocks are blockchain-based digital representations that mirror the price performance of traditional company shares or ETFs. A regulated issuer purchases and holds the actual underlying shares with licensed custodians, minting corresponding tokens on chains like Solana, Ethereum, or others. These tokens trade on centralized exchanges (CEXs) like

BingX or

decentralized platforms (DEXs), providing economic exposure, typically without voting rights or full shareholder protections, while maintaining a 1:1 peg through redemption mechanisms for eligible parties. This structure enables near-24/7 trading, low barriers to entry, and

DeFi composability, such as using tokens as collateral or in liquidity pools.

What Are the Benefits of Investing in Tokenized Equities?

Investing in tokenized equities offers several compelling advantages over traditional stock trading in 2026. Key benefits include extended or near-24/7 trading hours, allowing investors to react immediately to global news, earnings reports, or macroeconomic events outside conventional market sessions. Fractional ownership enables entry with small amounts, often as little as a few dollars, democratizing access to high-value stocks like Tesla, NVIDIA, or Apple and supporting better diversification.

Global accessibility removes barriers for users in regions with limited brokerage options, while instant on-chain settlement reduces counterparty risk and eliminates multi-day clearing delays. Additional perks encompass lower transaction costs in many cases, enhanced liquidity through peer-to-peer mechanisms, and

DeFi integration for advanced strategies like using tokens as collateral in lending protocols, providing yield via liquidity pools, or enabling programmable features.

These elements combine to create a more efficient, inclusive, and flexible bridge between traditional finance and blockchain ecosystems, with the tokenized asset market's rapid quadrupling in value through 2025 underscoring growing demand for these efficiencies.

What Are the Top 10 Platforms to Trade Tokenized Stocks in 2026?

Several platforms stand out for trading tokenized stocks in 2026, ranging from user-friendly CEXs to

DeFi-native options on

Solana. Here is a ranked list highlighting the top choices based on accessibility, liquidity, features, regulatory backing, and user adoption.

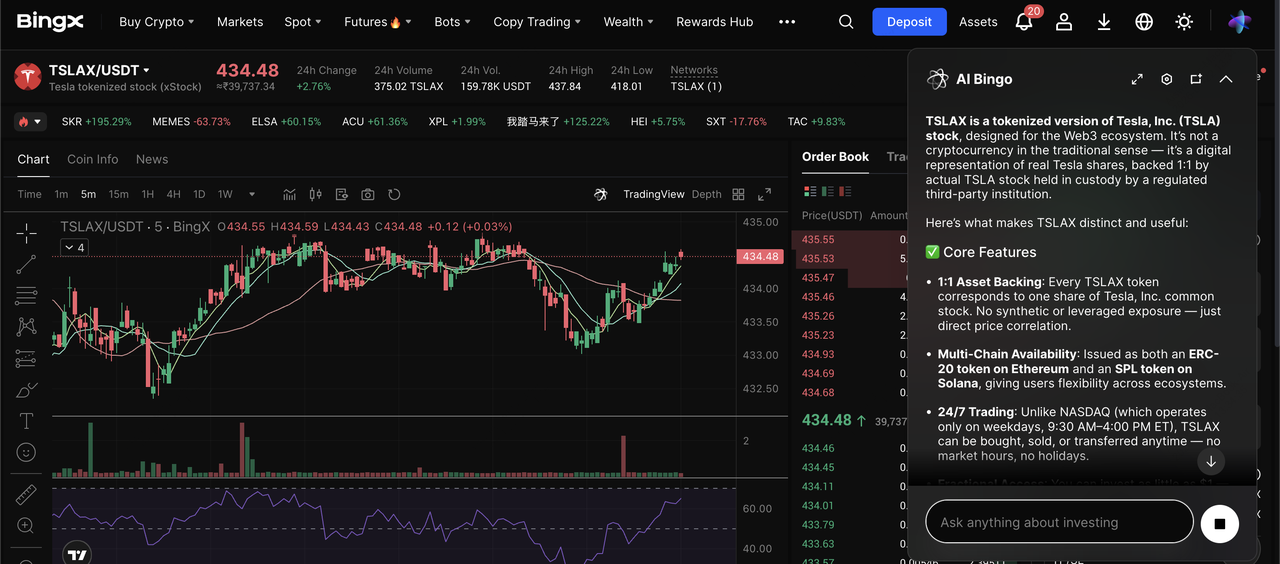

BingX spot market and

futures markets ranks as the top choice due to its seamless integration of tokenized stocks with crypto trading tools. It offers both spot and futures markets for a wide range of tokenized equities, including Solana-based xStocks like

AAPLx,

NVDAx, and

TSLAX, alongside Ondo-issued assets such as GOOGLon, SPYon, and other U.S. equity trackers, supporting up to 35 spot tokenized equities and 26 futures markets.

BingX is highly versatile as it also supports trading traditional stock futures with crypto in addition to tokenized stocks. Key advantages include trading with

USDT/

USDC, fractional access starting from pennies, zero-fee spot trades in many cases,

BingX AI-powered insights for real-time trend detection and analytics, leverage options in futures for advanced strategies like longing or shorting tokenized positions, high liquidity with deep order books, copy-trading features for beginners, and a familiar, intuitive interface that bridges tokenized stock exposure with crypto-native features, making it ideal for beginners and experienced traders seeking diversified, around-the-clock access without traditional brokerage hurdles, especially in regions with restricted access.

Beyond tokenized stocks,

BingX TradFi enables traders to trade stock perpetual futures directly with crypto, offering 24/7 access to global equity exposure without a traditional brokerage account. On BingX TradFi, users can trade popular stock perpetuals such as

Apple (AAPL),

Tesla (TSLA),

NVIDIA (NVDA),

Microsoft (MSFT),

Amazon (AMZN),

Meta (META),

Alphabet (GOOGL), and stock indices like

S&P 500–linked products, all settled in

USDT.

NYSE is pioneering a blockchain-based platform for tokenized securities and ETFs, enabling 24/7 trading with instant settlement. As a major traditional exchange operator, it combines its established Pillar matching engine with on-chain capabilities and blockchain-based post-trade systems, potentially supporting fungible tokenized shares alongside native digital ones, including dividends, governance rights, dollar-based orders, and stablecoin funding, positioning it as a bridge for institutional adoption pending full regulatory rollout and expanding tokenized U.S. listed equities access.

Kraken xStocks provides reliable access to over 60 tokenized U.S. stocks and ETFs (including names like

TSLAx, AAPLx, NVDAx, and GameStop GMEx), backed 1:1 by real shares and issued as SPL tokens on-chain. It supports 24/5 trading (with expansions toward full 24/7 and weekend support), self-custody withdrawal to personal wallets, zero trading fees for certain purchases using USD or stablecoins, instant clearing, dividend adjustments reflected in token balances, and strong integration within a trusted crypto exchange environment, making it especially strong for non-U.S. users seeking compliant, regulated exposure with growing liquidity.

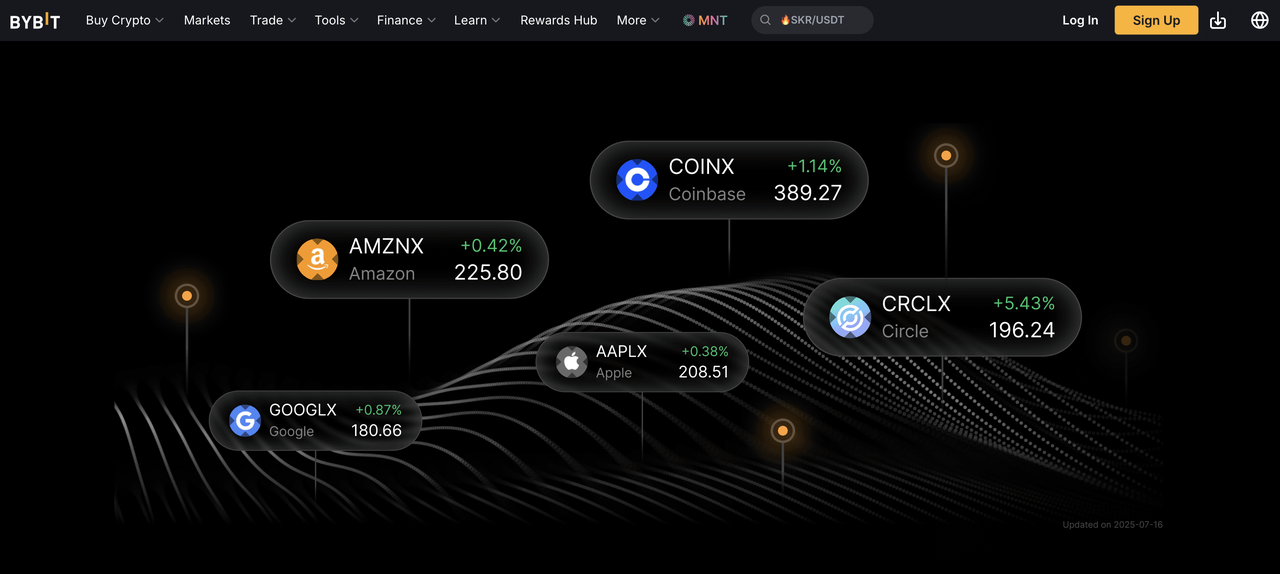

4. Bybit xStocks

Bybit xStocks delivers 24/7 spot trading of tokenized equities issued under Swiss regulations by providers like Backed Finance, with broad global accessibility (though restricted in some regions like parts of EEA), DeFi interoperability, and support for major names like NVIDIA, Tesla, Apple, and Amazon. It emphasizes borderless, on-chain experiences with competitive execution,

USDT trading pairs, fractional ownership, and seamless integration across

CEX and DeFi ecosystems for enhanced liquidity and flexibility.

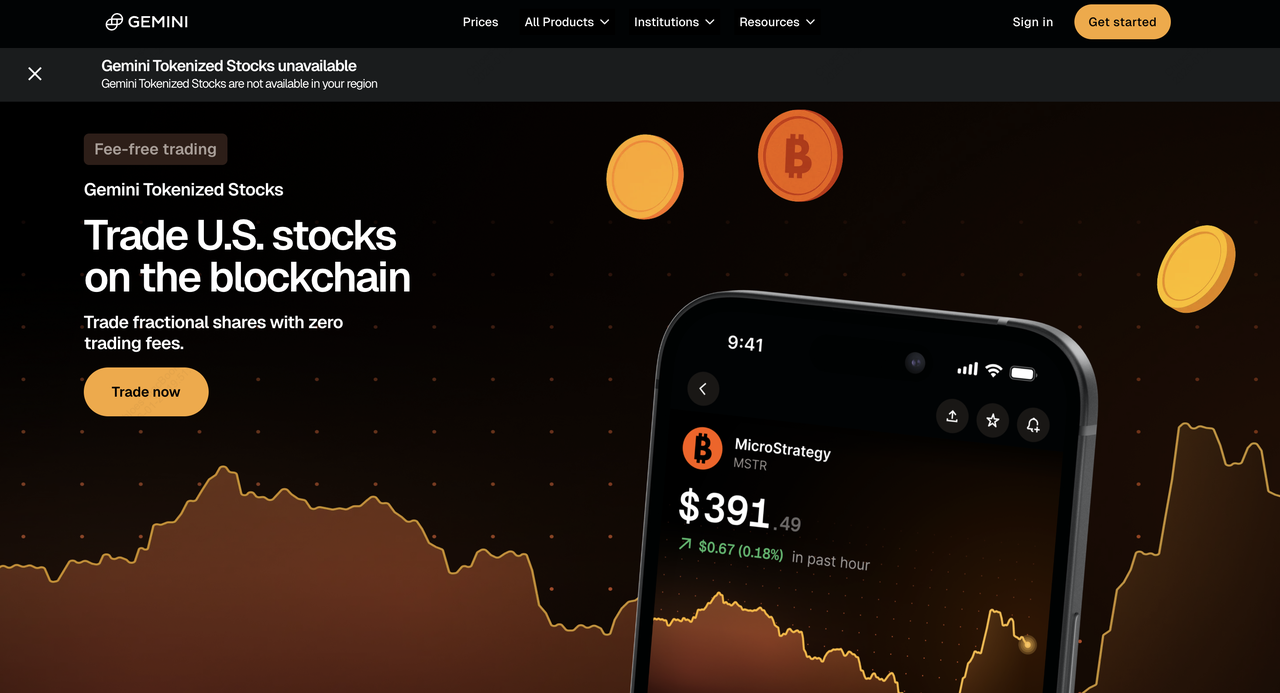

5. Gemini Tokenized Stocks

Gemini Tokenized Stocks focuses on EU users, providing fractional, blockchain-based U.S. equities (including partnerships like Dinari for assets such as MicroStrategy) without a traditional U.S. broker requirement. It combines crypto reliability with equity exposure in a highly regulated setting, robust custody, tight spreads (around 0.4% in tests), reliable order execution, and secure infrastructure suitable for compliant, secure trading in restricted jurisdictions.

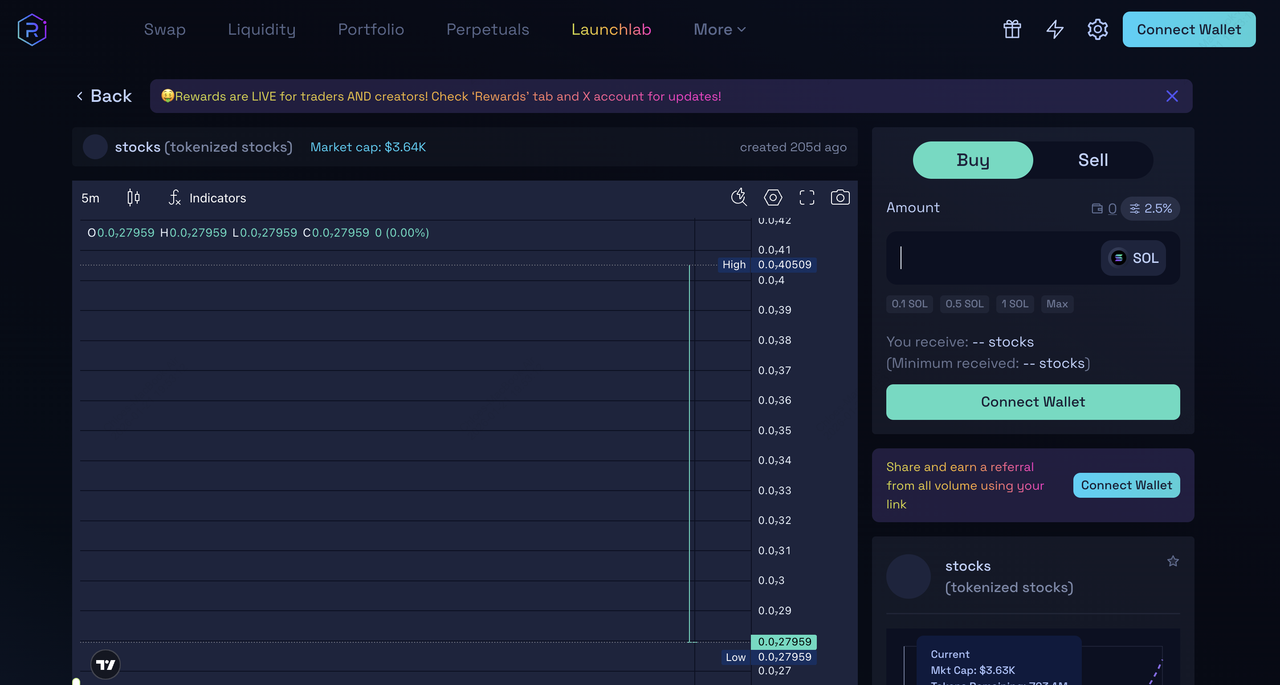

6. Raydium

Raydium is a leading Solana

DEX, serves as a primary liquidity hub for xStocks, enabling direct swaps, liquidity provision to earn fees, and on-chain trading in a fully decentralized DeFi environment. It offers fast, low-cost transactions leveraging Solana's high throughput, integration with tokenized equities for pools involving TSLAx or NVDAx, and composability with other protocols, ideal for users seeking self-custody and DeFi yield opportunities.

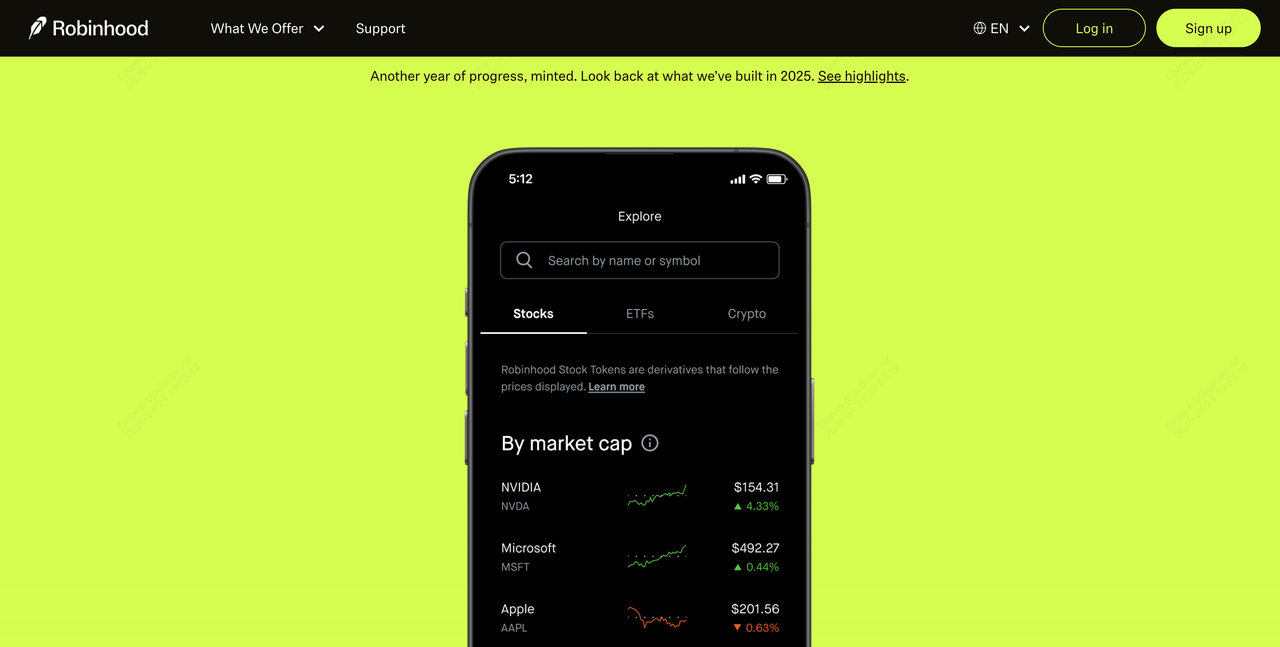

7. Robinhood EU

Robinhood EU offers tokenized versions of over 200 (and growing) U.S. stocks and ETFs exclusively for European users, built on networks like Arbitrum with near-24/7 access, zero commissions in many cases, dividend support via blockchain, fractional trading starting at €1, and a familiar, user-friendly mobile app interface, making it highly accessible for beginners in the EU seeking seamless entry into tokenized equities.

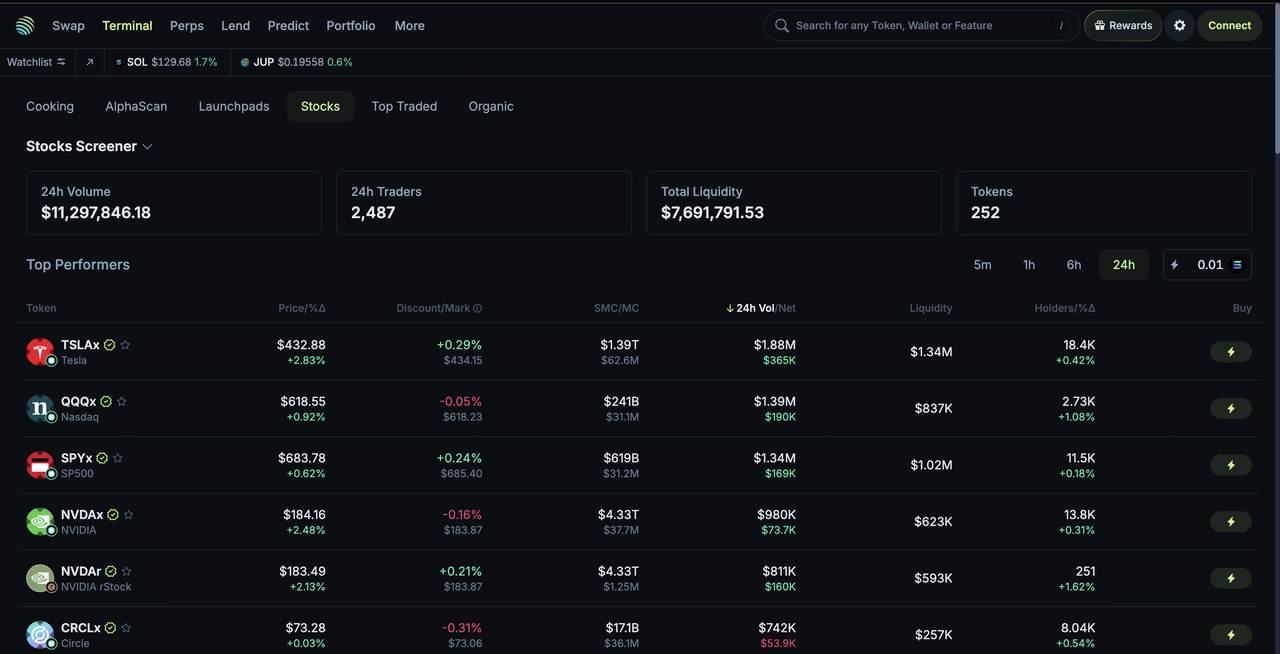

8. Jupiter

Jupiter is Solana's premier

DEX aggregator that routes trades across multiple protocols for optimal pricing and execution on tokenized stocks like xStocks. It supports efficient swaps, low slippage, integration with broader DeFi tools, and competitive routing for assets such as AAPLx or TSLAX, enhancing liquidity and best-price discovery in the

Solana ecosystem for advanced on-chain traders.

Kamino enhances tokenized stock utility on

Solana by allowing them as collateral in lending markets, enabling borrowing against positions like AAPLx, TSLAx, or NVDAx, yield strategies through structured products, automated lending/borrowing, and swaps via Kamino Swap. It provides decentralized leverage, risk management tools, and composability in DeFi, perfect for users looking to amplify exposure or generate yield on tokenized equities.

Phantom wallet provides native support for xStocks on

Solana, allowing users to hold, view, manage, and securely store tokenized equities alongside other assets with full self-custody. It features easy connectivity to

DEXs like Raydium or

Jupiter for trading, DeFi participation, wallet security tools, and seamless integration, serving as an essential gateway for on-chain tokenized stock holders prioritizing control and multi-asset management.

How to Trade Tokenized Stocks on BingX: Step-by-Step Guide

Source:

TSLAX/USDT trading pair on the spot market powered by BingX AI

BingX combines tokenized equities with

BingX AI–powered tools to help you identify trends, manage risk, and execute trades efficiently. Whether you prefer owning spot exposure or trading price movements with leverage, BingX offers two flexible ways to trade xStocks using crypto.

Buy and Sell Tokenized Stocks on the BingX Spot Market

Spot trading is ideal if you want direct price exposure to tokenized stocks without leverage.

1. Log in to your BingX account and fund it with

USDT.

3. Use BingX AI indicators and charts to analyze price trends and liquidity.

4. Place a Market order for instant execution or a Limit order at your preferred price.

5. Hold the xStock for long-term exposure or sell anytime; spot markets allow straightforward buy-and-hold strategies.

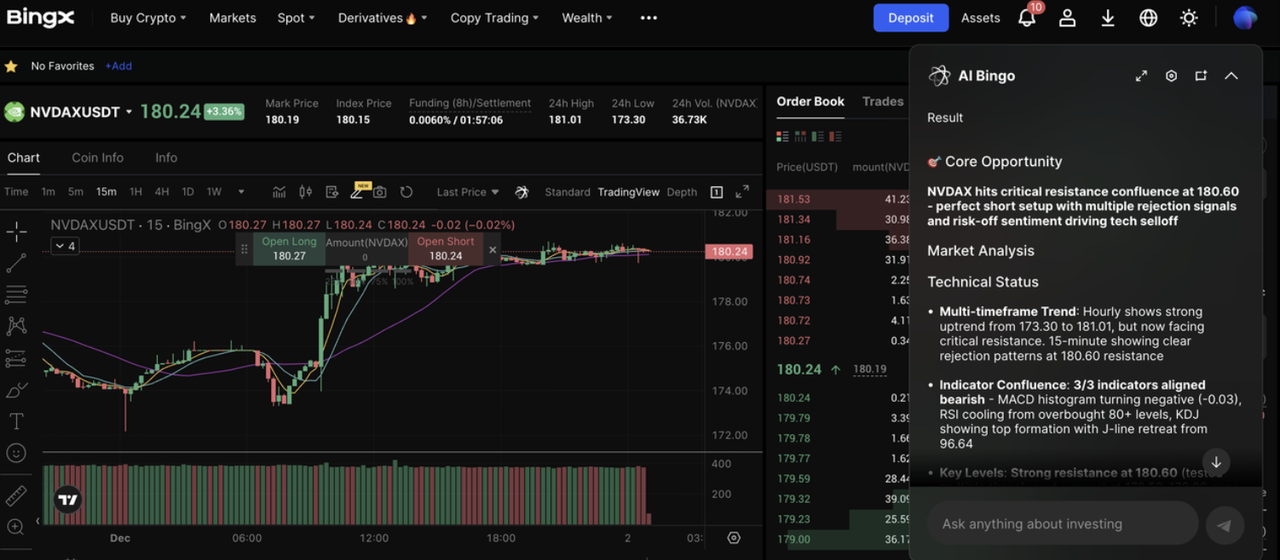

Long or Short Tokenized Stocks with Leverage on the Futures Market

NVDAX/USDT perpetual contact on the futures market powered by BingX AI

Futures trading suits active traders who want leverage, hedging, or short-selling flexibility.

3. Choose Cross or Isolated margin and set your leverage based on risk tolerance.

4. Use BingX AI insights,

funding rates, and order book depth to time entries.

Tip: Futures amplify gains and losses. Use conservative leverage and always apply TP/SL to protect capital.

Conclusion: Should You Trade Tokenized Stocks in 2026?

Tokenized stocks in 2026 bridge traditional finance and blockchain, delivering greater accessibility, flexibility, and innovation through extended hours, fractional investing, and DeFi potential. Platforms like BingX lead for ease and tools, while

Solana-based options such as Raydium, Jupiter, Kamino, and Phantom excel in on-chain composability, and regulated players like Kraken, Bybit, Gemini, Robinhood EU, and emerging NYSE developments ensure security and scale. As adoption grows amid projections of a multi-hundred-billion-dollar tokenized asset market, these assets promise to reshape global investing, though users should weigh risks like regulatory variances, market volatility, and platform-specific limitations before participating. Always conduct due diligence and invest responsibly.

Related Reading