Buying Bitcoin (BTC) in Russia in 2026 requires more attention to regulation, custody risk, and operational safety than in many other markets. While crypto ownership is increasingly recognized under Russian law, trading activity is moving into a tightly controlled regulatory framework, with stricter oversight, transaction limits for retail users, and new rules around asset seizure.

This guide explains what Russia’s crypto environment looks like in 2026, what it means for everyday

Bitcoin buyers, and the best crypto platforms Russians commonly use to

buy BTC safely and practically.

Russia Crypto Market Outlook in 2026: What Bitcoin Buyers Should Know

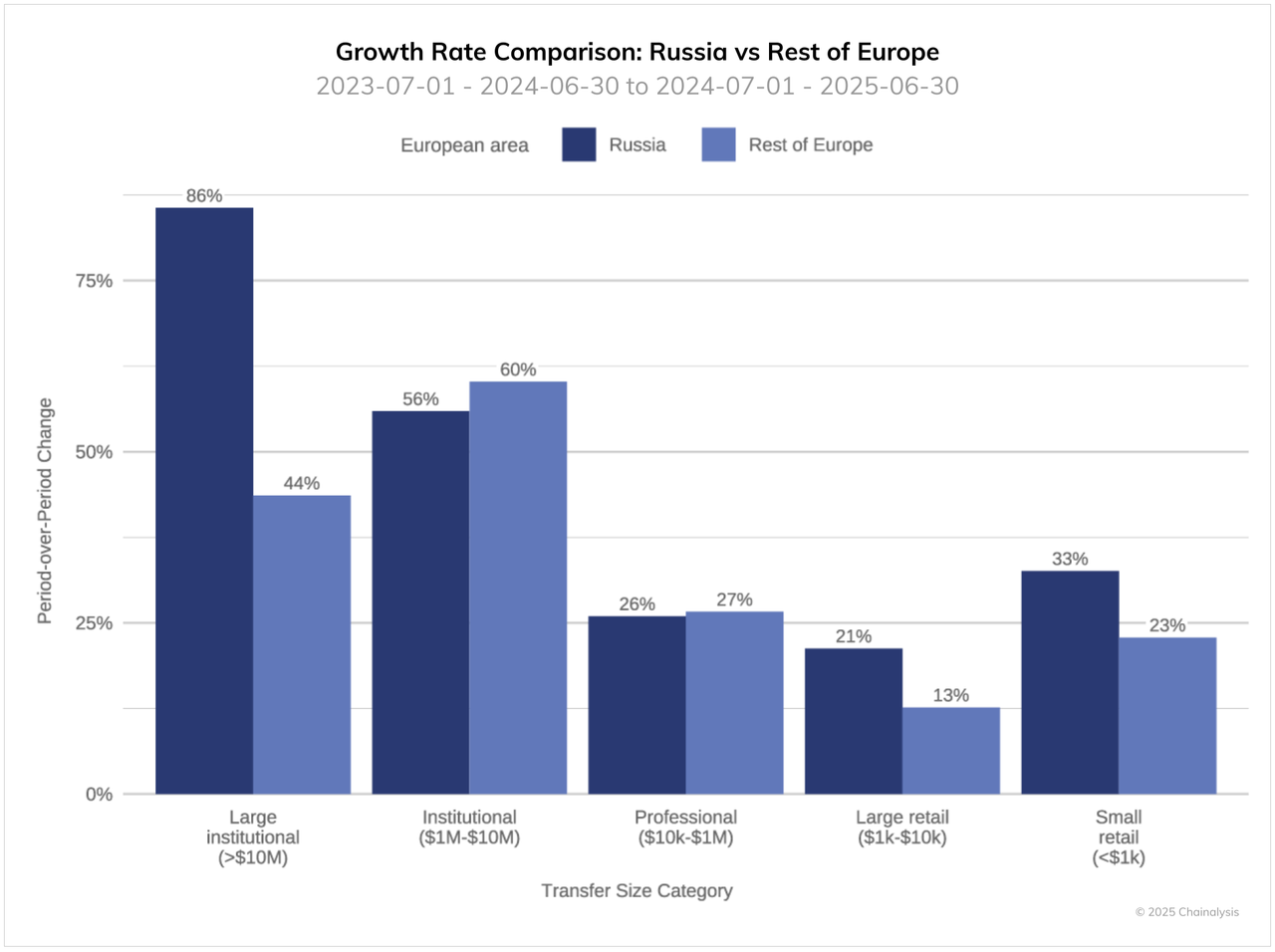

Russia's growing crypto adoption | Source: Chainalysis

Russia has entered a transition phase in crypto regulation. Lawmakers have advanced legislation that explicitly recognizes cryptocurrencies as property, allowing them to be seized and confiscated within criminal proceedings even before a full retail trading framework is finalized. At the same time, the Central Bank of Russia has proposed a comprehensive regulatory regime scheduled for adoption by mid-2026, signaling a shift from ambiguity to structured oversight.

Under the proposed framework, cryptocurrencies and stablecoins are treated as monetary assets that can be bought and sold but cannot be used as a means of domestic payment. Ordinary Russian citizens are expected to gain legal access to BTC through regulated platforms, but with annual purchase caps (currently proposed at 300,000 rubles per intermediary) and mandatory risk-awareness tests. Qualified investors may trade without volume caps but will also face compliance requirements.

Despite tighter rules, adoption remains extremely strong. According to Chainalysis, Russia ranked as Europe’s largest crypto market, receiving over $376 billion in crypto value between July 2024 and June 2025, driven by institutional flows, cross-border usage, and rising DeFi activity. This combination of high adoption and stricter controls makes platform choice especially important for Russian BTC buyers in 2026.

What Does This Mean for Russian Crypto Buyers?

• Russian users should expect stronger KYC/AML checks, transaction monitoring, and clearer enforcement rules.

• As a BTC buyer in Russia, you should prioritize platforms with clear compliance posture, transparent fees, and predictable BTC withdrawals to

self-custody.

• Custody matters more than ever, as crypto seizure laws emphasize asset control, not just ownership.

• Liquidity, execution quality, and operational safety often outweigh convenience when choosing where to buy BTC.

What Are the Best Crypto Platforms to Buy Bitcoin in Russia in 2026?

When choosing a Bitcoin platform in Russia, focus on security controls, custody transparency, liquidity, and withdrawal reliability, rather than just price. Based on these criteria, here are the eight most practical platforms Russians use to buy BTC in 2026.

1. BingX

BingX stands out in 2026 as a practical, globally accessible platform for buying and trading Bitcoin, particularly for users in Russia where

P2P remains the most reliable on-ramp. With more than 40 million users worldwide, BingX’s P2P marketplace supports bank transfers and local payment methods via verified merchants, allowing users to convert RUB to USDT efficiently before

trading BTC on the

spot market. This P2P to spot flow is widely used in Russia due to its flexibility, competitive pricing, and predictable settlement.

Beyond P2P, BingX supports fiat on-ramps that include RUB via partner channels, alongside deep BTC liquidity across spot and

derivatives markets and fast, transparent BTC withdrawals to

self-custody wallets, an important consideration in a shifting regulatory environment. BingX is also a leading social trading platform: its

BingX AI stack, including AI Bingo and AI Master, helps users interpret market conditions and manage leverage risk, while

Copy Trading lets beginners follow professional traders using clear metrics such as ROI, drawdown, and trade history. For diversification beyond crypto, BingX offers

tokenized stocks and

tokenized commodities on crypto markets and

BingX TradFi, which lets users trade

forex,

indices, stocks, and

commodities as USDT-settled perpetual futures, all from one account.

Best for: P2P buyers in Russia, beginner traders, copy traders, and users seeking BTC with global diversification and predictable withdrawals.

2. Matbea

Matbea is a Russia-focused crypto platform that has operated since 2014, initially as a Bitcoin web wallet and later expanding into a full exchange and

P2P ecosystem tailored to ruble users. It supports BTC and major cryptocurrencies, 3

stablecoins, and 49 crypto assets, with fiat on- and off-ramps handled via a dedicated P2P system that integrates widely used Russian payment methods such as Sberbank, Tinkoff, and the Fast Payment System (FPS). Matbea reports 200,000+ users, 22,000+ orders per week, and ₽3.8 billion in turnover in 2022, and offers tools like Matbea Swap for instant crypto–fiat conversion with minimal commissions, a multi-currency wallet, mobile apps, and address risk scoring to block high-risk funds.

Key consideration: because pricing often routes through P2P and instant swap mechanisms, liquidity and spreads can be less competitive during high volatility, so users should compare the all-in cost against global exchanges before executing larger BTC trades.

Best for: users who prefer a Russia-centric platform with straightforward BTC access.

3. Coinbase

Coinbase is one of the world’s most established crypto exchanges and the largest publicly traded crypto company, operating with quarterly financial disclosures and a strong compliance framework. It offers a clean, beginner-friendly interface for buying BTC, conservative custody practices where customer assets are not lent without consent, and access to Advanced Trade with real-time order books, TradingView-powered charts, and volume-based fees that can drop to 0.0% maker fees for active traders.

Key consideration: for users in Russia, local fiat access is limited and funding friction is higher, meaning purchases often rely on indirect rails and can carry higher effective costs (fees + spreads) compared to trading-focused global platforms.

Best for: beginners who value simplicity, brand trust, and regulatory clarity.

4. Kraken

Kraken is a security-focused global exchange founded in 2011, serving over 13 million users and consistently ranking among the world’s top venues by BTC liquidity, with recent 24-hour spot volume of $1.45 billion. It supports over 120 cryptocurrencies, advanced order, margin and futures trading up to 5× leverage, and publishes independent financial reserve audits, reinforcing its reputation for transparency and asset protection. On Kraken Pro, BTC trading fees can fall to 0.00% maker and 0.10–0.26% taker, making it cost-efficient for active traders.

Key consideration: for users in Russia, limited local funding options and fiat friction can increase operational complexity and all-in costs, meaning Kraken is best suited to users who prioritize security and liquidity over ruble-native convenience.

Best for: security-focused users comfortable with international funding rails.

5. Blockchain.com Wallet

Blockchain.com Wallet is one of the most widely used self-custody crypto wallets, enabling users to buy, store, swap, and manage BTC while retaining full control of their private keys across Bitcoin and other major networks. The wallet integrates built-in buy and swap features, supports dozens of crypto assets, and provides access to DeFi apps and on-chain services, making it attractive to Russian users who prioritize custody sovereignty and asset control as crypto is increasingly treated as property under law.

Key consideration: purchasing BTC directly inside a wallet typically involves higher spreads and fewer execution protections than centralized exchanges, so it is best suited for long-term holding and self-custody rather than cost-optimized or high-frequency BTC buying.

Best for: users who prioritize self-custody and long-term holding over active trading.

6. Telegram Wallet

Telegram Wallet is a lightweight, messaging-integrated crypto wallet that lets users send, receive, hold, and sometimes trade BTC directly inside Telegram, reaching an audience of 900M+ Telegram users. Recent upgrades added multi-asset support, basic trading, and yield-style features, such as earning on TON and USDT, making it convenient for small transfers and everyday P2P use.

Key consideration: wallets accessed via bots or in-app integrations can be custodial or semi-custodial, security settings vary, and regulatory clarity differs by region, factors that limit its suitability for large balances or cost-optimized BTC buying.

Best for: quick P2P BTC transfers, small balances, and users who want crypto access without leaving Telegram.

7. Bitpapa

Bitpapa is a global P2P crypto marketplace that lets users buy and sell BTC directly with one another using 100+ payment methods, including bank transfers and local options, with trades protected by escrow until completion. The platform emphasizes accessibility with 0% trading fees, a user-friendly interface, 24/7 support, and even a Telegram-based wallet and P2P bot, making it popular among users who prefer flexible payment routes and direct control over transactions rather than centralized exchange order books.

Key consideration: pricing depends on counterparties, so spreads can widen during volatility and users must carefully follow escrow rules to avoid disputes.

8. Whitebird.io

Whitebird is a Belarus-based, fully regulated crypto-fiat platform operating as a resident of the country’s High-Tech Park under Presidential Decree No. 8, positioning itself as one of the largest legal crypto platforms in the CIS. It offers instant crypto-fiat exchange, spot and margin trading, leverage up to 1:100, and supports major pairs like BTC/USD, BTC/USDT, ETH/USDT, alongside regional fiat rails for BYN, RUB, USD, and EUR. With 80,000+ clients, 100+ trading instruments, audited operations, and integrated crypto cards like Visa, Mastercard, MIR, Belkart for Belarus and Russia, Whitebird focuses on bridging traditional finance and crypto in a compliant, bank-adjacent model.

Key consideration: strong regulation and KYC/AML increase trust, but geographic scope and product access are primarily CIS-focused, which may limit flexibility for global users.

Best for: users in Belarus, Russia, and the CIS who want a legally compliant crypto-fiat exchange with banking-style rails and cards.

How to Buy Bitcoin (BTC) in Russia on BingX

If you want to buy Bitcoin in Russia, BingX keeps the process simple and controlled. Because BingX P2P supports USDT, you have two practical options depending on how you fund your account.

Option 1: Buy BTC in Russia with RUB via USDT First

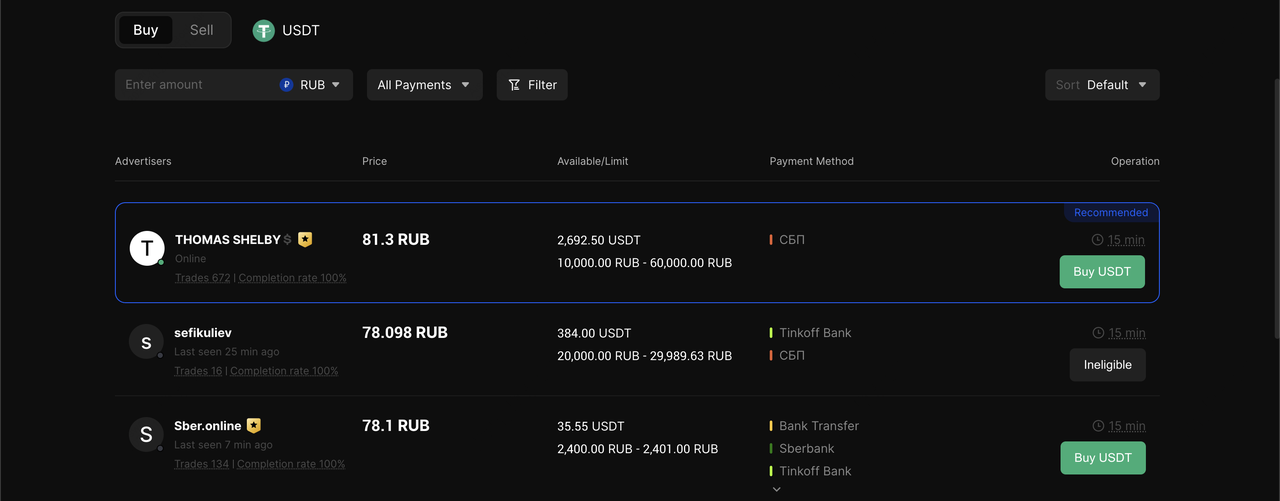

Fund your BingX account by buying USDT with RUB via P2P trading

2. Use supported fiat partners or P2P to

acquire USDT with RUB.

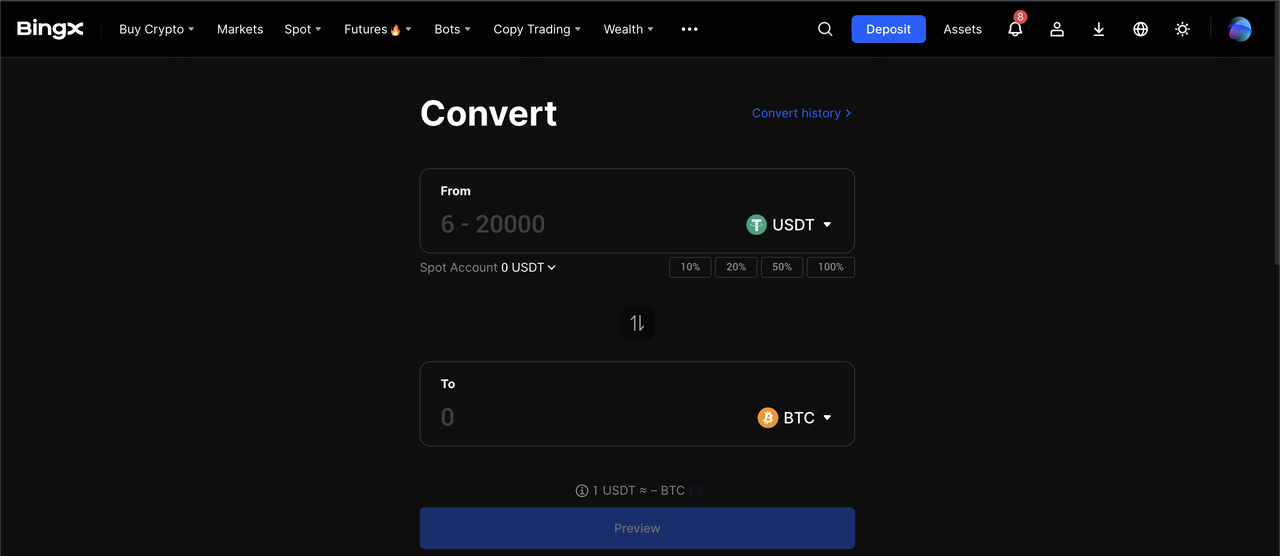

3. Convert USDT to BTC using Convert or trade BTC/USDT on the spot market.

4. Hold BTC on BingX or withdraw to your personal wallet for full custody control.

Swap USDT for BTC on BingX Convert

Option 2: Buy BTC on the Spot Market with Existing USDT

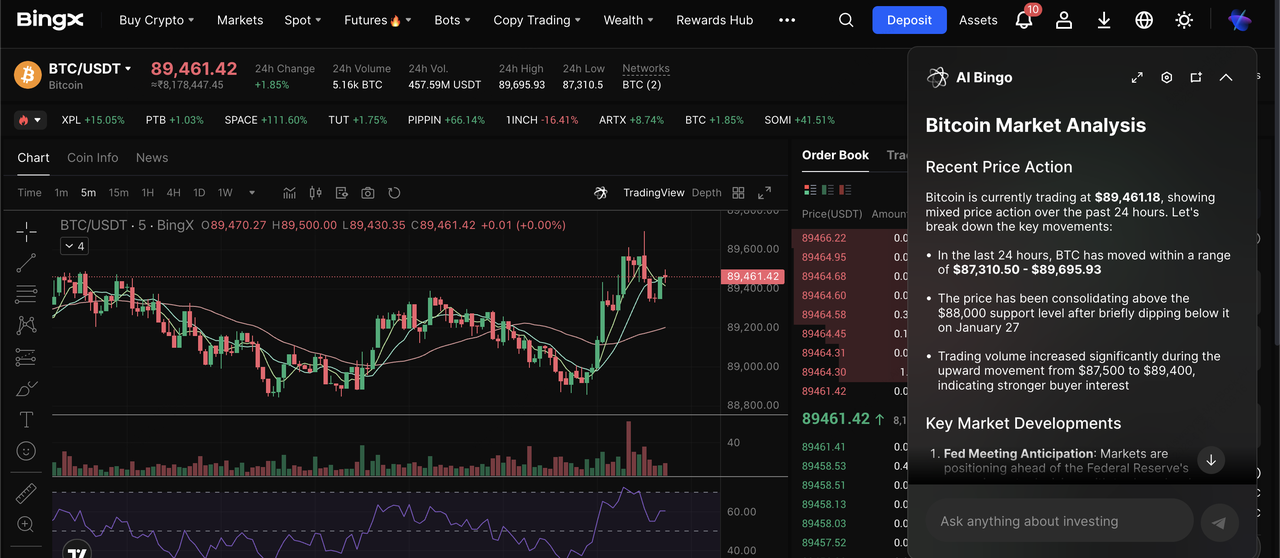

BTC/USDT trading pair on the spot market powered by BingX AI insights

1. Transfer USDT to your BingX account from another exchange or wallet.

2. Trade the

BTC/USDT pair on the spot market, supported by BingX AI insights for trend and risk analysis.

3. Keep BTC on BingX for trading or withdraw to self-custody when needed.

Top 5 Safety Tips for Buying BTC in Russia

Because Russia’s crypto rules increasingly emphasize asset control, custody responsibility, and enforcement, buying Bitcoin safely in 2026 requires disciplined operational habits, not just price comparison.

1. Enable

two-factor authentication (2FA) for both login and withdrawals immediately, using app-based authenticators to reduce the risk of account takeover.

2. Use unique, high-strength passwords and access exchanges only from secure, up-to-date devices to avoid malware,

phishing, or SIM-swap attacks.

3. Prioritize platforms that offer clear, fast, and predictable BTC withdrawals, so you can move funds to self-custody without unexpected delays or manual intervention.

4. Avoid off-platform deals, private brokers, or “guaranteed” pricing, which are common vectors for fraud and can leave you without legal or platform protection.

5. Store long-term BTC holdings in a self-custody wallet, ideally a

hardware wallet, and keep only the amount you actively trade on exchanges.

Final Thoughts: Choosing the Right BTC Platform in Russia

In 2026, buying Bitcoin in Russia is no longer unregulated, but it is more controlled, more monitored, and more custody-sensitive than before. The best platform is one that balances compliance, liquidity, security, and withdrawal freedom.

For users seeking flexibility, global access, and strong risk controls, BingX stands out as a practical all-around option that scales from first BTC purchase to advanced trading. Still, Bitcoin remains volatile and regulatory conditions continue to evolve, so always start small, secure your assets, and invest only what you can afford to lose.

Related Reading

FAQs on Buying Bitcoin in Russia

1. Is Bitcoin legal in Russia in 2026?

Bitcoin is recognized as property and can be bought and sold under regulated conditions, but it cannot be used for domestic payments.

2. Can I buy Bitcoin with RUB on BingX?

You can buy Bitcoin with RUB on BingX by first acquiring USDT using RUB via supported fiat partners or P2P, then converting or trading BTC/USDT on the spot market.

3. Are there limits on buying BTC in Russia?

As of January 2026, proposals currently suggest annual caps for non-qualified investors, with higher access for qualified investors.

4. Is it safe to store BTC on an exchange?

For convenience, many users keep trading balances on exchanges, but long-term BTC holdings are safer in personal wallets. Platforms like BingX reduce risk with cold storage and withdrawal controls, but self-custody remains best practice.