Entering 2026, the cryptocurrency market is no longer an experimental playground for a select few, but has gradually evolved into a mature market covering investment, trading, hedging, and cross-border asset allocation. As the boundaries between digital assets and traditional financial systems become clearer, cryptocurrencies are increasingly being incorporated into asset allocation by more investors and institutions, rather than being merely highly speculative options.

Meanwhile, the global regulatory environment is gradually taking shape. The U.S. cryptocurrency legislation

GENIUS Act officially launched in early 2026, and regulatory directions for cryptocurrency exchanges in major markets are becoming clearer. Exchanges are no longer just platforms providing buy-sell matching, but must also consider fundamental operational requirements such as liquidity management, risk control, and asset protection.

For Taiwanese users, these changes are directly reflected in practical usage scenarios. Among numerous trading platforms, how to choose a trading environment with smooth TWD deposit processes, stable trading liquidity, and relatively reliable overall operations has become an increasingly important consideration. As usage needs gradually extend from simple trading to diversified allocation and cross-market operations, exchanges themselves are becoming an important part of investment strategies. This article will use the Taiwan market as background to introduce common cryptocurrency exchange options in 2026, and through BingX's practical usage scenarios, explain the key points to consider when choosing an exchange.

What Is a Cryptocurrency Exchange and How Does It Work?

A cryptocurrency exchange can be understood as a trading platform and asset intermediary in the digital asset world. Users can exchange fiat currency (such as New Taiwan Dollar, US Dollar) for cryptocurrencies through exchanges, or buy and sell between different crypto assets. Its role is similar to stock exchanges in traditional financial systems, with the difference being that cryptocurrency exchanges operate 24 hours a day, 365 days a year, without fixed opening and closing hours.

Based on different operating methods, cryptocurrency exchanges can be roughly divided into two types.

1. Centralized Exchanges (CEX): These exchanges handle trade matching, asset custody, liquidity provision, and customer support. Users only need to register an account and complete basic verification to start trading. The overall operation process is relatively intuitive with comprehensive features, suitable for most general users, and is currently the most common and widely used trading form in the Taiwan market.

2. Decentralized Exchanges (DEX): Trading is completed directly on the blockchain, and users need to connect their wallets and manage private keys themselves, with assets not being held by the platform. This model emphasizes decentralization and asset autonomy, but also has relatively higher requirements for operational processes and risk management, making it more suitable for advanced users with some understanding of blockchain technology.

With market development, cryptocurrency exchange functions are no longer limited to simple buy-sell matching. In 2026, most major centralized exchanges have integrated spot trading, derivatives (such as perpetual contracts), asset management tools, and cross-chain transfers. For Taiwanese users, exchanges also serve as important gateways for converting New Taiwan Dollar to

stablecoins (such as USDT), thereby connecting to global crypto markets. The exchanges discussed in this article will focus on centralized exchanges, which are most commonly used by Taiwanese users in practice.

How to Choose a Cryptocurrency Exchange in Taiwan

When choosing among numerous cryptocurrency exchanges, whether it's suitable for long-term use often depends on stability and reliability in actual operations. For Taiwanese users, the key factors that truly affect trading experience usually fall on whether fund deposits and withdrawals are smooth, whether trading can be executed stably, and the platform's performance in security and risk management. Considering practical usage scenarios, the following four aspects are the most important indicators to prioritize when evaluating cryptocurrency exchanges in 2026.

1. TWD Deposit Friendliness

For Taiwanese users, local exchanges mostly support New Taiwan Dollar bank transfers and real-name account binding, with relatively intuitive processes, often used as starting points for fund deposits/withdrawals and currency exchange; while international exchanges provide more diversified trading tools and market options. In actual use, funding sources may come from TWD exchange, credit cards, stablecoin transfers, and other methods, depending on individual needs and platform support.

2. Platform Features and Trading Flexibility

Different exchanges have significantly different product positioning. Some platforms focus on spot trading, suitable for simple buying/selling or long-term holding; others emphasize derivatives trading, such as perpetual contracts and leveraged products, and further integrate copy trading, strategy tools, or wealth management functions. For most users, initially they may only need basic spot trading, but as operational experience accumulates, having more comprehensive trading tools will affect whether frequent asset transfers between different platforms are needed. Platforms with higher functional flexibility are usually more suitable as primary exchanges for long-term use.

3. Liquidity and Execution Quality

During significant market volatility, whether trades can be executed smoothly is often more important than fee levels. Platforms with insufficient liquidity tend to experience widened spreads or significant

slippage, causing actual execution prices to deviate from expectations. Generally, exchanges with larger user bases and stable trading volumes can provide deeper market depth for mainstream trading pairs, and execution quality is usually more stable for both daily operations and larger transactions.

4. Security and Platform Trust

Asset security has always been a core issue in cryptocurrency trading. By 2026, whether to publicly disclose Proof of Reserves, whether to have basic security mechanisms like cold-hot wallet separation and multi-signature, has become a basic threshold for exchanges. Additionally, whether the platform has experienced major security incidents in the past and whether user protection or risk reserve mechanisms are in place are also important bases for assessing trustworthiness. For Taiwanese users, choosing platforms with transparent systems and clear risk management can provide more stable protection for long-term use.

Best Cryptocurrency Exchanges in Taiwan for 2026

After understanding exchange evaluation indicators, actual selection still needs to return to usage scenarios themselves. Different platforms have their own focuses in functional design, liquidity performance, and risk management, and often play different roles. The following organizes several cryptocurrency exchanges most commonly encountered by Taiwanese users in 2026 with relatively clear positioning, as reference for actual selection.

1. BingX Exchange

• Liquidity: Mainstream trading pairs have sufficient market depth, high execution efficiency, low slippage, suitable for frequent trading and strategic operations

BingX was established in 2018, and its visibility in the Taiwan market has significantly increased in recent years. Its positioning is not as a single-function trading platform, but as an international exchange providing a complete set of trading tools. As of 2026, BingX's global user base has exceeded 40 million, with services covering multiple major markets, gradually becoming one of the important options for Taiwanese users in trading and strategic operations.

In terms of product structure, BingX not only covers spot and perpetual contract trading for mainstream cryptocurrencies, but also further integrates TradFi products, including tokenized stocks, gold, metals, and

commodities, allowing users to simultaneously observe and operate crypto assets and traditional financial markets within the same platform. The platform also provides strategic tools such as dollar-cost averaging and grid trading, combined with clear and consistent trading fee structures, particularly suitable for usage scenarios requiring batch entries, frequent position adjustments, or executing multiple trading strategies.

In actual trading experience, BingX's mainstream trading pairs have stable and sufficient market depth, with high overall execution efficiency and maintaining low slippage levels during market volatility. The platform also integrates cryptocurrency and TradFi market data through

BingX AI, providing analytical and decision-support tools. In terms of security, BingX adopts 100% Merkle Tree Proof of Reserves and has established a user protection fund, combined with cold-hot wallet separation and multi-factor authentication mechanisms to enhance asset transparency and system stability, enabling it to serve as a primary trading platform for long-term use.

2. Kraken Exchange

• Platform Feature Completeness: Focuses on spot trading as core, provides some derivatives and staking services, with relatively conservative feature configuration

• Liquidity: Stable trading depth for mainstream cryptocurrencies, suitable for medium to large single transactions

• Security: Long known for high-standard security and compliance, with regular third-party audits

Kraken was established in 2011 and is currently one of the oldest cryptocurrency exchanges. Its brand image and market positioning have long been built on "compliance, security, and conservative operations." For users who prioritize asset security and regulatory transparency, Kraken is often viewed as a lower-risk choice and has a stable user base in European and American markets.

In terms of trading functions, Kraken focuses on spot markets and provides limited derivatives and staking products, with relatively restrained overall product lines. This design helps reduce system complexity and operational risks, but also means lower strategic flexibility. For users accustomed to using perpetual contracts, grid trading, dollar-cost averaging, or multi-strategy tools, Kraken's feature options may be somewhat insufficient, making it less suitable as a primary operational platform for highly active traders.

In actual user experience, Kraken's mainstream trading pairs have good market depth, suitable for larger single transactions. However, its interface design and operational processes lean toward traditional financial style, with a relatively defined learning curve, which may not be as intuitive as Asian exchanges for some users. Additionally, the platform is relatively conservative in feature update speed and trading tool diversity, offering limited flexibility for users hoping to quickly try new trading tools or cross-market operations.

3. Crypto.com Exchange

• Platform Feature Completeness: Covers spot trading, some derivatives, staking and payment services, integrating App ecosystem

• Liquidity: Stable trading volume for mainstream cryptocurrencies, suitable for general trading and long-term allocation

• Security: Has published Proof of Reserves and provides user verification mechanisms

Crypto.com was established in 2016 and has long positioned itself with "cryptocurrency lifestyle" as its core, gradually building a complete consumption and financial ecosystem through mobile apps, Visa cards, and payment scenarios. Its brand has high recognition in global markets, and for users hoping to combine crypto assets with daily payments and financial functions, Crypto.com provides a relatively intuitive usage path.

In platform design, Crypto.com focuses on app experience as core, integrating spot trading, some derivatives, staking, and card rewards, reducing operational barriers for general users. However, this ecosystem orientation also means trading tools have trade-offs in depth and flexibility. Compared to platforms focusing on trading efficiency and strategic operations, Crypto.com has relatively limited options in contract flexibility, advanced trading tools, and multi-strategy configuration, making it less suitable as a primary operational platform for high-frequency or strategic trading.

In actual user experience, Crypto.com's mainstream trading pairs have stable liquidity, meeting general buying/selling and long-term holding needs. The shortcoming is that the platform's overall fee structure is relatively complex, with some trading conditions and features requiring holding or staking native tokens to access, which may not be intuitive for purely trading-oriented users in terms of cost structure.

4. MAX Exchange

• Platform Feature Completeness: Focuses on spot trading as core, supports TWD deposits and mainstream cryptocurrency trading, with limited advanced trading and strategic tools

• Liquidity: Liquidity concentrated in TWD trading pairs like USDT/TWD, BTC/TWD, with shallower market depth for non-mainstream cryptocurrencies

• Security: Adopts cold wallet management and asset separation mechanisms, with regular system and asset management controls

MAX was established in 2018, belonging to the MaiCoin Group, and is one of the local cryptocurrency exchanges most commonly encountered by Taiwanese users. Its core positioning is quite clear, focusing on providing stable TWD deposits and TWD trading pairs, serving as an important gateway for Taiwanese users entering the crypto market. For users hoping to directly purchase Bitcoin or stablecoins with New Taiwan Dollar, MAX's operational process is relatively intuitive and closer to local usage habits.

In terms of trading functions, MAX focuses on spot markets, supporting TWD trading pairs for mainstream assets like

BTC,

ETH, and

USDT, suitable for basic buying/selling and long-term holding. However, compared to international exchanges, MAX has limited options in perpetual contracts, grid trading, dollar-cost averaging, or multi-strategy tools, with overall feature configuration leaning toward basics, making it less suitable as a primary platform for high-frequency or strategic trading.

In actual trading experience, MAX's TWD trading pairs can execute smoothly within general trading amounts, but liquidity is mainly concentrated in a few mainstream trading pairs. During amplified market volatility or larger transactions, spreads and slippage still need attention. Non-mainstream cryptocurrencies have limited market depth, making it more suitable for allocation needs centered on mainstream assets. Overall, MAX is more suitable as a platform for TWD deposits/withdrawals and basic allocation rather than a primary exchange for function-oriented or strategic operations.

5. BitoPro Exchange

• Liquidity: Mainstream TWD trading pairs have basic execution depth, but overall market activity is limited

• Security: Adopts cold wallet management and asset separation design, with basic account security mechanisms

BitoPro was also established in 2018, but its platform design philosophy differs slightly from MAX. Compared to emphasizing trading efficiency and market depth, BitoPro leans more toward "reducing understanding costs" usage paths, with overall interface and feature configuration being more restrained, suitable for users hoping to complete buying/selling operations with minimal steps.

In trading functions, BitoPro focuses on spot markets, with relatively concentrated supported cryptocurrencies and trading pairs, allowing users to complete basic allocation without facing too many options. This design is more intuitive operationally but also means limited strategic flexibility. For users needing perpetual contracts, grid trading, dollar-cost averaging, or multi-strategy operation tools, BitoPro's feature configuration is not complete, making it less suitable as a platform for advanced trading or long-term strategy execution.

In actual trading experience, BitoPro's TWD trading pairs can execute smoothly under general trading scales, but market activity and depth are mainly concentrated in a few mainstream assets. During amplified market volatility or larger transactions, spreads and slippage still need attention. Overall, BitoPro's positioning is closer to a "simple operation, concentrated options" platform, suitable for usage scenarios focusing on basic buying/selling and asset allocation rather than function-oriented or strategic trading primary choice.

How to Choose the Best Cryptocurrency Exchange in Taiwan in 2026

After introducing the five exchanges separately, it's clear that each platform has distinct differences in feature configuration, trading depth, and usage positioning. For Taiwanese users, the key to choosing an exchange often lies in whether the platform can support long-term operational needs, not just short-term convenience.

The following organizes several cryptocurrency exchanges most commonly encountered by Taiwanese users using the same standards, and provides a horizontal comparison from aspects such as platform feature completeness, liquidity and execution performance, and security and asset transparency, as reference for overall selection.

| Exchange |

Platform Feature Completeness |

Liquidity & Execution Performance |

Security & Asset Transparency |

Overall Usage Positioning |

| BingX |

Covers spot, perpetual contracts, copy trading and TradFi (tokenized stocks, gold, commodities), and supports dollar-cost averaging and grid trading |

Mainstream trading pairs have sufficient market depth, fast execution speed, low slippage |

Publishes 100% Merkle Tree Proof of Reserves and has established user protection fund |

Feature complete, suitable as primary trading and strategic operation platform |

| Kraken |

Focuses on spot trading as core, provides some derivatives and staking services |

Stable market depth for mainstream cryptocurrencies, suitable for medium to large single transactions |

Long-term public Proof of Reserves and third-party audits |

Conservative approach, emphasizing security and stability |

| Crypto.com |

Covers spot trading, some derivatives, staking and payment services, integrating App ecosystem |

Stable liquidity for mainstream cryptocurrencies, execution performance related to order methods and market volatility |

Has published Proof of Reserves and provides user verification mechanisms |

Ecosystem and application-oriented, suitable for long-term holding and daily use |

| MAX Exchange |

Focuses on spot trading, supports TWD trading pairs |

TWD trading pair liquidity concentrated in mainstream cryptocurrencies, need to watch spreads for large transactions |

Adopts cold wallet management and asset separation mechanisms |

TWD deposit/withdrawal and basic trading gateway |

| BitoPro |

Focuses on spot trading, with relatively concentrated features and cryptocurrency configuration |

Limited market activity for TWD trading pairs, need to watch slippage during volatility |

Adopts cold wallet management and basic account security mechanisms |

Simplified operations, suitable for basic allocation |

From the overall comparison, it's clear that each exchange's role division is quite distinct: some platforms lean toward fund deposits/withdrawals and basic trading, some focus on payment and application ecosystems, and others prioritize completeness and operational flexibility of trading tools. When making actual choices, the key lies in whether users need to handle multiple trading types and different market operational needs within the same platform simultaneously.

In this context, BingX's positioning is relatively clear. It's not a single-function oriented platform, but focuses on trading and strategic operations, integrating spot, derivatives, and TradFi products to provide a more complete trading environment. The following will use BingX as an example to further explain how to register an account and actually start using the platform for trading.

How to Register on BingX and Buy Cryptocurrency in Taiwan: Step-by-Step Guide

For users already familiar with basic cryptocurrency operations, the process of actually starting to use BingX is quite intuitive. The overall operational logic is consistent with mainstream international exchanges, without requiring additional learning of special interfaces or conversion of usage habits.

Step 1: Register Account and Complete Basic Security Settings

Go to the BingX official website,

register an account with email or phone number, and complete

KYC (identity verification) according to platform instructions. The verification process has become highly automated in recent years and can usually be completed in a short time. After completing registration, it's recommended to enable

Google Two-Factor Authentication (2FA) simultaneously to reduce the risk of unauthorized account access, which is also an essential basic setting for long-term use of trading platforms.

Step 2: Choose Deposit Method and Obtain Trading Funds

BingX provides multiple deposit options. In actual use, you can choose suitable methods based on considerations of amount size, arrival speed, and fees. Different deposit methods have various differences in cost and efficiency, and users can flexibly choose according to their fund scale and usage frequency. Common scenarios can be roughly divided into two categories:

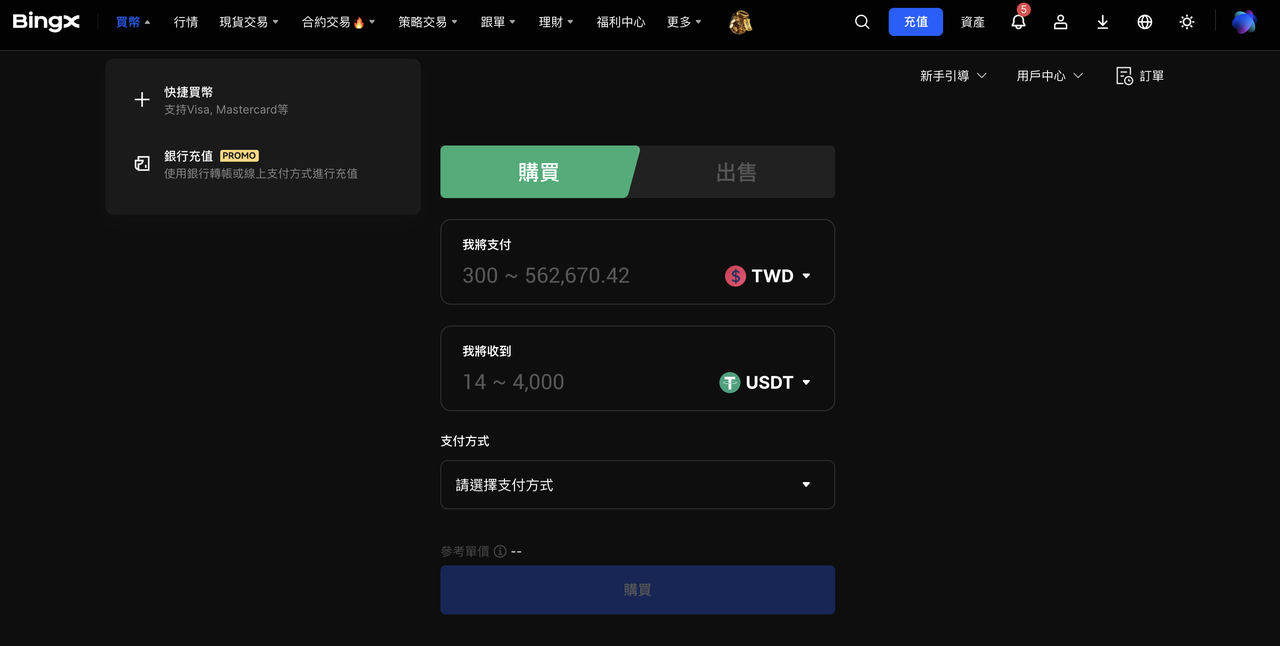

Method 1: Direct Stablecoin Purchase: After logging into BingX, go to the "

Quick Buy" page, select USDT as the cryptocurrency, enter the desired purchase amount, choose "Credit Card/Debit Card" or "Third-Party Payment" as payment method. The system will display corresponding limits, exchange rates, and fees for each option, allowing users to compare and choose. After completing card payment, USDT usually arrives within minutes.

Credit card stablecoin purchase has simple operational processes and fast arrival speed, suitable for users hoping to quickly complete setup and start trading.

Method 2: Transfer Existing Stablecoin Assets: If users already hold stablecoins, they can transfer assets to BingX through blockchain transfers, which usually have lower fees and are suitable for larger amounts or experienced usage scenarios.

Step 3: Start Trading and Strategic Operations

After completing deposits, you can start trading on the BingX platform. Besides basic spot trading, BingX also provides perpetual contracts, copy trading, dollar-cost averaging, and grid trading tools, allowing users to choose appropriate operation methods based on different market conditions. For users just getting acquainted with advanced features, they can start with spot trading or simpler strategies and gradually become familiar with other trading tools.

Overall, BingX's registration and actual operation process design leans toward simplification, suitable for users hoping to quickly complete setup and focus on trading and strategies themselves. Whether to further combine contract trading or other advanced features can be gradually adjusted according to personal experience and risk tolerance.

Conclusion: Why BingX Is a Secure Crypto Exchange for Taiwan Users

Returning to actual usage levels, for most Taiwanese users, the value of an exchange lies not in short-term gimmicks, but in whether it can continuously support operational needs across different market phases. When trading strategies extend from simple buying/selling to position management, risk control, and cross-market allocation, the platform's feature completeness, execution quality, and operational stability often directly affect the overall user experience.

In such usage scenarios, BingX provides a relatively complete and sustainable trading environment. Besides covering mainstream spot and contract trading, the platform also integrates various strategic tools and TradFi assets, allowing users to gradually build and adjust their operational methods within the same platform. Combined with clear interface design and comprehensive tutorials and operational instructions, BingX is more suitable as a long-term use platform rather than short-term entry and exit.

The following organizes BingX's current key trading functions and operational tools. Users can further check relevant instructions and actually operate according to their own needs:

FAQs on BingX Crypto Trading

1. Is BingX beginner-friendly for crypto trading in Taiwan?

Yes. BingX's interface design is relatively intuitive, spot trading processes are clear, and it provides copy trading, dollar-cost averaging, and comprehensive tutorials, allowing users new to cryptocurrency to gradually become familiar with operations. However, if using contracts or leveraged products, it's still recommended to fully understand the risks first.

2. Can I trade spot crypto on BingX without using futures or contracts?

Yes. BingX's features are modularly designed, and users can use only spot trading without needing to activate contracts or other advanced tools. Whether to use contracts, copy trading, or strategy tools depends entirely on individual needs and risk tolerance.

3. What are BingX trading fees?

Looking at the 2026 fee structure, BingX's trading fees are quite competitive among international exchanges.

• Spot Trading Fees: 0.1% (same for Maker/Taker)

• Perpetual Contract Trading Fees: Maker as low as 0.02%, Taker around 0.05%

This fee level is in the lower range among mainstream international exchanges, particularly in contract trading and high-frequency operation scenarios, effectively reducing long-term accumulated trading costs. Actual rates may still be adjusted according to account levels or activities, but the overall structure is clear and costs are predictable, suitable for long-term use and strategic operations.

4. Is BingX safe? How are user funds and assets protected?

BingX adopts 100% Merkle Tree Proof of Reserves and has established a user protection fund, combined with cold-hot wallet separation, multi-factor authentication and other security mechanisms. These designs are mainly used to enhance asset transparency and reduce systemic risks.

5. Can I trade both cryptocurrencies and traditional financial assets on BingX?

Yes. Besides cryptocurrency spot and contract trading, BingX also provides tokenized stocks, gold, metals and other TradFi commodities, suitable for usage scenarios hoping to conduct cross-market observation and operations within the same platform.

6. When should I use grid trading or copy trading on BingX?

Grid trading is usually suitable for disciplined operations in ranging markets; copy trading is suitable for users who don't want to frequently monitor charts and hope to reference other traders' strategies. Both are tool-type functions and do not guarantee profits. Users should understand their operating methods and risks before use.

7. Do beginners need to use all BingX features at once?

No. Most users start with a single function, such as spot trading, and gradually try contracts, strategy tools, or other markets as experience accumulates. BingX's design itself supports this progressive usage approach.