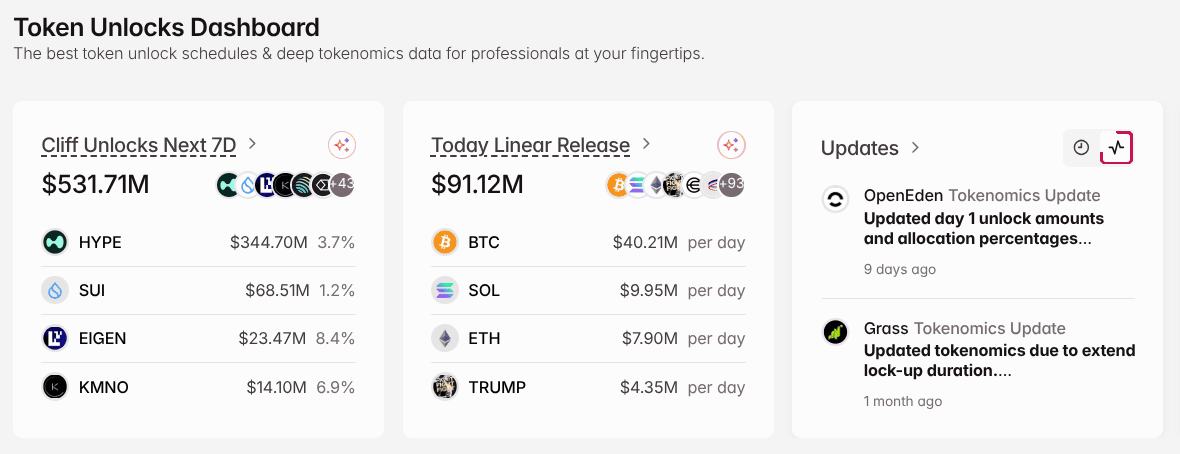

As the year reaches its final month, December 2025 is emerging as one of the most influential periods for token unlocks across the cryptocurrency markets. The total value of all scheduled releases is projected to exceed one billion dollars, positioning it as one of the largest monthly unlock events of the entire year. For traders, liquidity providers, and long-term ecosystem participants, this month brings heightened volatility risk along with significant opportunities.

Understanding which tokens unlock, how much supply enters circulation, and who receives these allocations is essential because unlock waves often act as short term catalysts that shift market sentiment. In this article, we break down the meaning of token unlocks, why they matter, and examine the largest events scheduled for December 2025 including

SUI,

Aptos,

Redstone,

Sei, and other notable projects.

What Are Token Unlocks?

Token unlocks happen when previously restricted or vested tokens are released into the circulating supply based on preset schedules established during fundraising rounds or protocol launches. These locked tokens are typically allocated to early investors, foundations, development teams, or ecosystem incentive pools and are held under multi-year vesting structures to create long-term alignment.

Once an unlock date arrives, the tokens become liquid and tradable, which increases circulating supply and potentially influences price. Unlock models vary widely and can include large one time cliff releases or gradual monthly linear unlocks that distribute tokens evenly over time. Because unlock structure communicates long term project intentions, the market watches these events closely to gauge investor commitment and potential supply pressure.

Why Do Token Unlocking Events Matter?

Source: Tokenomist

Token unlocks change the circulating supply, which directly impacts price, liquidity, and market sentiment. When a large batch of tokens is released, recipients may sell, creating short-term downward pressure, especially in low-liquidity or mid-cap markets. But if those tokens are staked or held long term, the impact can be minimal. Unlocks also reveal how insiders, investors, and teams behave after receiving tokens, offering signals about confidence, incentives, and potential sell pressure. Even though unlock schedules are public and often “priced in,” the real effect depends on on-chain flows, order book depth, and overall market conditions at the time of release.

Key Dynamics That Influence Crypto Unlocks

Understanding the forces behind token unlocks helps you anticipate how new supply, investor behavior, and market conditions may impact a token’s short-term price and long-term trajectory.

1. Supply Shock: A large unlock can rapidly increase circulating supply. If newly unlocked tokens are sold quickly, the sudden increase in available supply may create immediate downward price movement. A smaller unlock can still have noticeable effects in projects with lower trading volume or shallow liquidity.

2. Info Signals: Unlock allocation groups reveal information about conviction and incentives. Tokens given to core teams may indicate long term alignment, but large team unlocks often create fear of selling. Unlocks flowing to ecosystem funds, grants, and community programs signal continued growth investment rather than exit liquidity.

3. Liquidity Context: In markets with deep liquidity, even large unlocks may be absorbed with minimal disruption. However, smaller or newer ecosystems with less liquidity can experience amplified volatility when the unlock represents a large percentage of daily volume or market capitalization.

4. Pre-Priced Events: Because unlock schedules are public, markets often price them weeks or months ahead of time. The real signal emerges after the unlock when watching whether recipients deposit tokens on exchanges, stake them, move them across chains, or hold them. This post unlock behavior often drives price more than the unlock itself.

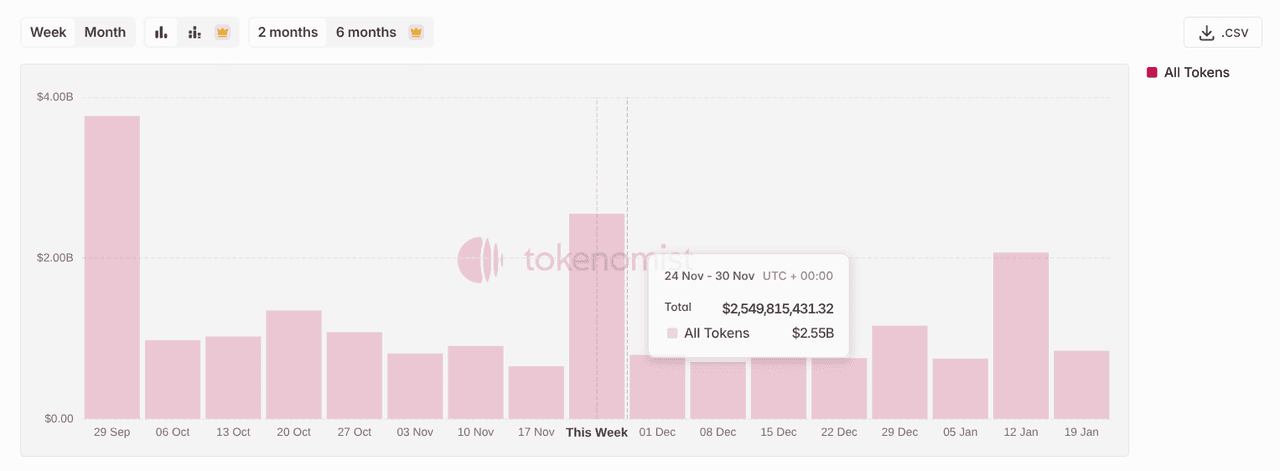

Top Token Unlocks to Watch in December 2025: The Big Picture

Source: Tokenomist

December 2025 features one of the most concentrated clusters of major unlock events this year, with cumulative token values in the high hundreds of millions. These unlocks span layer one blockchains, infrastructure protocols, and emerging ecosystems, creating a diverse landscape of potential supply events. Many of the largest projects unlocking this month represent networks with significant trading volume, meaning that some unlocks may be absorbed smoothly.

However, several mid cap and lower cap projects also have material unlocks scheduled, and these are historically more sensitive to sudden supply increases. With so many major unlock events occurring within a single month, the market may experience a temporary shift in liquidity distribution as traders reposition portfolios based on expected supply flows.

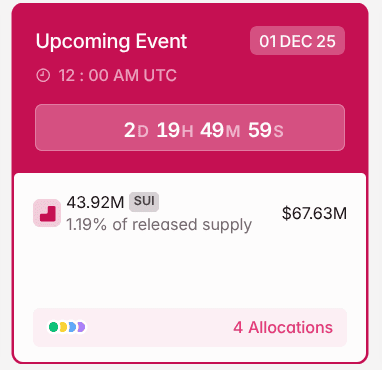

1. SUI (SUI)

Source: Tokenomist

• Unlock Date: December 1, 2025

• Number of Tokens to Be Unlocked: Approximately 64.19 million SUI (about 2.26% of its circulating supply)

• Current Circulating Supply: Around 3.68 billion SUI

• Total Supply: 10 billion SUI

SUI will release roughly 64.19 million tokens into circulation at the start of December, representing a sizable addition worth hundreds of millions of dollars based on recent price levels. Since SUI is widely used for gaming infrastructure and smart contract platforms, this unlock will test how effectively the ecosystem can absorb new supply. Strong on chain activity and high trading volume could help stabilize the market, while weaker liquidity may lead to short term volatility.

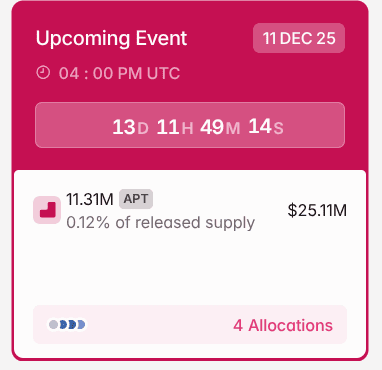

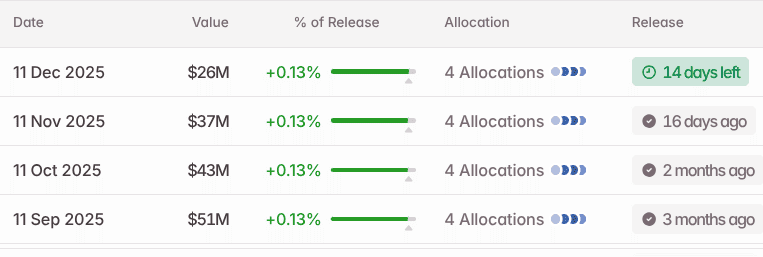

2. Aptos (APT)

Source: Tokenomist

• Unlock Date: December 11, 2025

• Number of Tokens to Be Unlocked: Approximately 11.31 million APT (about 0.33% of circulating supply)

• Current Circulating Supply: Not publicly confirmed

• Total Supply: Determined by ongoing vesting schedules

Aptos will unlock around 11.31 million tokens in mid December. This release fits within its regular linear emission structure, which may help the market view the event as predictable rather than disruptive. Even so, recipients of large allocations could still influence short term price action if they choose to move tokens to exchanges. Aptos continues to expand its developer ecosystem through new tooling, integrations, and applications, which may help support demand around the unlock.

3. RedStone (RED)

Source: Tokenomist

• Unlock Date: December 6, 2025

• Number of Tokens to Be Unlocked: Approximately 5.54 million RED (about 2.34% of circulating supply)

• Current Circulating Supply: ~294.3 million RED out of a maximum supply of 1.00 billion RED

• Total Supply (Max): 1.00 billion RED

RED is scheduled for a December 6 unlock of roughly 5.54 million tokens, representing around 2.34% of its circulating supply. As an oracle and data-infrastructure token, RedStone supports decentralized data delivery, oracle services, and cross-chain data feeds, which makes it critical in many Web3 applications. Given the size of this unlock and RED's role as a foundational infrastructure token, market participants will closely watch on-chain flows and exchange deposits to gauge whether the new supply is absorbed by demand from builders and infrastructure users or met with sell pressure.

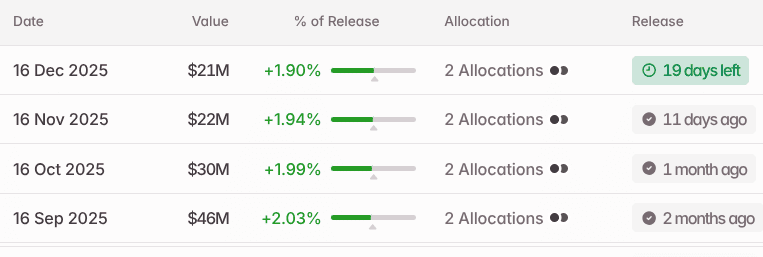

4. Sei (SEI)

• Unlock Date: Approximately December 15, 2025

• Number of Tokens to Be Unlocked: Approximately 55.56 million SEI (about 1.31% of circulating supply)

• Current Circulating Supply: Around 6.37 billion SEI

• Total Supply: 10 billion SEI

Sei's upcoming unlock will add more than 55 million tokens into circulation. As a younger network with a mid-sized and rapidly developing ecosystem, this release could have a noticeable impact depending on market conditions. The new supply may influence liquidity depth, validator engagement, and near term trading sentiment. If demand does not rise alongside the unlock, Sei may experience increased volatility during the period.

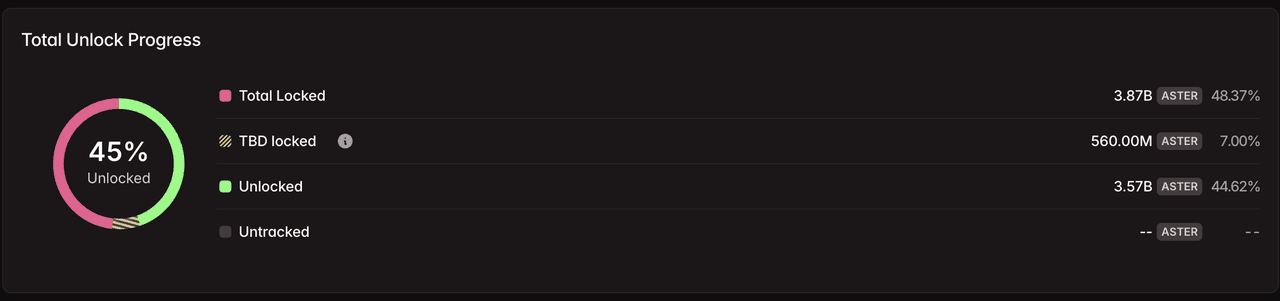

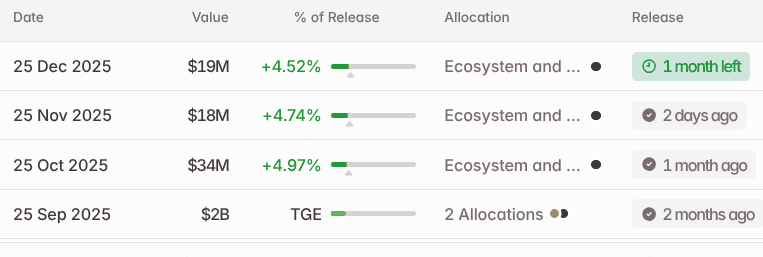

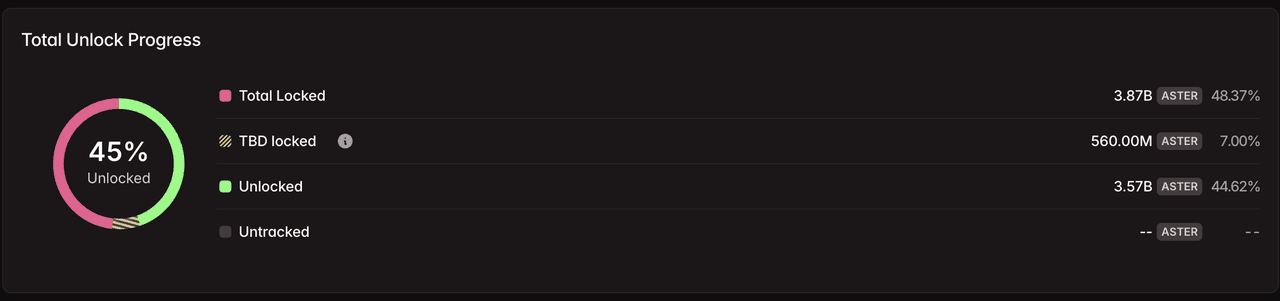

5. Aster

• Unlock Date: December 15, 2025

• Amount: 200,000,000 ASTER

• Percentage of total supply: 2.50%

• Purpose: Airdrop

• Estimated value: ~$218.60 million

ASTER token unlocks are scheduled for December 15, 2025, when 200 million ASTER tokens will be unlocked, representing 2.5% of the total supply. This unlock is designated for the airdrop allocation. There was some initial confusion with conflicting reports about the timeline, but the project clarified that the December 2025 unlock is happening as scheduled.

Other Notable Token Unlocks in Mid and Late December 2025

Beyond the largest unlocks of the month, several mid cap and emerging projects have meaningful releases scheduled that could influence liquidity conditions and trader behavior. These tokens often operate in ecosystems where volatility is more pronounced, which means even mid-sized unlocks can generate noticeable market reactions. Tracking these events is important for traders who focus on growth sector assets, infrastructure networks, and early stage platforms that are highly sensitive to supply changes.

1. EigenCloud (EIGEN)

Approximately 36.82 million

EigenCloud tokens unlocked on November 1, valued at around 43.8 million dollars and representing roughly 12.10% of circulating supply. As a decentralized cloud infrastructure project, such a large unlock may influence validator incentives, staking participation, and ecosystem commitment as the network scales.

Source: Tokenomist

2. Aptos (APT)

In mid November, Aptos released more than 40 million dollars worth of APT, equal to approximately 1.6% of total supply. As a competitive layer one with a growing developer base, this unlock ties directly to broader adoption trends. Monitoring whether unlocked tokens moved into staking or onto exchanges can provide insight into holder sentiment.

Source: Tokenomist

3. Arbitrum (ARB)

Arbitrum featured several unlock moments across November totaling about $37 million, or roughly 1.2% of supply. Because Arbitrum remains a leading layer two with heavy ecosystem activity, team and foundation allocations play a significant role in determining short term selling pressure and long term network growth funding.

Source: Tokenomist

4. ChainOpera AI (COAI) and Plasma (XPL)

The two early stage projects

ChainOpera AI and

Plasma experienced unlocks in the $30-35 million range during early and mid November.

AI networks and

stablecoin infrastructure platforms tend to be highly sensitive to token emissions, meaning unlocks of this size can influence staking rewards, liquidity depth, and early holder behavior.

Source: Tokenomist

5. Monad (MON)

Monad (MON) launched its token generation event on November 26, releasing approximately 12.5 million tokens valued at roughly 15 million dollars, representing about 2.8% of circulating supply. This unlock highlights early investor and team allocations, and how these tokens are moved into staking or trading could signal short-term selling pressure. Monitoring wallet flows and exchange activity will provide insights into liquidity and holder sentiment.

Source: CryptoRank

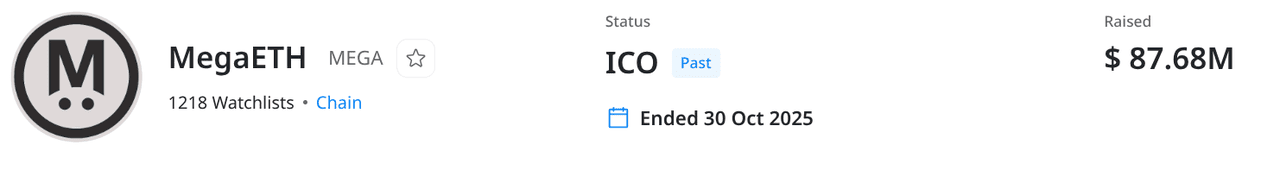

6. MegaETH (MEGA)

The

MegaETH Pre-Deposit Bridge went live on November 25, with over 8 million tokens, valued at around 9.2 million dollars, deposited on the first day, representing roughly 1.9% of circulating supply. Early adoption indicates network engagement and confidence, while the movement of these tokens post-bridge will impact liquidity and price trends. Traders should watch distribution and staking activity to gauge market reaction.

How Can Crypto Traders Prepare for Token Unlocks?

Preparing for token unlocks requires a combination of data awareness, risk management, and on chain observation. Traders should begin by tracking unlock calendars and noting the specific unlock amounts, dates, and allocation types. Understanding who receives tokens provides early clues about potential selling pressure because different groups exhibit different behavioral patterns. Position sizing should be adjusted conservatively ahead of major unlocks, particularly for assets with historically low liquidity or high volatility. Some traders may choose to scale out partial positions before unlocks or wait until after the unlock to re-enter once wallet flows become clear.

Monitoring wallet movements immediately after unlocks is one of the most valuable strategies. If newly unlocked tokens move directly to exchanges, this typically indicates selling intent. If tokens are staked, bridged, or retained in long term wallets, the market may interpret this as a sign of confidence. Combining this data with broader market indicators allows traders to form a clearer view of likely price impact. Ultimately, diversification across multiple assets and timeframes can help reduce the risk associated with large individual unlock events.

How to Trade Token Unlocks on BingX

ASTER/USDT trading pair on the spot market powered by AI BingX insights

Token unlocks can create sharp, short-lived opportunities or heavy downside risks. To trade them effectively, you need to prepare ahead of time, track supply dynamics, and use BingX tools to manage execution and risk:

1. Know the clock. Most unlocks drop at 00:00 or 12:00 UTC, so plan your orders and liquidity before the hour to avoid chasing volatile moves.

2. Focus on % supply, not just dollar value. A small unlock equal to 2–3% of circulating supply can trigger bigger moves in thin markets than a larger unlock in a deep-liquidity token.

3. Track recipient type. Tokens going to team or treasury wallets may stay locked longer, while investor or emissions unlocks are more likely to hit the market quickly. Check vesting dashboards like Tokenomist for wallet details.

4. Use BingX tools. Trade token unlock volatility via

spot or

futures, depending on whether price rallies pre-event or stabilizes post-event. Leverage

BingX AI for real-time sentiment, order-flow pressure, and volatility spikes to time entries more intelligently.

5. Apply strong risk controls. Define invalidation levels (e.g., VWAP or key support), keep leverage tight, and set alerts 30–60 minutes before and after the unlock window.

6. Watch narrative strength. Bullish catalysts like mainnet launches, listings, governance upgrades can partially absorb new supply. Always cross-check the project’s roadmap.

7. Time execution in three phases:

• Before unlock: Use BingX AI to check order-book stress; place bracket orders with stops and targets.

• During unlock: Keep size small; monitor 1–5 minute candles for cascades, liquidity grabs, and failed bounces.

• After unlock:

- If price holds support with spot demand + cooling funding, look for mean-reversion longs.

- If breakdown continues with rising OI + negative CVD, stick to trend-following shorts.

Conclusion

December 2025 stands out as one of the most significant months of token unlock activity in the cryptocurrency market, with several high profile projects releasing substantial supply into circulation. Unlocks from SUI, Aptos, Redstone, and Sei could influence market volatility, liquidity patterns, and investor sentiment as hundreds of millions in new supply become available. While unlock events can introduce short term risk, they also create opportunities for disciplined traders who analyze allocation recipients, track on chain flows, and navigate market conditions strategically. As the industry continues maturing, token unlocks remain a key component of project tokenomics, and understanding them is essential for anticipating market behavior heading into 2026.

Related Reading