The financial landscape of 2025 delivered a brutal reality check to the "digital gold" thesis, as

Bitcoin and physical gold diverged by a staggering 71% in annual performance. While

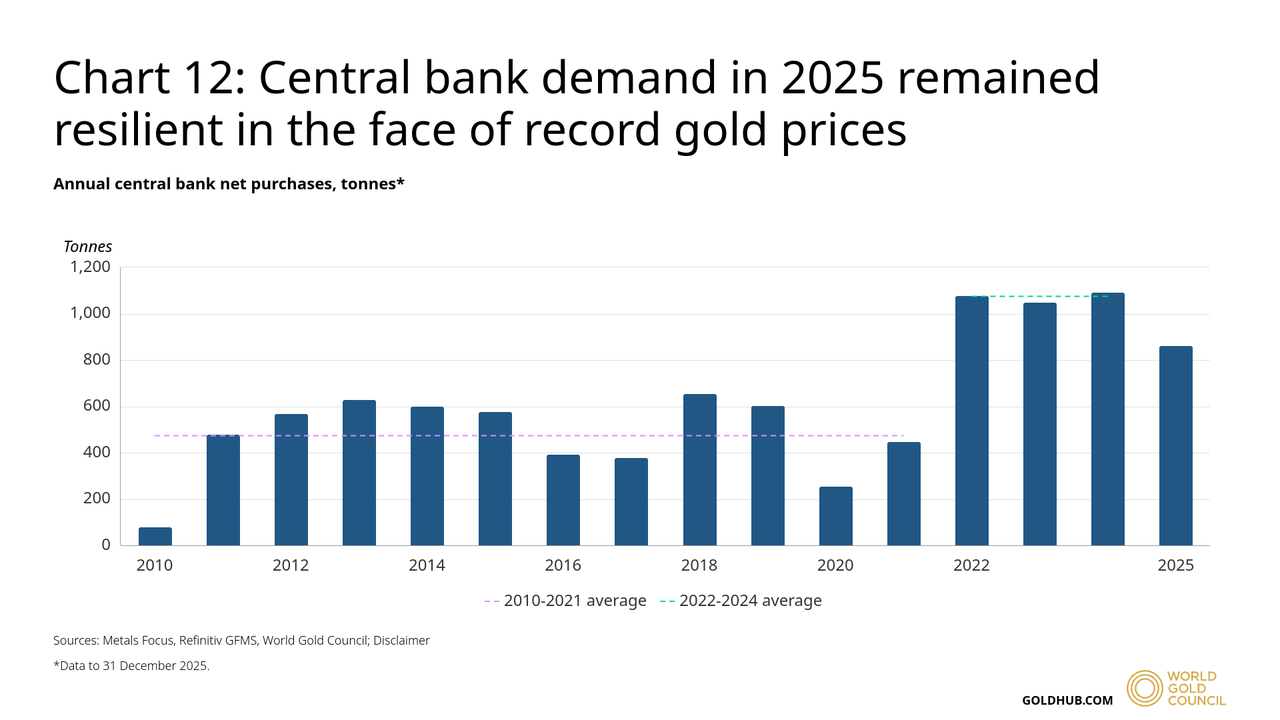

gold methodically climbed from $2,607 to over $4,315 per ounce, yielding a massive +65% return fueled by record-breaking central bank purchases of 863 tonnes,

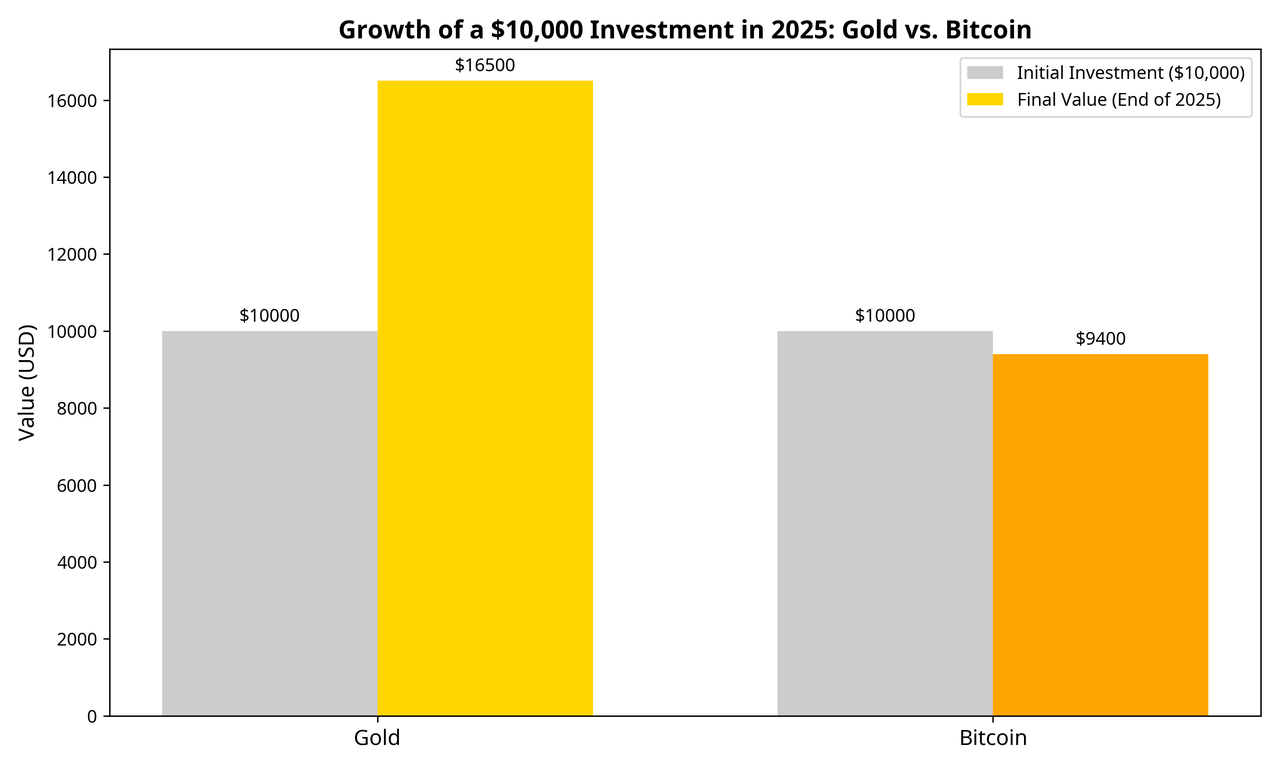

Bitcoin hit a euphoric wall. Despite reaching a mid-year peak above $126,000, the cryptocurrency ended 2025 in a defensive crouch, sliding to a 6% annual loss and crashing below $80,000 by February 2026. This sharp contrast transformed a hypothetical $10,000 allocation into either a $16,500 windfall in bullion or a $9,400 cautionary tale in crypto, proving that in a year defined by geopolitical tension and shifting reserve strategies, the "barbarous relic" still holds the throne of stability.

Key Takeaways

While Bitcoin has delivered astronomical returns over its 15-year history, 2025 served as a powerful reminder of its volatility and gold's enduring stability. A hypothetical $10,000 investment made on January 1, 2025, would have grown to $16,500 in gold, while the same amount in Bitcoin would have shrunk to $9,400.

• Gold's +906% return from 2005 to 2025 demonstrates its reliability as a long-term store of value. Its remarkable +65% rally in 2025 was underpinned by powerful fundamental drivers, including unprecedented buying from central banks and its role as a safe-haven asset.

• Bitcoin's journey from less than a dollar to a peak of $126,000 has been a story of explosive, cycle-driven growth. However, its -6% loss in 2025, despite hitting a new all-time high, underscores its profound volatility and adherence to its cyclical, post-halving boom-and-bust pattern.

• The analysis of both the long-term history and the 2025 performance highlights the distinct roles these assets play. Gold serves as a portfolio stabilizer and a reliable store of value, while Bitcoin functions as a high-risk, high-reward speculative asset.

Introduction: The Great Debate of Allocating $10,000 into Gold and Bitcoin in 2025

Imagine an investor at the dawn of 2025, faced with a classic but increasingly complex decision: where to allocate $10,000. On one side stands gold, the millennia-old store of value, a tangible asset steeped in history and trusted by empires. On the other hand,

Bitcoin, the digital upstart, a decentralized and volatile asset hailed by its proponents as the future of finance. The year 2025 provided a dramatic, real-world test for this great debate, and the results were anything but ambiguous.

This article dissects the divergent paths these two assets took throughout 2025. We will explore the fundamental drivers that propelled gold to one of its best years on record while simultaneously examining the cyclical forces that saw Bitcoin reach a euphoric peak only to suffer a significant downturn. For any investor navigating these markets in 2026, the lessons of the previous year are invaluable.

A Tale of Two Returns: The 2025 Performance Gap Between Gold and BTC

The performance gap between gold and Bitcoin in 2025 was not a narrow margin; it was a chasm. While one asset created substantial wealth, the other eroded capital, resulting in a staggering 71-percentage-point difference in annual returns. In 2025, the performance of these two assets diverged significantly, highlighting the contrasting volatility in the market.

Gold proved to be a standout performer; starting with an initial investment of $10,000, it surged to a final value of $16,500, yielding a substantial annual return of 65%. In contrast, Bitcoin struggled to maintain its value over the same period. An identical $10,000 investment in the cryptocurrency dipped to $9,400 by the end of the year, resulting in a 6% loss.

Source: Analysis of data from BullionVault and Yahoo Finance

As the chart vividly illustrates, an investor in gold saw their capital steadily appreciate, ending the year with a significant gain. In stark contrast, a Bitcoin investor, despite witnessing a new all-time high mid-year, ended up with less than their initial investment. It was a year where gold had one of its best years on record, while the explosive growth asset hit the brakes. The performance gap wasn’t just a statistic; it was a chasm, resulting in a 71-percentage-point difference in annual returns.

Why Gold Shone in 2025: A Perfect Storm of Demand for 65% Gains

Gold’s surge beyond $4,000 per ounce marked one of the most decisive rallies in modern commodity markets. Rather than being driven by short-term speculation, the move reflected a convergence of structural demand forces that reshaped gold’s role as a global reserve and portfolio asset, placing it among the best-performing major assets of the year.

1. Sustained Central Bank Buying

A central driver of the rally was the scale and persistence of central bank buying. Official institutions continued to accumulate gold at a pace rarely seen outside periods of systemic stress, reinforcing a longer-term shift toward reserve diversification and reduced reliance on the U.S. dollar. This demand proved notably resilient, continuing even as prices reached historic highs.

Research from major investment banks suggests the trend is structural rather than tactical, with central bank demand expected to remain elevated through 2026 and beyond. As a result, official sector purchases absorbed a meaningful share of global supply, creating sustained upward pressure on prices.

Source: World Gold Council

By late 2025, global central bank gold holdings had risen to about 36,300 tonnes, according to World Gold Council and IMF‑based estimates, placing gold at roughly 20% of official reserves worldwide, a share that reflects sustained reserve diversification away from traditional fiat assets. Emerging market central banks were particularly active, reflecting both geopolitical considerations and a reassessment of long-term reserve risk. This steady accumulation provided gold with a powerful and consistent demand base that helped stabilize the market during periods of volatility.

2. Macroeconomic and Geopolitical Drivers Boost Gold Demand

Gold gained ground as investors navigated a mix of economic and geopolitical uncertainty. Rising tensions in the Middle East and Eastern Europe, combined with slower global growth, projected at 2.8% for 2026 by the IMF, led investors to seek safer assets. Expectations of extended low interest rates from the U.S. Federal Reserve and the ECB further supported gold’s appeal.

3. Increased Investor Participation

Investor participation added another layer of momentum. Capital flows into

gold-backed investment products and physical holdings increased as gold’s role as both a hedge and a strategic allocation regained prominence. This combination of official and private demand amplified price movements and supported the rally during key periods of market stress.

As these dynamics unfolded, analyst expectations adjusted sharply. Price forecasts were revised higher across the industry, reflecting recognition that gold’s rally was underpinned by durable fundamentals rather than temporary shocks. While short-term corrections emerged along the way, they were widely viewed as consolidations within a broader uptrend, not a reversal of the underlying narrative.

Taken together, the surge in central bank accumulation, heightened macro uncertainty, and renewed investor interest created a rare alignment of forces. This perfect storm of demand explains not only how gold surpassed $5,000 per ounce, but why many market participants believe its strategic importance and price momentum will extend well beyond a single cycle.

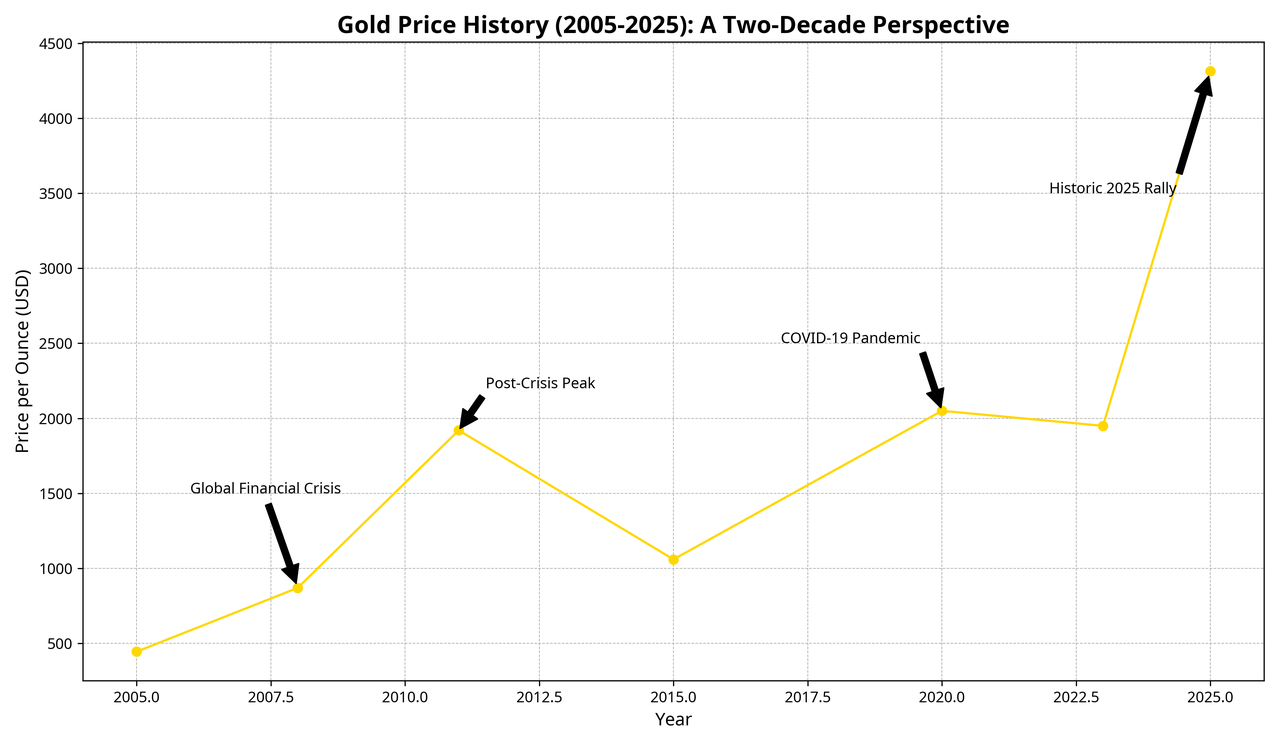

The Long View: Gold’s Two-Decade Journey of Steady Growth by 900%

Gold’s performance over the past 20 years is a masterclass in quiet competence. It’s a story of resilience, a testament to its enduring role as a safe harbor in a storm. From a price of around $445 per ounce in 2005, gold has methodically climbed to over $4,300 by the end of 2025, delivering a total return of more than 900%, according to historical data from StatMuse Money. This wasn’t a reckless, speculative surge, but a series of steady advances, often in direct response to global turmoil.

Source: Historical data from StatMuse Money

Looking back, you can see gold reacting to history in real-time. It rallied in the chaotic aftermath of the 2008 Global Financial Crisis, peaking near $1,900 in 2011. After a few quiet years, it found renewed purpose during the uncertainty of the COVID-19 pandemic in 2020. Then, in 2024 and 2025, it embarked on its most significant rally to date, fueled by a perfect storm of central bank buying and geopolitical instability.

Gold Futures Trading Volume Nears 450,000 in Feb 2026

Gold futures continue to rank among the most actively traded commodity derivatives globally, reflecting their role as a core hedge and macro trading instrument. As of February 3, 2026, total daily gold futures volume reached around 447,700 contracts, with the majority of activity concentrated in the April 2026 contract, which alone accounted for over 385,000 contracts in volume and 293,000 contracts in open interest. This concentration highlights where institutional liquidity is deepest, making front- and near-dated gold contracts the preferred vehicles for traders positioning around inflation trends, interest-rate expectations, and risk-off market moves across global markets operated by CME Group.

How to Trade Gold Futures with Crypto on BingX TradFi

GOLD perpetual contract on the BingX futures market

BingX TradFi lets you

trade gold futures using USDT as collateral, backed by strong market adoption, with the platform surpassing $1 billion in 24-hour TradFi trading volume in January 2026, including over $500 million from gold trading alone, giving you liquid, round-the-clock access to gold price movements without traditional brokers.

1. Log in to BingX and switch to the TradFi markets or head to the

Futures trading section.

2. Deposit or transfer

USDT into your futures wallet to use as margin.

5. Go Long or Short to trade rising or falling gold prices, and manage risk with stop-loss and take-profit tools in real time.

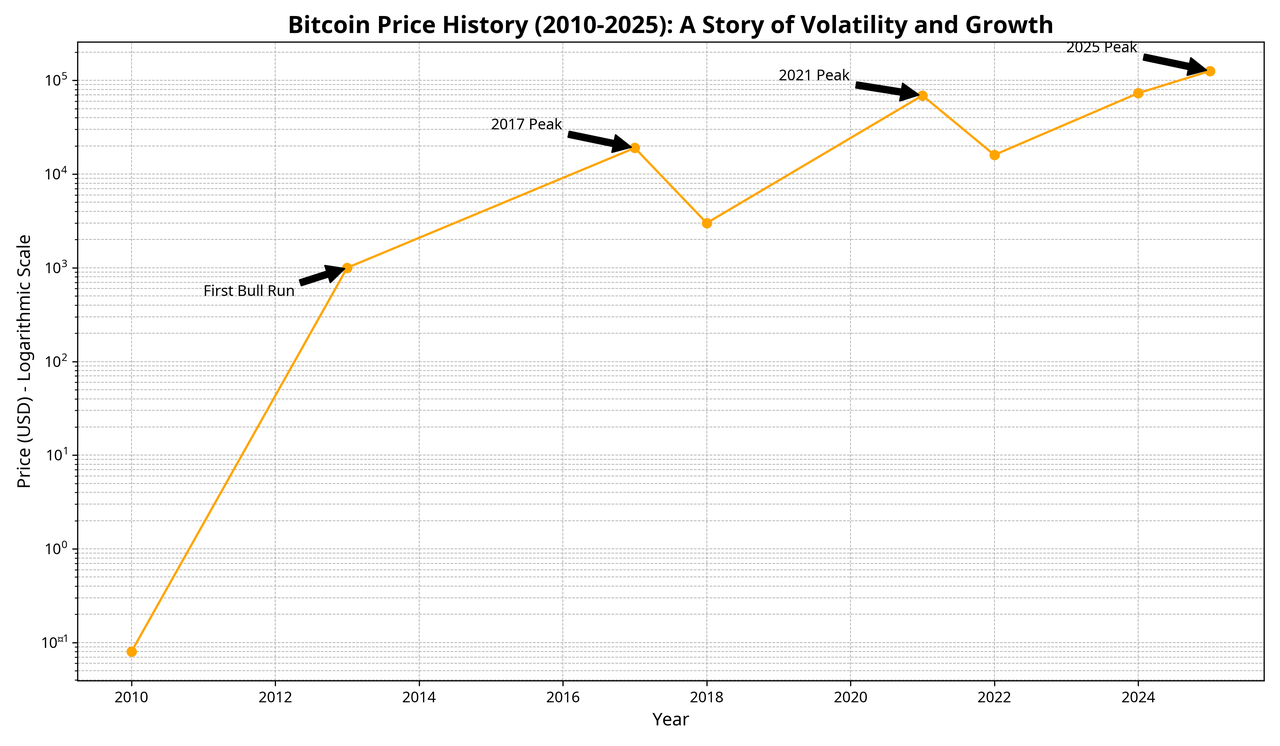

The Digital Age: Bitcoin’s Explosive and Cyclical 20,000,000% Rise

If gold’s story is a steady climb, Bitcoin’s is a series of rocket launches. Its history is shorter, far more dramatic, and defined by a scale of growth that has no parallel in modern finance. Since its first recorded price of less than ten cents in 2010, Bitcoin has generated returns exceeding 20,000,000% at its peak, as tracked by crypto data provider CoinGlass. But this explosive growth has come at a price: gut-wrenching volatility and a distinct, four-year cycle of boom and bust, tied to its “halving” events.

Source: Analysis of Historical Data from CoinGlass

Note: The vertical axis is on a logarithmic scale to visualize the vast price changes.

Bitcoin’s journey has been a rollercoaster. Major

bull runs in 2013, 2017, 2021, and most recently 2025, each saw the price multiply by staggering amounts. But each peak was followed by a punishing “

crypto winter,” with drawdowns often exceeding 80%. This pattern, while wildly profitable for those who can navigate it, underscores the immense risk and speculative nature of the asset.

Bitcoin’s Volatile Cooldown: BTC Price Dropped Below $80,000 in Feb 2026

Bitcoin’s 2025 story was a classic crypto drama. It was a year of incredible highs and sobering lows, a perfect illustration of its inherent volatility.

The price action followed the script of its historical four-year cycle almost to the letter. After the “halving” event in April 2024, the clock started ticking. As predicted by the cycle, the market peaked 18 months later, with Bitcoin hitting a breathtaking $126,000 in October 2025. But what goes up in a speculative frenzy must come down. The subsequent sharp decline was the inevitable start of the next “crypto winter,” a pattern well-documented across crypto market data providers like Yahoo Finance.

Even the arrival of institutional investors and

Bitcoin ETFs couldn’t prevent the cyclical downturn. While these developments have brought new legitimacy and capital to the market, 2025 proved that they haven’t tamed Bitcoin’s wild spirit. The asset still dances to the beat of its own drum, driven by internal market cycles and speculative fervor.

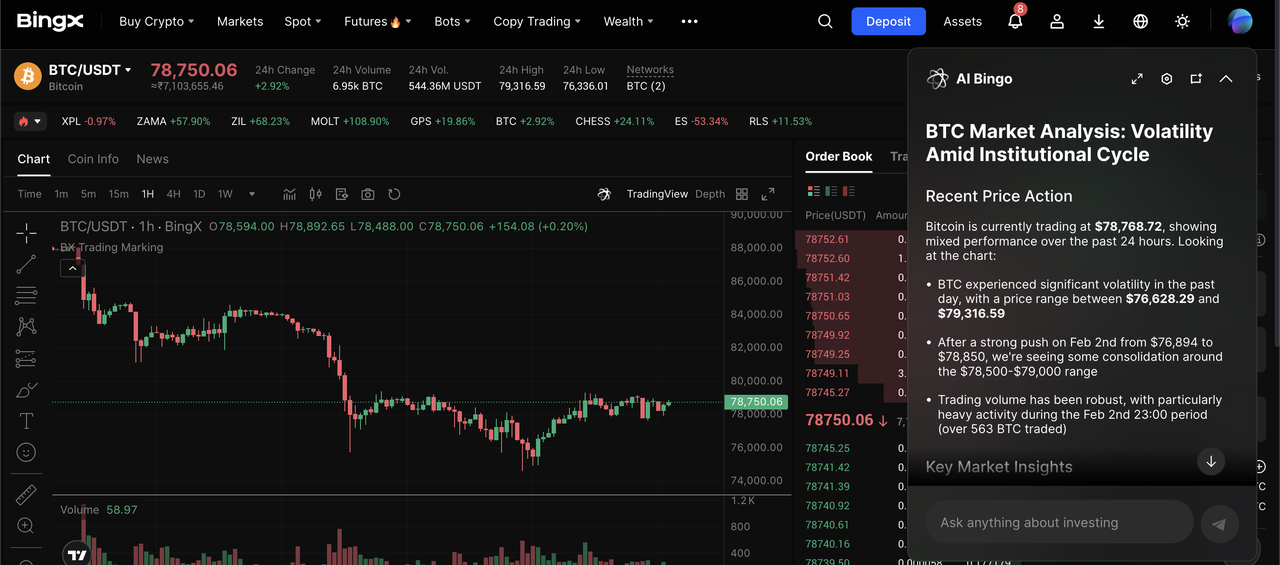

How to Trade Bitcoin (BTC) on BingX

BTC/USDT trading pair on the spot market powered by BingX AI insights

BingX lets you trade Bitcoin (BTC) with support from

BingX AI tools, helping you analyze market trends, manage risk, and execute trades more efficiently across different trading modes.

• Buy and Sell BTC on Spot Trading: Buy and sell BTC instantly at market or limit prices, ideal for long-term holding or short-term trading without leverage.

• Long or Short BTC on Futures Trading: Trade BTC with leverage to go long or short, enabling you to profit from both rising and falling markets while using advanced risk controls. Learn more about how to

long Bitcoin on the futures market.

• DCA Bitcoin on Recurring Buy: Automate BTC purchases at fixed intervals to average your entry price over time, a simple strategy for long-term accumulation amid market volatility. Learn more about how to

DCA Bitcoin via

BingX Recurring Buy.

The Investor's Dilemma: Buy Gold or Bitcoin in 2026?

The story of 2025, set against the backdrop of two decades of history, offers clear lessons for any investor.

For gold, the fundamental drivers that led to its 2025 rally remain firmly in place. JPMorgan’s Global Commodities Strategy team remains bullish, forecasting that the powerful combination of central bank and investor demand could push prices toward $6,000/oz by the end of 2026. The case for gold as a core part of a diversified portfolio has rarely been stronger.

For Bitcoin, the outlook is more complex. It remains a high-risk, high-reward proposition. Its history is a testament to its ability to generate life-changing wealth, but 2025 was a stark reminder that this potential comes with the risk of severe and prolonged downturns. Its role, for now, is that of a speculative asset, not a portfolio stabilizer.

Conclusion: Two Assets, Two Different Roles

In the head-to-head contest of 2025, gold was the clear winner. It delivered on its age-old promise as a store of value, rewarding investors with substantial, fundamentally-driven returns. Bitcoin, after a spectacular speculative surge, succumbed to its cyclical nature, reminding everyone of the risks involved.

The ultimate takeaway, however, isn’t that one is “better” than the other. It’s that they serve two vastly different purposes. Gold has proven itself, time and again, as a reliable hedge and a preserver of wealth. Bitcoin offers the tantalizing potential for exponential growth, but with commensurate risk. The dramatic story of 2025 provides a powerful and timely lesson in understanding this difference and the enduring value of a truly diversified portfolio.

Related Reading