One of the key tiggers that drove

Bitcoin’s drop from $92,000 to $86,000 at the start of December 2025 wasn’t caused by anything inside the crypto market. The real shock came from Japan, where 10-year Japanese

government bond (JGB) yields surged to their highest level since 2008 and the Bank of Japan signaled its first meaningful rate hike in nearly two decades.

Japan has long been a major source of ultra-cheap liquidity through the yen carry trade, where investors borrow low-yield yen to buy higher-return assets like Bitcoin. When the BOJ tightens, that cheap liquidity begins to unwind, and crypto, as one of the most liquidity-sensitive risk assets, feels the impact immediately.

This article explains how BOJ policy could directly influence Bitcoin’s price flows, how the yen carry trade might affect the broader crypto market, and what traders should expect if the BOJ proceeds with a December rate hike.

How Is the Bank of Japan (BOJ) Affecting the Crypto Market?

Japan is suddenly in the spotlight because its central bank, the Bank of Japan (BOJ), is

preparing to do something it hasn’t done in years: raise interest rates. For a country that has kept borrowing costs near zero for decades, even a small move sends a shock to global markets. Japan is openly discussing the “pros and cons” of raising

interest rates, language that markets interpret as a direct warning.

BOJ Signals a December Rate Hike

In a recent speech, BOJ Governor Kazuo Ueda indicated that the central bank will seriously evaluate raising rates at its December 18–19 meeting. His comments immediately pushed market expectations for a hike from 60% to 80%, reflecting how strongly traders believe the BOJ is preparing for a shift.

Ueda also expressed renewed confidence that Japan’s economy will rebound from its recent slowdown, noting that the impact of U.S. tariffs appears smaller than initially feared. More importantly, he highlighted several conditions the BOJ has been waiting for:

• Wage growth is accelerating

• Labour shortages are worsening

• Corporate profits are still strong

• Japan’s business lobby is urging companies to continue raising salaries

These developments suggest that inflationary pressures could finally become sustainable. Ueda emphasized that the BOJ is now “actively collecting” wage data ahead of its December meeting.

One strategist, Naomi Muguruma, chief bond strategist at Mitsubishi UFJ Morgan Stanley Securities, put it bluntly: “Ueda essentially pre-announced a December hike.” That is why traders now believe the BOJ is preparing markets for a move.

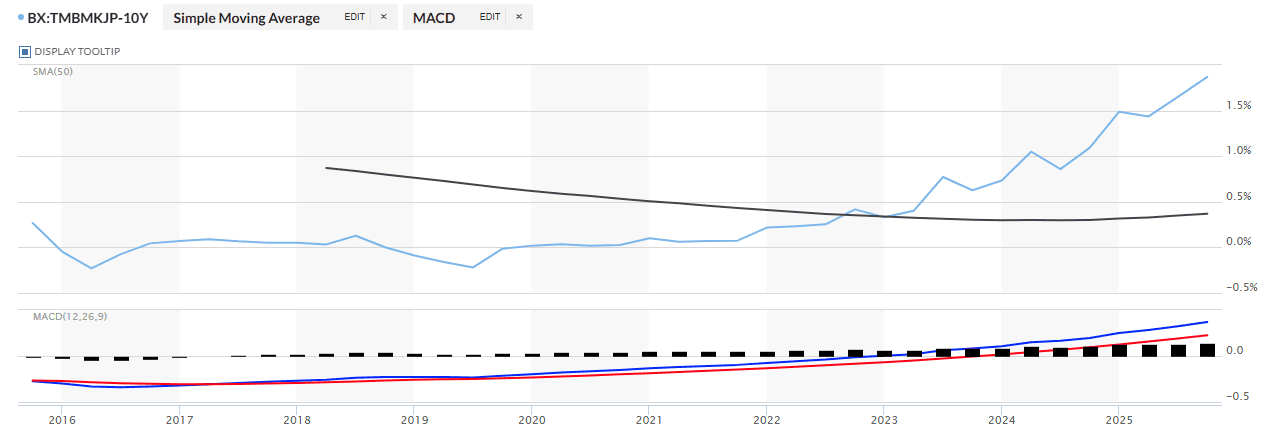

Bond Yields Hit Multi-Decade Highs

Japan’s bond market responded immediately to Ueda’s comments, and the shift is visible across the entire yield curve. The 10-year Japanese Government Bond (JGB) yield jumped to 1.873%, its highest level since 2008. This is a major move for a country that spent years keeping long-term yields close to zero.

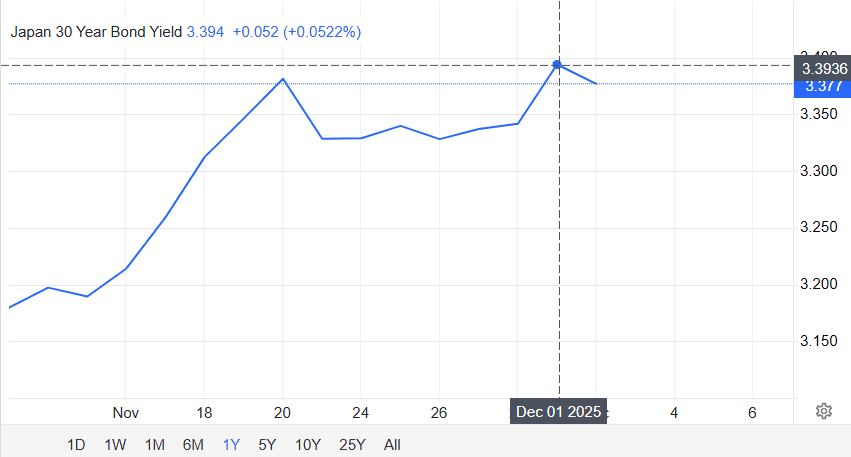

A similar trend appeared in longer-dated bonds. According to Trading Economics

data, the 30-year JGB yield climbed to 3.39%, rising 1.09 percentage points compared to the same period last year. This reflects growing expectations that Japan’s era of ultra-low interest rates is coming to an end.

Japan 30-Year Government Bond – Source: TradingEconomics

Short-term rates also spiked. The 2-year JGB yield, often the first to react to BOJ policy, jumped to 1.01%, its highest level since 2008. When short- and long-term yields rise simultaneously, it signals that markets expect more than a one-off adjustment. Instead, they anticipate a broader shift in monetary policy.

In total, Japanese government bond yields have risen by roughly 90 basis points since early 2025. For a country that spent decades suppressing yields through aggressive stimulus, this is a meaningful and rapid change. The surge is a clear sign that investors are positioning for tighter policy, and that shift is already spilling into global markets, including crypto.

Why Is Japan's Interest Rate Hike Shift a Big Deal for the Crypto Market?

Even a small rate increase in Japan can reshape global financial flows because:

• Japan has supplied ultra-cheap money to the world for decades

• Investors borrow low-cost yen to buy higher-yielding assets elsewhere

• When Japan’s yields rise, borrowing becomes more expensive

• The yen strengthens, forcing investors to unwind leveraged trades

• Global liquidity tightens very quickly

Ueda himself explained that raising rates now is more like “easing off the accelerator” than applying the brakes. Real interest rates in Japan are still deeply negative, but the direction has changed, and that alone is enough to shake markets.

With yen weakness becoming a political issue and concerns rising about inflation from expensive imports, the BOJ is under pressure to act. Reuters sources confirm that the central bank is preparing markets for a rate hike as soon as December, sending negative signals and putting downward pressure on

crypto markets.

How Does Japan’s Rate Hike Impact Global Markets?

Japan plays a much bigger role in global financial markets than many crypto traders realize, and a rate hike there can trigger ripple effects across the world. Higher Japanese yields change where money flows, how investors manage risk, and even how much leverage traders can use.

All of this directly influences Bitcoin and the broader crypto market.

1. Japan is the World’s Largest Foreign Holder of US Treasuries

According to

USAfacts, Japan holds roughly $1.1 trillion in US Treasuries, more than any other country. When Japanese bond yields rise, domestic investors have less incentive to hold US government debt. Instead, they can earn higher returns at home with lower risk.

If this rotation begins, it removes liquidity from global markets at a time when the US is issuing record amounts of debt. Lower liquidity typically translates into weaker demand for risk assets, including cryptocurrencies.

2. Rising Japanese Yields Reduce Appetite for Risk Assets

When the Japanese government bond yields spool up, they shift the risk–reward balance. Suddenly, relatively safe JGBs begin to offer competitive returns, turning heads away from volatile assets like crypto, tech equities, and emerging-market plays. That triggers a shift toward safety.

This shift toward safer assets is known as risk aversion. It usually leads to reduced trading activity and sharper price reactions during negative news cycles, which is exactly what the crypto market has been experiencing.

This isn’t theoretical, it’s happening now. On December 1, 2025, as yields surged to 17-year highs after hawkish comments from Bank of Japan (BOJ), global markets saw a wave of risk-off flows. Bitcoin dipped below $87,500 almost immediately, as investors pulled out from risky trades.

The conclusion is clear: higher yields are reshaping investor preferences. As safe-asset returns rise, e.g., for

gold, risk assets like digital assets and equities lose appeal and crypto, with its high volatility and dependence on global liquidity, feels the pain first.

3. Yen Strengthens = Carry Trades Unwind

When the yen strengthens, the classic yen carry trade begins to break down. Traders who borrow cheap yen to buy Bitcoin,

US equities, or emerging-market assets suddenly face rising funding costs. To limit losses, they start closing those positions, which means

selling crypto and other risk assets. This creates volatility and accelerates market pullbacks.

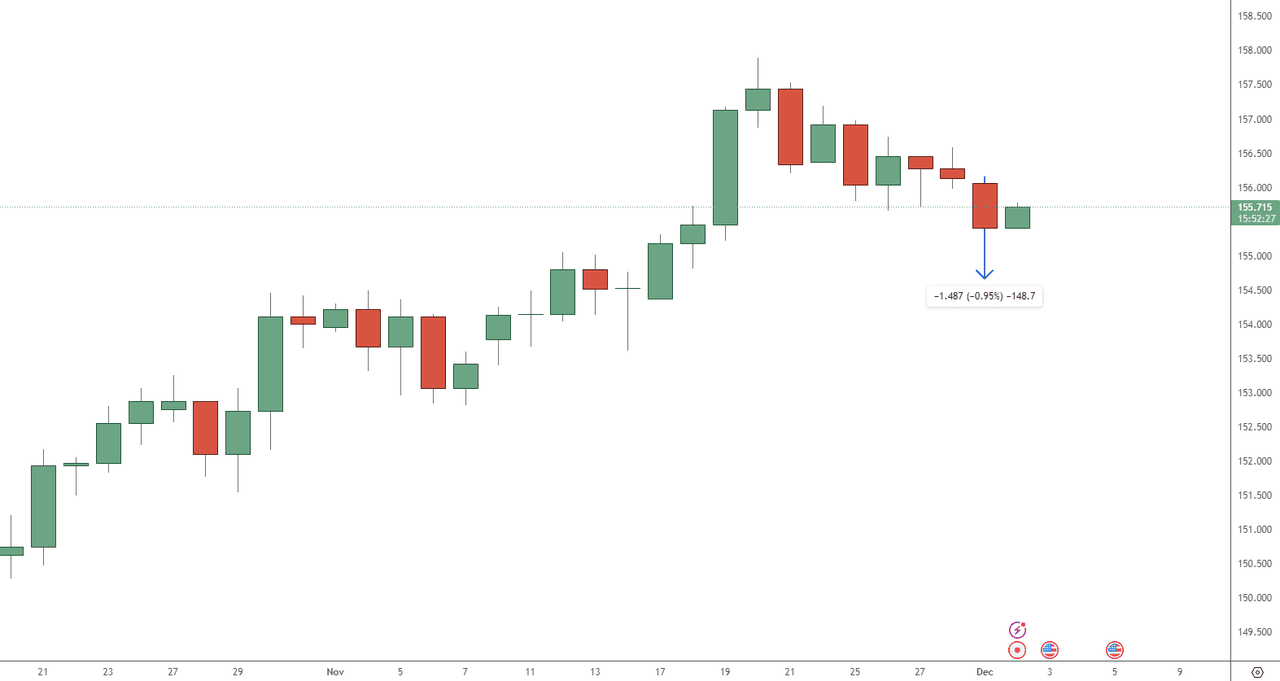

USD/JPY Price Chart - Source: Tradingview

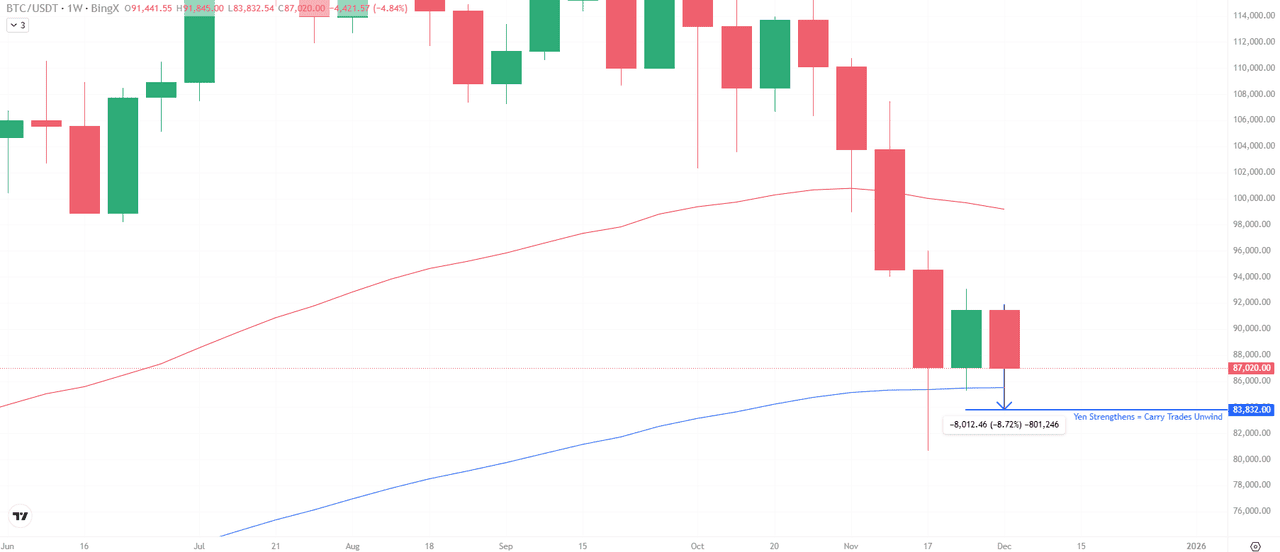

A real example came on December 1, 2025, when the yen jumped to 154.66 per dollar low after BOJ’s rate-hike signal. Within hours, Bitcoin slid from $92,000 to $83,832 low, a move directly linked to carry-trade unwinding in Asia.

Bitcoin (BTC/USD) Price Chart - Source:

BingX

Arthur Hayes summed it up clearly: “A stronger yen means less fuel for the casino.”

Why Is the Crypto Market the First to Feel the Impact of the Yen Carry Trade?

What Is the Yen Carry Trade?

For years, the yen has been one of the cheapest currencies to borrow. Traders, hedge funds, and global institutions take advantage of this by borrowing low-interest yen and investing that money into higher-yielding assets such as Bitcoin, altcoins, tech stocks, and emerging-market equities. As long as the yen stays weak and borrowing costs remain low, this strategy is profitable and widely used.

What Happens When BOJ Hikes Interest Rates?

A potential BOJ rate hike changes the entire equation. When interest rates rise:

• the yen strengthens

• borrowing becomes more expensive

• leveraged yen-funded trades become unprofitable

As a result, traders begin unwinding carry trades. They close positions financed with yen and sell assets, including Bitcoin, to repay those loans. This triggers selling pressure and increases volatility across global markets.

A recent example shows this clearly. On December 1, 2025, after Governor Ueda signaled a December rate hike, the yen strengthened sharply. Within a few hours, market participants noted a noticeable pick-up in forced selling across Asian crypto markets, consistent with carry-trade unwinds.

Evidence from Crypto Markets on the Yen Carry Trade's Impact

The market reaction over the past two weeks shows a clear pattern: as BOJ tightening expectations rose and the yen strengthened, crypto saw immediate outflows and sharp price resets. The timing of each move lines up directly with Governor Ueda’s latest comments.

On the weekly Bitcoin chart, BTC dropped toward the 83,800 USDT region, marking an 8.7% weekly decline at the exact moment yen strength accelerated. This move is consistent with a carry-trade unwind, where yen-funded positions are closed quickly to avoid rising funding costs.

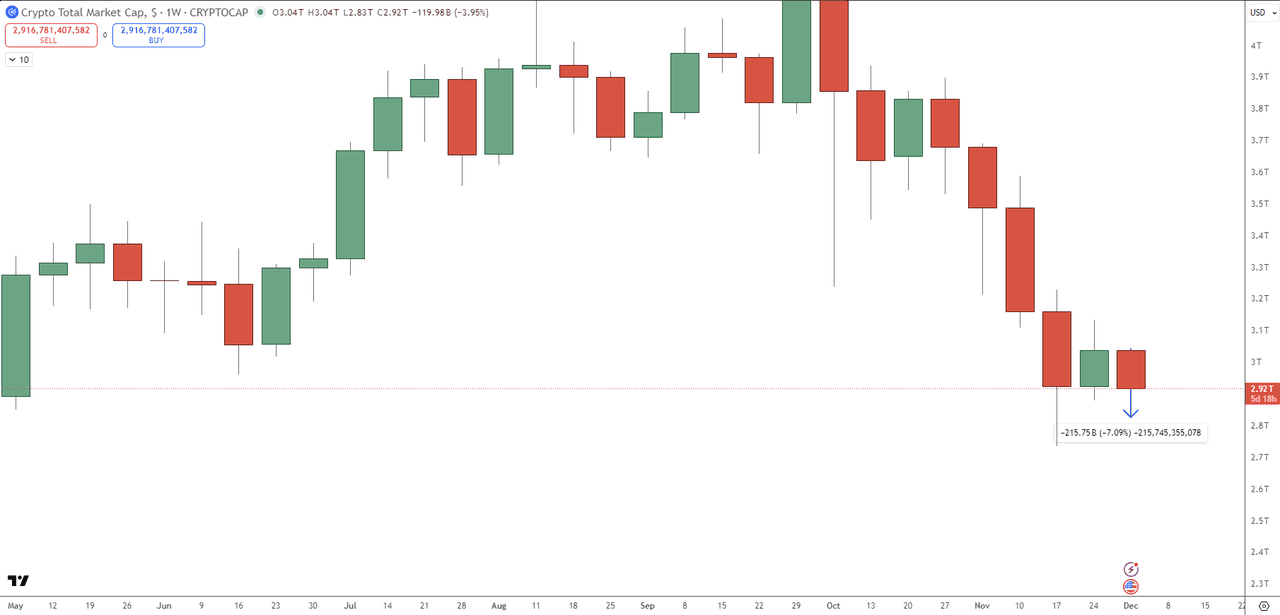

Crypto Market Cap Chart - Source: Tradingview

A similar trend appears across the broader crypto market. The total crypto market cap fell by 7.09% in the same week, losing roughly $215 billion. This broad decline signals that selling pressure wasn’t limited to Bitcoin, it was a full market-wide risk reduction triggered by global macro stress rather than crypto-specific news.

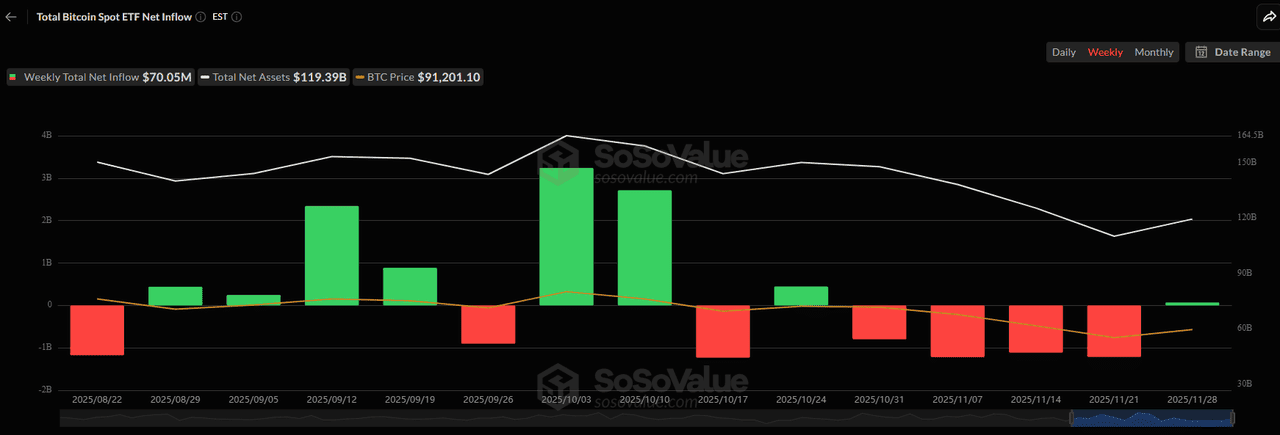

Spot Bitcoin ETF Flows Confirm Liquidity Is Exiting Crypto

ETF flows mirror exactly what the charts show: liquidity is leaving the crypto market as BOJ tightening odds rise. For the week ending November 28, spot Bitcoin ETFs recorded another round of negative flows, extending a multi-week streak of outflows driven by risk aversion. Total ETF assets under management have slipped toward $119 billion, reflecting a clear reduction in institutional exposure.

Weekly Bitcoin Spot ETF Net Inflow - Source:

SoSoValue

The message is consistent across Bitcoin price action, market cap data, and ETF flows: rising Japanese yields and yen strength are pulling liquidity out of high-volatility assets. This correction is macro-driven, not crypto-driven, and ETFs provide the clearest confirmation of that shift.

Bitcoin Price Prediction Based on Possible BOJ Rate Decision Scenarios

Japan’s December 18–19

BOJ meeting is now the single most important macro event for global risk markets. Based on current pricing and the latest statements from Governor Ueda, here are the three realistic paths forward.

Scenario 1: BOJ Hikes in December (Most Likely Outcome)

Markets currently price an 80% probability of a December rate hike, making this the baseline scenario.

If the BOJ raises rates:

• The yen strengthens further, increasing funding costs for traders relying on cheap yen borrowing.

• Carry trades unwind, forcing more selling of BTC, tech stocks, and emerging-market assets.

• Global liquidity tightens, as Japanese capital flows back into domestic bonds offering higher yields.

• Bitcoin may retest the $82,000–$84,000 support zone.

• In a deeper liquidity squeeze, BTC could briefly dip toward $78,000, where major weekly liquidity sits.

This would confirm the end of Japan’s ultra-loose policy and trigger a second wave of risk-off positioning across crypto.

Scenario 2: BOJ Holds Rates Steady (Short-Term Bullish Relief)

If Ueda decides not to hike in December, despite preparing the market for one, we should expect a sharp reversal across risk assets.

If BOJ stays on hold:

• The yen weakens again, lowering funding costs for leveraged positions.

• Traders rebuild risk exposure, reversing part of the carry-trade unwind.

• Crypto stabilizes after several volatile weeks.

• Bitcoin could rebound toward the $90,000–$92,000 range as liquidity flows back into ETFs and exchanges.

Even a temporary pause would unwind the fear premium that has built up across BTC and altcoins over the past two weeks.

Scenario 3: BOJ Begins Full Policy Normalization (The Most Bearish Case)

This is the least likely scenario, but the most consequential if it happens. A full normalization cycle means Japan gradually moves away from the low-rate framework it has maintained since the early 2000s.

If BOJ signals a multi-step tightening plan:

• Japanese yields continue rising across the curve.

• Large institutions unwind international positions to rotate back into domestic bonds.

• Global liquidity contracts for several months, not just weeks.

• Bitcoin could enter a multi-month consolidation phase, with rallies capped by persistent macro headwinds.

• Altcoins would likely face deeper corrections due to higher volatility and lower liquidity.

This would remove one of the biggest remaining sources of cheap global liquidity, a structural shift that crypto cannot ignore.

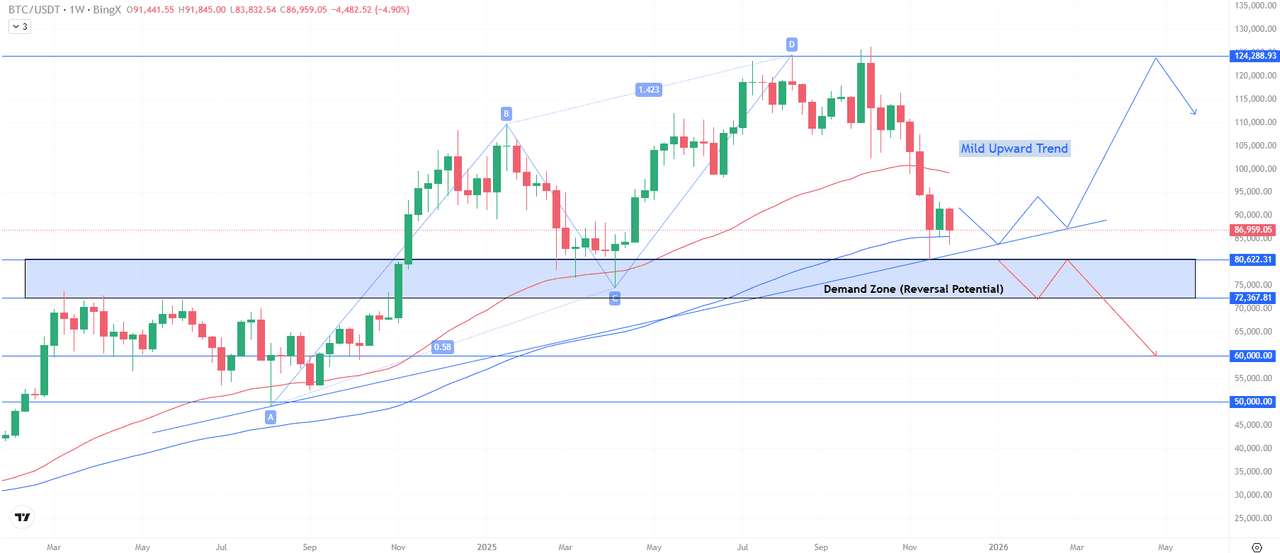

Bitcoin (BTC/USD) Faces Key Resistance Near $92,000, Reversal Near $80,600

Bitcoin is now sitting within a key demand zone, where past price action has repeatedly triggered strong buying interest. This area, between $80,600 and $72,300, represents a high-probability reversal region, especially if BOJ policy stabilizes in the coming weeks. A clean break below this range, however, would signal a deeper macro-driven correction.

Bitcoin (BTC/USD) Price Chart - Source:

BingX

On the other hand, BTC faces immediate

resistance, near $90,000–$92,000, followed by a broader supply zone toward $124,000, where the market previously rejected higher prices.

Traders should pay close attention to how price reacts to trendline support and the 50- and 200-week

moving averages, both of which historically guide long-term trend direction on BingX charts.

What to Monitor Next?

The next major moves in Bitcoin will depend less on crypto-native news and more on how global macro conditions evolve. Traders should keep an eye on:

• ETF flows: Outflows confirm risk-off behavior; inflows signal recovery in institutional appetite.

• USDJPY volatility: A strengthening yen typically pressures BTC due to carry-trade unwinds.

• Bond yields (10Y and 30Y): Rising Japanese yields tighten global liquidity and reduce risk appetite.

• Liquidity indicators: TVL trends, exchange inflows/outflows, and market depth all reveal how much capital is entering or leaving the crypto ecosystem.

Final Takeaway: Will Japan Push Crypto Lower?

Bitcoin’s drop is not a crypto-driven correction, it directly reflects Japan’s bond-market shock and a rapid tightening in global liquidity. As long as Japanese yields rise and the yen strengthens, risk assets will stay vulnerable to further de-risking.

If the BOJ hikes in December, Bitcoin may retest the lower end of its demand zone. If the BOJ holds or softens its tone, liquidity could stabilize quickly and BTC may reclaim the $90K region.

For now, traders should watch Japan’s bond market as closely as Bitcoin’s chart. A single policy shift in Tokyo can reset global risk appetite and decide whether crypto extends its pullback or starts a sharp recovery.

Related Articles

FAQs on Japanese Interest Rates and Bitcoin Price

1. Why does Japan’s interest rate matter for Bitcoin and the wider crypto market?

Japan has supplied cheap liquidity to global markets for decades. When the BOJ raises rates, borrowing costs rise, the yen strengthens, and leveraged positions in Bitcoin and other risk assets are forced to unwind. This often triggers sell-offs in crypto.

2. How did BOJ comments cause Bitcoin to drop from $92K to $86K?

After Governor Ueda signaled a possible December hike, Japanese bond yields surged to 17-year highs and the yen strengthened. This led to a rapid unwinding of yen-funded carry trades, directly pressuring Bitcoin and crypto markets.

3. What is the yen carry trade and why does it affect crypto?

Traders borrow low-interest yen to buy higher-yielding assets like BTC. When the yen strengthens or rates rise, these trades become unprofitable. Traders exit positions quickly, creating volatility across crypto markets.

4. What happens to the crypto market if the BOJ hikes rates in December?

A December hike would likely strengthen the yen further, tighten global liquidity, and increase the risk of additional BTC downside. Bitcoin could retest the $82K–$84K zone or even briefly dip toward $78K.

5. What key indicators should crypto traders watch next?

Key signals include USDJPY volatility, JGB yields (10Y/30Y), ETF flows, and on-chain liquidity measures such as TVL, exchange inflows/outflows, and market depth.