Ethereum is trading near $2,966 on Dec 26, Boxing Day, edging higher as markets digest ETF outflows amid thin Christmas liquidity. While institutional flows turned cautious into the holiday break, ETH price action remains technically constructive, with buyers continuing to defend key support levels following the early December selloff.

At current levels, Ethereum remains the second-largest cryptocurrency by market capitalization at roughly $358 billion, with 24-hour trading volume exceeding $15.3 billion.

Price has stabilized just below the $3,000 mark, a zone that has repeatedly acted as both support and resistance in recent weeks, keeping the market locked in consolidation rather than breakdown.

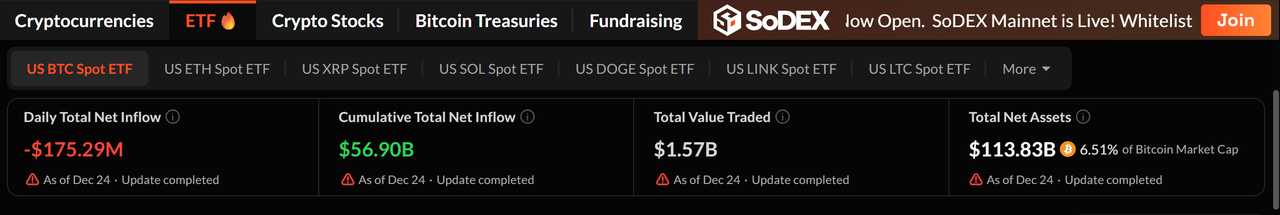

Bitcoin and Ethereum ETFs See Holiday-driven Outflows

Exchange-traded funds tracking Bitcoin and Ethereum recorded combined net outflows of about $232 million on Dec. 24, according to SoSoValue data, investors reduced exposure ahead of the Christmas break.

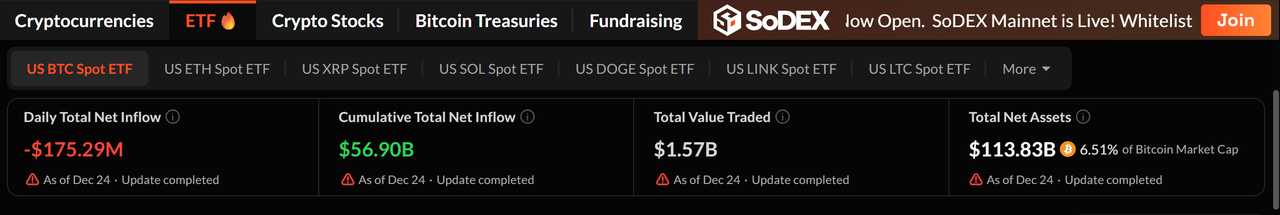

Bitcoin-focused ETFs accounted for the bulk of withdrawals, with roughly $175 million exiting the space. BlackRock’s IBIT led the redemptions with $91.37 million, while Grayscale’s GBTC saw $24.62 million leave the fund. Despite the daily decline, cumulative net inflows into Bitcoin ETFs remain elevated at around $56.9 billion, with total net assets near $113.8 billion, suggesting short-term positioning rather than a structural shift in demand.

US BTC Spot ETF - Source: Sosovalue

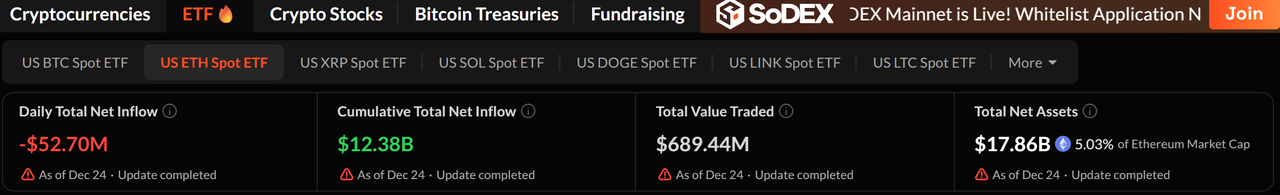

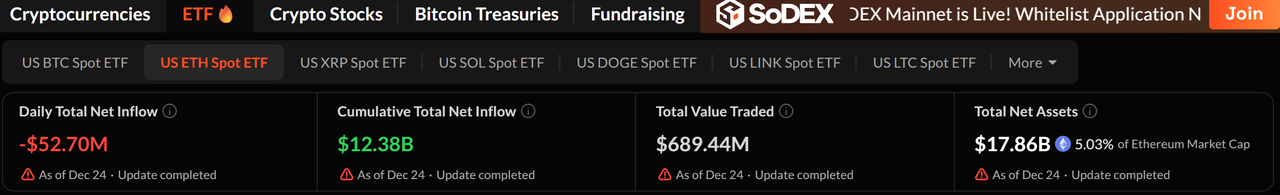

Ethereum ETFs also faced pressure, recording about $57 million in net outflows during the same session. Grayscale’s ETHE led the exits with $33.78 million in redemptions, pushing its lifetime outflows to roughly $5.08 billion. Grayscale’s Ethereum Mini Trust ETF stood out as an exception, attracting $3.33 million in fresh inflows and lifting its cumulative intake to about $1.51 billion.

US ETH Spot ETF - Source: Sosovalue

Holiday trading periods typically see reduced institutional participation and thinner liquidity, which can exaggerate daily fund flow figures without necessarily altering the broader market trend.

While Ethereum consolidates during the Christmas lull, it’s worth revisiting

how Bitcoin’s Christmas pricing has historically marked key turning points, rising from $0.003 to almost $87,000 in 16 years.

Ethereum Technical Analysis: Consolidation Holds above $2,900, Not a Breakdown

On the four-hour chart, Ethereum appears to be at an inflection point rather than in a renewed downtrend. After the sharp decline earlier this month, ETH formed a base in the $2,650–$2,700 zone, where price repeatedly found demand along a rising trendline drawn from the November lows. That trendline remains intact and continues to support a sequence of higher lows.

ETH is now consolidating just below $3,000, with the 50-period

EMA (Exponential Moving Average) flattening near current price and the 100-period EMA acting as overhead

resistance. The structure resembles a short-term falling wedge evolving into a basing pattern, a setup often seen before a directional move. Recent

candlesticks show smaller bodies and overlapping ranges, including a bullish engulfing reaction from $2,775 followed by indecision near resistance.

RSI has recovered into the mid-50s, signaling stabilization rather than strong momentum. Importantly, there is no clear bearish divergence as price retests resistance, indicating that selling pressure is easing rather than accelerating.

Ethereum Price Prediction: Can ETH Break $3,150 and Target $3,400 Next?

ETH may continue to range between $2,900 and $3,150 in the near term as the market absorbs supply. A sustained close above $3,150 would mark a structural shift and expose $3,286, followed by $3,446 if momentum builds. On the downside, a decisive break below $2,775 would weaken the recovery setup and reopen $2,650.

From a trading perspective, Ethereum favors patience rather than aggressive positioning. Holding above the rising trendline keeps the accumulation narrative intact, with upside potential toward $3,300–$3,450 if resistance gives way once liquidity normalizes after the holidays.

Conclusion

From a trading perspective, Ethereum favors patience rather than aggressive positioning. Holding above the rising trendline keeps the accumulation narrative intact, even as ETF flows soften during the holiday period. If liquidity improves and resistance levels give way in the days ahead, ETH could transition from consolidation into a renewed recovery phase, with $3,300–$3,450 emerging as realistic upside targets as the market moves beyond the Christmas lull.