This is not a typical bull-or-bear setup. Instead, Ethereum’s 2026 outlook is defined by how demand is changing, where activity is moving, and what role

ETH plays in a layered financial system.

This guide explains what to realistically expect from Ethereum in 2026, grounded in institutional research, on-chain mechanics, regulatory developments, and network-level economics, so ETH traders and long-term holders can plan with clarity rather than narratives.

Key Takeaways at a Glance

1. Institutional demand is structurally outpacing new ETH issuance, driven primarily by spot ETH ETFs and the growth of tokenized assets, according to Bitwise’s 2026 outlook, creating a demand floor that did not exist in earlier cycles.

2. Layer-2 networks now process the majority of retail Ethereum activity, while Ethereum

Layer-1 has evolved into a settlement, staking, and security layer supporting rollups, institutional DeFi, and regulated financial products.

3. Regulatory clarity, not short-term hype, is the most important potential catalyst for ETH in 2026, with US market-structure legislation, such as the proposed CLARITY Act, playing a central role in shaping institutional participation.

4. Ethereum’s value capture model is shifting away from per-transaction fee spikes toward staking yield, settlement demand, and ETH’s role as a monetary and collateral asset within a layered ecosystem.

5. 2026 could become a transition year for Ethereum, characterized by heightened volatility, sector rotation, and structural repositioning, rather than a single, retail-driven cycle peak.

An Overview of Ethereum and Why It Still Matters in the Crypto Market

Ethereum is a decentralized, open-source blockchain platform designed to support smart contracts and decentralized applications (dApps). Proposed in 2013 by Vitalik Buterin and launched in 2015, Ethereum expanded the idea of blockchain beyond simple peer-to-peer payments by enabling programmable finance, digital assets, and autonomous applications to run on a shared global network. A major milestone came with Ethereum 2.0, completed in 2022, which transitioned the network from energy-intensive proof-of-work to proof-of-stake, improving security, sustainability, and the foundation for long-term scaling. Since then, Ethereum’s roadmap has focused on incremental upgrades rather than radical redesigns, reinforcing its role as a neutral and reliable base layer for the crypto economy.

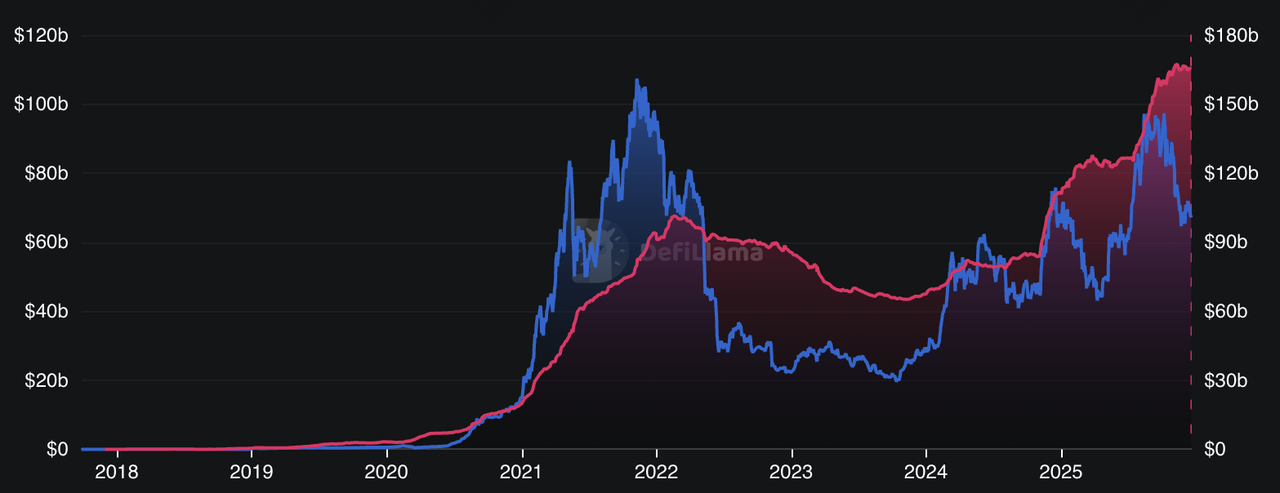

Ethereum L2 TVL | Source: L2Beat

As of late 2025, Ethereum remains the core infrastructure layer of crypto, even as most user activity shifts to Layer-2 networks. The network secures the largest share of DeFi total value locked at about $67.8 billion, hosts a stablecoin market cap of roughly $165.2 billion, and anchors an expanding Layer-2 ecosystem with around $43 billion in TVL, underscoring its dominance in onchain capital and settlement. Recent upgrades such as

Dencun significantly reduced data costs for rollups, accelerating Layer-2 adoption, while upcoming roadmap phases like

Fusaka aim to further optimize scalability and efficiency. Together, these developments show that Ethereum’s relevance in 2026 is defined less by raw Layer-1 transaction counts and more by its role as the settlement layer for onchain capital, the trust anchor for Layer-2 ecosystems, and the base network for institutional crypto adoption.

Where Ethereum Stands Entering 2026

Entering 2026, Ethereum sits in a structurally stronger but more complex position than in past cycles. ETH trades well below its previous all-time high near $5,000, yet underlying network fundamentals remain robust: usage continues to grow, primarily through Layer-2 networks, while institutional access has expanded via spot ETFs, regulated custody, and tokenized finance platforms.

Recent upgrades such as Dencun and

Pectra have improved scalability and rollup efficiency but have not eliminated Layer-1 fee pressure, reinforcing Ethereum’s shift toward a settlement-centric role. As highlighted in Bitwise’s The Year Ahead: 10 Crypto Predictions for 2026, Ethereum’s market dynamics are now shaped less by short-term retail speculation and more by regulated capital flows, tokenization demand, and macro-driven investment behavior, marking a decisive break from its earlier, retail-led cycles.

What to Expect From Ethereum L1 and Its L2 Ecosystem in 2026

Ethereum is no longer designed to operate as a single execution environment, and that change is deliberate. Over the past three years, Ethereum has transitioned into a layered financial system, where execution and settlement are intentionally separated. This architectural shift is now the defining factor behind how Ethereum scales, how users interact with the network, and how value accrues to ETH in 2026.

According to Bitwise Asset Management and Blockworks Research, Ethereum’s growth is no longer measured by Layer-1 transaction counts alone. Instead, it is reflected in where activity occurs (Layer-2s), where capital settles (Layer-1), and how institutions interact with the network through regulated rails. This design mirrors traditional financial systems, where consumer transactions run on fast, low-cost networks while final settlement occurs on slower, highly secure infrastructure.

Layer-2s Are Now Ethereum’s Retail Execution Layer

By 2026, the majority of retail-facing Ethereum activity, including

DEX trading, NFT minting, gaming, social apps, and everyday token transfers, takes place on Layer-2 networks, not on Ethereum’s base layer. Leading rollups such as

Arbitrum,

Optimism,

Base, and

zkSync have effectively become Ethereum’s primary execution environments for retail users, while Ethereum Layer-1 increasingly serves as a settlement and security backbone rather than a consumer transaction layer.

According to data aggregated by Blockworks Research and cited by Bitwise, Layer-2s now process the majority of Ethereum-based transactions by count, reflecting a clear migration of user activity. Average transaction costs on L2s are 90–99% lower than on Ethereum Layer-1, and total value locked across Ethereum Layer-2 networks has reached approximately $43 billion, signaling sustained user adoption and liquidity concentration. This shift is not speculative; it is measurable and ongoing.

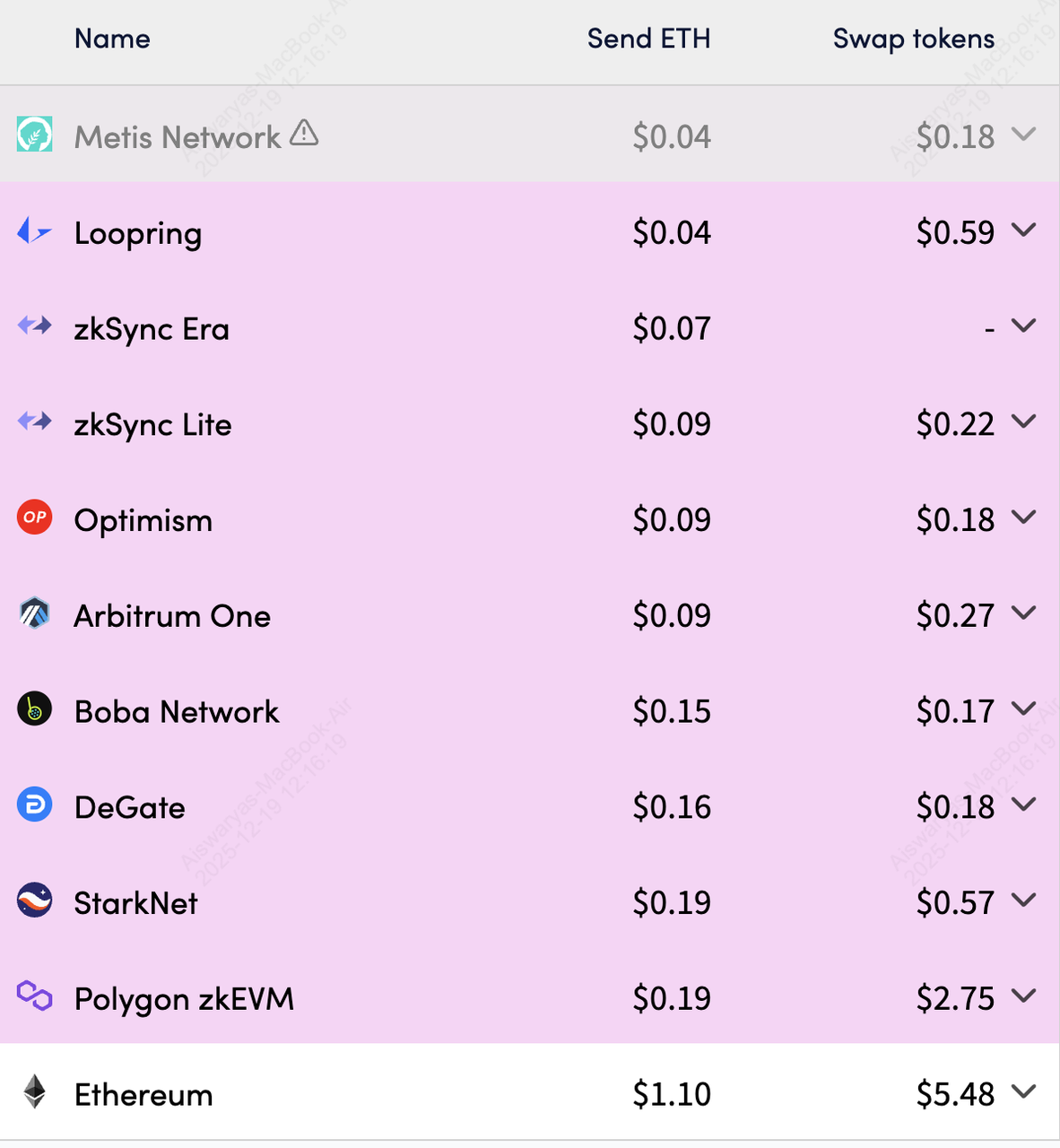

Ethereum vs. L2 gas fees comparison | Source: L2Fees

Fee comparisons from late 2025 show why retail behavior has structurally changed: Ethereum Layer-1 transactions typically cost $3–$20 during congestion, while Arbitrum and Optimism average $0.05–$0.30, and Base often falls below $0.10. For small and medium-sized trades, frequent interactions, and consumer-grade applications, Layer-1 is economically impractical. As a result, wallets and dApps increasingly default users to Layer-2s, often abstracting the underlying network entirely. In practical terms, many retail users now “use Ethereum” every day without directly interacting with Ethereum Layer-1 at all.

Why the Ethereum Layer-1 Still Anchors the Entire System

While retail execution has moved to Layer-2s, Ethereum Layer-1 has not lost relevance. Instead, its role has become more specialized, and more valuable. Ethereum’s base layer increasingly serves functions that do not require frequent interaction but demand maximum trust, neutrality, and finality.

Ethereum Layer-1 is now primarily responsible for:

• Final settlement for Layer-2 rollups

• Validator staking and network consensus

• Security guarantees for the entire rollup ecosystem

• Issuance and settlement of tokenized real-world assets

• Institutional DeFi, onchain funds, and regulated financial products

This structure closely mirrors traditional financial systems, where everyday retail payments are processed on fast, low-cost networks optimized for volume and convenience. Final settlement, however, takes place on slower but highly secure infrastructure designed to prioritize trust, accuracy, and systemic stability over speed.

Ethereum is following the same structural path. According to Bitwise, this design is a key reason Ethereum continues to attract institutional interest, even as retail transaction volume migrates elsewhere. Layer-2 growth does not replace Ethereum Layer-1; it depends on it for security, settlement, and coordination.

In 2026, Ethereum’s importance is therefore not defined by how many transactions Layer-1 processes, but by its role as the settlement layer for the largest pool of onchain capital, the trust anchor for Layer-2 ecosystems, and the base network for institutional crypto adoption. This layered architecture is the foundation upon which Ethereum’s next phase of growth, and ETH’s long-term value proposition, rests.

Ethereum Network Upgrades Optimizing L1 for Settlement and L2 for Scale

Ethereum’s technical roadmap heading into 2026 is explicitly rollup-centric, meaning upgrades are designed to improve how Layer-2s use Ethereum, rather than to turn Layer-1 back into a high-throughput retail execution chain. Core upgrades such as Dencun in March 2024 and Pectra in May 2025 significantly reduced

data availability costs for rollups by introducing and expanding blobs, which lowered L2 transaction fees by an estimated 80–90% compared with pre-Dencun levels, according to analysis from Ethereum Foundation researchers and Blockworks Research. At the same time, these upgrades improved validator efficiency and network stability without materially increasing Layer-1 transaction throughput.

From an L1 vs. L2 perspective, this direction is intentional. Ongoing blob capacity expansion primarily benefits Layer-2 scalability, allowing rollups to post more compressed data to Ethereum at lower cost, while Layer-1 blockspace remains scarce and premium. As Ethereum co-founder Vitalik Buterin reiterated at ETHGlobal Prague in June 2025, Ethereum L1 is optimized to be a settlement, data availability, and security layer, not a consumer transaction network. In practice, this means Ethereum L1 fees are expected to remain variable and occasionally high during demand spikes, because fee pressure is a feature of scarce, high-security blockspace rather than a flaw to be engineered away.

The practical takeaway for 2026 is clear and data-backed. Do not expect Ethereum Layer-1 fees to disappear, as no roadmap item targets mass retail execution on L1. Expect Layer-2 networks to continue delivering cheaper, faster UX, driven by blob scaling and rollup optimization. And expect Ethereum Layer-1 to become increasingly institutional, anchoring validator staking, rollup settlement, tokenized real-world assets, and regulated onchain finance, while Layer-2s absorb the bulk of retail activity.

Ethereum Price Prediction 2026: What the L1–L2 Dynamic Means for ETH’s Price

Ethereum’s transition to a layered architecture has altered the core drivers of ETH’s valuation, making it essential to understand how the interaction between Layer-1 and Layer-2 networks shapes price dynamics in 2026.

From Fee-Driven Cycles to Structural Value Capture

The interplay between Ethereum Layer-1 and Layer-2s fundamentally reshapes how ETH’s price should be evaluated in 2026. In earlier cycles, ETH price appreciation was closely tied to Layer-1 congestion, gas fees, and retail speculation. That relationship has weakened. Retail execution has largely migrated to Layer-2s, but value capture has not left Ethereum; it has shifted toward settlement demand, staking economics, and institutional accumulation, which now play a larger role in ETH’s price formation.

Institutional Demand Is Decoupling ETH From Retail Usage

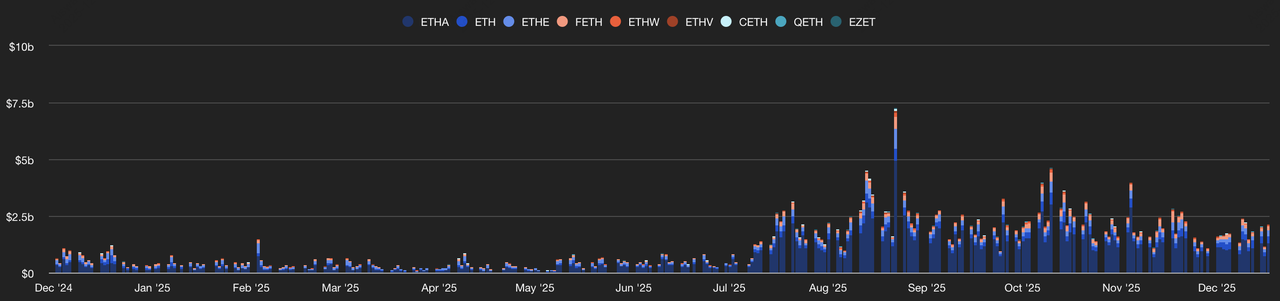

Spot Ethereum ETF volumes | Source: TheBlock

From a demand perspective, institutional research from Bitwise estimates that Ethereum will issue roughly around 960,000 ETH in 2026, while spot ETH ETFs and regulated investment vehicles are expected to absorb more than that amount if current trends continue. This mirrors

Bitcoin’s ETF-driven supply imbalance and suggests that ETH demand is increasingly decoupled from Layer-1 retail activity. Even as Layer-2s reduce direct fee pressure on L1, they expand the number of users, applications, and assets that ultimately rely on Ethereum for settlement, supporting long-term demand for ETH as the network’s core asset.

Supply, Burn, and Staking in a Rollup-Centric Model

On the supply side, the L1–L2 architecture creates a more nuanced picture. Lower Layer-1 fees during normal conditions may reduce ETH burn compared with peak DeFi or NFT cycles, but this is partially offset by higher aggregate activity across Layer-2s, continued staking lock-ups, and institutional holdings that are less price-sensitive. Analysts cited by Bitwise and Blockworks Research increasingly frame ETH in 2026 not as a simple “gas token,” but as a yield-bearing settlement asset, similar to how sovereign bonds function in traditional financial systems. This implies fewer explosive, fee-driven price spikes, but a greater likelihood of higher, more resilient valuation ranges if institutional demand persists.

What This Means for ETH Price in 2026

As a result, most credible

ETH price outlooks converge around scenario-based ranges rather than single targets. In a constructive scenario, where ETF inflows remain strong and US market-structure regulation advances, ETH could retest or exceed its prior all-time high near $5,000, supported by structural demand rather than retail speculation. In a neutral scenario, where Layer-2 growth continues but macro and regulatory conditions remain mixed, ETH is more likely to

trade range-bound, reflecting its transition into a settlement-centric asset. The key insight is clear: Layer-2 adoption is not bearish for ETH. In 2026, ETH’s price will be driven less by how crowded Layer-1 becomes, and more by how indispensable Ethereum is as the settlement layer beneath an expanding Layer-2 and institutional ecosystem.

Other Key Factors That Could Drive ETH’s Price in 2026 Beyond the L1–L2 Shift

The following factors act as macro drivers layered on top of the L1–L2 architecture, influencing ETH’s price formation in 2026 without changing the core dynamic that Layer-2s handle execution while Layer-1 captures long-term value.

1. Institutional Supply–Demand Imbalance (ETFs): According to Bitwise, Ethereum is expected to issue approximately 960,000 ETH in 2026 valued around $3 billion at December 2025 prices, while spot ETH ETFs and other regulated vehicles are already absorbing more ETH than net new issuance on an annualized basis. This mirrors Bitcoin’s ETF dynamic, where ETFs purchased more than 2× new BTC supply, and introduces a structural demand floor that did not exist in earlier, retail-driven cycles.

2. Shift to Long-Duration, Regulated Demand: Unlike prior Ethereum bull markets dominated by short-term retail flows, a growing share of ETH demand in 2026 is institutional, regulated, and portfolio-allocated. As per Bitwise's forecasts, his changes how ETH trades during volatility, making price action less dependent on Layer-1 congestion and more tied to capital allocation decisions by asset managers and funds.

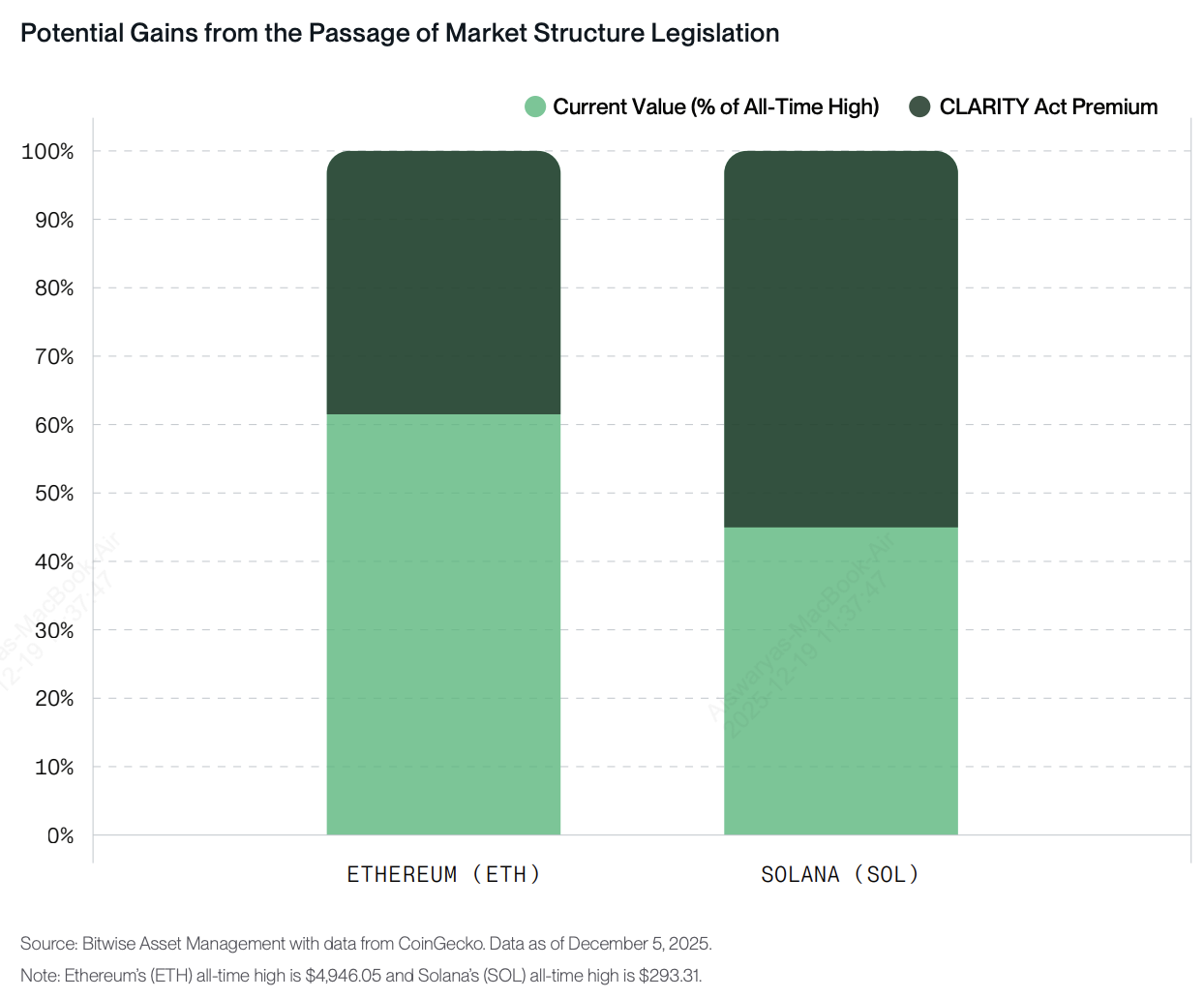

Ethereum outook on legislative clarity | Source: Bitwise

3. Regulatory Clarity in the US: The passage of the

GENIUS Act in July 2025 reduced uncertainty around stablecoins and enabled banks and asset managers to expand

tokenized products on Ethereum. The remaining catalyst is US market-structure legislation via the proposed CLARITY Act, which would clarify ETH’s regulatory treatment under the SEC or CFTC. Bitwise notes that clearer market structure could significantly accelerate institutional participation.

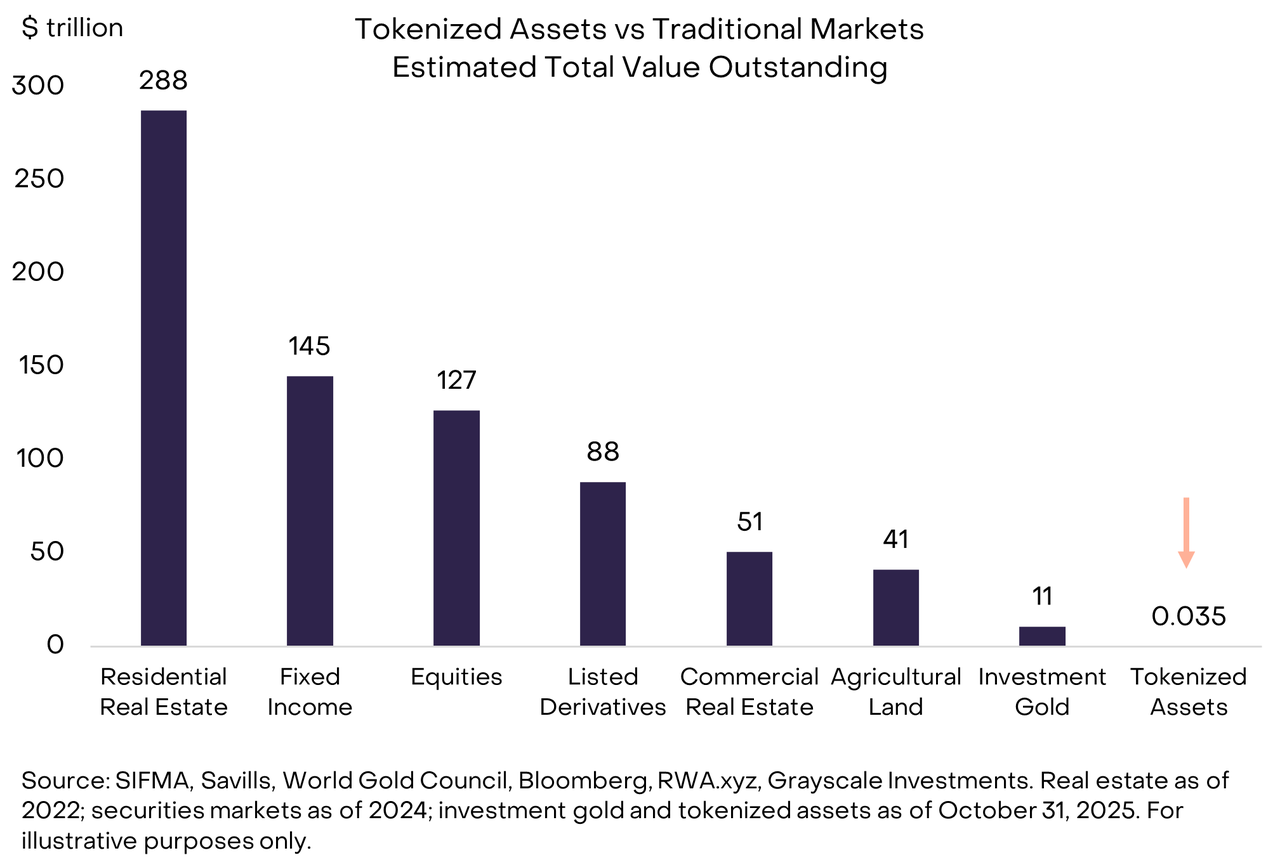

Scope for growth in RWA tokenized products | Source: Grayscale

4. Tokenization and Onchain Financial Products: As per research by Bitwise and Grayscale, continued growth in tokenized funds, stablecoins, and onchain vaults increases Ethereum’s role as a settlement layer, reinforcing ETH demand even as retail execution shifts to Layer-2s.

5. Macro and Liquidity Conditions: JPMorgan and CCN analysts believe that broader risk appetite, interest-rate policy, and global liquidity will continue to influence ETH’s price in 2026. Even with strong L1–L2 fundamentals, macro tightening or risk-off conditions could temporarily cap upside or increase volatility.

Ethereum Price Outlook for 2026: Scenario-Based Expectations

There is no single credible price target for Ethereum in 2026. Instead, most institutional and on-chain analysts frame ETH’s outlook around scenarios, reflecting uncertainty around regulation, macro conditions, and the pace of institutional adoption. The common thread across all scenarios is that ETH’s price is increasingly driven by settlement demand, ETFs, and the L1–L2 architecture, rather than retail congestion on Layer-1.

1. Bull Case: $5,000 as Institutional Expansion Accelerates

In a constructive 2026 scenario as forecast by analysts at Bitwise, Standard Chartered, and Tom Lee at Fundstrat, spot ETH ETF inflows continue to absorb a large share of new supply, with Bitwise estimating annual issuance of around 960,000 ETH, while clearer US market-structure rules expand institutional participation. Standard Chartered and Fundstrat both point to accelerating tokenization and onchain fund issuance on Ethereum as incremental demand drivers.

Outcome: ETH retests or exceeds its prior all-time high near $5,000, with upside supported by steady, regulated capital rather than short-lived retail speculation.

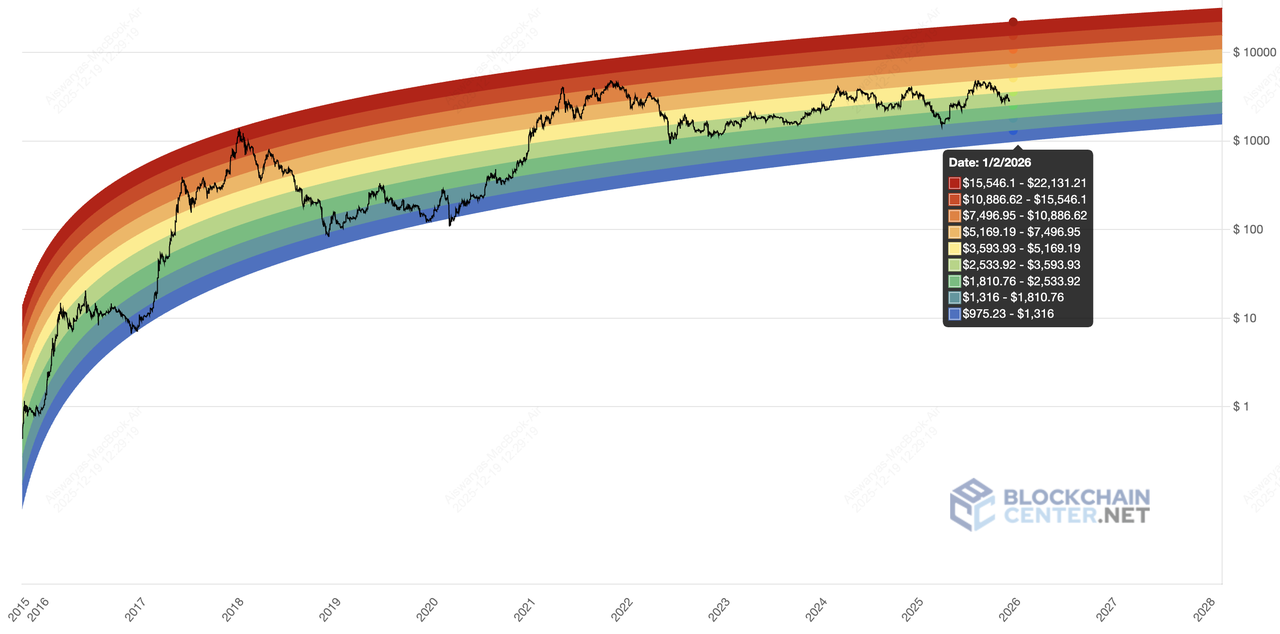

2. Base Case: Range-Bound Trading Between $2,5000 and $5,000 in the Transition Year

Ethereum rainbow chart | Source: Blockchain Center

In the most widely cited base case as per ETH rainbow chart and on-chain analysis, institutional buying offsets profit-taking by long-term holders as Layer-2 adoption continues to mute fee-driven spikes on Layer-1. Rainbow Chart frameworks and on-chain analysts suggest ETH remains fundamentally supported but constrained by mixed macro conditions and episodic regulatory headlines.

Outcome: ETH trades in a broad $2,500–$5,000 range, marked by sharp rotations rather than a sustained directional trend.

3. Bear Case: $2,000 or Even Lower Amid Macro or Regulatory Shock

In a downside 2026 scenario, spot ETH ETF inflows slow materially or turn negative, global liquidity tightens, and progress on US crypto market-structure legislation stalls. JPMorgan has highlighted $94,000 for Bitcoin as a production-cost floor, implying correlated downside risk for ETH in a broader risk-off environment, while CCN’s technical and wave-based models project ETH trading as low as $800–$1,200 in a severe drawdown, with $2,000–$2,500 acting as a more moderate support zone if selling pressure is contained. Outcome: ETH revisits lower support ranges before stabilizing, with any sustained recovery likely deferred to 2027, contingent on improving macro liquidity and clearer regulatory signals.

Outcome: ETH revisits lower support zones around $2,000 before stabilizing and rebuilding momentum into 2027.

What This Means for Retail ETH Traders

In 2026, ETH is less about chasing a single price target and more about navigating a range-driven, institutionally influenced market shaped by the evolving L1–L2 architecture.

• ETH Remains the Core Exposure: Regardless of Layer-2 growth, ETH underpins staking, rollup security, ETFs, and institutional settlement. Trading ETH on the BingX Spot Market remains the most direct way to gain broad Ethereum exposure.

• Accumulation Often Beats Timing: Given structural demand but high volatility, DCA strategies, such as BingX Recurring Buy, are often better suited to Ethereum’s 2026 profile than aggressive market timing.

• Volatility Creates Opportunity, and Risk: Ethereum’s transition phase is likely to produce headline-driven rallies and sharp pullbacks. ETH futures can be used tactically, but low leverage and strict risk management are essential.

How to Trade Ethereum on BingX

BingX offers multiple ways to trade Ethereum (ETH), allowing you to choose a strategy based on your experience level, risk tolerance, and market outlook. Whether you prefer simple spot trades or more advanced derivatives strategies, the platform provides flexible tools to participate in Ethereum’s 2026 market dynamics.

Buy and Sell ETH on the Spot Market

ETH/USDT trading pair on the spot market powered by BingX AI

The

BingX Spot Market is the most straightforward way to trade Ethereum. You can

buy ETH using

USDT and place

market orders for instant execution or limit orders to trade at a specific price. Spot trading suits users who want direct exposure to ETH without leverage, making it ideal for long-term holding or accumulation strategies during market dips.

Go Long or Short ETH with Futures

ETH/USDT perpetual contract on the futures market powered by BingX AI

For traders looking to capitalize on price movements in either direction,

ETH futures on BingX allow you to go long or short using leverage.

Futures trading is commonly used to hedge spot positions or trade short-term volatility. Because leverage amplifies both gains and losses, it’s best approached with low leverage and strict risk controls, especially during headline-driven market swings.

Copy Trade Top Ethereum Traders

Copy trading on BingX

BingX’s

Copy Trading feature lets you automatically replicate the strategies of experienced ETH traders. This can be useful if you want exposure to active trading strategies without managing positions manually. You maintain control over risk parameters while benefiting from professional trading insights.

Automate Strategies with Trading Bots

Grid trading bots on BingX

For users who prefer systematic trading,

BingX trading bots enable automated strategies such as grid trading or trend-following on ETH pairs. Bots can help manage volatility, capture range-bound movements, and reduce emotional decision-making, particularly useful in Ethereum’s expected 2026 trading environment.

In summary, BingX supports a full range of Ethereum trading approaches. from simple spot purchases to advanced derivatives, automation, and copy trading, allowing you to adapt as market conditions evolve.

Key Considerations for Ethereum Investors and Traders in 2026

As Ethereum transitions into a more institutional and Layer-2–driven ecosystem, investors and traders should focus less on short-term narratives and more on the structural and macro factors that can influence ETH’s price and risk profile.

• Regulatory Progress in the US: Slower or stalled progress on US market-structure legislation could prolong regulatory uncertainty around ETH, limiting institutional participation and increasing price volatility despite strong onchain fundamentals.

• Fragmentation Across Layer-2 Ecosystems: While Layer-2 growth supports scalability, excessive fragmentation across rollups can split liquidity and complicate user experience, potentially dampening activity and slowing value capture at the Ethereum base layer.

• ETH Supply and Fee-Burn Dynamics: As more transactions move to Layer-2s, Layer-1 fee burn may remain muted during normal conditions, affecting ETH’s short-term supply dynamics and making price action more dependent on staking and institutional demand.

• Macro and Liquidity Conditions: Broader macroeconomic tightening, such as higher interest rates or reduced global liquidity, can pressure risk assets, including ETH, regardless of improvements in Ethereum’s network fundamentals.

Final Outlook: What to Expect From Ethereum in 2026

Ethereum in 2026 is best understood as a maturing financial network, not a platform chasing raw transaction growth. Retail activity increasingly takes place on Layer-2 networks, where execution is fast and inexpensive, while Ethereum Layer-1 functions as the settlement, security, and staking layer for the ecosystem. In this structure, ETH’s role shifts toward that of a regulated, yield-bearing monetary asset, supported by staking, institutional custody, ETFs, and tokenized finance, rather than a token whose value depends primarily on retail congestion or speculative usage.

For BingX users, the practical takeaway is to align strategies with this layered reality. Long-term exposure increasingly depends on understanding where value accrues (settlement, staking, and institutional demand), while short-term price action remains sensitive to macro conditions, regulation, and market sentiment. Although Ethereum’s fundamentals appear more durable than in past cycles, ETH remains a volatile asset, and prices can move sharply in response to external shocks.

Managing risk, avoiding outdated narratives, and sizing positions appropriately remain essential when navigating Ethereum’s 2026 market environment.

Related Reading