The crypto market traded in a cautious risk-off environment this week, shaped by macro uncertainty, thinning liquidity, and shifting expectations around the December 10 Federal Reserve rate decision, where markets are pricing in an 80% chance of a rate cut. Total market cap has hovered near $3.1 trillion, extending a month-long drawdown as derivatives volumes contracted and investor positioning rotated toward higher-quality assets.

Against this backdrop, traders closely monitored catalysts such as institutional ETF filings, network upgrades, and governance-driven narratives, factors that helped tokens like

Monad (MON),

Zcash (ZEC), and

WLFI outperform broader market sentiment. Their double-digit rallies over the past week reflect a mix of ecosystem growth, renewed institutional interest, and political or governance engagement, even as the broader market waits for macro clarity and signs of a liquidity rebound ahead of the Fed’s upcoming policy shift.

Key Crypto Market Highlights From The Past Week

This week, three crypto tokens stood out due to price momentum, adoption, and notable ecosystem activity. Investors and traders should be aware of the following:

• Monad mainnet launched on November 24: Monad's mainnet officially launched on November 24, marking the network’s transition into full production and triggering a wave of new listings, including its debut on major exchanges such as BingX.

• Zcash (ZEC) surged amid the privacy coin revival: Zcash has surged back into prominence following a 1,000% rally earlier this year. Recent filings by an institutional firm to convert its ZEC trust into the first U.S.

spot Zcash ETF has renewed investor attention.

• World Liberty Financial (WLFI) surges 22%: Trading volume for WLFI has climbed to 17.3 million dollars this week, with social media engagement reaching over 25,000 mentions across crypto-focused channels, reflecting heightened market interest.

What Are the Top Weekly Crypto Gems, Nov 24-30, 2025?

Each week brings a new set of high-momentum tokens, and the following picks highlight the standout crypto gems showing strong activity from November 24–30, 2025.

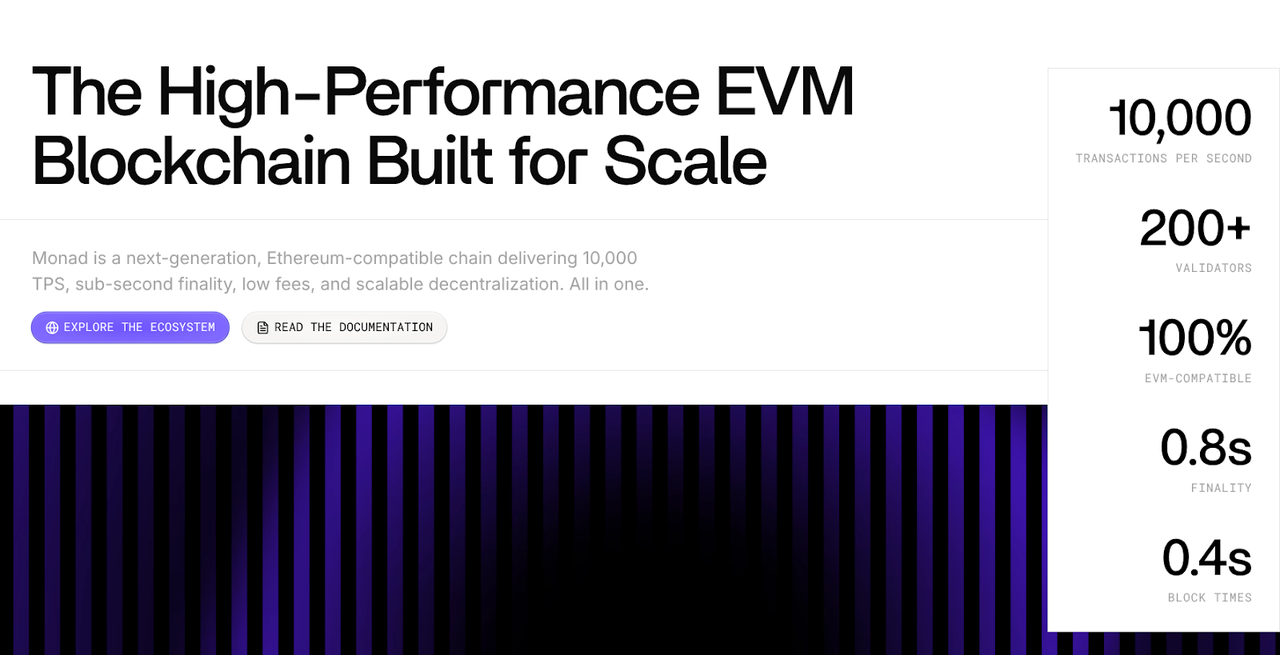

1. Monad (MON)

Source: Monad

Founded in 2024, Monad is an EVM-compatible layer-1 blockchain engineered for high throughput, near-instant finality, and extremely low fees. The project gained early momentum through its widely followed Coinbase presale, and excitement accelerated with the official mainnet launch on November 24, which saw over 125 projects deploy within the first month.

Following mainnet activation, MON was listed on leading exchanges,

including BingX, giving traders global access to the token and deepening market liquidity. MON powers the Monad ecosystem by enabling transaction fees, staking, governance, and dApp interactions, ensuring that growing network usage directly supports long-term token demand.

The launch accelerated developer and staker activity, with the EVM-compatible L1 processing high throughput at extremely low fees, pushing weekly on-chain transaction volume past $245M and daily active addresses above 112,000. Early mainnet adoption and broader exchange availability are together driving stronger liquidity, user growth, and momentum around the MON token.

Monad Price Momentum: What's Driving the MON Token Rally?

MON is up roughly 18% this week, supported by daily active addresses rising from 72,000 to over 112,000 in a month and weekly transaction volume surpassing $245 million. In addition to the mainnet launch and new exchange listings, a wave of new DeFi apps, NFT projects, and cross-chain integrations, combined with a 32% jump in staking to 11.6 million MON and doubled DEX liquidity, has accelerated demand, trading activity, and short-term price momentum.

MON/USDT Technical Analysis: Support Test Before Rally?

MON/USDT on the 2-hour (2H) chart on BingX is pulling back from point B near $0.052, where price was firmly rejected at resistance. The decline since then has unfolded inside a controlled

descending channel, keeping MON below the 20-EMA while the 50-EMA flattens, a sign of cooling bearish momentum rather than trend reversal.

Candles have shifted into exhaustion mode, with frequent Dojis and spinning tops as price approaches the key $0.028–$0.026 support zone.

Meanwhile, the

RSI is forming a bullish divergence, often a precursor to a CD-leg reversal in harmonic structures. As long as MON holds above $0.0167, the broader

ABCD pattern remains valid, projecting an eventual move toward $0.060 at the 1.272 Fibonacci extension.

MON/USDT Potential Trading Opportunity

A potential long setup forms if MON rebounds from $0.028–$0.026 with a

bullish engulfing candle or long-wick rejection on the 2H chart. A stop below $0.0167 protects against pattern failure, while upside targets sit at $0.052 and $0.060 if the full CD-leg activates.

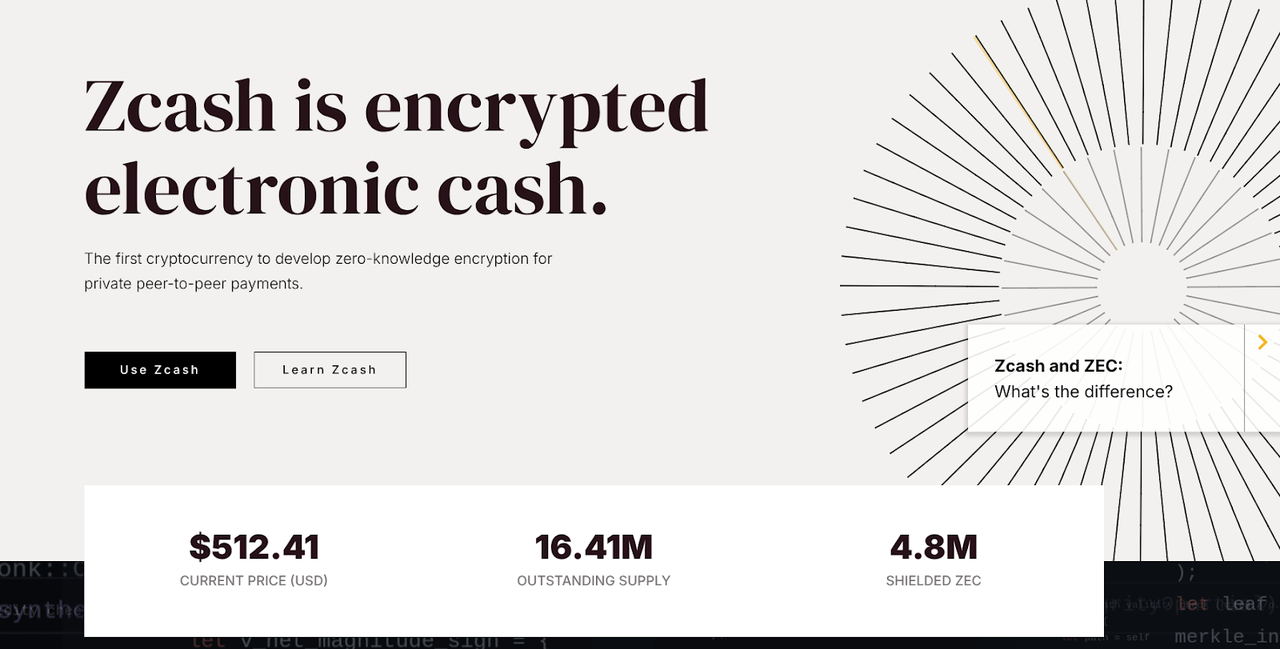

2. Zcash (ZEC)

Source: Zcash

Founded in 2016 by Zooko Wilcox-O'Hearn, Zcash focuses on privacy-preserving digital payments. Continuous upgrades to privacy protocols, scalability, and wallet integration have maintained its relevance. The potential launch of a U.S. spot ETF further strengthens institutional appeal and long-term adoption potential.

ZEC is built on zero-knowledge proof cryptography, enabling fully private transactions while maintaining a public ledger. Users can choose between shielded or transparent transactions, providing versatility for payments, confidential DeFi interactions, and enterprise usage. These privacy features support both practical adoption and speculative demand.

Zcash Price Momentum: Key Reasons Behind the ZEC Rally

ZEC is up about 12% this week after Grayscale filed to convert its ZEC trust into a U.S. spot ETF, pushing daily trading volume past $980 million, up 45% from last week. The ETF catalyst has driven strong retail and institutional buying, with rising wallet inflows and on-chain activity signaling continued momentum. At the same time, Zcash’s work on shielded transactions, private DeFi, and privacy-centric NFT infrastructure is boosting network usage and fees, reinforcing renewed confidence in the project and attracting longer-term capital.

Zcash (ZEC/USDT) Technical Analysis: Triple Bottom and Symmetrical Triangle Breakout

ZEC/USDT on the BingX 4-hour (4H) chart is edging lower after failing to sustain momentum above the $480 triple-bottom neckline. Price remains capped by the long-term descending channel stretching from $608–$718, and the market continues to trade below both the 50-EMA ($538) and 100-EMA ($545), a zone that now acts as a bearish crossover barrier.

If sellers retain control, the symmetrical triangle breakdown could extend into a deeper leg, with the projected ghost-candle path reflecting a possible –43% follow-through toward the $310 support. The RSI at 34 suggests the market is nearing oversold territory, but a bullish divergence has not yet appeared, keeping downside risks elevated unless ZEC reclaims $365.

ZEC/USDT Potential Trade Setup

Traders may place a stop below $280, targeting $365 initially and $480 on a stronger rebound. A reclaim of $365 would be the first sign that bearish momentum is fading. Until confirmation appears, the structure still favors a continuation toward the projected ghost-candle zone before any meaningful recovery.

3. World Liberty Financial (WLFI)

Source: WorldLibertyFinancial

Launched in early 2025, World Liberty Financial aims to merge traditional finance and decentralized finance. Governance participation, political relevance, and protocol development have driven adoption and speculative interest. Continued ecosystem expansion and staking incentives suggest that WLFI could maintain momentum in the near term.

WLFI functions as a governance token, enabling holders to vote on protocol decisions, treasury management, and project integrations. Staking WLFI rewards participants while allowing them to influence ecosystem development, linking token utility directly to market demand.

Why Is WLFI Rallying This Week?

WLFI is up about 20% this week, with trading volume rising to $17.3 million, nearly double the previous week, and over 25,000 social mentions signaling stronger community momentum. Recent integrations with DeFi lending and staking modules have increased active wallets and token circulation, while governance activity and high-profile political associations have amplified demand, liquidity, and overall trading interest.

WLFI/USDT Technical Analysis: Rebound or Breakdown Ahead?

WLFI/USDT on the 4-hour (4H) chart on BingX is trading just under the key $0.1666

pivot point, a level repeatedly rejected from the broad supply zone between $0.1666 and $0.1878. The recent drop broke below the ascending micro-trendline, sending the price back toward $0.1458 support while candles formed long lower wicks, a sign of early buyer defense.

WLFI currently trades below

EMA (Exponential Moving Average), such as, the 50-EMA ($0.1540) and 100-EMA ($0.1484), indicating short-term bearish momentum, yet the downside is slowing. The RSI sits around neutral levels, hinting at potential stabilization as WLFI approaches the $0.1307 support, which aligns with late-November reaction lows. A recovery above $0.1666 would shift momentum bullish toward $0.2099 and $0.2224.

WLFI/USDT Potential Trade Idea

A potential long setup appears if WLFI retests $0.1458–$0.1307 and prints a bullish confirmation such as a long-wick rejection or bullish engulfing candle on the 4H chart. Traders may place a protective stop below $0.1144, the next structural support. Upside targets include $0.1666 (pivot resistance), with extended targets at $0.1878 and $0.2099 on strong momentum. A break above $0.1666 would confirm a shift back into a bullish structure.

Conclusion

This week's highlights, Monad finally shipped its blazing-fast mainnet, MON’s live and hovering around $0.04 after a wild airdrop and $269 M raise. WLFI just laughed off Senate drama and phishing scares, climbing another 8 % to $0.16 on big buybacks and whale love. And Zcash? Pure privacy rocket fuel, still sitting comfy near $500 after a 10× run, with institutions piling in and shielded coins hitting record highs.

Make sure to check the on-chain data and do your own research before taking any position as momentum is real, but so is the risk.

Related Reading