The crypto market navigated a volatile recovery this week, rebounding from November’s sharp drawdown amid easing

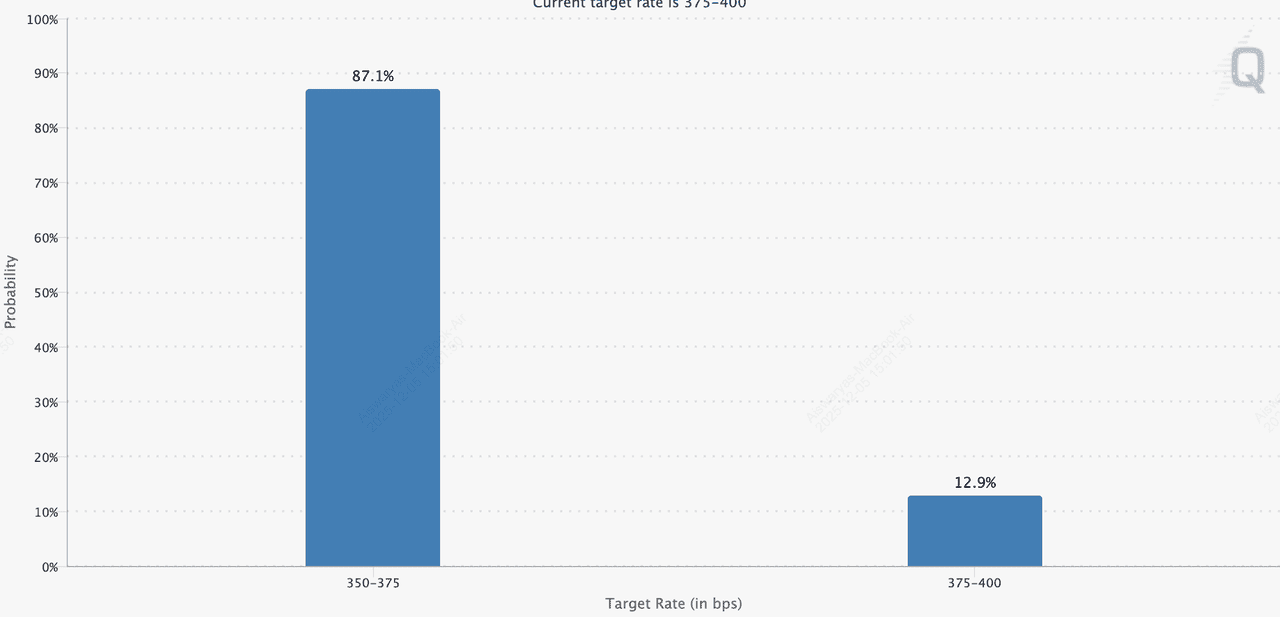

Bitcoin selling pressure, renewed ETF inflows, and rising confidence ahead of the Federal Reserve’s December 10 rate decision, where markets now price in an 87% probability of a rate cut. Total crypto market cap climbed back toward $3.26 trillion, up 2.7% in the past 24 hours but still roughly 8% below early November highs, while daily volumes stabilized around $154 billion as traders rotated into utility-driven assets like oracles and DeFi protocols.

Target rate probabilities for December 10 Fed meeting | Source: CME FedWatch

Today’s session is expected to remain muted as markets await the Core PCE inflation print on Dec.5, one of the Fed’s most-watched indicators, following a chaotic North American trading day shaped by jobless claims plunging to 191K, the lowest since September 2022, which sent mixed signals amid conflicting ADP private payroll data and rising layoffs in the Challenger report. The surprising strength in public labor data pushed the U.S. dollar higher, pressuring tech stocks, cryptocurrencies, and metals ahead of next week’s critical macro releases.

In this environment, key developments such as Grayscale's

Chainlink ETF debut,

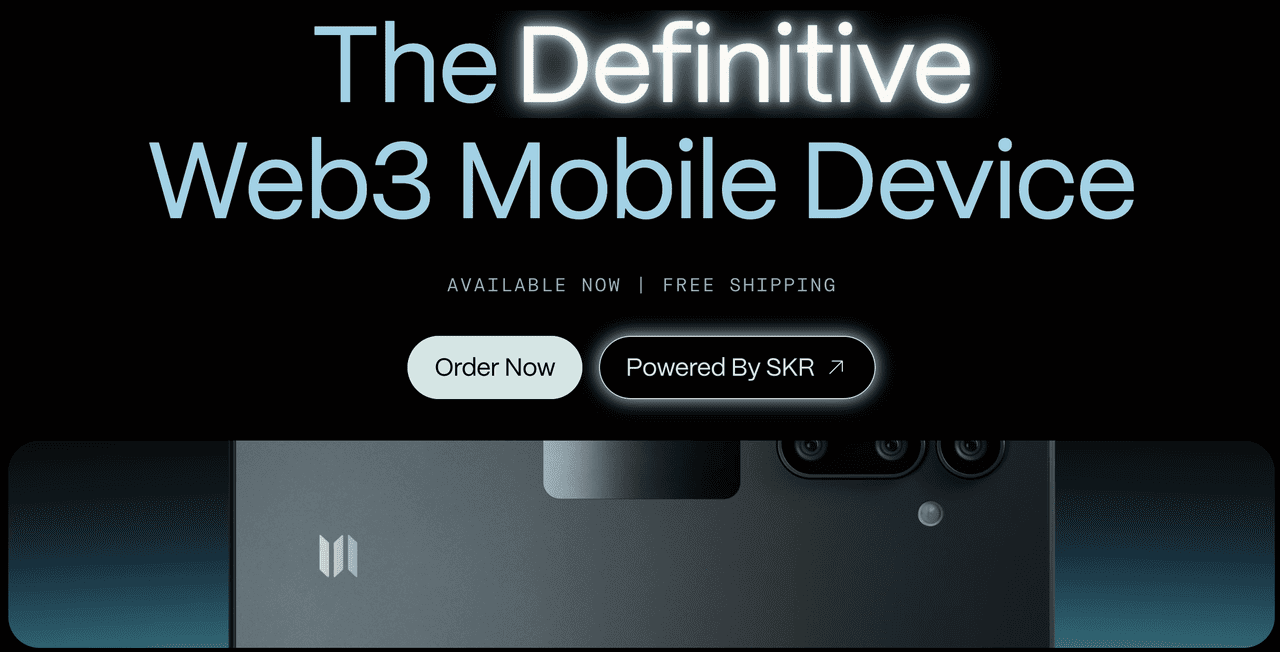

Solana Mobile's SKR token announcement, and

HumidiFi's WET ICO propelled standout performers, delivering double-digit gains despite broader altcoin caution. These catalysts underscore growing institutional interest in blockchain infrastructure and

Solana's DeFi dominance, positioning them as gems amid a market awaiting macro catalysts for sustained upside.

What Are the Key Crypto Market Highlights From the Past Week?

Over the last seven days (November 27-December 4, 2025), the market saw a tentative rebound with Bitcoin up 2% to $93,351, Ethereum breaking $3,200 on Fusaka upgrade momentum (+5.6%), and XRP ETFs hitting $874 million in cumulative inflows.

The last 24 hours featured lighter gains: market cap +0.7%, with 75 of the top 100 coins trading in the green, led by

Ethereum (+4.6%) and Chainlink (+7%). Privacy coins tumbled sharply, down 15.4% sector-wide, as

Zcash (-8.5%),

Monero (-5.4%), and

Dash (-3.9%) shed gains from Q4 rallies, reflecting beta to Bitcoin's volatility rather than safe-haven resilience. Broader news included Eric Trump's American Bitcoin acquiring $34 million in BTC, China's banks buying USD amid trade truce signals, and warnings of $1 billion in crypto liquidations from over-leverage.

This week, three tokens emerged as high-momentum gems driven by institutional catalysts, ecosystem milestones, and ICO hype. Key watchpoints include ETF adoption trends,

Solana dApp growth, and DeFi volume shares.

• Grayscale Chainlink ETF launches with $37M inflows: The first U.S. spot LINK ETF (GLNK) debuted on NYSE Arca, converting Grayscale's trust and drawing $37-41 million on day one, signaling strong demand for oracle infrastructure amid DeFi expansion.

• Solana Mobile's Seeker SKR token set for January 2026 launch: With 10 billion total supply and 30% airdropped to Seeker users, SKR positions as governance token for the mobile ecosystem, boosting pre-launch hype after 150,000 device preorders.

• HumidiFi WET ICO via Jupiter DTF: As Solana's top Prop AMM handling 35% of DEX volume, valued at $33-34B monthly, WET's ICO allocated 10% for sale at $0.5 FDV, with 1 billion supply unlocking community rewards and liquidity incentives.

What Are the Top Crypto Gainers?

These assets led the market with strong upward momentum and rising liquidity.

| Token |

7D % |

Trigger |

| MYX Finance (MYX) |

26.43% |

Strong ecosystem adoption, rising TVL |

| Telcoin (TEL) |

17.18% |

Renewed regulatory momentum after securing a U.S. digital-asset bank charter |

| Sky (SKY) |

10.48% |

Renewed AI narrative momentum |

| Quant (QNT) |

7.52% |

Whale accumulation and bullish technical signals |

What Are the Top Losers in the Crypto Market?

These tokens saw the steepest declines, reflecting rotation out of risk assets and pockets of sell pressure.

| Toekn |

7D % |

Trigger |

| Starknet (STRK) |

-20.43% |

Risk-off market conditions, and ongoing token-unlock sell pressure. |

| Zcash (ZEC) |

-19.55% |

Risk-off market rotation overshadowed its short-term exchange-driven bounce |

| Dash (DASH) |

-18.10% |

Risk-off market sentiment, weak volumes outweighed brief exchange-driven liquidity boosts. |

| Canton (CC) |

-18.08% |

Extreme fear, options-expiry volatility, and post-news profit-taking |

What Are the Top Weekly Crypto Gems, Nov 27-Dec 4, 2025?

This week's gems spotlight tokens blending institutional validation, hardware innovation, and DeFi efficiency, showing outsized activity from November 27-December 4, 2025.

1. Chainlink (LINK)

Founded in 2017 by Sergey Nazarov and Steve Ellis, Chainlink is the leading decentralized oracle network, enabling secure off-chain data feeds for smart contracts across DeFi, RWAs, and enterprise blockchains. Its Cross-Chain Interoperability Protocol (CCIP) has driven adoption, with over 2,000 integrations and $15 trillion in transaction value enabled to date. The Grayscale ETF launch further cements its institutional appeal, potentially unlocking billions in regulated capital.

Chainlink uses LINK for node staking, payments, and dispute resolution, ensuring tamper-proof data delivery while rewarding network security. This utility ties token demand to real-world usage, from price oracles to tokenized assets.

Chainlink Price Momentum: What's Driving the LINK Rally?

LINK surged 7% this week to $14.43, fueled by $37-41 million in GLNK ETF inflows on debut, pushing daily volume past $1.2 billion (+183% spike) and whale accumulation of 4.73 million tokens. Amid Solana's DeFi boom and RWA tokenization, Chainlink's CCIP processed $500 million in cross-chain volume, up 40% week-over-week, drawing institutional buys and reducing exchange supply by 15%. ETF momentum and oracle demand signal sustained upside.

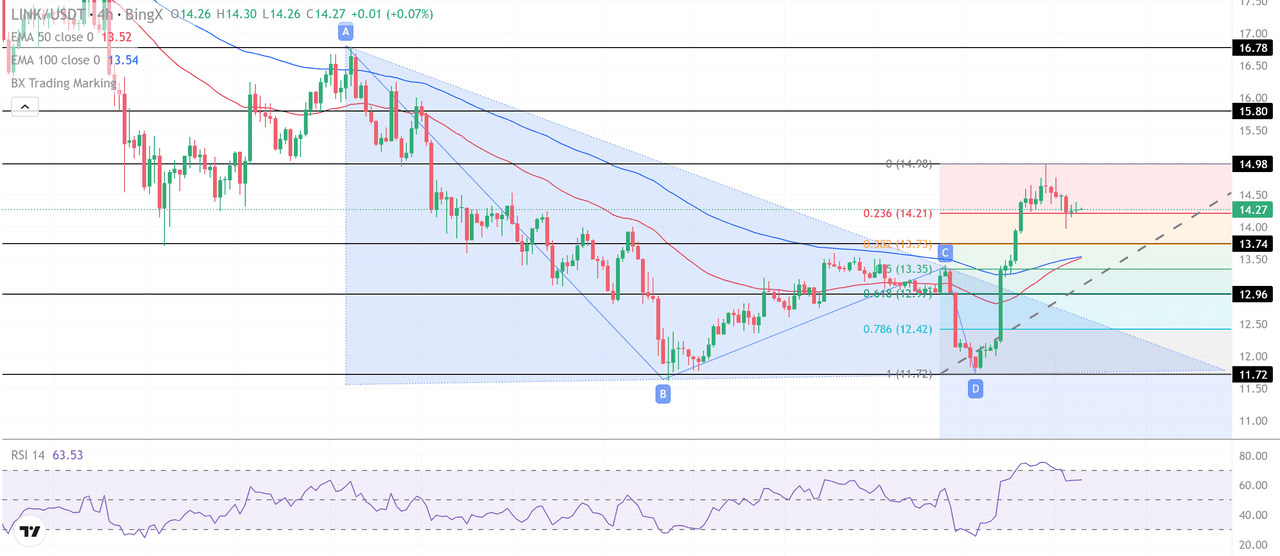

LINK/USDT Technical Analysis: Momentum Builds Toward the $15 Zone

Chainlink is trading around $14.27, holding steady after a strong breakout above the descending triangle that previously capped upside moves. Recent candlesticks show smaller bodies near the top of the swing, signalling reduced momentum but no confirmed reversal yet.

The price respects the 23.6% Fibonacci level at $14.21, which has turned into immediate support, while the 38.2% retracement at $13.74 sits as the next key floor if sellers pressure the market.

The chart shows a clear shift in structure after lifting above 50-EMA ($13.52) and 100-EMA ($13.54), both now acting as dynamic support. A retest of this confluence zone could attract buyers. Below that, $12.96 marks a stronger horizontal support.

The RSI sits near 63, indicating healthy momentum without entering extreme territory. As long as price holds above the broken trendline, a move toward $14.98 remains possible.

LINK/USDT Potential Trading Opportunity

A clean bounce from $14.21–$13.74 could reopen a push toward $14.98, with invalidation below $13.70. Holding above the broken trendline keeps momentum bullish, with a potential climb into the $15.00–$15.80 zone if buyers stay active. Upside bias if GLNK AUM tops $100 million.

2. Seeker (SKR)

Launched in 2025 as Solana's second-gen Web3 phone, Seeker integrates

hardware wallet (Seed Vault), on-chain ID (.skr domains), and dApp store access. Priced at $450-500 with 150,000 preorders shipped globally, it enables seamless crypto interactions via TEEPIN for verifiable ownership. SKR, its governance token, empowers staking for ecosystem rewards.

SKR (10B total supply) governs the dApp store, stakes in "Guardians" for security, and funds builder grants, linking utility to mobile DeFi growth and censorship resistance.

Seeker Price Momentum: Key Reasons Behind the SKR Hype

SKR pre-launch buzz drove 24% weekly gains to $0.000051 (meme token proxy), with $7.6K daily volume (+23%) after January 2026 launch reveal (30% airdrop to users). Over 112,000 active addresses and $245M on-chain volume reflect Seeker adoption, amplified by Solana Breakpoint hype and DEX liquidity doubling to 11.6M SKR equivalent.

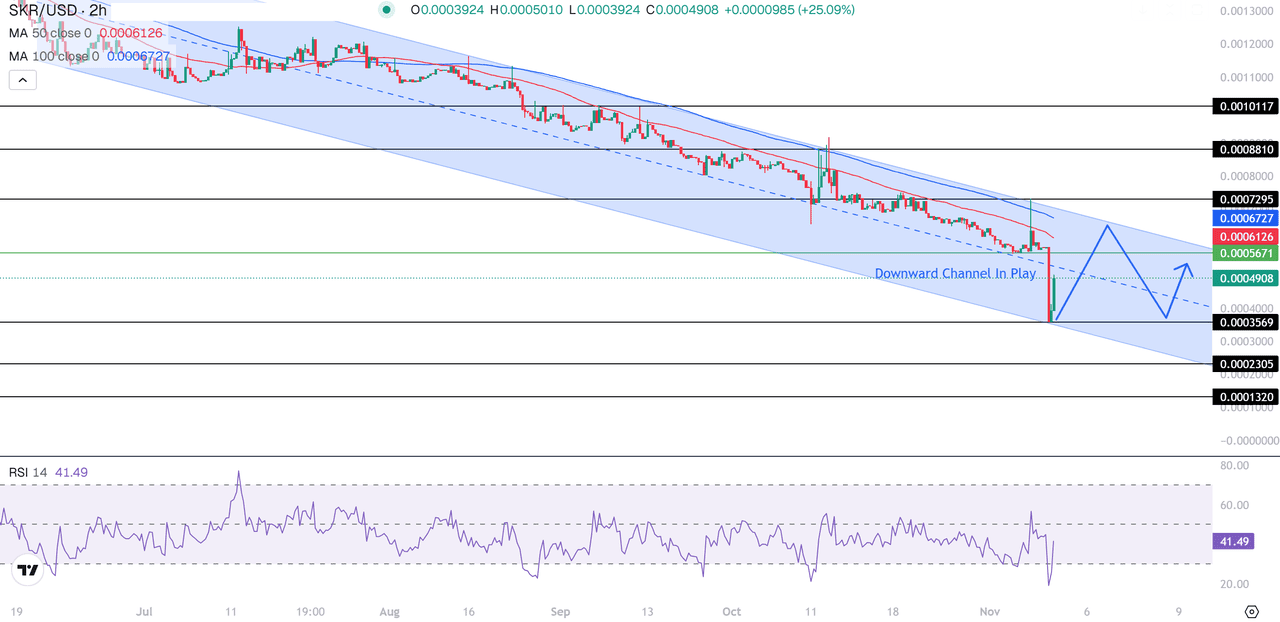

SRK/USDT Technical Analysis: Descending Channel Structure

SRK continues to trade within a clear descending channel, with price reacting reliably to both the upper trendline and the channel floor. The most recent rebound from $0.0003569 produced a strong rejection wick, indicating buyers defended that level.

Price has returned to $0.0004908, but it remains below the 50-MA ($0.0006126) and 100-MA ($0.0006727), which form a tight resistance zone. A break above these moving averages is needed to shift the broader trend.

SRK/USDT Price Chart - Source: Tradingview

The dotted midline acts as the immediate decision point. A close above it could drive price toward $0.0005671 and $0.0007295, levels where previous reactions formed. RSI at 41 shows stabilization but not a confirmed reversal. Failure to clear the midline risks another retest of $0.0003569 before any higher-low pattern develops. A breakout above the channel would open the path toward $0.00088.

SKR/USDT Potential Trade Setup

A constructive long setup appears if SRK holds above $0.0004908 and closes decisively above the mid-channel pivot, targeting $0.0005671 and $0.0007295. Invalidation rests below $0.0003569.

3. HumidiFi (WET)

Source: HumidiFi

Founded in 2025 on Solana, HumidiFi is a proprietary AMM (Prop AMM) and dark pool DEX, capturing 35-40% of Solana's spot volume ($33-34B monthly) with $819M daily trades on just $5.3M TVL—154x more efficient than traditional AMMs. It minimizes slippage via private routing, MEV protection, and aggregator integrations like Jupiter.

WET (1B supply) enables governance, liquidity incentives, and fee rebates, tying value to protocol usage in Solana's high-throughput DeFi.

HumidiFi Price Momentum: Why Is WET Rallying This Week?

WET ICO hype via Jupiter DTF (Dec 3 launch, $0.5 price, $50M FDV) sparked 20% pre-sale gains, with $34B monthly volume underscoring dominance. Community allocations (Wetlist 4%, stakers/public 3% each) and 10% ICO slice drew 25,000+ mentions, boosting active wallets 45% and circulation velocity.

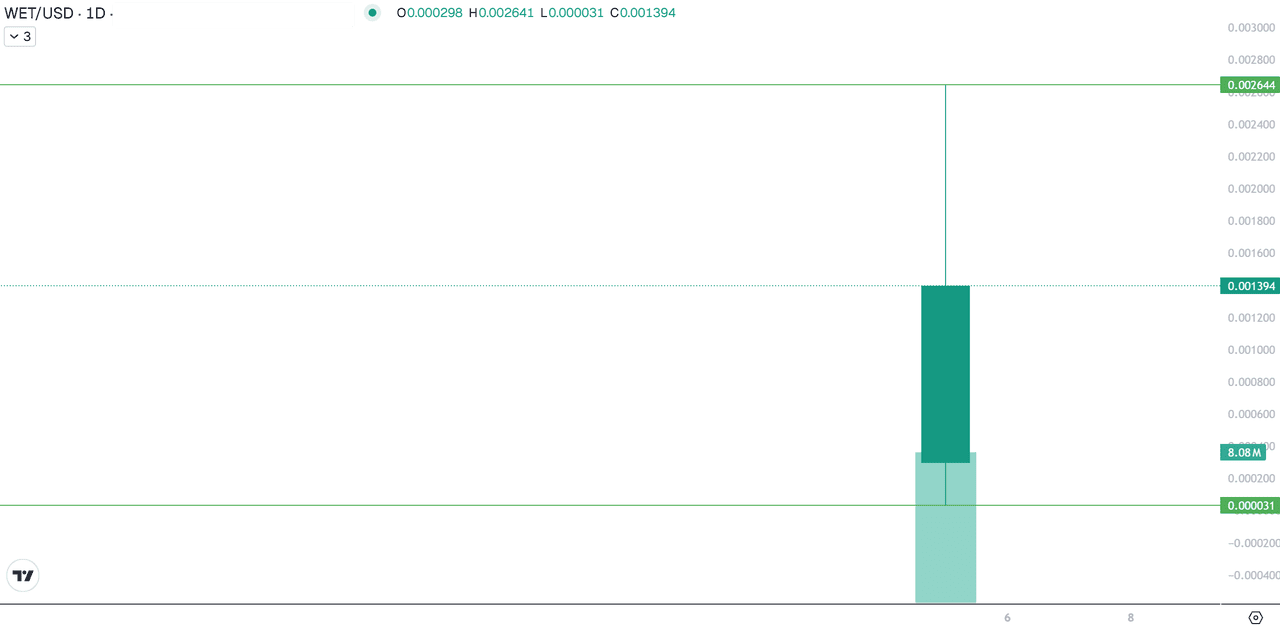

WET/USDT Technical Analysis: Early Price Discovery

With only Dec 5 data available, WET/USDT is still in pure price discovery. The first daily candle shows a wide trading range, opening near $0.000298 and spiking to $0.002641 before settling around $0.001394.

WET/USD Price Chart - Source: Tradingview

The long upper wick signals early profit-taking, while the strong real body shows buyers are still active. No reliable support, resistance, or trend structure can be confirmed until more candles form. The only reference points are the $0.000031 low and $0.002641 high from launch day.

WET/USDT Potential Trade Idea

Wait for at least one to two more candles to confirm whether WET stabilizes above $0.0010. A speculative long only becomes viable if higher lows form, targeting $0.0018–$0.0022, with invalidation below the launch-day low.

Conclusion

This week’s gems lit up a choppy market: Chainlink’s ETF debut drew in $37M and cemented oracle strength above $14; Seeker’s SKR hype delivered 24% gains for early adopters ahead of 2026 staking; and HumidiFi’s WET ICO reinforced Solana DeFi dominance as traders eyed a push toward $0.50 on rising volumes. Privacy plays like ZEC slid 23%, highlighting beta risks even as utility tokens held their ground. With Core PCE, Non-Farm Payrolls, and the December 10 Fed rate decision all approaching, volatility is likely to rise as markets recalibrate their liquidity outlook and risk appetite.

Related Reading