Can a single candle reveal when a massive market sell-off is about to hit a brick wall? While most traders fear a falling market, those who can identify an inverted hammer candlestick see a golden opportunity for a bullish reversal. This pattern serves as a high-stakes battleground where bearish momentum finally meets its match, signaling a potential shift in control from sellers to buyers.

In this guide, we will break down how this upside down hammer functions as a leading reversal signal. You will learn how to identify an inverted hammer correctly, the psychological reasons it appears after a downtrend, and how to distinguish it from a shooting star.

From proper

risk management to using momentum indicators for confirmation, we’ll provide the roadmap to trading the inverted hammer candlestick pattern with clinical precision.

What Is an Inverted Hammer Candlestick Chart Pattern?

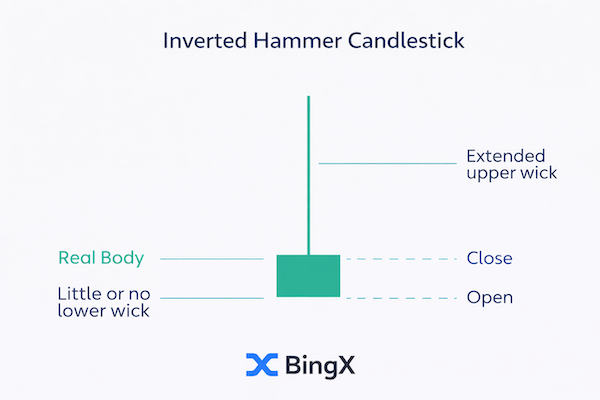

The inverted hammer candlestick is a bullish reversal chart pattern that serves as a visual representation of a shift in market control. It typically appears after a downtrend, marking a point where the prolonged selling pressure is being challenged by emerging buyers.

At its core, the inverted hammer shows a tug-of-war: sellers tried to keep prices low, but buyers stepped in with enough strength to push the price significantly higher during the session. Even if the price settles back near the open, the long upper shadow acts as a footprint of bullish intent.

Key Features of the Inverted Hammer Pattern

To identify an inverted hammer correctly, you must look for four specific physical characteristics:

-

Small Body at the Bottom: The opening price and closing price are very close to each other, resulting in a small body located at the lower end of the session's range.

-

Long Upper Wick / Long Upper Shadow: This is the most defining feature. The upper shadow should be at least two to three times the length of the candle's body.

-

Little to No Lower Shadow: A true inverted hammer forms with a very short or non-existent lower shadow, indicating that the market did not trade significantly below its opening or closing price.

-

Market Context: The pattern only carries a bullish signal when it occurs after a clear downtrend.

What Is the Psychology Behind the Long Upper Wick in an Inverted Hammer?

The long upper wick (or long upper shadow) is the most critical part of the story. It represents a bold attempt by bulls to push prices higher.

-

Buyers Testing Higher Prices: For the first time in the bearish trend, buyers were strong enough to drive the price up significantly.

-

Sellers Losing Control: Although sellers managed to push the price back down toward the open, they were unable to create a new low. This failure to continue the downtrend indicates that the bearish pressure is fading.

Why the Body at the Inverted Hammer's Bottom Matters

The small body at the bottom of the candle is equally important. It shows that despite the volatility and the massive spike in price during the session, the opening price and closing price remained near the session's lows. This compressed body at the bottom signifies a "standoff." The bears couldn't push the price lower, and the bulls couldn't hold the peak—but the refusal of the market to make a lower low is a bullish signal.

Why Does the Inverted Hammer Signal a Potential Bullish Reversal?

The inverted hammer signals a potential bullish reversal by showing bears are losing control. The long upper wick proves buyers finally found the bullish momentum to challenge prolonged selling pressure. Even without a high close, this "test" suggests bearish pressure is exhausted.

When this candlestick pattern appears after a clear downtrend, it marks a psychological shift where a trend reversal becomes imminent.

What the Inverted Hammer Reflects About Market Sentiment

The inverted hammer candlestick meaning goes far deeper than just its shape on a price chart; it is a visual map of a psychological shift in market sentiment. After a period of prolonged selling pressure, the market reaches a state of exhaustion.

When an inverted hammer forms, it tells the story of a dramatic intraday battle where the "bears" (sellers) finally met significant resistance.

In a clear downtrend, the sentiment is overwhelmingly negative. However, the inverted hammer shows the first real crack in that bearish armor. It reflects a moment where the bearish momentum is challenged by a sudden influx of buyers. Even if the price doesn't close at its daily high, the fact that it reached those levels at all suggests that the "bottom" may be near.

Potential Shift in Control: Bearish Pressure vs. Bullish Momentum

The inverted hammer reflects a transition phase:

-

Phase 1: The market is dominated by bearish momentum and constant selling.

-

Phase 2: The inverted hammer appears, showing bulls are finally "testing the waters."

-

Phase 3: A potential shift in control occurs as the market prepares for a bullish reversal.

Understanding this candlestick pattern means recognizing that while the bears haven't left the building yet, the bulls have officially arrived to claim their territory.

How to Trade the Inverted Hammer Pattern: Trading Strategy

Trading the inverted hammer pattern requires a systematic approach to avoid false signals. Using the

Bitcoin (BTC/USDT) example, we can see how the inverted hammer signal develops into a high-probability trade when combined with market context.

1. The Entry Strategy: Patience for Confirmation

Never enter a trade the moment an inverted hammer forms. To identify an inverted hammer correctly as a tradeable event, you must wait for confirmation.

-

The Trigger: Place a buy order just above the inverted hammer's high. In the example, the entry is set at the $81,300 level.

-

The Confirmation: The next candle must be a strong bullish candle closing above the entry line.

2. Stop Loss Placement: Protecting Your Capital

Proper risk management protects your capital from bearish momentum restarts.

3. Technical Synergy

In the example, the inverted hammer appears while the

Relative Strength Index (RSI) is in the Oversold Zone (marked by the orange circle). This confluence of a candlestick pattern and momentum indicators creates a much stronger signal.

Inverted Hammer vs. Shooting Star: Key Differences

| Feature |

Inverted Hammer |

Shooting Star |

| Visual Shape |

Small body, long upper wick |

Small body, long upper wick |

| Prior Trend |

Bearish trend (Downtrend) |

Bullish trend (Uptrend) |

| Signal Type |

Bullish reversal signal |

Bearish signal |

| Market Sentiment |

Sellers are losing control |

Buyers are losing control |

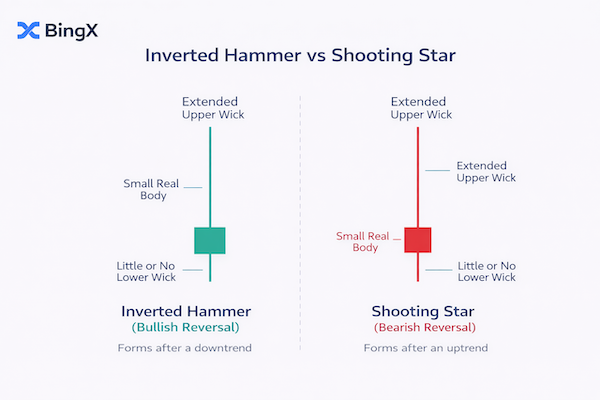

One of the most common points of confusion for new traders is the distinction between the inverted hammer and the

shooting star. Visually, they have the same shape: a small body at the bottom with a long upper shadow and little to no lower shadow.

However, in

technical analysis, the shape is only half the story. The broader market context, specifically where the candle appears on the price chart, determines whether the signal is a bullish reversal or a bearish reversal.

Different Market Context, Different Meaning

The primary difference lies in the preceding trend. Without identifying the trend, you cannot identify an inverted hammer correctly.

-

The Inverted Hammer: This pattern appears after a clear downtrend or a period of prolonged selling pressure. In this context, it acts as a possible bullish reversal signal, suggesting the bottom is in.

-

The Shooting Star: This candle appears at the peak of an uptrend. In this context, the same shape indicates that buyers are exhausted and the price has hit a ceiling, signaling a bearish reversal.

By understanding this distinction, you can avoid the "trap" of entering a trade based on shape alone. Always zoom out to see the market context before placing an order.

How to Use Technical Indicators With the Inverted Hammer

While the inverted hammer candlestick is a powerful visual cue, relying on a single candle is risky. To improve reliability and filter out false signals, professional traders look for confluence with other technical indicators.

Key Technical Pairings

The Takeaway: No pattern is an island. Always combine the inverted hammer signal with momentum indicators and market context to increase your win rate and ensure proper risk management.

When Does the Inverted Hammer Pattern Fail?

Even a perfect upside down hammer can result in a loss. Recognizing failure is vital for proper risk management.

-

Sideways Markets: Without a clear downtrend, the inverted hammer candlestick pattern lacks the bearish pressure necessary to trigger a reversal.

-

Weak Confirmation: If the next candle fails to close above the hammer’s high, the bullish momentum has likely stalled.

-

The Invalidation Point: If the price breaks below the inverted hammer’s low, the potential bullish reversal is dead. This often reinforces a bearish signal, suggesting sellers have regained control.

Conclusion: How to Trade Crypto with the Inverted Hammer

The inverted hammer is a powerful ally for any trader, but its effectiveness lies in discipline. While it signals a possible bullish reversal, remember that market context matters far more than the shape of a single candle. To trade with confidence, always wait for confirmation, a strong bullish candle closing above the hammer's high is your green light.

Maximize your success by combining this candlestick pattern with technical analysis tools like support levels and momentum indicators. Above all, apply proper risk management to protect your capital.

The Takeaway: The inverted hammer is not a magic signal, it’s an early warning of a potential trend reversal that requires a patient, data-driven approach.

Related Reading

-

-

-

-

-

-

-

FAQs on Using the Inverted Hammer Candlestick Pattern in Crypto

1. Is the inverted hammer bullish?

Yes, the inverted hammer is considered a bullish reversal signal. However, its "bullishness" depends entirely on its location; it must appear after a downtrend and be validated by a bullish candle closing above its high to be considered a reliable trade signal.

2. What does a green inverted hammer mean?

A green inverted hammer (where the closing price is higher than the opening price) suggests that bullish momentum was strong enough to overcome the initial bearish pressure within that specific session. While the shape is more important than the color, a green candle often provides a slightly stronger signal for a potential shift in trend.

3. Can an inverted hammer appear in an uptrend?

Yes, but it is no longer called an inverted hammer; it is known as a shooting star. When this pattern appears during an uptrend, it carries a bearish reversal meaning rather than a bullish one. This is why the broader market context is essential for technical analysis.

4. What confirms an inverted hammer?

Confirmation occurs when the next candle is a strong bullish candle that closes above the inverted hammer's high. This price action proves that buyers have successfully absorbed the selling pressure and are beginning to push prices higher.