The landscape of

Ethereum ownership has undergone a seismic shift in early 2026. What was once a decentralized network dominated by DeFi pioneers and developers is now a playground for trillion-dollar asset managers,

Ethereum Treasury Companies (EthCos), and institutional stakers. As Ethereum trades near the $1,950 mark following a volatile February marked by mild austerity signals from its founders, the concentration of supply within the

ETH staking ecosystem has reached an all-time high.

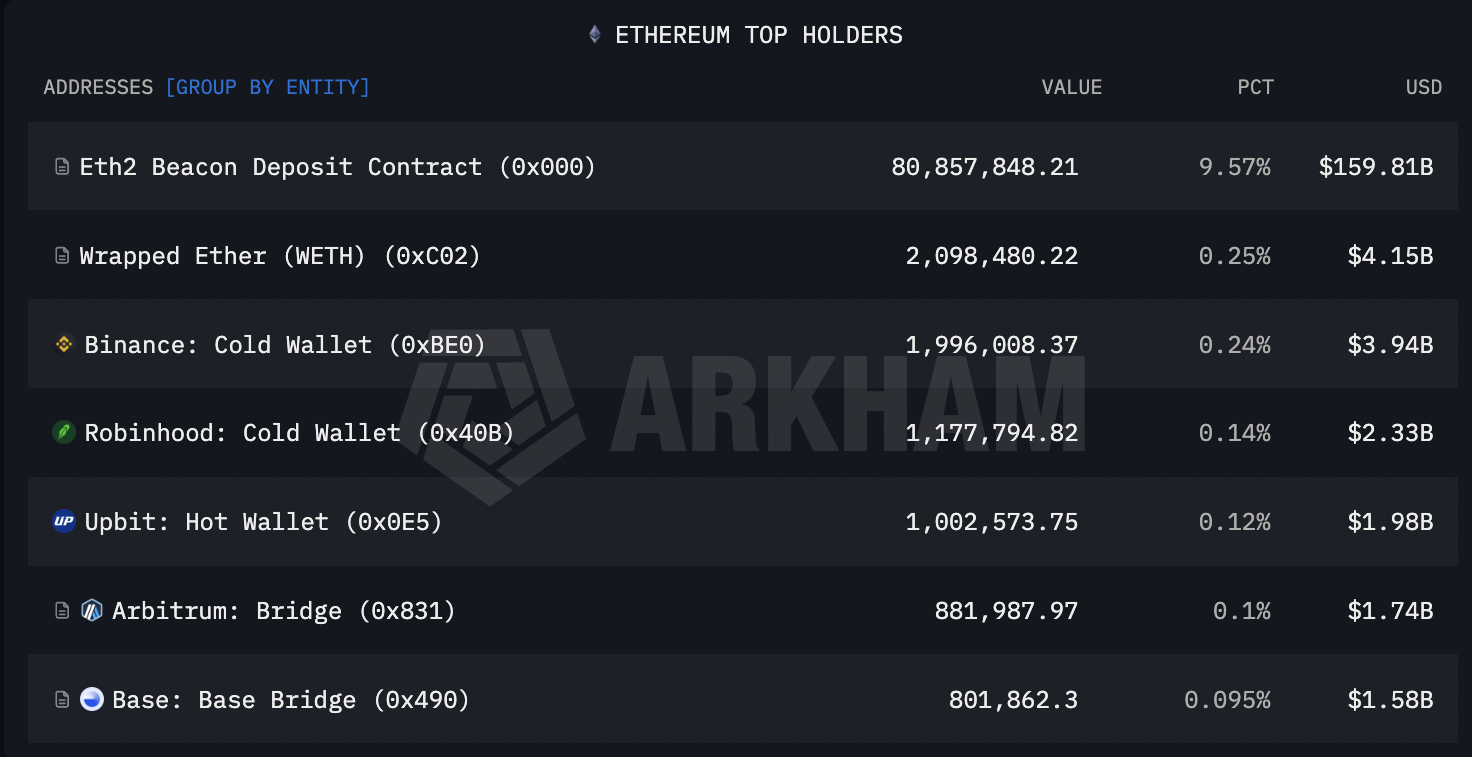

Ethereum top holders | Source: Arkham Intelligence

By February 2026, over 30% of the total

ETH supply is officially locked in the proof-of-stake consensus mechanism. While Ethereum does not have a hard cap like

Bitcoin, its real liquid supply is at its tightest in years. With massive institutional accumulation through

Spot Ethereum ETFs and billions in ETH burned or bridged to

Layer 2 networks like

Arbitrum and

Base, the 2026 market cycle is being defined by a staking supply shock.

This article breaks down the 2026 Ethereum Rich List, identifying the top 10 ETH whales, protocols, and corporate giants that control the world’s most active smart-contract platform.

Who Are the Top 10 Ethereum Holders: 2026 Entity Breakdown

Whether you want to join the mega-stakers or capitalize on the 2026 volatility, BingX offers the tools to trade ETH like a whale by integrating

BingX AI (BingAI), a native trading strategist that provides real-time position analysis and trend forecasting.

| Rank |

Entity |

Entity Type |

ETH Holdings |

USD Value |

| 1 |

Beacon Deposit Contract |

Staking Protocol |

77,186,906 |

$150.74B |

| 2 |

Binance |

Exchange (Total) |

4,158,880 |

$8.12B |

| 3 |

BlackRock (ETHA) |

ETF Issuer |

3,500,000 |

$6.83B |

| 4 |

Bitmine |

Public Company |

3,000,000 |

$5.86B |

| 5 |

Coinbase |

Exchange/Custodian |

2,904,924 |

$5.67B |

| 6 |

Wrapped Ether (WETH) |

DeFi Contract |

2,580,623 |

$5.04B |

| 7 |

Upbit |

Exchange |

1,518,654 |

$2.96B |

| 8 |

Robinhood |

Trading Platform |

1,500,000 |

$2.93B |

| 9 |

OKX |

Exchange |

1,100,000 |

$2.15B |

| 10 |

Kraken |

Exchange |

1,100,000 |

$2.15B |

Data as of February 17, 2026. Values calculated at a market price of ~$1,952/ETH.

1. Eth2 Beacon Deposit Contract

The undisputed King of Ethereum holdings is the Beacon Deposit Contract, which as of February 2026 holds a staggering 77.1 million ETH, representing over 63% of Ether's total supply. This protocol-level contract serves as the bedrock of the network's security, locking up over $150 billion in value across thousands of global validator nodes. The sheer volume of ETH stored here highlights the success of the Staking Economy, where nearly two-thirds of all circulating Ether has transitioned from a liquid speculative asset into a productive, yield-bearing instrument securing the global settlement layer.

2. Binance

As the world’s largest cryptocurrency exchange, Binance manages approximately 4.1 million ETH, valued at $8.1 billion, within its consolidated reserves. In 2026, Binance remains the primary venue for global price discovery, with its 34xp4 cold wallet acting as a critical buffer for retail and institutional trade flow. Despite the surge in ETFs, Binance’s

Proof of Reserves (PoR), which currently shows an over-collateralized 105% reserve ratio for ETH, provides the real-time transparency necessary to maintain its status as the world's most trusted centralized exchange for high-velocity traders.

3. BlackRock iShares Ethereum Trust (ETHA)

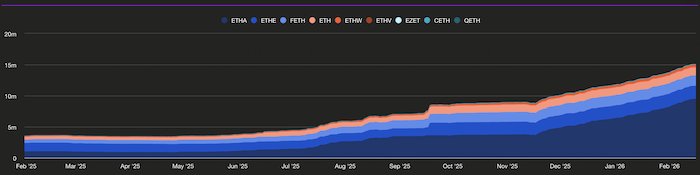

Spot Ethereum ETF on-chain holdings in ETH | Source: TheBlock

BlackRock’s ETHA has redefined institutional ETH ownership, amassing 3.5 million ETH, approx. $6.8 billion, by mid-February 2026. Leveraging a multi-year technology integration with Coinbase Prime, BlackRock has become the institutional floor for Ethereum, absorbing nearly 4% of the circulating supply into its regulated vaults. For Wall Street, ETHA is no longer just a crypto bet; it is viewed as a digital bond, providing traditional portfolios with seamless exposure to Ethereum's staking yields and the broader Web3 infrastructure. This institutional pivot was recently punctuated by Harvard University, whose $56.9 billion endowment disclosed its first-ever Ether position on February 13, 2026, acquiring nearly 3.9 million shares of ETHA, valued at $86.8 million, while simultaneously trimming its Bitcoin exposure.

4. Bitmine Immersion Technologies (BMNR)

Led by the Michael Saylor of Ethereum, Tom Lee, Bitmine has aggressively pivoted to an Ethereum-First treasury strategy, now holding 4.3 million ETH. As of February 2026, Bitmine is the world's largest corporate ETH holder, utilizing its Alchemy of 5% goal to accumulate 5% of the total supply. With an estimated 2.9 million ETH currently staked via its proprietary Made in America Validator Network (MAVAN), Bitmine generates over $370 million in annual staking rewards, effectively outperforming traditional high-yield corporate treasuries.

5. Coinbase

Coinbase remains the central pillar of the U.S. crypto economy, controlling 2.9 million ETH across its retail and institutional Coinbase Prime custody divisions. Beyond acting as the primary custodian for the majority of Spot ETH ETFs, Coinbase’s

liquid staking token, cbETH, has reached a circulating supply of over 130,000 units. This allows Coinbase to capture a massive share of the staking market while providing users with the liquidity to use their ETH in DeFi even while it is earning rewards.

6. Wrapped Ether (WETH) Contract

A cornerstone of the 2026 DeFi landscape, the WETH contract holds 2.6 million ETH, valued at $5.04 billion. As Ethereum transitions into a layered financial system, WETH serves as the critical lubricant for on-chain capital, allowing native ETH to interact with ERC-20 compliant

decentralized exchanges and

lending protocols. The balance in this contract is a high-fidelity indicator of capital efficiency; it reflects how much Ether is being actively utilized in the $100 billion+ DeFi ecosystem rather than sitting dormant.

7. Upbit

Dominating the South Korean market with a 70% domestic share, Upbit manages 1.5 million ETH to support its retail-heavy liquidity hub. In 2026, Upbit's influence is shaped by the Kimchi Premium, where local ETH valuations often trade 2–10% above global levels. With fiat-denominated KRW trading volume rivaling the USD in 2026, Upbit’s ETH holdings are a vital proxy for Asian retail sentiment, particularly during altcoin rotation cycles where ETH volume frequently rivals Bitcoin's.

8. Robinhood

Robinhood has matured into a significant retail whale, holding 1.5 million ETH on behalf of millions of U.S. and European users. Following the 2025 launch of the Robinhood Chain, an Ethereum Layer 2, the platform has moved beyond simple trading into deep ecosystem participation. Its ETH reserves reflect the shift of mainstream retail capital from speculative meme coin trading into the core infrastructure of the World Computer.

9. OKX

With a global reserve exceeding $30 billion, OKX holds 1.1 million ETH at a verified 105% reserve ratio. In 2026, OKX has distinguished itself by bridging its centralized liquidity with the OKX

Web3 Wallet, which utilizes Smart Accounts (TEE technology) to secure user assets. This integration has turned OKX into a major gateway for Kinetic Finance, where on-chain ETH assets move seamlessly between the exchange and decentralized Layer 2 networks to maximize yield.

10. Kraken

Rounding out the top 10 is Kraken with 1.1 million ETH, as it gears up for a high-profile 2026 IPO. Despite historical regulatory hurdles, Kraken’s compliance-first strategy has attracted a massive influx of institutional capital, positioning its staking infrastructure as the cleanest alternative to Coinbase. A significant portion of its holdings is dedicated to its high-security staking vaults, which doubled in volume in late 2025 as the exchange expanded its derivatives and MiCA-compliant European services.

Honorable Mentions: The Legends and the Lost ETH Whales

Beyond the institutional giants, several legendary individual stashes and protocol-bridged funds play a pivotal role in Ethereum’s long-term liquidity and historical narrative.

-

Rain Lohmus aka The Burned Whale: The largest individual holder is technically Rain Lohmus, an ICO participant with 250,000 ETH. However, these funds, worth over $780 million, are permanently inaccessible because he lost his private keys.

-

Vitalik Buterin: The largest accessible individual holder is co-founder Vitalik Buterin, who holds approximately 240,000 ETH. In February 2026, his activity has been closely watched as the Ethereum Foundation entered a period of mild austerity to fund new R&D. Learn more about

Vitalik Buterin's net worth in our detailed guide.

-

Layer 2 Bridges: Arbitrum at 770K ETH and Base at 736K ETH hold massive amounts of bridged supply, reflecting the shift of user activity from the mainnet to scaling solutions.

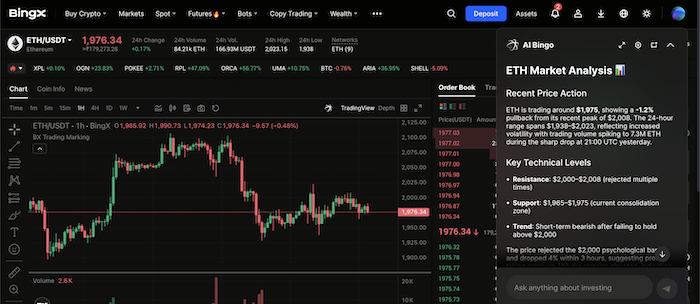

How to Trade Ethereum (ETH) on BingX

Whether participating in the staking economy or managing shorter-term volatility, BingX provides tools to trade ETH by integrating

BingX AI, a native strategist for real-time position analysis.

Buy or Sell ETH on the Spot Market

ETH/USDT trading pair on the spot market with BingX AI insights

Spot trading is ideal for long-term holders looking to build a diamond hands position.

-

Create and verify your account on BingX.

-

-

Use BingX AI-driven insights to find optimal entry points.

-

Securely store your ETH in the BingX wallet.

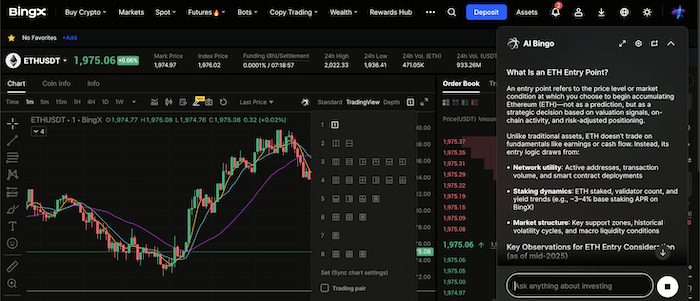

Long or Short ETH Futures with Leverage

ETH/USDT perpetuals on the futures market featuring BingX AI insights

Capitalize on the V-shaped recovery predicted by market bulls using BingX Futures.

-

-

-

Apply up to 150x leverage with professional risk management tools.

-

Set Stop-Loss and Take-Profit to protect against sudden whale movements.

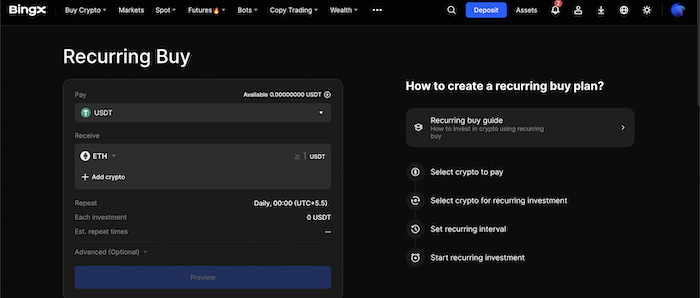

Dollar-Cost Averaging (DCA) ETH with BingX Recurring Buy

DCA Ethereum (ETH) on BingX Recurring Buy

If you prefer a low-stress, long-term strategy,

BingX Recurring Buy lets you accumulate ETH automatically over time, smoothing out market volatility.

-

Open Recurring Buy: Log in to BingX and navigate to the Recurring Buy feature from the trading menu.

-

Select ETH: Choose ETH as the asset you want to accumulate and USDT as the payment currency.

-

Set Your Plan: Define the investment amount and frequency like daily, weekly, or monthly based on your budget.

-

Confirm and Automate: Review the plan and activate your ETH DCA plan. BingX will automatically buy ETH on schedule, helping you build a long-term position without timing the market.

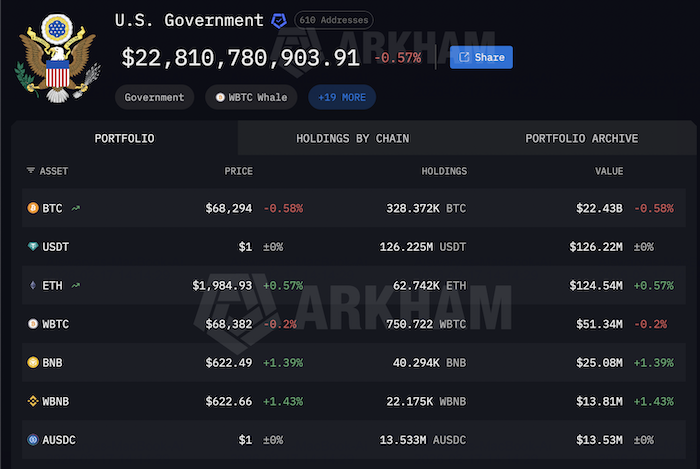

What Are the 4 Key Risks for Ethereum Holders in 2026?

US government's crypto holdings, including Ethereum | Source: Arkham Intelligence

As Ethereum continues to evolve in 2026, holders should be aware of several technical, market, and regulatory risks that could impact ETH’s price and long-term outlook.

-

Founder Sell-offs: Recent sales by Vitalik Buterin and early developers to fund austerity budgets can create short-term bearish sentiment.

-

Staking Illiquidity: With 30% of supply locked, a sudden mass exit from Ethereum staking could cause network congestion or liquidity mismatches.

-

L2 Value Capture: As more activity moves to Arbitrum and Base, the burn on the mainnet decreases, potentially making ETH slightly inflationary.

-

Regulatory Seizures: The U.S. Government holds over 60K ETH from criminal seizures; any announced auction remains a potential black swan for prices.

Conclusion: Should You Follow the ETH Whales?

The 2026 Ethereum Rich List indicates that institutional and corporate entities are increasingly viewing ETH as a foundational reserve asset. While the top 10 holders command a significant portion of the supply, tools like BingX DCA or BingX AI-powered Analysis allow individual participants to build positions alongside these larger players. As supply continues to move into long-term staking contracts, market participants should remain attentive to on-chain data and institutional flows.

Risk Reminder: Cryptocurrency investment is subject to high market risk. The information provided in this article is for educational purposes only and does not constitute financial or investment advice. Investors should conduct their own research (

DYOR) and consider their risk tolerance before trading.

Related Reading