The narrative of

XRP has fundamentally shifted in 2026. After a transformative 2025 that saw the launch of the

RLUSD stablecoin and the full activation of the EVM Sidechain, the

XRP Ledger (XRPL) has solidified its position as the institutional choice for regulated DeFi. As of February 2026, XRP maintains a dominant top-tier presence with a market capitalization exceeding $88 billion, processing millions of transactions daily with sub-cent fees.

While the early era of XRPL was defined by simple cross-border payments, the 2026 ecosystem is a robust financial layer. Recent breakthroughs, such as the implementation of Confidential Transfers and Single Asset Vaults (XLS-65), demonstrate that capital on the ledger is moving from passive holding to active, yield-bearing utility.

This guide provides an exhaustive overview of the 10 best XRP wallets in 2026, evaluating their roles in security, liquidity access, and technical compatibility with the modern XRPL.

What Are the 10 Best XRP Wallets to Use in 2026?

As the XRPL reaches a period of institutional maturity, the following wallets have emerged as leaders based on security architecture, liquidity depth, and protocol-level integration.

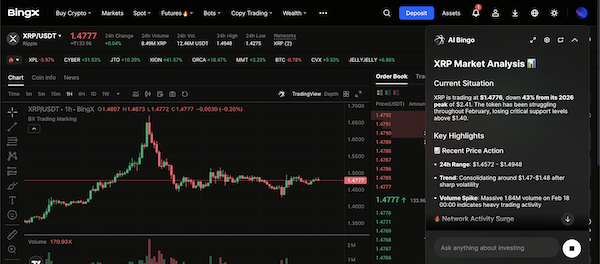

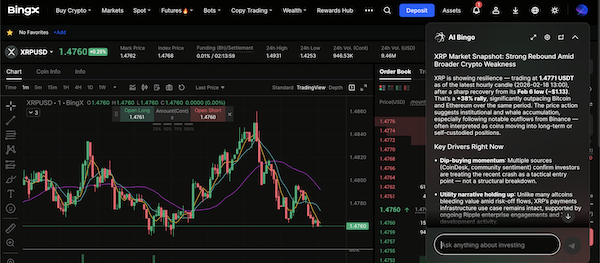

1. BingX

BingX positions itself as a high-liquidity trading hub for XRP, combining deep order books, AI-enhanced analytics, and institutional-grade security. As of 2026,

BingX Earn’s Simple Earn program offers XRP holders an estimated 0.24%–0.36% APR, providing a low-friction yield option without locking assets on-chain. For active traders,

BingX AI-integrated

Spot and

Perpetual Futures markets are designed to capture XRP’s historically high intraday volatility, with tools such as real-time risk alerts, adaptive margin controls, and automated strategy execution.

BingX also supports native XRPL deposits, alongside bridged XRP representations on EVM-compatible networks, giving users flexibility across centralized and cross-chain trading strategies. This multi-rail asset support, combined with fast execution and immediate liquidity access, makes BingX a practical choice for traders optimizing both yield and short-term price exposure.

Key Consideration: XRP yield on BingX is generated via exchange-based lending mechanisms, not on-chain staking.

Best Suited For: Active traders and portfolio managers seeking instant liquidity, modest passive yield, and AI-driven market insights within a single platform.

2. Tangem Wallet

Tangem has pioneered a seedless hardware revolution for 2026, replacing bulky traditional devices with an IP69K-rated card that is waterproof, dustproof, and resistant to extreme temperatures, X-rays, and EMPs. The wallet utilizes a Samsung-developed EAL6+ certified secure element, the same security level used in biometric passports, to generate and permanently lock private keys within the chip. By leveraging NFC technology, Tangem eliminates the vulnerabilities of Bluetooth, batteries, and USB ports, allowing users to sign transactions with a single tap. Through its deep integration with Xaman, Tangem acts as a physical key for the XRP Ledger, enabling secure interaction with the 2026 ecosystem of MPTs and native lending protocols without ever exposing private keys to an online environment.

Key Consideration: Requires an NFC-enabled mobile device and utilizes a Smart Backup system where extra cards act as your recovery method instead of a traditional paper seed phrase.

Best Suited For: Investors seeking high-durability cold storage that combines the security of an air-gapped vault with the convenience of a credit card.

3. BitPay

BitPay remains the industry benchmark for real-world XRP utility, bridging the gap between digital assets and global commerce via its open-source, non-custodial architecture. As of February 2026, BitPay supports direct XRP payments at over 250 major brands, including AMC Theatres, Ralph Lauren, and Newegg, alongside a robust ecosystem of 250+ instant-delivery gift cards. The wallet’s standout feature, HODL Pay, allows users to leverage DeFi by borrowing stablecoins against their XRP collateral via

Aave integration to settle any BitPay invoice without triggering a taxable sale. With institutional-grade security features like multi-signature (multisig) support, biometric authentication, and Unstoppable Domains integration, BitPay transforms XRP into a high-velocity functional currency capable of settling in 3–5 seconds for sub-cent fees.

Key Consideration: Optimized for high-frequency spending, bill payments, and fiat conversion rather than complex on-chain yield farming or NFT minting.

Best Suited For: Users who view XRP as a primary medium of exchange and want a seamless way to pay bills, shop with top brands, or use the BitPay Mastercard for real-time crypto-to-fiat spending.

4. Xaman (Formerly Xumm)

Xaman is the definitive Super App for the XRP Ledger, serving as the primary gateway for over 2 million users to access the network’s 2026 institutional DeFi upgrades. The recent Xaman 5.0.0 release has introduced Virtual Assets and true offline resilience, allowing core manual actions like transaction signing and Trust Line management even when primary backend infrastructure is unavailable. As the most technically advanced interface for the ledger, it provides native support for the XLS-66 Lending Protocol and Multi-Purpose Tokens (MPT), integrating them directly into the home screen with real-time fiat valuations. Beyond standard wallet functions, Xaman’s xApp ecosystem allows users to interact with advanced features like AMM Liquidity, Xahau Hooks, and Single Asset Vaults (XLS-65), all within a self-custodial environment that has maintained a zero-breach security record for over five years.

Key Consideration: While Xaman is a hot wallet, it offers a Hardware-Backed security model when paired with Tangem-powered Xaman Cards, effectively turning your mobile interface into a cold storage portal.

Best Suited For: Power users, developers, and DeFi participants who require a feature-complete interface to manage complex

on-chain positions and early-access protocol features.

5. SafePal S1

The SafePal S1 remains a benchmark for zero-connectivity security, utilizing a 100% air-gapped signing mechanism that completely eliminates Bluetooth, WiFi, NFC, and USB data vulnerabilities. Priced at a competitive $49.99, the device features a CC EAL6+ independent secure element and an on-device camera for high-speed QR code scanning, ensuring private keys never leave the hardware. Its 2026 technical profile includes a high-durability 400mAh battery, providing up to 20 days of standby, and a sophisticated anti-tamper self-destruct mechanism that wipes all data upon physical breach detection. Beyond cold storage, the S1 provides an institutional-grade gateway to the XRPL through its native App, supporting cross-chain swaps, Binance Earn integration, and a dedicated bridge for the emerging XRPL EVM sidechain.

Best Suited For: Security-first investors seeking an affordable, credit-card-sized cold storage solution that offers a completely offline environment without sacrificing DeFi utility.

6. Trezor Safe 3

The Trezor Safe 3 is the industry’s leading transparent cold storage solution, combining a fully open-source hardware and software architecture with a specialized EAL6+ certified secure element. This dual-chip design addresses the blind trust issue of traditional hardware by allowing the community to audit the code while maintaining a dedicated, tamper-resistant vault for private keys. In 2026, the device remains a powerhouse for XRP holders through the Trezor Suite, which supports Shamir Backup (SLIP-0039), a high-redundancy protocol that allows users to split their recovery seed into multiple shares, e.g., 3-of-5, to eliminate single points of failure. With its minimalist two-button interface and a monochrome OLED screen for on-device transaction verification, the Trezor Safe 3 ensures that your XRP, MPTs, and Trust Lines are never exposed to online threats, all while upholding the SatoshiLabs legacy of total user anonymity.

Key Consideration: Optimized for Android and Desktop (Windows/macOS/Linux); iOS functionality is currently restricted to view-only via the Trezor Suite Lite app.

Best Suited For: Privacy-focused HODLers and technical users who demand a community-audited, transparent security model without proprietary black box components.

7. Cypherock X1

The Cypherock X1 has set a new benchmark for 2026 by being the world’s first hardware wallet to eliminate the Single Point of Failure through native Shamir Secret Sharing (SSS). Rather than relying on a vulnerable 24-word paper backup, the X1 cryptographically splits your private key into five shards distributed across one OLED Vault and four EAL6+ certified smartcards, the same security grade as high-end banking chips. This 2-of-5 recovery model ensures that your XRP remains secure even if you lose the Vault and up to two cards, or if one component is stolen. Furthermore, the 2026 Cypherock Cover integration introduces the industry's first non-custodial, non-KYC inheritance plan, allowing you to designate a nominee who can recover your assets after a defined period of inactivity, solving the dead man's switch problem without ever compromising your privacy.

Key Consideration: While it supports over 9,000 assets, including native XRPL tokens and MPTs, the unique shard-based recovery requires a disciplined physical strategy for geographic distribution of your cards.

Best Suited For: Institutional-level HODLers, high-net-worth whales, and estate planners who demand automated inheritance and a security model that survives both physical theft and the loss of a recovery phrase.

8. Ledger Nano X

The

Ledger Nano Gen5, launched in late 2025, marks the evolution of the iconic Nano series into a modern secure signer designed for the AI era. Replacing the button-based interface with a 2.76-inch monochrome E Ink touchscreen, the Gen5 brings high-resolution Clear Signing and Transaction Check to an accessible price point of $179. It features a major security leap with a CC EAL6+ certified secure element (ST33K1M5) and adds NFC connectivity alongside Bluetooth 5.2 and USB-C. This triple connectivity enables the use of the Ledger Security Key for passwordless FIDO2 logins and seamless integration with the Ledger Recovery Key, a physical, encrypted spare key included in every box. While it maintains the compact portability of the Nano X, its upgraded 10-hour battery life and superior UX make it the foundational tool for managing over 15,000 assets and interacting with institutional DeFi via the rebranded Ledger Wallet app.

Key Consideration: While the E Ink touchscreen significantly improves transaction legibility to prevent phishing, the device still requires the Ledger OS (closed-source firmware) for its secure element operations.

Best Suited For: Investors who want the security of a flagship touchscreen device like the Stax or Flex but prefer the portable, Goldilocks form factor and price of the Nano series.

9. Atomic Wallet

Atomic Wallet remains a dominant non-custodial software solution in 2026, serving over 15 million users with an interface designed for massive asset variety. As a Hierarchical Deterministic (HD) wallet, it allows users to manage over 1,000+ assets, including XRP, Monad, and advanced L1 tokens, across 60+ blockchains from a single master seed. While it lacks the deep, native XRPL-specific protocol access of Xaman, such as XLS-66 lending, it excels as a yield hub, offering in-app staking for 20+ Proof-of-Stake assets with APYs reaching up to 20% on tokens like SOL and ADA. Following a major security overhaul after the June 2023 exploit, the wallet has implemented a $1 million Security Bounty Program, mandatory AES encryption for locally stored data, and a bounty-hardened 2026 release (v1.39+) featuring real-time transaction notifications and instant DEX swaps with up to 1% cashback in AWC tokens.

Key Consideration: Security is non-custodial and device-dependent; the wallet lacks native

hardware wallet (cold storage) integration and built-in

2FA, making local device hygiene (anti-malware) critical.

Best Suited For: Retail investors who prioritize a single-pane-of-glass experience for a diverse multi-chain portfolio and desire high-yield staking without the complexity of individual chain-specific wallets.

10. Cobo Wallet

Cobo has solidified its position in 2026 as the world’s first omni-custody platform, offering a high-security bridge for institutions transitioning from passive holding to active participation in the XRP Ledger’s XLS-66 lending markets. By integrating MPC (Multi-Party Computation) and Hardware Security Modules (HSMs) with a SOC 2 Type II and ISO 27001 certified security matrix, Cobo enables mini-funds and corporate treasuries to manage billions with zero reported breaches since inception. Its 2026 technical stack features a Hot-Warm-Cold storage model, keeping 95% of assets in FIPS 140-2 Level 3 offline vaults while maintaining 5% in a high-velocity MPC layer for Just-in-Time (JIT) liquidity. This architecture is uniquely optimized for the XRPL's new Institutional DeFi primitives, allowing for automated token sweeping, real-time KYT (Know Your Transaction) monitoring, and delegated access for trading desks via granular, role-based approval workflows.

Key Consideration: The platform’s hybrid nature allows for Co-managed Custody (MPC) or Full Custody (HSM), requiring organizations to maintain strict internal governance over which stakeholder holds specific key shards.

Best Suited For: Hedge funds, family offices, and professional trading firms that require bank-grade compliance, multi-user signing quorums, and a seamless interface to capture multi-billion dollar yield opportunities on the XRPL.

How to Trade XRP (XRP) on BingX

Powered by BingX AI, the platform combines real-time market analytics with high-liquidity Spot and Futures markets, helping you trade XRP with greater precision and risk control.

Buy and Hold XRP on the Spot Market

XRP/USDT trading pair on the spot market powered by BingX AI insights

-

Fund your Spot wallet with

USDT and navigate to the

XRP/USDT Spot pair.

-

Use BingX AI insights to analyze historical price trends, key support and resistance levels, then place a

Market or Limit order to accumulate XRP at your preferred entry.

Trade XRP Futures with Leverage

XRP/USDT perpetuals on the futures market featuring BingX AI insights

-

-

Choose your margin mode and leverage, then apply automated

Stop-Loss and Take-Profit tools, enhanced by BingX AI risk analytics, to manage downside while trading XRP’s short-term price movements.

Top 3 Considerations Before Investing in XRPL Projects

Before investing in XRPL-based projects, it’s important to understand the unique technical, regulatory, and ecosystem factors that influence their performance, adoption, and long-term risk profile.

-

Account Reserves: The XRPL requires a base reserve of 10 XRP to activate a new wallet and 2 XRP for each Trust Line added.

-

Regulatory Shifts: 2026 remains a year of evolving global standards for tokenized assets; always ensure your wallet supports MPT compliance flags.

-

Technical Execution: Future performance is contingent on the successful deployment of the Alpenglow consensus upgrade and the EVM sidechain stability.

Final Thoughts

By early 2026, the XRP Ledger has evolved into a mature, enterprise-grade network supporting payments, tokenized assets, and emerging DeFi use cases. Whether you prioritize everyday transaction efficiency with BitPay, deep XRPL ecosystem access through Xaman, or maximum self-custody security with hardware solutions like Cypherock X1, selecting the right XRP wallet plays a critical role in how you interact with the network.

Wallet choice directly affects asset security and usability. Software wallets carry exposure to device-level risks, while hardware wallets require careful backup and recovery management. Always verify wallet compatibility with the XRP Ledger, safeguard your recovery credentials offline, and never store more XRP than you can afford to lose on any single platform.

Related Reading