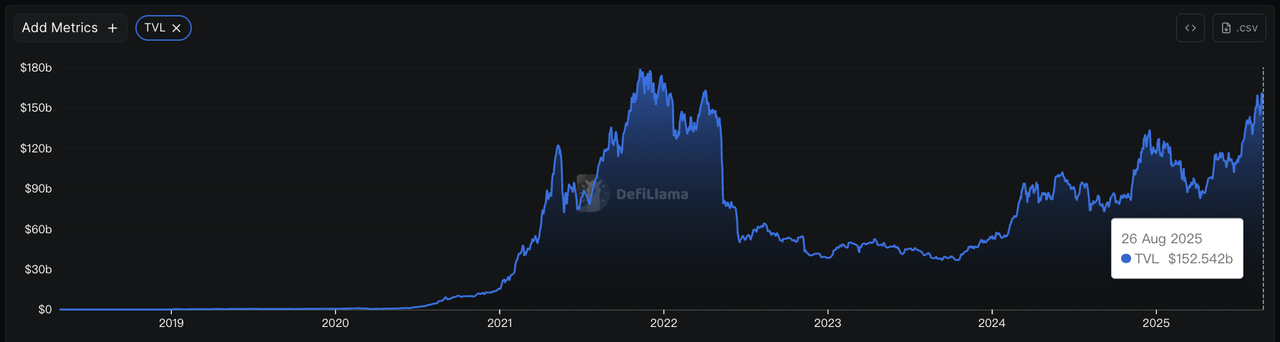

Decentralized finance (DeFi) is experiencing a strong resurgence in 2025. By July, the

total value locked (TVL) across DeFi protocols climbed to a three-year high of $153 billion, marking a 57% increase since April. This surge highlights both the maturity of DeFi infrastructure and the rising confidence of investors.

At the center of this expansion is yield farming, one of the most popular ways for users to earn returns in DeFi. By supplying liquidity or lending assets on platforms such as Aave, Compound, Uniswap, or PancakeSwap, investors can access attractive yields that often outpace traditional banking.

In mid-2025,

APYs vary depending on the platform and strategy.

Stablecoin deposits on Aave and Compound typically earn 5–15%, while liquidity pools on Uniswap and PancakeSwap often offer 5–25%. For comparison, savings accounts at traditional banks usually provide just 1–3% annually, which helps explain why yield farming continues to draw both retail and institutional interest.

In this guide, we will explain what yield farming is, how it works, the main strategies, how it compares to staking, and the key risks to understand before getting started.

What Is Yield Farming?

Yield farming is a way for cryptocurrency holders to earn passive income by putting their digital assets to work in decentralized finance (DeFi) protocols. Instead of leaving tokens idle in a wallet, users supply them to lending markets, liquidity pools, or other smart contracts in exchange for rewards.

At its core, yield farming is about providing liquidity. When you deposit tokens into a protocol, you help power services like decentralized exchanges (DEXs) or

lending platforms. In return, you can earn a share of trading fees, interest payments, or newly issued tokens.

The term “farming” reflects the idea of growing returns from your assets over time. Unlike traditional bank savings accounts, which generate fixed interest, yield farming rewards can vary widely depending on the protocol, the assets you deposit, and overall market conditions.

This practice became especially popular during the “DeFi Summer” of 2020, when protocols like Compound and Uniswap began distributing governance tokens to liquidity providers. Today, yield farming remains one of the main drivers of user activity in DeFi, offering opportunities that range from relatively stable strategies with moderate returns to highly complex setups with potentially higher but riskier yields.

How Does Yield Farming Work?

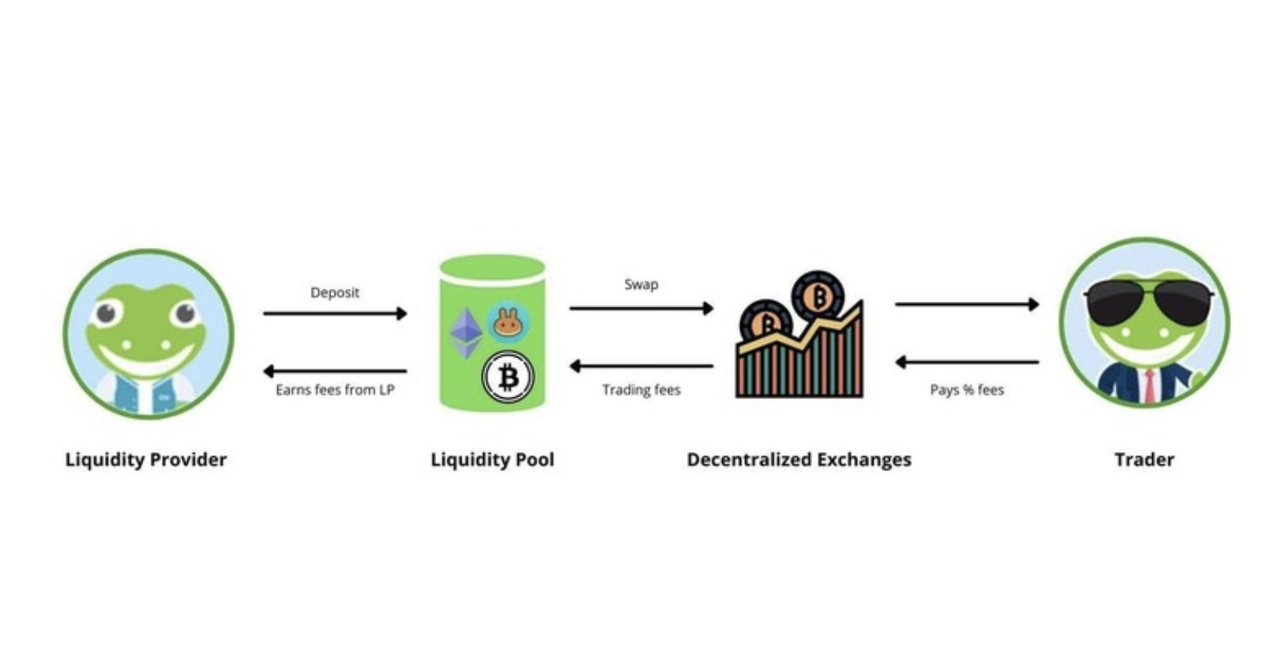

Yield farming lets users participate as a liquidity provider (LP) in decentralized protocols. When you supply tokens to a platform, they are locked in smart contracts that power trading, lending, or borrowing. In return, you earn rewards.

Source: CoinGecko

Here’s how the entire yield farming process works:

Step 1: Deposit Assets

Users deposit cryptocurrencies into a DeFi protocol. On decentralized exchanges, this usually means depositing two tokens of equal value into a liquidity pool, while on lending platforms, users supply single tokens such as stablecoins. These deposits provide the capital needed for trading, lending, or borrowing to take place.

Step 2: Track Your Position

Protocols issue different forms of proof depending on the service. On decentralized exchanges, users typically receive liquidity provider (LP) tokens that represent their share of the pool. On lending platforms, deposits accrue interest directly over time without LP tokens. In both cases, this step ensures that users’ positions and entitlements are recorded on-chain.

Step 3: Earn Rewards

As a liquidity provider, you usually earn in two ways:

• Trading Fees or Interest: A share of transaction fees on exchanges, or borrower interest on lending platforms.

• Governance Token: Additional incentives, often in the form of governance tokens, through a process known as liquidity mining.

Step 4: Redeem Assets

Users can withdraw at any time. On exchanges, LP tokens are returned to reclaim the initial deposit plus accumulated fees or incentives. On lending platforms, users simply withdraw their supplied assets along with the accrued interest.

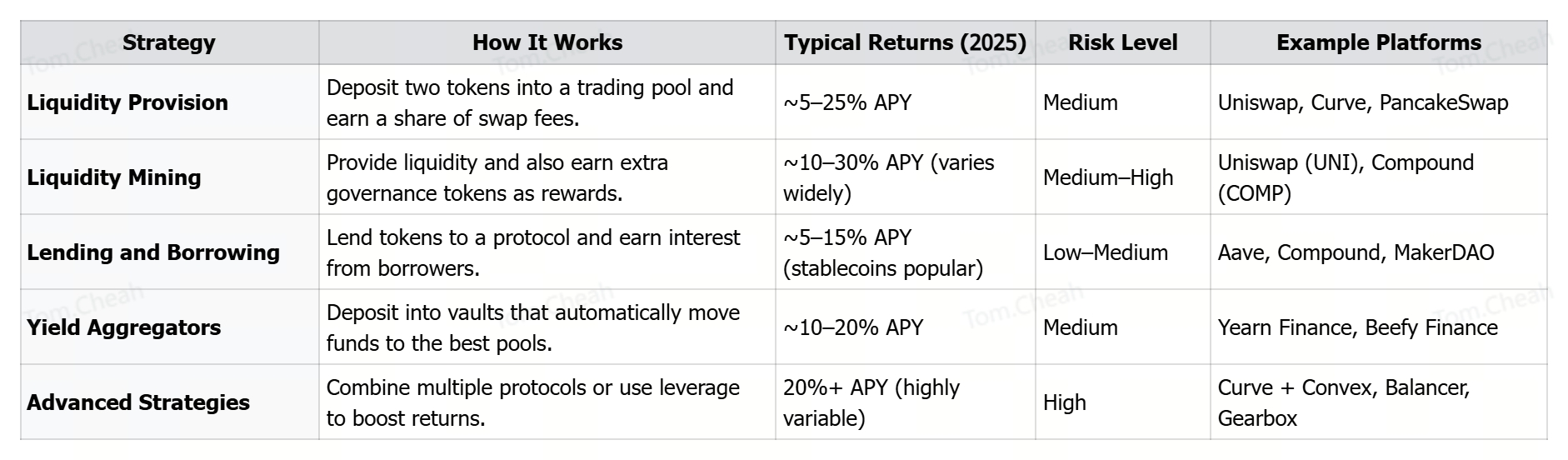

Top 5 Different Types of Yield Farming Strategies

Not all yield farming is the same. Strategies vary in complexity, risk, and potential reward. Here are the most common types:

1. Liquidity Provision - Earn trading fees by providing token pairs

Protocol Types: Decentralized Exchange (DEX), Automated Market Maker (AMM)

Liquidity provision allows decentralized exchanges (DEXs) to operate without traditional order books. Instead of matching buyers and sellers, DEXs use

automated market makers (AMMs), which rely on mathematical formulas, most commonly "x* y = k", to set token prices based on the ratio of assets in the pool.

To supply the liquidity needed for this system, users act as liquidity providers by depositing two tokens of equal value, for example $1,000 in

ETH and $1,000 in

USDC, into a shared pool. When someone buys ETH with USDC, ETH leaves the pool and USDC enters, which automatically pushes the ETH price higher for the next trade. This mechanism guarantees continuous liquidity while prices adjust dynamically to reflect supply and demand. Liquidity providers are essential in this framework because they ensure tokens are always available in the pool for swaps to happen, and in return, they receive transaction fees as incentives for providing liquidity.

Typical returns range from 5–25% APY, depending on trading pair volume and volatility. Stablecoin pairs usually offer steadier yields of 5–10%, while volatile pairs can generate higher rewards but expose users to impermanent loss. Market conditions also play a major role: bull markets typically increase trading volumes and fee income, while bear markets tend to reduce them. Some platforms add temporary bonus incentives to attract liquidity, particularly for newer token pairs, and newer DEX designs with concentrated liquidity allow providers to position their funds more efficiently.

2. Liquidity Mining - Receive governance tokens as additional rewards

Protocol Types: Decentralized Exchange (DEX), Lending Protocol, and Yield Aggregator

Liquidity mining evolved from traditional liquidity provision during 2020's "DeFi Summer" when protocols began distributing governance tokens as additional incentives. Users earn base yields (trading fees or interest) plus native protocol tokens, with returns ranging from 8-50% APY depending on token market value and distribution rates. Token distribution typically follows predetermined emission schedules, with many protocols implementing decreasing rewards over time to ensure long-term sustainability.

These governance tokens provide voting rights for protocol decisions like fee structures and new features, helping bootstrap new protocols through early adoption incentives. However, token values can be highly volatile and may decline due to selling pressure from farmers, making it crucial to understand long-term tokenomics rather than chasing short-term high yields. Successful liquidity mining requires timing market entry during favorable token price periods and understanding when emission rates change, as many protocols implement halving events or graduation from mining programs.

3. Lending and Borrowing - Earn interest by supplying assets to lending protocols

Protocol Types: Lending Protocol, Money Market

Popular Platforms/ Projects: Aave (AAVE), Compound (COMP), Maker (MKR),

Euler (EUL)

Lending protocols operate as decentralized money markets using algorithmic interest rate models that automatically adjust rates based on supply and demand. Users deposit crypto assets into lending pools borrowed by others for trading or arbitrage, earning interest that typically ranges from 3-8% APY for stablecoins and 2-6% APY for volatile assets like ETH. Interest compounds automatically on most platforms, with rates updating in real-time based on utilization ratios, typically targeting 80% optimal utilization.

This strategy offers the most stable and predictable DeFi returns without impermanent loss risks. Interest rates increase when utilization is high to attract more lenders, and decrease when supply exceeds demand. Many platforms also distribute governance tokens to lenders and borrowers, providing additional earning potential beyond base interest rates. Users should monitor utilization rates as extremely high utilization (95%+) can temporarily prevent withdrawals, and different assets have varying risk profiles with stablecoins generally offering the most predictable returns while maintaining lower volatility exposure.

4. Yield Aggregators and Vaults - Automated yield optimization across protocols

Protocol Types: Yield Aggregator, Vault Protocol

Yield aggregators function as automated portfolio managers that continuously monitor DeFi ecosystem yields and allocate funds to highest-yielding opportunities. These platforms use complex algorithms to harvest rewards, swap them for base assets, and reinvest everything to compound returns, typically delivering 8-20% APY while charging 0.5-2% management fees annually. Advanced aggregators implement strategies like auto-harvesting optimal timing, MEV protection, and gas optimization to maximize net returns for users.

The automation eliminates manual yield farming by implementing sophisticated strategies too complex or gas-expensive for individual users. They work across all DeFi protocol types including DEXs, lending platforms, and specialized farming contracts, providing convenience and often better returns through professional management while adding additional smart contract risk layers. Many aggregators offer different risk tiers, from conservative stablecoin strategies to aggressive multi-token approaches, and some implement insurance mechanisms or partnerships to provide additional user protection against smart contract failures.

5. Advanced Strategies - Complex multi-protocol approaches for experienced users

Protocol Types: Various (Multi-Protocol Integration, Leveraged Farming)

Advanced yield farming strategies combine multiple DeFi protocols to maximize returns through methods such as recursive lending, using LP tokens as collateral, or employing delta-neutral positions. These approaches can potentially generate anywhere from 15% to over 100% APY, but they demand deep technical knowledge and active management across decentralized exchanges, lending platforms, and derivatives markets. Success often depends on precise market timing, efficient gas fee management, and a strong understanding of liquidation mechanics across multiple protocols.

Many advanced strategies rely on leverage, which amplifies both potential rewards and risks. For example, users may stake Curve LP tokens in Convex for boosted rewards or engage in recursive lending by borrowing against deposits to expand positions. These setups require monitoring shifting reward rates, managing liquidation thresholds, and understanding complex tokenomics such as vote-locking mechanisms. Because of the high risk and complexity, these strategies are generally suitable only for experienced users with significant capital who can actively manage positions across several interconnected protocols.

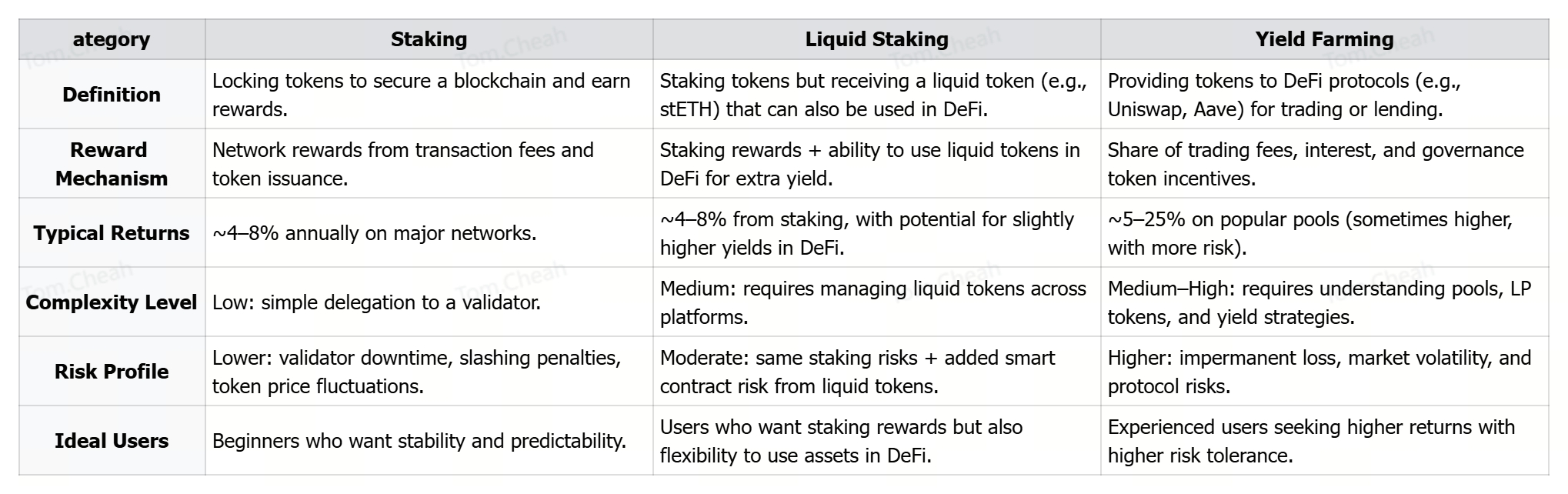

Staking vs. Liquid Staking vs Yield Farming: What Are the Key Differences?

Crypto investors have several ways to earn passive income, but not all strategies work the same way. The three most common are staking, liquid staking, and yield farming. Each approach has its own source of rewards, level of complexity, and risk.

• Staking is the most straightforward option. Users lock tokens directly on a blockchain (like Ethereum or Solana) to help secure the network and earn rewards from transaction fees and token issuance.

• Liquid staking is a variation of staking. Users still stake tokens, but instead of keeping them locked, they receive a tradeable “liquid token” (such as stETH from Lido). This liquid token continues to earn staking rewards while also being usable in DeFi protocols, giving users more flexibility.

• Yield farming is more complex. Users supply liquidity directly to DeFi protocols such as Uniswap, Aave, or Curve. Rewards come not only from fees or interest but also from additional incentives like governance tokens. Unlike liquid staking, which extends staking rewards, yield farming is built around liquidity provision and carries higher risks such as impermanent loss.

The table below compares the three approaches side by side:

Risks and Considerations for Yield Farming

Yield farming can generate high returns, but it also carries important risks that every investor should understand:

1. Impermanent Loss: This happens when the prices of the two tokens you provide to a liquidity pool change at different rates. The bigger the price swing, the more your share in the pool may be worth less than if you had simply held the tokens in your wallet.

2. Smart Contract Risk: DeFi protocols run on code, and any bug or vulnerability can be exploited by hackers. Even reputable platforms have experienced exploits, which makes smart contract risk one of the biggest concerns.

3. Platform Risk: Not all projects are reliable. Some protocols may fail due to poor design, while others can be outright scams (often called rug pulls) where developers disappear with user funds.

4. Market Volatility: Crypto prices can swing sharply, and those moves can erase profits even in high-yield pools. A 20% APY can quickly turn into a loss if token values drop significantly.

5. Liquidity Risk: Smaller or low-volume pools can make it difficult to withdraw assets at the right time, especially during market stress.

6. Regulatory Risk: DeFi still operates in a gray area. Future regulations on stablecoins, lending, or decentralized exchanges could limit access to platforms or reduce returns.

Final Thoughts

Yield farming has become one of the most popular ways to earn passive income in decentralized finance. By providing liquidity or lending assets through DeFi platforms, investors can access returns that are often far higher than traditional savings or even staking.

At the same time, yield farming is not risk-free. Factors like impermanent loss, market volatility, and smart contract vulnerabilities mean that high APYs come with trade-offs. The key is to research carefully, start with trusted platforms, and only commit funds you are prepared to risk.

For beginners, yield farming can be a valuable way to learn how DeFi works while potentially earning extra rewards. With the right approach and awareness of risks, it can serve as both an educational experience and an investment strategy in the evolving world of crypto.

Related Reading