In September 2025,

Sign (SIGN) has broken into the crypto spotlight as a fast-growing credential and token-distribution play across multiple chains. The token has rallied almost 60% over the past 30 days, helped by a completed $12 million buyback, the Orange Dynasty SuperApp rollout, and sustained attention from April’s Binance HODLer Airdrops campaign, all tightening supply while expanding use cases. Real-time price dashboards show outsized weekly gains and heavy volumes as traders reposition around these catalysts.

In this article, you’ll learn what Sign Protocol is, how its ecosystem works, plus how you can trade SIGN on BingX.

What Is Sign Protocol (SIGN)?

Sign Protocol is an omni-chain attestation protocol designed to make information on the internet verifiable and portable across blockchains. Think of it as a universal notary for Web3: instead of trusting screenshots or centralized authorities, users and apps can create structured attestations, e.g., “

KYC verified,” “wallet eligible for rewards,” or “contract signed,” that are stored on-chain and easily verified by anyone.

To handle different use cases, data can be kept fully on-chain or anchored off-chain using

Arweave or IPFS, which makes it cost-efficient while still tamper-proof. The protocol powers an expanding ecosystem of products, such as:

• TokenTable – a multi-chain token distribution suite, such as airdrop, vesting, unlocks, used for large-scale drops, including

TON-based campaigns, with public docs for EVM/TON integrations.

• EthSign – on-chain e-signing for contracts and consent.

• Orange Dynasty (SuperApp) – a SocialFi app that ties on-chain credentials to engagement and rewards; public testing/launch activities began in mid-August 2025.

The SIGN token powers utility, governance, and incentives across this stack.

How the Sign Ecosystem Works

Sign Protocol makes credentials interoperable across chains such as

Ethereum,

Solana, and TON. For example, a project could airdrop tokens only to wallets with verified attestations, or a DeFi protocol could reduce risk by onboarding users with on-chain proof of identity. Here's an overview of how it works:

1. Create a schema → define the data fields you’ll attest, e.g., “KYC: passed/failed, timestamp”.

2. Make an attestation → wallets, apps, or services sign structured data that adheres to that schema; large payloads can be anchored on Arweave/IPFS.

3. Query & verify → apps read attestations through Sign’s indexers/APIs to drive reputation, rewards, or compliance logic.

This design makes credentials & program logic portable across chains (EVM, Solana, TON, etc.), and lets distribution tools like TokenTable target real users based on verifiable conditions.

In short, Sign Protocol is important because it provides the infrastructure of trust for Web3, turning claims into proofs that can be used across different apps and ecosystems.

SIGN Token Rallied Nearly 60% in August Amid the Buyback and Launch Campaign

Sign Protocol (SIGN) token surges almost 60% in a month | Source: BingX

On Aug 13–18, 2025, the Sign Foundation executed a $12 million token buyback, including $8 million from the open-market and $4 million worth of privately held tokens, retiring about 117 million SIGN and shrinking circulating supply by an estimated ~8–9% at the time. Buybacks reduce sell pressure and signal conviction, both supportive for price.

Days later, public testing/launch activity for the Orange Dynasty app on Aug 18 stoked user engagement and social buzz around credential-linked rewards, a direct utility loop for SIGN within a consumer app. Momentum from this rollout overlapped with the buyback window, reinforcing the uptrend.

Earlier distribution also mattered. Binance’s April HODLer Airdrops put 200 million SIGN, around 2% of the token's supply, into many hands, creating a holder base ready to trade new catalysts. Add in strong 7-day and 30-day volume on tracking sites, and you get favorable market structure to sustain a breakout.

What Is SIGN Token Utility and Tokenomics?

The SIGN token is the backbone of the Sign ecosystem, powering utility, governance, and incentives across products like Sign Protocol, TokenTable, EthSign, and the Orange Dynasty SuperApp. Holding SIGN allows users to pay for attestations, participate in DAO-style governance, stake for rewards, and access exclusive community incentives. In addition, it aligns long-term contributors, from backers to developers to governments, by distributing ownership across multiple stakeholder groups.

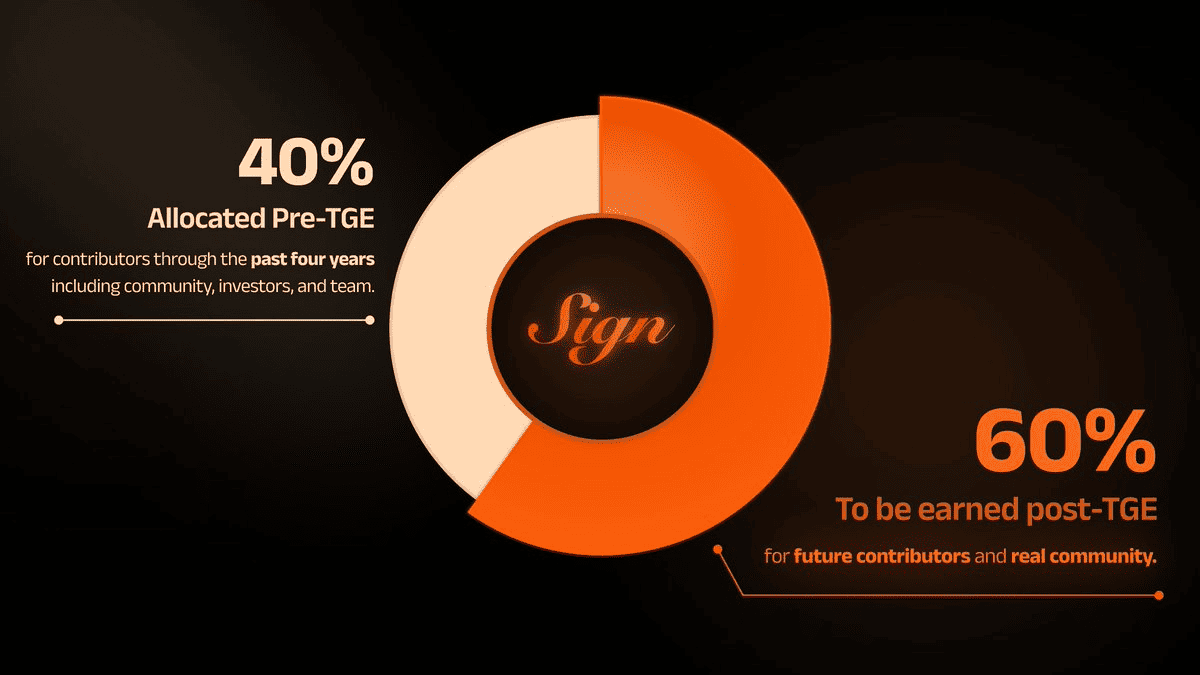

SIGN Token Allocation

SIGN token distribution | Source: Sign Protocol on X

The SIGN token has a maximum supply of 10 billion, with about 12% released at TGE across Ethereum,

BNB Chain, and Base. A snapshot for Sign Protocol airdrop eligibility was taken on April 25, 2025, at 12:00 UTC.

• 40% – Community Incentives

• 10% TGE airdrop for early supporters and exchange users

• 30% for future rewards and airdrops tied to app launches like the SuperApp

• 20% – Backers, strategic partners and early investors, subject to cliffs/vesting

• 20% – Foundation, reserved for long-term ecosystem sustainability

• 12% – Core Contributors, to attract and retain developer talent

• 10% – Early Team Members, foundational team with 1-year cliff + linear vesting

• 10% – Ecosystem Partnerships, to fund integrations with companies, governments, and communities

• 3.5% – Liquidity Incentives, market-making and exchange support

• 2% – Compliance Budget, covering regulatory/legal costs

• 2% – Operational Budget, infrastructure and running costs

• 0.5% – Donations, supporting open-source initiatives and references used in building Sign

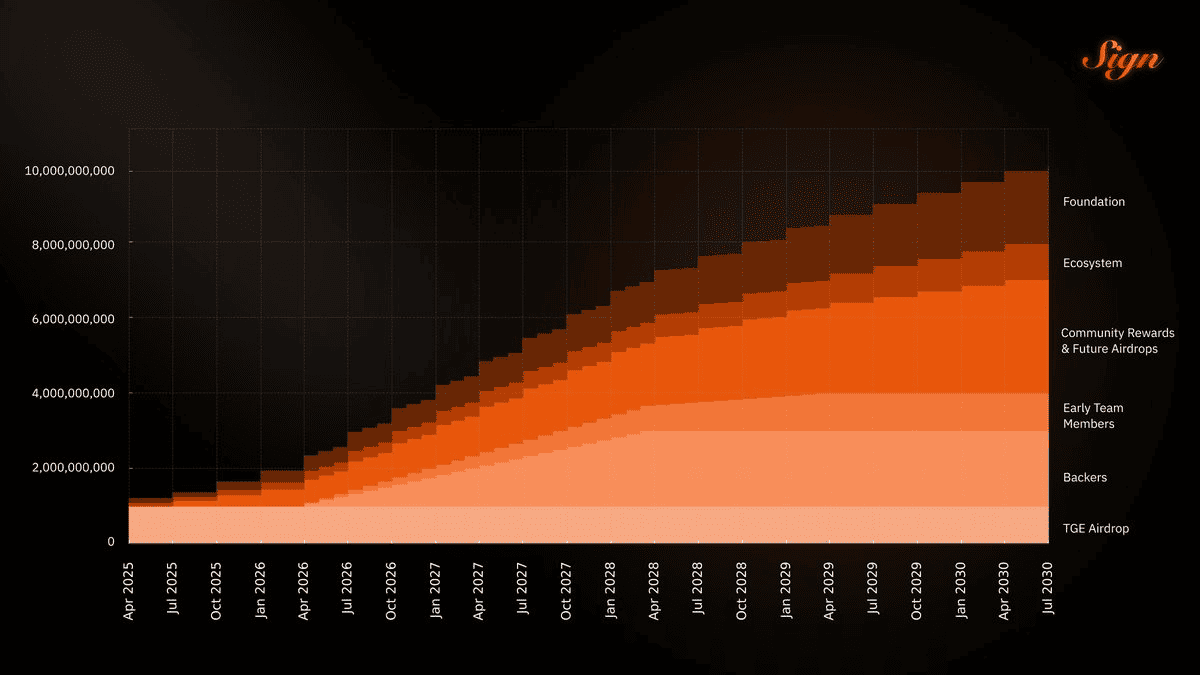

SIGN Vesting Schedule

SIGN token unlock schedule | Source: Sign Protocol on X

The SIGN token release is structured to balance early liquidity with long-term sustainability. At TGE, airdropped tokens were fully unlocked, while backers face a one-year cliff followed by a two-year linear release.

Team members and core contributors also have a one-year cliff, but their tokens vest gradually over three years. Allocations for the foundation and ecosystem will unlock in stages across five years, and community rewards will roll out in monthly distributions starting three months after TGE, continuing over a five-year period.

How to Trade SIGN Token on BingX

On BingX, you can trade SIGN in two ways,

spot trading for long-term holding or

futures trading for short-term strategies, with

BingX AI providing real-time insights on price trends, volatility, and support/resistance levels to help you make smarter decisions.

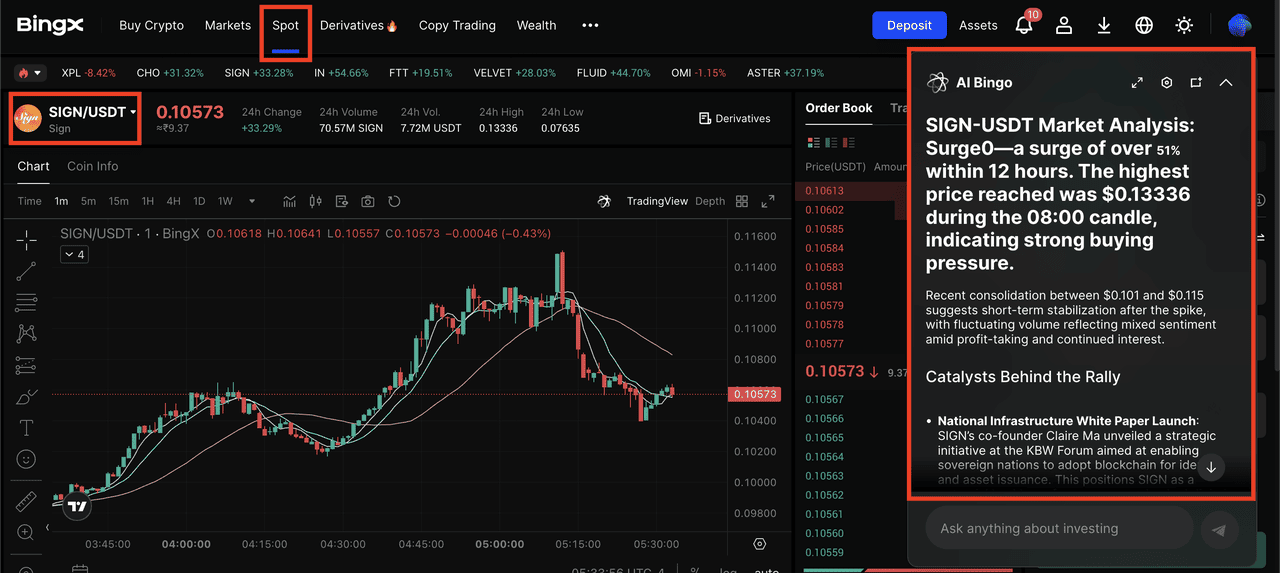

1. Buy and Sell SIGN Tokens on the Spot Market

SIGN/USDT trading pair on the spot market powered by AI Bingo, BingX's AI trading assistant

Spot trading is best if you believe in the project’s long-term growth and want exposure without leverage risk.

1. Go to the Spot section and search for

SIGN/USDT.

2. Decide how much

USDT you want to convert into SIGN. Beginners can start with

limit orders at support levels to cost-average instead of chasing price spikes.

3. Once purchased, you can hold SIGN directly in your BingX wallet.

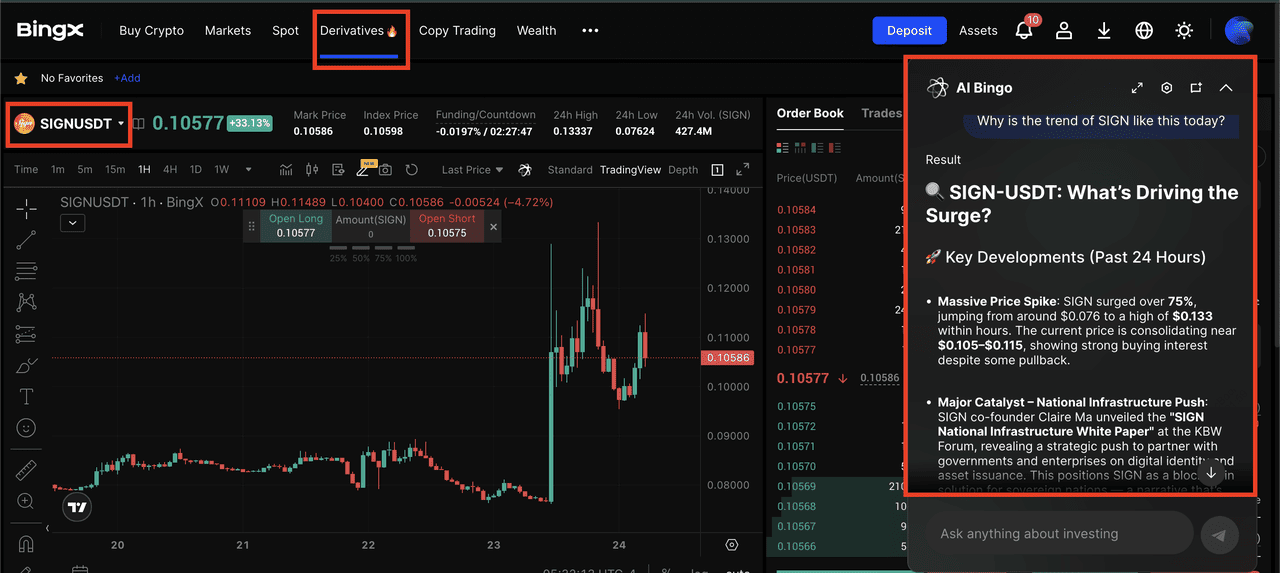

2. Long or Short SIGNUSDT on the Futures Market

SIGNUSDT perpetual contract on the futures market, powered by AI Bingo

2. Start with low leverage, such as 2–3×, to reduce liquidation risk, as SIGN is a low-float token prone to sharp moves.

4. Use BingX AI insights to track volatility, support/resistance zones, and momentum indicators, helpful when trading around news like buybacks or SuperApp updates.

Tip: SIGN has shown strong reactions to catalysts such as foundation buybacks, SuperApp launches, and airdrop announcements. Review the latest updates before entering a trade, and size positions carefully to manage risk.

Key Considerations Before Investing in Sign Protocol

Before buying SIGN, it’s important to understand the factors that could impact both short-term price swings and long-term value.

• Execution risk: The recent rally was fueled by the Foundation’s buyback program and the Orange Dynasty SuperApp launch. However, these drivers depend on consistent execution and user adoption, which may not always continue.

• Unlock dynamics: Large token allocations to backers, team members, and community rewards will gradually unlock over the next 2–5 years. These releases can increase supply and put pressure on price, so keep an eye on the official vesting schedule.

• Market beta: Like most altcoins, SIGN’s price is closely tied to broader crypto market sentiment. A

Bitcoin pullback or risk-off environment could amplify downside moves. Use proper position sizing, set stop-losses, and avoid overexposure to a single catalyst.

Closing Thoughts

Sign Protocol is positioning itself as a critical piece of Web3 infrastructure by standardizing verifiable attestations across multiple chains. The recent 60% rally in SIGN reflects a combination of supply reduction from buybacks, new demand from the Orange Dynasty SuperApp, and lingering support from Binance’s HODLer Airdrops. These factors highlight how product milestones and token economics can work together to drive momentum.

That said, SIGN remains an early-stage, low-float token, which makes it highly volatile. Future unlocks, shifting market sentiment, or slower-than-expected adoption could quickly reverse gains. If you decide to trade or invest, approach with discipline, monitor official updates, and never risk more capital than you can afford to lose.

FAQs on Sign Protocol (SIGN)

1. What exactly does Sign Protocol do?

Sign Protocol standardizes verifiable attestations across chains so apps can trust-but-verify claims (identity, eligibility, reputation) without central intermediaries.

2. Why did SIGN rise almost 60% in September?

SIGN's price surge was the result of a $12 milion buyback, Orange Dynasty app activity, and a supportive holder base from Binance’s HODLer Airdrops, which tightened supply and lifted demand concurrently.

3. Does Sign Protocol handle big data?

Yes, hybrid storage anchors large payloads off-chain (Arweave/IPFS) while keeping verifiable references on-chain.

4. What’s TokenTable’s role in the Sign Protocol Ecosystem?

Sign Protocol's TokenTable's powers airdrops/vesting/unlocks across EVM, TON, and more, crucial for fair, compliant distribution at scale.

Related Reading