Perpetual futures dominate crypto futures trading because they don’t expire, unlike traditional standard futures. This flexibility attracts both retail and institutional traders, but it creates a challenge: without an expiry date, contract prices can drift far away from the spot market. That’s where the funding rate comes in, a mechanism designed to keep perpetual contract prices aligned with the spot market.

Although it often looks like a small percentage, the funding rate has a powerful impact. It determines who pays whom between long and short traders, directly shaping

trading costs and influencing overall market sentiment. Even a seemingly minor 0.01% funding rate can add up to hundreds of dollars over time, which makes it critical for beginners and professionals alike to understand how it works.

For anyone trading with

leverage, funding payments accumulate quickly and can make the difference between profit and loss. That’s why mastering funding is essential for both active day traders and long-term market participants.

What Is the Funding Rate in Futures Trading?

The funding rate is a periodic payment exchanged directly between long and short traders in perpetual futures. Its main purpose is to keep the price of perpetual contracts aligned with the spot market price of the underlying asset.

When perpetual contracts trade above spot, the funding rate turns positive and long traders pay shorts. When they trade below spot, the rate becomes negative and short traders pay longs. This constant transfer of payments discourages imbalances and keeps perpetuals anchored to the real market price.

Each exchange uses its own formula, but most funding calculations include two key components:

• Interest rate element – a small fixed rate that reflects the cost of holding capital.

• Premium index – a dynamic measure of how far the perpetual contract price deviates from the spot market.

Together, these elements ensure that funding rates continuously push perpetual prices back toward spot, reducing distortions that could destabilize the market.

How the Funding Rate Mechanism Works

The funding rate acts as a balancing mechanism between perpetual contracts and the

spot market. Whenever the two prices diverge, the system shifts costs between long and short traders to bring contracts back in line with the underlying asset.

When perpetual contracts trade above the spot price, the funding rate turns positive and long traders pay shorts. This discourages overcrowded long positions and encourages more short exposure, which helps push the contract price back toward spot. When perpetual contracts trade below spot, the funding rate turns negative and shorts pay longs. This raises the cost of shorting, attracts more long traders, and pulls the price upward.

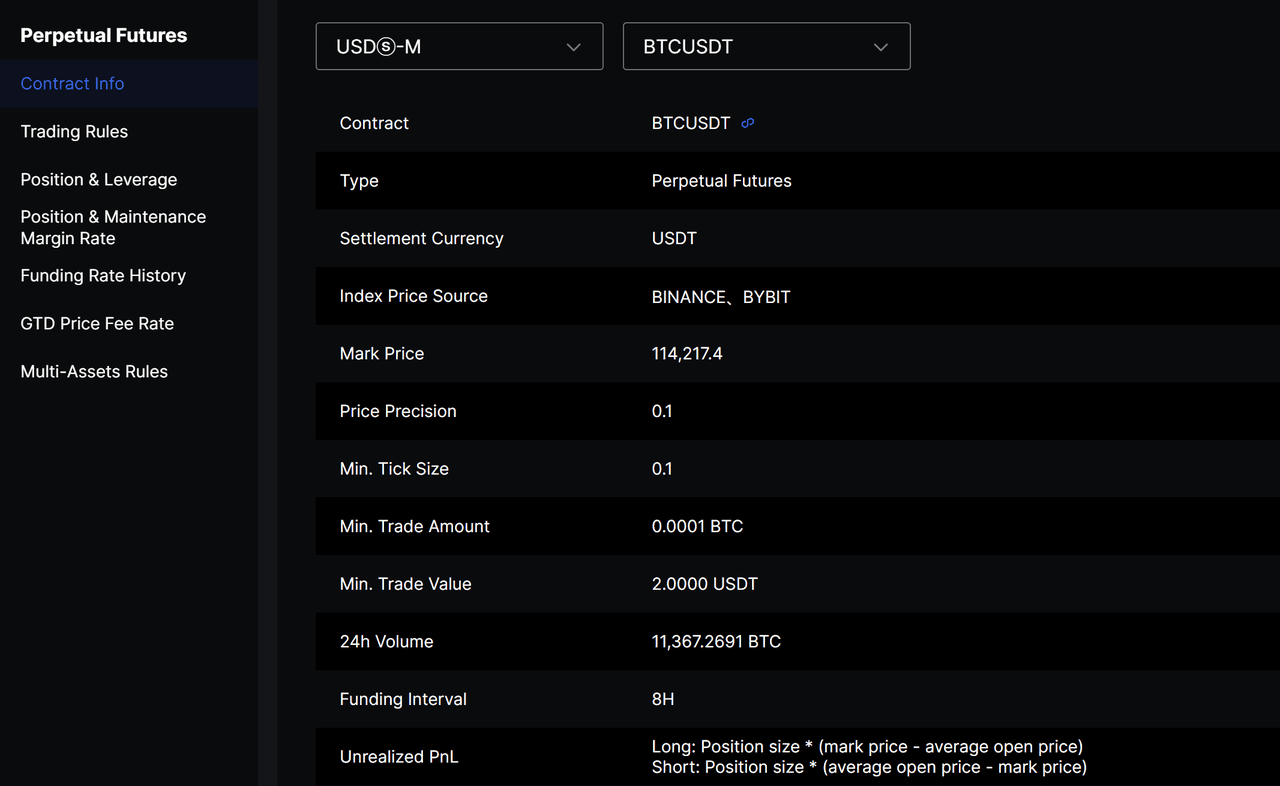

Source: Perpetual Futures Contract

BingX

On BingX,

Bitcoin perpetual futures (BTC/USDT) currently trade above $114,000 as of press time, with funding intervals set at every 8 hours (00:00, 08:00, 16:00 UTC). This structure aligns closely with major platforms like Binance and OKX, keeping perpetual contracts anchored to the spot index.

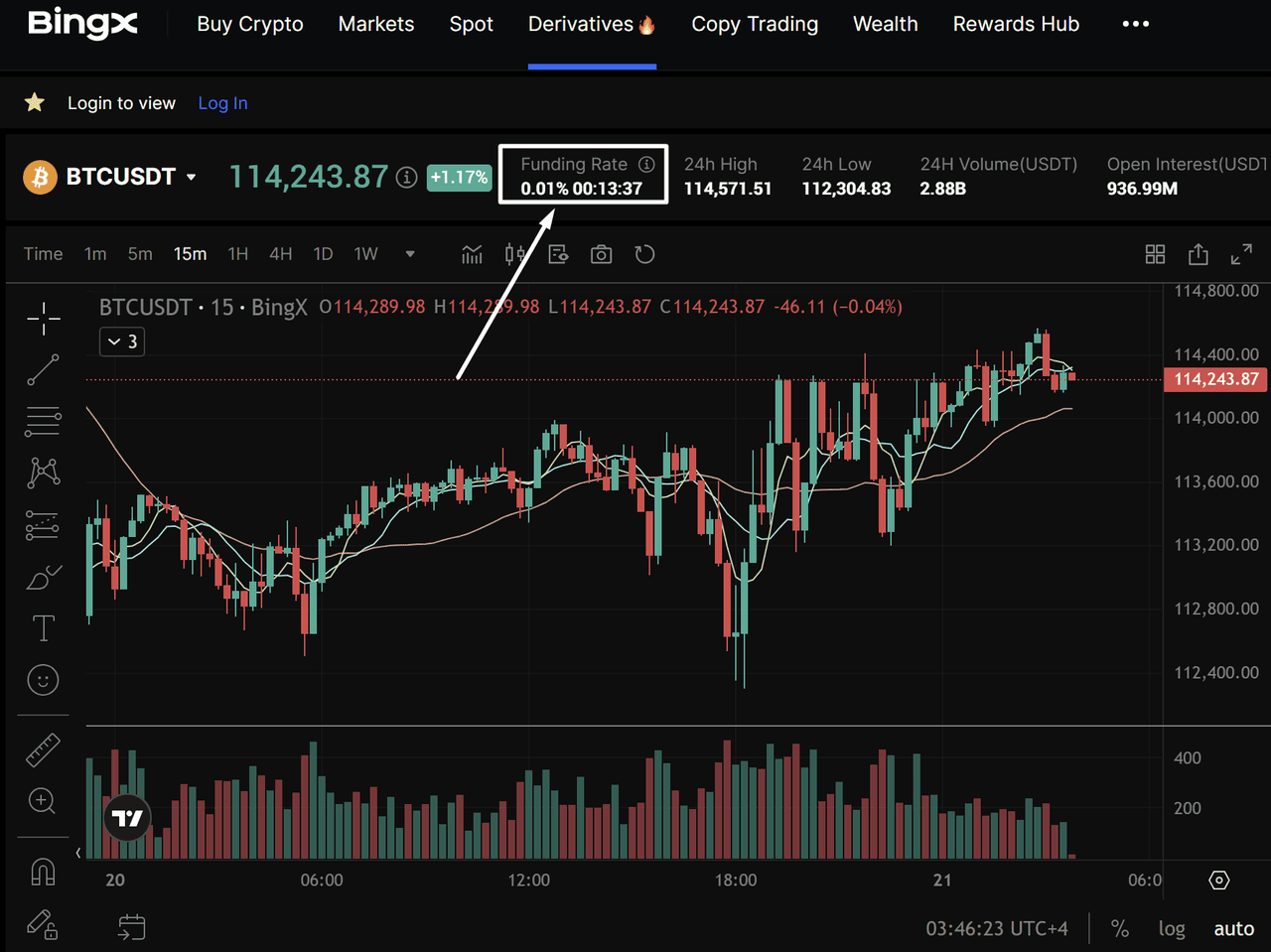

Source:

BTC/USDT Perpetual Futures Contract

The calculation is straightforward:

Funding Fee = Position Value × Funding Rate

• Example: A $100,000 long position at a funding rate of +0.01% incurs a $10 payment at settlement.

• If the funding rate flips negative, the same position would instead earn $10 from the short side.

Importantly, these payments are

peer-to-peer; the exchange facilitates the transfer, but it does not keep the fee.

Positive vs. Negative Funding Rates

The direction of the funding rate shows not only who pays but also how the market is positioned.

Positive funding means longs pay shorts. This usually occurs in bullish conditions, when traders aggressively open long positions and drive perpetual prices above spot.

Negative funding means shorts pay longs. This is more common in bearish markets, when traders rush into shorts and push perpetuals below spot.

Neutral funding indicates a balanced market, where perpetual prices stay close to spot and neither side pays significantly.

To prevent destabilizing spikes, most exchanges apply limits and safeguards. On BingX, as on other leading platforms, caps and thresholds are used to avoid extreme charges and protect traders from sudden, outsized costs.

How Are Funding Rates Related to Market Sentiment?

Funding rates act as a window into trader psychology. They show which side of the market is willing to pay in order to hold leverage, making them a valuable real-time sentiment indicator.

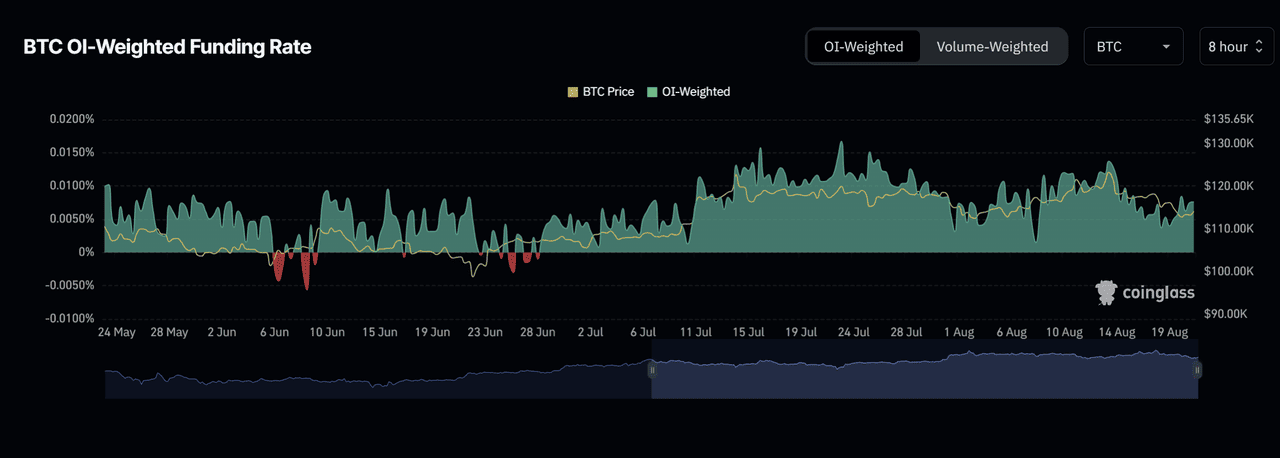

When funding rates remain positive, it signals that long traders dominate. This reflects bullish sentiment, as participants expect higher prices and are willing to bear the cost of paying shorts. In contrast, negative funding rates indicate that shorts are in control. This reflects bearish sentiment, often driven by fear or caution as traders pay to stay short.

At the extremes, funding rates can highlight crowded positions. Very high positive rates often suggest that longs are overleveraged and vulnerable to liquidation cascades, while deeply negative rates may signal panic shorting that sometimes precedes a rebound.

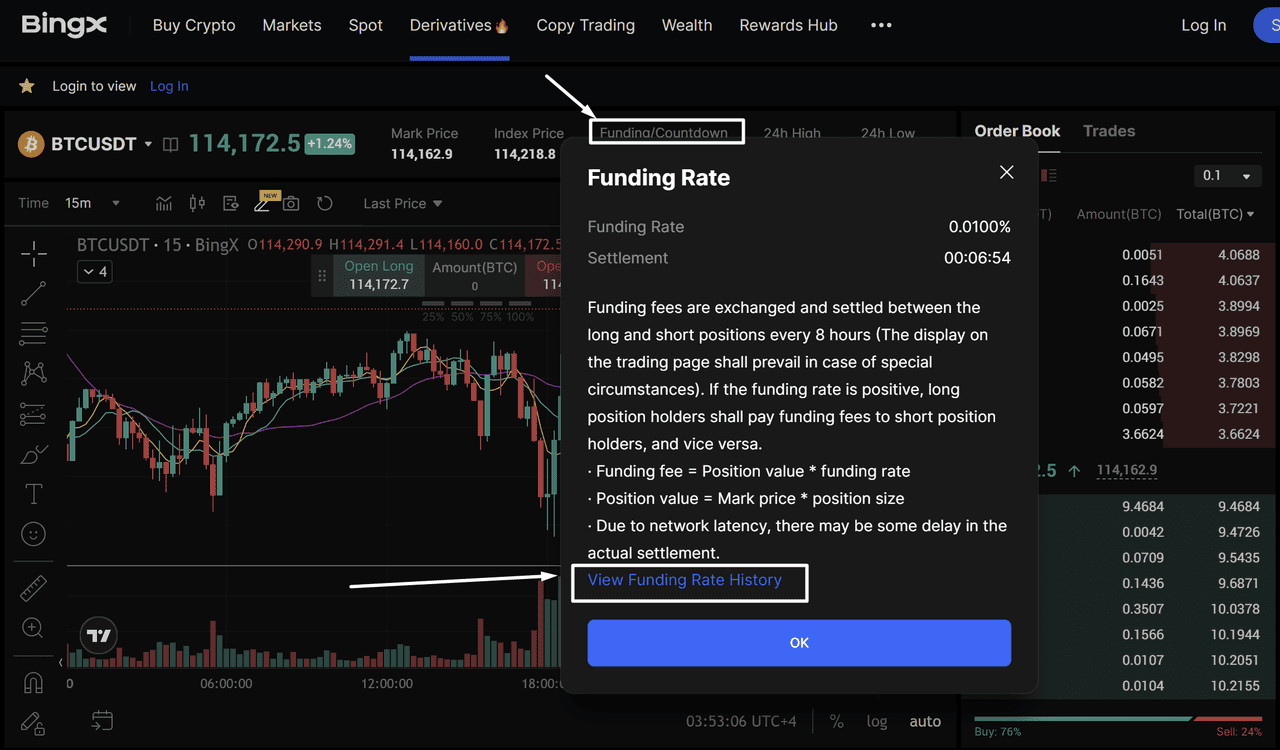

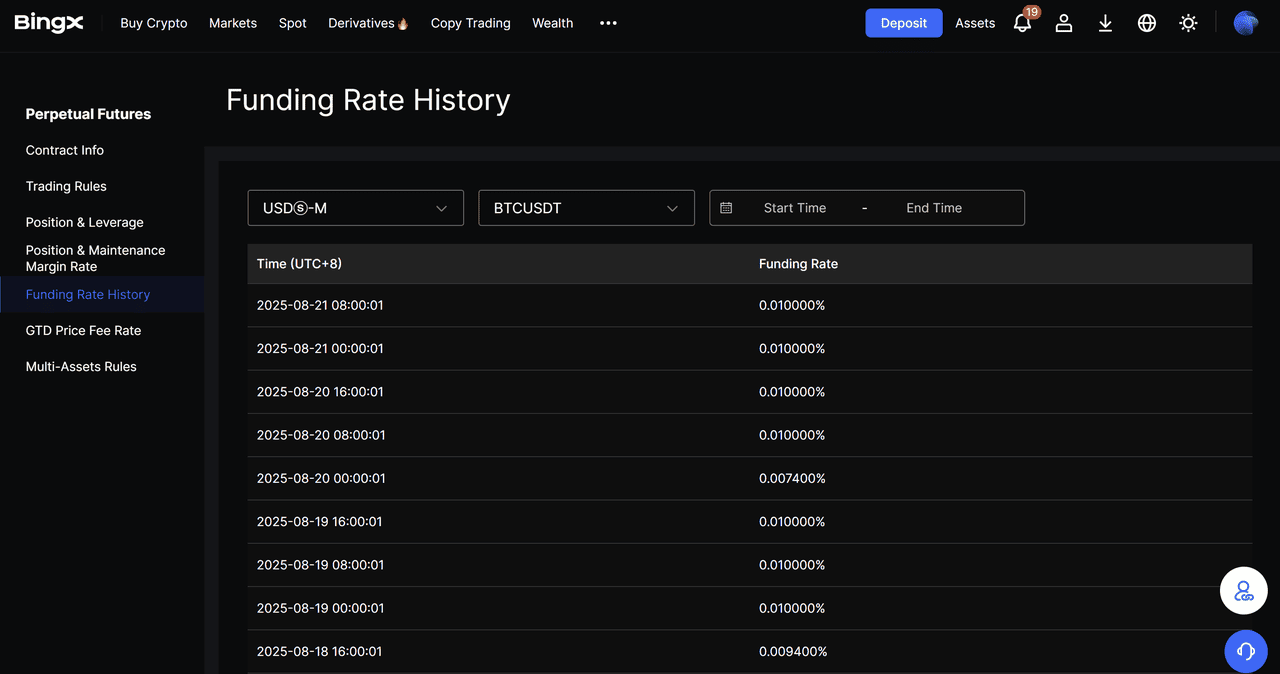

On BingX, traders can track funding directly on the

Funding Rate History dashboard, alongside open interest and volume. For instance, when BTC/USDT perpetuals hold funding around +0.01% every 8 hours, it points to mild bullishness. But if the rate spikes to +0.05% or more, it often signals overcrowded longs that may unwind.

Source:

BTC/USDT Perpetual Futures Contract

This is why professionals rarely look at funding in isolation. They combine it with:

• Open interest (OI) to gauge the scale of leveraged positions.

• Price action to see whether sentiment aligns with momentum.

• Volume and liquidations to detect when positions are getting squeezed.

In practice, funding rates serve as a sentiment filter. They help traders anticipate when optimism or fear has gone too far and when the market may be due for a reset.

Impact of Funding Rate on Trading Costs

Funding rates have a direct impact on trading costs and can significantly affect profit and loss.

For traders holding leveraged positions, these periodic payments accumulate quickly. For example, a long Bitcoin position worth $100,000 with a funding rate of +0.01% would result in a payment of $10 every eight hours, or around $30 per day.

Over the course of a month, this could add up to nearly $900 in costs, even if the price moves in the trader’s favor. On the other side, a short trader in the same scenario would receive those payments, turning funding into a source of income.

Importantly, these charges only apply if the position is open at the exact settlement time; closing before the funding timestamp avoids the fee entirely. This is why funding must be factored into position sizing, holding periods, and overall risk management.

How to Use Funding Rates in Trading Strategies

Funding rates are not just costs; they can also be tools. Traders often use them in different strategies depending on market conditions. Let’s break down the main approaches:

1. Funding Capture (Earning the Rate)

When funding stays positive, long traders pay shorts. This creates opportunities for market-neutral strategies where traders short perpetual contracts and hedge with spot or futures.

For example, if Bitcoin funding holds at +0.02% every 8 hours, a trader shorting $100,000 in perps and having an equal spot long could earn about $60 per day purely from funding, independent of price direction. The opposite works in negative funding environments, where going long perps and hedging with shorts generates income.

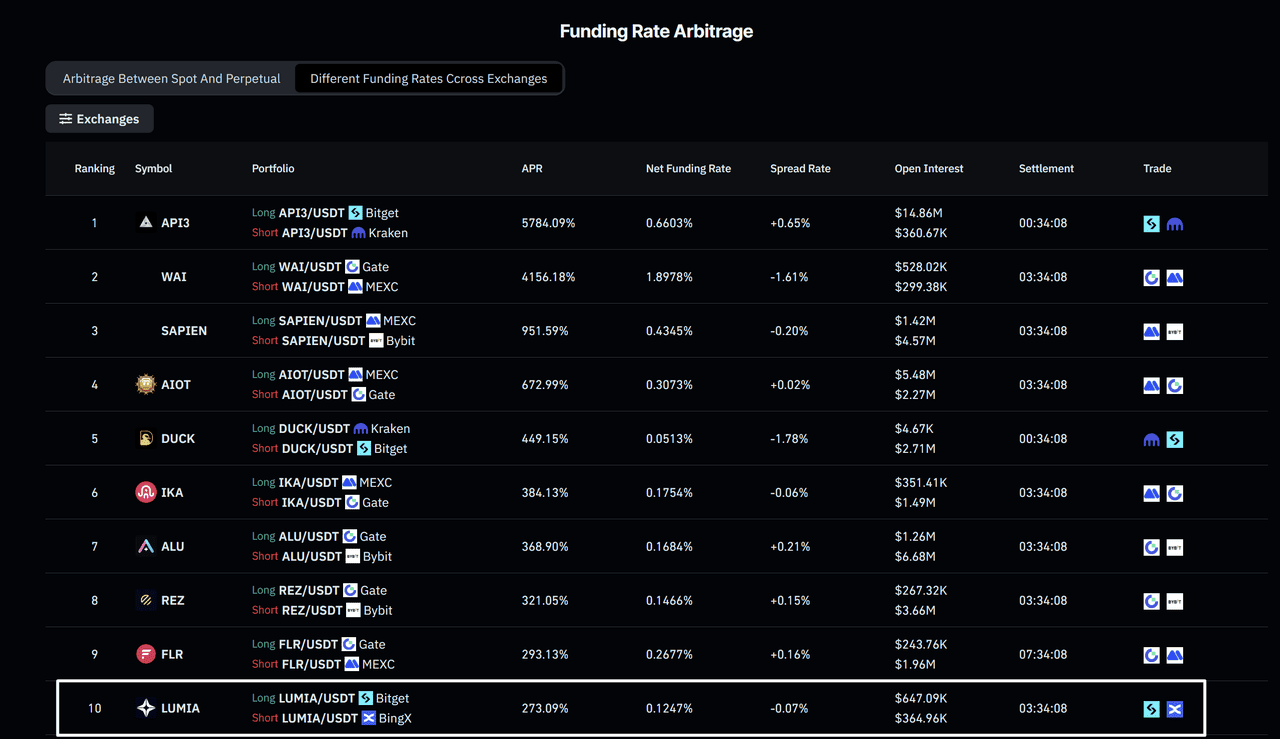

2. Arbitrage Across Exchanges

Funding also creates arbitrage opportunities across exchanges when rates diverge. A practical example comes from

LUMIA/USDT, where BingX and Bitget displayed different funding levels. In this case, a trader could go long LUMIA on Bitget, where funding pressure is lower, while shorting LUMIA on BingX, where funding is higher.

By balancing exposure, the trader remains neutral on price but collects the funding spread every interval. The APR for this opportunity was shown at more than 270%, illustrating how funding gaps can be turned into steady returns.

Why It Works

This strategy works because each exchange calculates funding independently. When one platform shows stronger long demand than another, rates diverge. Traders open offsetting positions to capture the spread, earning funding until it narrows. Monitoring BingX’s funding rate dashboard helps identify such short-lived but profitable setups.

3. Spotting Crowded Trades

Funding rates are often used to identify when one side of the market is overcrowded. If funding rises to unusually high positive levels, it suggests that too many traders are betting on longs. In these situations, the market becomes vulnerable to pullbacks or liquidation cascades, as leveraged longs can be forced to close positions when prices move against them.

On the other hand, when funding turns deeply negative, it signals panic shorting. These moments sometimes precede rebounds, since traders rushing into shorts may already represent the peak of bearish sentiment.

If Bitcoin trades at $115,000 and the funding rate climbs to +0.05% every eight hours, it shows aggressive long demand and a market vulnerable to pullbacks or liquidations. If the rate flips to -0.03%, it signals panic shorting, which often occurs near market bottoms and can precede rebounds.

4. Planning Costs in Advance

Funding can quietly eat into profits if not planned for. Suppose a trader holds a $50,000 Bitcoin long while the funding rate is +0.015% every 8 hours. That adds up to about $7.50 per interval, or $22.50 per day. Over one week, the cost reaches roughly $157, and in a month, it can exceed $675.

For swing traders and longer-term positions, these hidden costs can reduce gains or even turn a profitable trade into a loss. This is why it’s essential to check the funding rate before committing to multi-day holds and adjust position size or duration accordingly.

5. Hedging Basis Differences

Sometimes perpetual futures trade at a premium compared to dated futures. Traders can take advantage of this by shorting the perpetual while buying the dated contract, locking in the spread.

For example, if Bitcoin’s perpetual price is $115,500 while the nearest dated future trades at $115,000, the $500 difference represents the basis. If the funding rate on the perpetual is +0.02% every 8 hours, the short position on the perp earns funding payments while the long in the dated future offsets price risk.

This strategy requires larger capital and careful execution, but it demonstrates how funding rates and futures spreads create opportunities beyond simple directional trading. For professional traders, it’s a way to turn market imbalances into predictable returns.

Key Factors Influencing Funding Rates

Funding rates do not move randomly. They change based on a few clear factors, and understanding these helps traders read market conditions better.

1. Price Gap Between Perpetuals and Spot: The largest driver of funding rates is how far perpetuals trade from spot. If Bitcoin trades at $115,200 on perps while spot is $115,000, the premium makes funding positive and longs pay shorts. If perps fall below spot, funding turns negative.

2. Leverage Demand and Open Interest: High demand for leverage pushes funding higher. During bullish runs, funding can rise to +0.05% every eight hours as longs crowd the market. In heavy selloffs, funding often flips negative, such as -0.03%, showing that shorts dominate positioning.

3. Volatility and Liquidity: Large swings and thin liquidity widen spreads between perpetual and spot prices. A sudden $3,000 move in Bitcoin can shift funding from +0.01% to -0.02% within hours as traders pile into one side.

4. Exchange Policies: Exchanges apply limits to prevent extreme funding. On BingX, funding is settled every eight hours, keeping charges under control and reducing the risk of compounding costs.

5. Interest Rate Component: Most exchanges add a small fixed rate, often 0.01% per eight hours. While minor, it compounds quickly on larger positions and contributes to overall funding costs.

Conclusion

Funding rates are a central feature of perpetual futures, keeping contract prices aligned with spot while reflecting market sentiment. Positive rates indicate that longs dominate, negative rates highlight short pressure, and extreme values often signal potential turning points.

For traders, funding is both a cost and a strategic tool. Monitoring these rates on BingX helps manage risk, anticipate market crowding, and uncover opportunities. In fast-moving crypto markets, understanding funding dynamics is essential for making informed and profitable decisions.

Related Articles

FAQs on Funding Rate

1. What is a funding rate in crypto?

The funding rate is a periodic payment between long and short traders in perpetual futures. It ensures perpetual prices stay close to the spot market.

2. Why do funding rates matter?

They affect trading costs and reveal market sentiment. Positive rates mean longs dominate, while negative rates show shorts are in control.

3. How often are funding payments made on BingX futures?

On BingX, funding is settled every eight hours at 00:00, 08:00, and 16:00 UTC. Traders only pay or receive if their position is open at that time.

4. Can funding rates predict crypto market moves?

Yes. Extreme positive rates often signal crowded longs and risk of pullbacks, while deep negative rates may indicate panic shorting and possible rebounds.

5. How can I use funding rates in crypto trading?

Funding can be factored into costs, used to spot overcrowded trades, or turned into income through strategies like funding capture, arbitrage, and hedging.