Decentralized Finance (DeFi) has become one of the most important developments in the crypto space, offering an alternative to traditional financial systems. Built on public blockchains, DeFi enables users to access financial tools like trading, lending, and earning yield without relying on banks or centralized platforms.

In this guide, we’ll break down what DeFi is, how it works, and how to start using different types of on-chain protocols to earn, borrow, and participate in the future of finance.

What Is Decentralized Finance (DeFi)?

Decentralized Finance (DeFi) is a blockchain-based financial system that replaces banks, brokers, and other traditional intermediaries with

smart contracts. These are self-executing programs that run on public blockchains like

Ethereum and

Solana, enabling users to lend, borrow, trade, and earn yield without needing approval from centralized institutions.

DeFi opens access to financial services for anyone with an internet connection. There are no credit checks, no paperwork, and no gatekeepers. Users retain full control over their assets and interact directly with

decentralized applications (dApps) that automate financial processes in a secure and transparent way.

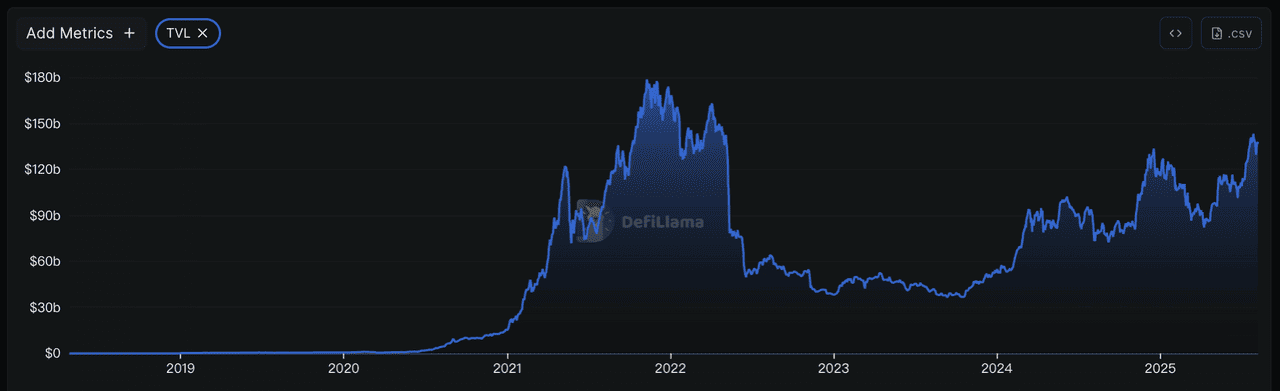

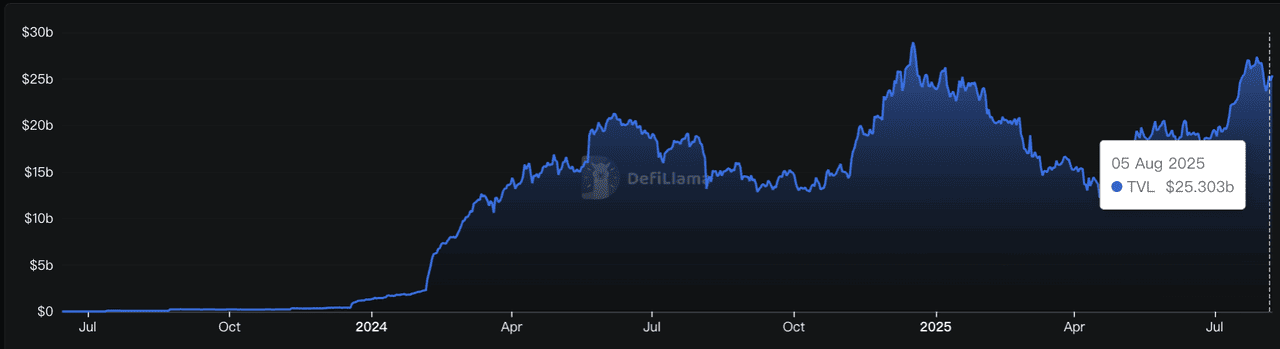

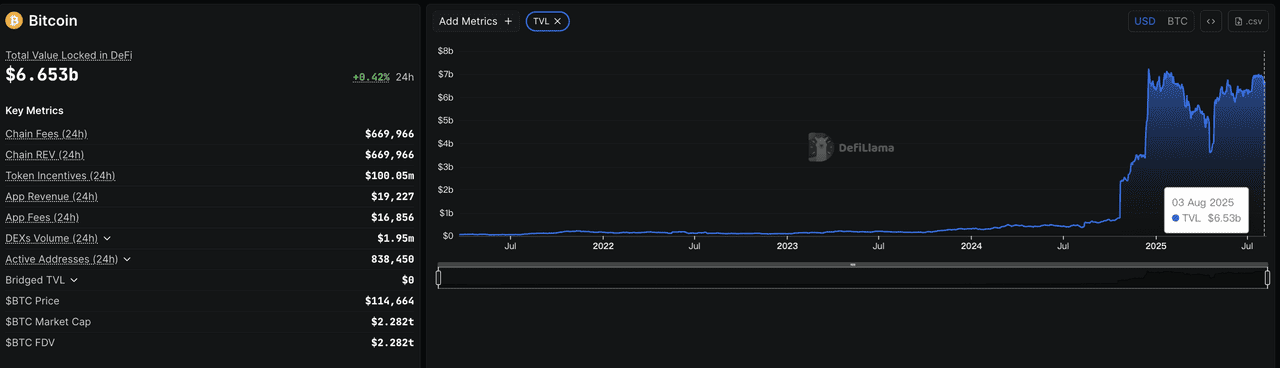

TVL in DeFi protocols reached three-year high in July 2025 | Source:

DefiLlama

The sector has experienced explosive growth in 2025. According to

Coindesk,

total value locked (TVL) in DeFi protocols reached a three-year high of $153 billion in July, driven by Ethereum’s 60% rally and growing institutional participation. Major players are gaining interest in DeFi as well. BlackRock is seeking to launch a

Ethereum staking ETF, and an increasing number of firms are deploying crypto as reserved assets such as

ETH treasury and

BNB treasury, and

stablecoins into DeFi platforms to generate yield. Over 14 million unique wallets now engage with DeFi, with Ethereum maintaining 59.5% market share. Solana has surged to $9.3 billion in TVL, establishing itself as a major competitor.

VanEck projects that DeFi could surpass $200 billion in TVL by the end of 2025, fueled by the rise of decentralized exchanges, expanding financial access, and the continued shift toward permissionless on-chain financial infrastructure.

Top 8 Types of DeFi Applications and What They Do

The DeFi ecosystem is made up of many different applications, each designed to serve a specific financial function without the need for traditional intermediaries. From decentralized exchanges to staking protocols, these platforms form the foundation of on-chain finance. Below are the 8 most widely used types of DeFi applications, how they work, and what makes them essential in today’s decentralized economy.

1. Decentralized Exchanges (DEXs)

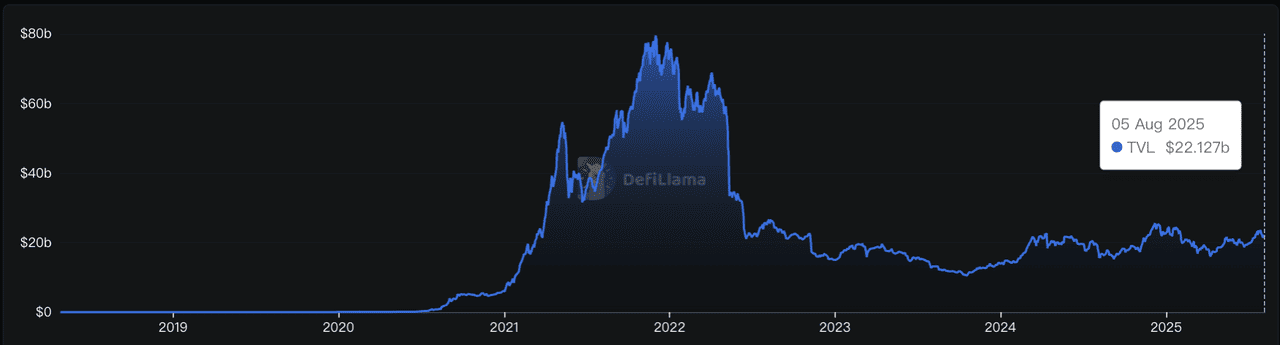

TVL for Decentralized Exchanges (DEXs) | Souce: DefiLlama

How they work: Trade cryptocurrencies directly with other users without centralized intermediaries.

Decentralized exchanges (DEXs) revolutionized cryptocurrency trading by eliminating intermediaries and enabling direct peer-to-peer transactions through smart contracts. Instead of relying on traditional order books managed by centralized entities, DEXs utilize

automated market makers (AMMs) and liquidity pools where users contribute cryptocurrency pairs to facilitate trading, earning fees from every trade that occurs in their pool.

The DEX landscape emerged in 2018 with early protocols, but truly exploded during the 2020 DeFi summer when total value locked across all DEXs surged from under $1 billion to over $20 billion. Users benefit from complete control over their assets, no KYC requirements, resistance to censorship, and the ability to trade newly launched tokens immediately without waiting for centralized exchange listings.

What Are Some Leading DEX Platforms?

• Uniswap (Ethereum):

Uniswap(UNI) Pioneered the AMM model in 2018 and remains the dominant DEX with over $1.2 trillion in lifetime trading volume, introducing innovations like concentrated liquidity and governance through UNI tokens. The protocol operates across multiple chains including Ethereum mainnet,

Polygon, and

Arbitrum, setting the standard for decentralized trading interfaces.

• Curve Finance (Ethereum, Polygon): Launched in 2020 specifically optimized for stablecoin trading,

Curve (CRV) uses sophisticated bonding curves to minimize slippage and maximize efficiency for similar-value asset swaps. The platform has become essential infrastructure for stablecoin liquidity, processing billions in weekly volume while offering CRV token rewards to liquidity providers.

• PancakeSwap (BNB Chain): Built on Binance Smart Chain,

PancakeSwap (CAKE) emerged as the leading DEX for lower-cost transactions outside Ethereum, combining AMM functionality with yield farming opportunities and lottery features that attracted millions of users seeking affordable DeFi access.

2. Lending Protocols

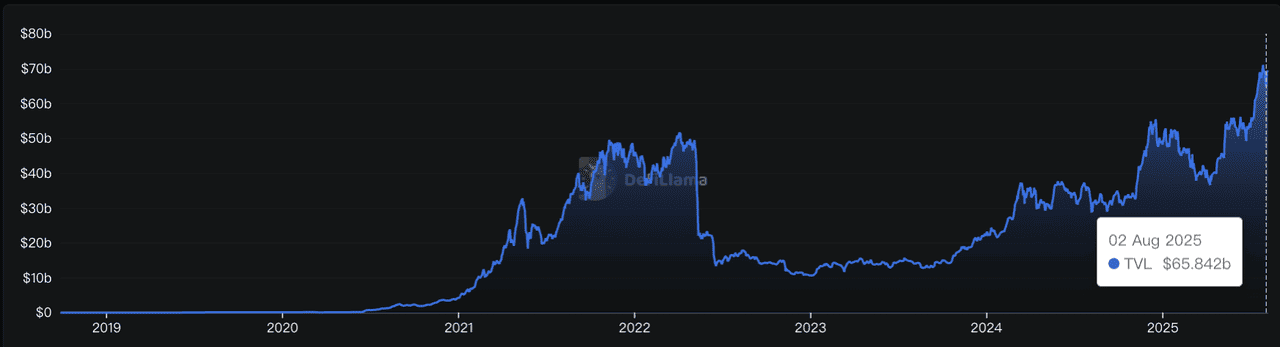

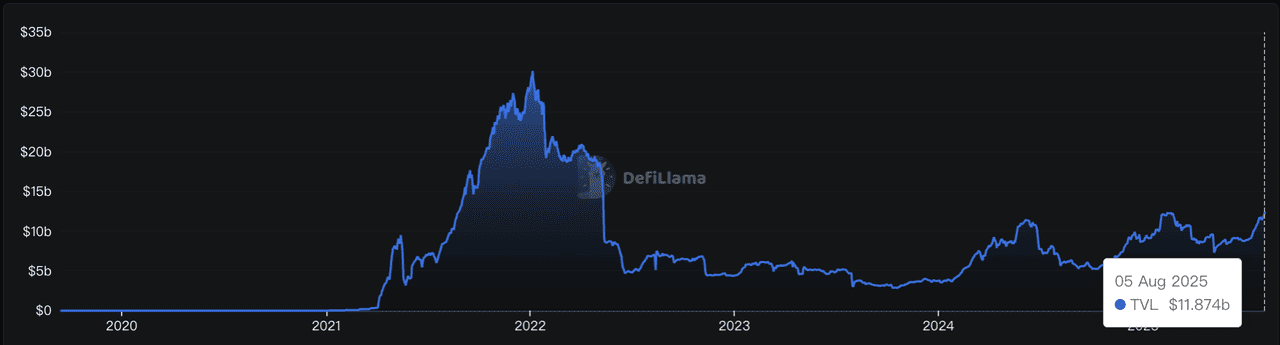

TVL for Lending Protocols | Source: DefiLlama

How they work: Earn interest by lending your crypto or borrowing assets using your holdings as collateral.

DeFi lending protocols transformed traditional finance by creating permissionless money markets where anyone can lend cryptocurrency to earn interest or borrow assets using digital collateral. These protocols operate through smart contracts that automatically manage interest rates based on supply and demand dynamics, with lenders earning interest from borrowers who pay fees to access liquidity.

The lending space became DeFi's second-largest category by total value locked, reaching peaks of over $30 billion during 2021's DeFi boom and establishing sustainable yields for crypto holders. Users benefit from earning higher interest rates than traditional savings accounts, accessing instant liquidity without selling their holdings, and participating in a global financial system that operates continuously without human underwriters or lengthy approval processes.

Popular DeFi Lending Platforms

• Aave (Ethereum, Polygon, Avalanche): Launched in 2020 as a rebranding of ETHLend,

Aave (AAVE) pioneered innovative features like flash loans and variable interest rates, currently maintaining over $10 billion in total value locked across multiple chains. The protocol introduced the concept of undercollateralized flash loans and offers both stable and variable interest rate options for borrowers.

• Compound (Ethereum): One of the earliest DeFi lending protocols launched in 2018,

Compound (COMP) popularized algorithmic interest rates and governance tokens through COMP distribution, establishing the foundation for modern DeFi lending mechanics. The protocol's simple yet effective cToken system became the template for numerous lending protocols that followed.

• MakerDAO/ Sky (Ethereum): Created in 2017 as the oldest DeFi lending protocol,

MakerDAO (MKR) enables users to mint

DAI stablecoins by depositing ETH and other collateral, pioneering the concept of decentralized stablecoins and maintaining billions in locked value through economic downturns.

3. Liquid Staking Protocols

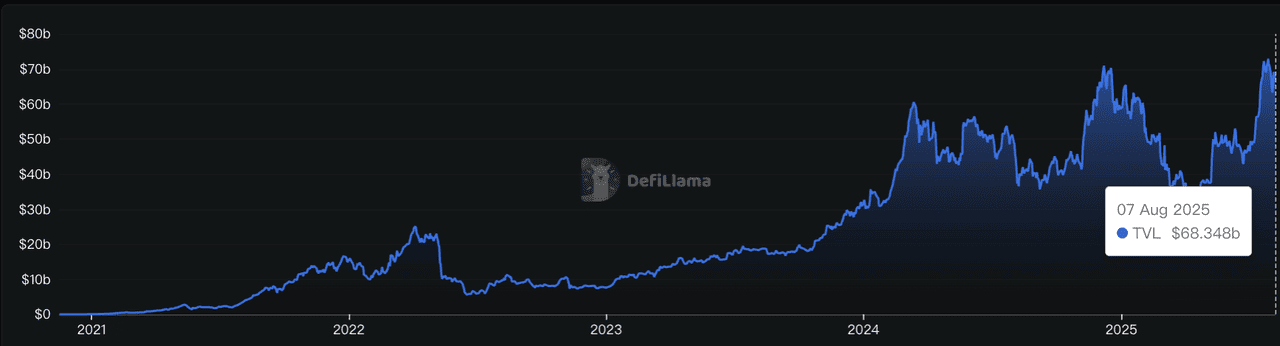

TVL for Liquid Staking Protocols |Source: DefiLlama

How they work: Earn staking rewards while keeping your tokens liquid and usable in other DeFi protocols.

Liquid staking emerged as a solution to the liquidity problem inherent in Proof-of-Stake blockchain networks, where users traditionally had to lock their tokens for extended periods to earn staking rewards. These protocols allow crypto holders to stake their assets while receiving liquid staking tokens (LSTs) that automatically earn staking rewards and can be freely traded, used as collateral, or deployed in other DeFi protocols.

The liquid staking sector exploded after

Ethereum's transition to Proof-of-Stake in September 2022, growing from virtually zero to over $50 billion in total value locked as stakers sought to maximize capital efficiency. Users benefit from earning passive staking rewards while maintaining liquidity, eliminating the lengthy unbonding periods typical of native staking, and compounding their returns through additional DeFi strategies.

Leading Liquid Staking Platforms

• Lido (Ethereum, Solana, Polygon): Launched in December 2020,

Lido (LDO) became the dominant liquid staking provider by offering stETH tokens that maintain liquidity while earning Ethereum staking rewards. The protocol operates across multiple chains and has grown to secure over $30 billion in staked assets.

• Jito (Solana): Built specifically for Solana's high-performance blockchain,

Jito (JTO) offers liquid staking with additional MEV rewards through its validator network. The protocol has become the leading liquid staking solution on Solana with its jitoSOL token.

• Rocket Pool (Ethereum): Operating since 2021 as a fully decentralized alternative,

Rocket Pool (RPL) allows anyone to run validator nodes with just 16 ETH while distributing rETH tokens to stakers. The protocol's trustless architecture appeals to users prioritizing decentralization.

4. Restaking Protocols

TVL for Restaking Protocols |Source: DeFiLlama

How they work: Use your already-staked tokens to secure additional networks and earn extra rewards.

Restaking represents the next evolution in capital efficiency for staked assets, enabling users to reuse their liquid staking tokens to secure additional networks and applications beyond the base layer blockchain. This innovative concept allows already-staked ETH to simultaneously validate emerging protocols like rollups and data availability layers, earning additional rewards on top of base staking yields without requiring extra capital.

The restaking ecosystem gained significant momentum in 2023 with the introduction of EigenLayer's mainnet, creating a new category that rapidly accumulated billions in deposits as users sought to amplify their staking yields. Users benefit from enhanced returns without additional capital requirements, supporting the security of promising new protocols, and maintaining liquidity through liquid restaking tokens (LRTs) that can be deployed across DeFi.

Top Restaking Platforms

• EigenLayer (Ethereum):

EigenLayer (EIGEN) pioneered the restaking concept in 2023 by allowing staked ETH to secure external protocols called Actively Validated Services (AVS). The protocol's innovative approach to "cryptoeconomic security" has attracted billions in restaked assets.

• Ether.fi (Ethereum):

Ether.fi (ETHFI) launched as a liquid restaking protocol that simplifies the restaking process through user-friendly interfaces and automated strategy management. The platform combines liquid staking with restaking opportunities in a streamlined interface.

• Renzo (Ethereum):

Renzo (REZ) operates as a liquid restaking protocol focused on optimizing yields across multiple AVS opportunities while maintaining strong security practices. The protocol emphasizes user education and risk management for newcomers to restake.

5. Yield Farming and Liquidity Mining

TVL for Yield Farming Protocols | Source: DefiLlama

How they work: Maximize returns by moving assets between protocols and providing liquidity for token rewards.

Yield farming and

liquidity mining emerged during the 2020 DeFi summer as protocols began incentivizing users with token rewards for providing liquidity and engaging with their platforms. Yield farming involves strategically moving crypto assets between different DeFi protocols to capture the highest available returns, with automated platforms like Yearn Finance handling the complexity of optimizing yields across multiple opportunities.

This innovation sparked the explosive growth of DeFi total value locked from $1 billion to over $100 billion in 2020-2021, as yield farmers chased increasingly sophisticated opportunities across multiple chains. Users benefit from potentially high returns on their crypto holdings, early access to promising protocol tokens, and the ability to participate in governance of their favorite platforms, though they must navigate complex strategies and smart contract risks.

Best Yield Farming Platforms

• Yearn Finance (Ethereum): Created by Andre Cronje in 2020,

Yearn (YFI) pioneered automated yield farming through its vault system that automatically allocates user funds to the highest-yielding opportunities. The platform's YFI governance token became one of DeFi's most valuable assets despite having no pre-mine or founder allocation.

• Convex Finance (Ethereum): Built specifically to optimize Curve Finance yields,

Convex (CVX) allows users to stake their Curve LP tokens to earn boosted CRV rewards plus CVX tokens. The protocol has become essential infrastructure for Curve users seeking maximum yields without managing vote-locked positions.

6. Derivative Protocols

TVL for Derivative Protocols | Source: DefiLlama

How they work: Trade leveraged positions and hedge risks through contracts based on underlying asset prices.

DeFi derivatives brought sophisticated trading instruments to decentralized finance, enabling users to trade contracts based on underlying asset values without actually owning them. These protocols replicate traditional financial derivatives through smart contracts that automatically execute trades, manage collateral, and settle positions, with some platforms allowing users to provide liquidity and earn fees from trading activity.

The derivatives sector gained significant traction during 2021-2022 as traders sought more capital-efficient ways to gain exposure to crypto assets, with some platforms processing billions in monthly trading volume. Users benefit from enhanced capital efficiency allowing larger position sizes with less capital, the ability to hedge existing crypto holdings against market downturns, and access to 24/7 trading without geographic restrictions.

Leading On-Chain Derivative Platforms

• dYdX (Ethereum, StarkEx):

dYdX (DYDX) is one of the first major DeFi derivatives platforms launched in 2019, offering perpetual futures trading with up to 20x leverage. The platform has processed over $1 trillion in cumulative trading volume and migrated to its own blockchain in 2023.

• Synthetix (Ethereum, Optimism): Operating since 2018,

Synthetix (SNX) enables users to mint synthetic assets (Synths) that track real-world asset prices through its SNX collateral system. The platform's debt pool mechanism creates a unique economic model for synthetic asset creation.

• MYX Finance (BNB Chain):

MYX built on

BNB Chain to offer low-cost perpetual trading with up to 100x leverage on cryptocurrency pairs. The protocol focuses on providing accessible derivatives trading with minimal fees for retail users.

7. Yield-Bearing Stablecoins

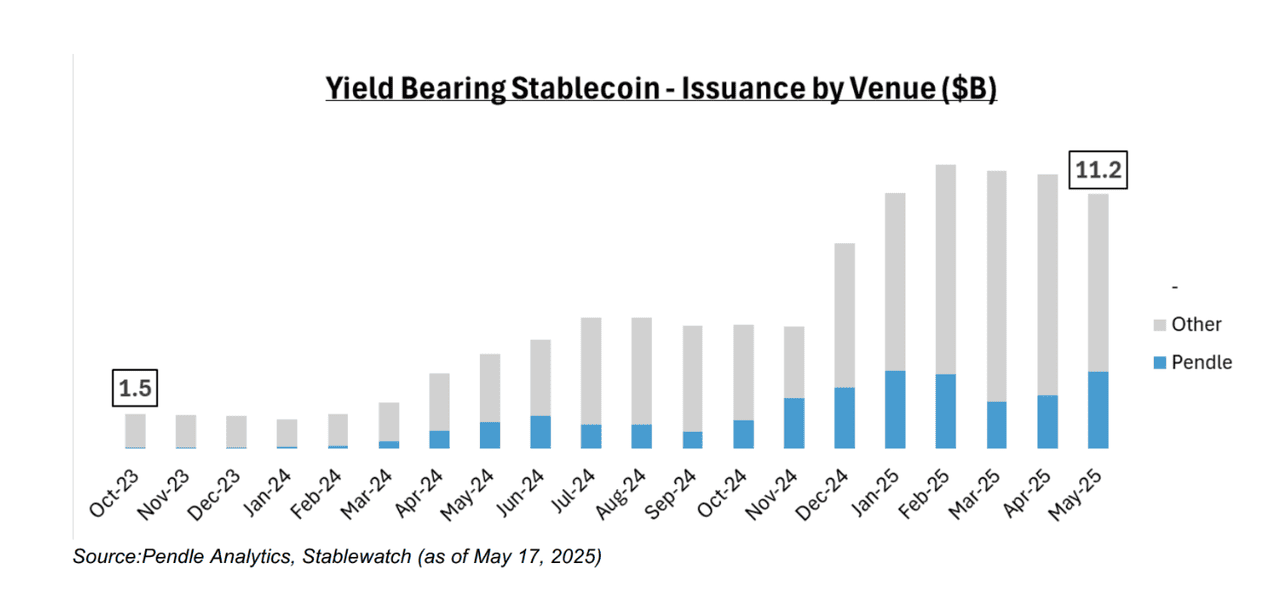

Yield-bearing stablecoins' market cap | Source: Pendle

How they work: Hold stable dollar-pegged tokens that automatically earn yield while maintaining their value.

Yield-bearing stablecoins represent an evolution of traditional

stablecoins, maintaining their dollar peg while automatically generating passive income through various yield mechanisms including savings rates and real-world asset investments. These innovative tokens solve the opportunity cost problem of holding cash-equivalent assets in DeFi by earning returns without sacrificing stability, requiring users to simply hold or deposit their stablecoins to benefit from yield generation.

The yield-bearing stablecoin sector emerged prominently in 2022-2023 as protocols sought to offer competitive yields amid rising traditional interest rates, with some platforms managing billions in assets and offering yields that rival or exceed traditional savings accounts. Users benefit from earning passive income on their stable asset holdings, maintaining full DeFi compatibility for use in lending and trading protocols, and accessing professionally managed yield strategies without active portfolio management.

Top Yield-Bearing Stablecoin Platforms

• Sky (MakerDAO) - USDS/sUSDS (Ethereum): Evolved from the original MakerDAO protocol launched in 2017, Sky's

USDS represents the successor to DAI with enhanced yield features through sUSDS. The protocol offers approximately 4.5% APY from real-world asset investments while maintaining the overcollateralized security model.

• Ethena - USDe/sUSDe (Ethereum): Launched in 2023 with an innovative synthetic stablecoin approach,

Ethena (ENA) maintains

USDe's dollar peg through delta-neutral hedging strategies. The protocol's sUSDe generates variable yields from funding rate arbitrage and has attracted significant attention for its sophisticated trading strategies.

8. Bitcoin DeFi (BTCFi)

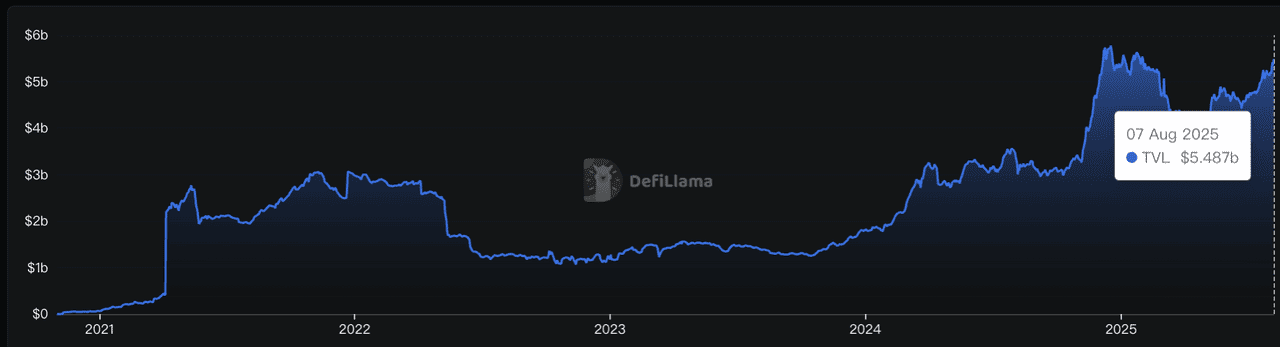

TVL of BTC in DeFi | Source: DefiLlama

How they work: Use Bitcoin in DeFi protocols for staking, lending, and yield generation while maintaining Bitcoin exposure.

Bitcoin DeFi represents the emerging ecosystem of decentralized finance protocols built specifically for

Bitcoin, enabling users to earn yield on their BTC holdings without converting to other cryptocurrencies. BTCFi protocols utilize innovative approaches like Bitcoin liquid staking, wrapped Bitcoin on Layer 2 networks, and Bitcoin-backed lending to unlock DeFi functionality for the world's largest cryptocurrency. These solutions address Bitcoin's traditionally limited DeFi capabilities while preserving the security and value proposition that makes BTC attractive to institutional and retail investors.

BTCFi experienced explosive growth in 2024, with total value locked surging over 2,000% to reach $6.5 billion, marking Bitcoin's "breakout year" in decentralized finance. The sector gained significant momentum through developments in Bitcoin staking protocols, particularly following Bitcoin's transition toward supporting more sophisticated smart contract functionality. Users benefit from earning yields on their Bitcoin holdings, accessing institutional-grade Bitcoin lending products, and participating in Bitcoin-native staking while maintaining exposure to BTC's price appreciation and store-of-value properties.

Leading Bitcoin DeFi Platforms

• Babylon (Bitcoin): Launched in 2024 as the pioneering Bitcoin staking protocol,

Babylon (BABY) controls over 80% of BTCFi's total value locked with its TVL soaring 222% from $1.61 billion to over $5.2 billion by December 2024. The protocol introduced Bitcoin-native staking for the first time in crypto history, allowing users to secure proof-of-stake networks using their Bitcoin.

• Solv Protocol (Bitcoin): Operating as a Bitcoin yield and liquid staking platform,

Solv Protocol (SOLV) enables institutional-grade Bitcoin staking solutions with liquid staking tokens (LSTs). The platform focuses on providing professional Bitcoin yield products while maintaining regulatory compliance and institutional security standards.

• BounceBit (Bitcoin): Built as a Bitcoin restaking infrastructure protocol,

BounceBit (BB) combines Bitcoin's security with additional yield opportunities through restaking mechanisms. The protocol enables Bitcoin holders to earn enhanced yields by securing multiple networks while maintaining their BTC exposure through innovative restaking strategies.

How to Get Started with DeFi?

Starting your DeFi journey is easier than you might think. You don’t need to be a developer. With a few tools and basic precautions, you can begin using DeFi confidently. It’s smart to start small, stick with reliable platforms, and always consider

gas fees, especially on Ethereum. As you go, stay curious and informed. The DeFi space moves quickly, and new opportunities are constantly emerging. Here’s how to begin:

Step 1: Set Up a Web3 Wallet

Install a

Web3 wallet that supports the blockchain you want to use. For example, you can use

MetaMask for Ethereum,

Phantom for Solana, or

Trust Wallet (or a custom-configured MetaMask) for BNB Chain. Your wallet acts as your digital identity and bank account. It stores your crypto and allows you to connect directly to DeFi platforms from your browser or mobile device.

Step 2: Buy Some Crypto

Use a reliable centralized exchange like BingX to purchase

ETH,

SOL, or stablecoins such as

USDC through the

BingX Spot Market. These are the main assets used across most DeFi platforms. It's a good idea to buy a little extra to cover transaction fees, which vary depending on the blockchain network.

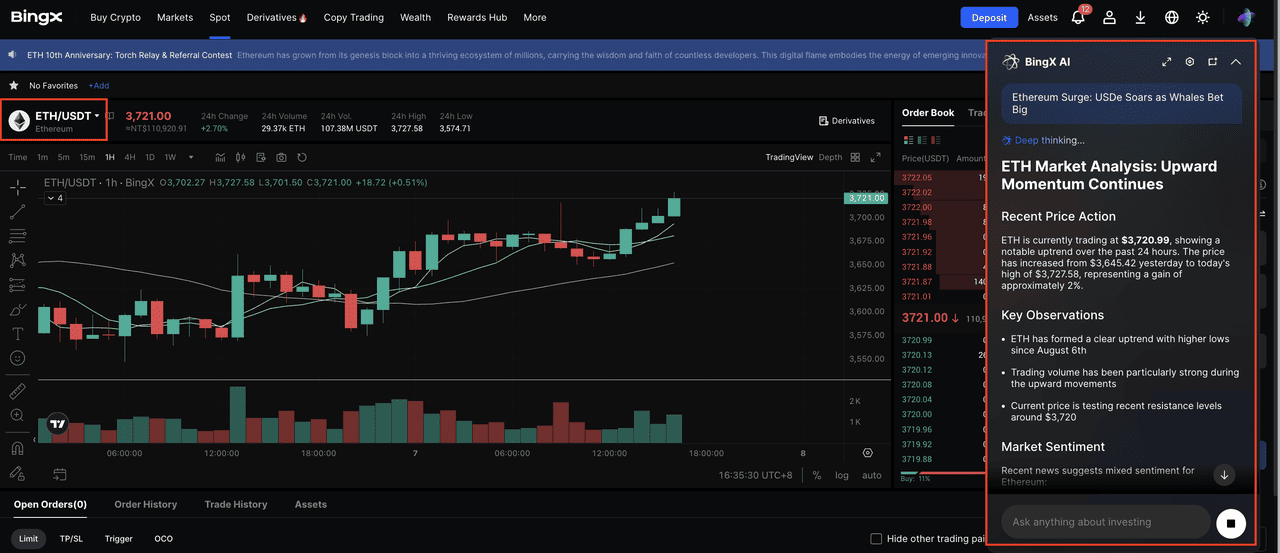

BingX AI also provides market analysis to help you identify better entry points based on real-time trends and token activity, making it easier to plan your first DeFi transaction with more confidence.

Source:

ETH/USDT Market Analysis Using BingX AI

Step 3: Connect and Explore

Once your wallet is set up and funded, you can start exploring DeFi platforms. From trading and lending to staking and yield farming, there’s a wide range of services available. We’ll cover the most common types of DeFi in the next section.

Key Risks and Considerations Before Using DeFi on Chains

While DeFi offers open access and higher yields, it also comes with important risks that every user should understand before getting started.

1. Smart Contract Vulnerabilities: Most DeFi protocols rely on complex smart contracts. If the code contains bugs or is exploited, funds can be lost. Even audited platforms like Compound and Curve have experienced major exploits in the past.

2. Market Volatility: Crypto assets are highly volatile. Sudden price swings can trigger liquidations or reduce the value of your collateral. Stablecoins may also lose their peg during periods of market stress.

3. Regulatory Uncertainty: DeFi exists in a rapidly evolving legal landscape. Future regulations could impact protocol access, token classifications, or require platforms to enforce KYC, limiting open participation.

4. Centralization Risks: Not all DeFi is fully decentralized. Some platforms rely on multisig wallets, centralized teams, or hosted frontends, introducing single points of failure or censorship.

5. User Errors: In DeFi, users are fully responsible for their own funds. Mistakes such as sending assets to the wrong address, signing malicious transactions, or falling for phishing scams can lead to irreversible losses.

How to Reduce Risk

• Stick to audited and well-known protocols like Aave, Lido, or Uniswap

• Diversify across protocols and avoid overexposing to any single platform

• Use hardware wallets eg.

Ledger for added protection

• Always double-check wallet approvals and transactions

DeFi offers powerful tools, but caution and research are essential before diving in.

The Future of DeFi

DeFi is no longer just an experiment. With over $153 billion in total value locked in 2025 and rising institutional interest, it's becoming a core part of the global financial system.

Looking ahead, key trends like cross-chain interoperability, tokenized real-world assets, and AI-driven automation are pushing DeFi into new territory. Platforms are becoming more user-friendly, while infrastructure is evolving to support both casual users and large-scale capital.

As the technology matures, DeFi continues to offer something traditional finance can’t: open, permissionless access to financial services for anyone, anywhere. Whether you're here to earn, build, or learn, DeFi is only getting started.

Related Reading