As of mid-August 2025,

Chainlink (LINK) continues to reaffirm its central role in the evolving Web3 ecosystem. Its native token recently soared roughly 10%, hitting a seven-month high and extending weekly gains to over 40%. The rally followed the launch of the Chainlink Reserve and new enterprise collaborations, marking the strongest performance among the top 50 tokens by market capitalization in the summer of 2025.

LINK price surged over 35% in a month | Source: BingX

LINK Price

This surge comes as LINK’s market capitalization hovers around $16–17 billion, placing it firmly above the symbolic $10 billion club that is often used to mark blue-chip status in crypto. LINK crossed this threshold earlier this year and now sits well ahead of it, signaling sustained institutional trust and growth potential.

At the same time, the rising demand for Chainlink is not just speculative but fundamental. With its decentralized oracle infrastructure powering

decentralized finance (DeFi),

real-world asset (RWA) tokenization, and cross-chain interoperability, Chainlink is increasingly recognized as the backbone connecting blockchains to real-world data and applications.

What Is Chainlink?

Chainlink is a

decentralized oracle network that functions as a critical bridge between blockchain systems and external data sources. Blockchains are highly secure and efficient for executing transactions, but they operate in isolation and cannot natively access off-chain information such as market prices, weather data, or institutional payment systems. This structural limitation restricts the scope of

smart contracts.

Chainlink addresses this gap by delivering secure, reliable, and tamper-resistant data feeds to smart contracts. Through its decentralized network of independent nodes, Chainlink ensures that external information is verified and trustworthy before being integrated on-chain.

What initially launched as a price oracle for DeFi has expanded into a comprehensive infrastructure platform that supports a wide range of applications, including banking, capital markets, asset management, payments,

stablecoins, and decentralized finance. Today, Chainlink provides open standards, composable services, and end-to-end solutions, making it a foundational layer for advanced blockchain applications.

What Sets Chainlink Apart

• Decentralized Oracle Networks: Multiple independent nodes deliver data, eliminating single points of failure and improving reliability.

• Cross-Chain Interoperability: The Cross-Chain Interoperability Protocol (CCIP) enables seamless communication across blockchains, with rapid expansion to new networks such as the Monad testnet.

• Data Verification: Chainlink aggregates and validates data from multiple sources to ensure accuracy and prevent manipulation.

• Flexible Integration: Supports diverse data types, from financial market data and enterprise APIs to IoT and real-world event inputs.

Why Is Chainlink Getting Attention in 2025?

Chainlink’s prominence in 2025 is being driven by a combination of new tokenomics, institutional adoption, and the rapid expansion of real-world asset (RWA) tokenization. Together, these developments have positioned Chainlink as a critical layer of blockchain infrastructure.

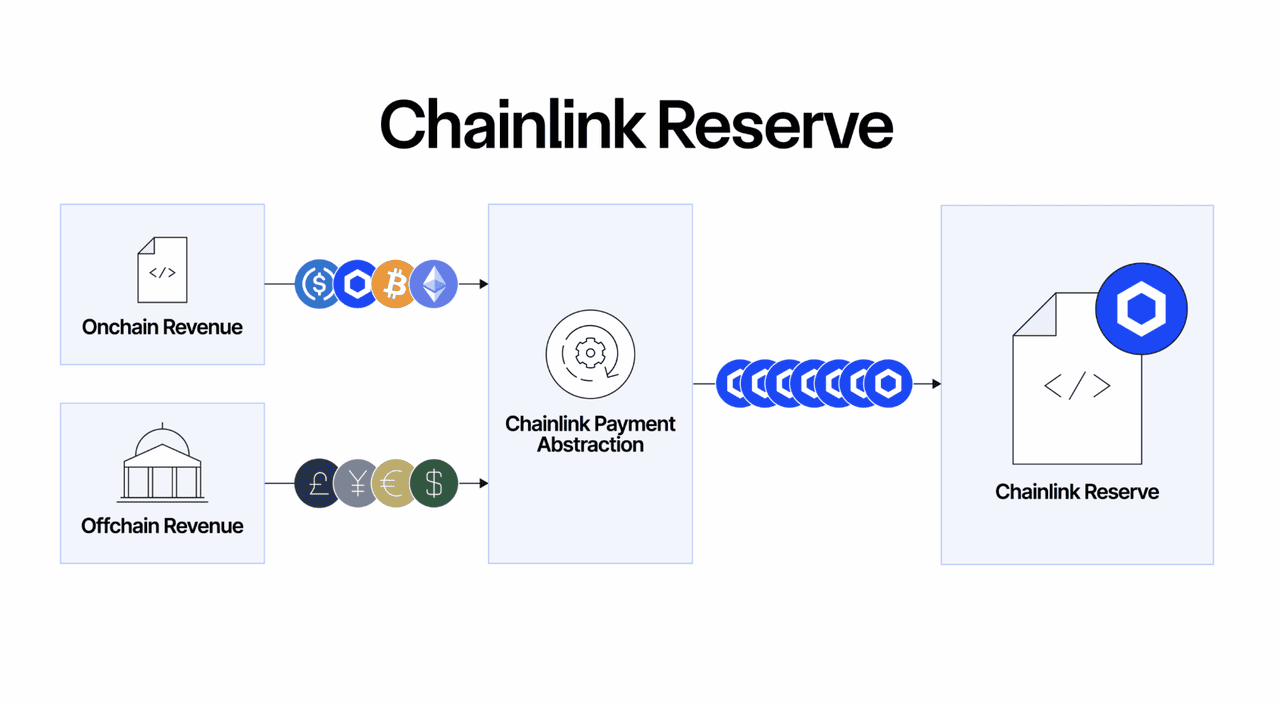

1. The launch of the Chainlink Reserve

How Chainlink Reserve Works | Source: Chainlink

In August 2025, Chainlink introduced the Chainlink Reserve, an on-chain mechanism that strengthens the network’s tokenomics by accumulating LINK from both enterprise fees and on-chain usage. All payments, whether from institutions or decentralized applications, are automatically converted into LINK, creating continuous demand for the token and pushing LINK’s price up 36% in just one month.

Unlike

the treasuries of Bitcoin,

Ethereum, and

BNB, which focus on asset preservation and yield generation from

lending or

staking in DeFi, Chainlink’s treasury model actively reduces

circulating supply. With a fixed maximum supply of 1 billion tokens, LINK is designed as a scarce asset. The Chainlink Reserve strengthens this dynamic by converting enterprise and on-chain fees into LINK, effectively absorbing tokens from the market over time. This mechanism resembles a recurring buyback, creating persistent demand and tying the growth of Chainlink’s services directly to the long-term value of its native token.

Co-founder Sergey Nazarov described the launch as “a pivotal evolution for Chainlink,” aligning revenue growth with long-term demand for its services and reinforcing LINK’s role as the central settlement asset of the ecosystem.

2. Expanding institutional integration

Chainlink has significantly expanded its role as the infrastructure connecting traditional finance with blockchain networks. A high-profile partnership with Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, has brought foreign exchange and precious metals data on-chain. In Q2 2025, Chainlink infrastructure enabled a cross-chain Delivery versus Payment (DvP) transaction linking J.P. Morgan’s Kinexys interbank network,

Ondo Chain, and a tokenized U.S. Treasuries fund, demonstrating secure institutional-grade settlement.

Beyond transactions, Chainlink’s credibility is reinforced through partnerships with Swift, DTCC, and ANZ Bank, which validate its infrastructure for global finance. On the investment side, the Grayscale Chainlink Trust (GLNK) has provided institutions with a regulated vehicle to gain exposure to LINK, with more than $26 million in assets under management.

3. Leading the growth of real-world asset tokenization

The tokenization of real-world assets has become one of the largest opportunities in blockchain. The RWA market now exceeds $26 billion on-chain, up over 14 percent month-over-month, and is forecast to surpass $50 billion by year-end. Chainlink is positioned as the primary infrastructure provider for this sector, enabling secure pricing, data verification, and cross-chain orchestration. By 2030, analysts project trillions of dollars in tokenized assets including real estate, private equity, and infrastructure to be brought on-chain, with Chainlink as the backbone of that growth.

In August 2025, LINK’s market capitalization stands above $16 billion, placing it firmly within the “$10 billion club” of established blockchain projects. This milestone reflects Chainlink’s evolution from a specialized oracle service into a broad infrastructure layer underpinning Web3 adoption at scale.

How Does Chainlink Work?

Chainlink operates as a comprehensive blockchain infrastructure platform built around three major product lines. Each addresses a key limitation that has historically prevented blockchain from scaling into mainstream finance and enterprise applications. Together, these services allow smart contracts to connect with real-world data, communicate across blockchains, and support the tokenization of traditional financial assets.

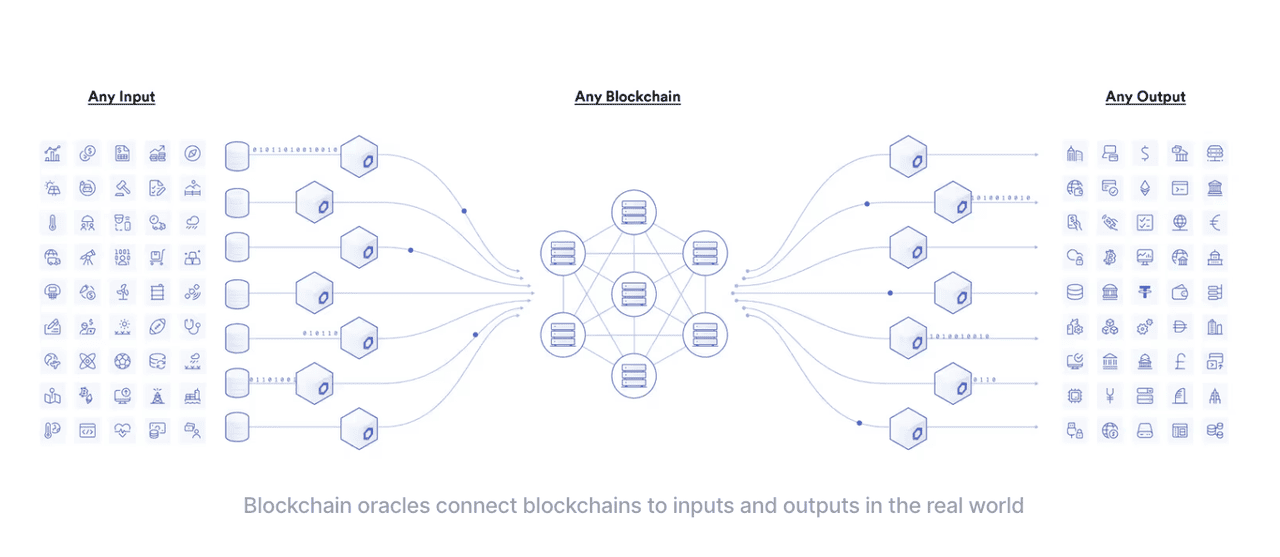

1. Oracle Services: Connecting blockchains to real-world data

How Oracles Work | Source: Chainlink

Chainlink’s decentralized oracle network is its most established product line and the foundation of its ecosystem. Blockchains are inherently closed systems, unable to fetch external information such as stock prices, weather data, or compliance records. This problem, known as the "oracle problem", severely limits smart contracts. Chainlink resolves this by using a decentralized network of independent nodes to fetch, verify, and deliver data to on-chain applications, ensuring accuracy and tamper resistance. Through the Chainlink Runtime Environment (CRE), developers and enterprises can combine any blockchain with any off-chain system into a single workflow.

So far, Chainlink oracles have enabled more than $8.8 trillion in transaction value and delivered over 10.8 billion data points to blockchains. They are critical for DeFi,

NFTs, gaming, insurance, and enterprise solutions, making them one of the most widely used infrastructure layers in Web3.

What Chainlink Oracles Enable:

• Price feeds and data streams: Deliver secure, real-time price data for cryptocurrencies, commodities, FX, and traditional assets. The Multistream upgrade enables thousands of data points to be transmitted in parallel, increasing throughput by more than 1000 times and supporting institutional-scale applications.

• Proof of Reserve and verification: Provides autonomous, on-chain verification that tokenized assets, stablecoins, and wrapped tokens are fully backed by reserves. This reduces counterparty risk, increases transparency, and enables safeguards such as circuit breakers.

• VRF and automation: Chainlink VRF offers provably fair randomness, used in gaming, lotteries, and NFT distributions. Chainlink Automation allows smart contracts to automatically execute pre-set conditions, reducing manual intervention and enhancing operational efficiency.

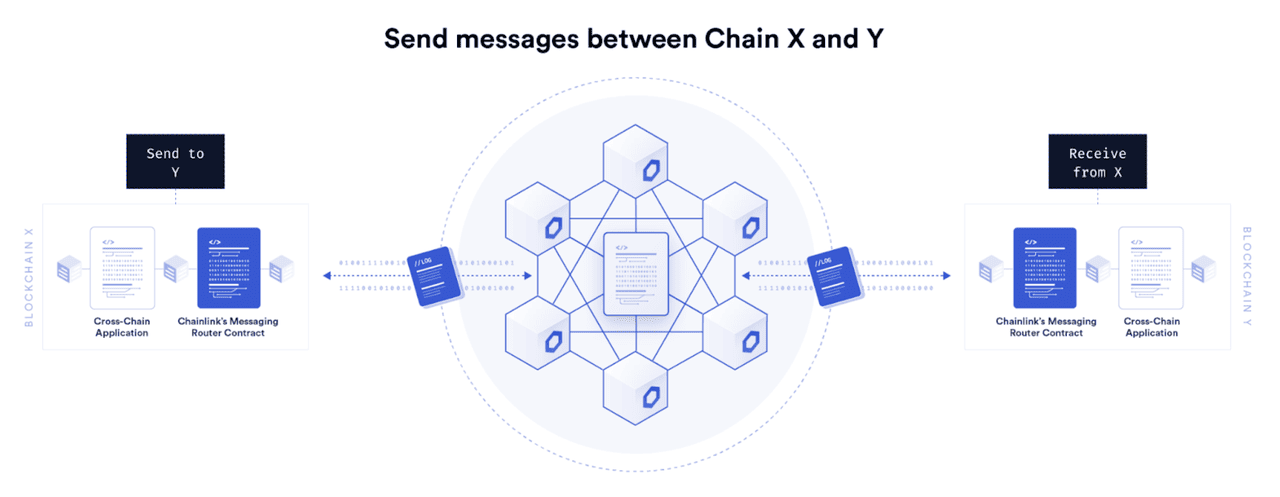

2. Cross-Chain Interoperability Protocol (CCIP): Universal blockchain connectivity

How CCIP Works | Source: Chainlink

The blockchain ecosystem remains highly fragmented, with hundreds of networks operating in isolation. This fragmentation creates liquidity silos and prevents the development of global financial applications that can function seamlessly across chains. Chainlink’s Cross-Chain

Interoperability Protocol (CCIP) addresses this challenge by creating a universal standard for communication and value transfer, sometimes referred to as an Internet of Contracts.

The Cross-Chain Token (CCT) standard, powered by CCIP, already secures more than $24 billion in token value. It has been adopted by leading projects such as

Aave’s GHO, OpenUSDT,

SolvBTC, and

Shiba Inu. CCIP is rapidly becoming the preferred infrastructure for cross-chain applications and tokenized asset settlement.

What Chainlink CCIP Enables:

• Cross-chain token transfers: Provide a secure and standardized method for moving assets across blockchains, reducing the risks associated with custom bridges and improving liquidity across networks.

• Rapid blockchain expansion: In 2025, CCIP integrated with more new blockchains than ever before, including the first day-one deployment on the Monad testnet, demonstrating its scalability and flexibility.

• Enterprise integration: Chainlink has demonstrated CCIP’s compatibility with traditional financial infrastructure. A collaboration with the Swift network showed how over 11,000 banks can instruct tokenized value transfers across public and private blockchains without replacing existing systems.

• CCIP Token Manager: Provides a simple web interface that allows developers to deploy, configure, and manage their own cross-chain tokens, lowering technical barriers and accelerating adoption.

3. Real-world asset (RWA) solutions: Tokenizing traditional finance

Source: Chainlink

The tokenization of real-world assets is one of the largest opportunities in blockchain, with estimates placing the long-term market in the hundreds of trillions of dollars. Today, the RWA market already exceeds $26.3 billion on-chain, representing a 14 percent monthly increase, and is forecast to surpass $50 billion by the end of 2025. Chainlink delivers the infrastructure needed for the complete lifecycle of tokenized assets, from issuance and compliance to valuation, settlement, and ongoing data enrichment.

Chainlink’s advantage lies in its ability to connect off-chain data and systems directly to tokenized assets, ensuring they are accurate, auditable, and interoperable across chains. By offering compliance, pricing, and cross-chain transfer tools, Chainlink has become the most advanced RWA infrastructure provider in the market.

Notable implementations include collaborations with Euroclear, Clearstream, BNP Paribas, BNY Mellon, Citi, ANZ Bank, Coinbase Project Diamond, and JPMorgan’s Kinexys network. These pilots validate Chainlink’s role as the institutional standard for tokenized asset management.

What Chainlink RWA Enables:

• Real-world data integration: Adds external information such as valuations, compliance reports, and identity verification to

tokenized assets. Services like Proof of Reserve and DECO ensure this data is accurate while protecting sensitive details.

• Cross-chain asset movement: Tokenized assets can be transferred seamlessly across public and private blockchains through CCIP, improving accessibility and liquidity in global markets.

• Continuous updates: Maintains a “golden record” of essential data that travels with tokenized assets as they circulate across different on-chain environments, ensuring consistency and transparency.

A unifying payment system

Chainlink applies a payment abstraction framework across all its product lines. Users can pay fees in tokens such as

ETH or

USDC, which are automatically converted into LINK. This makes services more accessible for enterprises while ensuring that all activity ultimately drives demand for LINK. Combined with the Chainlink Reserve, payment abstraction supports a sustainable tokenomics model and reinforces LINK as the foundation of the ecosystem.

What Is the LINK Token?

At the center of the Chainlink ecosystem is the LINK token, an

ERC-20 asset that underpins the network’s security, utility, and economic alignment. Launched in 2017 alongside the protocol, LINK has become one of the most widely recognized tokens in the blockchain industry, consistently ranking among the largest cryptocurrencies by market capitalization.

LINK plays several essential roles within the ecosystem:

• Payment for services: Fees for using Chainlink’s oracles, CCIP, and RWA solutions are paid in LINK, compensating node operators for delivering secure and reliable data.

• Staking and security: Node operators and community participants can stake LINK to secure the network, creating economic guarantees that discourage dishonest behavior.

• Incentives for operators: LINK rewards are distributed to node operators, ensuring accurate data delivery and reliable network performance.

• Tokenomics alignment: Features like payment abstraction and the Chainlink Reserve ensure that growing demand for Chainlink’s services translates into sustained demand for LINK.

In practice, LINK functions as both a utility token and a security mechanism. Its integration across oracles, interoperability, and tokenized assets ensures that the expansion of Chainlink directly reinforces the value and use of LINK.

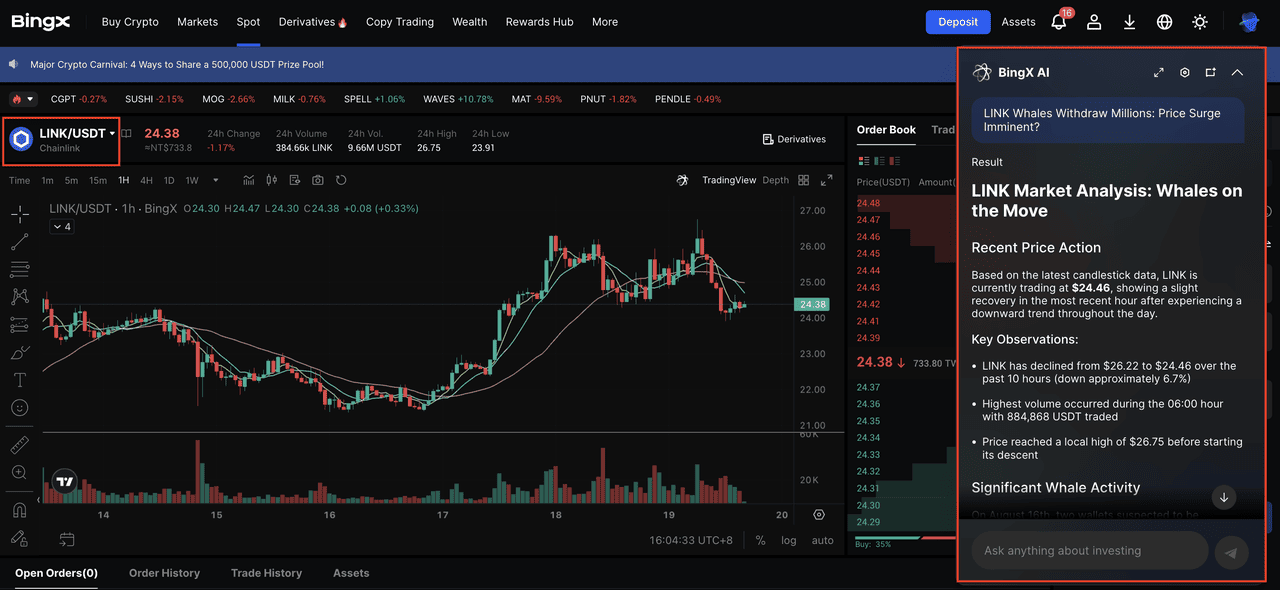

How to Trade Chainlink (LINK) Tokens on BingX

Whether you are accumulating LINK on pullbacks, trading short-term volatility, or following broader market trends, BingX provides multiple ways to execute your strategy. With

BingX AI integrated directly into the trading interface, you can access real-time insights that help you make smarter decisions across both spot and futures markets.

1. Spot Trading: Build Your Position with AI Support

If you want to accumulate LINK or enter during price dips, the spot market is the most straightforward choice.

Step 2: On the trading chart, click the AI icon to activate BingX AI.

Step 3: The tool will analyze price action, highlight key support and resistance levels, and detect patterns such as breakouts or reversals.

For example, if LINK is trading around $15 but BingX AI identifies strong support near $14.30, you might set a limit order close to that level instead of chasing a rally.

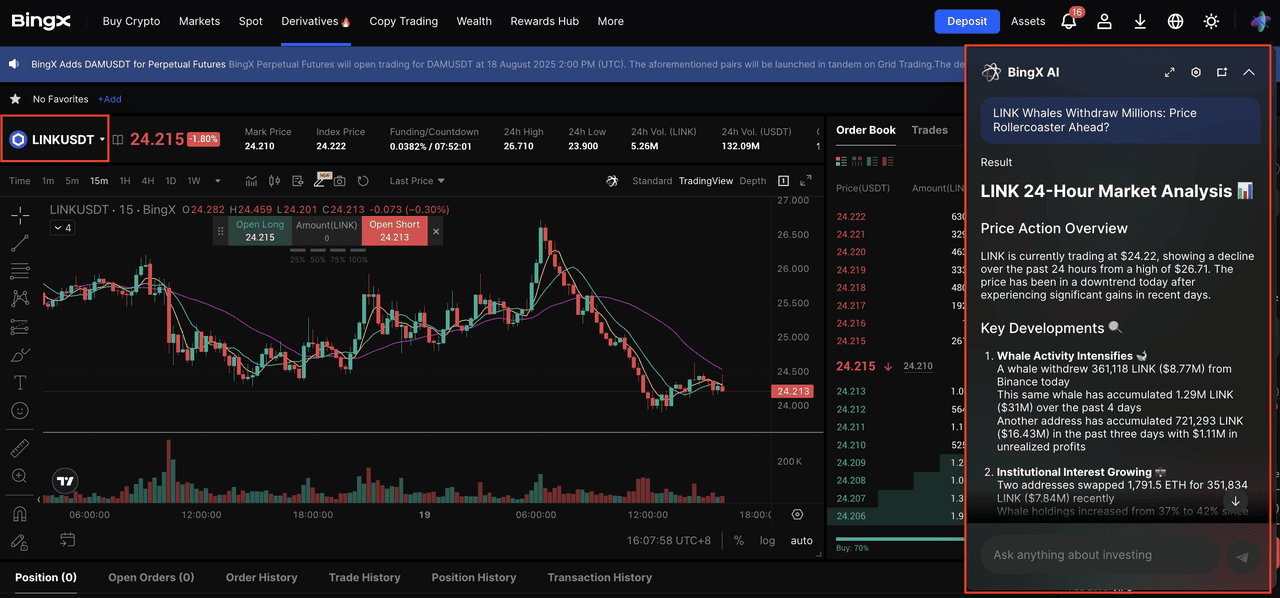

2. Futures Trading: Capture Short-Term Volatility with Confidence

For active traders, BingX

Perpetual Futures allows you to go long or short on LINK with leverage, making it possible to benefit from both rising and falling prices.

Step 1: Search for

LINK/USDT Perpetual in the Futures section.

Step 2: Click the AI icon on the chart to access advanced market intelligence.

Step 3: BingX AI will help you track trend strength, momentum shifts, and volatility levels so you can better time your entries and exits.

You can also ask BingX AI to analyze your open position, suggesting adjustments to take-profit targets or stop-loss levels to manage risk more effectively.

Future Outlook: What's Next for Chainlink?

Chainlink has grown from a decentralized oracle network into a broad infrastructure platform that supports the next phase of blockchain adoption. Its three core product lines, oracle services, CCIP, and real-world asset solutions, address the key limitations that have held back smart contracts and decentralized applications. The launch of the Chainlink Reserve in 2025 further strengthened tokenomics by linking adoption to consistent demand for LINK.

With a fixed supply and growing integration across finance, enterprise, and DeFi, LINK has become more than a utility token. It now serves as the economic backbone of a system that connects blockchains to real-world data, enables cross-chain communication, and supports the tokenization of traditional assets.

For investors, LINK represents exposure to one of the most widely integrated and institutionally validated platforms in Web3, positioned to expand its role in global blockchain infrastructure in the years ahead.

Related Reading