In 2025, crypto staking is one of the simplest ways to

earn passive income, no trading needed. You lock tokens into a Proof-of-Stake (PoS) network and earn steady rewards that typically range from ~3% to 20%+ APY, depending on the asset and method. The scale is real: about 29.6% of all

Ethereum is staked (over $150B in value),

Solana’s staking ratio sits around 66%, and

Polkadot’s is near 49%, while some networks like

Cosmos (ATOM) still post ~20% APY.

For beginners, think of it like earning interest, but paid in crypto. You can start in a few clicks with

BingX Earn (flexible or fixed terms), or, if you’re more advanced, run a validator or use

liquid staking for extra flexibility. Whether you hold

ETH,

SOL, or

DOT, staking in 2025 offers multiple, beginner-friendly paths to grow your portfolio while helping secure the blockchains that power Web3.

Learn how to earn passive income through crypto staking in 2025 with this complete guide covering methods like pools, solo validators, delegated staking, liquid staking, risks, and how to get started with BingX Earn.

What Is Crypto Staking and How Does It Work?

Crypto staking is the process of committing your digital assets, such as Ethereum (ETH), Solana (SOL), or Polkadot (DOT), to a blockchain network that uses a Proof-of-Stake (PoS) consensus mechanism. By staking, you’re essentially helping the network confirm transactions, secure its operations, and keep everything running smoothly. In return, you earn staking rewards, often expressed as annual percentage yield (APY).

Here’s how it works in simple terms: imagine depositing $1,000 worth of ETH into a staking program that offers a 4% APY. At the end of one year, you would earn about $40 in ETH rewards, paid directly in crypto, on top of your original stake. Different networks offer different yields:

• Ethereum (ETH) averages around 3–4% APY

• Solana (SOL) yields about 7–8% APY

• Polkadot (DOT) offers 10–12% APY

• Cosmos (ATOM) can reach 20% APY or more

Unlike Proof-of-Work mining, such as

Bitcoin mining, which requires expensive hardware and high energy usage, staking is far more energy-efficient because it relies on participants “voting” with their tokens rather than competing with computing power.

Anyone can participate in staking:

• Validators are users who run specialized nodes and stake large amounts of crypto (e.g., 32 ETH for Ethereum) to process transactions directly.

• Delegators are everyday investors who delegate their tokens to trusted validators through pools or exchanges, earning a share of the rewards without running hardware.

In short, staking is like putting your crypto to work: you hold it, the network benefits from your contribution, and you earn passive income in return.

Why Stake Crypto in 2025?

Beyond merely earning rewards, staking is becoming one of the most practical ways to grow your crypto portfolio while supporting the blockchain ecosystem. Here’s why staking crypto matters in 2025:

• Earn Reliable Rewards: Staking provides predictable returns, often higher than traditional savings accounts. For example, Ethereum (ETH) yields about 3–4% APY,

Cardano (ADA) averages 4–5% APY, Polkadot (DOT) offers 10–12% APY, and Cosmos (ATOM) can exceed 20% APY. This makes staking a consistent income stream for long-term holders.

• Support Ecosystems: When you stake, you’re earning rewards while also helping blockchains stay secure and decentralized. Your staked tokens act as “votes of confidence” for the network, making it harder for bad actors to attack and ensuring transactions remain fast and reliable. The more people stake, the stronger and more resilient these ecosystems become.

• Institutional Adoption: Large firms and funds are also joining the staking trend, signaling growing trust in its potential. For instance, in 2025, institutions have allocated billions into Ethereum staking products, treating them as an alternative to bonds or dividend-paying stocks. This institutional confidence has further legitimized staking as a mainstream investment strategy.

• Beginner-Friendly Access: Unlike running a complex mining setup, staking can be as simple as a few clicks. Platforms like BingX Earn allow you to start staking ETH, SOL, or

USDT instantly with flexible or fixed-term options, with no technical expertise required.

In short, staking in 2025 offers steady yields, ecosystem impact, and increasing global credibility, making it an appealing option for both beginners and professionals looking to maximize the value of their crypto holdings.

What Are the Top 5 Ways to Stake Crypto in 2025?

Staking isn’t one-size-fits-all; in 2025, you can choose from several methods depending on your budget, skill level, and risk appetite. From beginner-friendly exchange staking on platforms like BingX Earn to advanced validator setups and liquid staking, here are the top ways to put your crypto to work.

1. Passive Staking via Staking Pools

Staking pools are a great entry point for beginners who don’t have enough crypto or technical expertise to run their own validator. Instead of meeting high minimum requirements (like 32 ETH for Ethereum), you can combine your tokens with thousands of other users. The pool stakes collectively, and rewards are distributed proportionally to each participant based on how much they contribute.

For example, if a Polkadot (DOT) pool offers 10% APY and you stake $1,000 worth of DOT, you could earn around $100 in rewards per year. The best part? You don’t need to manage hardware, install special software, or stay online 24/7. All the technical work is handled by the pool operator, making it simple and low-maintenance.

2. Staking-as-a-Service for Hands-off Crypto Staking

If you want an even more hands-off experience, centralized exchanges now offer staking-as-a-service. Platforms like BingX Earn let you stake popular tokens such as ETH, SOL, or USDT directly from your account in just a few clicks. You can pick between:

• Flexible terms: withdraw anytime, usually with lower APYs.

• Fixed terms: lock your tokens for weeks or months for higher yields, sometimes up to 10–15% depending on the asset.

This approach is especially practical for beginners since it removes the need to use external wallets or validators. Everything, staking, tracking rewards, and redeeming, is managed within the exchange interface, making it one of the most accessible ways to start earning passive income through staking.

3. Solo Staking By Running Your Own Validator Node

For advanced users, the most direct way to stake is by running your own validator node. This gives you complete control over your funds and allows you to keep the full share of staking rewards without paying fees to pools or third parties. Validators are essential to blockchain networks. They confirm transactions, create new blocks, and keep the system secure. In return, they earn rewards that typically range from 3–8% APY, depending on the network.

However, this method requires a large upfront investment and technical setup. On Ethereum, for example, you need to stake at least 32 ETH (worth over $130,000 in mid-2025) to become a validator. You’ll also need reliable hardware, fast internet, and the ability to keep your node online 24/7. If your system goes offline or makes errors, you risk penalties known as slashing, which can reduce your staked funds.

Running a validator can be worthwhile for long-term holders with substantial crypto portfolios who want maximum independence. But for most beginners, the cost and complexity make it less practical than using staking pools or exchange-based services.

4. Delegated Staking

Delegated staking is a popular option for users who don’t want to run their own validator but still want to earn rewards. Instead of setting up hardware or locking huge amounts of crypto, you simply delegate your tokens to a trusted validator who does the technical work. You still retain ownership of your tokens in your wallet, while the validator earns rewards for securing the network and shares them with you. The only cost is a small commission fee (usually between 5–10%) deducted from your rewards.

This method is especially common in networks like Polkadot (DOT) and Cardano (ADA). For example, if you delegate 1,000 DOT to a validator offering 12% APY, you might earn about 120 DOT per year. After a typical 10% validator fee, your net reward would be 108 DOT, all while keeping your original stake safe in your wallet. The process is simple: choose a validator from your network’s official wallet interface, delegate your tokens, and start receiving payouts automatically.

Delegated staking strikes a balance between accessibility and control. It’s easier and cheaper than running your own validator, while still letting you participate directly in securing the blockchain. Just make sure to research validator performance and reliability; choosing one with a poor track record could reduce your rewards or expose you to slashing risks.

5. Liquid Staking

Liquid staking is designed for users who want to earn staking rewards without locking up their crypto completely. When you stake tokens through platforms like Lido or Rocket Pool, you receive

liquid staking tokens (LSTs) such as stETH (for Ethereum) or rETH. These tokens represent your staked assets and continue earning rewards, but unlike traditional staking, you can also use them across DeFi platforms, for lending, borrowing, or trading.

For example, staking 10 ETH through Lido (with an average yield of about 3–4% APY) gives you 10

stETH, which earns staking rewards automatically. At the same time, you can deposit stETH into a

lending protocol to earn an extra 2–5% APY, effectively creating two streams of income. This makes liquid staking especially attractive to investors looking for higher capital efficiency.

The trade-off is that liquid staking adds another layer of risk and complexity. While you keep your liquidity, you also take on smart contract risk, price fluctuations of the LST compared to the original token, and platform reliability. Still, with nearly $40B in staked ETH now managed through liquid staking services in 2025, it has become one of the fastest-growing ways for both beginners and advanced users to make their crypto work harder.

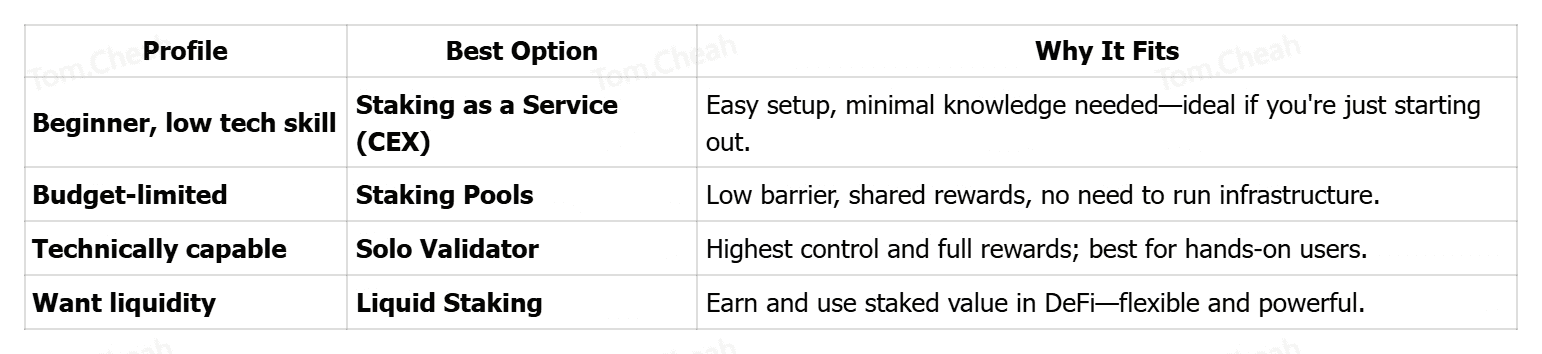

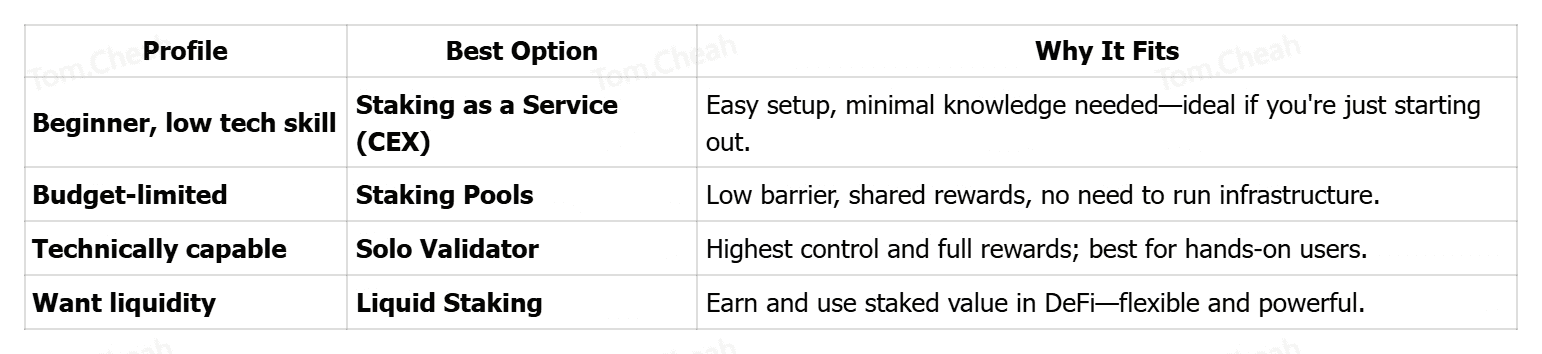

What’s the Best Staking Method for You?

The best staking method depends on your budget, technical skills, and risk tolerance. If you’re new to crypto and want a simple, low-risk option, exchange-based staking services like BingX Earn are ideal since they require no setup and let you choose between flexible or fixed terms. If you hold smaller amounts of tokens and want to avoid lock-up minimums, staking pools allow you to combine funds with others and still earn steady rewards.

For investors with larger portfolios and technical know-how, running your own validator node offers the highest control and full rewards but comes with higher costs and risks, such as slashing penalties. Meanwhile, delegated staking strikes a middle ground, giving you control of your tokens while earning through a trusted validator, and liquid staking adds flexibility by letting you use staked tokens in DeFi for extra yield. In short, beginners should start with exchange staking or pools, while advanced users can explore validators or liquid staking for greater efficiency.

How to Stake Crypto via BingX Earn

If you’re just starting out, BingX Earn offers one of the easiest ways to stake crypto with no technical setup required.

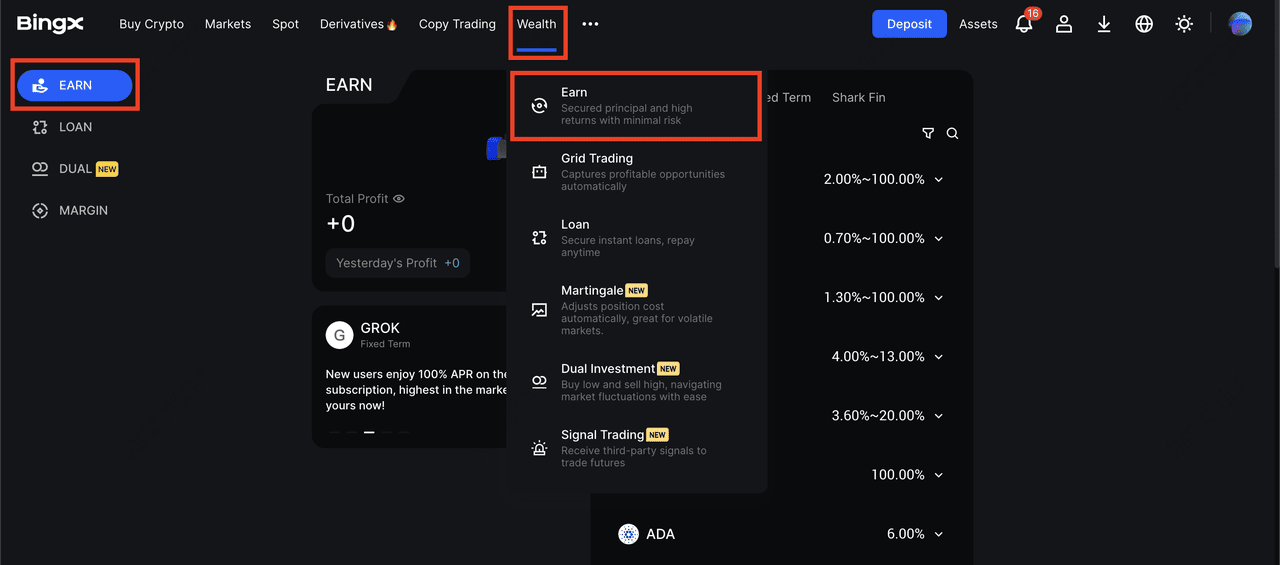

2. Go to the “Wealth” section on the website or app and select Earn.

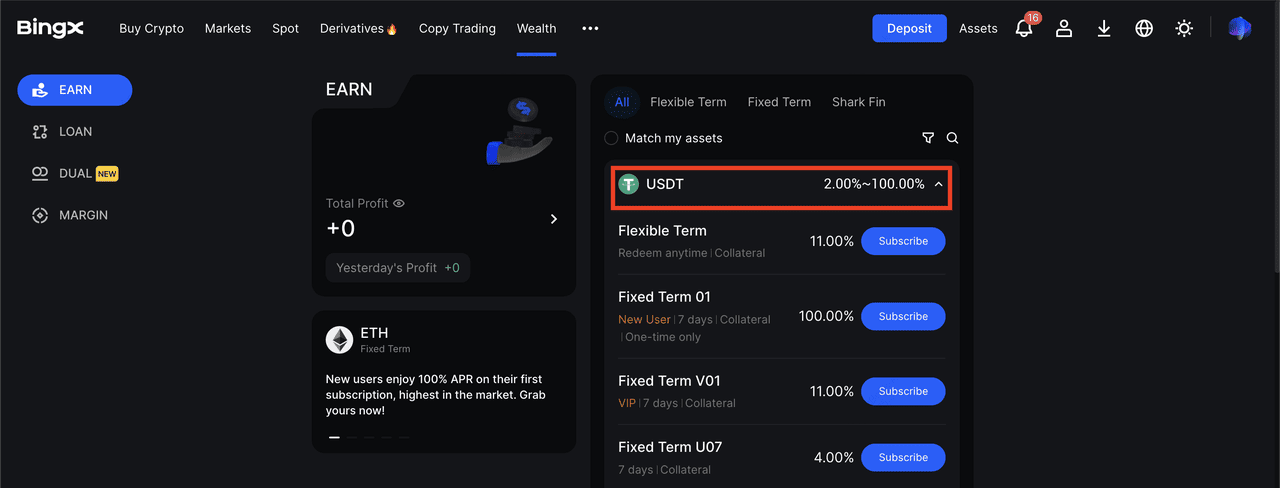

3. Choose your asset. Popular options include ETH,

ADA, SOL, or USDT.

4. Pick your staking type:

• Flexible staking lets you withdraw anytime, with lower APYs.

• Fixed-term staking locks your assets for a set period, often giving higher returns (sometimes up to 10–15% APY).

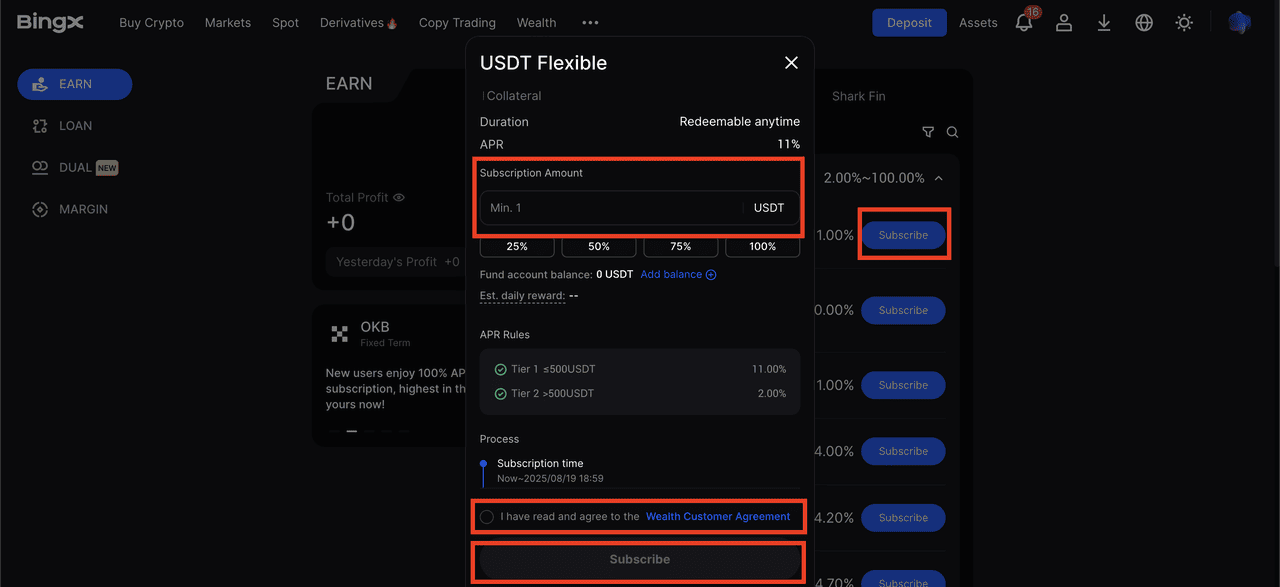

5. Confirm your stake by accepting the terms and clicking Subscribe. Your tokens will be locked, and rewards will start accruing automatically in the same token.

This step-by-step process allows beginners to start earning passive income from their crypto with just a few clicks, all managed within the BingX platform.

Risks and Key Considerations of Staking Cryptocurrency

Like any investment, staking comes with trade-offs. Most networks have lock-up periods that limit access to your funds for days, weeks, or even months. During this time, your tokens may drop in value due to price volatility, reducing both your stake and the rewards you earn. Validators can also face slashing penalties if they go offline or act maliciously, which may impact your returns if you’ve delegated to them.

There are also technical and protocol risks to consider. Liquid staking and restaking rely on smart contracts, which may contain vulnerabilities or bugs, while validator mismanagement can reduce rewards. To minimize risk, always research the lock-up terms, validator reputation, and staking mechanics before committing your assets. Diversifying across different tokens and staking methods can also help balance risk and reward.

Conclusion: Should You Stake Your Crypto?

Crypto staking in 2025 offers practical, hands-off ways to grow your holdings, especially suitable for long-term HODLers. Whether via easy CEX solutions like BingX Earn, pools, liquid staking, or running your own node, there’s a method to suit every comfort level and technical skill.

That said, staking is not risk-free. Carefully assess lock-up constraints, technical or contract risks, and your own liquidity needs before diving in. If you're informed and cautious, staking can be an effective component of a diversified passive income strategy.

Related Reading