Crypto day trading is a short-term strategy where traders buy and sell cryptocurrencies within the same day to profit from price changes. Unlike long-term investing, it focuses on quick gains by analyzing charts, trends, and market signals. Traders use tools like

candlestick charts,

moving averages, and volume indicators to find ideal entry and exit points. Because the crypto market runs 24/7, day trading offers flexible opportunities, but also comes with higher risk due to constant price swings.

This beginner’s guide to crypto day trading will help you explore how day trading in crypto works, key strategies, and what you need to start trading cryptocurrencies within a single day.

What Is Crypto Day Trading and How Does It Work?

Day trading in crypto is a short-term trading strategy where you buy and sell cryptocurrencies within the same day, often within minutes or hours, to take advantage of small price movements. Unlike long-term investors who hold crypto for weeks or months, day traders aim to profit from rapid market fluctuations that occur over short timeframes.

Here's how it works: A day trader closely monitors crypto charts, market trends, and news events to spot quick trading opportunities. They typically use technical analysis tools—like candlestick patterns, moving averages, and indicators such as

relative strength index (RSI) or

moving average convergence divergence (MACD), to predict where prices might go next. Most day traders focus on highly liquid cryptocurrencies like

Bitcoin (BTC),

Ethereum (ETH), or trending altcoins because they offer faster order execution and smaller spreads.

Trades are often placed on spot or futures markets using limit or market orders, depending on the strategy. Some traders also use leverage to amplify gains (and risks), especially on derivatives platforms. A typical day trader might make multiple trades a day, trying to capture even small gains like 1%–5% per trade, which can add up over time.

To succeed in day trading, you need:

• A reliable trading platform or exchange with low fees and real-time data, such as BingX

• A clear trading plan and discipline to avoid emotional decisions

While day trading can be profitable, it's also risky due to the volatility of crypto markets. Beginners should practice with demo accounts or small capital before committing significant funds.

How Day Trading Crypto Differs From Other Strategies

Day trading involves buying and selling cryptocurrencies within the same day to capitalize on short-term price movements. It’s fast-paced, requires constant market monitoring, and often relies on technical analysis and news-based reactions. Coins like Bitcoin and Ethereum are popular among day traders because they offer high liquidity, meaning trades can be executed quickly with low slippage and minimal fees.

In contrast, HODLing is a long-term strategy where investors hold onto their crypto assets for months or even years, ignoring short-term volatility in favor of future growth potential. Swing trading falls somewhere in between. Traders aim to ride trends that develop over several days or weeks, using both technical and fundamental analysis to time their entries and exits. Unlike day trading, swing and long-term strategies don't require constant attention, making them more beginner-friendly in terms of time and emotional demands.

What Is Intraday Crypto Trading?

Intraday crypto trading means opening and closing positions within a single trading day. The goal is to profit from short-term price movements without holding positions overnight, reducing exposure to sudden market changes.

Traders rely on lower timeframes to track price trends and execute trades with precision. A common charts used include:

• 1-minute chart – Used for rapid-fire scalping strategies

• 5-minute chart – Offers a balance between speed and pattern clarity

• 15-minute chart – Helps confirm breakouts and trend shifts

Every second matters. In volatile markets, hesitation can turn a profitable setup into a loss. This is why technical analysis, timing, and risk control are essential for intraday trading.

Why Is BingX the Best Platform for Intraday Crypto Trading?

BingX offers tools that support day trading cryptocurrency efficiently:

• Real-time TradingView charts to track entry and exit points

• Demo mode to test strategies without real capital

• Fast execution and tight spreads for scalping or short setups

With 24/7 access and a clean trading interface, BingX allows traders to respond to market conditions with minimal delay and complete control.

Is Crypto Day Trading for Beginners? Key Things to Know

Crypto day trading is accessible to beginners, but it’s not easy. The cryptocurrency market moves fast, and success depends on more than just knowing where to buy or sell. It requires discipline, a solid trading strategy, and a high level of emotional control. Here are the top things you need to know before getting started with crypto day trading:

1. Develop Essential Skills:

• Technical analysis: Learn how to read candlestick charts and use indicators like

moving averages and RSI to spot potential entry and exit points.

• Risk management: Use stop-loss orders to limit losses, calculate position sizes based on your account size, and avoid putting too much capital in a single trade.

• Emotional discipline: Stay calm during market swings and avoid letting fear or greed influence your decisions.

2. Start Small or Use Demo Trading: It’s best to begin with a small amount of capital while you're learning to avoid large losses early on. BingX offers a demo trading mode where you can practice strategies with virtual funds and gain experience without risk. You can also try keeping a trade journal to help you review what’s working and improve your skills over time.

3. Why Starting Early Helps: The sooner you start, the quicker you’ll learn to manage emotions, spot patterns, and make timely decisions under pressure. Building habits like reviewing trades and journaling gives you an edge as you develop your strategy.

4. Be Aware of the Risks: Crypto markets are volatile, and it’s possible to lose money quickly if you overtrade or ignore stop-losses. Beginners often fall into emotional traps like revenge trading or chasing losses, which can make things worse. Without a solid plan, short-term success can create overconfidence, leading to poor decision-making later on.

Day trading crypto isn’t about guessing right once; it’s about consistent execution. Beginners who treat it as a long-term skill have a better chance of success.

How to Day Trade Cryptocurrency

To start crypto day trading, you'll need a few essential tools. First, use a reliable exchange like BingX, which offers real-time execution, spot and futures markets, and built-in TradingView charts. Charting tools such as candlestick patterns, moving averages, RSI, and volume indicators help you analyze price movements. Stay updated on market sentiment through news sources or BingX’s own updates. Finally, keeping a trade journal is key to tracking your trades, identifying mistakes, and improving your strategy over time.

To succeed in day trading cryptocurrency, you need more than intuition. A structured routine, with the right tools, process, and mindset, is essential for navigating the fast-moving crypto market while managing risk effectively.

A Step-by-Step Guide for Day Trading Cryptocurrency

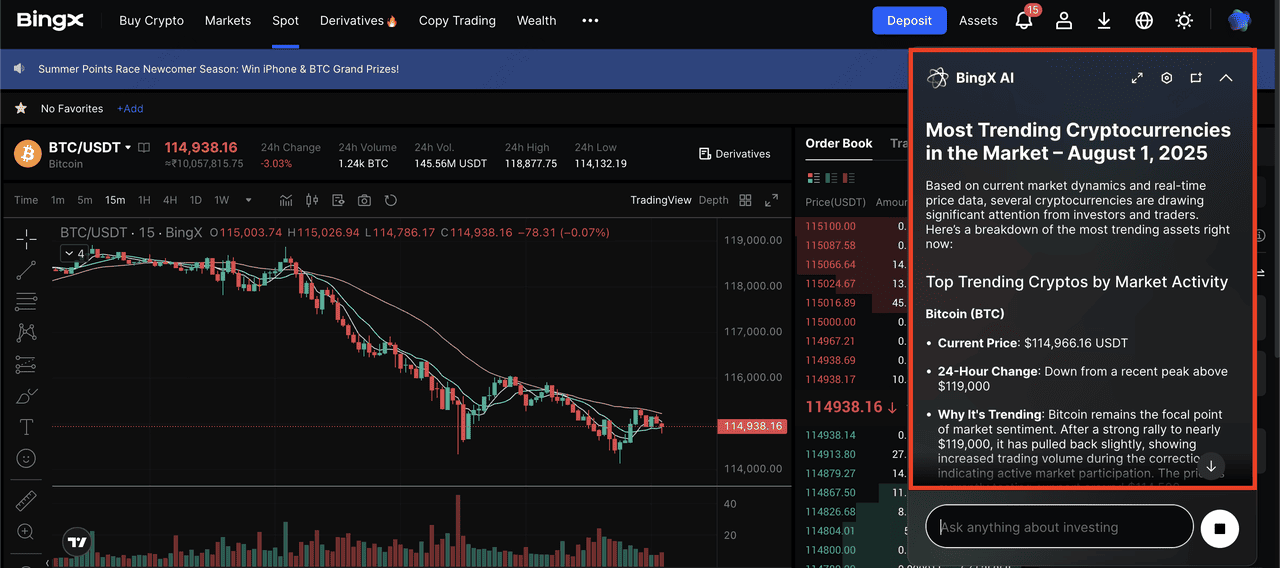

Crypto day trading powered by BingX AI

If you're new to crypto day trading, following a clear process can help you build discipline and avoid costly mistakes. Here’s a beginner-friendly breakdown of each step:

• Market Scan: Use BingX AI to quickly identify trending cryptocurrencies with strong price movements, high trading volume, or breaking news that could lead to short-term opportunities.

• Setup: Use charts to identify common patterns like breakouts, trend reversals, or support and resistance levels. Indicators like RSI or MACD can help confirm your setup.

• Entry: Once your setup looks promising, enter the trade at a price that fits your strategy, ideally near a support level or breakout point.

• Risk Management: Set a stop-loss to limit potential losses. Many traders risk just 1–2% of their capital per trade. BingX AI can help calculate optimal stop levels based on volatility and historical data.

• Review: After closing the trade, log the results in a journal. Note what worked, what didn’t, and what you can improve for next time. This habit helps you grow as a trader. Use BingX’s AI-powered trade analysis tools to detect patterns in your performance and improve over time.

Leverage is also available on BingX, allowing traders to amplify their positions. For instance, using 10x leverage, you can control a $1,000 trade with just $100. However, leverage cuts both ways: a 1% adverse move could wipe out your capital.

For beginners, using low or no leverage is the safer way to gain experience without exposing yourself to significant losses.

Top 5 Crypto Day Trading Strategies

Whether you're just starting out or refining your edge, mastering a few reliable techniques can make all the difference. Below are five proven day trading strategies used by crypto traders on BingX, each illustrated with real

BTC/USDT chart setups and clear execution logic.

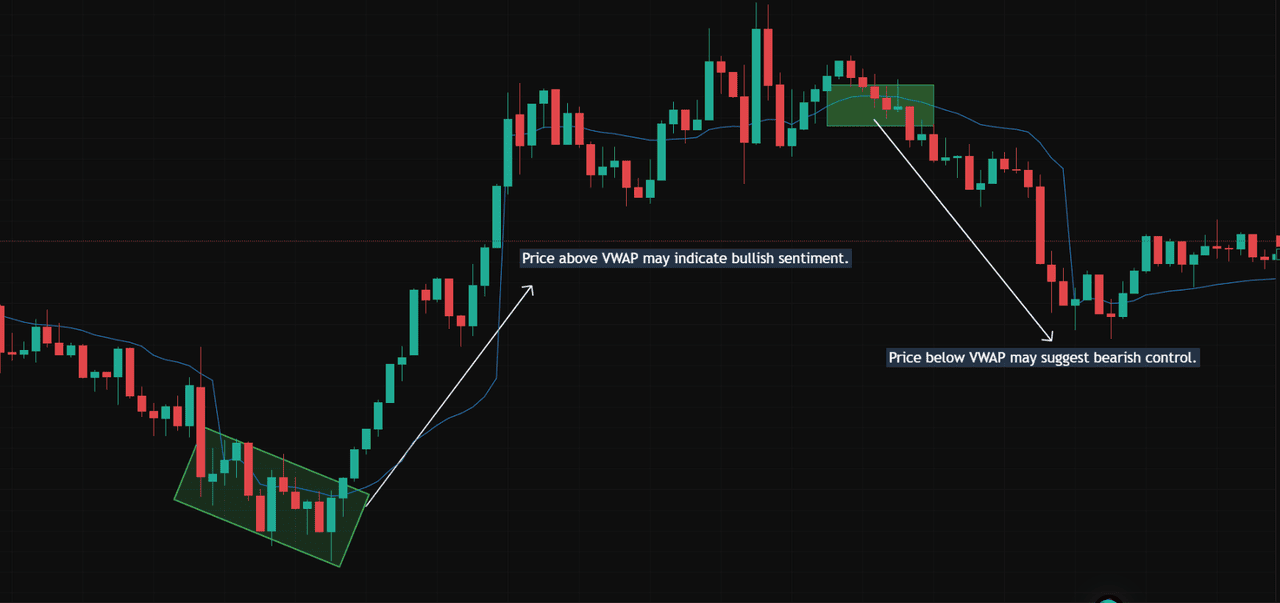

1. VWAP Strategy: Measuring Intraday Sentiment and Fair Value

The Volume-Weighted Average Price (VWAP) calculates an asset’s average trading price, weighted by volume. It acts as a dynamic support/resistance level and a reference point for institutional sentiment.

If the price trades above VWAP, buyers are likely in control. If it drops below, selling pressure dominates.

In the BTC/USDT chart from BingX, price initially trades below VWAP during a downtrend, confirming bearish control.

After forming a base near support, price reclaims VWAP around $101,000, signaling a sentiment shift. Momentum accelerates as BTC rallies toward $109,000.

Later, BTC fails to hold above VWAP again, triggering a reversal, a clean example of VWAP’s strength as a trading guide.

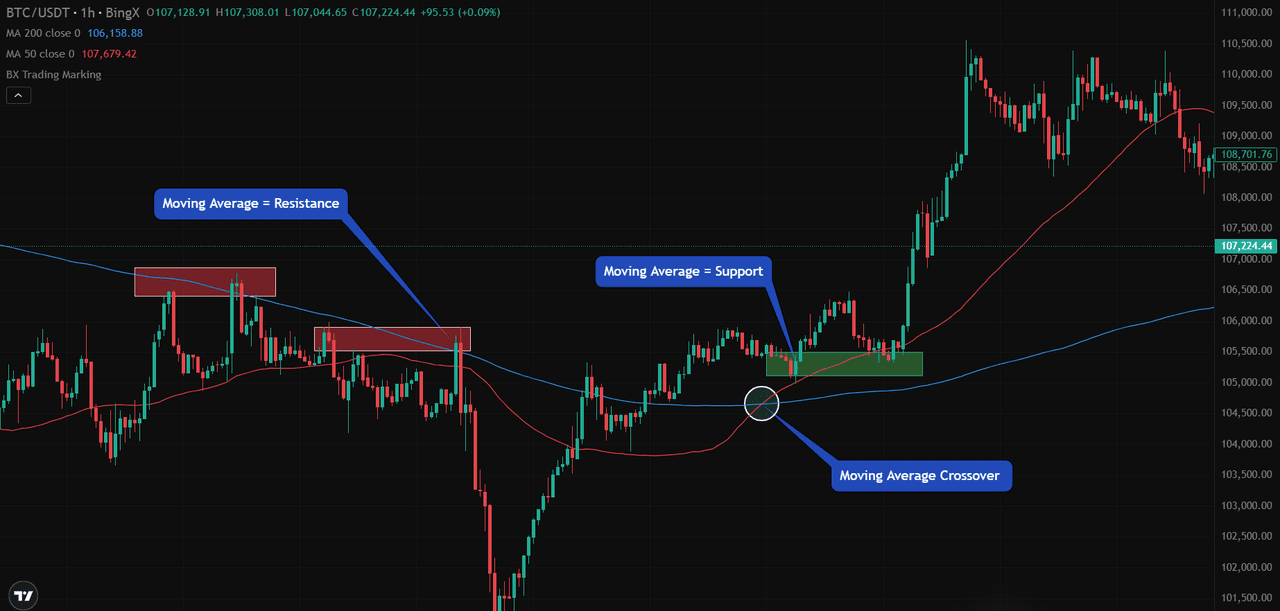

2. Moving Average Strategy: Crossover and Bounce

This strategy uses

moving averages, typically the 50-MA and 200-MA, to identify trend direction and entry points. When a shorter moving average crosses above a longer one, it suggests bullish momentum (a “golden cross”).

Conversely, a cross below signals bearish momentum. Once the trend is established, traders look to buy pullbacks to these moving averages, which often act as dynamic support or resistance.

On the 1-hour chart, BTC was rejected multiple times near the 200-MA at $106,150, confirming it as resistance. After the 50-MA crossed above the 200-MA around $105,000, a bullish trend emerged.

Price then pulled back and bounced from the $105,000–$105,500 zone, right near both MAs. A long entry here with a stop-loss below $104,700 and a target near $108,700 offered a clean risk-reward setup.

Traders on BingX could monitor this using built-in TradingView tools to manage entries and exits with precision.

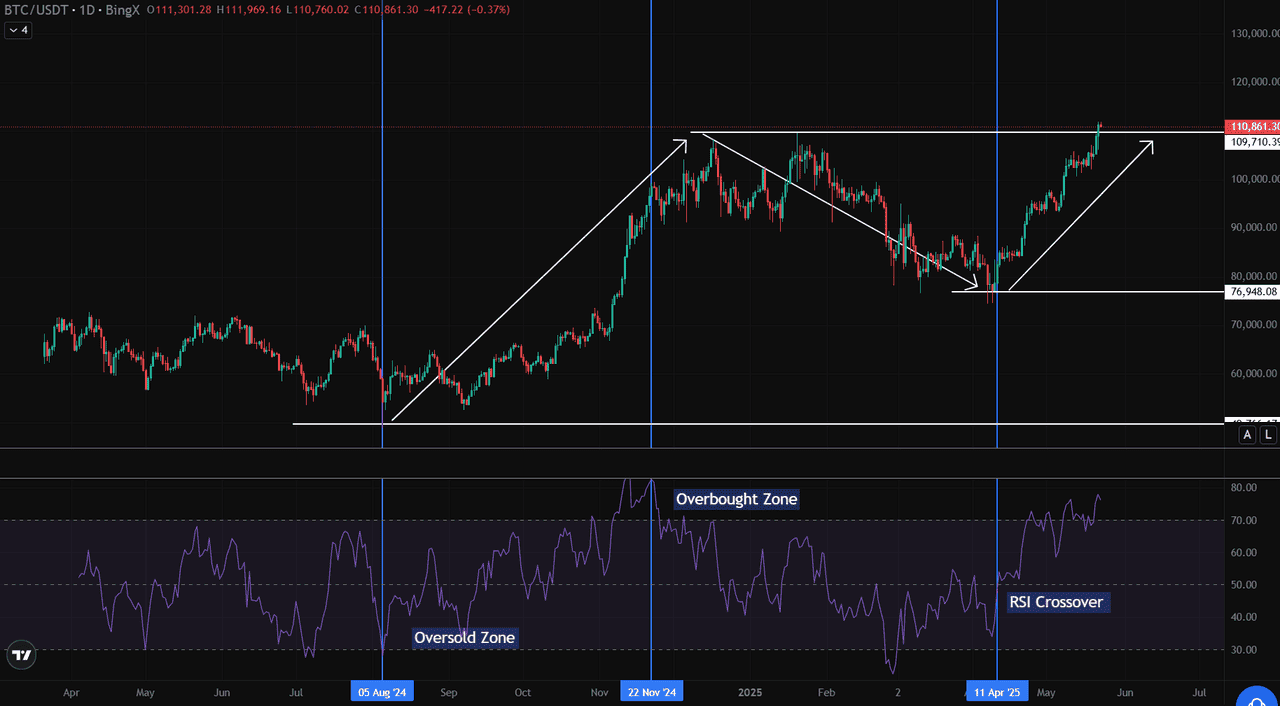

3. RSI Strategy: Spotting Overbought and Oversold Conditions

The Relative Strength Index (RSI) helps traders identify potential reversal zones by measuring momentum. Readings above 70 suggest overbought conditions, while levels below 30 point to oversold zones.

On BingX, this tool is especially useful when combined with support and resistance.

In the BTC/USDT chart, RSI dropped below 30 in August 2024 near $76,950, signaling an oversold bounce. Later, RSI crossed above 70 in November as BTC peaked near $120,000, warning of a potential pullback.

More recently, RSI crossed 50 in April 2025 during a breakout from $90,000, aligning with bullish momentum and validating a trend continuation.

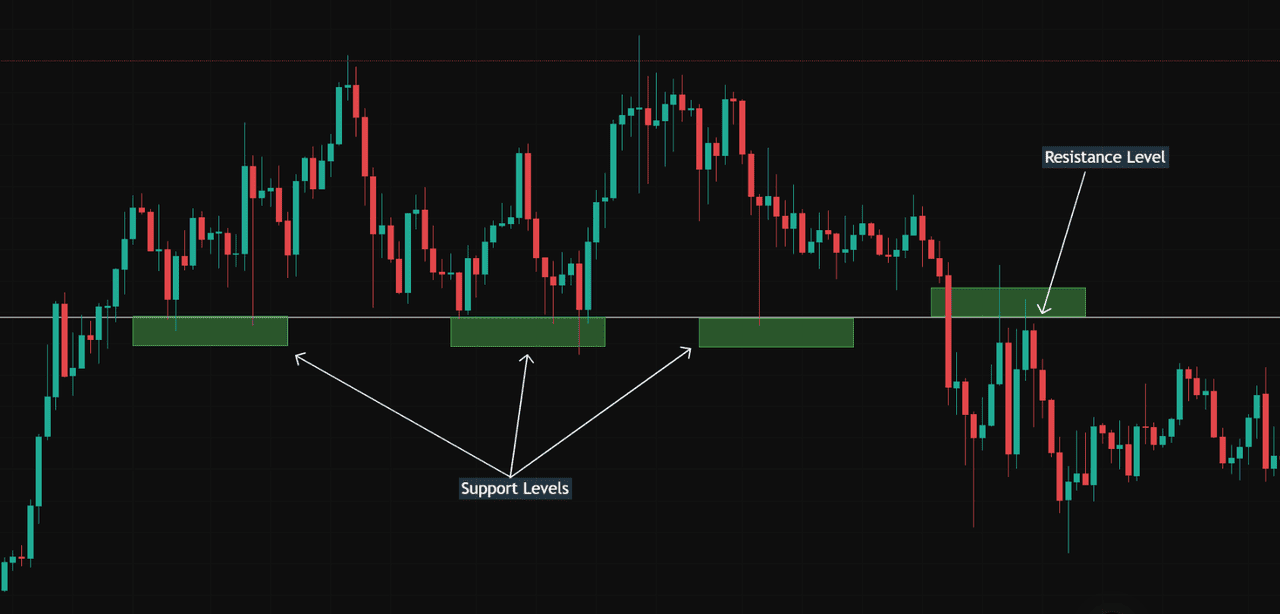

4. Support and Resistance Bounces

Support and resistance are key concepts in crypto day trading. Support levels are price zones where buying typically steps in, halting a decline. Resistance levels mark areas where selling pressure prevents price from rising further.

In the BTC/USDT chart on BingX, we see the price repeatedly bounce off support and reject resistance, clear signs of market reaction.

Day traders use these zones to plan trades: buying near support and selling near resistance. BingX’s charting tools make it easy to draw and adjust these levels, helping traders identify entry points based on historical price patterns and real-time market behavior.

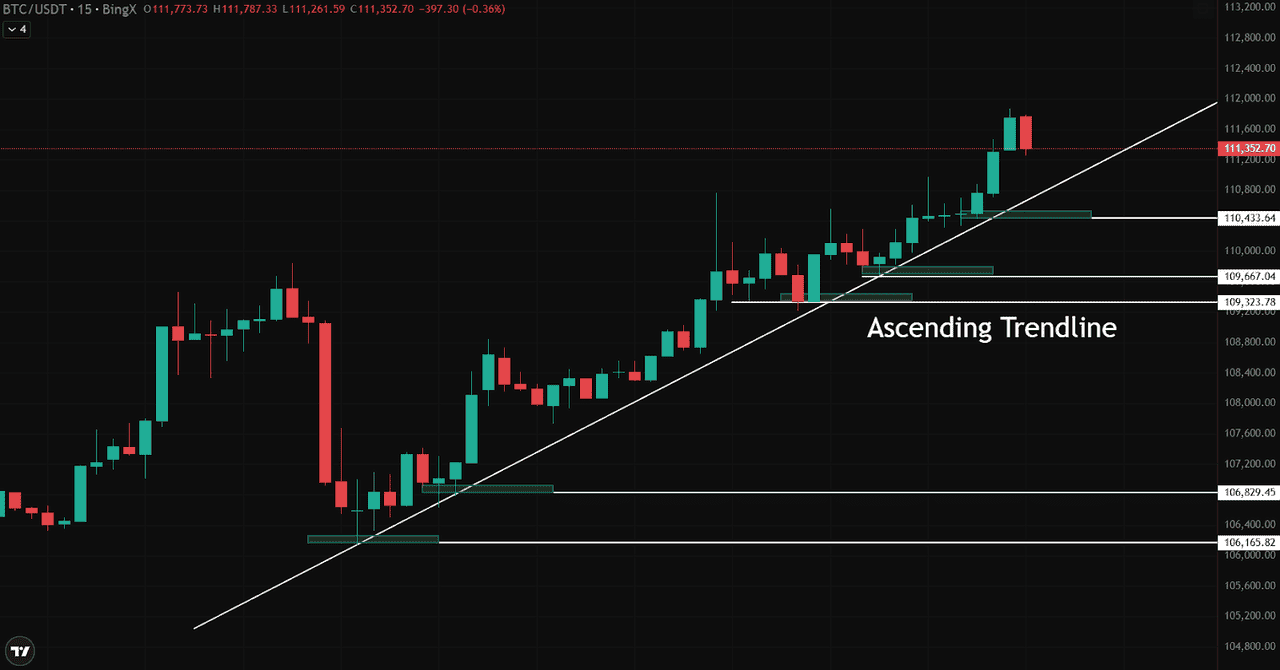

5. Trendline Strategy: Identifying and Trading Market Momentum

Trendlines are one of the most fundamental tools in crypto technical analysis, helping traders identify the prevailing market direction, potential support or resistance zones, and trend reversals.

A trendline connects key swing points on a chart, either higher lows in an uptrend or lower highs in a downtrend, offering a visual representation of market momentum.

In the first BTC/USDT chart on BingX, we see a clear

descending trendline formed by connecting lower highs from around $106,800 down to $99,500 and $96,000.

Each time BTC rallies into the trendline, it gets rejected, confirming the bearish structure.

In the second chart, BTC flips into a bullish trend, forming an ascending trendline by connecting higher lows from $106,165 to $109,323 and $110,433. Price consistently respects this line as support, offering long entries on each pullback. This structure continues until the trendline is eventually broken, potentially signaling a slowdown or reversal.

The strength of a trendline increases with the number of touches and how long it holds. Traders on BingX can easily draw and extend these lines using built-in tools to plan entries, exits, or stop-loss zones.

Is Crypto Day Trading Hard? Key Challenges

Day trading cryptocurrency looks simple on the surface: buy low, sell high. But in practice, the challenge lies in managing risk, speed, and emotion in an unpredictable market.

• Market volatility: Crypto assets can swing 5–10% in minutes. This creates opportunity, but also risk. One delayed exit can wipe out a day’s gains.

• Noisy signals: Many price movements are driven by low-volume trades, bots, or short-term speculation. It’s hard to separate valid setups from random spikes.

• Emotional pressure: Fear of missing out (FOMO), frustration after a loss, or revenge trading can derail even a sound trading strategy.

• Lack of structure: Without a defined process, traders often react to price rather than plan ahead, leading to inconsistent results.

• High-frequency decision making: Every trade requires fast, high-stakes decision making. Inexperienced traders often freeze or overreact under pressure.

Common Pitfalls for New Day Traders

Common mistakes in crypto day trading include overtrading without clear setups, forcing trades during low-volume or sideways markets, taking oversized positions without stop-losses, and focusing too much on short-term wins instead of long-term consistency. Even experienced traders lose, but they manage risk and follow a disciplined strategy. For most beginners, the biggest challenge isn’t the market - it’s their own behavior.

Wrapping Up

Crypto day trading offers speed, flexibility, and opportunity, but it also demands structure, discipline, and emotional control. Success doesn’t come from guessing right, but from managing risk, refining your process, and staying consistent.

Start with small trades or use a BingX demo account to practice without financial risk. Focus on mastering key tools like RSI, VWAP, and trendlines. Over time, a clear strategy and strong habits matter more than timing the perfect trade.

Treat day trading as a skill to build, not a shortcut to fast profits, and you'll be better positioned to grow in any market condition.

Related Articles

FAQs on Crypto Day Trading

1. What is crypto day trading?

Crypto day trading involves buying and selling cryptocurrencies within the same day to profit from short-term price movements.

2. Is crypto day trading risky?

Yes. It involves high volatility, emotional pressure, and potential losses, especially when using leverage without proper risk management.

3. Can beginners start day trading crypto?

Yes, but it's best to start with a demo account, learn technical analysis basics, and trade small amounts until consistent.

4. What tools do crypto day traders use?

Popular tools include RSI, moving averages, VWAP, candlestick charts, and platforms like BingX with real-time execution.

5. How much can I earn from day trading?

Earnings vary widely. Some traders make small daily gains, while others face losses. Skill, discipline, and market conditions play key roles.