Wspierany przez 28 milionów dolarów finansowania od gigantów branży takich jak Bitfinex i

Tether, StableChain oferuje finalizację w mniej niż sekundę oraz transfery bez opłaty za gaz na poziomie protokołu, aby wypełnić lukę między tradycyjną technologią finansową a zdecentralizowanymi finansami. Na dzień luty 2026,

Stable (STABLE) znajduje się obecnie na 75. pozycji w rankingu kryptowalut pod względem kapitalizacji rynkowej, z kapitalizacją w wysokości 557,05 miliona dolarów i prawie 6000 posiadaczy. Projekt StableChain (STABLE) szybko zyskuje na popularności po udanej aktualizacji v1.2.0 Mainnet z 4 lutego 2026 roku, która ugruntowała jego pozycję jako warstwy rozliczeń gotowej do produkcji poprzez pełną integrację USDT0 jako natywnego tokena gazowego oraz wprowadzenie zwolnień z opłat za gaz na poziomie instytucjonalnym dla płynnego dołączania użytkowników.

W tym artykule dowiesz się, czym jest protokół Stable, jak działa jego unikalny model USDT-jako-Gas, dlaczego liderzy instytucjonalni patrzą na tę infrastrukturę jako przyszłość płatności stablecoinami, jaka jest użyteczność tokena zarządzania STABLE oraz jak handlować STABLE na BingX.

Czym Jest Blockchain Warstwy 1 Stable (STABLE) dla Stablecoinów?

Stable to pierwszy Stablechain, wyspecjalizowany

blockchain warstwy 1 skrupulatnie zoptymalizowany do emisji, rozliczeń i zarządzania

USDT. W przeciwieństwie do blockchainów ogólnego przeznaczenia, które priorytetowo traktują złożone kontrakty smart, Stable został zaprojektowany dla realnej gospodarki, koncentrując się na szybkich, tanich i zgodnych z przepisami transakcjach opartych na dolarze.

W lipcu 2025 roku Stable pozyskał 28 milionów dolarów finansowania zalążkowego współprowadzonego przez Bitfinex i Hack VC, ze strategicznym udziałem Franklin Templeton, Castle Island Ventures i Susquehanna. Kluczowym doradcą projektu jest Paolo Ardoino, CEO Tether, zapewniając, że sieć jest idealnie dostosowana do potrzeb największego

stabblecoina na świecie.

Stable działa na trzech filarach technicznych:

1. Wykonanie natywne USDT: Po aktualizacji v1.2.0 sieć używa USDT0,

LayerZero omnichain USDT, jako natywnego tokena gazowego, eliminując potrzebę posiadania przez użytkowników niestabilnych aktywów takich jak

ETH czy

SOL do płacenia za transakcje.

2. Wysokowydajny konsensus: Wykorzystując StableBFT, sieć osiąga finalizację bloku w mniej niż sekundę, czyniąc ją odpowiednią do rozliczeń detalicznych w punktach sprzedaży i instytucjonalnych.

3. Funkcje na poziomie instytucjonalnym: Protokół wbudowuje Guaranteed Blockspace dla przedsiębiorstw oraz Confidential Transfers, aby chronić prywatność transakcji przy zachowaniu zgodności z przepisami.

Czym Jest Aktualizacja Mainnet Stable v1.2.0?

Aktualizacja Mainnet v1.2.0, uruchomiona 4 lutego 2026 roku, oficjalnie przenosi StableChain z architektury wczesnego etapu do warstwy rozliczeń gotowej do produkcji. Poprzez wycofanie starszego gUSDT na rzecz

USDT0 jako natywnego tokena gazowego, sieć wyeliminowała tarcie związane z wrap/unwrap, pozwalając użytkownikom przenosić wartość i płacić opłaty jednym aktywem, jednocześnie umożliwiając zarządzane przez API zwolnienia z opłat za gaz dla płynnego dołączania użytkowników.

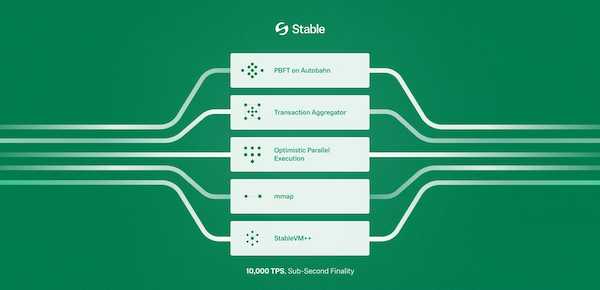

Patrząc w przyszłość, Faza 2 skupi się na skalowalności przedsiębiorstw poprzez agregatory transferów USDT i gwarantowaną przestrzeń bloków dla partnerów instytucjonalnych. Do drugiego kwartału 2026 roku Faza 3 ma na celu wdrożenie konsensusu opartego na DAG, Autobahn oraz silnika wykonawczego StableVM++, dążąc do przełomowej przepustowości 10 000+ TPS, aby wspierać następną generację globalnych aplikacji fintech.

Jak Działa Blockchain Stable (STABLE)?

Jak działa sieć Stable | Źródło: dokumentacja Stable

Stable zastępuje wielowalutowe tarcie tradycyjnych blockchainów usprawnionym, jednowalutowym doświadczeniem. Podąża za modelem priorytetowo traktującym wydajność, który optymalizuje każdy etap cyklu życia transakcji.

1. USDT jako natywny gaz, aktualizacja v1.2.0

Najbardziej znaczącą innowacją Stable jest jego model gazu. W standardowej transakcji protokół nalicza opłatę z góry w USDT0 i rozlicza rzeczywisty koszt po wykonaniu. Wraz z hard forkiem v1.2.0 sieć usunęła proces wrappingu, pozwalając użytkownikom wysyłać wartość i płacić opłaty tym samym aktywem. Ponadto transfery peer-to-peer są zwolnione z opłat za gaz na poziomie protokołu, czyniąc przekazy praktycznie bezpłatnymi.

2. StableBFT i konsensus oparty na DAG

Obecnie Stable używa StableBFT, dostosowanego protokołu dPoS, aby zapewnić wysoką przepustowość i odporność na błędy. Zgodnie z mapą drogową na 2026 rok sieć przechodzi na Autobahn, architekturę konsensusu opartą na DAG. Ta aktualizacja ma na celu przesunięcie sieci w kierunku 10 000+ TPS, eliminując wąskie gardła pojedynczych proponentów.

3. Optymistyczne wykonywanie równoległe (OPE)

Stable wykorzystuje technologię Block-STM do przetwarzania transakcji równolegle. Podczas gdy starsze blockchainy przetwarzają transakcje pojedynczo, Stable zakłada, że transakcje są niezależne i wykonuje je jednocześnie, ponownie przetwarzając je tylko wtedy, gdy zostanie wykryty konflikt. Skutkuje to co najmniej dwukrotną poprawą szybkości przetwarzania end-to-end.

4. Stable Pay i UX Web2.5

Aby napędzić adopcję głównego nurtu, portfel Stable Pay umożliwia logowanie społecznościowe dla doświadczenia Web2.5 oraz identyfikatory czytelne dla człowieka poprzez Stable Name, zastępując długie, złożone adresy szesnastkowe prostymi nazwami.

Do Czego Używany Jest Token STABLE?

Token STABLE jest podstawą zarządzania i bezpieczeństwa sieci. Podczas gdy gaz płacony jest w USDT, token STABLE napędza podstawową infrastrukturę.

• Stakowanie walidatorów: Aby zabezpieczyć sieć, walidatorzy muszą stakować tokeny STABLE. W zamian oni (i ich delegatorzy) otrzymują nagrody denominowane w USDT zebrane z opłat za gaz w sieci.

• Zarządzanie protokołem: Posiadacze głosują nad aktualizacjami, strukturami opłat oraz alokacją 40% funduszu Ecosystem and Community.

• Poświadczenia przedsiębiorstw: Tokeny STABLE mogą służyć jako poświadczenie dla instytucji w dostępie do Guaranteed Blockspace, zapewniając, że ich transakcje są priorytetowe nawet podczas szczytowego przeciążenia sieci.

Uwaga: Łączna podaż jest ustalona na 100 miliardów tokenów STABLE, z około 17,6% lub 17,6 miliarda obecnie w obiegu.

Czym Jest Tokenomika STABLE?

Emisja tokenów STABLE | Źródło: dokumentacja Stable

Token STABLE charakteryzuje się ustaloną łączną podażą 100 000 000 000 lub 100 miliardów tokenów, zaprojektowany jako aktywo nieinflacyjne w celu wyrównania długoterminowych interesów między walidatorami a ekosystemem.

• Ekosystem i społeczność (40%): Przeznaczony na granty dla deweloperów, integracje partnerów płatniczych oraz zachęty do dołączania użytkowników w celu napędzania rozwoju sieci.

• Inwestorzy i doradcy (25%): Przydzielony wczesnym wspierającym, podlegający jednorocznej klauzuli cliff oraz 4-letniemu harmonogramowi liniowego odblokowania.

• Zespół (25%): Zarezerwowany dla członków założycielskich i głównych współpracowników, zapewniający długoterminowe zaangażowanie z 48-miesięcznym okresem odblokowania i jednoroczną klauzulą cliff.

• Dystrybucja Genesis (10%): W pełni odblokowana przy uruchomieniu w celu zapewnienia natychmiastowej płynności rynkowej i nagradzania wczesnych zwolenników poprzez wydarzenia airdrop.

Jak Handlować Stable (STABLE) na BingX

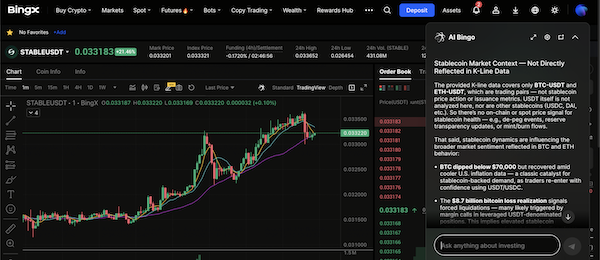

BingX zapewnia analizy w czasie rzeczywistym i wglądy napędzane przez AI, aby pomóc Ci poruszać się po rynku STABLE, który ostatnio odnotował znaczący wzrost wolumenu.

Jak Kupić STABLE na Rynku Spot

Para handlowa STABLE/USDT na rynku spot napędzana przez wglądy AI BingX

1. Doładuj konto: Zarejestruj się na BingX i

wpłać USDT.

2. Znajdź parę: Wyszukaj parę handlową

STABLE/USDT na rynku spot.

Wykorzystanie Dźwigni na STABLE na Rynku Futures

Perpetualne kontrakty STABLE/USDT na rynku futures z wglądami AI BingX

1. Włącz futures: Przenieś USDT na swoje konto futures.

3 Kluczowe Czynniki Przed Inwestowaniem w Stable (STABLE)

Przed inwestowaniem w Stable (STABLE) ważne jest zrozumienie kluczowych czynników, które mogą wpłynąć na jego wyniki cenowe, profil ryzyka i długoterminową trwałość w niestabilnych warunkach rynkowych.

1. Zależność od USDT: Użyteczność Stable jest głęboko powiązana z przyjęciem i statusem regulacyjnym Tether (USDT). Każda znacząca zmiana w pozycji rynkowej USDT bezpośrednio wpływa na StableChain.

2. Ryzyko wykonania Fazy 3: Nadchodząca aktualizacja do konsensusu opartego na DAG (Faza 3) to poważna przeszkoda techniczna. Sukces tutaj jest wymagany do osiągnięcia instytucjonalnego celu 10 000+ TPS.

3. Zarządzanie vs. Zysk: Pamiętaj, że STABLE to token zarządzania/bezpieczeństwa. Jego wartość jest napędzana przez popyt na sieć i nagrody ze stakowania płacone w USDT, a nie przez cenę stablecoinów, które przenosi.

Końcowe Myśli: Czy Stablechain Stable to Przyszłość Płatności USDT?

Stable (STABLE) pozycjonuje się jako wyspecjalizowana warstwa infrastruktury dla globalnego rynku stablecoinów w 2026 roku. Poprzez integrację USDT0 jako natywnego tokena gazowego i wprowadzenie funkcji instytucjonalnych, takich jak gwarantowana przestrzeń bloków, sieć ma na celu wyeliminowanie tarcia technicznego zazwyczaj związanego z blockchainami ogólnego przeznaczenia. Ze strategicznym wsparciem liderów branży, takich jak Bitfinex i mapą drogową techniczną ukierunkowaną na 10 000+ TPS poprzez konsensus oparty na DAG, projekt służy jako znaczące studium przypadku w przejściu stablecoinów ze spekulacyjnych aktywów do głównych szynach rozliczeń.

Jednak długoterminowa żywotność sieci pozostaje ściśle związana z ciągłą dominacją i statusem regulacyjnym ekosystemu USDT. Podczas gdy aktualizacja v1.2.0 rozwiązuje natychmiastowe przeszkody UX, pomyślne wykonanie zaawansowanego konsensusu Fazy 3 pozostaje krytycznym kamieniem milowym.

Ostrzeżenie o ryzyku: Inwestycje w kryptowaluty, szczególnie w powstającą infrastrukturę Warstwy 1, niosą ze sobą wysoką zmienność i ryzyko techniczne. Token STABLE to aktywo zarządzania i bezpieczeństwa, a nie stablecoin; użytkownicy powinni przeprowadzić dokładną analizę due diligence i zarządzać ekspozycją zgodnie z ich tolerancją ryzyka.

Polecane Artykuły