Rayls (RLS) is a modular EVM-based blockchain built to bring $100 trillion in TradFi liquidity and 6 billion banked users on-chain, combining a public L1 with privacy-preserving institutional networks powered by

zero-knowledge cryptography.

The Rayls airdrop claim is officially live from December 1, 2025, giving early community members the chance to claim RLS, the native token of Rayls’ institutional-grade blockchain. Eligible wallets from the Rayls Community Reward Program Season 2 can now claim directly via the official Rayls claim portal.

In this guide, you’ll learn what Rayls is, how the

airdrop works, who is eligible, how to claim your RLS safely, and how to trade RLS/USDT on BingX Spot once your tokens arrive.

What Is Rayls (RLS) and How Does It Work?

Rayls is a modular EVM blockchain system built for banks and financial institutions, designed to bring $100 trillion of TradFi liquidity and over 6 billion banked users on-chain. It combines a public

Layer 1 with private institutional networks, so regulated players can interact with DeFi while still meeting strict compliance rules.

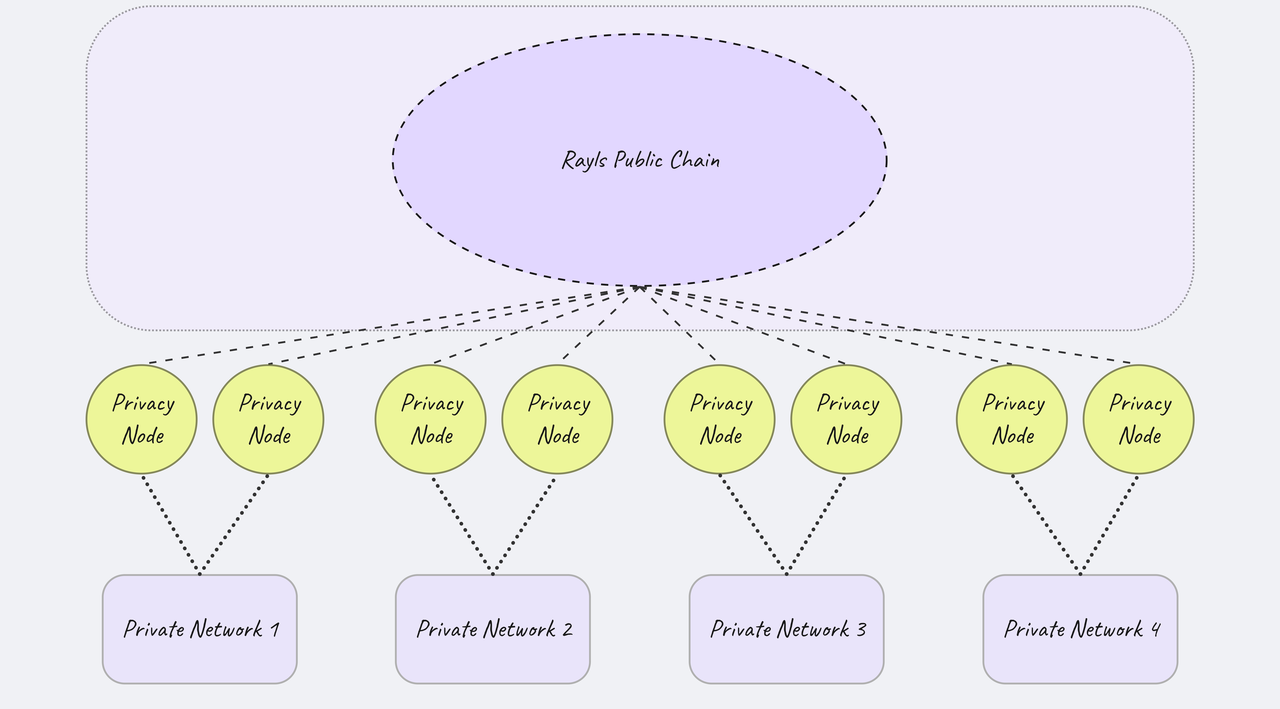

An overview of Rayls's architecture | Source: Rayls docs

The architecture revolves around several core components:

• Rayls Public Chain – An EVM-compatible L1 with deterministic finality, predictable gas fees, MEV protection, and on-chain identity. It’s the permissionless entry point where DeFi protocols, retail users, and institutions meet.

• Rayls Privacy Nodes – Institution-run private EVM chains used for client accounts, internal transfers, token issuance, and high-throughput operations with no user-facing gas.

• Rayls Private Networks – Permissioned networks that connect multiple Privacy Nodes under shared rules, e.g., jurisdiction, asset type, for inter-bank settlement and

RWA-based workflows.

A privacy protocol called Enygma powers confidential transactions with zero-knowledge proofs and post-quantum-secure key exchange, while still allowing regulators to audit flows when needed. Assets can move from private domains to the public chain, giving tokenized receivables, CBDC pilots, and other RWAs direct access to public liquidity.

What Is the RLS Token Utility on Rayls Network?

RLS is the native token that ties together Rayls’ public and private environments. It has three primary functions:

• Validator Staking: Validators must stake RLS to secure the network and validate both normal transactions and zero-knowledge proofs. Misbehaving validators can be slashed, while honest validators earn RLS from the Network Security Pool.

• Gas Fees on Private Chains: Institutions running Privacy Nodes and Private Networks pay their usage fees in RLS directly or via a broker, linking private-chain activity to on-chain token demand.

• Governance: Over time, RLS holders will help govern protocol upgrades, validator rules, and ecosystem funding via a Rayls Governance DAO, transitioning from the current Rayls Foundation-led model.

All fees ultimately flow through RLS: on the public chain, gas is pegged to USD, then converted into RLS. On both public and private chains, 50% of RLS collected as fees is burned and 50% goes to validators and ecosystem funding, creating structural deflation as usage grows.

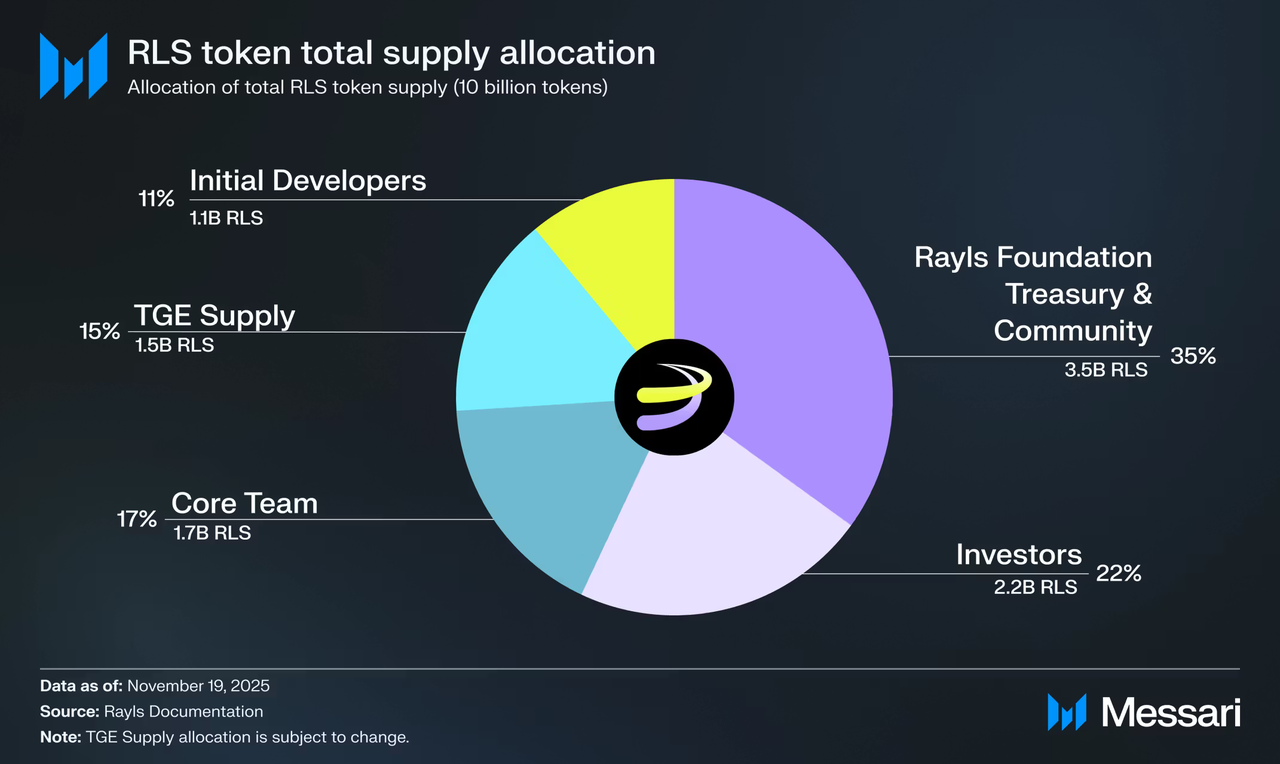

What Is Rayls (RLS) Tokenomics?

According to the official Rayls tokenomics primer, RLS has a fixed maximum supply of 10 billion tokens, minted as an ERC-20 on

Ethereum and used across the broader Rayls ecosystem.

RLS token allocation | Source: Messari

RLS Token Distribution

• 35% – Foundation Treasury and Community: Ecosystem incentives, community rewards (including the Season 2 airdrop), grants, and long-term development.

• 22% – Investors: Early backers, typically with 4-year vesting.

• 17% – Core Team: Founders and key contributors, also with 4-year vesting.

• 15% – TGE Supply: Liquidity, exchange listings, and initial market formation.

• 11% – Initial Developers: Early technical contributors, with long-term vesting.

For the Season 2 Community Reward Program, 0.5% of total supply or 50 million RLS has been set aside for eligible users, distributed using a weighted model that rewards deeper and more consistent contribution rather than pure volume or short-term farming.

The fee-burn design, combined with growing institutional activity visible via the Proof-of-Usage (PoU) dashboard, is intended to turn real-world settlement flows into long-term demand for RLS.

What Is the Rayls (RLS) Community Airdrop?

The current airdrop is Rayls Community Reward Program – Season 2, Rayls’ first major on-chain distribution to early users who completed quests, testnet tasks, and humanity verification. Eligible wallets can now claim their allocation from December 1, 2025, via the official claim portal: tokenclaims.rayls.com.

Rather than a public “claim for everyone,” the program specifically targets genuine contributors who helped test Rayls infrastructure, participated in learning campaigns, and passed rigorous

Proof-of-Humanity (PoH) checks. The result is a curated list of around 100,000 real users from an initial funnel of over 700,000 wallets.

Important: As of December 2, 2025, Rayls has not publicly announced an exact claim end date for Season 2. You should assume the window may be limited and claim as soon as possible.

Rayls Airdrop Snapshot and Key Dates

Here’s a simplified timeline for the Rayls Community Reward Program Season 2 campaign and the airdrop claim:

• Earlier in 2025 – Loyalty Program and Quests: Rayls ran quests via Fuul, social and learning campaigns, and waitlist/testnet activities where users accumulated points.

• PoH and Registration Period (Ended): Eligible users had to complete Proof-of-Humanity via Authena, mint a PoH NFT, and register their wallet for rewards. The registration portal closed around late November 2025.

• December 1, 2025 – Claims Open: Rayls confirmed that “eligible wallets are now able to claim their $RLS reward.”

• Mainnet Launch – Early 2026 (Planned): The Season 2 rewards are part of a broader roadmap that includes the Rayls Public Chain mainnet launch in early 2026, with validator staking and more institutional integrations.

Always rely on official Rayls channels like the official website and @RaylsLabs on X for any updated deadlines or claim instructions.

Who Is Eligible for the RLS Airdrop?

According to Rayls’ official blog and third-party airdrop trackers, eligibility for the Season 2 RLS airdrop is based on three main pillars:

1. Participation in Rayls Quests and Loyalty Programs

- Completing tasks on Fuul, social campaigns, and learning missions.

- Earning Rayls Points tied to on-chain and off-chain engagement.

2. Proof-of-Humanity (PoH) Verification via Authena

- Connecting real-world accounts, e.g., social, identity signals, to earn Humanity Points.

- Reaching the required threshold and minting a PoH NFT on

Base, marking your wallet as a verified human.

3. Clean Sybil Analysis and Compliance Screening

- Surviving advanced sybil detection that removed clustered “funding rings” and bot farms.

- Passing sanctions checks via Chainalysis’ Sanctions Oracle.

If you skipped PoH or never joined the quests, you’re very likely not eligible for this specific season’s airdrop. However, Rayls has signaled more reward seasons in the future, so completing PoH now can still benefit you.

How the $RLS Airdrop Campaign Tackles Sybil Attacks and Bot Farming

Rayls built one of the stricter anti-sybil funnels in recent airdrop campaigns:

• Phase 1 – Wide Funnel (~700k Wallets): Anyone who joined quests or loyalty tasks entered the candidate pool.

• Phase 2 – Proof-of-Humanity Filter (~150k Wallets Left): Mandatory PoH via Authena cut the pool by over 75%, as only users willing to pay a small fee and verify personhood progressed.

• Phase 3 – Advanced Sybil Analysis (~100k Wallets Left): Collaboration with Passport.Human.Tech identified suspicious clusters and “funding rings” or one entity funding many wallets. These clusters were aggressively filtered out.

• Phase 4 – Weighted Rewarding: A quadratic points curve plus 2x / 3x multipliers for “Power Users” and the top “Champion” wallet ensured that deeper engagement earned more RLS, while everyone eligible got at least something.

• Phase 5 – Compliance Screening: Final lists were checked against the Chainalysis Sanctions Oracle to remove sanctioned or high-risk addresses.

The result is an airdrop that heavily favors real, engaged humans, not pure farmers; good news if you genuinely participated.

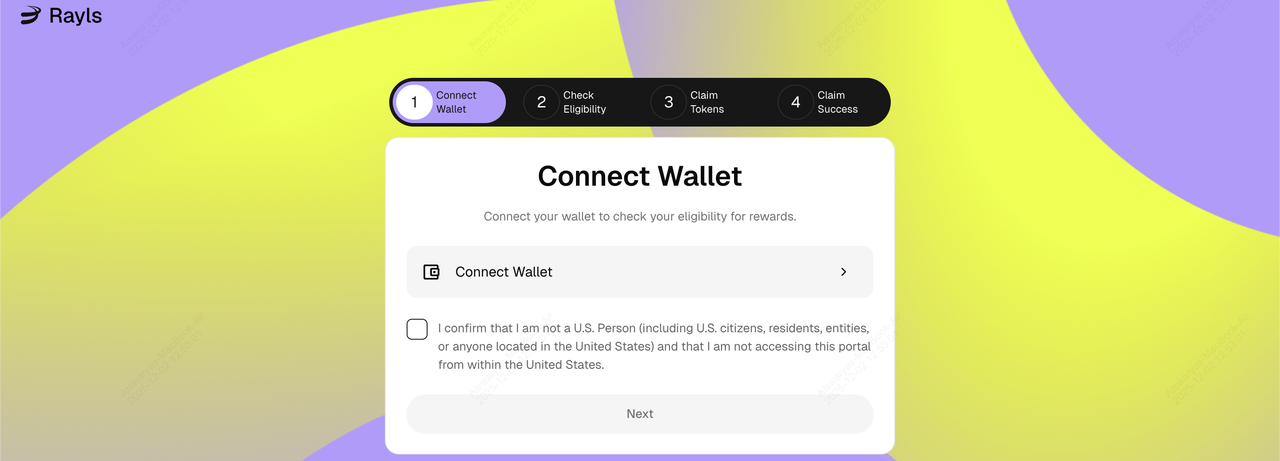

How to Claim Your RLS Airdrop: Step-by-Step Guide

Source: Rayls airdrop claim portal

Before you start, make sure:

• You participated in Season 2 and completed PoH.

• You still control the same

EVM wallet you used for quests and registration.

• You’re accessing only official links, not random airdrop DMs.

Step 1: Go to the Official Rayls Claim Portal

Open your browser and visit:

https://tokenclaims.rayls.com. Double-check the URL spelling and certificate. Rayls has confirmed that this is the only official claim site for the community rewards airdrop.

Step 2: Connect Your Eligible Wallet

Click “Connect Wallet” and choose your EVM wallet, e.g.,

MetaMask.

• Use the same address you used for Rayls quests and PoH.

• Sign the connection message; this is just a signature, not a token transfer.

If you connect a different wallet, you’ll likely see “No allocation found.”

Step 3: Check Eligibility and View Allocation

Once connected, the portal will automatically:

• Check if your address is on the Season 2 eligibility list.

• Display your RLS allocation, including any Power User or Champion multipliers if applicable.

If you’re not eligible, the portal result is final; there’s no manual appeal.

Step 4: Confirm Terms and Start the Claim

Read and accept any Terms of Use, Reward Terms, and Privacy Policy shown in the interface. Then click the main “Claim” or “Reveal” button to begin the on-chain claim transaction. Your wallet will pop up with:

• Network details (Ethereum mainnet).

• Destination contract.

• Estimated gas fee in ETH.

Review and click “Confirm” in your wallet.

Step 5: Wait for On-Chain Confirmation

After submitting the transaction, wait for it to confirm. This could usually take from a few seconds to a few minutes, depending on Ethereum network conditions.

• The claim page should update to “Claimed” or similar status.

• Your RLS will be sent directly to your wallet.

If you don’t see RLS in your wallet UI, you may need to:

• Add the RLS token contract manually, using the address from Rayls’ official docs or CMC.

• Or use a block explorer / portfolio tracker to confirm your new balance.

Step 6: Keep Your RLS Safe

Treat your new tokens like any other valuable asset:

• Never share your seed phrase or private keys.

• Ignore DMs claiming they can “boost” your allocation or fix a failed claim.

• Only follow links from rayls.com or official @RaylsLabs posts when interacting with the airdrop.

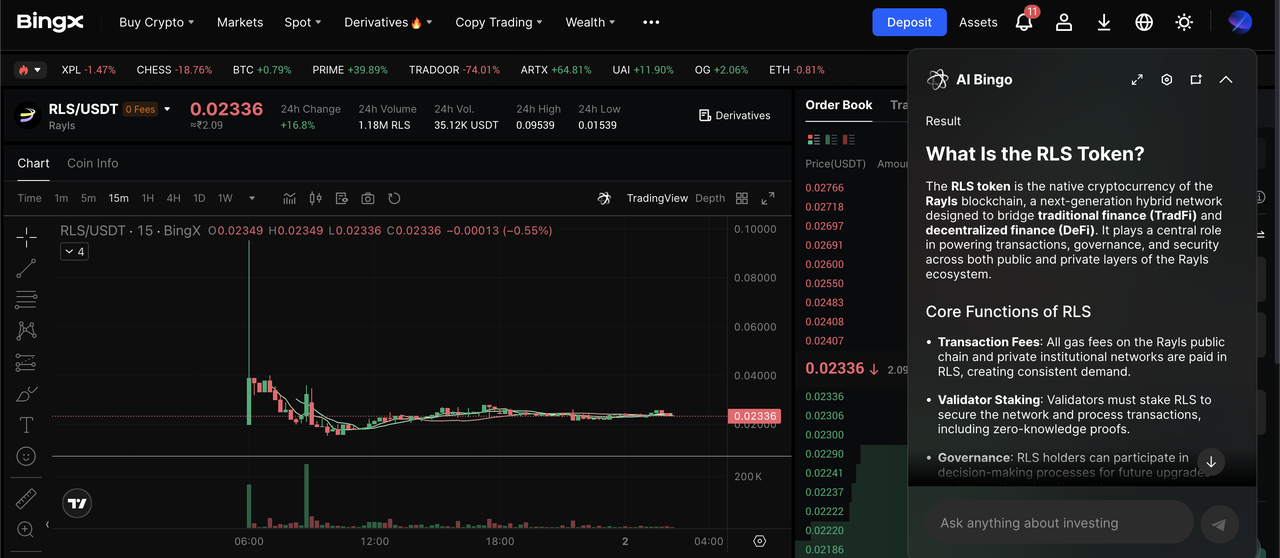

How to Trade Rayls (RLS) on BingX After the Airdrop

BingX has announced the

listing of Rayls (RLS) on the Spot Market, with the RLS/USDT trading pair live from December 1, 2025, 11:00 UTC, plus a limited-time zero-fee trading period till December 8, 2025.

How to Buy or Sell RLS on BingX Spot

RLS/USDT trading pair on the spot market powered by BingX AI insights

Once your RLS token airdrop has landed, or if you want to accumulate more tokens, you can trade RLS on BingX in a few steps:

1. Create and Verify Your BingX Account: Sign up on BingX web or app. Complete

KYC verification to unlock full features.

2. Deposit USDT or Crypto: Buy USDT via card, P2P, bank transfer, or local payment methods. You can also

deposit crypto like

BTC or

ETH and

swap to USDT on BingX.

3. Open the Spot Market: Go to Spot, search for “RLS,”and select the

RLS/USDT trading pair.

4. Place Your Order

• Market order: Buy or sell RLS instantly at the current market price.

• Limit order: Set your desired price and let the order fill when the market reaches it.

5. Manage Your Holdings: Your RLS appears in your Spot wallet. You can hold for the long term, trade actively, or transfer part of your balance to a

self-custody wallet that supports RLS if you prefer full control.

Tip: During the zero-fee promo window, active traders may benefit from tighter execution and lower costs when rotating in and out of RLS.

Final Thoughts: Should You Claim the Rayls Airdrop?

The Rayls airdrop stands out for its strict anti-sybil design, deep institutional focus, and a token model that directly links real-world financial activity to RLS demand through fee burning and validator rewards. If you participated in Rayls quests and completed PoH, claiming your RLS is a logical next step; you’re effectively receiving a share of a carefully curated community allocation tied to a live, exchange-listed asset.

At the same time, RLS remains a high-risk, early-stage token. Its long-term value will depend on how many banks and institutions actually deploy Privacy Nodes and Private Networks, how much volume flows through the Rayls Public Chain, and broader crypto-market conditions. Treat the airdrop as volatile exposure, size your positions conservatively, and never invest more than you can afford to lose.

Related Reading